Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BIOGEN INC. | tysform8-kbody.htm |

| EX-99.1 - PRESS RELEASE - BIOGEN INC. | tyspressrelease.htm |

TITLE OF PRESENTATION FEBRUARY 6, 2013 BIOGEN IDEC TO PURCHASE FULL RIGHTS TO TYSABRI BIOGEN IDEC

Agenda INTRODUCTION CLAUDINE PROWSE, Ph.D., VP, Investor Relations OVERVIEW GEORGE SCANGOS, Ph.D., Chief Executive Officer FINANCIAL UPDATE PAUL CLANCY, EVP, Chief Financial Officer CLOSING REMARKS GEORGE SCANGOS Q&A to include TONY KINGSLEY, EVP, Global Commercial Operations 2

Agenda INTRODUCTION CLAUDINE PROWSE, Ph.D., VP, Investor Relations OVERVIEW GEORGE SCANGOS, Ph.D., Chief Executive Officer FINANCIAL UPDATE PAUL CLANCY, EVP, Chief Financial Officer CLOSING REMARKS GEORGE SCANGOS Q&A to include TONY KINGSLEY, EVP, Global Commercial Operations 3

Forward-Looking Statements This presentation contains forward-looking statements, including statements about our expected cash generation, our entry into a line of credit, the synergies we expect from the transaction, the expected accretion to earnings per share and the impact of the transaction on our margins. These forward-looking statements may be accompanied by such words as “anticipate,” “believe,” “could,” “estimate,” “expect,” “forecast,” “intend,” “may,” “plan,” “potential,” “project,” “target,” “will” and other words and terms of similar meaning. You should not place undue reliance on these statements. These statements involve risks and uncertainties that could cause actual results to differ materially from those reflected in such statements, including our dependence on our three principal products, AVONEX® (interferon beta-1a), TYSABRI® (natalizumab) and RITUXAN® (rituximab), the importance of TYSABRI’s sales growth, uncertainty of success in commercializing and developing other products, product competition, the occurrence of adverse safety events with our products, changes in the availability of reimbursement for our products, adverse market and economic conditions, our dependence on collaborations and other third parties over which we may not always have full control, problems with our manufacturing processes and our reliance on third parties, failure to comply with government regulation, our ability to protect our intellectual property rights and have sufficient rights to market our products together with the cost of doing so, the risks of doing business internationally, failure to manage our growth and execute our growth initiatives, charges and other costs relating to our properties, fluctuations in our effective tax rate, our ability to attract and retain qualified personnel, product liability claims, fluctuations in our operating results, the market, interest and credit risks associated with our portfolio of marketable securities, environmental risks, change of control provisions in our collaborations, and the other risks and uncertainties that are described in the Risk Factors section of our most recent annual or quarterly report and in other reports we have filed with the SEC. These statements are based on our current beliefs and expectations and speak only as of the date of this presentation. We do not undertake any obligation to publicly update any forward-looking statements. 4 4

Agenda INTRODUCTION CLAUDINE PROWSE, Ph.D., VP, Investor Relations OVERVIEW GEORGE SCANGOS, Ph.D., Chief Executive Officer FINANCIAL UPDATE PAUL CLANCY, EVP, Chief Financial Officer CLOSING REMARKS GEORGE SCANGOS Q&A to include TONY KINGSLEY, EVP, Global Commercial Operations 5

Clear and Compelling Rationale Furthers key strategic priority to grow the commercial business and strengthen the Multiple Sclerosis (MS) franchise Consolidates ownership of important MS therapy in the growing high efficacy segment with increasing revenues, expanding margins and potential for use in other indications such as Secondary Progressive MS Streamlines control of TYSABRI, allowing for enhanced execution Eliminates change of control restriction for Biogen Idec Leverages asset purchase transaction structure to enable fair valuation, reduce financial and execution risk and realize operational and tax synergies Biogen Idec to Purchase Full Rights to and Control of TYSABRI from Elan for Upfront Cash and Contingent Payments 6

Important MS Therapy 7 High Efficacy Therapies Oral Therapies Injectable Therapies

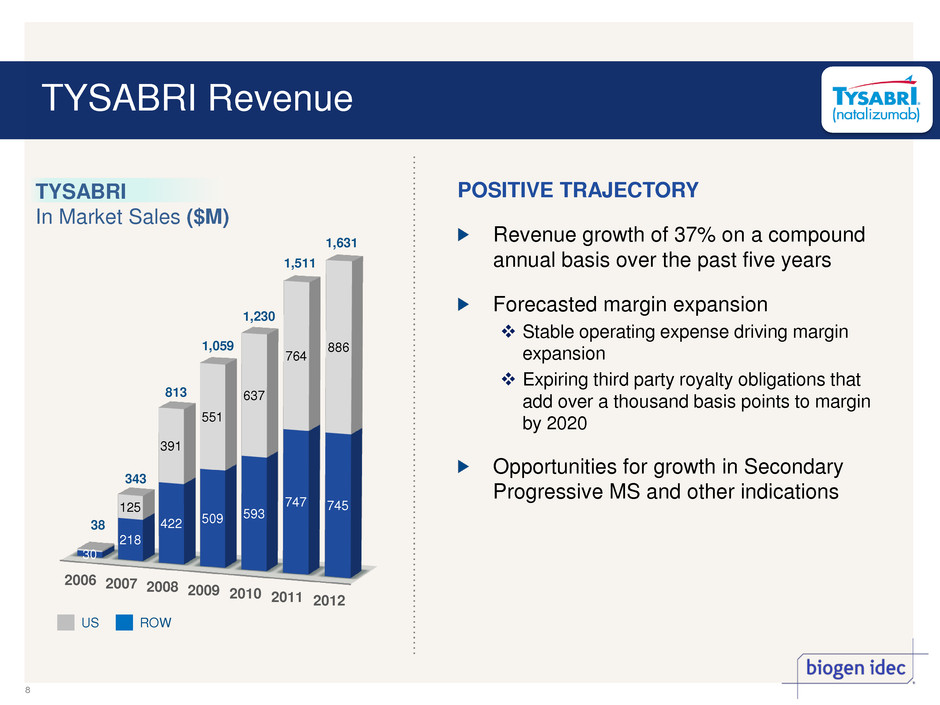

Revenue growth of 37% on a compound annual basis over the past five years Forecasted margin expansion Stable operating expense driving margin expansion Expiring third party royalty obligations that add over a thousand basis points to margin by 2020 Opportunities for growth in Secondary Progressive MS and other indications 2006 2007 2008 2009 2010 2011 2012 30 218 422 509 593 747 745 125 391 551 637 764 886 38 343 813 1,059 1,230 1,511 US ROW TYSABRI In Market Sales ($M) POSITIVE TRAJECTORY 1,631 TYSABRI Revenue 8

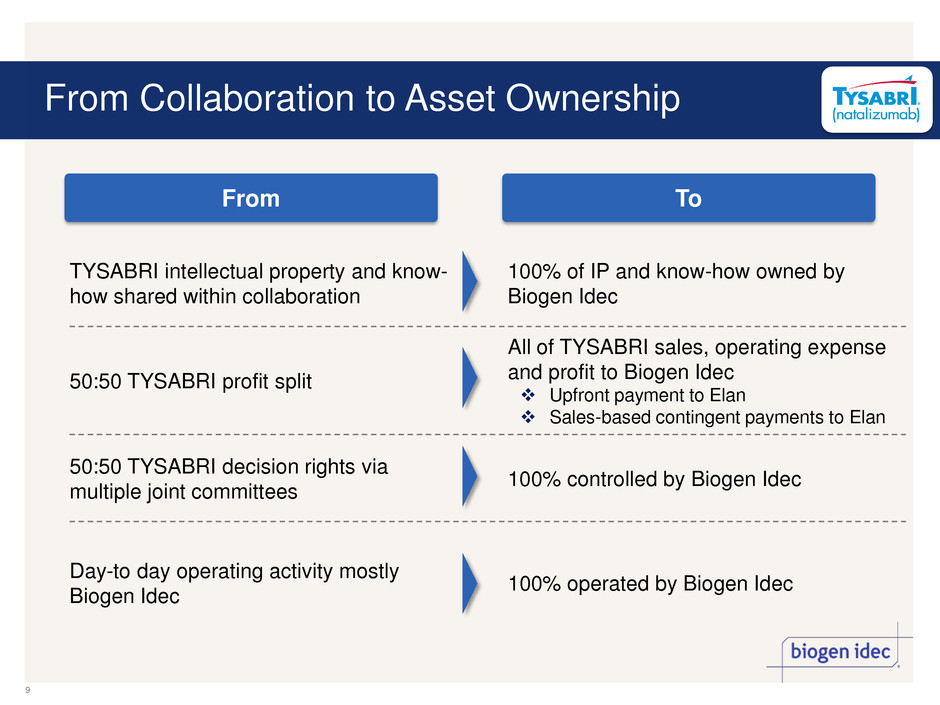

From Collaboration to Asset Ownership TYSABRI intellectual property and know- how shared within collaboration 100% of IP and know-how owned by Biogen Idec 50:50 TYSABRI profit split All of TYSABRI sales, operating expense and profit to Biogen Idec Upfront payment to Elan Sales-based contingent payments to Elan 50:50 TYSABRI decision rights via multiple joint committees 100% controlled by Biogen Idec Day-to day operating activity mostly Biogen Idec 100% operated by Biogen Idec From To 9

Agenda INTRODUCTION CLAUDINE PROWSE, Ph.D., VP, Investor Relations OVERVIEW GEORGE SCANGOS, Ph.D., Chief Executive Officer FINANCIAL UPDATE PAUL CLANCY, EVP, Chief Financial Officer CLOSING REMARKS GEORGE SCANGOS Q&A to include TONY KINGSLEY, EVP, Global Commercial Operations 10

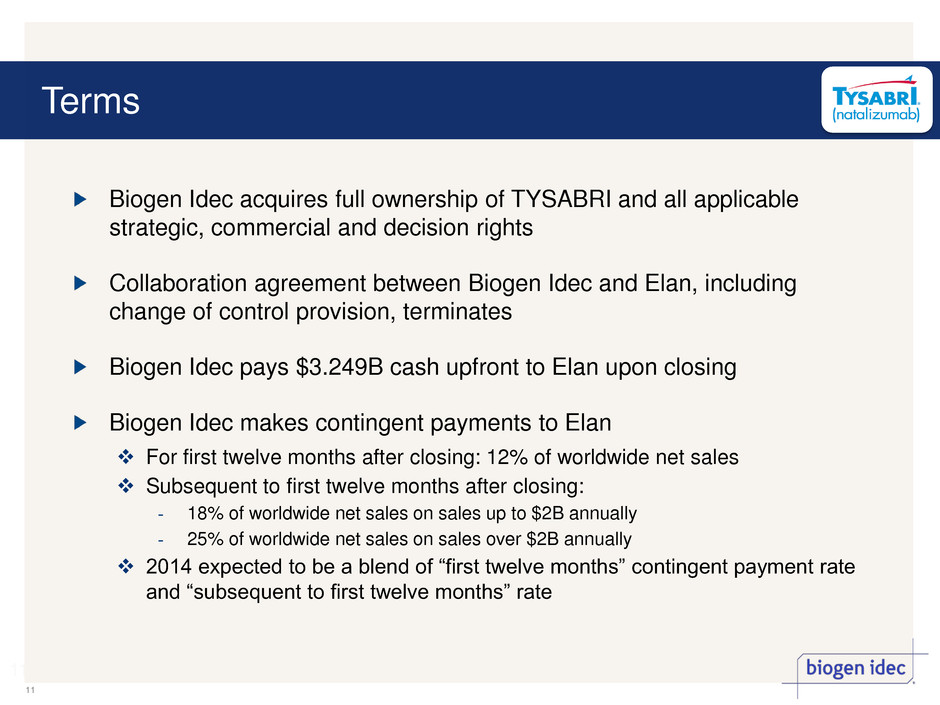

Terms 11 11 Biogen Idec acquires full ownership of TYSABRI and all applicable strategic, commercial and decision rights Collaboration agreement between Biogen Idec and Elan, including change of control provision, terminates Biogen Idec pays $3.249B cash upfront to Elan upon closing Biogen Idec makes contingent payments to Elan For first twelve months after closing: 12% of worldwide net sales Subsequent to first twelve months after closing: - 18% of worldwide net sales on sales up to $2B annually - 25% of worldwide net sales on sales over $2B annually 2014 expected to be a blend of “first twelve months” contingent payment rate and “subsequent to first twelve months” rate

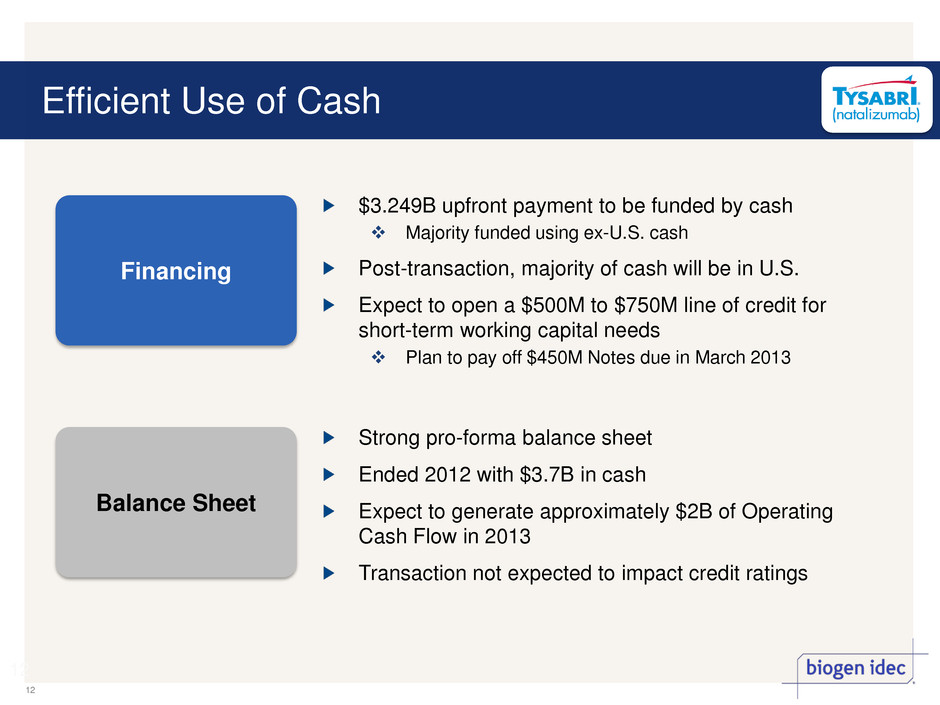

Efficient Use of Cash 12 12 $3.249B upfront payment to be funded by cash Majority funded using ex-U.S. cash Post-transaction, majority of cash will be in U.S. Expect to open a $500M to $750M line of credit for short-term working capital needs Plan to pay off $450M Notes due in March 2013 Strong pro-forma balance sheet Ended 2012 with $3.7B in cash Expect to generate approximately $2B of Operating Cash Flow in 2013 Transaction not expected to impact credit ratings Financing Balance Sheet

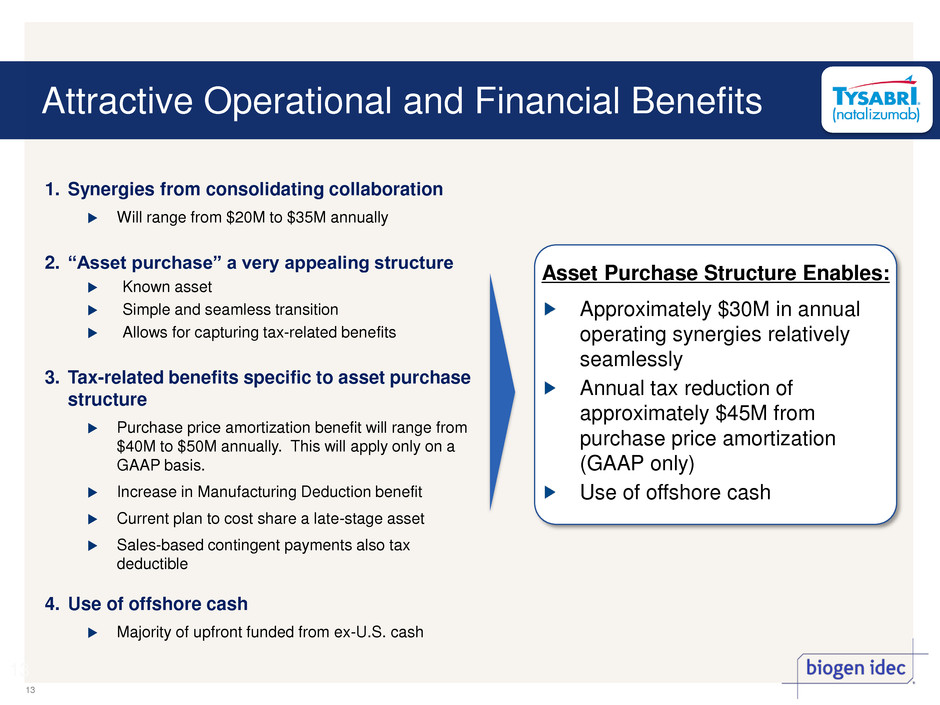

Attractive Operational and Financial Benefits 13 13 1. Synergies from consolidating collaboration Will range from $20M to $35M annually 2. “Asset purchase” a very appealing structure Known asset Simple and seamless transition Allows for capturing tax-related benefits 3. Tax-related benefits specific to asset purchase structure Purchase price amortization benefit will range from $40M to $50M annually. This will apply only on a GAAP basis. Increase in Manufacturing Deduction benefit Current plan to cost share a late-stage asset Sales-based contingent payments also tax deductible 4. Use of offshore cash Majority of upfront funded from ex-U.S. cash Asset Purchase Structure Enables: Approximately $30M in annual operating synergies relatively seamlessly Annual tax reduction of approximately $45M from purchase price amortization (GAAP only) Use of offshore cash

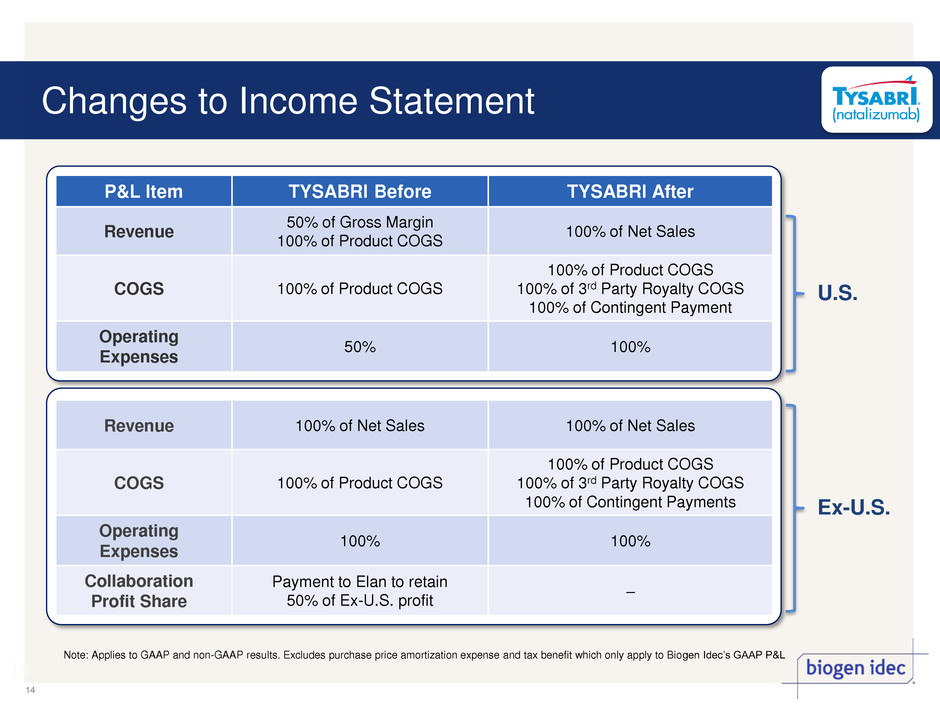

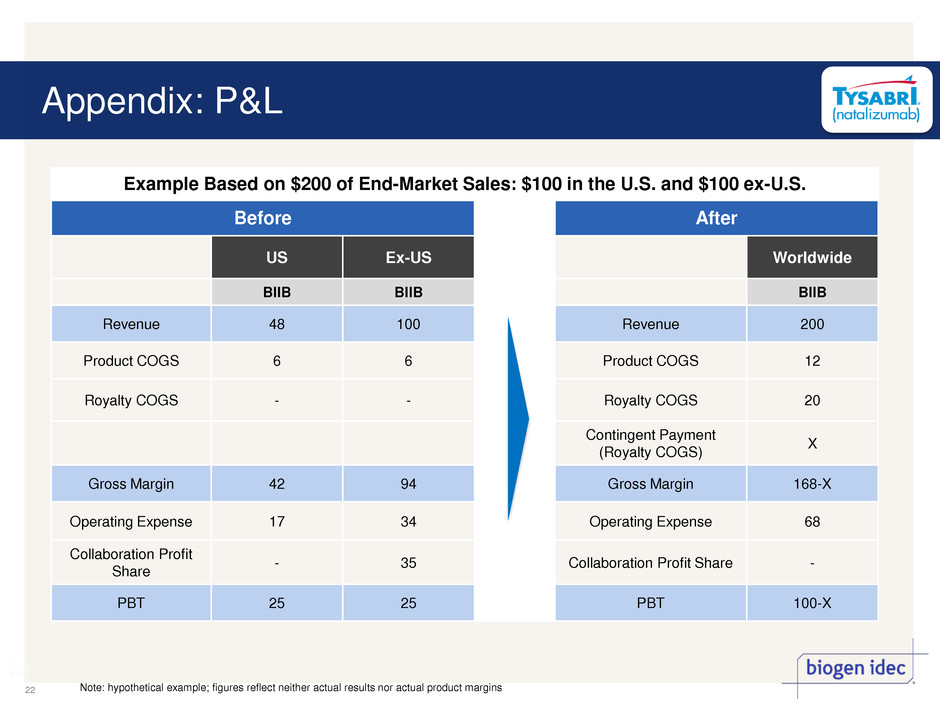

Changes to Income Statement 14 14 P&L Item TYSABRI Before TYSABRI After Revenue 50% of Gross Margin 100% of Product COGS 100% of Net Sales COGS 100% of Product COGS 100% of Product COGS 100% of 3rd Party Royalty COGS 100% of Contingent Payment Operating Expenses 50% 100% Revenue 100% of Net Sales 100% of Net Sales COGS 100% of Product COGS 100% of Product COGS 100% of 3rd Party Royalty COGS 100% of Contingent Payments Operating Expenses 100% 100% Collaboration Profit Share Payment to Elan to retain 50% of Ex-U.S. profit – Note: Applies to GAAP and non-GAAP results. Excludes purchase price amortization expense and tax benefit which only apply to Biogen Idec’s GAAP P&L U.S. Ex-U.S.

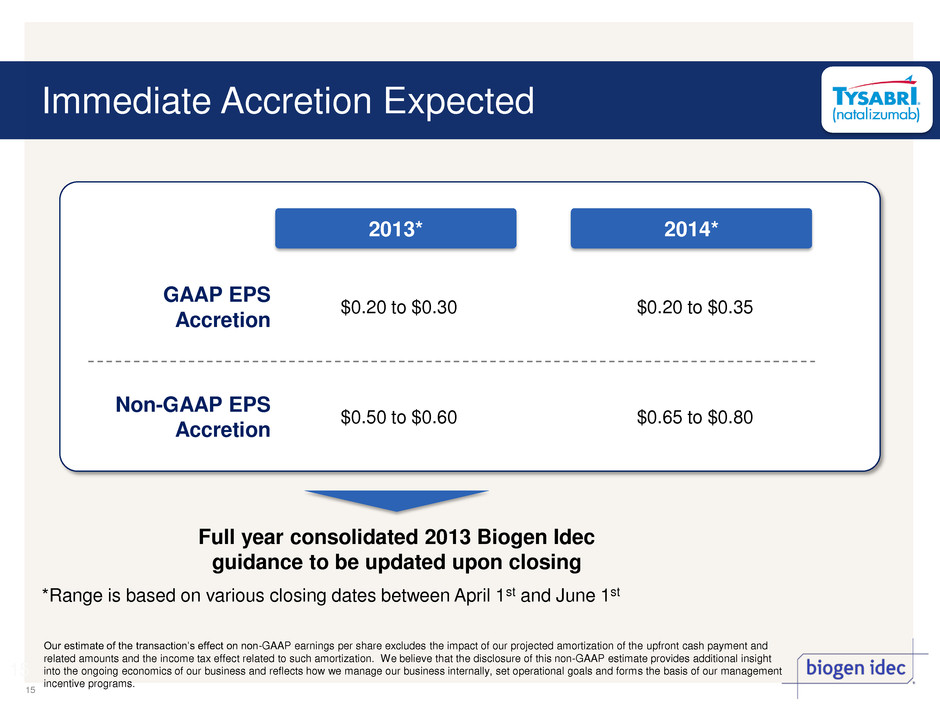

Immediate Accretion Expected 15 15 GAAP EPS Accretion $0.20 to $0.30 $0.20 to $0.35 Non-GAAP EPS Accretion $0.50 to $0.60 $0.65 to $0.80 2013* 2014* Full year consolidated 2013 Biogen Idec guidance to be updated upon closing *Range is based on various closing dates between April 1st and June 1st Our estimate of the transaction’s effect on non-GAAP earnings per share excludes the impact of our projected amortization of the upfront cash payment and related amounts and the income tax effect related to such amortization. We believe that the disclosure of this non-GAAP estimate provides additional insight into the ongoing economics of our business and reflects how we manage our business internally, set operational goals and forms the basis of our management incentive programs.

Financial Logic 16 16 Consolidates ownership of a key strategic asset Provides fair valuation and operational and tax synergies, balancing risk Makes efficient use of offshore cash Delivers immediate and sustainable earnings accretion Subject to Customary Regulatory Approvals

Agenda INTRODUCTION CLAUDINE PROWSE, Ph.D., VP, Investor Relations OVERVIEW GEORGE SCANGOS, Ph.D., Chief Executive Officer FINANCIAL UPDATE PAUL CLANCY, EVP, Chief Financial Officer CLOSING REMARKS GEORGE SCANGOS Q&A to include TONY KINGSLEY, EVP, Global Commercial Operations 17

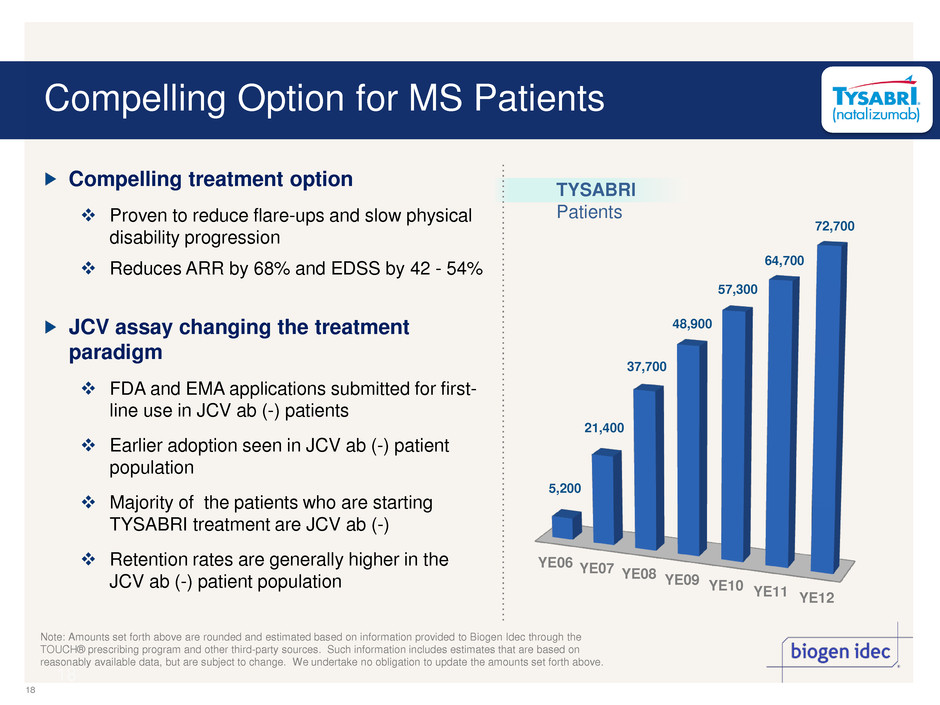

18 YE06 YE07 YE08 YE09 YE10 YE11 YE12 Compelling Option for MS Patients Note: Amounts set forth above are rounded and estimated based on information provided to Biogen Idec through the TOUCH® prescribing program and other third-party sources. Such information includes estimates that are based on reasonably available data, but are subject to change. We undertake no obligation to update the amounts set forth above. 18 5,200 21,400 37,700 48,900 57,300 64,700 72,700 TYSABRI Patients Compelling treatment option Proven to reduce flare-ups and slow physical disability progression Reduces ARR by 68% and EDSS by 42 - 54% JCV assay changing the treatment paradigm FDA and EMA applications submitted for first- line use in JCV ab (-) patients Earlier adoption seen in JCV ab (-) patient population Majority of the patients who are starting TYSABRI treatment are JCV ab (-) Retention rates are generally higher in the JCV ab (-) patient population

Secondary Progressive MS Opportunity SPMS is a large portion of the MS market: ~35% No effective therapies for SPMS Consistent trends towards improved ambulation in patients with SPMS seen in two prior TYSABRI trials An investigation of whether TYSABRI treatment slows the accumulation of disability not related to relapses in patients with SPMS Primary endpoint: the proportion of subjects experiencing confirmed progression of disability as measured by a composite endpoint SPA with accepted regulatory endpoint Data readout expected 2015 ASCEND TRIAL OVERVIEW 19

Summary 20 20 BIIB purchases full ownership of important therapy with positive share and revenue growth trajectory as well as expanding margins Enables operational simplicity that will allow for more nimble and focused execution Offers fair valuation with significant potential operational and tax synergies Eliminates change of control restrictions Immediately and sustainably accretive to earnings

TITLE OF PRESENTATION BIOGEN IDEC QUESTIONS & ANSWERS QUESTIONS AND ANSWERS

Appendix: P&L 22 22 Example Based on $200 of End-Market Sales: $100 in the U.S. and $100 ex-U.S. Before After US Ex-US Worldwide BIIB BIIB BIIB Revenue 48 100 Revenue 200 Product COGS 6 6 Product COGS 12 Royalty COGS - - Royalty COGS 20 Contingent Payment (Royalty COGS) X Gross Margin 42 94 Gross Margin 168-X Operating Expense 17 34 Operating Expense 68 Collaboration Profit Share - 35 Collaboration Profit Share - PBT 25 25 PBT 100-X Note: hypothetical example; figures reflect neither actual results nor actual product margins