Attached files

| file | filename |

|---|---|

| S-1/A - NORTH TEXAS ENERGY, INC. FORM S-1A7 FEBRUARY 4, 2013 - North Texas Energy, Inc. | northtexasenergys1a7201324.htm |

| EX-5.1 - LEGAL OPINION LETTER - North Texas Energy, Inc. | ex5-1.htm |

| EX-23.1 - AUDITOR CONSENT LETTER - North Texas Energy, Inc. | ex23-1.htm |

Exhibit 99.1

John M. Durkee, PE 4915 South Newport Avenue Tulsa, Okla. 74105-4619

voice 918-381-9292 fax 918-742-0624

December 5, 2012

Mr. Kevin Jones, CEO/Director

North Texas Energy, Inc.

5057 Keller Springs Road, Suite 300

Addison, Texas 75001

Re: Independent Technical Report

Dear Mr. Jones:

At your request, I have prepared the following Technical Report (“Report”) for North Texas Energy, Inc. (“Company”) in satisfaction of requirements expressed in the comments. This report will supersede all previous plans, projections, reserve reports, responses or communications relating to this matter.

Purpose

The purpose of this report is to incorporate changes to plans and reporting style required to comply with the US Securities and Exchange Commission rules.

The Company

North Texas Energy, Inc. is an ‘Enhanced Oil Recovery’ company whose primary function is to increase the ultimate recovery of oil and gas from the wells it presently owns or will acquire in the future in order to maximize value to it’s stockholders. At this time the registrant has no ‘Proved’ reserves. ‘Probable’ and ‘Possible’ reserves projected are all located in the state of Texas. North Texas Energy owns 100% working interest in 438.75 acres with eighteen unproductive oil wells, zero productive oil wells and zero productive gas wells. The company owns no undeveloped acreage. This report covers 100% of North Texas

Energy’s reserves.

Strategy

The company will use proprietary tools, technologies and the experience of the management team and consultants to find and extract oil from reservoirs, to differentiate between projects suitable for the application of proven techniques and to monitor new exploration and recovery technology for successful proof of concept.

1

John M. Durkee, PE 4915 South Newport Avenue Tulsa, Okla. 74105-4619

voice 918-381-9292 fax 918-742-0624

Tactics

The company will acquire existing production projects, productive and non-productive leases and will enter into joint ventures with other operators that add necessary project acreage or improve the likelihood of a projects’ success.

Data and Assumptions

Information and data for the analysis of this acreage are from electric logs, drillers’ logs, completion and production reports obtained from the Texas Railroad Commission (RRC), IHS Energy Corporation, Dwight’s database, The Texas Well Log Libraries, the NRIS database, published reports, public well records of ongoing operations in the area and my private files.

This data was probabilistically used to evaluate the New Diana and Minerva-Rockdale reservoir formation and field production history to estimate the level of potentially moveable oil and the likelihood of recovering any of that oil. There are no ‘Proved’ reserves identified by this report.

The various models all using the $96.13 per barrel price that is the average of the first-day-of-the-month price for the past twelve months are based upon an effective date of December 1, 2012. Models were based upon decline curve analysis, volumetrics and cash flow projections using production derived graphically and declined at 1% per month; oil price and cost held constant throughout the life of the projects. Insufficient data exists for meaningful material balance calculations.

Cash flow projections based upon a review of the reservoir conditions and a single recovery plan for the M. W. Balch and two possible plans for the New Diana leases were prepared to estimate if any Enhanced Oil Recovery (EOR) methodologies might cause the economic recovery of any crude oil from the presently owned fields. It appears at this time that Waterflooding augmented by polymer and microbes will satisfy that criteria for both existing projects.

New Diana Field

For the New Diana field, existing wells will be reworked with new oil and gas extraction equipment. The assumptions, data, methods, and procedures that were utilized are necessary and appropriate for the purpose served by this report.

Of the original oil volumetrically calculated to have been in place in the Woodbine sand under the three hundred forty eight acres of this group of leases, it is estimated that 47,690 barrels of oil “net probable reserves” may be economically produced, net of royalty to the account of North Texas Energy and will probably be produced by converting one well to disposal and producing the other six existing wells, after reworking, equipping all seven of the wells and installing the injection system necessary to automatically re-inject produced water.

2

John M. Durkee, PE 4915 South Newport Avenue Tulsa, Okla. 74105-4619

voice 918-381-9292 fax 918-742-0624

It is further estimated that 243,302 barrels of oil “net possible reserves,” net of royalty to the account of North Texas Energy, out of the oil theoretically moveable based on official estimates that 80% of OOIP might be moveable through the use of Waterflooding augmented by polymer and microbes.

The Remainder of This Page Intentionally Left Blank

3

John M. Durkee, PE 4915 South Newport Avenue Tulsa, Okla. 74105-4619

voice 918-381-9292 fax 918-742-0624

North Texas Energy, Inc.

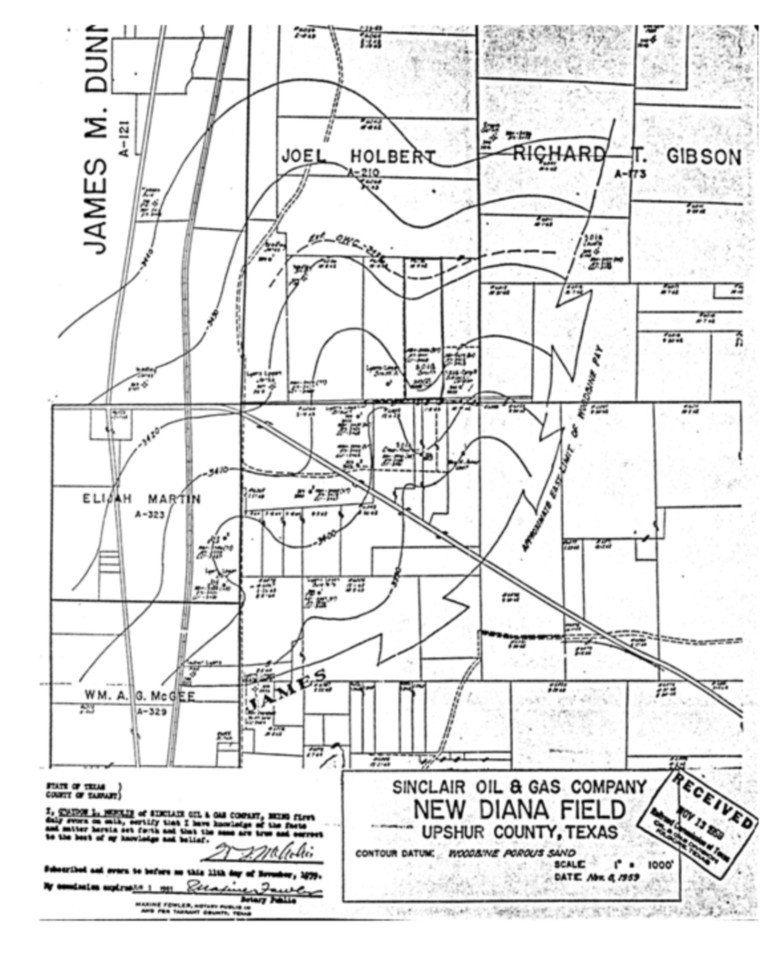

New Diana Field

Figure 1. Map of the New Diana Field, Upshur County, Texas

4

John M. Durkee, PE 4915 South Newport Avenue Tulsa, Okla. 74105-4619

voice 918-381-9292 fax 918-742-0624

Balch Lease

For the M. W. Balch lease there are no ‘Proved’ or ‘Probable’ reserves. We can speculate that 115,589 barrels of oil “net possible reserves,” net of royalty, to the account of North Texas Energy, might be economically produced, out of the of the original oil calculated to be moveable at the 80% level in the Minerva sand through the use of Waterflooding augmented by polymer and microbes.

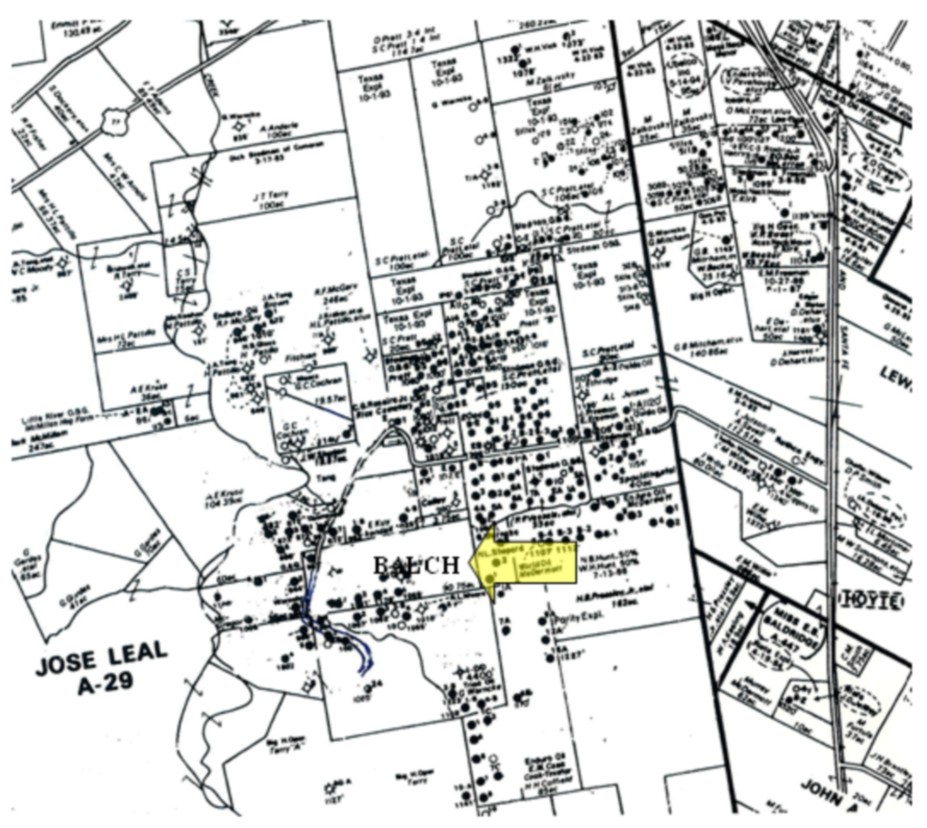

North Texas Energy, Inc.

Balch Lease

Figure 2. Map of part of the Minerva-Rockdale Oilfield showing location of the M. W. Balch lease

5

John M. Durkee, PE 4915 South Newport Avenue Tulsa, Okla. 74105-4619

voice 918-381-9292 fax 918-742-0624

Taking a statistical approach, as a user and observer of MEOR for the last thirty years, I am 100% certain that 10% of the moveable oil can ultimately be produced and I am 10% certain that 100% of the moveable oil might be produced. This report takes the position that only the first 10% of the projected moveable oil remaining at this time will be recovered for reserve purposes.

Table of Oil Reserves

Stock Tank Barrels (42 gal.)

|

Reserves as of 12/1/2012

|

||||||||||||||||||||

|

Reserve Category

|

Oil

|

Natural

|

Synthetic

|

Synthetic

|

Other

|

|||||||||||||||

|

Gas

|

Oil

|

Gas

|

Products

|

|||||||||||||||||

|

(All Barrels net of Royalty & State Tax)

|

(mbbls)

|

(mmcf)

|

(mbbls)

|

(mmcf)

|

||||||||||||||||

|

Location

|

||||||||||||||||||||

|

All Reserves located State of Texas

|

||||||||||||||||||||

|

United States of America

|

||||||||||||||||||||

|

Proved Developed Producing

|

0 | 0 | 0 | 0 | 0 | |||||||||||||||

|

Proved Undeveloped Producing

|

0 | 0 | 0 | 0 | 0 | |||||||||||||||

|

Proved Developed Non-Producing

|

0 | 0 | 0 | 0 | 0 | |||||||||||||||

|

Proved Undeveloped Non-Producing

|

0 | 0 | 0 | 0 | 0 | |||||||||||||||

|

Probable Developed Producing

|

0 | 0 | 0 | 0 | 0 | |||||||||||||||

|

Probable Undeveloped Producing

|

0 | 0 | 0 | 0 | 0 | |||||||||||||||

|

Probable Developed Non-Producing

|

47.690 | 0 | 0 | 0 | 0 | |||||||||||||||

|

Probable Undeveloped Non-Producing

|

0 | 0 | 0 | 0 | 0 | |||||||||||||||

|

Possible Developed Producing

|

0 | 0 | 0 | 0 | 0 | |||||||||||||||

|

Possible Undeveloped Producing

|

0 | 0 | 0 | 0 | 0 | |||||||||||||||

|

Possible Developed Non-Producing

|

0 | 0 | 0 | 0 | 0 | |||||||||||||||

|

Possible Undeveloped Non-Producing

|

358,891 | 0 | 0 | 0 | 0 | |||||||||||||||

Figure 3. Table of Reserves

6

John M. Durkee, PE 4915 South Newport Avenue Tulsa, Okla. 74105-4619

voice 918-381-9292 fax 918-742-0624

Summary & Conclusions

It is the opinion of the author that the Company’s Plan, as previously discussed and as described in this Report, and the 47,690 barrels of “net probable reserves” and the 358,891 barrels of oil “net possible reserves” claimed in the table above comply with the rules and comments of the US Securities and Exchange Commission.

Qualifications

I certify that I am a Consulting Petroleum Engineer, registered with the State of Oklahoma, State Board of Registration for Professional Engineers and Land Surveyors, Number 14481 and that I hold no equity position in the Company.

Limitations and Risk

A copy of this report was given and reviewed by North Texas Energy, Inc. for comment on any factual errors; however, the analysis and conclusions contained herein are those of the author alone. No audits of reserves have been done since this is the first estimate for filing and no field operations are presently being conducted by North Texas Energy.

All parties reading this Report are advised of the inherent high risks involved in all aspects of the oil and gas industry. The possibility exists that the program contemplated by this Report may not recover any hydrocarbons.

‘Reserve Estimates’ as the name implies are estimates. They are usually the result of an examination of the best available data, calculated where possible, but sometimes inferred from data on nearby or analogous reservoirs considered by an experienced engineer to be a valid representation of the likely outcome of a particular plan for the recovery of oil considered to be moveable within the reservoir under the prevailing or required economic conditions.

The process of estimating moveable oil and natural gas is complex, requiring significant decisions and assumptions in the evaluation of available geological, engineering, and economic data for each reservoir. As a result, the estimates are inherently imprecise evaluations of unknown quantities and could materially affect the quality and value of an investment.

EOR and production operations are subject to various types of regulation at the federal, state and local levels. The regulations include maintaining bonding requirements to rework or operate wells, defining potential well locations, specifying well casing integrity, plugging and abandoning well statutes, and the surface use and restoration of properties on which wells are operated. Operations are also subject to various conservation laws and regulations. These include the regulation of spacing or proration of wells (the density of wells in a given field). In addition, state

conservation laws establish maximum rates of production from oil and natural gas wells. The effect of these regulations is to limit the amounts of crude oil and natural gas we can produce from our wells.

7

John M. Durkee, PE 4915 South Newport Avenue Tulsa, Okla. 74105-4619

voice 918-381-9292 fax 918-742-0624

Regulation of the oil industry is frequently driven by political considerations rather than engineering considerations. Regulations can therefore completely negate the best plan for any reserve recovery.

Consent

John M. Durkee has consented to the submission of this Report to the U. S. Securities and Exchange Commission (SEC).

8