Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Delek US Holdings, Inc. | a8kinvestorpresentation2-5.htm |

Investor Presentation February 2013

Safe Harbor Provision 2 Delek US Holdings is traded on the New York Stock Exchange in the United States under the symbol “DK” and, as such, is governed by the rules and regulations of the United States Securities and Exchange Commission. This presentation may contain forward-looking statements that are based upon current expectations and involve a number of risks and uncertainties. Statements concerning our current estimates, expectations and projections about our future results, performance, prospects and opportunities and other statements, concerns, or matters that are not historical facts are “forward-looking statements,” as that term is defined under United States securities laws. Investors are cautioned that the following important factors, among others, may affect these forward-looking statements. These factors include but are not limited to: risks and uncertainties with the respect to the quantities and costs of crude oil, the costs to acquire feedstocks and the price of the refined petroleum products we ultimately sell; management's ability to execute its strategy through acquisitions and transactional risks in acquisitions; our competitive position and the effects of competition; the projected growth of the industry in which we operate; changes in the scope, costs, and/or timing of capital projects; losses from derivative instruments; general economic and business conditions, particularly levels of spending relating to travel and tourism or conditions affecting the southeastern United States; potential conflicts of interest between our majority stockholder and other stockholders; and other risks contained in our filings with the United States Securities and Exchange Commission. Forward-looking statements should not be read as a guarantee of future performance or results and will not be accurate indications of the times at, or by which such performance or results will be achieved. Forward-looking information is based on information available at the time and/or management’s good faith belief with respect to future events, and is subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in the statements. Delek US undertakes no obligation to update or revise any such forward-looking statements.

3 High Return “Quick Hit” Capital Projects Completed Unlocked Value of Logistics Assets Significant Retail Presence Focused on Returns to Shareholders Net Cash Position Improving Crude Slate Increasing Value Across the Company

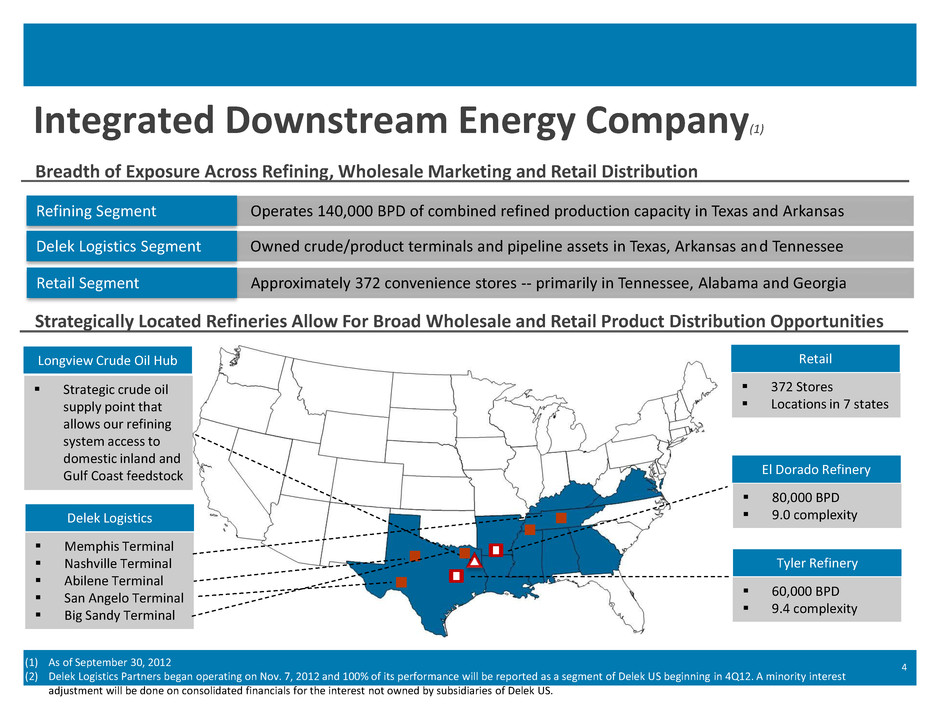

Integrated Downstream Energy Company(1) Breadth of Exposure Across Refining, Wholesale Marketing and Retail Distribution Operates 140,000 BPD of combined refined production capacity in Texas and Arkansas Refining Segment ) Owned crude/product terminals and pipeline assets in Texas, Arkansas and Tennessee Delek Logistics Segment Approximately 372 convenience stores -- primarily in Tennessee, Alabama and Georgia Retail Segment 4 60,000 BPD 9.4 complexity (1) As of September 30, 2012 (2) Delek Logistics Partners began operating on Nov. 7, 2012 and 100% of its performance will be reported as a segment of Delek US beginning in 4Q12. A minority interest adjustment will be done on consolidated financials for the interest not owned by subsidiaries of Delek US. Tyler Refinery 80,000 BPD 9.0 complexity El Dorado Refinery Strategically Located Refineries Allow For Broad Wholesale and Retail Product Distribution Opportunities Longview Crude Oil Hub Strategic crude oil supply point that allows our refining system access to domestic inland and Gulf Coast feedstock 372 Stores Locations in 7 states Retail Delek Logistics Memphis Terminal Nashville Terminal Abilene Terminal San Angelo Terminal Big Sandy Terminal

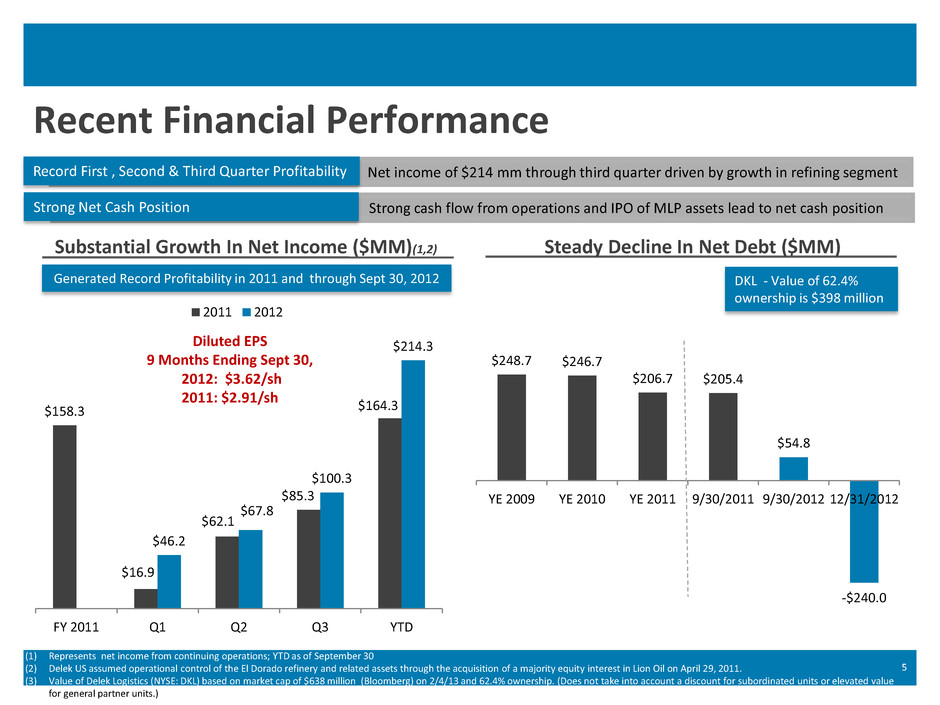

$158.3 $16.9 $62.1 $85.3 $164.3 $46.2 $67.8 $100.3 $214.3 FY 2011 Q1 Q2 Q3 YTD 2011 2012 Recent Financial Performance 5 (1) Represents net income from continuing operations; YTD as of September 30 (2) Delek US assumed operational control of the El Dorado refinery and related assets through the acquisition of a majority equity interest in Lion Oil on April 29, 2011. (3) Value of Delek Logistics (NYSE: DKL) based on market cap of $638 million (Bloomberg) on 2/4/13 and 62.4% ownership. (Does not take into account a discount for subordinated units or elevated value for general partner units.) Substantial Growth In Net Income ($MM)(1,2) Steady Decline In Net Debt ($MM) $248.7 $246.7 $206.7 $205.4 $54.8 -$240.0 YE 2009 YE 2010 YE 2011 9/30/2011 9/30/2012 12/31/2012 Net income of $214 mm through third quarter driven by growth in refining segment Record First , Second & Third Quarter Profitability Strong cash flow from operations and IPO of MLP assets lead to net cash position Strong Net Cash Position Generated Record Profitability in 2011 and through Sept 30, 2012 Diluted EPS 9 Months Ending Sept 30, 2012: $3.62/sh 2011: $2.91/sh DKL - Value of 62.4% ownership is $398 million

Refining Segment Operational Update

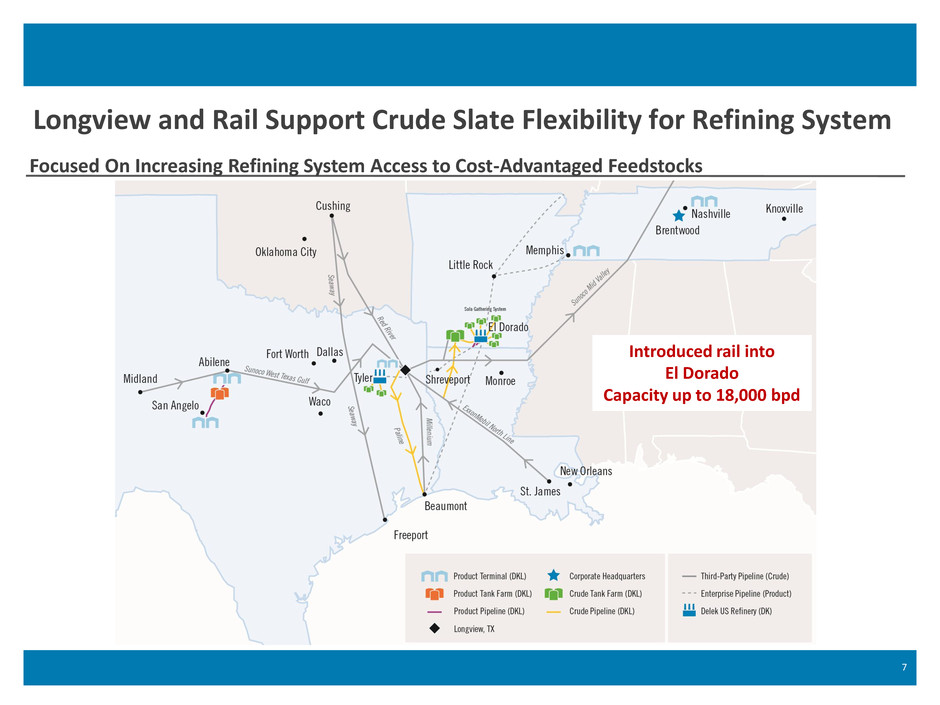

Longview and Rail Support Crude Slate Flexibility for Refining System 7 Focused On Increasing Refining System Access to Cost-Advantaged Feedstocks Introduced rail into El Dorado Capacity up to 18,000 bpd

$17.54 $23.14 $30.80 $20.34 $22.98 $23.87 $25.42 $29.96 $26.71 $26.50 $22.20 $0.00 $5.00 $10.00 $15.00 $20.00 $25.00 $30.00 $35.00 Q1 Q2 Q3 Q4 FY 2011 2012 2013 +$3.52/bbl on a y/y basis 54,407 60,032 47,452 55,317 58,461 127,784 145,878 146,190 134,017 127,097 130,346 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 Year-over-Year Improvement in Refining Economics 8 Tracking the HSD 5-3-2 Gulf Coast Crack Spread Per Barrel(2) Lion Oil Acquisition More Than Doubled Throughput Volumes (1) 60,000 bpd Tyler Refinery Only 60,000 bpd Tyler Refinery (and) 80,000 bpd El Dorado Refinery (1) Delek US operated the El Dorado refinery for 247 days in 2011, following our acquisition of majority ownership (2) Source: Platts; Q1 2013 data through January 31, 2013

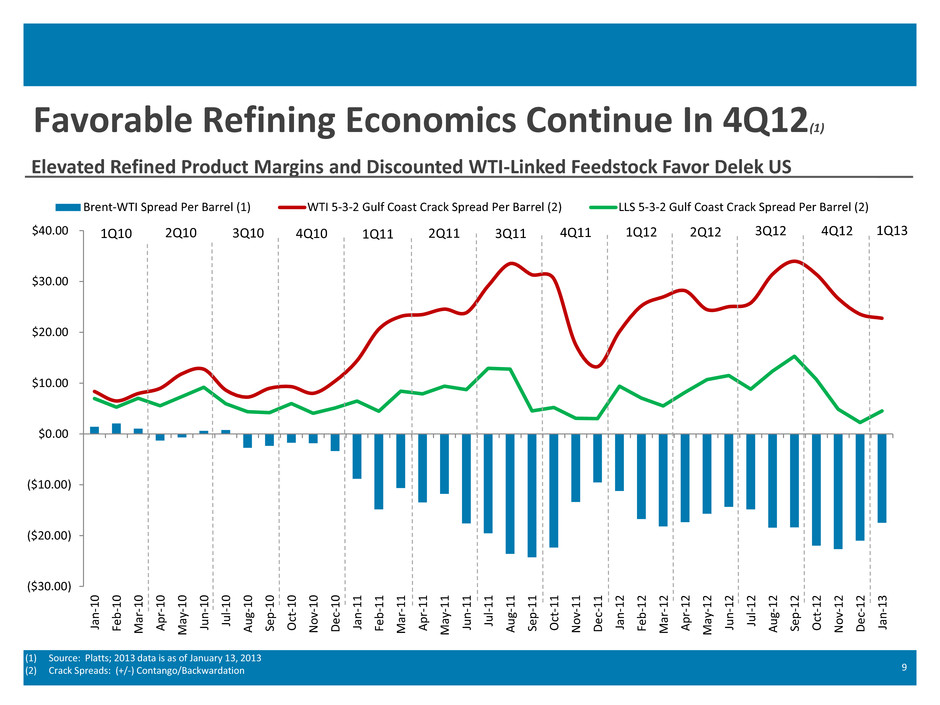

($30.00) ($20.00) ($10.00) $0.00 $10.00 $20.00 $30.00 $40.00 Ja n -1 0 Fe b -1 0 M ar -1 0 A p r- 1 0 M ay -1 0 Ju n -1 0 Ju l- 1 0 A u g- 1 0 Se p -1 0 Oct -1 0 N o v- 1 0 D e c- 1 0 Ja n -1 1 Fe b -1 1 M ar -1 1 A p r- 1 1 M ay -1 1 Ju n -1 1 Ju l- 1 1 A u g- 1 1 Se p -1 1 Oct -1 1 N o v- 1 1 D e c- 1 1 Ja n -1 2 Fe b -1 2 M ar -1 2 A p r- 1 2 M ay -1 2 Ju n -1 2 Ju l- 1 2 A u g- 1 2 Se p -1 2 Oct -1 2 N o v- 1 2 D e c- 1 2 Ja n -1 3 Brent-WTI Spread Per Barrel (1) WTI 5-3-2 Gulf Coast Crack Spread Per Barrel (2) LLS 5-3-2 Gulf Coast Crack Spread Per Barrel (2) Favorable Refining Economics Continue In 4Q12(1) 9 Elevated Refined Product Margins and Discounted WTI-Linked Feedstock Favor Delek US (1) Source: Platts; 2013 data is as of January 13, 2013 (2) Crack Spreads: (+/-) Contango/Backwardation 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13

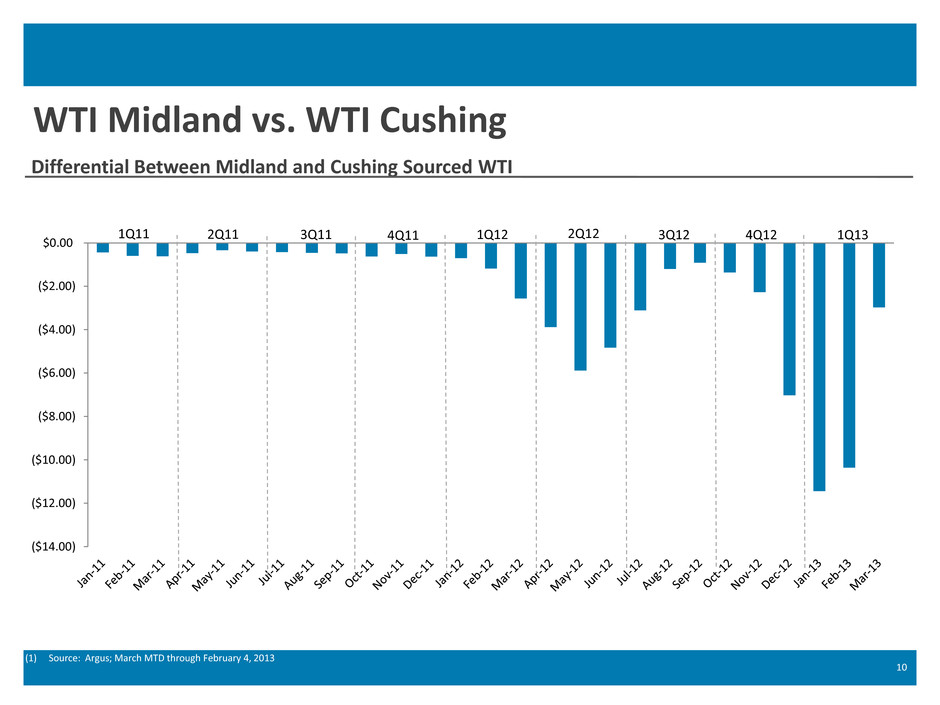

($14.00) ($12.00) ($10.00) ($8.00) ($6.00) ($4.00) ($2.00) $0.00 WTI Midland vs. WTI Cushing 10 Differential Between Midland and Cushing Sourced WTI (1) Source: Argus; March MTD through February 4, 2013 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 1Q13

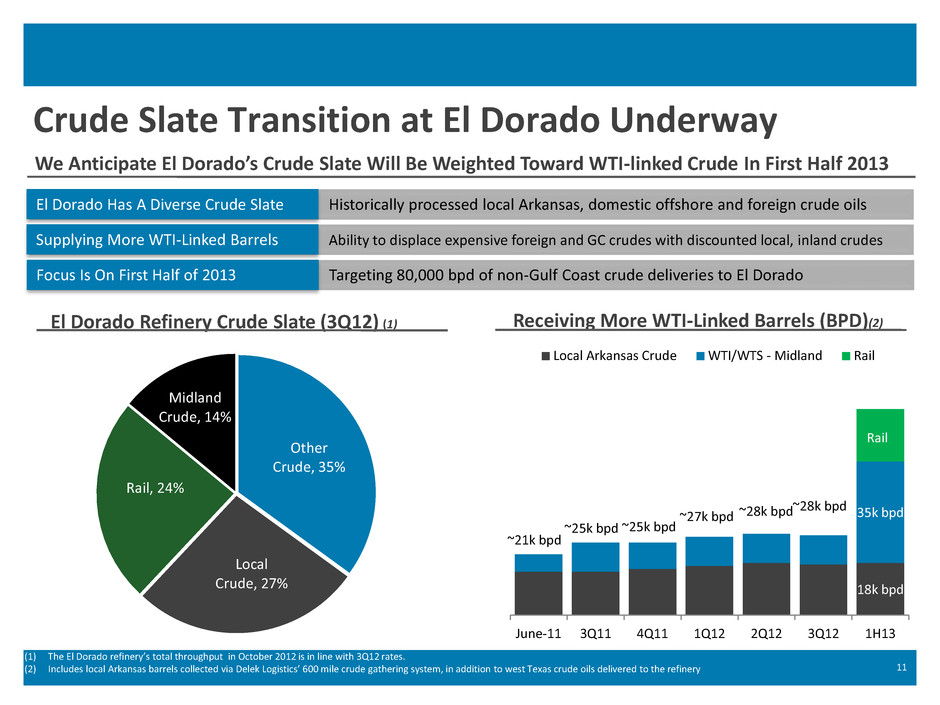

Crude Slate Transition at El Dorado Underway 11 Historically processed local Arkansas, domestic offshore and foreign crude oils El Dorado Has A Diverse Crude Slate Ability to displace expensive foreign and GC crudes with discounted local, inland crudes Supplying More WTI-Linked Barrels We Anticipate El Dorado’s Crude Slate Will Be Weighted Toward WTI-linked Crude In First Half 2013 Targeting 80,000 bpd of non-Gulf Coast crude deliveries to El Dorado Focus Is On First Half of 2013 Receiving More WTI-Linked Barrels (BPD)(2) (1) The El Dorado refinery’s total throughput in October 2012 is in line with 3Q12 rates. (2) Includes local Arkansas barrels collected via Delek Logistics’ 600 mile crude gathering system, in addition to west Texas crude oils delivered to the refinery El Dorado Refinery Crude Slate (3Q12) (1) Other Crude, 35% Local Crude, 27% Rail, 24% Midland Crude, 14% 18k bpd 35k bpd June-11 3Q11 4Q11 1Q12 2Q12 3Q12 1H13 Local Arkansas Crude WTI/WTS - Midland Rail ~27k bpd ~28k bpd ~28k bpd ~21k bpd ~25k bpd ~25k bpd Rail

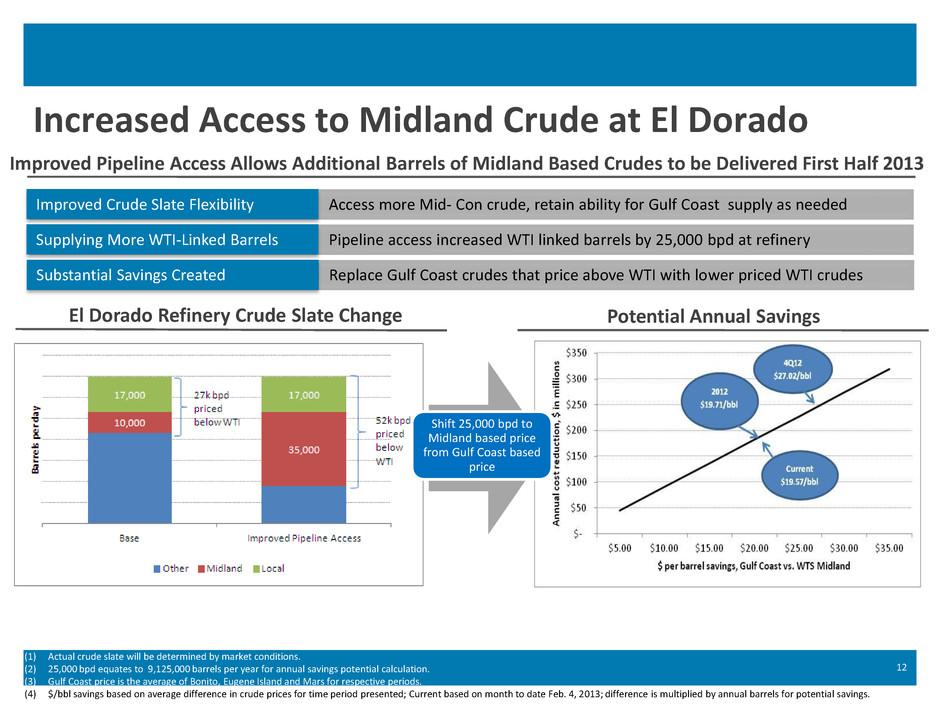

Increased Access to Midland Crude at El Dorado 12 Access more Mid- Con crude, retain ability for Gulf Coast supply as needed Improved Crude Slate Flexibility Pipeline access increased WTI linked barrels by 25,000 bpd at refinery Supplying More WTI-Linked Barrels Improved Pipeline Access Allows Additional Barrels of Midland Based Crudes to be Delivered First Half 2013 Replace Gulf Coast crudes that price above WTI with lower priced WTI crudes Substantial Savings Created Potential Annual Savings (1) Actual crude slate will be determined by market conditions. (2) 25,000 bpd equates to 9,125,000 barrels per year for annual savings potential calculation. (3) Gulf Coast price is the average of Bonito, Eugene Island and Mars for respective periods. (4) $/bbl savings based on average difference in crude prices for time period presented; Current based on month to date Feb. 4, 2013; difference is multiplied by annual barrels for potential savings. El Dorado Refinery Crude Slate Change Shift 25,000 bpd to Midland based price from Gulf Coast based price

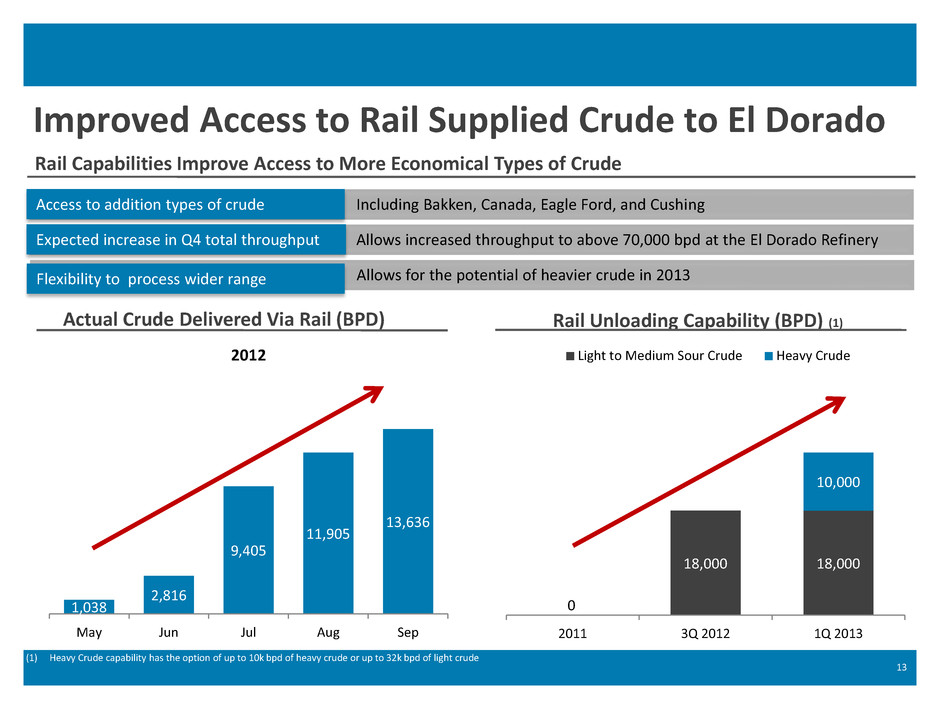

Improved Access to Rail Supplied Crude to El Dorado 13 Including Bakken, Canada, Eagle Ford, and Cushing Access to addition types of crude Allows increased throughput to above 70,000 bpd at the El Dorado Refinery Expected increase in Q4 total throughput Rail Capabilities Improve Access to More Economical Types of Crude Allows for the potential of heavier crude in 2013 Flexibility to process wider range Rail Unloading Capability (BPD) (1) Actual Crude Delivered Via Rail (BPD) 0 18,000 18,000 10,000 2011 3Q 2012 1Q 2013 Light to Medium Sour Crude Heavy Crude 1,038 2,816 9,405 11,905 13,636 May Jun Jul Aug Sep 2012 (1) Heavy Crude capability has the option of up to 10k bpd of heavy crude or up to 32k bpd of light crude

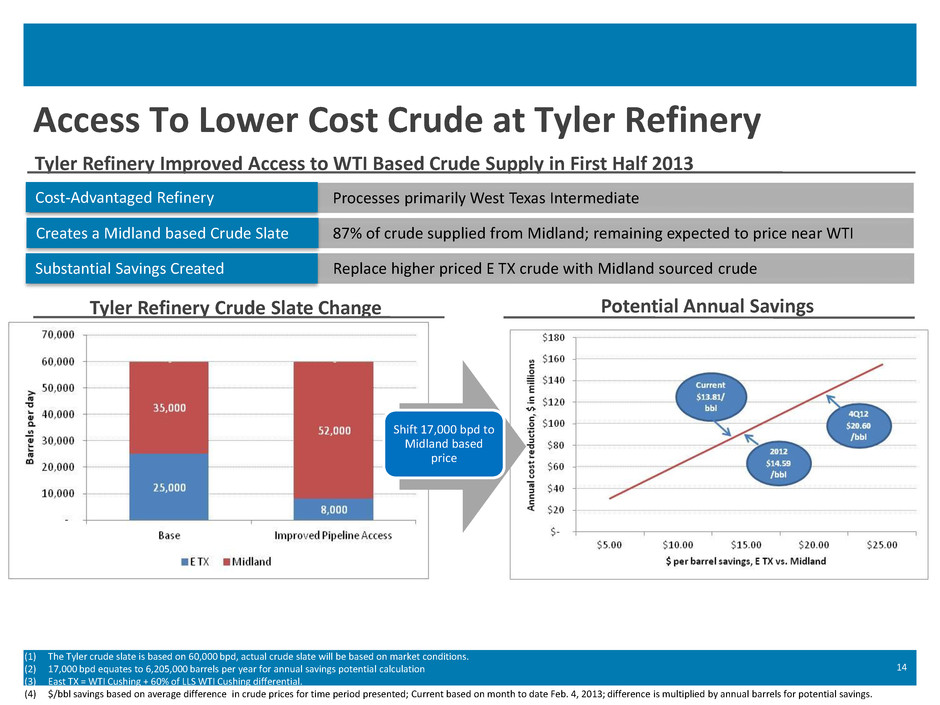

Access To Lower Cost Crude at Tyler Refinery 14 Processes primarily West Texas Intermediate 87% of crude supplied from Midland; remaining expected to price near WTI Creates a Midland based Crude Slate Tyler Refinery Improved Access to WTI Based Crude Supply in First Half 2013 Replace higher priced E TX crude with Midland sourced crude Substantial Savings Created Tyler Refinery Crude Slate Change Cost-Advantaged Refinery (1) The Tyler crude slate is based on 60,000 bpd, actual crude slate will be based on market conditions. (2) 17,000 bpd equates to 6,205,000 barrels per year for annual savings potential calculation (3) East TX = WTI Cushing + 60% of LLS WTI Cushing differential. (4) $/bbl savings based on average difference in crude prices for time period presented; Current based on month to date Feb. 4, 2013; difference is multiplied by annual barrels for potential savings. Potential Annual Savings Shift 17,000 bpd to Midland based price

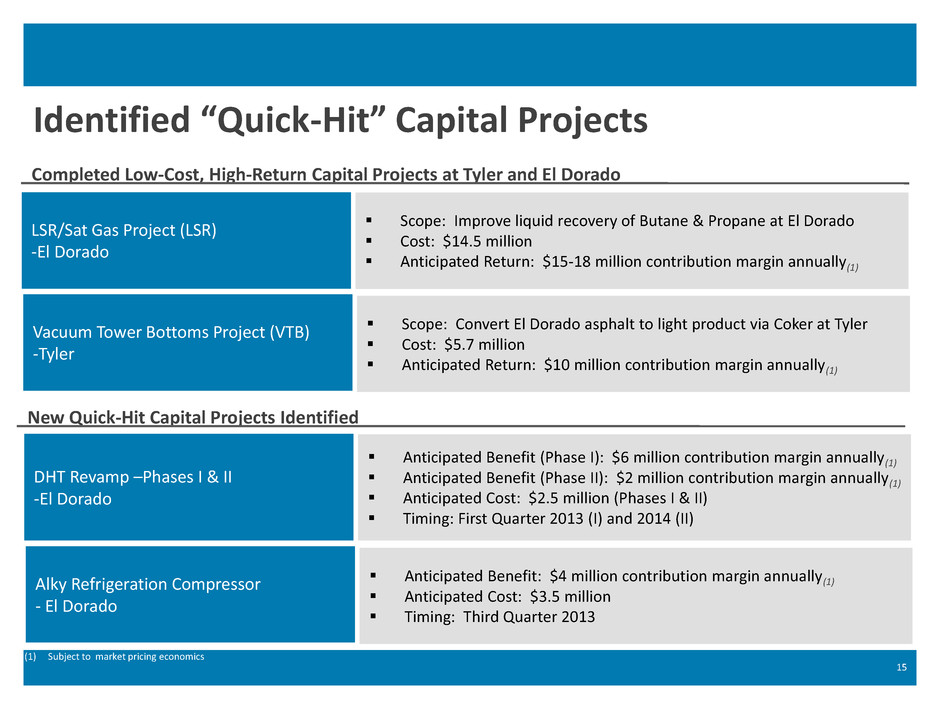

Identified “Quick-Hit” Capital Projects 15 Completed Low-Cost, High-Return Capital Projects at Tyler and El Dorado LSR/Sat Gas Project (LSR) -El Dorado Scope: Improve liquid recovery of Butane & Propane at El Dorado Cost: $14.5 million Anticipated Return: $15-18 million contribution margin annually(1) Vacuum Tower Bottoms Project (VTB) -Tyler Scope: Convert El Dorado asphalt to light product via Coker at Tyler Cost: $5.7 million Anticipated Return: $10 million contribution margin annually(1) New Quick-Hit Capital Projects Identified (1) Subject to market pricing economics DHT Revamp –Phases I & II -El Dorado Anticipated Benefit (Phase I): $6 million contribution margin annually(1) Anticipated Benefit (Phase II): $2 million contribution margin annually(1) Anticipated Cost: $2.5 million (Phases I & II) Timing: First Quarter 2013 (I) and 2014 (II) Alky Refrigeration Compressor - El Dorado Anticipated Benefit: $4 million contribution margin annually(1) Anticipated Cost: $3.5 million Timing: Third Quarter 2013

Retail Segment Operational Update

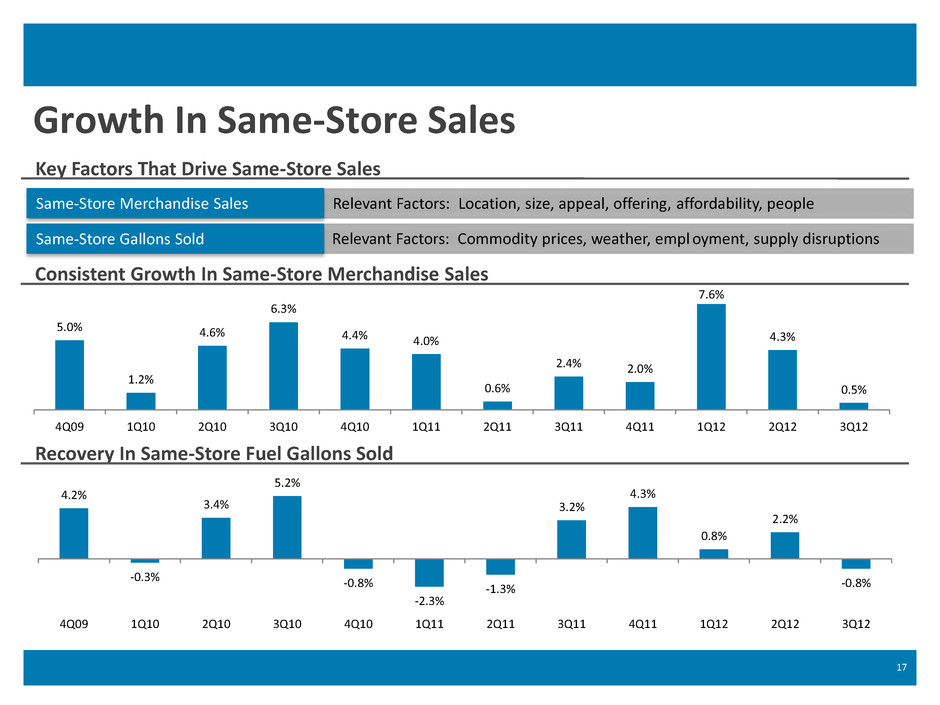

Growth In Same-Store Sales Key Factors That Drive Same-Store Sales Relevant Factors: Location, size, appeal, offering, affordability, people Same-Store Merchandise Sales ) Relevant Factors: Commodity prices, weather, empl oyment, supply disruptions Same-Store Gallons Sold 17 Consistent Growth In Same-Store Merchandise Sales Recovery In Same-Store Fuel Gallons Sold 4.2% -0.3% 3.4% 5.2% -0.8% -2.3% -1.3% 3.2% 4.3% 0.8% 2.2% -0.8% 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 5.0% 1.2% 4.6% 6.3% 4.4% 4.0% 0.6% 2.4% 2.0% 7.6% 4.3% 0.5% 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12

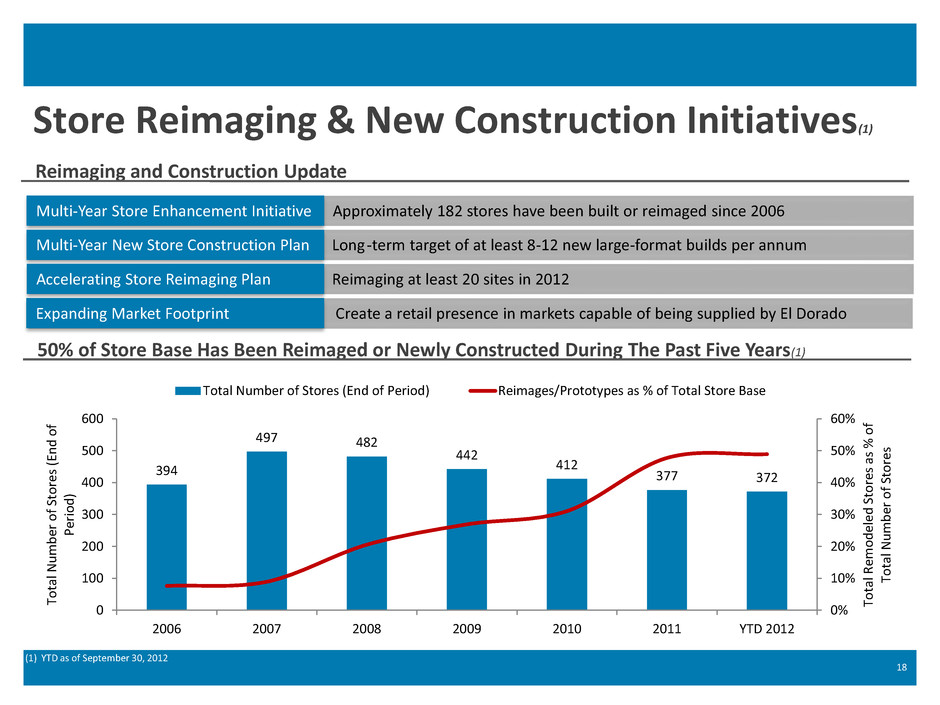

Store Reimaging & New Construction Initiatives(1) Reimaging and Construction Update Approximately 182 stores have been built or reimaged since 2006 Multi-Year Store Enhancement Initiative ) Long-term target of at least 8-12 new large-format builds per annum Multi-Year New Store Construction Plan 18 50% of Store Base Has Been Reimaged or Newly Constructed During The Past Five Years(1) Create a retail presence in markets capable of being supplied by El Dorado Expanding Market Footprint (1) YTD as of September 30, 2012 ) Reimaging at least 20 sites in 2012 Accelerating Store Reimaging Plan 394 497 482 442 412 377 372 0% 10% 20% 30% 40% 50% 60% 0 100 200 300 400 500 600 2006 2007 2008 2009 2010 2011 YTD 2012 To tal Re m o d eled St o res as % o f To tal N u m b er o f St o re s To tal N u m b er o f St o res (En d o f P er io d ) Total Number of Stores (End of Period) Reimages/Prototypes as % of Total Store Base

Marketing Segment Operational Update

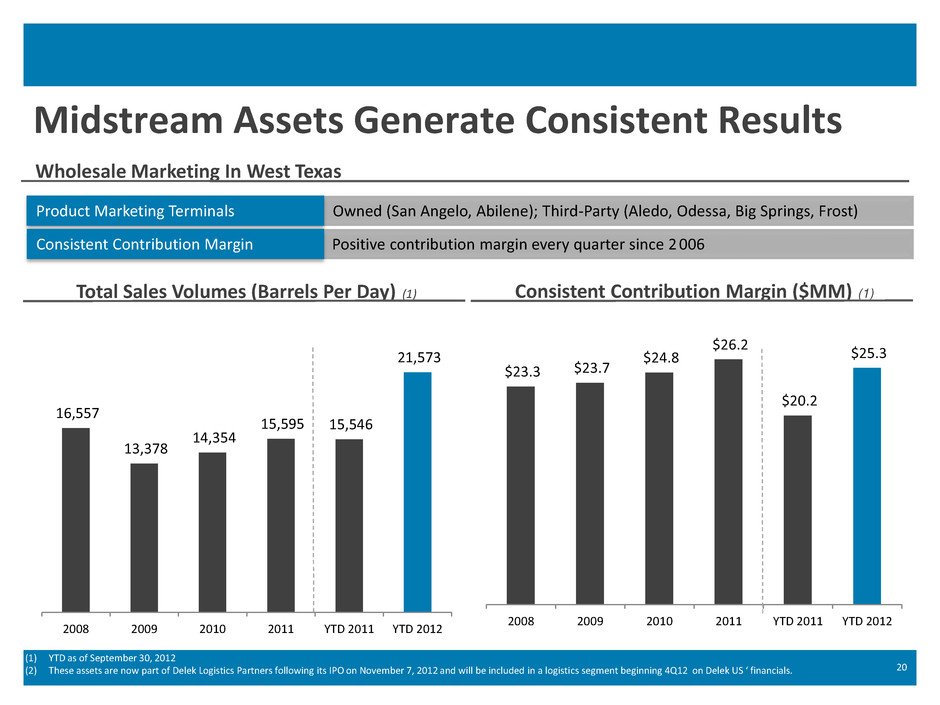

$23.3 $23.7 $24.8 $26.2 $20.2 $25.3 2008 2009 2010 2011 YTD 2011 YTD 2012 16,557 13,378 14,354 15,595 15,546 21,573 2008 2009 2010 2011 YTD 2011 YTD 2012 Midstream Assets Generate Consistent Results Wholesale Marketing In West Texas Owned (San Angelo, Abilene); Third-Party (Aledo, Odessa, Big Springs, Frost) Product Marketing Terminals 20 ) Positive contribution margin every quarter since 2 006 Consistent Contribution Margin Total Sales Volumes (Barrels Per Day) (1) Consistent Contribution Margin ($MM) (1) (1) YTD as of September 30, 2012 (2) These assets are now part of Delek Logistics Partners following its IPO on November 7, 2012 and will be included in a logistics segment beginning 4Q12 on Delek US ‘ financials.

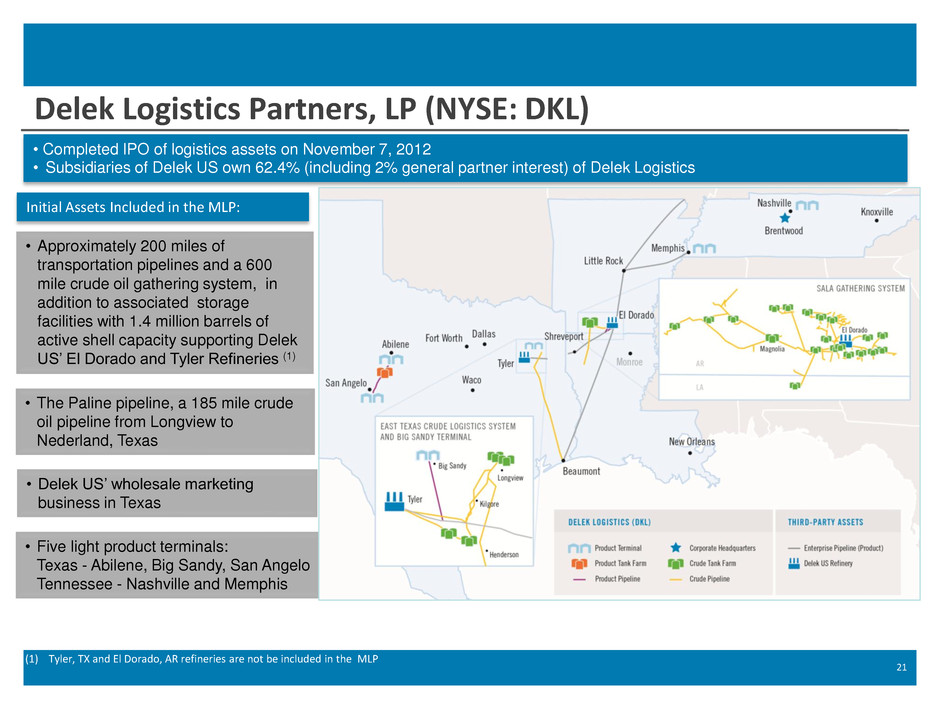

Delek Logistics Partners, LP (NYSE: DKL) 21 (1) Tyler, TX and El Dorado, AR refineries are not be included in the MLP • Approximately 200 miles of transportation pipelines and a 600 mile crude oil gathering system, in addition to associated storage facilities with 1.4 million barrels of active shell capacity supporting Delek US’ El Dorado and Tyler Refineries (1) • The Paline pipeline, a 185 mile crude oil pipeline from Longview to Nederland, Texas • Five light product terminals: Texas - Abilene, Big Sandy, San Angelo Tennessee - Nashville and Memphis • Completed IPO of logistics assets on November 7, 2012 • Subsidiaries of Delek US own 62.4% (including 2% general partner interest) of Delek Logistics • Delek US’ wholesale marketing business in Texas Initial Assets Included in the MLP:

Appendix Additional Data

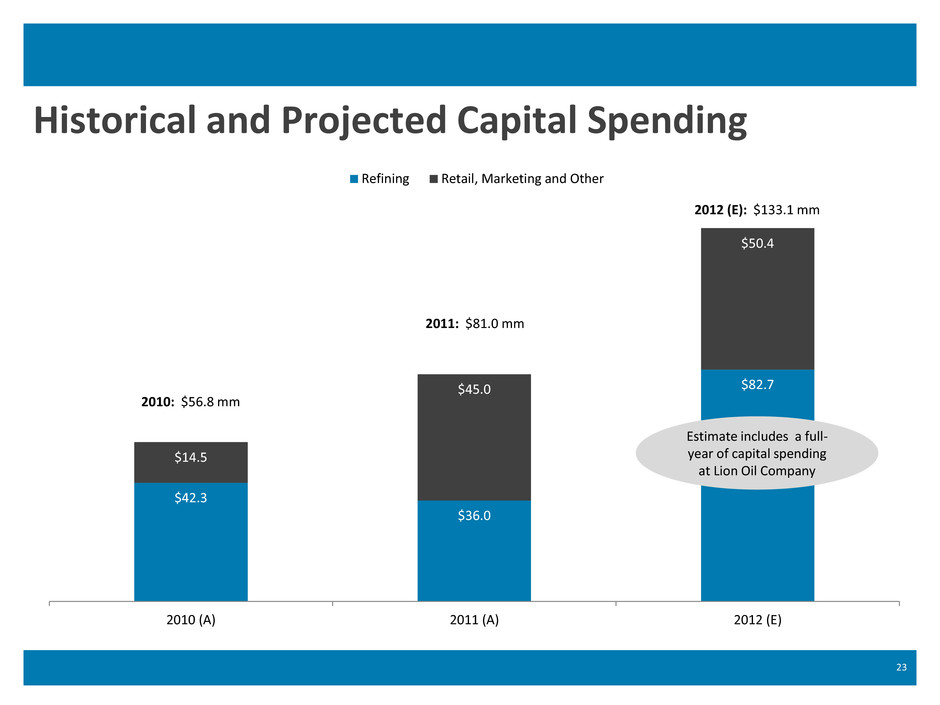

$42.3 $36.0 $82.7 $14.5 $45.0 $50.4 2010 (A) 2011 (A) 2012 (E) Refining Retail, Marketing and Other Historical and Projected Capital Spending 23 2010: $56.8 mm 2011: $81.0 mm 2012 (E): $133.1 mm Estimate includes a full- year of capital spending at Lion Oil Company

Investor Relations Contact: Assi Ginzburg Keith Johnson Executive Vice President and CFO Vice President of Investor Relations 615-435-1452 615-435-1366