Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Azteca Acquisition Corp | a13-4402_18k.htm |

| EX-99.1 - EX-99.1 - Azteca Acquisition Corp | a13-4402_1ex99d1.htm |

Exhibit 99.2

|

|

Investor presentation February 2013 HEMISPHERE MEDIA GROUP |

|

|

Forward-Looking Statements This presentation may contain certain statements about Azteca, Cinelatino, WAPA and Hemisphere that are "forward-looking statements" within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. The forward-looking statements contained in this presentation may include statements about the expectations that the proposed transaction can be effected before April 6, 2013, the date by which Azteca is required to consummate an initial business combination, or commence liquidation, the expected effects on Azteca, Cinelatino, WAPA and Hemisphere of the proposed transaction, the anticipated timing and benefits of the proposed transaction, the anticipated standalone or combined financial results of Azteca, Cinelatino, WAPA and Hemisphere and all other statements in this report other than historical facts. Without limitation, any statements preceded or followed by or that include the words "targets," "plans," "believes," "expects," "intends," "will," "likely," "may," "anticipates," "estimates," "projects," "should," "would," "expect," "positioned," "strategy," "future," or words, phrases or terms of similar substance or the negative thereof, are forward-looking statements. These statements are based on the current expectations of the management of Azteca, Cinelatino, WAPA and Hemisphere (as the case may be) and are subject to uncertainty and changes in circumstance and involve risks and uncertainties that could cause actual results to differ materially from those expressed or implied in such forward-looking statements. In addition, these statements are based on a number of assumptions that are subject to change. Such risks, uncertainties and assumptions include: (1) the ability to have the Registration Statement on Form S-4 filed with the SEC by Hemisphere on January 25, 2013 declared effective with sufficient time to hold a meeting of the Azteca stockholders and warrantholders prior to April 6, 2013; (2) the satisfaction of the conditions to the proposed transaction and other risks related to the completion of the proposed transaction and actions related thereto; (3) the ability of Azteca, Cinelatino, WAPA and Hemisphere to complete the proposed transaction on anticipated terms and schedule, including the ability to obtain stockholder or regulatory approvals of the proposed transaction and related transactions; (4) risks relating to any unforeseen liabilities of Azteca, Cinelatino, WAPA and Hemisphere; (5) the amount of redemptions made by Azteca stockholders; (6) future capital expenditures, expenses, revenues, earnings, synergies, economic performance, indebtedness, financial condition, losses and future prospects; businesses and management strategies and the expansion and growth of the operations of Azteca, Cinelatino, WAPA and Hemisphere; (7) Cinelatino's and WAPA's ability to integrate successfully after the proposed transaction and achieve anticipated synergies; the risk that disruptions from the transaction will harm Cinelatino's and WAPA's businesses; (8) Azteca's, Cinelatino's, WAPA's plans, objectives, expectations and intentions generally; and (9) other factors detailed in Azteca's reports filed with the SEC, including its Annual Report on Form 10-K under the caption "Risk Factors." Forward-looking statements included herein are made as of the date hereof, and none of the parties undertakes any obligation to update publicly such statements to reflect subsequent events or circumstances. This document contains registered and unregistered trademarks and service marks of Cinelatino, WAPA America and WAPA and their affiliates, as well as trademarks and service marks of third parties. All brand names, trademarks and service marks appearing in this document are the property of their respective holders. TRADEMARKS DISCLAIMER Neither Hemisphere or Azteca, nor any of their respective affiliates makes any representation or warranty as to the accuracy or completeness of the information contained in this presentation. The sole purpose of the presentation is to assist persons in deciding whether they wish to proceed with a further review of the proposed transaction discussed herein and is not intended to be all-inclusive or to contain all the information that a person may desire in considering the proposed transaction discussed herein. It is not intended to form the basis of any investment decision or any other decision in respect of the proposed transaction. |

|

|

Important Other Information Azteca, Cinelatino, WAPA and Hemisphere and certain of their respective directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies from Azteca’s stockholders and warrant holders in respect of the proposed transaction under the rules of the SEC. Information regarding Azteca’s participants is available in Azteca’s Annual Report on Form 10-K for the year ended December 31, 2011 which is filed with the SEC on March 21, 2012 and in the proxy statement/prospectus filed by Hemisphere with the SEC on January 25, 2013. Information about the directors and executive officers of Cinelatino, WAPA and Hemisphere who may, under the rules of the SEC, be deemed participants in the solicitation of the Azteca stockholders and warrant holders in connection with the proposed transaction is set forth in the proxy statement/prospectus. PARTICIPANTS IN SOLICITATION IMPORTANT ADDITIONAL INFORMATION FILED WITH THE SEC In connection with the proposed transaction, Hemisphere has filed with the SEC a Registration Statement on Form S-4, containing a Proxy Statement/Prospectus. Investors and security holders of Azteca are urged to read the Registration Statement, including the Proxy Statement/Prospectus that is part of the Registration Statement, and any other relevant documents that have been or will be filed with the SEC when they are available, because they contain, or will contain, important information about Hemisphere, Azteca, the proposed transaction and related matters. Investors and security holders of Azteca can obtain copies of the Registration Statement and the Proxy Statement/Prospectus, as well as other filings with the SEC containing information about Hemisphere and Azteca, without charge, at the SEC’s Internet site (http://www.sec.gov). These documents may also be obtained for free from Hemisphere by directing a request to Hemisphere’s Investor Relations, 2000 Ponce de Leon Boulevard, Suite 500, Coral Gables, FL 33134 or from Azteca by directing a request to Azteca Investor Relations, 421 N. Beverly Drive, Suite 300, Beverly Hills, CA 90210. In addition to financial information presented in accordance with U.S. GAAP, Hemisphere has presented certain non-GAAP financial measures, specifically EBITDA and Adjusted EBITDA. Management of WAPA and Cinelatino use these measures to assess the operating results and performance of the business, perform analytical comparisons and identify strategies to improve performance. WAPA and Cinelatino believe EBITDA and Adjusted EBITDA are relevant to investors because it allows them to analyze the operating performance of each business using the same metrics used by management. WAPA and Cinelatino exclude from Adjusted EBITDA depreciation expense, amortization of intangibles, certain impairment charges, loss (gain) on disposition of assets, non-recurring expenses, interest expense, interest income, income tax and loss from discontinued operations. RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES |

|

|

Opportunity overview HEMISPHERE MEDIA GROUP |

|

|

Opportunity overview Cinelatino, WAPA America and WAPA will combine to create the only pure-play Hispanic networks and content platform Targeting the fast growing and highly attractive U.S. Hispanic and Latin American markets #1 Broadcast Network in Puerto Rico Leading U.S. Hispanic Cable Network #1 U.S. Spanish-Language Movie Channel |

|

|

Alan Sokol Chief Executive Officer Nearly 20 years experience in the television and film industries as an operator, advisor and investor, with specific focus on Hispanic media Architect of InterMedia’s Hispanic strategy, including acquisitions of Cinelatino, WAPA and WAPA America Together with Jim McNamara, oversaw growth of Telemundo from a $0.7bn asset to a $2.7bn asset in only five years Craig Fischer Chief Financial Officer Over 15 years experience in the media and entertainment industry as an operator, advisor and investor Partner at InterMedia responsible for Hispanic and other investments, including acquisitions of Cinelatino, WAPA, and WAPA America Member of the executive team that launched the YES Network Former media banker at Goldman Sachs, and accountant at Ernst & Young Jim McNamara Chairman, Cinelatino Over 25 years executive experience in the media and entertainment industry Chairman of Cinelatino and Pantelion Films; Founder of Panamax Films Together with Alan Sokol, oversaw growth of Telemundo from a $0.7bn asset to a $2.7bn asset in only five years Jose Ramos President, WAPA Over 28 years of television experience Most experienced television executive in Puerto Rico 14 years as President and General Manager of WAPA 13 years at Telemundo, serving in various senior positions including Senior Vice President, General Manager and President Best-in-class management team Unparalleled Hispanic media expertise and track record |

|

|

Large and growing Hispanic media opportunity in the U.S. and Latin America Collection of high performance assets with leading market positions Attractive financial model with strong track record of growth Unique, compelling growth platform Investment highlights |

|

|

Large and growing Hispanic media opportunity in the U.S. and Latin America HEMISPHERE MEDIA GROUP |

|

|

Dynamic U.S. Hispanic demographic U.S. Hispanic market is the second largest Hispanic economy in the world U.S. Hispanic population growth (Figures in millions) U.S. Hispanic population as % of total U.S. population Source: U.S. Census Bureau 3.5x growth 2.4x growth Fast growing demographic Contributed more than half of the total U.S. population growth from 2000–2010 |

|

|

Multiple drivers of growth in Hispanic pay-TV and package subscribers Large and growing U.S. Hispanic media opportunity 2012 2014E Hispanic TV HHs Hispanic package subs 4.2 Hispanic Pay-TV subs 14.1 11.9 Source: Hispanic TV HHs and Hispanic Pay-TV subs from Nielsen Universe Estimates, all other data from Management. (Figures in millions) Hispanic TV HHs Hispanic package subs 2.6 Hispanic Pay-TV subs 11.6 8.8 2006 Compounding effect of growing population and increased penetration will drive subscriber growth 8mm+ untapped opportunity Hispanic TV HHs Hispanic Pay-TV subs Hispanic Package Subs 4.9 13.0 15.4 |

|

|

|

|

|

Comparison of advertising wallet to viewing share U.S. Hispanic buying power vs. Hispanic media spend Significant U.S. Hispanic cable advertising opportunity Advertising market does not yet reflect Hispanic economic impact (a) Represents January 2008 and January 2011 Source: Nielsen, SNL Kagan Source: U.S. Census, The Shelby Report, Advertising Age, Kantar Media (2010) U.S. Hispanic cable advertising primed for explosive growth (a) |

|

|

U.S. Hispanic cable advertising Fastest growing advertising sector in television 2011 – 2014 CAGR Significant U.S. Hispanic cable advertising opportunity Hispanic cable advertising growth dramatically outpacing the broader U.S. cable market ($ in millions) Source: SNL Kagan U.S. Hispanic cable advertising is expected to grow at nearly 50% through 2014 16% growth |

|

|

Latin America pay-TV subscribers (a) Latin America pay-TV penetration (a) Significant subscriber growth opportunity in Latin America Latin America's growing pay-TV subscribers provide meaningful upside (a) Excludes Brazil. Source: SNL Kagan (Figures in millions) |

|

|

Collection of high performance assets with leading market positions HEMISPHERE MEDIA GROUP |

|

|

Only Spanish-language cable television movie network distributed by all major U.S. multichannel providers The primary television destination for U.S. Hispanics to view current Spanish language box office hits and local favorites Distributed to over 12 million subscribers globally including 4 million in the U.S. and 8 million across 15 Latin American countries Over 80% of revenue contribution from the U.S. Multiple distribution relationships Major supplier relationships Robust content portfolio with exclusive rights to box office hits and critically acclaimed films Extensive industry relationships drive unique ability to acquire the best content Library of over 400 titles from over 50 suppliers Licensed over 70% of the top Mexican box office hits since 2006 Unique advantage as the only network that buys the rights for the U.S. and Latin America “one-stop shop” for film distributors Titles typically acquired exclusively for 3 – 4 years and include VOD and digital rights Cinelatino The leading Spanish-language movie network Cinelatino has a broad distribution platform across the U.S. and Latin America and a diverse network of programming relationships that is difficult to replicate Latin America |

|

|

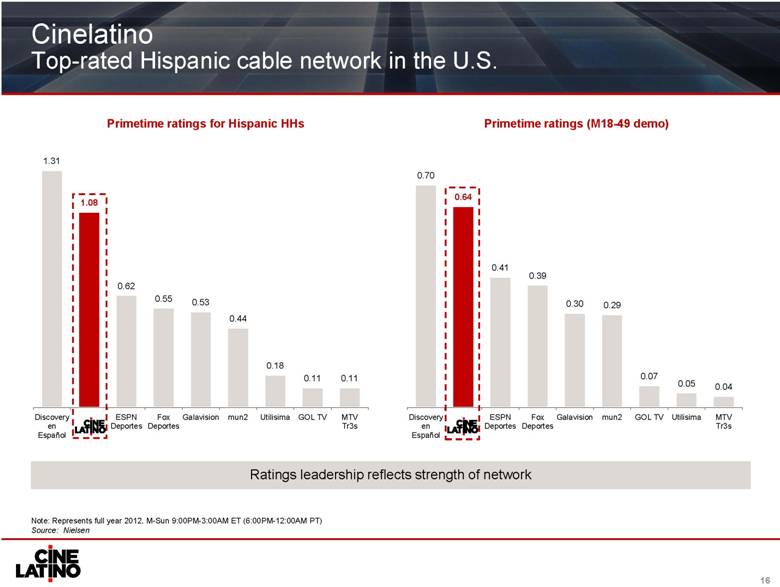

Cinelatino Top-rated Hispanic cable network in the U.S. Primetime ratings for Hispanic HHs Primetime ratings (M18-49 demo) Note: Represents full year 2012, M-Sun 9:00PM-3:00AM ET (6:00PM-12:00AM PT) Source: Nielsen Ratings leadership reflects strength of network |

|

|

Cinelatino Large growth potential in Mexico and rest of Latin America DISH Mexico – 20 Highest-Rated Cable Networks (a) Cinelatino Latin America Distribution Cinelatino Subscribers (MM) Pay-TV Subscribers (MM) (b) Cinelatino Penetration (%) Mexico 2.2 13.1 17% Argentina 1.7 7.6 23% Colombia 1.9 4.2 46% Chile 0.2 2.3 11% Peru 0.2 1.3 14% Other (c) 1.5 8.8 17% Total Latin America (d) 7.8 37.3 21% (a) Source: Ibope, represents full year 2012, M-Sun 6:00PM - 1:00AM (excludes children’s networks) (b) Source: SNL Kagan, represents 2012E (c) Other category includes subscribers from Costa Rica, Dominican Republic, Ecuador, El Salvador, Guatemala, Honduras, Nicaragua, Panama, Uruguay and Venezuela (d) Excludes Brazil Strong performance in Mexico is expected to translate into high growth in Latin America |

|

|

WAPA America Leading Spanish-language cable network in the U.S. Over 5 million U.S. subscribers Majority of revenues generated from contracted, recurring, multi-year subscriber fees Significant opportunity to drive advertising sales High margin, high cash flow business WAPA America leverages content produced by WAPA PR Broad distribution relationships Broadly appealing Spanish-language content, with special appeal to Puerto Ricans and other Caribbean Hispanics Leverages over 60 hours of weekly local programming from WAPA PR to create a unique cable network in the U.S. Programming supplemented by acquired telenovelas and other entertainment programming, popular sports programming from Puerto Rico, and programming from WAPA’s library WAPA America is the most broadly distributed independently-owned Spanish-language cable network in the U.S. Acquired Programming Baloncesto Superior Nacional WAPA America is the exclusive U.S. television partner of Puerto Rico’s men’s professional basketball league and will televise regular season and playoff games Minga y Petraca One of Puerto Rico’s most popular comedies during the 1990’s and early 2000’s. A scripted comedy about two middle aged, mustached “ladies” Mujeres al Limite A one-hour reality television series featuring women telling their own true stories of love and heartbreak Jugando Pelota Dura A one-hour political show analyzing the most noteworthy political events, similar to CNN’s The Situation Room |

|

|

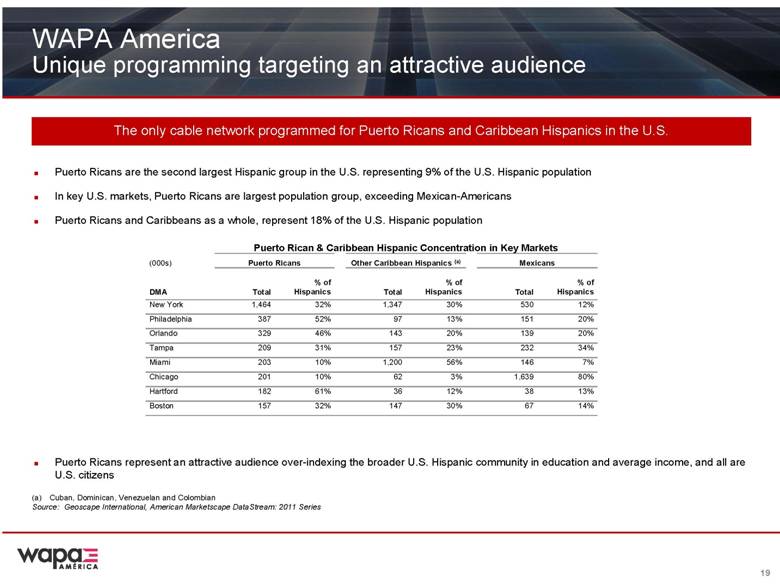

Puerto Ricans are the second largest Hispanic group in the U.S. representing 9% of the U.S. Hispanic population In key U.S. markets, Puerto Ricans are largest population group, exceeding Mexican-Americans Puerto Ricans and Caribbeans as a whole, represent 18% of the U.S. Hispanic population Puerto Ricans represent an attractive audience over-indexing the broader U.S. Hispanic community in education and average income, and all are U.S. citizens WAPA America Unique programming targeting an attractive audience Puerto Rican & Caribbean Hispanic Concentration in Key Markets (000s) Puerto Ricans Other Caribbean Hispanics (a) Mexicans DMA Total % of Hispanics Total % of Hispanics Total % of Hispanics New York 1,464 32% 1,347 30% 530 12% Philadelphia 387 52% 97 13% 151 20% Orlando 329 46% 143 20% 139 20% Tampa 209 31% 157 23% 232 34% Miami 203 10% 1,200 56% 146 7% Chicago 201 10% 62 3% 1,639 80% Hartford 182 61% 36 12% 38 13% Boston 157 32% 147 30% 67 14% The only cable network programmed for Puerto Ricans and Caribbean Hispanics in the U.S. Cuban, Dominican, Venezuelan and Colombian Source: Geoscape International, American Marketscape DataStream: 2011 Series |

|

|

WAPA America’s distribution has grown dramatically since being acquired by InterMedia, resulting in significantly higher subscriber fee revenue Primarily distributed on Hispanic programming packages nationally, and on digital basic in select major markets (Orlando, Tampa and Miami) WAPA America Distributed nationwide by all major U.S. distributors Subscribers (mm) WAPA America Distribution * * Nationwide distribution on satellite operators Hispanic programming packages Digital basic |

|

|

WAPA PR The leading Puerto Rican television network Grew from #3 rated network in 2007 to #1 in 2009 Continued momentum in business expanded lead each of the last three years since becoming #1 Top revenue generating network in Puerto Rico for three consecutive years Began earning retransmission fees in 2008 most recent retransmission renewals have yielded significant fee increases 2012 primetime rating and audience share (a) #1 rated television network in Puerto Rico for four consecutive years Primetime ratings over 50% higher than each of Univision and Telemundo Over 30% share of the primetime audience (a) Total households, primetime indicates Mon-Fri 6:00PM-11:00PM; represents full year 2012 data Source: Nielsen |

|

|

WAPA PR Puerto Rico is a unique and powerful broadcast TV market WAPA dwarfs the U.S. TV networks in primetime ratings (a) Pay-TV penetration in Puerto Rico Note: U.S. television ratings based on ’11/’12 broadcast season (a) Represents full year 2012, M-F 6:00-11:00PM for Puerto Rico, and M-F 8:00-11:00PM for U.S. Source: Nielsen Source: Mediafax and Nielsen With 1.4 million TV households, Puerto Rico is the second largest U.S. Hispanic market behind only Los Angeles Consistent low penetration rate of pay-TV in Puerto Rico creates a competitive advantage for TV broadcasters Primetime ratings 3x higher than the four major U.S. television networks Primetime ratings substantially equivalent to the aggregate ratings of the four major U.S. television networks |

|

|

WAPA PR Major content production engine Entertainment Programs Idol Puerto Rico #1 Reality Show Idol Kids Puerto Rico Ground breaking format for Idol franchise launched in 2012 Risas en Combo & Sunshine Remix #1 Comedy WAPA a las Cuatro Fast-paced daily news magazine series Entre Nosotras #1 Local Talk Show Pégate al Mediodía #1 Midday Program De Película Movie previews and star interviews #1 Morning News #1 Midday News #1 Evening News #1 Late Night News News Produces nearly 30 hours of entertainment programming each week Leading news producer in Puerto Rico with nearly 40 hours each week Nearly all shows are produced at WAPA’s state-of-the-art facilities in San Juan |

|

|

Attractive financial model with strong track record of growth HEMISPHERE MEDIA GROUP |

|

|

Consolidated Net Revenue Consolidated Adjusted EBITDA Proven track record of growth Note: See Appendix A for a reconciliation of Adjusted EBITDA for 2008-2011. As the audit of our 2012 financial statements is not complete, the 2012 results presented above are estimates and preliminary, and therefore, may change. Estimates of 2012 GAAP results and reconciliation of Adjusted EBITDA is not provided as they are not yet available. Adjusted EBITDA margin: ($ in millions) 28% 37% 37% 41% Consistent revenue and Adjusted EBITDA growth of 11% and 23% (CAGR 2008-12), respectively, despite challenging economic environment Attractive dual revenue streams comprised of approximately 60% advertising and 40% subscriber / retransmission fees 11% CAGR 23% CAGR 28% |

|

|

2012 – 2013 Adjusted EBITDA bridge ($ in millions) Note: As the audit of our 2012 financial statements is not complete, the 2012 results presented above are estimates and preliminary, and therefore, may change. Estimates of 2012 GAAP results and reconciliation of Adjusted EBITDA is not provided because they are not yet available. No reconciliation of 2013E GAAP to Adjusted EBITDA is provided because they are not available. See Appendix A for a reconciliation of Adjusted EBITDA for 2008-2011. 26% |

|

|

Unique, compelling growth platform HEMISPHERE MEDIA GROUP |

|

|

Compelling growth platform Multiple avenues of growth Macroeconomic growth Growth in U.S. Hispanic population driving: growth in pay-TV HHs growth in Hispanic programming package subscribers Significant and growing Hispanic cable advertising opportunity in the U.S. Growth in Latin America pay-TV subscribers Organic growth Continue to drive ratings at all assets which in turn drives advertising sales Monetize advertising sales upside convert Cinelatino to ad-supported model build up of “U.S. ad sales team” for Cinelatino and WAPA America Grow retransmission and subscription revenue Grow Latin America subscribers launch in new markets launch on additional systems in under-penetrated markets Acquisition-driven growth Leverage expertise of management team and portfolio of assets to drive growth through acquisitions U.S. Spanish-language cable networks Latin American broadcast and cable television networks production companies content libraries |

|

|

Transaction overview HEMISPHERE MEDIA GROUP |

|

|

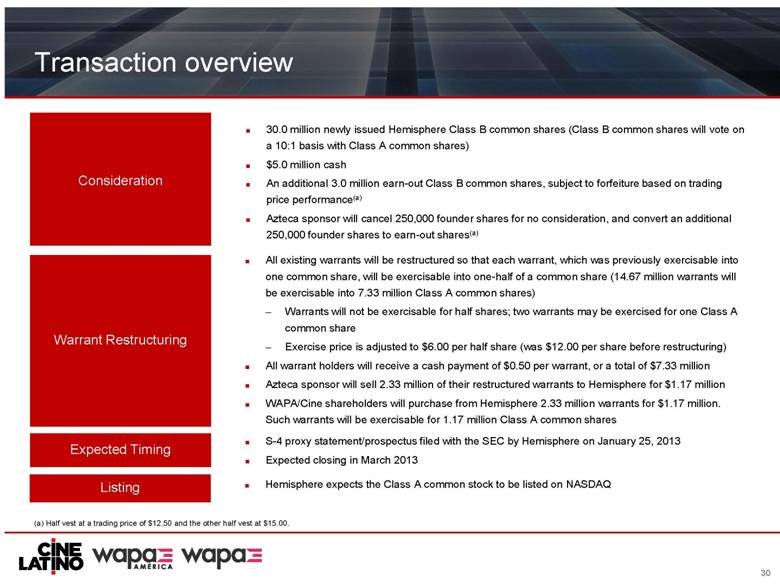

Transaction overview Consideration Expected Timing 30.0 million newly issued Hemisphere Class B common shares (Class B common shares will vote on a 10:1 basis with Class A common shares) $5.0 million cash An additional 3.0 million earn-out Class B common shares, subject to forfeiture based on trading price performance(a) Azteca sponsor will cancel 250,000 founder shares for no consideration, and convert an additional 250,000 founder shares to earn-out shares(a) All existing warrants will be restructured so that each warrant, which was previously exercisable into one common share, will be exercisable into one-half of a common share (14.67 million warrants will be exercisable into 7.33 million Class A common shares) Warrants will not be exercisable for half shares; two warrants may be exercised for one Class A common share Exercise price is adjusted to $6.00 per half share (was $12.00 per share before restructuring) All warrant holders will receive a cash payment of $0.50 per warrant, or a total of $7.33 million Azteca sponsor will sell 2.33 million of their restructured warrants to Hemisphere for $1.17 million WAPA/Cine shareholders will purchase from Hemisphere 2.33 million warrants for $1.17 million. Such warrants will be exercisable for 1.17 million Class A common shares S-4 proxy statement/prospectus filed with the SEC by Hemisphere on January 25, 2013 Expected closing in March 2013 Warrant Restructuring (a) Half vest at a trading price of $12.50 and the other half vest at $15.00. Listing Hemisphere expects the Class A common stock to be listed on NASDAQ |

|

|

Implied Transaction Value Pro Forma Equity Ownership(a) Sources and Uses Ownership Detail Transaction valuation and ownership Note: Assumes no redemptions. Share price represents estimated amount in Trust per Azteca share. (a) Excludes earn-out shares and warrants. (b) Cash payment of $0.50 per 14.67 million warrants in connection with the warrant restructuring. (c) Exercisable into 7.33 million common shares. Warrants are exercisable at $6.00 per half share. Sources: Uses: Azteca Cash $100.5 Cash Consideration $5.0 WAPA/Cine Warrant Purchase 1.2 Warrant Restructuring (b) 7.3 Warrant Purchase from Azteca Sponsor 1.2 Fees and Expenses 11.6 Azteca Cash to Balance Sheet 76.6 Total $101.7 Total $101.7 Implied share price $10.05 Common shares(a) 41.265 Implied equity value $414.7 WAPA/Cine net debt (as of 12/31/12) 68.5 Azteca cash to balance sheet 76.6 Implied enterprise value $406.6 2012E EBITDA $39.2 Implied TEV / 2012E EBITDA 10.4x 2013E EBITDA $40.9 Implied TEV / 2013E EBITDA 9.9x ($ in millions, except per share data) Earn-out Shares Shares At $12.50 At $15.00 Warrants(c) WAPA/Cine Shareholders 30.00 1.50 1.50 2.33 Azteca Public Shareholders 10.00 - - 10.00 Azteca Founders 1.26 0.48 0.50 2.33 Total 41.26 1.98 2.00 14.67 |

|

|

2012E - 2013E EBITDA growth 2012 / 2013 EBITDA margin(c) 2013 TEV / EBITDA Valuation framework Hemisphere Media is expected to be the fastest growing public cable network business in the U.S. Note: As the audit of our 2012 financial statements is not complete, the 2012 results presented above are estimates and preliminary, and therefore, may change. Estimates of 2012 GAAP results and reconciliation of Adjusted EBITDA is not provided because they are not available. No reconciliation of 2013E GAAP to Adjusted EBITDA is provided because they are not available. See Appendix A for a reconciliation of Adjusted EBITDA for 2008-2011. Excludes estimated public company costs and corporate overhead in 2013. Hemisphere Media’s growth rates exclude the impact of political advertising in 2012. Darker shaded columns indicate 2012E figure and lighter shaded columns indicate 2013E figure. Source: FactSet, market data as of 1/31/13, balance sheet data as of 9/30/12. For purposes of calculating TEV, minority interest based on reported book value. Hemisphere Media Hemisphere Media 2012 TEV / EBITDA (a) (b) |

|

|

Appendix A: Reconciliation of GAAP to Non-GAAP Financial Measures The following table represents consolidated EBITDA and Adjusted EBITDA measures, which was derived from WAPA and Cinelatino 's stand-alone reconciliations, assuming the transaction is consummated for the periods indicated (a): Year Ended December 31, ($ in thousands) 2011 2010 2009 2008 Reconciliation of net income (loss) to EBITDA and Adjusted EBITDA: Net income (loss) $ 13,623 $ 36,682 $ (2,839) $ (16,905) Add (deduct): Income tax expense (benefit) 8,010 (15,840) (1,544) 9,638 Other expenses, net 5,451 3,270 4,916 9,496 Impairment of broadcast license - - 13,830 11,671 Loss (gain) on disposition of assets (39) 399 18 233 Depreciation and amortization 3,430 3,130 2,964 2,966 EBITDA $ 30,475 $ 27,641 $ 17,344 $ 17,099 Non-recurring expenses 88 - - - Management fees 625 250 - - Adjusted EBITDA $ 31,188 $ 27,891 $ 17,344 $ 17,099 (a) See Registration Statement on Form S-4 filed with the SEC by Hemisphere on January 25, 2013 for reconciliations of net income (loss) to Adjusted EBITDA for WAPA and Cinelatino on non-consolidated bases. |