Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - C. H. ROBINSON WORLDWIDE, INC. | d480245d8k.htm |

| EX-99.1 - EX-99.1 - C. H. ROBINSON WORLDWIDE, INC. | d480245dex991.htm |

Earnings Conference Call –

Fourth Quarter 2012

February 5, 2013

John Wiehoff, Chairman & CEO

Chad Lindbloom, CFO

Tim Gagnon, Director, Investor Relations

Exhibit 99.2 |

2

Safe Harbor Statement

Except for the historical information contained herein, the matters set forth in

this presentation and the accompanying earnings release are

forward-looking statements that represent our expectations, beliefs,

intentions or strategies concerning future events. These forward-looking

statements are subject to certain risks and uncertainties that could cause actual

results to differ materially from our historical experience or our present

expectations, including, but not limited to such factors as changes in

economic conditions, including uncertain consumer demand; changes in market

demand and pressures on the pricing for our services; competition and growth

rates within the third party logistics industry; freight levels and increasing costs and

availability

of

truck

capacity

or

alternative

means

of

transporting

freight,

and

changes

in

relationships

with

existing

truck,

rail,

ocean

and

air

carriers; changes

in

our

customer

base

due

to

possible

consolidation

among

our

customers;

our

ability

to integrate

the

operations

of

acquired

companies

with

our

historic

operations

successfully;

risks associated with litigation and

insurance coverage; risks associated with operations outside of the U.S.; risks

associated with the potential impacts of changes in government regulations;

risks associated with the produce industry, including food safety and

contamination issues; fuel prices and availability; the impact of war on the

economy; and other risks and uncertainties detailed in our Annual and Quarterly

Reports.

Any forward-looking statement speaks only as of the date on which such

statement is made, and we undertake no obligation to update such statement

to reflect events or circumstances arising after such date. All remarks made

during our financial results conference call will be current at the time of

the call and we undertake no obligation to update the replay. |

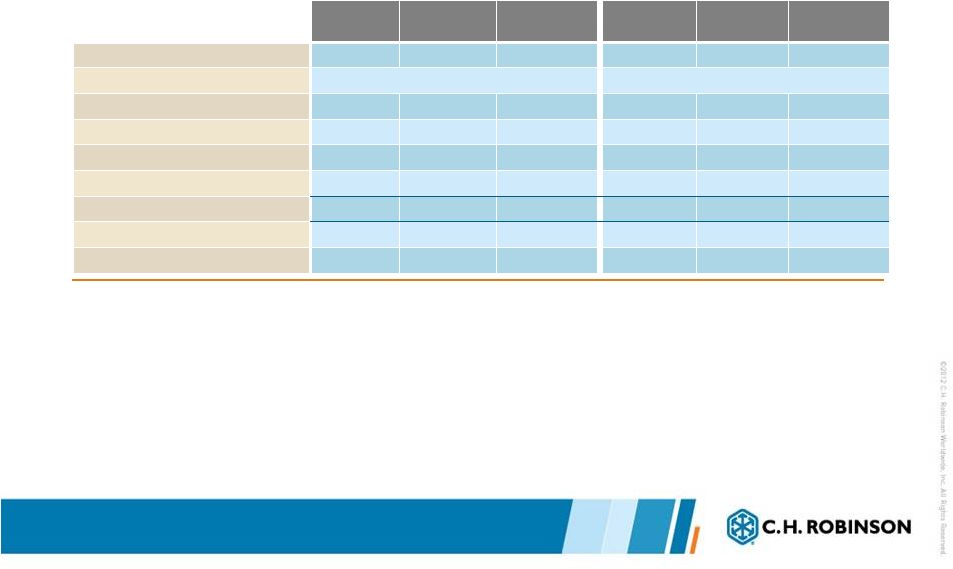

3

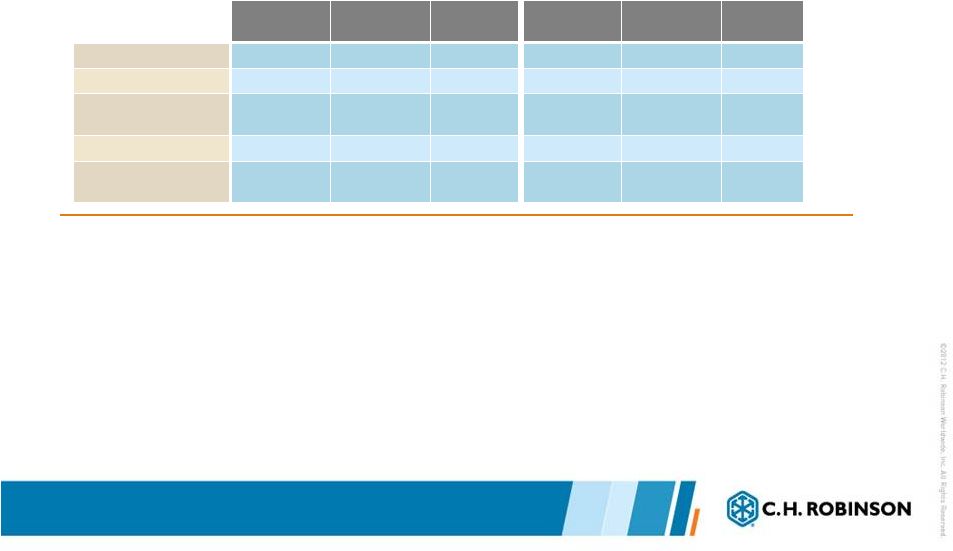

Summarized Adjusted Income Statement

•

The term “Adjusted”

refers to non-GAAP financial information, adjusted to exclude

certain transaction impacts.

•

Non-recurring

personnel

expenses

is

primarily

an

incremental

expense

related

to

the

vesting of restricted equity, driven by the impact that the T-Chek gain had on

EPS. •

Non-recurring other operating expenses are investment banking, external legal

and financial due diligence fees, related to the acquisition of Phoenix and

Apreo, and the divestiture of T-Chek.

•

Non-recurring investment income, is the gain on the sale of T-Chek.

In thousands, except per share amount

Actual

Non-recurring

Transaction

Impacts

Adjusted

Actual

Non-recurring

Transaction Impacts

Adjusted

Total net revenues

$444,632

$0

$444,632

$1,717,571

$0

$1,717,571

Personnel expenses

226,042

34,592

191,450

766,006

34,592

731,414

Other operating expenses

84,986

9,115

75,871

276,245

10,604

265,641

Total operating expenses

$311,028

$43,707

$267,321

$1,042,251

$45,196

$997,055

Income from operations

$133,604

-$43,707

$177,311

$675,320

-$45,196

$720,516

Investment & other income

282,166

281,551

615

283,142

281,551

1,591

Income before taxes

415,770

237,844

177,926

958,462

236,355

722,107

Provision for income taxes

159,378

90,023

69,355

364,658

89,558

275,100

Net income

$256,392

$147,821

$108,571

$593,804

$146,797

$447,007

Net income per share (diluted)

1.58

0.68

3.67

2.76

Weighted average shares (diluted)

161,799

1,190

160,609

161,946

277

161,669

Three months ended December 31, 2012

Twelve months ended December

31,2012 |

4

Adjusted Q4 & YTD 2012 Results

Adjusted

2012

2011

% Change

Adjusted

2012

2011

% Change

Total revenues

$2,970,876

$2,568,284

15.7%

$11,359,113

$10,336,346

9.9%

Total net revenues

$444,632

$401,385

10.8%

$1,717,571

$1,632,658

5.2%

Income from

operations

$177,311

$171,955

3.1%

$720,516

$692,730

4.0%

Net income

$108,571

$109,214

-0.6%

$447,007

$431,612

3.6%

Earnings per share

(diluted)

$0.68

$0.67

1.5%

$2.76

$2.62

5.3%

Three months ended December 31

Twelve months ended December 31

In thousands, except per share amounts

•

Full

year,

2012

truckload

volume

growth,

10%

•

Active

customers

in

2012:

approximately

42,000,

compared

to

37,000

in

2011

•

Active

carriers

in

2012:

approximately

56,000,

compared

to

53,000

in

2011

•

Q4

2011,

T-Chek

had

$12.5

million

net

revenue

and

$6.4

million

income

from

operations

•

Excluding

T-Chek

from

Q4

results

in

both

2012

and

2011;

•

Adjusted

net

revenue

increased

approximately

14

percent,

year

over

year

in

quarter

4

•

Adjusted

income

from

operations

increased

approximately

6.5

percent,

year

over

year

in

quarter

4 |

5

2012 Review

•

Recap of previously communicated strategic alignment

•

Phoenix International acquisition

•

T-Chek divestiture

•

Commitment to Europe

•

Operational and execution highlights and challenges

•

Highlights

•

We continue to grow market share

•

We are aggressively selling and developing our relationships

•

Our account management initiatives are expanding our service offerings and

account penetration

•

Challenges

•

Truckload margin compression continues |

6

Transportation Results Q4 2012

•

Q4 consolidated transportation net revenue margin on the lower end of our 10 year

performance

•

Volumes up in nearly all services in Q4

•

The revenue mix has changed with the acquisition of Phoenix International

2012

2011

% Change

2012

2011

% Change

Total revenues

$2,585,930

$2,200,258

17.5%

$9,685,415

$8,740,524

10.8%

Total net revenues

$409,141

$358,672

14.1%

$1,528,137

$1,443,916

5.8%

Net revenue margin

15.8%

16.3%

-2.9%

15.8%

16.5%

-4.5%

Three months ended December 31

Twelve months ended December 31

TRANSPORTATION in thousands

TRANSPORTATION NET REVENUE MARGIN PERCENTAGE

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

Q1

17.7%

17.8%

16.8%

17.4%

18.3%

20.2%

18.2%

22.6%

17.4%

17.2%

16.9%

Q2

16.1%

15.9%

15.4%

16.3%

17.1%

17.9%

15.4%

20.6%

15.8%

16.2%

14.9%

Q3

15.6%

16.0%

15.9%

16.3%

17.5%

18.0%

15.9%

19.8%

16.6%

16.4%

15.6%

Q4

16.2%

15.8%

16.0%

15.7%

18.3%

17.7%

19.0%

18.3%

17.6%

16.3%

15.8% |

7

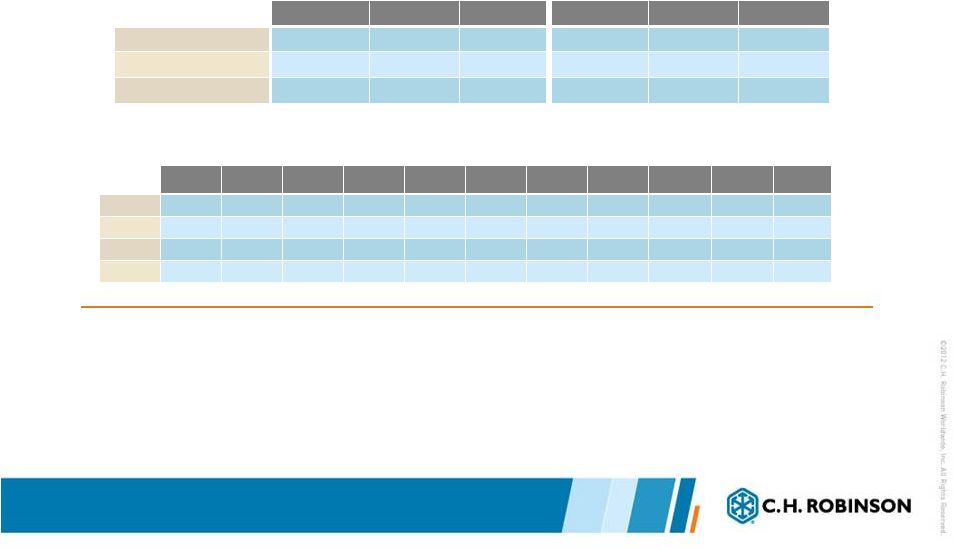

Truck Results Q4 2012

2012

2011

% Change

2012

2011

% Change

$328,273

$306,443

7.1%

$1,284,280

$1,236,611

3.9%

Three months ended December 31

Twelve months ended December 31

TRUCK NET REVENUES in thousands

Quarter

Year to Date

Volume

12%

10%

Pricing *

1%

1%

Net revenue margin

TRUCKLOAD

Quarter

Year to Date

Volume

16%

16%

Pricing

Net revenue margin

LTL

Year over year change

Year over year change

*Excluding estimated impact of fuel

•

North American Truckload volume increased 8% in the fourth quarter

•

We estimate that our acquisition of Apreo Logistics in Poland contributed

approximately 4% to our volume growth in the fourth quarter

•

North American Truckload cost per mile increased approximately two percent and our

pricing to our customers increased approximately one percent

•

Less-than-Truckload volume increased 16% in the fourth quarter while net

revenue margin declined |

8

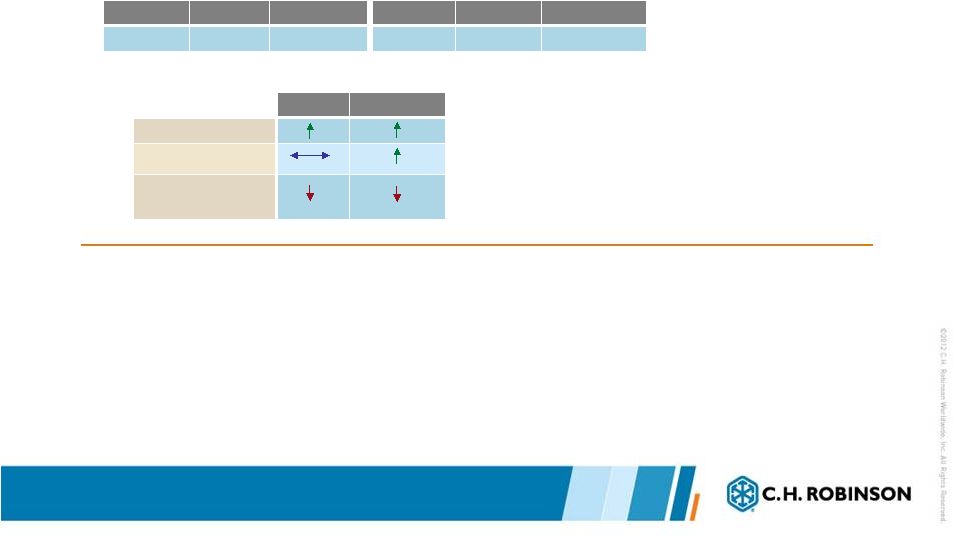

Intermodal Results Q4 2012

•

Net

revenue

declined,

due

to

a

change

in

our

mix

of

business

and

an

increased

cost

of

capacity

•

Length of haul increased in the fourth quarter

•

Approximately 1,000 owned containers now in service

2012

2011

% Change

2012

2011

% Change

$9,011

$10,189

-11.6%

$38,815

$41,189

-5.8%

Three months ended December 31

Twelve months ended December 31

INTERMODAL NET REVENUES in thousands

Quarter

Year to Date

Volume

Pricing

Net revenue margin

Year over year change |

9

Ocean & Air Results Q4 2012

2012

2011

% Change

2012

2011

% Change

Ocean

$33,707

$17,022

98.0%

$84,924

$66,873

27.0%

Air

$15,948

$8,811

81.0%

$44,444

$39,371

12.9%

Three months ended December 31

Twelve months ended December 31

NET REVENUES in thousands

Quarter

Year to Date

Volume

Pricing

Net revenue margin

OCEAN

Quarter

Year to Date

Volume

Pricing

Net revenue margin

AIR

Year over year change

Year over year change

•

Ocean

net

revenues

increased

98

percent

in

the

fourth

quarter

of

2012.

Excluding

Phoenix,

we estimate that ocean transportation net revenues increased approximately three

percent in the fourth quarter. The net revenue increases (excluding Phoenix)

resulted in part from increased pricing, partially offset by decreased

volumes. •

Air net revenues increased 81 percent in the fourth quarter of 2012. Excluding

Phoenix, we estimate that air transportation net revenues increased

approximately 19 percent in the fourth quarter.

The

net

revenue

increase

(excluding

Phoenix)

was

due

to

the

decreased

cost

of capacity

and increased pricing, partially offset by decreased volumes.

|

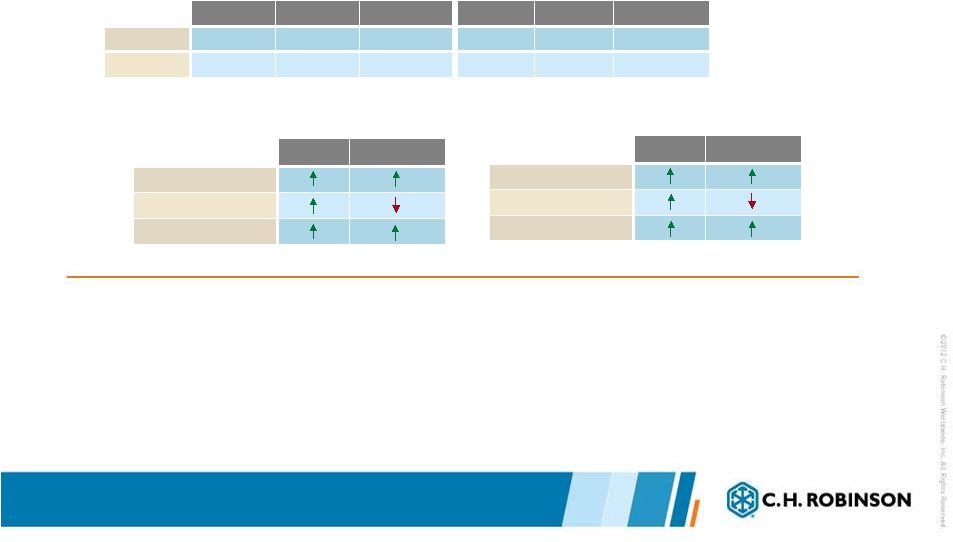

10

Other Logistics Services Results Q4 2012

•

Other Logistics Services includes Transportation Management Services, Customs,

Warehousing, and Small Parcel.

•

Other Logistics Services net revenues increased 37 percent in the fourth quarter.

Excluding Phoenix, we estimate Other Logistics Services net revenues

increased approximately 15 percent in the fourth quarter.

2012

2011

% Change

2012

2011

% Change

$22,202

$16,207

37.0%

$75,674

$59,872

26.4%

Three months ended December 31

Twelve months ended December 31

NET REVENUES in thousands

|

11

Sourcing Results Q4 2012

•

Sourcing net revenue growth was driven by an increase in net revenue margin

•

We had case volume growth with large customers in the fourth quarter

2012

2011

% Change

2012

2011

% Change

Total revenues

$379,479

$352,744

7.6%

$1,620,183

$1,535,528

5.5%

Total net revenues

$30,543

$27,431

11.3%

$136,438

$128,448

6.2%

Net revenue margin

8.0%

7.8%

3.5%

8.4%

8.4%

0.7%

Three months ended December 31

Twelve months ended December 31

SOURCING in thousands |

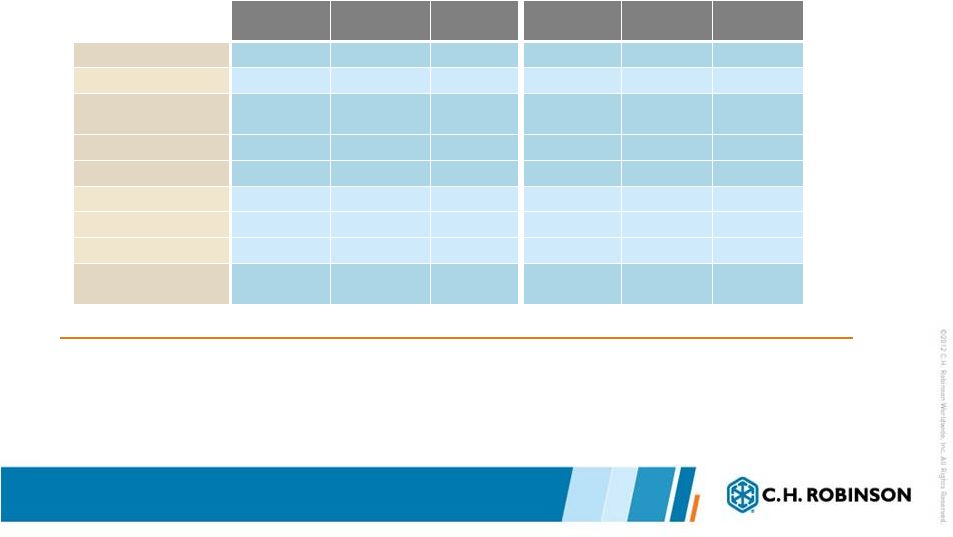

12

2012 Adjusted Results Compared to 2011

Adjusted

2012

2011

% Change

Adjusted

2012

2011

% Change

Total net revenues

$444,632

$401,385

10.8%

$1,717,571

$1,632,658

5.2%

Operating expenses:

Personnel expenses

$191,450

$164,062

16.7%

$731,414

$696,233

5.1%

Percent of net revenues

43.1%

40.9%

42.6%

42.6%

Other operating expenses

$75,871

$65,368

16.1%

$265,641

$243,695

9.0%

Percent of net revenues

17.1%

16.3%

15.5%

14.9%

Total Operating expenses

$267,321

$229,430

16.5%

$,997,055

$939,928

6.1%

Income from Operations

$177,311

$171,955

3.1%

$720,516

$692,730

4.0%

Percent of net revenues

39.9%

42.8%

41.9%

42.4%

Three months ended December 31

Twelve months ended December 31

•

The term “Adjusted”

refers to non-GAAP financial information, adjusted to exclude certain

transaction impacts.

•

Estimated impact of Phoenix to consolidated personnel as a percent of net revenue

was an increase of 1%.

•

Q4 2011 personnel expense was unusually low, due to reductions in certain incentive

compensation plans that are based on growth in earnings. These

reductions were driven by a slowing

of

earnings

growth

in

Q4

2011

compared

to

the

first

nine

months

of

2011.

•

The increase in other operating expenses as a percent of net revenues was driven

primarily by two months of intangible amortization ($2.7 million) related to

the Phoenix acquisition. In thousands |

13

2012 Adjusted Results Compared to 2011(continued)

Adjusted

2012

2011

% Change

Adjusted

2012

2011

% Change

Total revenues

$2,970,876

$2,568,284

15.7%

$11,359,113

9.9%

Total net revenues

$444,632

$401,385

10.8%

$1,717,571

$1,632,658

5.2%

Income from

operations

$177,311

$171,955

3.1%

$720,516

$692,730

4.0%

Other income

615

1,373

-55.2%

1,591

1,974

-19.4%

Income before taxes

177,926

173,328

2.7%

722,107

694,704

3.9%

Income taxes

69,355

64,114

8.2%

275,100

263,092

4.6%

Effective tax rate

39.0%

37.0%

38.1%

37.9%

Net income

$108,571

$109,214

-0.6%

$447,007

$431,612

3.6%

Earnings per share

(diluted)

$0.68

$0.67

1.5%

$2.76

$2.62

5.3%

Three months ended December 31

Twelve months ended December 31

In thousands, except per share amounts

•

The

term

“Adjusted”

refers

to

non-GAAP

financial

information,

adjusted

to

exclude

certain

transaction impacts.

•

Other income/expense decrease driven by lower investment income and interest

expense from debt used to finance a portion of the Phoenix purchase

price. $10,336,346 |

14

2012

2011

% Change

2012

2011

% Change

Net cash provided by operating

activities

$193,186

$136,157

41.9%

$460,342

$429,712

7.1%

Capital expenditures, net

$11,765

$23,725

-50.4%

$50,656

$52,806

-4.1%

Three months ended December 31

Twelve months ended December 31

Quarter

Year to Date

Shares repurchased

1,452,903

4,237,555

Average price per

share

$61.92

$60.66

Total cost of shares

repurchased

$89,959

$257,064

December 31, 2012

Cash &

investments

$210,019

Current assets

$1,672,290

Total assets

$2,804,225

Debt

$253,646

Current liabilities

$1,232,217

Stockholders’

investment

$1,504,372

CASH FLOW DATA

2012

BALANCE SHEET DATA

REPURCHASES OF COMMON STOCK

Other Financial Information

In thousands, except share and per share amounts |

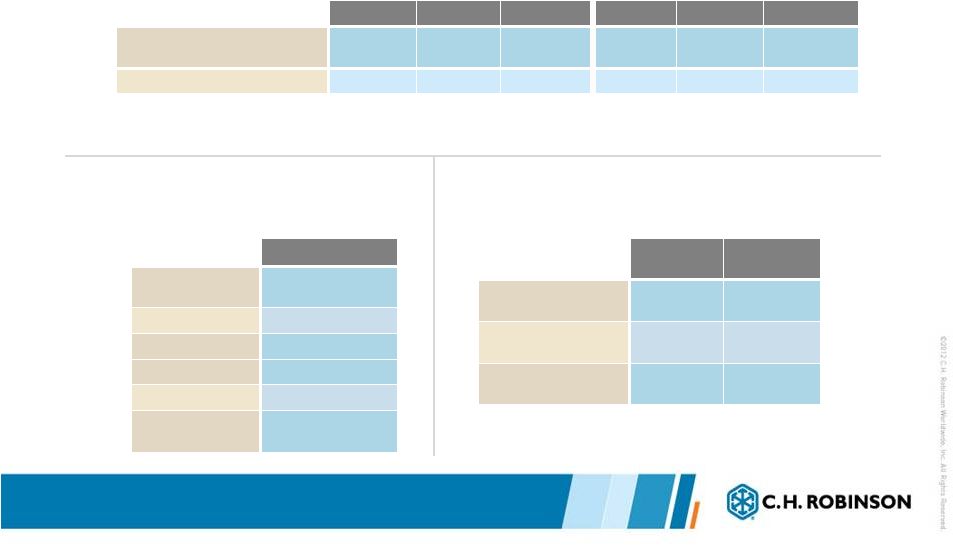

15

Review of Unaudited Pro Forma Condensed Combined

Financial Information

•

Unaudited

pro

forma

condensed

combined

financial

information

for

the

company

should

be

reviewed with Form 8-K/A filed on January 14, 2013.

•

Phoenix, historically has had a higher transportation net revenue margin than C.H.

Robinson. In thousands

Historical

C.H. Robinson

Pro Forma

Phoenix including

purchase

accounting

Pro Forma

Combined

Historical

C.H. Robinson

Pro Forma Phoenix

including purchase

accounting

Pro Forma

Combined

Revenues:

Transportation

$8,740,524

$817,748

$9,558,272

$4,653,602

$414,303

$5,067,905

Sourcing

1,535,528

0

1,535,528

822,327

0

822,327

Information services

60,294

0

60,294

31,899

0

31,899

Total Revenues

$10,336,346

$817,748

$11,154,094

$5,507,828

$414,303

$5,922,131

Net Revenues:

Transportation

$1,443,916

$165,689

$1,609,605

$736,222

$82,920

$819,142

net revenue margin

16.5%

20.3%

16.8%

15.8%

20.0%

16.2%

Sourcing

128,448

0

128,448

72,148

0

72,148

net revenue margin

8.4%

0.0%

8.4%

8.8%

0.0%

8.8%

Information Services

60,294

0

60,294

31,899

0

31,899

net revenue margin

100.0%

0.0%

100.0%

100.0%

0.0%

100.0%

Total net revenues

$1,632,658

$165,689

$1,798,347

$840,269

$82,920

$923,189

net revenue margin

15.8%

20.3%

16.1%

15.3%

20.0%

15.6%

Year ended December 31, 2011

Six months ended June 30, 2012 |

16

Review of Unaudited Pro Forma Condensed Combined

Financial Information

•

Intangible asset amortization expense impacted operating expenses and operating

expenses as a percent of net revenue.

•

Phoenix, like similar international forwarding companies, has had a lower operating

income as a percent of net revenues compared to C.H. Robinson.

In thousands

Historical

C.H. Robinson

Pro Forma

Phoenix including

purchase

accounting

Pro Forma

Combined

Historical

C.H. Robinson

Pro Forma Phoenix

including purchase

accounting

Pro Forma

Combined

Total net revenues

$1,632,658

$165,689

$1,798,347

$840,269

$82,920

$923,189

Personnel expenses

696,233

79,177

775,410

360,622

41,100

401,722

percent of net revenues

42.6%

47.8%

43.1%

42.9%

49.6%

43.5%

Intangible asset amortization

0

16,265

16,265

0

8,133

8,133

percent of net revenues

0.0%

9.8%

0.9%

0.0%

9.8%

0.9%

Other operating expenses

243,695

33,341

277,036

125,188

18,750

143,938

percent of net revenues

14.9%

20.1%

15.4%

14.9%

22.6%

15.6%

Total operating expenses

$939,928

$128,783

$1,068,711

$485,810

$67,983

$553,793

percent of net revenues

57.6%

77.7%

59.4%

57.8%

82.0%

60.0%

Income from operations

$692,730

$36,906

$729,636

$354,459

$14,937

$369,396

percent of net revenues

42.4%

22.3%

40.6%

42.2%

18.0%

40.0%

Year ended December 31, 2011

Six months ended June 30, 2012 |

17

2013

•

We will continue to expand our global network.

•

We expect continued growth with our Management & Integrated services.

•

Our productivity remains a critical success factor in our business.

•

We are committed to a successful deployment of Navisphere, our global

platform. •

Our people are a competitive advantage

•

Target capital structure strategy is being reviewed |

|