Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Symetra Financial CORP | d477623d8k.htm |

February 5, 2013

Fourth Quarter 2012 Review

and 2013 Outlook

Exhibit 99.1 |

Forward-Looking Statements

›

the

effects

of

fluctuations

in

interest

rates

and

a

prolonged

low

interest

rate

environment;

›

general economic, market or business conditions, including further economic

downturns or other adverse conditions in the global and domestic capital and

credit markets; ›

the effects of changes in monetary and fiscal policy;

›

the

effects

of

changes

in

government

programs

to

stimulate

mortgage

refinancing

and

significant

increases

in

corporate

refinance

activity;

›

the performance of our investment portfolio;

›

the

continued

availability

of

quality

commercial

mortgage

loan

investments

and

our

continued

capacity

to

invest

in

commercial

mortgage

loans;

›

our ability to successfully execute on our strategies;

›

recorded reserves for future policy benefits and claims subsequently proving to be

inadequate or inaccurate; ›

deviations

from

assumptions

used

in

setting

prices

for

insurance

and

annuity

products

or

establishing

cash

flow

testing

reserves;

›

continued viability of certain products under various economic, regulatory and

other conditions; ›

market pricing and competitive trends related to insurance products and

services; ›

changes

in

amortization

of

deferred

policy

acquisition

costs

and

deferred

sales

inducements;

›

financial strength or credit ratings changes;

›

the availability and cost of capital and financing;

›

the continued availability and cost of reinsurance coverage;

›

changes in laws or regulations, or their interpretation, including those which

could increase Symetra's business costs, reserve levels and required capital

levels; ›

the ability of subsidiaries to pay dividends to Symetra;

›

the effects of implementation of the Patient Protection and Affordable Care

Act; ›

our ability to implement effective and sufficient risk management policies and

procedures, including hedging strategies; ›

the initiation of legal or regulatory investigations against us and the results of

any legal or regulatory proceedings; ›

the effects of implementation of the Dodd-Frank Wall Street Reform and Consumer

Protection Act of 2010; and ›

the

risks

that

are

described

from

time

to

time

in

Symetra's

filings

with

the

Securities

and

Exchange

Commission,

including

those

in

Symetra's

2011

Annual Report on Form 10-K and 2012 Quarterly Reports on Form 10-Q.

2

Statements made in the following presentation that relate to anticipated financial performance or

business operations, business services and product prospects and plans, reinvestment

opportunities, changes in the amount of cash flow testing reserves, regulatory developments,

accounting standard changes and similar matters may be considered “forward-looking

statements” within the meaning of Section 27A of the Securities Act of 1933 and Section

21E of the Securities Exchange Act of 1934. All statements, other than statements of current or historical

facts, are forward-looking statements. Forward-looking statements are subject to a number of

risks, uncertainties and contingencies that may cause the operations, performance, development

and results of our business to differ materially from those suggested by such statements.

Consequently, all of the forward-looking statements made in this presentation are qualified by these cautionary statements. The

information contained in this presentation speaks as of February 5, 2013. Symetra undertakes no

obligation to update any such forward- looking statements, whether as a result of new

information, future events or otherwise. Historical results are not necessarily indicative of

future results. Future results, including our financial performance, business operations and trends in

our business and industry, are subject to significant risks and uncertainties, including

without limitation the following: |

2012: Year in Review

3

›

Improved capabilities across the company

›

Benefits –

built out Group Life & Disability Income (DI) business

›

Retirement –

expanded bank channel distribution for Edge Pro Fixed Indexed

Annuity; built True Variable Annuity (VA) product

›

Individual Life –

enhanced product and distribution capabilities

›

But missed on sales targets for new products (True VA, Classic Universal Life (UL),

Group Life & DI)

›

Solid performance in core business lines

›

Medical stop-loss: strong sales, loss ratio consistent with

long-term target range ›

Deferred fixed annuities: sales down (consistent with industry trend), but

maintained strong relationships with bank distribution partners; held

interest spreads stable despite challenging interest rate environment

›

Maintained underwriting and pricing discipline

We’re well positioned to leverage the investments made in 2012

and drive improved sales results in 2013 |

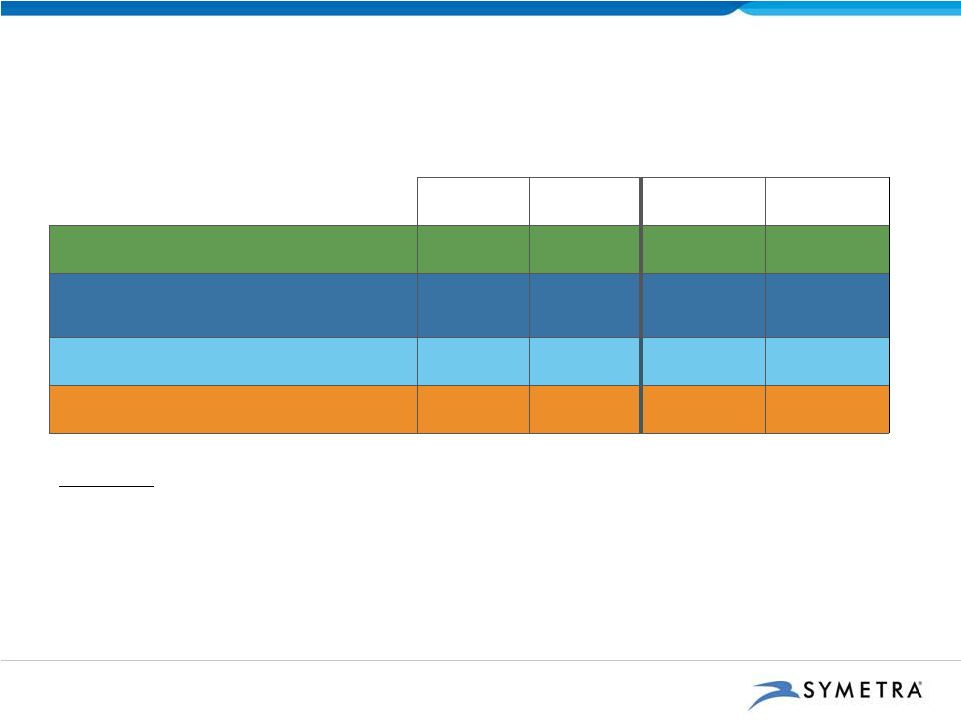

Financial Results

4

Twelve Months

Ended Dec. 31

2012

2011

Return on Equity (ROE)

6.1%

7.2%

Operating Return on Average Equity (ROAE)

8.5%

9.5%

4Q12

4Q11

2012

2011

Net Income

$ 31.0

$ 73.7

$ 205.4

$ 195.8

Less: Net realized investment gains

(losses)

1

(2.6)

22.2

20.2

4.7

Add: Net realized gains (losses) –

FIA

1, 2

(0.7)

(0.4)

0.1

(0.9)

Adjusted Operating Income

3

$ 32.9

$ 51.1

$ 185.3

$ 190.2

Historical financial information has been restated to reflect retrospective

adoption of a new accounting standard for deferred acquisition costs on Jan. 1, 2012.

1

Net of taxes.

Fixed indexed annuity.

A non-GAAP financial measure. See Appendix for a definition of

this measure and a reconciliation to the most directly comparable GAAP

measure. $ in millions

2

3

3 |

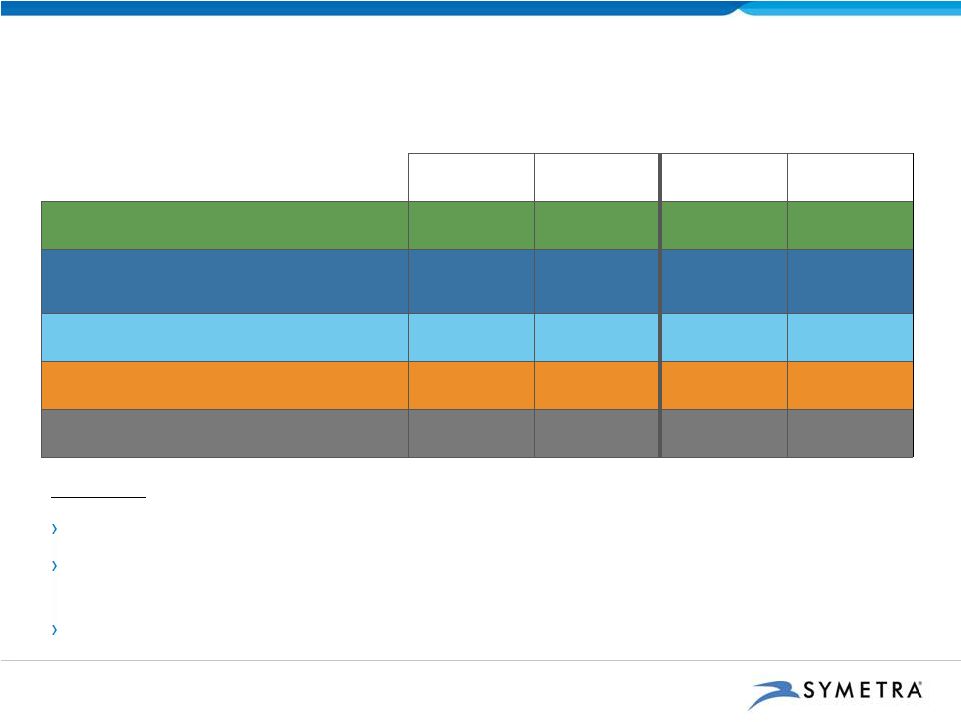

5

Benefits Segment

29% of 2012 Pretax Adjusted Operating Income

1

Priorities:

›

Maintain leadership position in medical stop-loss market, while achieving loss

ratio

in

line

with

long-term

target

range

of

63%

-

65%

›

Drive growth in group life & DI premium

$ in millions

1

Total pretax adjusted operating income includes Other segment loss. A

non-GAAP financial measure. See Appendix for a definition of this

measure and a reconciliation to the most directly comparable GAAP measure.

2

Total revenue excluding net realized investment gains (losses).

4Q12

4Q11

2012

2011

Operating

Revenues

$ 153.7

$ 148.7

$ 601.6

$ 533.3

Pretax Adjusted Operating

Income

$ 12.4

$ 24.2

$ 70.5

$ 79.1

Loss Ratio

67.7%

59.6%

65.1%

63.1%

Total Sales

$ 25.7

$ 26.5

$ 159.3

$ 118.7

2 |

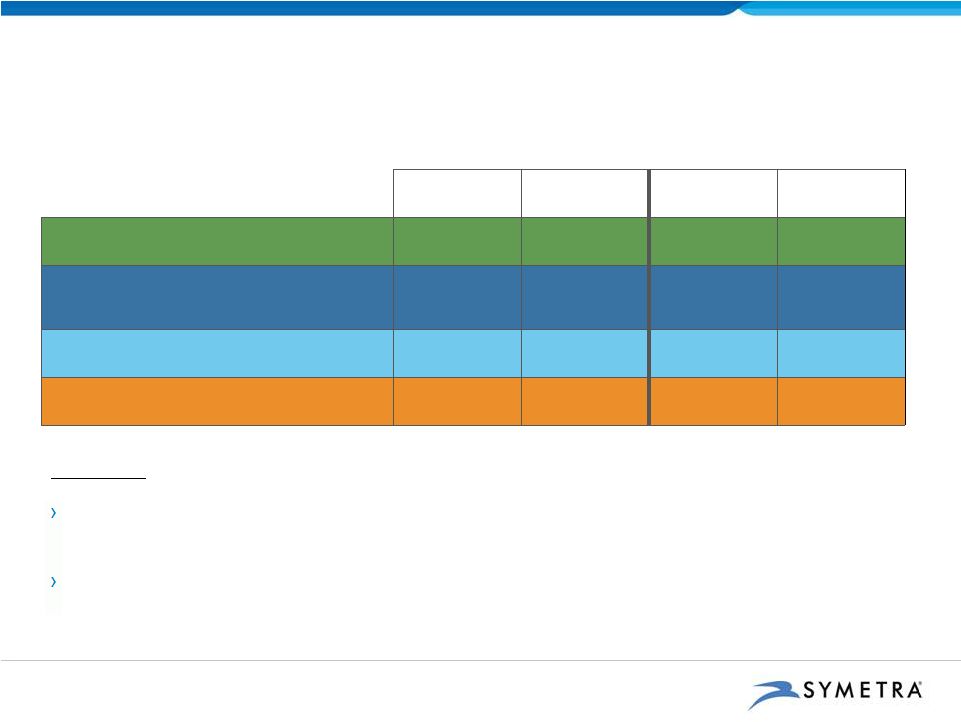

Deferred Annuities Segment

43% of 2012 Pretax Adjusted Operating Income

1

Priorities:

Maintain solid interest spread on fixed annuities

Maintain sales of fixed annuities and expand sales of fixed indexed annuities (FIA)

through banks and broker-dealers

Continue to enhance FIA and VA product line up

$ in millions

1

Total pretax adjusted operating income includes Other segment loss. A

non-GAAP financial measure. See Appendix for

a

definition

of

this

measure

and

a

reconciliation

to

the

most

directly

comparable

GAAP

measure.

2

Total

revenue

excluding

net

realized

investment

gains

(losses)

and

including

net

realized

gains

(losses)

–

FIA.

3

Excludes

impact

of

asset prepayments, mortgage-backed securities prepayment speed adjustments and

deferred sales inducement unlocking. 4Q12

4Q11

2012

2011

Operating

Revenues

2

$ 146.4

$ 147.5

$ 568.0

$ 546.5

Pretax Adjusted Operating

Income

$ 29.1

$ 27.5

$ 102.7

$ 95.8

Base

Interest

Spread

3

1.78%

1.81%

1.83%

1.82%

Total Sales

$ 300.8

$ 356.8

$ 1,146.6

$ 1,815.3

Ending Account Values

$11,786.7

$11,326.9

6 |

Income Annuities Segment

19% of 2012 Pretax Adjusted Operating Income

1

Priorities:

Continue

to

stabilize

the

profitability

of

existing

block

in

low

interest

rate

environment with commercial mortgage loan origination strategy

Focus sales effort on shorter duration retail opportunities (structured settlement

sales discontinued in 4Q12)

4Q12

4Q11

2012

2011

Operating

Revenues

$ 102.3

$ 104.5

$ 416.7

$ 414.9

Pretax Adjusted Operating

Income

$ 5.1

$ 6.5

$ 45.0

$ 35.1

Base

Interest

Spread

0.45%

0.53%

0.51%

0.50%

Total Sales

$ 57.6

$ 54.1

$ 258.2

$ 221.9

7

1

Total pretax adjusted operating income includes Other segment loss. A

non-GAAP financial measure. See Appendix for a definition of this

measure and a reconciliation to the most directly comparable GAAP measure.

2

Total revenue excluding net realized investment gains (losses).

3

Excludes impact of asset prepayments and mortgage-backed securities prepayment

speed adjustments. $ in millions

3

2 |

Individual Life Segment

20%

of

2012

Pretax

Adjusted

Operating

Income

1

Priorities:

›

Drive sales of Classic UL and Classic UL with Lapse Protection Benefit rider

›

Drive sales of variable COLI (corporate-owned life insurance) product

4Q12

4Q11

2012

2011

Operating

Revenues

2

$ 110.8

$ 116.7

$ 450.2

$ 452.0

Pretax Adjusted Operating

Income

$ 5.5

$ 18.1

$ 47.0

$ 65.3

BOLI Base ROA

3

0.66%

0.98%

0.88%

0.98%

Individual Sales

$ 1.3

$ 3.1

$ 9.1

$ 11.7

BOLI / COLI Sales

$ --

$ --

$ 2.0

$ --

8

1

Total pretax adjusted operating income includes Other segment loss. A non-GAAP

financial measure. See Appendix for

a

definition

of

this

measure

and

a

reconciliation

to

the

most

directly

comparable

GAAP

measure.

2

Total

revenue

excluding

net

realized

investment

gains

(losses)

.

3

Excludes

impact

of

asset

prepayments,

mortgage-backed

securities

prepayment speed adjustments and deferred sales inducement unlocking.

$ in millions |

9

Estimated

2013

Operating

EPS

1

range:

$1.30-$1.50

1

Denotes

a

non-GAAP

financial

measure

also

referred

to

as

“adjusted

operating

income

per

common

share

–

diluted.”

See Appendix for definition.

Operating EPS Guidance for 2013

Year-over-year sales growth for new product lines

Expenses flat relative to full year 2012 Low

interest rate environment, holding rates at current levels through 2013

Benefits loss ratio at higher end of long-term target range (63%-65%)

Continued abundance of attractively priced commercial mortgage loans

Mortality experience in line with historical experience (~ neutral) Continued favorable effective tax rate

Assumptions for 2013: |

Prolonged Path to ROE Improvement

›

Challenging interest rate environment lengthens our path

›

Steps we’re taking to drive improvement, over time:

›

Profitable growth

›

Accretive acquisitions

›

Share repurchases, dividends

10 |

2013: Leveraging Investments Made in 2012

›

Focus on driving sales results, while maintaining our discipline

›

Solid sales expected in 2013 for core business lines:

›

Medical stop-loss

›

Fixed deferred annuities

›

Year-over-year growth expected in 2013 for newer products:

›

Group life & DI

›

Fixed indexed annuities

›

True VA

›

Classic UL

›

Variable COLI

11 |

Appendix

12 |

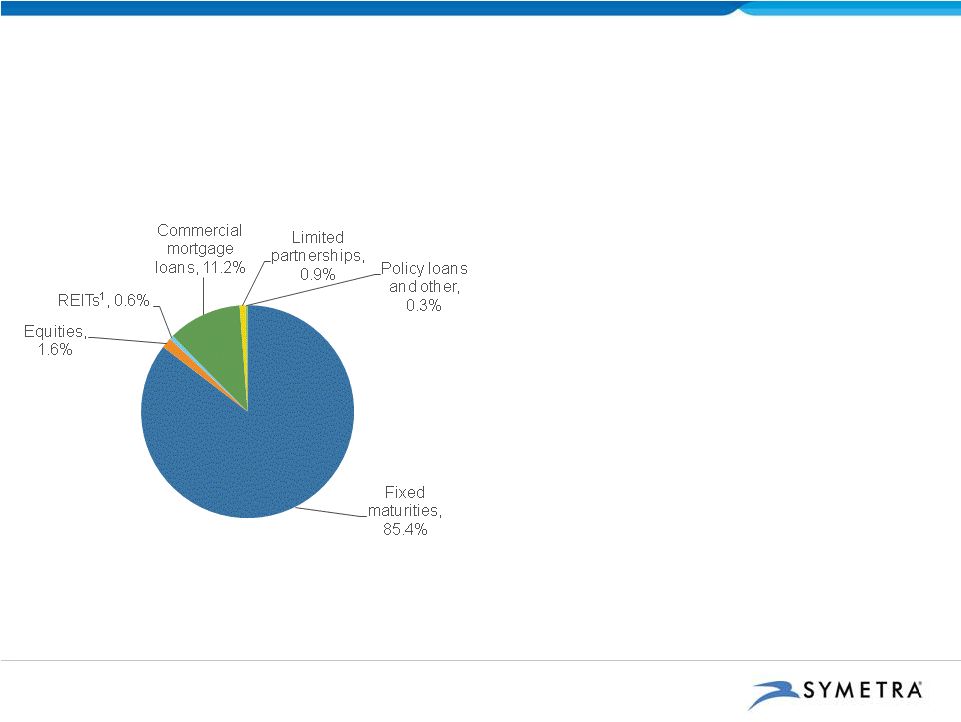

$27.6 billion

Portfolio Composition

As of 12/31/12

13

High-Quality Investment Portfolio

1

Included in trading marketable equity securities.

2

From

inception

of

Symetra

equity

portfolio

in

January

2005

and

Symetra

REIT

portfolio

in

April

2011.

3

FTSE NAREIT All Equity REITs Index.

›

Pretax impairments of $3.8M in 4Q12 vs $5.5M in 4Q11

›

AOCI of $1,371.2M at 12/31/12 vs $1,027.3M at 12/31/11

›

RMBS of $3.0B

›

Gross premium of $53.4M

›

Gross discount of $62.3M

›

Average mortgage loan rate of 5.2%

›

Outstanding long-term equity portfolio performance:

Life-to-date annualized total return of 9.5% (vs

4.2% for S&P 500 Total Return Index)

›

Life-to-date annualized total return for REITs of

9.2% vs benchmark

total return of 9.4%

›

European exposure of $1.6B

›

$0.7M of sovereign

›

$191.1M of financials

›

Largest holding = $125.0M of Deutsche Telekom

›

Commercial mortgage loans offer attractive yields:

4Q12 originations funded at 313 bps spread over

Treasury securities

2

3

2 |

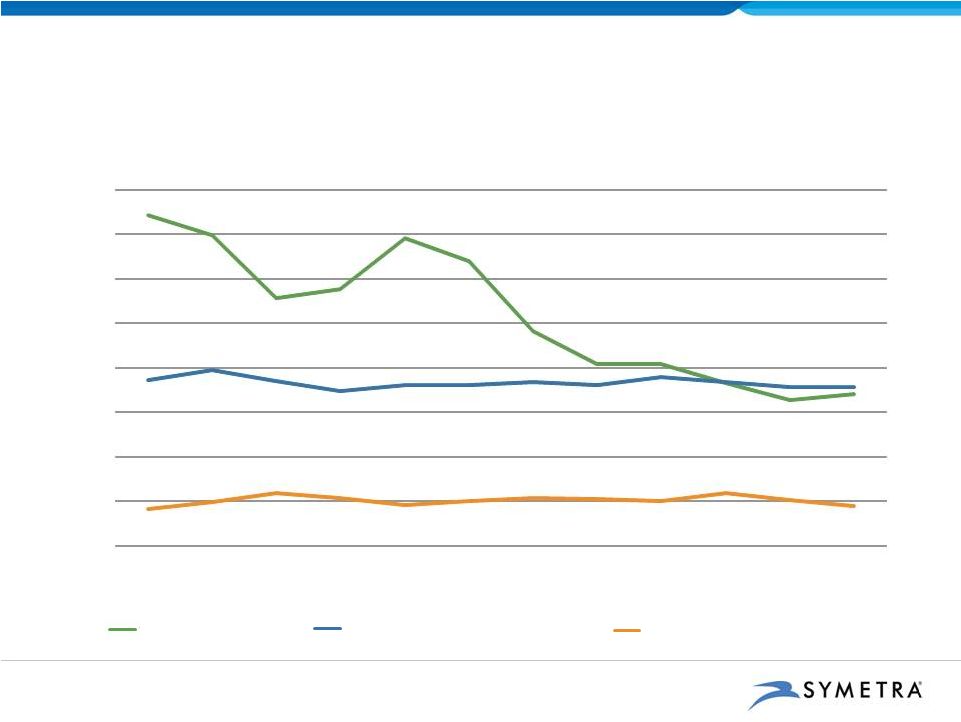

(Percent)

14

Effective Asset-Liability Management

-

0.50

1.00

1.50

2.00

2.50

3.00

3.50

4.00

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

10-Yr Treasury Rate

Deferred Annuities -

Base Spread

Income Annuities -

Base Spread

Holding annuity interest spreads stable in a challenging rate environment

|

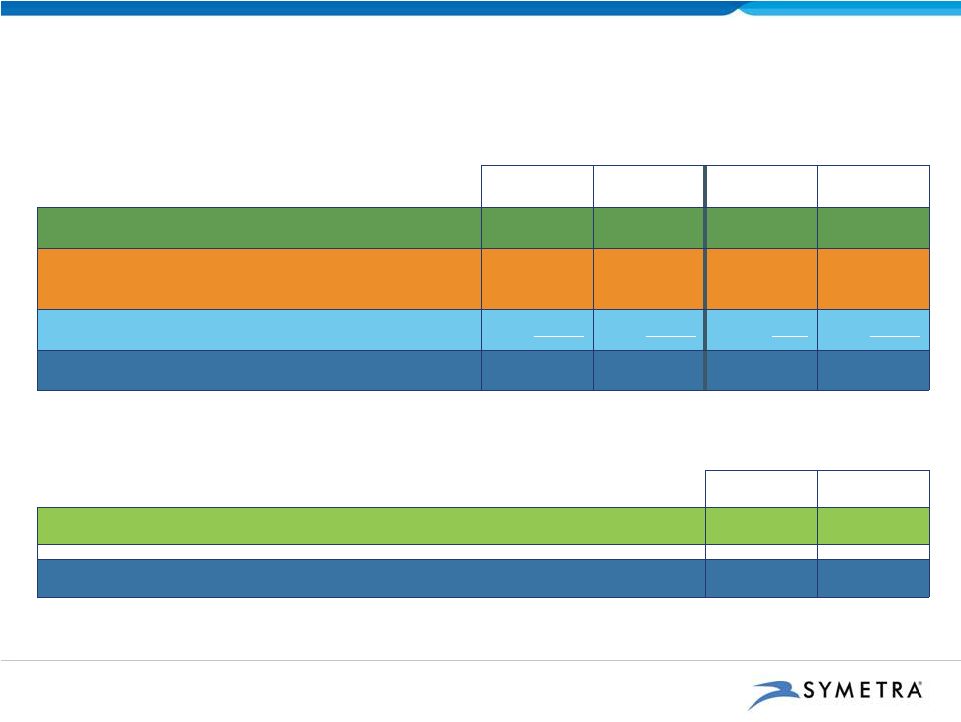

15

›

Reinvestment risk is relatively small due to:

›

Effective ALM program (matching asset and liability cash flows)

›

Flexibility from rate resetting capabilities (except in Income Annuities

segment) ›

Attractive investment opportunity in commercial mortgage loan originations

›

Our estimates could be affected by changes in monetary policy, government programs

to stimulate mortgage refinancing and significant increases in corporate

refinance activity Estimated Amount of

Reinvestment

(2013 –

2015)

Risk Management Tools

Surplus

~ $250 / year

CML

Deferred Annuity

< $50 / year

Rate resets

Income Annuity

< $50 / year

CML

BOLI

~ $400 / year

CML, rate resets,

other product levers

Prolonged Low Interest Rate Environment

Minimal Reinvestment Risk

$ in millions |

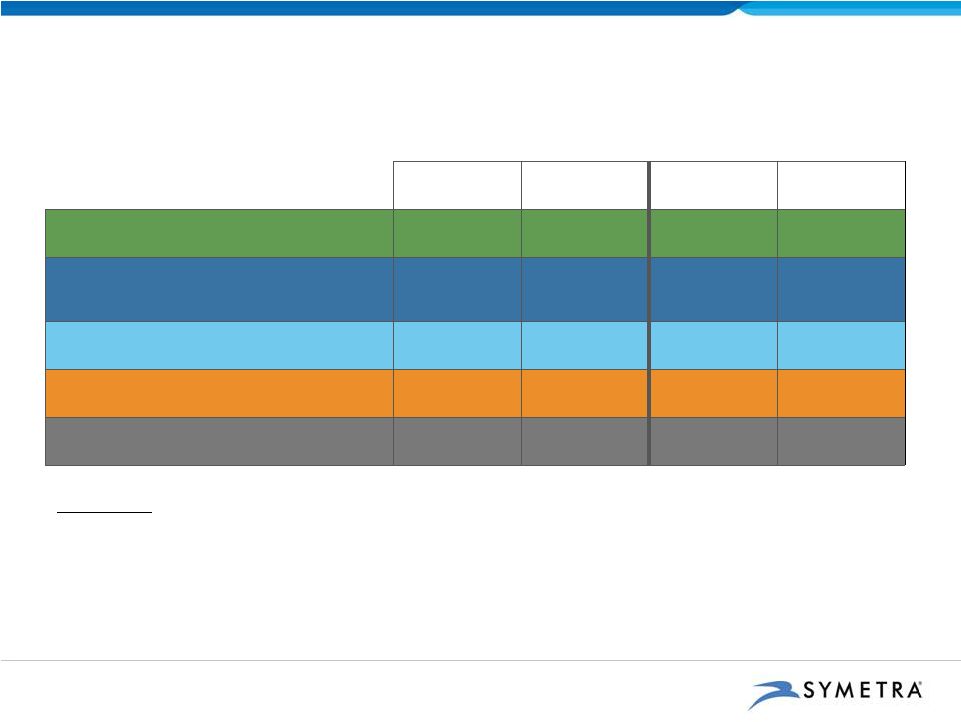

Reconciliation of Non-GAAP Measures

16

Three Months

Ended Dec. 31

Twelve Months

Ended Dec. 31

2012

2011

2012

2011

Net income

$ 31.0

$ 73.7

$ 205.4

$ 195.8

Less: Net realized investment gains (losses) (net of taxes)

(2.6)

22.2

20.2

4.7

Add:

Net

realized

gains

(losses)

–

FIA

(net

of

taxes)

(0.7)

(0.4)

0.1

(0.9)

Adjusted operating income

1

$ 32.9

$ 51.1

$ 185.3

$ 190.2

Twelve Months

Ended Dec. 31

2012

2011

Return on equity (ROE)

6.1%

7.2%

Net income

$ 205.4

$ 195.8

Average book value

3,383.9

2,710.2

Operating

return

on

average

equity

(ROAE)

1

8.5%

9.5%

Adjusted operating income

1

$ 185.3

$ 190.2

Average adjusted book value

1

2,185.7

2,002.4

1

Denotes a non-GAAP measure. See slide 18 for definition.

$ in millions |

Reconciliation of Non-GAAP Measures (cont.)

17

Three Months

Ended Dec. 31

Twelve Months

Ended Dec. 31

2012

2011

2012

2011

Segment pretax adjusted operating income (loss):

Benefits

$ 12.4

$ 24.2

$ 70.5

$ 79.1

Deferred Annuities

29.1

27.5

102.7

95.8

Income Annuities

5.1

6.5

45.0

35.1

Individual Life

5.5

18.1

47.0

65.3

Other

(5.3)

(5.2)

(26.1)

(10.7)

Pretax adjusted operating income

1

46.8

71.1

239.1

264.6

Add:

Net

realized

investment

gains

(losses)

–

excluding

FIA

(2.9)

34.8

31.0

8.6

Income from operations before income taxes

$ 43.9

$ 105.9

$ 270.1

$ 273.2

$ in millions

1

Denotes a non-GAAP measure. See slide 18 for definition.

|

Non-GAAP Measures

18

Adjusted Operating Income and Pre-tax Operating Income

Adjusted operating income consists of net income, less after-tax net realized

investment gains (losses), plus after-tax

net

investment

gains

(losses)

on

FIA.

Net

income

is

the

most

directly

comparable

GAAP

measure

to

adjusted operating income.

Pre-tax

adjusted

operating

income

is

adjusted

operating

income

on

a

pre-tax

basis.

It

also

represents the

cumulative total of segment pre-tax adjusted operating income, which at the

segment level is a GAAP measure. Income from operations before income taxes

is the most directly comparable GAAP measure to pre-tax adjusted

operating income. Pre-tax adjusted operating income excludes pre-tax net

realized investment gains (losses), except pre-tax net realized

investment gains (losses) on FIA. Adjusted Operating Income per Common Share

– Diluted, or Operating EPS

Adjusted

operating

income

per

common

share

—

diluted

consists

of

adjusted

operating

income

divided

by

the

GAAP-basis

weighted

average

diluted

shares

outstanding.

Net

income

per

common

share

—

diluted

is

the

most directly comparable GAAP measures.

Adjusted Book Value

Adjusted

book

value

consists

of

stockholders’

equity,

less

AOCI.

Stockholders’

equity

is

the

most

directly

comparable GAAP measure to adjusted book value. AOCI, which is primarily composed

of the net unrealized gains (losses)

on

our

fixed

maturities,

net

of

taxes,

is

a

component

of

stockholders’

equity.

Operating Return on Average Equity, or Operating ROAE

Operating return on average equity, or operating ROAE, consists of adjusted

operating income for the most recent four quarters, divided by average

adjusted book value, both of which are non-GAAP measures as described

above. We measure average adjusted book value by averaging adjusted book value for

the most recent five quarters. Return on stockholders’

equity, or ROE, is the most directly comparable GAAP measure. Return on

stockholders’

equity for the most recent four quarters is calculated as net income for such

period divided by the average stockholders’

equity for the most recent five quarters. |

Symetra®

and

the

Symetra

logo

are

registered

service

marks

of

Symetra

Life

Insurance

Company,

777

108

th

Ave

NE,

Suite

1200,

Bellevue,

WA

98004. |