Attached files

| file | filename |

|---|---|

| 8-K/A - 8-K/A - CIMPRESS plc | d479045d8ka.htm |

Q2

Fiscal Year 2013 Earnings Presentation, Commentary

& Financial Results Supplement

January 31, 2013

Exhibit 99.2 |

This document

is Vistaprint’s second quarter fiscal year 2013 earnings commentary. This document contains slides and accompanying comments in the

“notes”

section below each slide. |

Safe

Harbor Statement 2

This presentation and the accompanying notes contain statements about our future

expectations, plans and prospects of our business that constitute

forward-looking statements for purposes of the safe harbor provisions under the Private

Securities Litigation Reform Act of 1995, including but not limited to our

financial guidance, outlook, expectations, and investment areas for the

third quarter and fiscal year 2013; our planned investments in our business

and the anticipated effects of those investments; our operational growth

strategy, our 2016 financial targets, and the anticipated development of our

business and financial results in response to our strategy; and the anticipated growth and development of our

business and markets, especially in Europe. Forward-looking projections and

expectations are inherently uncertain, are based on assumptions and

judgments by management, and may turn out to be wrong. Our actual results may differ

materially from those indicated by these forward-looking statements as a result

of various important factors, including but not limited to flaws in the

assumptions and judgments upon which our projections and guidance are based;

our failure to execute our strategy; our failure to make the investments in

our business that we plan to make or the failure of those

investments to have the effects that we expect; our failure to identify and address

the causes of our revenue weakness in Europe; our failure to acquire new

customers and enter new markets, retain our current customers, and sell more

products to current and new customers; the willingness of purchasers of marketing

services and products to shop online; currency fluctuations that affect our

revenues and costs; costs and disruptions caused by acquisitions; the failure of our

acquired businesses to perform as expected; difficulties or higher than anticipated

costs in integrating the systems and operations of our acquired businesses

into our systems and operations; unanticipated changes in our market, customers

or business; our failure to promote and strengthen our brand; the failure of our

current and new marketing channels to attract customers; our failure to

manage the growth, changes, and complexity of our business and expand our operations;

competitive pressures; our failure to maintain compliance with the financial

covenants in our revolving credit facility or to pay our debts when due;

costs and judgments resulting from litigation; changes in the laws and regulations or in the

interpretations of laws or regulations to which we are subject, including tax laws,

or the institution of new laws or regulations that affect our business; and

general economic conditions. You can also find other factors described in our

Form

10-Q for the fiscal quarter ended September 30, 2012 and the other documents

we periodically file with the U.S. Securities and Exchange Commission.

|

Please read

the above safe harbor statement. Additionally, a detailed reconciliation of GAAP and non-GAAP measures is posted in the appendix of the Q2 fiscal 2013 earnings

presentation that accompanies these remarks. |

Presentation Organization & Call Details

3

Presentation Organization:

•

Quarterly review and update

on initiatives

•

Q2 FY13 operating and

financial results

•

Looking ahead to Q3 and

remainder of fiscal year

•

Long-term outlook commentary

•

Supplementary information

•

Reconciliation of GAAP to

Non-GAAP results

Live Q&A Session:

•

5:15 p.m. Eastern

•

Link from the IR section of

www.vistaprint.com

•

Hosted by:

Robert Keane

President & CEO

Ernst Teunissen

EVP & CFO |

This

presentation is organized into the categories shown on the left hand of this slide.

Robert Keane, CEO, and Ernst Teunissen, CFO, will host a live question and answer conference

call at 5:15 p.m. US Eastern time which you can access through a link on the investor

relations section of www.vistaprint.com. |

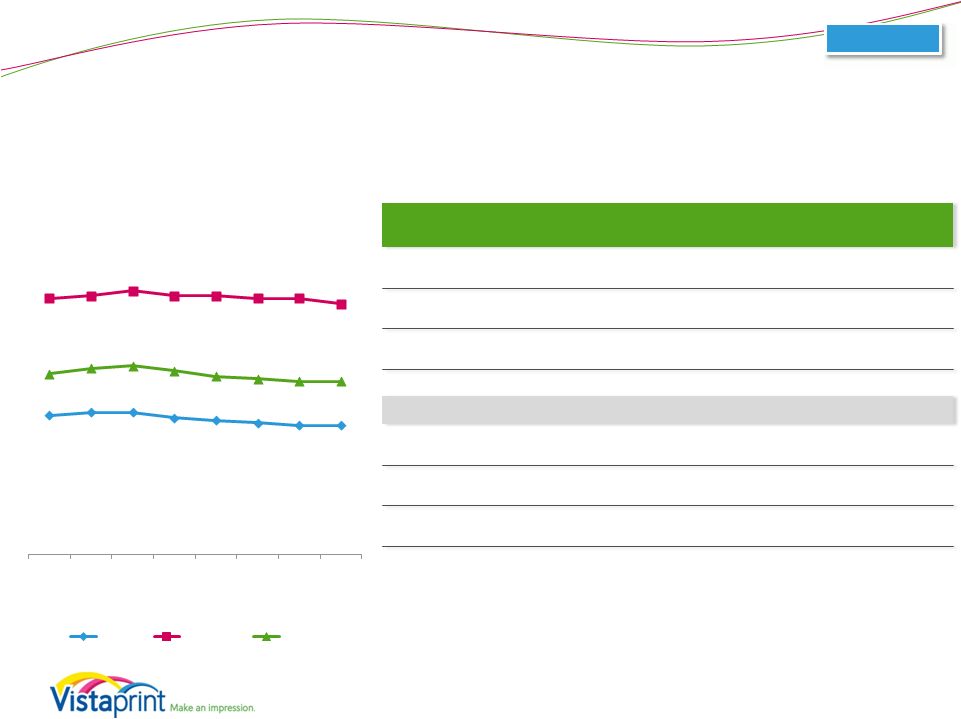

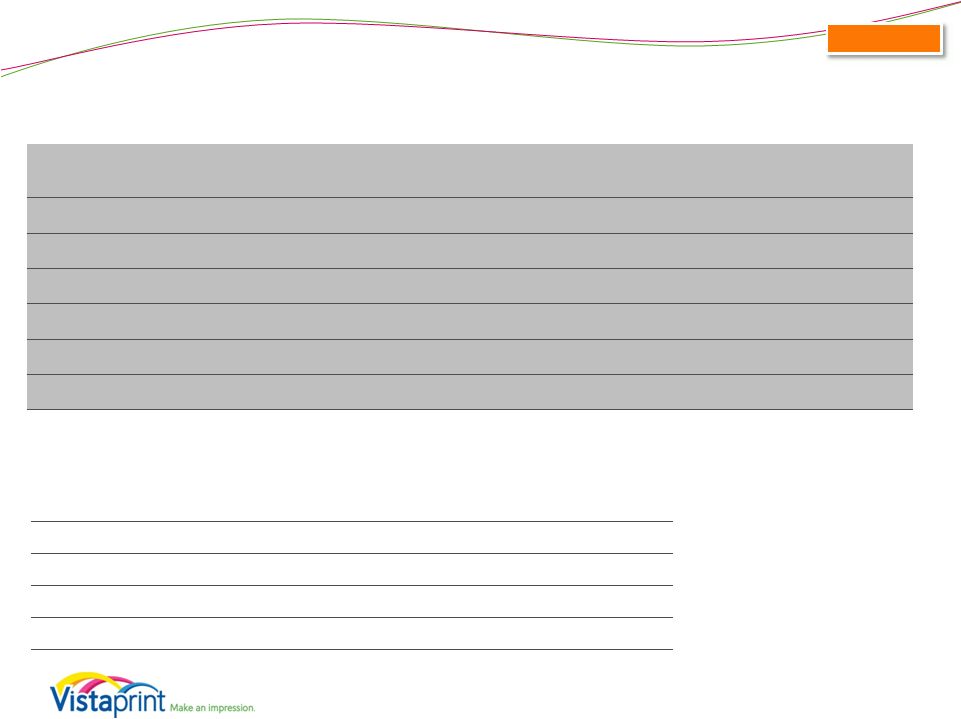

Quarterly Financial Results

4

* Per diluted share

Consolidated

$0.51

$0.32

$0.19

$0.82

$0.01

$0.10

$(0.05)

$0.66

$0.63

$0.43

$0.31

$0.97

$0.29

$0.40

$0.25

$1.02

Q3 FY11

Q4 FY11

Q1 FY12

Q2 FY12

Q3 FY12

Q4 FY12

Q1 FY13

Q2 FY13

GAAP EPS*

Non-GAAP EPS*

$204

$209

$212

$300

$258

$250

$251

$348

Q3 FY11

Q4 FY11

Q1 FY12

Q2 FY12

Q3 FY12

Q4 FY12

Q1 FY13

Q2 FY13

Webs revenue (millions)

Albumprinter revenue (millions)

Organic revenue (millions)

Revenue

and

EPS

results

for

the

consolidated

business,

including

Albumprinter

and

Webs

results

since

October

31,

2011

and

December

28,

2011

(dates of purchase, respectively).

Non-GAAP adjusted net income per diluted share for all periods presented

excludes the impact of share-based compensation expense and its related

tax effect, amortization of acquired intangible assets and a tax charge related to the alignment of Webs IP with our global structure. Please

see reconciliation to GAAP net income (loss) at the end of this

presentation. |

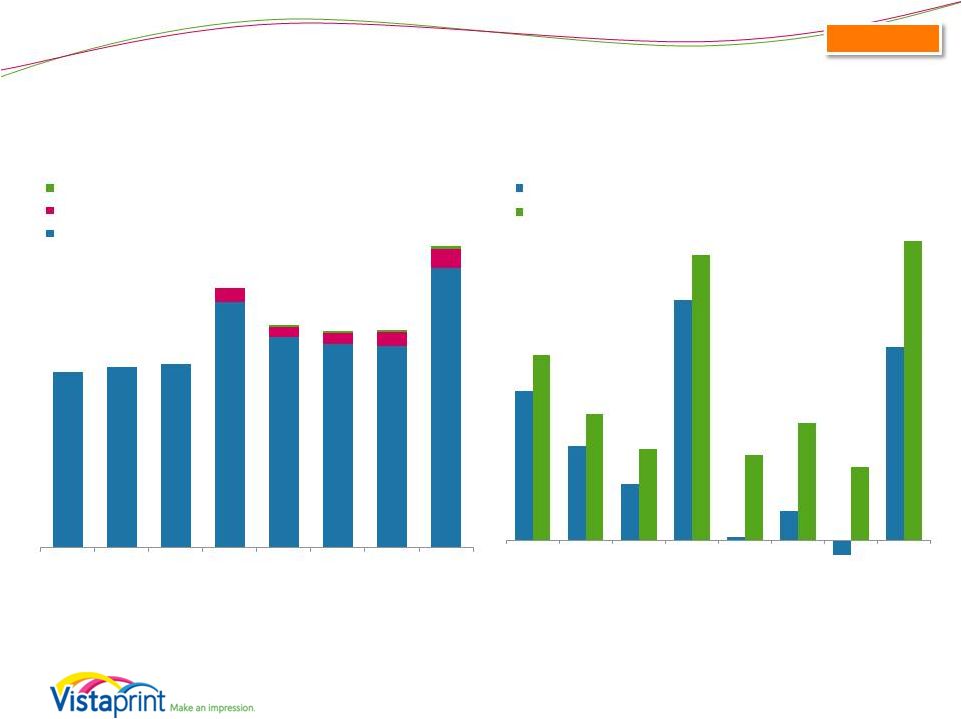

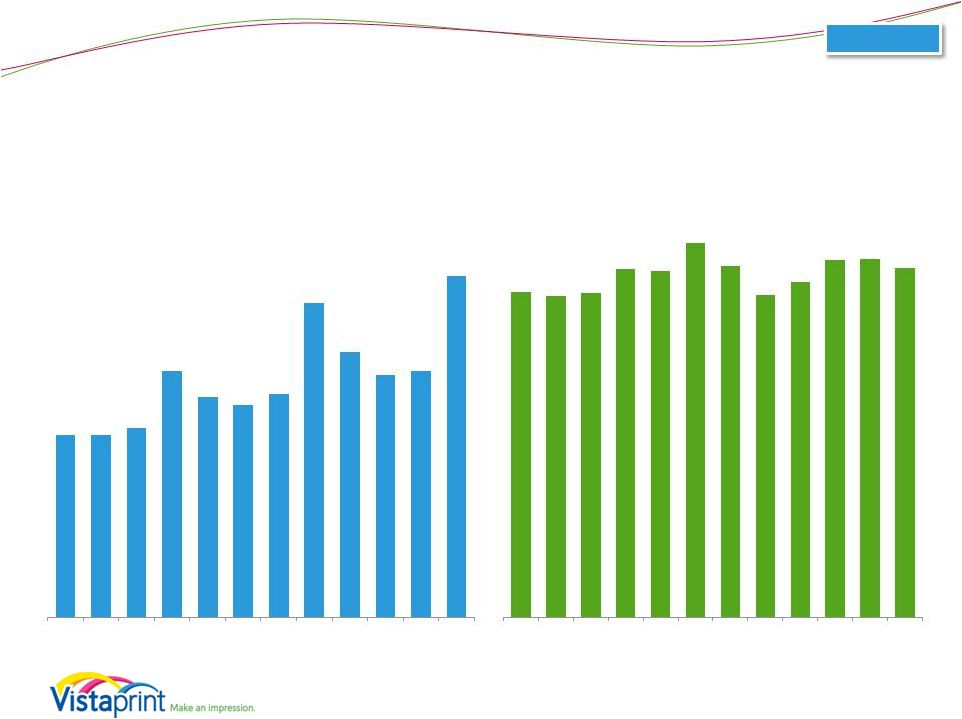

Our

consolidated revenue in the second quarter of fiscal 2013 was above the midpoint of the range we set three months ago. Revenue grew 17% on a

consolidated constant currency basis, to $348 million, including revenue from our Albumprinter

and Webs acquisitions. On an organic constant currency basis, revenue grew 14%

globally. Earnings per share for the quarter was above our

expectations at $0.66, due primarily to strong gross margin performance and one-time favorability in our tax

rate. We are on track and committed to delivering EPS in line with the annual guidance

we provided at the beginning of the year. We are pleased with

the progress we have made in many of our strategic initiatives, but we remain disappointed with our European marketing performance. As

we described last quarter, we are working hard to overcome the growth challenges we have faced

in Europe in recent quarters but a sustainable turn-around in Europe will take

time. We believe the year-over-year uptick in our European growth rate from last quarter was largely due to our seasonal consumer and

holiday business, which will not be a major part of our revenue in the back half of the year.

|

Operational Performance:

Reinvigorate Growth in the Core Business

5

Strategy Element

Description

Long-Term Goals

Q2 FY13 Results/Examples

Major improvements to customer

experience, satisfaction and loyalty

Change success metrics from

short-term transaction-focused

value to longer-term life time value

and achieve higher life time value

per customer

•

Continued improvements in net

promoter score, a leading

retention indicator

•

Tested changes to pricing

transparency, simplicity and

consistency

•

Packaging improvements

Invest more deeply into selected

traditional Vistaprint marketing

channels and expand in relatively

new channels such as broadcast

with higher than average COCA,

but excellent longer term ROI

Accelerate new customer

acquisition

Reach offline audiences not

currently looking to online suppliers

•

Tested new TV broadcast

creative in NA including holiday

products

•

Improved efficiency in NA

channels

•

Continued testing into new

channels in Europe and APAC

•

18 months of experience in this

initiative will enable optimization

based on historical data trends

Accelerate investment in production

process improvements, employee

training, supply chain management

and manufacturing-related

engineering

Step function changes in quality

and reliability

Significantly lower unit

manufacturing costs

•

New product launch: iPhone

cases

•

Continued efforts in improving

manufacturing operating metrics

(quality, speed, delivery, cost,

reliability)

Customer Value

Proposition

Improvements

Life Time Value

Based Marketing

World Class

Manufacturing |

During the

quarter, we made progress in each of our strategic initiatives that are designed to reinvigorate growth in our organic business. In terms of improving our

customer value proposition, we introduced better substrates for many of our products, we

increased the exposure of our service telephone numbers, and we tested ways to increase

pricing simplicity, clarity and consistency. In our LTV-based advertising initiatives, we launched a North American broadcast test that incorporated home and

family holiday products as part of the message, and we rolled out new broadcast creative in

several European markets. With 18 months of increased LTV advertising under our

belts, we are starting to be able to measure historical results relative to our original expectations, and we believe that over the coming year we will be able to use such

data to improve the quality of our ad spend based on forecasted net present value. Our

manufacturing investments led to lower cost of goods sold and increased delivery

performance and product quality, and enabled new product launches and upgraded substrate

quality.

|

Regional Strategy Execution Update

6

•

Product quality improvements

•

Manufacturing process investments

•

Customer service expansion

•

Enhanced site experience

•

Increased advertising spend

•

Customer research

•

Advertising consistent with brand values

•

Integrated cross-channel advertising

•

Pricing methodology improvements

•

Improved creative treatments

•

Deeper & broader marketing leadership

•

Have not progressed as needed on the above

NA strengths

•

Product and creative not as localized as in

North America

•

17 markets; 14 languages

•

Organizational, leadership and process

changes required

Common Strategy

in North America and Europe

Additional NA Strengths

European Challenges |

As you know,

we made some structural and management changes in our marketing organization at the beginning of FY13. Six months have passed, and we

continue to improve our understanding of the factors that have led to our diverging

performance in our North American and European businesses. Some of our strategic investments have been common to both North America and Europe, and we

are seeing early indicators of success in many of these investments in both

regions. Examples of common strategic progress include improvements in product quality, manufacturing processes, customer service, and

site experience, as well as increased advertising spend and customer research. Results

have included increased customer satisfaction scores for product quality and customer

service availability, as well as improved net promoter scores across both regions.

However we have also experienced important differences by region that we believe have

influenced the relative performances of North America and Europe. As an example

of some of these differences: •

In North America we have been able to more effectively evolve our sales and marketing methods

in line with our overall strategic move to be more customer-centric. Examples

are advertising messaging and tactics that speak to our brand values rather than our traditional deep discount direct marketing,

integration of common messaging across advertising channels and campaigns, enhancements to our

pricing methodology through greater simplicity and clarity, and improvements to our

creative treatments. In North America we have also benefitted from a more seasoned and experienced marketing

executive team that has very effectively managed and improved our quarter-to-quarter

marketing tactics. •

In Europe, we have struggled to move as quickly in each of the above areas that have

been strengths in North America. We also have more work to do to localize our

product formats, services and creative content for European customers. Of course, these are more difficult challenges for a region serving 17

countries in 14 languages, but we believe we can do better. As discussed in recent earnings

calls, we have been making organizational and leadership changes in Europe to address

these and related challenges. We are working hard to make improvements, but expect a turnaround in European

performance will be a long-term effort. Our success in North America gives us confidence that our key strategy themes will enable our

efforts to improve European performance over the longer term.

|

Operational Performance:

Build Foundations for Future Growth

7

Strategy Element

Description

Long-Term Goals

Q2 FY13 Results/Examples

Digital small business marketing

offerings (websites, email

marketing, social media)

Lay foundations for continued rapid

growth five and more years in the

future

Seek M&A opportunities of firms that

possess technology, market

presence and/or expertise in target

areas

•

Continued digital subscriber adds in

Q2 with continued increase in ARPU

•

Continued with Webs integration and

technology investments including

offer enhancements

Enable customers to share and

preserve memories through

personalized products for home

and family use

•

Strong holiday results globally

•

Rolled out Albumprinter photo books

to Vistaprint’s EU customer base

•

Continued Albumprinter

manufacturing process

improvements based upon work with

Vistaprint manufacturing

Expand to markets beyond

Europe and North America

Current focus on building

foundation for future growth in

Asia

•

Continued organizational building of

Singapore leadership team

•

Opened India production & service

operations, initial site launch

•

Ops planning, recruitment, cross-

training & process development for

China minority interest

Digital Marketing

Home & Family

Geographic Expansion |

In addition

to our initiatives impacting our organic business, efforts in our adjacencies continued, with the objective of building foundations for future growth.

Our Vistaprint-branded digital subscriber base reached 357,000 customers with continued

improvement in monthly revenue per customer. In addition, our Webs-branded

business continued to grow in line with expectations and we continued progress toward technology integration. In the home and family market,

we had very good results in our core holiday business around the world, and our Albumprinter

team continued to integrate with European countries and streamline manufacturing and

production. Finally, we continued to build out our teams in Singapore, India and, via our indirect minority investment, China.

These and other emerging markets will not have any significant impact on our revenue in the

near term, but we remain confident that that they offer attractive

long term growth opportunities for Vistaprint. |

Q2

FY 2013 Operating and Financial Results

8 |

Q2

FY 2013: Key Financial Metrics* 9

*

Financial metrics for the consolidated business, including Albumprinter results

since October 31, 2011 and Webs results since December 28, 2011 (dates of

purchase). **

Non-GAAP adjusted net income and non-GAAP adjusted EPS exclude

share-based compensation expense and its related tax effect,

amortization of acquired intangible assets, and charges related to the alignment

of Webs IP with our global operations. Please see reconciliation to GAAP

net income (loss) and EPS at the end of this presentation. Quarter Ended

12/31/2012 YTD Period Ending 12/31/2012

Revenue

•

$348.3 million

16% y/y growth

17% y/y constant currency growth

14% y/y organic constant currency

(ex-acquisitions)

•

$599.7 million

17% y/y growth

19% y/y constant currency growth

14% y/y organic constant currency

(ex-acquisitions)

GAAP Net

Income (Loss)

•

$23.0 million

6.6% net margin vs. 10.6% last year

decrease of 28% y/y

•

$0.66 Diluted EPS

decrease of 20% y/y

•

$21.3 million

3.6% net margin vs. 7.8% last year

decrease of 47% y/y

•

$0.61 Diluted EPS

decrease of 38% y/y

Non-GAAP

Adjusted Net

Income**

•

$35.9 million

10.3% net margin vs. 12.6% last

year

decrease of 5% y/y

•

$1.02 Non-GAAP Diluted EPS

increase of 5% y/y

•

$44.8 million

7.5% net margin vs. 9.9% last year

decrease of 12% y/y

•

$1.26 Non-GAAP Diluted EPS

increase of 1% y/y

Consolidated |

Turning to

financials, and as noted above, Vistaprint generated revenue of $348 million in the second quarter, reflecting a 16% year over year increase. In organic constant-

currency terms, excluding Albumprinter and Webs, this reflected 14% year over year growth for

the business, at the midpoint of the constant-currency expectations we set three

months ago. GAAP net income for the second quarter was $23.0 million, or 6.6% of

revenue, reflecting a 28% decrease year over year. GAAP EPS in the second quarter was $0.66,

reflecting a decrease of 20% year over year. We expected GAAP net income and EPS to

decline year over year due to the dilutive impact of the Webs and Albumprinter

acquisitions, as well as several differences in below-the-line items compared with Q2

2012: Non-GAAP adjusted net income in the second quarter was $35.9 million, or 10.3%

of revenue, reflecting a decrease of 5% year over year. Non-GAAP adjusted net income

declined less than GAAP net income primarily due to higher stock-based compensation from

our acquisitions and the accounting timing impact of our recent premium price stock

option grants for our executive officers, of which the most significant portion has an accelerated expense profile versus traditional stock options and RSUs. Non-GAAP

adjusted EPS was $1.02 in the second quarter of fiscal 2013, which is up 5% year over year,

due to the effect of our share repurchases over the past year. Q2 13

Q2 12

Comments

GAAP Operating income

$33.0M

$32.5M

Interest income (expense),

net

($1.3)M

($0.4)M

Borrowings from share repurchases and acquisitions

Other income (expense)

($0.3)M

$2.4M

Q2 12 gain from currency transactions related to Albumprinter

acquisition

Income tax provision

$8.2M

$2.9M

Q2 12 rate favorability due to currency revaluations on inter-

company loan for Albumprinter acquisition; Q2 13 higher cost base

and acquisition-related tax partially offset by one-time tax benefit

Earnings in equity interests

($0.3)M

-

Q2 13 losses from equity interest in China

GAAP Net Income

$23.0M

$31.7M |

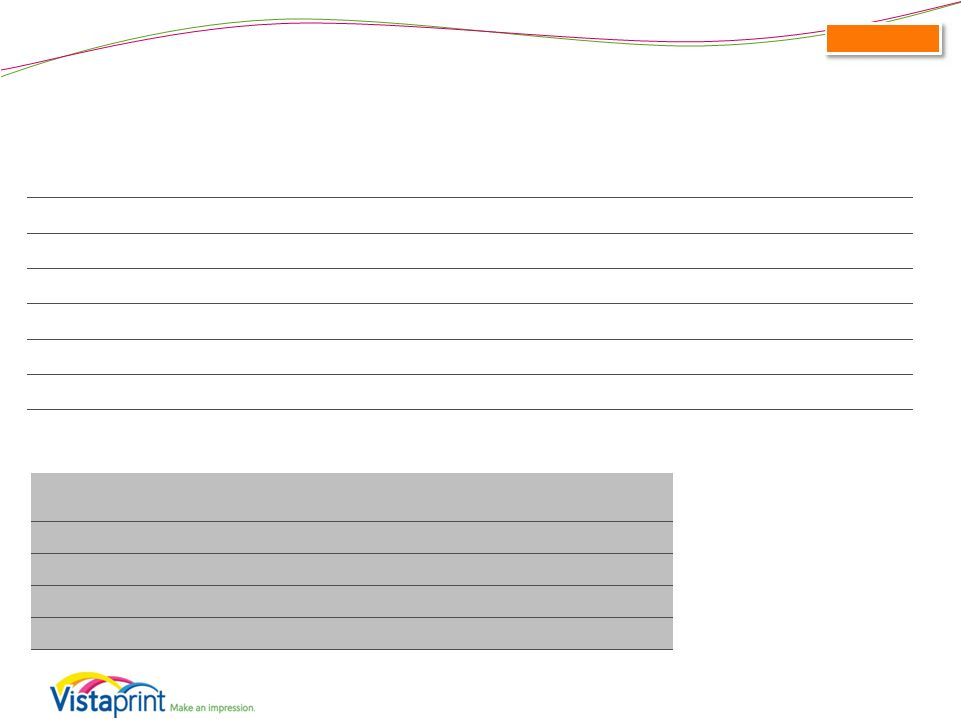

Cash Flow & ROIC Highlights*

Quarterly cash flows and investments (in millions)

Q2FY13

Q2FY12

Cash flow from operations

$88.5

$81.1

Free cash flow**

$58.7

$66.4

Capital expenditures

$27.6

$13.4

as % of revenue

7.9%

4.5%

Trailing Twelve Month Return on Invested Capital*** (GAAP)

7%

26%

Trailing Twelve Month Return on Invested Capital*** (Non-GAAP)

17%

34%

10

Share repurchase program

Q2FY13

Shares purchased

827,346

Average cost per share

$29.94

Total purchase spend, inclusive of transaction costs, in millions

$24.8

Balance sheet (in millions, as of December 31, 2012)

Cash and cash equivalents

$64.7

Consolidated

*

Financial results for the consolidated business, including Albumprinter and Webs results **

FCF = Cash Flow from Operations – Capital Expenditures – Purchases of Intangible

assets not related to acquisitions – Capitalized Software Expenses

***

ROIC = NOPAT / (Debt + Equity – Excess Cash) Net operating profit after taxes

(NOPAT) Excess cash is

cash and investments of 5% of last twelve month revenues

Operating leases have not been converted to debt Non-GAAP TTM ROIC excludes

share-based compensation expense and its related tax effect, amortization of acquired

intangibles, and charges related to the alignment of Webs IP with our global structure on NOPAT

Excess cash definition updated in period ending 12/31/2012 and for prior periods. |

Cash and cash

equivalents were approximately $64.7 million as of December 31, 2012. During the

quarter, Vistaprint generated $88.5 million in cash from operations, compared with

$81.1 million in the second quarter of fiscal 2012. Free cash flow was $58.7

million in the second quarter, down from $66.4 million in the second quarter of fiscal

2012. On a trailing twelve-month basis, return on invested capital (or ROIC)

as of December 31, 2012 declined due to the planned

reduced profitability in our business during the fiscal year. Including share based

compensation expense, it was approximately 7%, and excluding share based compensation

expense, it was approximately 17%. We expect ROIC to improve significantly over

time, as we expect our FY12 and FY13 investments to bear fruit later in FY14 and beyond.

The company repurchased 827,346 shares during the quarter at an average cost per share of

$29.94. We have approximately 375,000 shares left under the repurchase authorization

approved by our shareholders in November 2011 and under the Supervisory Board approval

of February 2012. We also received shareholder authorization to repurchase up to an additional 6.8

million of our outstanding shares at our November 2012 annual general meeting, but our

Supervisory Board has not yet approved any repurchase program pursuant to this

shareholder authority. We sought this approval for flexibility, and any decision to make

additional repurchases will be weighed carefully by our Supervisory Board and Management

Board, and will depend upon many factors. |

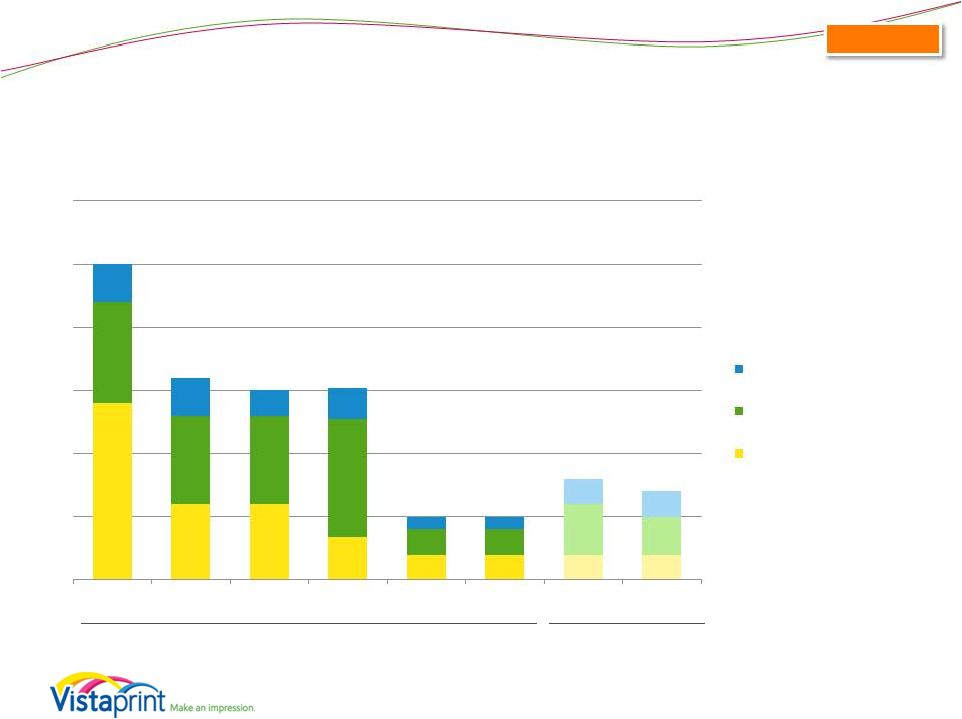

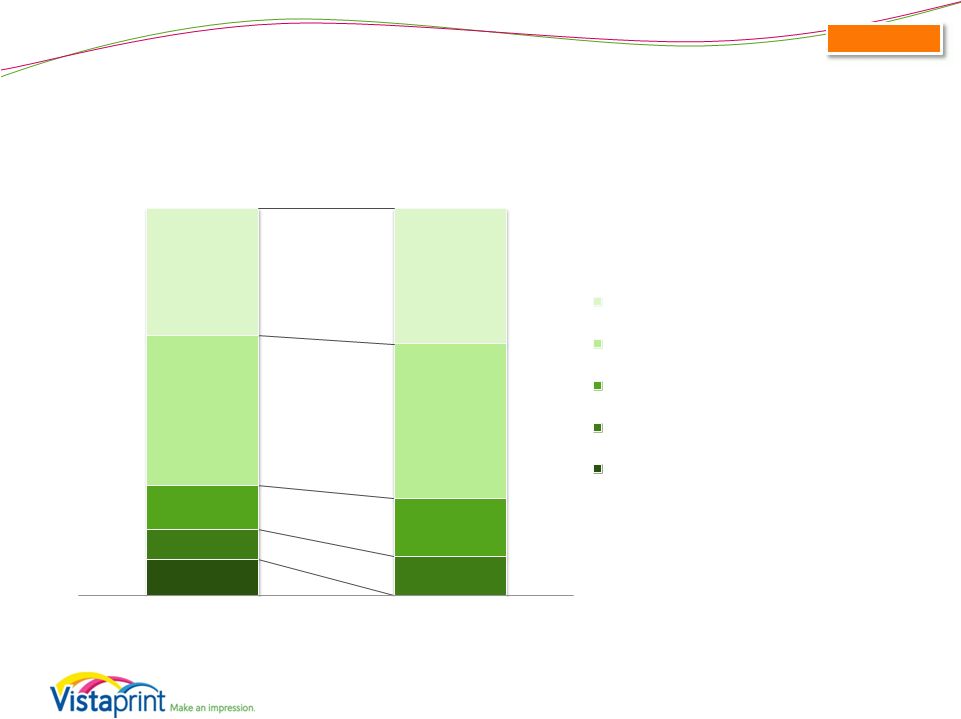

Geographic Segment Revenue -

Quarterly

(millions)

North America:

48% of total revenue

20% y/y growth

20% y/y constant currency

growth including Webs

18% y/y organic constant

currency growth

Europe:

46% of total revenue

11% y/y growth

14% y/y constant currency

growth including Albumprinter

9% y/y organic constant

currency growth

Asia Pacific:

6% of total revenue

26% y/y growth

24% y/y constant currency

growth

Q2 FY2013

11

$115.5

$119.2

$118.7

$139.8

$139.7

$140.9

$141.6

$164.7

$2.3

$2.5

$2.6

$2.8

$77.7

$77.8

$80.0

$127.3

$88.4

$79.1

$74.3

$136.5

$15.7

$11.8

$12.9

$15.4

$22.8

$10.5

$11.8

$13.7

$17.0

$15.4

$15.1

$17.5

$21.5

Q3 FY11

Q4 FY11

Q1 FY12

Q2 FY12

Q3 FY12

Q4 FY12

Q1 FY13

Q2 FY13

Asia-Pacific

Albumprinter (inc. in Europe)

Europe

Webs (inc. in North America)

North America

Consolidated

Revenue results for the consolidated business, including Albumprinter and Webs results since

respective acquisition dates. All Albumprinter revenue included in European segment. All

Webs revenue included in NA segment. Note: Constant currency basis is estimated by translating all non-U.S. Dollar denominated revenue

generated in the current period using the prior year period’s average exchange rate for

each currency to the U.S. Dollar and excludes the impact of gains and losses on effective foreign currency hedges

recognized in revenue.

Please see reconciliation to reported revenue growth rates at the end of this

presentation. |

For the

second quarter, revenue performance by geography, inclusive of Albumprinter and Webs revenues, was as follows:

•

North American revenue was $167.5 million, reflecting 20% growth year over year in both

reported and constant currency terms. This revenue is inclusive of the $2.8 million of revenue from

the Webs acquisition. Excluding Webs, our North American business grew 18% year over

year in constant currency. We saw continued strength in our results in North America, which we

attribute largely to solid execution against the key strategy initiatives we launched 18

months ago. Within the North American business, the US growth rate remained steady, while the Canadian

growth rate slowed slightly due to pricing tests we rolled out since last year which are

intended to test enhancements to our pricing methodology, including greater simplicity and clarity beyond

what we have already implemented in the US market.

•

European revenue was $159.3 million, reflecting 14% growth year over year in constant currency

and 11% growth year over year as reported. This revenue is inclusive of the $22.8 million of

revenue from the Albumprinter acquisition. Excluding Albumprinter, our European business

grew 9% year over year in constant currency. Even during the seasonally strong consumer quarter

for Europe, this growth was lower than what we believe is possible longer term in Europe. In

addition to the operational issues we have discussed above and in the past, we believe it is possible

that the macroeconomic environment in Europe is having an impact on us, but we can’t

quantify it. Instead we are focusing on our own value proposition and marketing execution in Europe,

both of which we are working to improve.

•

Asia-Pacific revenue was $21.5 million, reflecting 26% growth year over year in reported

terms and 24% growth year over year in constant currency. This remains our fastest growing geography.

That being said, we expect growth rates here to decline further for the foreseeable future as

we reach relative maturity in the Australian and New Zealand markets, which currently constitute

the vast majority of our revenue in this region. Similar to Canada, we implemented changes to

pricing and the presentation of our offers as part of our commitment to improving our customer

value proposition. We believe these changes negatively impacted our growth rate in the

region in the second quarter and are likely to continue to impact the growth rate near term. But we

believe that these are the right marketing practices for improving our longer-term

customer loyalty. Currency exchange rates in the quarter had a slightly negative impact on revenue growth year

over year. The Euro weakened against the U.S. dollar since Q2 2012, partially offset by a strengthened

British pound, Canadian Dollar and Australian Dollar. The net result of currency

movements year over year in Q2 was a negative impact of approximately $2 million on a consolidated basis.

Sequentially, the Euro, Canadian dollar and Pound strengthened against the U.S. dollar, while

the Australian Dollar remained flat. The net effect of all currencies on revenue was a benefit of

approximately $4 million versus first quarter rates. Compared to the currency rates we

assumed when we gave guidance in October, the currency impact was neutral.

|

Operational Metrics

(Excludes Albumprinter and Webs)

12

Organic

$34.79

$34.56

$34.69

$36.17

$36.03

$37.75

$36.38

$34.61

$35.38

$36.73

$36.78

$36.25

FY10

FY10

FY11

FY11

FY11

FY11

FY12

FY12

FY12

FY12

FY13

FY13

Average Order Value

4.8

4.8

5.0

6.5

5.8

5.6

5.9

8.3

7.0

6.4

6.5

9.0

FY10

FY10

FY11

FY11

FY11

FY11

FY12

FY12

FY12

FY12

FY13

FY13

Orders (M)

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2 |

Vistaprint’s organic business metrics, excluding Albumprinter and Webs, were as follows:

•

•

Total orders processed in the quarter were approximately 9.0 million reflecting growth of 8%

year over year. Average order value was $36.25, up from an

average order value of $34.61 in Q2 of last fiscal year. AOV was up year over year in North America, yet down

slightly in Europe and Asia Pacific. Currency had a slightly negative impact in Europe year

over year. These metrics should be viewed together and not

individually, as factors such as currency, product mix, marketing campaigns, partner performance, seasonality,

and the like, can impact them. |

Operational Metrics

(Excludes Albumprinter and Webs)

13

3.2

Organic

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

0%

5%

10%

15%

20%

25%

30%

35%

$21

$22

$23

$24

$24

$26

$27

$26

$26

$25

$28

$27

0 $

5 $

10 $

15 $

20 $

25 $

30 $

35 $

20%

21%

21%

22%

21%

23%

24%

27%

26%

24%

26%

27%

New Customers

(million)

Advertising as

% of Revenue

Implied COCA |

Additional

customer metrics for the organic business for the period ending December 31, 2012, were as follows:

•

Quarterly new customer additions excluding Albumprinter and Webs were approximately 3.2

million, reflecting 10% year over year growth over the approximately 2.9 million new

customer adds in Q2 of last fiscal year. This quarter, we passed the anniversary of two initiatives that helped us accelerate new customer growth last year: our

increased advertising expense as a percentage of revenue, and our partnership with

Staples. We continue to expect new customer growth as a part of our efforts to extend

our reach, but we don’t believe we will see 30% growth this fiscal year like we did last

year. In addition, our European new customer add growth rate was weaker than the

North American growth rate and slowed from last quarter. •

Vistaprint uses the term “implied cost of customer acquisition” or “implied

COCA” to describe total advertising expense in a period divided by the number of unique first

time customers in that period. The second chart illustrates our implied COCA, which was

down from Q1 to Q2 at approximately $27 but is higher than the prior fiscal year second

quarter due to our planned increased investment in advertising over time.

•

Advertising costs for the organic business were $87.3 million, or 27.0% of organic revenue in

the quarter. As part of our strategic investments, we expected this increase

versus years past.

|

Historical Revenue Driver Metrics

(Quarterly)

14

11.1

11.4

11.9

*trailing twelve month at period end

12.9

Organic

13.8

14.4

14.9

15.4

3.9

4.0

4.2

4.5

4.8

5.0

5.2

5.4

7.2

7.4

7.7

8.4

9.0

9.4

9.7

10.0

FY11

FY11

FY12

FY12

FY12

FY12

FY13

FY13

New Customers Aquired in Period

Customers Repeating from Prior Periods

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

FY11

FY11

FY12

FY12

FY12

FY12

FY13

FY13

TTM Unique Customers (M)

11.1

11.4

11.9

12.9

13.8

14.4

14.9

15.4

TTM New

Customers (M)

7.2

7.4

7.7

8.4

9.0

9.4

9.7

10.0

TTM Repeating

Customers (M)

3.9

4.0

4.2

4.5

4.8

5.0

5.2

5.4

As % of Unique

Customers

TTM New Customers

65%

65%

65%

65%

65%

65%

65%

65%

TTM Repeating Customers

35%

35%

35%

35%

35%

35%

35%

35%

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Y/Y

Growth

TTM Unique Customers

21%

19%

19%

22%

24%

26%

25%

19%

TTM New

Customers

16%

16%

17%

20%

25%

27%

26%

19%

TTM Repeating

Customers

30%

25%

24%

25%

23%

25%

24%

20%

Implied

Retention**

42%

42%

42%

42%

43%

44%

44%

42%

**TTM repeating customers as % of year

ago unique customers

TTM* Unique Customers (M) |

Our unique

customer metrics for the organic business on a trailing twelve month basis were as follows:

•

•

As we have described in the past, many of the changes we have made since the beginning of FY12

are impacting our metrics in different ways. While one of our long-term

objectives is to increase retained customers as a percent of the prior year’s total unique customer count, we previously noted that this metric

repeat order activity due in part to some of our customer value proposition changes (which

influences the numerator of this metric). For example, excluding the impact of

retail partners, the percentage of repeating customers from prior periods would have been flat sequentially.

could decline in FY13 due to the significant acceleration of new customers we added in FY12

(the denominator of this metric), as well as some slowing of

On a TTM basis for the period ending December 31, 2012, unique customer count was 15.4

million, reflecting 19% year over year growth of unique customers. First-time unique customers in the TTM period ending December

31, 2012 grew 19% year over year while unique customers transacting from prior periods

grew 20% year over year. |

Historical Revenue Driver Metrics

15

Average Customer Spend:

Organic

Q3

FY11

Q4

FY11

Q1

FY12

Q2

FY12

Q3

FY12

Q4

FY12

Q1

FY13

Q2

FY13

$99

$100

$102

$100

$100

$99

$99

$97

Average Spend Per Unique

Customer (USD)

$70

$72

$73

$71

$69

$68

$67

$67

$54

$55

$55

$53

$52

$51

$50

$50

Q3

FY11

Q4

FY11

Q1

FY12

Q2

FY12

Q3

FY12

Q4

FY12

Q1

FY13

Q2

FY13

Average

Spend per Unique

Customer

$70

$72

$73

$71

$69

$68

$67

$67

Average Spend per New

Customer

$54

$55

$55

$53

$52

$51

$50

$50

Average Spend per Repeat

Customer

$99

$100

$102

$100

$100

$99

$99

$97

Y/Y

Growth

Average

Spend per Unique

Customer

4%

1%

(1%)

(6%)

(8%)

(6%)

Average Spend

per New

Customer

2%

(2%)

(4%)

(7%)

(9%)

(6%)

Average Spend

per Repeat

Customer

3%

2%

1%

(1%)

(3%)

(3%)

FY11-FY16, long-term

target of low-

to mid-

single digit growth in bookings per

unique customer.

New

Repeat

Total |

Average spend

per unique customer for the organic business on a trailing twelve month basis for the period ended

December 31, 2012 developed as follows:

•

Average spend per unique customer during the TTM period ending

December 31, 2012 was $67, reflecting a 6%

decline year over year. We believe this decline was due to several factors, including:

•

The near-term drag created by changes we made in FY12 to drive long-term customer

retention, such as reduced in-transaction cross sell. This was most apparent

in the European TTM average spend per unique customer, which continued to decline and

created a drag on the average. This was due to lower growth of average spend for

both unique new and repeat customers in the TTM period; •

The impact of our success with wholesale partnerships such as FedEx Office and Staples, for

which we receive wholesale revenue per order that is on average lower than our

direct-to-customer business; and •

A year-over-year negative impact of currency movements, which impacts this metric, as

well as the sub- metrics below.

•

Average spend per new customer acquired in the TTM period was $50, reflecting a 6% decline

year over year. •

Average spend per customer transacting in prior periods during

the TTM period was $97, reflecting a 3% decline

year over year. |

Looking Ahead

16 |

FY13 Outlook Commentary

17

•

Revenue guidance midpoint reduced by $30M

o

Operational performance: underperformance of European

business plus reduction in advertising expense (adjusted down

by about $35M)

o

Currency outlook (adjusted up by about $5M)

•

EPS guidance unchanged

o

Positives: continued GM strength, H2 reductions to advertising

expense, Q2 tax rate favorability, reduced share count

o

Negatives: reduced revenue outlook, some one-time expenses

related to changes in our European business, additional

interest expense from recent share repurchases |

With the

first half of the fiscal year behind us, we are adjusting our full fiscal year 13 guidance as follows:

Revenue We are

lowering our revenue guidance range by $30M at the guidance range midpoint. This reflects two primary factors:

•

Our expectations for revenue have been lowered by about $35M for the full year, reflecting

European weakness and a decision to trim advertising expense, which will further reduce

revenue. •

Currency has moved in our favor since we gave guidance in October. We are adjusting our

expectations to reflect an expected $5M benefit for the year.

Though our Q2 European growth rate was an improvement from the 1% we delivered in Q1 of this

fiscal year, we believe this was largely due to some success in our holiday and

consumer business in Europe, which will not repeat in the back half of the year. Given the execution challenges we have experienced in Europe, we believe it

is prudent to expect that the shift from our Q2 holiday-oriented focus to our

small-business-oriented focus in the third and fourth quarters will be even more challenging

than it has been historically. Our new revenue range incorporates a range of second half

outcomes for Europe, including very little growth at the low end of the range, to

modest growth similar to our first half constant currency growth of 6% at the high end of the

range. Our expectation is that we can continue to deliver strong growth in North America for the

remainder of the fiscal year, in line with our recent performance ranges. In

Asia-Pacific, we expect some deceleration in growth rates year-over-year primarily

due to customer-value-oriented pricing and offer changes described earlier.

EPS

We remain confident in our ability to deliver EPS in line with our previously announced annual

guidance. As a result, we are narrowing our FY13 EPS guidance range to the upper part

of our prior guidance range. There are several positives and negatives influencing this number relative to past guidance, which net out to roughly no

change.

|

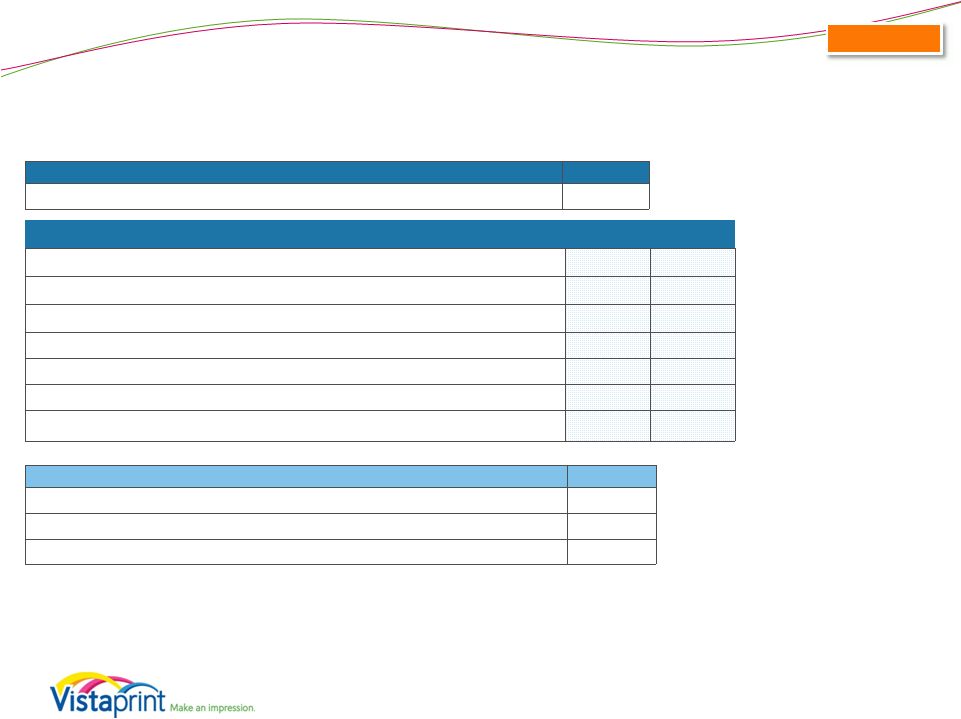

Financial Guidance*

(as of October 25, 2012)

The

Company

is

providing

the

following

assumptions

to

facilitate

non-GAAP

adjusted

net

income

per

diluted

share

comparisons

that

exclude

share-

based compensation related expenses, amortization of acquired intangible assets and

tax charges related to the alignment of IP with our global operations:

FY13

ending 06/30/2013

Q3 FY13

ending 3/31/2013

Revenue

$1,145 -

$1,175

$275 -

$290

Revenue growth from FY 2012 period

12% -

15%

7% -

13%

Organic constant currency revenue growth estimate

10% -

13%

5% -

11%

GAAP EPS

$0.50 -

$0.70

EPS decline from FY 2012 period

(56%) -

(38%)

GAAP share count

34.6 million

FY13

ending 06/30/2013

Non-GAAP adjusted EPS

$1.79 -

$1.99

EPS decline from FY 2012 period

(8%) –

2%

Non-GAAP share count

35.2 million

Non-GAAP exclusions

$45.3

* Millions, except share and per share amounts and as noted

18

Consolidated |

The table

above is Vistaprint’s financial guidance as of January 31, 2013. This guidance reflects our expected market opportunity and planned investments for growth and

competitive advantage. Vistaprint specifically disclaims any obligation to update any

forward-looking statements, which should not be relied upon as representing our

expectations or beliefs as of any date subsequent to January 31, 2013, the date of this

presentation.

Our expectations for the full fiscal year ending June 30, 2013 are as follows:

•

For full year revenue, our organic constant-currency growth expectations are 10% to 13%

growth, and consolidated constant-currency growth expectations are 12% to

15%. If exchange rates stay the same as they were for the 30-day average in

mid-January 2013, we would expect consolidated revenue to be $1,145 million to $1,175

million, an increase of 12% to 15% year over year in U.S. dollars. Of course, actual

revenue will depend in part on currency exchange rate development throughout the

remainder of the fiscal year. •

Full fiscal year GAAP EPS, on a diluted basis, is expected to be between $0.50 and

$0.70 based on about 34.6 million weighted average shares outstanding.

Our consolidated revenue expectations for the quarter ending March 31, 2013, the third quarter

of fiscal year 2013, are expected to be in the range of $275 million to $290 million,

an increase of 7% to 13% in U.S. dollars, and 6% to 12% in constant currencies. We expect organic constant-currency growth of 5% to 11% year over year.

|

Financial Guidance*

(as of October 25, 2012)

The

Company

is

providing

the

following

assumptions

to

facilitate

non-GAAP

adjusted

net

income

per

diluted

share

comparisons

that

exclude

share-

based compensation related expenses, amortization of acquired intangible assets and

tax charges related to the alignment of IP with our global operations:

FY13

ending 06/30/2013

Q3 FY13

ending 3/31/2013

Revenue

$1,145 -

$1,175

$275 -

$290

Revenue growth from FY 2012 period

12% -

15%

7% -

13%

Organic constant currency revenue growth estimate

10% -

13%

5% -

11%

GAAP EPS

$0.50 -

$0.70

EPS decline from FY 2012 period

(56%) -

(38%)

GAAP share count

34.6 million

FY13

ending 06/30/2013

Non-GAAP adjusted EPS

$1.79 -

$1.99

EPS decline from FY 2012 period

(8%) –

2%

Non-GAAP share count

35.2 million

Non-GAAP exclusions

$45.3

* Millions, except share and per share amounts and as noted

19

Consolidated |

We are

providing the assumptions noted on our guidance slide to facilitate comparisons with non-GAAP adjusted net income per diluted

share.

•

Based on these assumptions, for the full fiscal year 2013, non-GAAP adjusted EPS is

expected to be between $1.79 and $1.99, and excludes expected acquisition-related

amortization of intangible assets of approximately $8.4 million; share-based compensation

expense and its related tax effect of approximately $34.6 million; charges related to the

alignment of acquisition-related intellectual property with global operations of

approximately $2.4 million; and 35.2 million shares outstanding.

•

We expect these expenses which are excluded from non-GAAP results to be fairly evenly

distributed throughout the fiscal year, with the exception of the alignment of the

acquisition-related intellectual property which is recorded based on the timing of how the profits

come in on a quarterly basis.

|

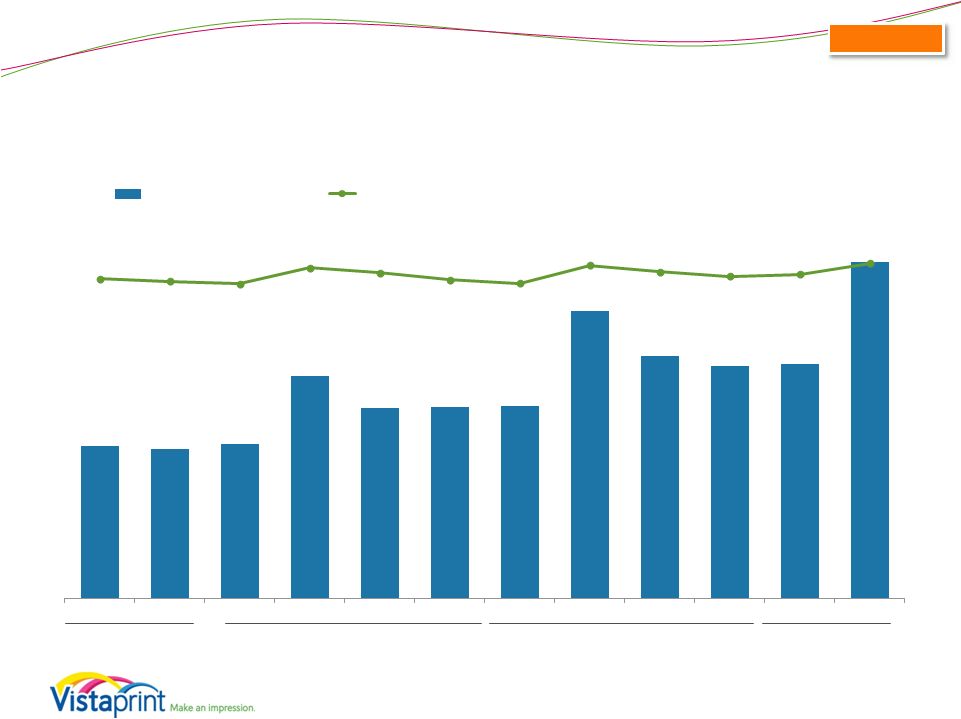

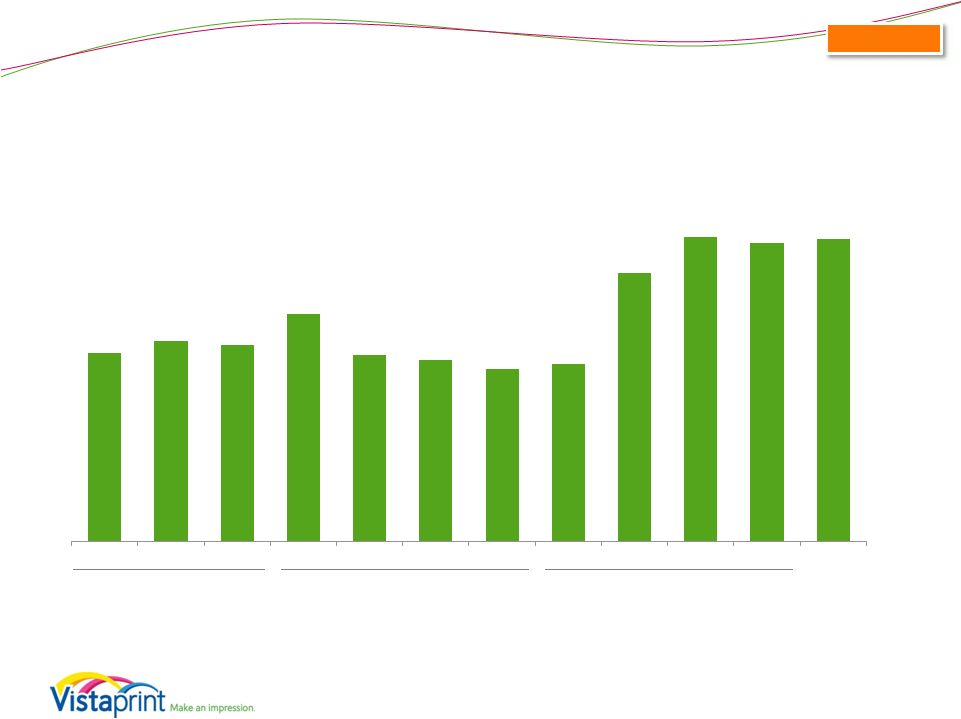

Capital

Expenditures Guidance (as of January 31, 2013)

Expressed as percent of revenue

FY 2013 Guidance:

•

•

Actuals

Guidance

$63M

$63M

$76M

$95M

$85M

$101M

$37M

20

Consolidated

$46M

25%

16%

15%

5%

8%

15%

5%

7%

14%

6%

6%

3%

2%

2%

2%

2%

8%

7%

7%

9%

2%

2%

4%

3%

3%

3%

2%

3%

1%

1%

2%

2%

FY 2007

FY 2008

FY 2009

FY 2010

FY 2011

FY 2012

FY 2013

-

High

FY 2013

-

Low

Other

Land and Facilities

Manufacturing &

Automation Equipment

7% -

8% of revenue

guidance midpoint

$85M -

$95M |

This chart

shows capital expenditures in dollars and as a percentage of revenue for the past several years, and also shows our

expectations for fiscal 2013 at the midpoint of our revenue guidance range. We expect capital

expenditures as a percentage of revenue and in absolute dollars to increase in fiscal

2013 over 2012. For FY 2013, we have narrowed our previous guidance range and now

expect capital expenditures of $85 to $95 million, or 7% to 8% of our revenue guidance

midpoint. This guidance includes the expansion of our Venlo production facility,

capital expenditures to create a small production facility in India, and other IT and

manufacturing equipment requirements to support our growth plans.

|

Commentary on Revenue and EPS Seasonality

21

•

As previously noted, no longer provide quarterly EPS guidance

•

Expect our typical seasonality trends to continue

•

We have already delivered majority of annual GAAP EPS in

our second fiscal

quarter

o

In line with recent years

•

Will provide quarterly revenue guidance

o

Quarterly updates on our annual revenue and EPS guidance

|

Our business

is seasonal. We want to provide some color on the expected trends in the business through the year:

•

We expect the seasonal revenue trends in our business to continue, notwithstanding recent

weakness in Europe, which typically has a higher percentage of home and family

oriented revenue than other regions. The addition of Albumprinter increases the seasonal nature of our business. Now that our seasonally

strong second fiscal quarter is behind us, we expect lower revenue and profits in the back

half of the year.

•

We expect our recent trend of delivering a majority of annual GAAP earnings during our second

fiscal quarter to continue in FY 2013. Given our year-to-date FY 13 EPS of

$0.66, and our full fiscal year guidance range of $0.50 to $0.70, it is possible that we will lose money in the second half of the fiscal year, as we

did in Q1.

We will continue to provide annual revenue and EPS guidance, with quarterly updates. We

will also provide quarterly revenue guidance.

|

Commentary on Long-Term Outlook

22

•

Continue to believe scale matters and

market opportunity is large

•

Continue to target $2B in annual revenue

and beyond as we strive to create

enduring transformational business

institution

•

Current reality of disappointing revenue

results in Europe means we are likely to

reach $2B later than the FY16 mark that

we originally targeted

•

Despite weaker revenue outlook, we

believe we have multiple levers for profit

growth

•

Still targeting FY16 net income goal

•

We believe we have opportunity

to

achieve this through mix of execution

of strategic plan and careful investment

trade-offs

•

Per our usual annual cycle, we will take

remainder of FY13 to plan for these

trade-offs, but our current FY14 view is

that we expect revenue growth to be

subsidiary to building strong foundations

in our business and to profit growth

Revenue

Profit |

Before

closing, we’d like to comment on our long-term outlook. In the past we have described publicly our 2016 financial targets as part of our long-term strategy and investment approach. As a growing

business, we regularly make investment trade-off decisions that we anticipate will have

near- and long-term impacts to revenue and profitability. As our performance and anticipated investment returns

evolve over time, it may be prudent for us to make adjustments to our plans that we believe

will best position us to achieve our strategic and financial objectives.

As an example, the continuing weakness of our performance in Europe in recent quarters has put

significant pressure on our ability to achieve our 2016 financial targets. We continue to believe that scale

drives competitive advantage in this business and that our market opportunity is large.

We also continue to target at least $2B in annual organic revenue in the future. However, based on our most

recent outlook in light of our performance to-date in FY13, we now believe it is unlikely

that we will achieve $2B in annual organic revenue in FY16 as we had originally targeted.

On the profit side, we believe we have many levers to help us minimize the impact of our

weaker revenue outlook. We continue to target our FY16 goal of $220 million of net income, plus or minus 10%,

and over the next six months, we will work on evolving our plans to achieve this profit goal

in light of our new revenue outlook. In FY12 and FY13, our focus has been to deemphasize near-term profits in

order to fund significant investments targeting long-term revenue growth. In FY14

through FY16, as described previously, we expect to continue to invest for the long term, but we will also seek to drive

margin improvements that make our long-term profit objective feasible. We believe we

can achieve profit growth through a mix of the expected benefits of our strategy execution (such as improved

gross margin due to manufacturing efficiencies) combined with a series of investment

tradeoffs, improvements to our organizational effectiveness, advertising optimization and expense management.

Not only do we believe such improvements and investment trade-offs will support

near-term profitability, but we will seek to take actions consistent with our goal of long-term value creation.

We have described in this presentation a mixed picture of our recent performance: •

On the positive side, we believe that many of our strategic initiatives are gaining traction,

and we are proud of what we have accomplished so far in areas like product quality improvements, our

North American marketing improvements and revenue results, manufacturing, software

development, customer service, digital products, the European photo book market, and APAC.

•

Conversely, our results in Europe have not been nearly what we had planned, and we believe our

revenue challenges there will persist through at least the remainder of FY13. This creates significant

ripple effects for the entire business. •

As discussed in slide 5, we now have 18 months of historical data relating to our LTV based

advertising investments, and we expect to make NPV-based optimization decisions as a result. Choosing to

reduce our advertising as a percent of revenue in FY14 would likely impact our revenue growth

negatively, but should improve our operating margins and the NPV of our still-substantial advertising

budget.

We have a varied set of similar inputs for our planning process for FY14 and beyond. Our

current view of FY14 is that while we expect revenue growth will remain important during this time, it will be

subsidiary to our goals of building solid operational and management foundations designed to

address the shortcomings we have seen to date in certain parts of our business, and to building toward our

2016 profit objectives. As an example, depending on the options we choose to manage

through our European challenges, we could decide to accept continued low revenue growth in Europe in FY14 as

we focus on our efforts to become more customer centric and improve our execution and

profitability there. As our team looks at the opportunities ahead of us, we want to focus on creating the best

possible plan, and we will take the remainder of FY13 to do so, as we typically do in every

annual planning cycle. |

Investor Day Update

23

•

Investor Day will be postponed to August 6, 2013 to align

with our annual planning sequence

•

We expect a higher quality event at that time as we will

have completed our FY14 planning process and can

provide more concrete insight into our investment

decisions and their impact to our long-term outlook

|

Finally, as

our shareholders know, we had been planning to host an Investor Day on February 7, 2013. We have

decided to postpone this event until after our Q4 2013 earnings announcement. The new

date will be August 6, 2013. We believe that moving the date to the beginning of

the new fiscal year, after we have completed our strategic and financial planning

process for FY14, will give us the chance to provide our investors more concrete insight into our

investment plans for FY14 and the impact we expect them to have on our longer-term revenue

and earnings results. We apologize for any inconvenience caused by this decision,

but expect our shareholders will find the postponed event to include a

higher-quality discussion of our plans and outlook. Going forward, we would expect to continue to hold

our annual Investor Day around the same time in August each year.

|

Summary

•

Solid revenue results relative to guidance, with continued

mixed execution:

o

Stronger NA marketing execution

o

Weaker EU marketing execution

•

Strong progress in other parts of the business

o

Value proposition, LTV advertising, manufacturing

o

Foundations for future in digital, Asia & EU photo books

•

Believe we have the right strategy to drive

o

Long-term revenue and profit growth

o

Competitive advantage

o

Significant value for long-term shareholders

24 |

In summary,

our second fiscal quarter revenue results were solid relative to the expectations we

set three months ago, but tracking below our longer-term aspirations largely due to

continued challenges in our European business. We are working hard to address

this issue, but believe this will not be a short-term turnaround.

We are making good progress relative to our objectives in other areas, including improving our

customer value proposition, investing in life time value based advertising, improving

our manufacturing and supply chain capabilities, expanding our technology resources and

laying foundations for future growth in digital, Asia and the European photo book

market. We remain confident in the overall approach we are taking to drive

long-term revenue and profit growth worldwide, and in our ability to respond

flexibly to changing circumstances we might face in the future. We intend to continue to

leverage the benefits of our scale and core capabilities, and believe that we are building

toward a solid future of growth, competitive advantage and value for our long-term

shareholders. |

Q&A Session

Please go to the

Investor Relations section of www.vistaprint.com

for the live Q&A call at

5:15 pm EDT on January 31, 2013 |

Q2

Fiscal Year 2013 Financial and Operating Results Supplement

|

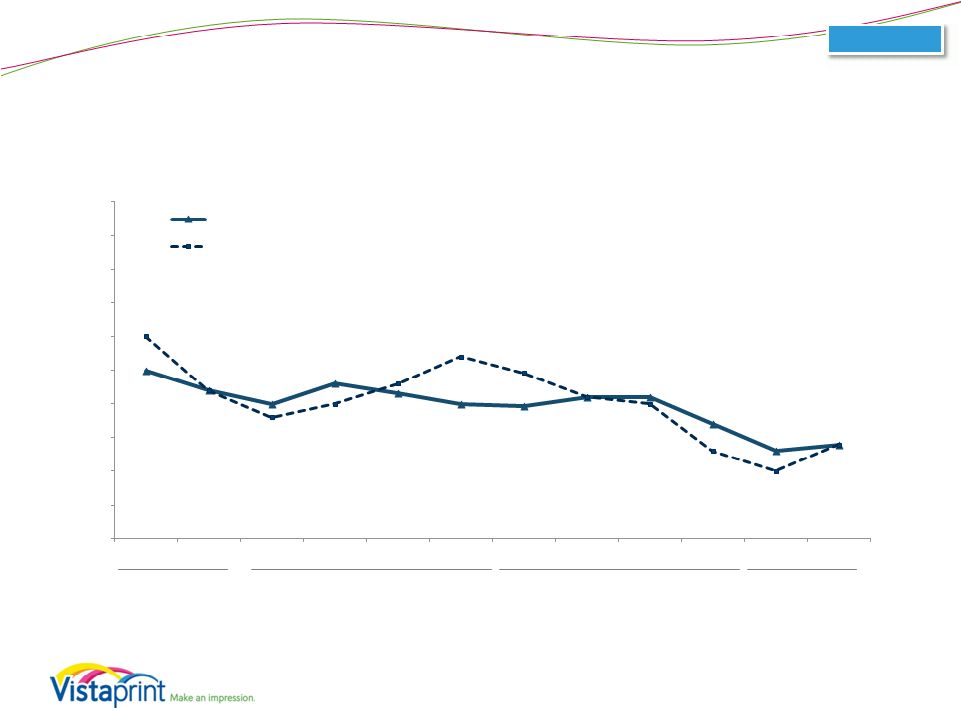

Total Company Organic Growth Rates

(Excludes Albumprinter and Webs)

Note: Constant currency basis is estimated by translating all non-U.S. Dollar

denominated revenue generated in the current period using

the

prior

year

period’s

average

exchange

rate

for

each

currency

to

the

U.S.

Dollar

and

excludes

the

impact

of

gains

and

losses

on

effective foreign currency hedges recognized in revenue.

Please see reconciliation to reported revenue growth rates at the end of this

presentation. 14%

reported

14%

constant-currency

FY10

28% constant-currency growth

27

FY11

22% constant-currency growth

FY12

20% constant-currency growth

YTD FY13

14% constant-currency growth

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

50%

Q3 FY10

Q4 FY10

Q1 FY11

Q2 FY11

Q3 FY11

Q4 FY11

Q1 FY12

Q2 FY12

Q3 FY12

Q4 FY12

Q1 FY13

Q2 FY13

Constant-Currency

Reported

Organic |

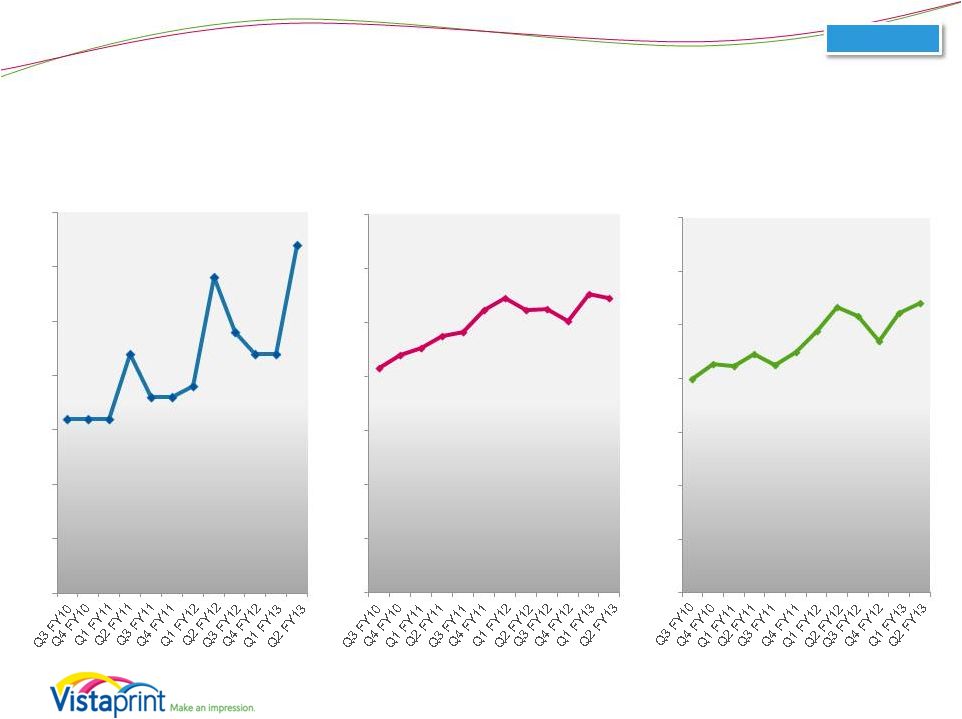

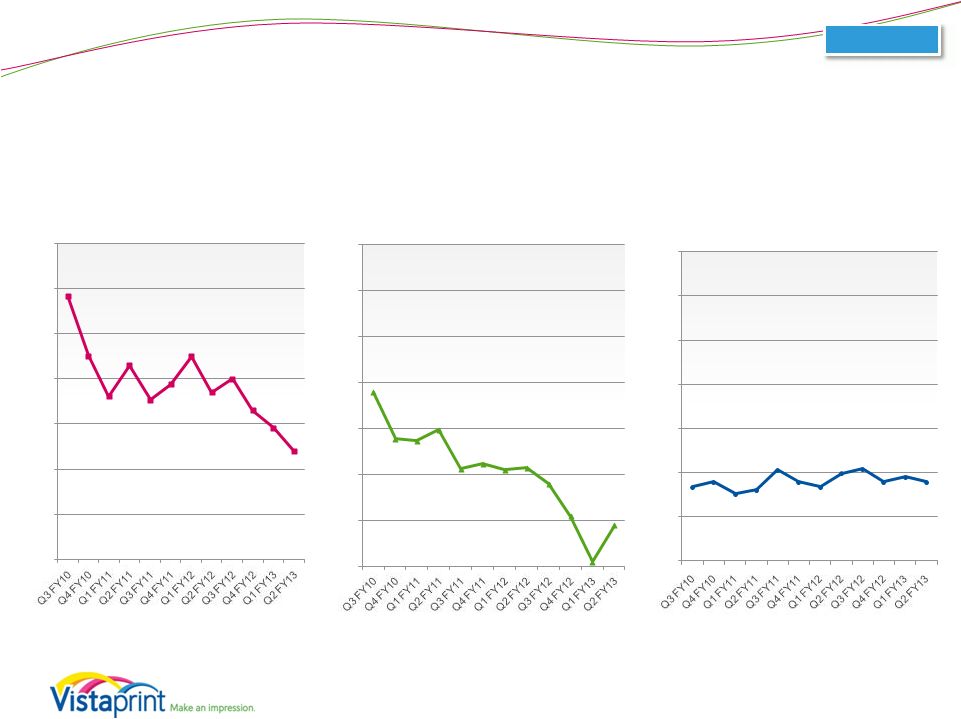

Segment Revenue Growth Rates

Constant Currency Organic

28

Organic

10%

20%

30%

40%

50%

60%

70%

APAC

10%

20%

30%

40%

50%

60%

70%

Europe

10%

20%

30%

40%

50%

60%

70%

North America

58%

45%

36%

43%

35%

39%

45%

37%

40%

33%

29%

24%

38%

28%

27%

30%

21%

22%

21%

22%

18%

11%

1%

9%

17%

18%

15%

16%

21%

18%

17%

20%

21%

18%

19%

18%

0%

0%

0% |

Gross Margin and Gross Profit

29

FY10 64.2%

FY11 64.8%

FY12 65.2%

FY13 YTD 66.3%

Gross Profit (millions)

GM %

$234

64.1%

63.6%

63.1%

66.3%

65.3%

63.9%

63.2%

66.8%

65.5%

64.6%

65.0%

67.2%

$106

$105

$108

$155

$133

$133

$134

$200

$169

$162

$163

Q3 FY10

Q4 FY10

Q1 FY11

Q2 FY11

Q3 FY11

Q4 FY11

Q1 FY12

Q2 FY12

Q3 FY12

Q4 FY12

Q1 FY13

Q2 FY13

Consolidated |

GAAP Net Income (Loss) and Net Margin

30

FY10 $68

FY11 $82

FY12 $44

FY13 YTD $21

Consolidated

GAAP Net Income (loss), in millions

GAAP Net Margin

9.7%

7.1%

6.3%

14.5%

11.3%

6.9%

3.8%

10.6%

0.1%

1.5%

-0.7%

6.6%

5.0%

0.0%

5.0%

10.0%

15.0%

-

Q3 FY10

Q4 FY10

Q1 FY11

Q2 FY11

Q3 FY11

Q4 FY11

Q1 FY12

Q2 FY12

Q3 FY12

Q4 FY12

Q1 FY13

Q2 FY13

$(2)

$16

$12

$11

$34

$23

$14

$8

$32

$0

$4

$23 |

Non-GAAP Adjusted Net Income*

and Adjusted Net Margin

*Non-GAAP adjusted net income for all periods presented excludes the impact of

share-based compensation

expense

and

its

related

tax

effect,

amortization

of

acquired

intangibles,

and

charges

related

to the alignment of Webs IP with our global structure. Please see

reconciliation to GAAP net income at the end of this presentation.

31

FY10 $91

FY11 $105

FY12 $77

FY13 YTD $45

Consolidated

Non-GAAP Adjusted Net Income (millions)

Non-GAAP Adjusted Net Margin

12.9%

10.5%

9.6%

17.3%

13.8%

9.4%

6.1%

12.6%

4.4%

3.5%

10.3%

5.9%

$21

$17

$16

$40

$28

$20

$13

$38

$11

$15

$9

$36

Q3 FY10

Q4 FY10

Q1 FY11

Q2 FY11

Q3 FY11

Q4 FY11

Q1 FY12

Q2 FY12

Q3 FY12

Q4 FY12

Q1 FY13

Q2 FY13 |

Q2

Income Statement Comparison to Prior Year (as a percentage of revenue)

32

Consolidated

9.5%

10.9%

7.6%

9.1%

11.5%

9.9%

38.6%

36.9%

32.8%

33.2%

Q2 FY2013

Q2 FY2012

Cost of revenue

Marketing and selling

Technology and development

General and administrative

Income from operations |

Q2

Income Statement Comparison to Prior Quarter (as a percentage of

revenue) 33

Consolidated

9.5%

0.1%

7.6%

10.1%

11.5%

15.0%

38.6%

39.8%

32.8%

35.0%

Q2 FY2013

Q1 FY2013

Cost of revenue

Marketing and selling

Technology and development

General and administrative

Income from operations |

Share-Based Compensation* (millions)

* Share-based compensation (SBC) expense

includes SBC-related tax adjustment. 34

FY10 $23.2

FY11 $22.4

FY12 $26.1

Consolidated

$5.3

$5.7

$5.6

$6.4

$5.3

$5.1

$4.9

$5.0

$7.6

$8.6

$8.4

$8.5

Q3 FY10

Q4 FY10

Q1 FY11

Q2 FY11

Q3 FY11

Q4 FY11

Q1 FY12

Q2 FY12

Q3 FY12

Q4 FY12

Q1 FY13

Q2 FY13 |

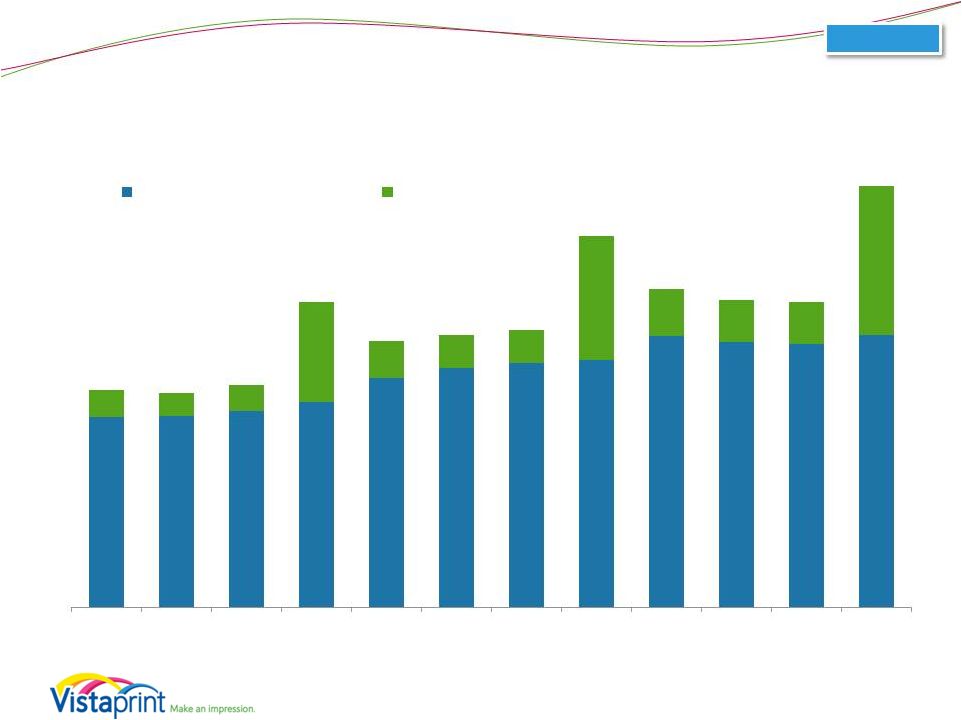

Revenue Seasonality

(Excludes Albumprinter and Webs)

* Home and family revenue is calculated using a product format-based

approach 35

Organic

$166

$164

$170

$234

$204

$209

$212

$284

$244

$235

$233

$323

Q3 FY10

Q4 FY10

Q1 FY11

Q2 FY11

Q3 FY11

Q4 FY11

Q1 FY12

Q2 FY12

Q3 FY12

Q4 FY12

Q1 FY13

Q2 FY13

Small Business Marketing

Home and Family* |

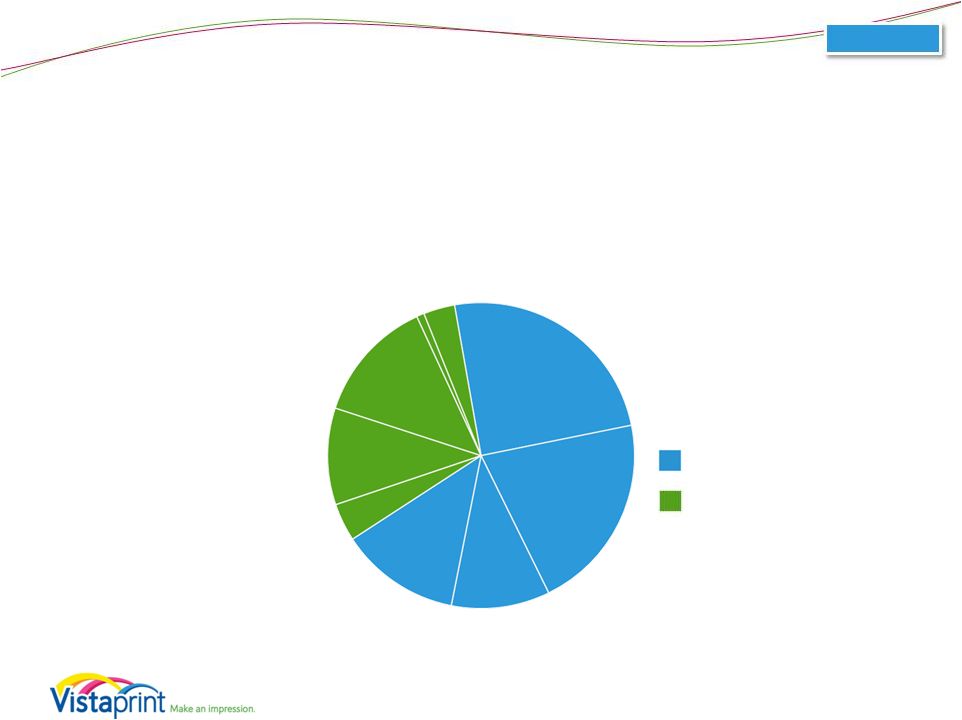

Q2 FY 2013

Bookings by Marketing Channel (excludes Albumprinter and Webs bookings)

~3.2 million new customers in Q2 FY2013

Paid

Search

Other

Channels

and Partners

3 Party Permission-

Based email

Direct URL Type-In

Paid

Search

Other

Channels and

Partners

Our Own

Permission-Based

email

Direct URL Type-

In

First-time Order Bookings: 32%

Repeat Order Bookings: 68%

Our Own

Permission-Based

email

36

Organic

rd |

Balance Sheet Highlights

Balance Sheet highlights, in millions, at period end

12/31/12

09/30/12

06/30/12

3/31/12

12/31/11

Total assets

$653.7

$620.5

$592.4

$588.0

$590.3

Cash and cash equivalents

$64.7

$59.3

$62.2

$52.1

$67.5

Total current assets

$132.3

$114.6

$115.6

$103.5

$123.7

Goodwill and intangible assets

$179.2

$179.5

$180.7

$192.0

$196.6

Total liabilities

$443.8

$421.3

$403.1

$306.0

$322.5

Current liabilities

$182.4

$129.4

$142.0

$148.1

$166.2

Long-term debt

$230.5

$259.3

$229.0

$126.5

$140.5

Shareholders’

Equity

$209.9

$199.2

$189.3

$281.9

$267.8

Treasury shares (in millions)

16.4

15.7

15.8

13.0

13.1

37

Consolidated |

Long-Term Debt

Availability under our credit facility

12/31/12

Maximum aggregate available borrowing amounts

$387.5M

Outstanding borrowings of credit facility

($230.5M)

Remaining amount

$157.0M

Limitations to borrowing due to debt covenants and other obligations*

($31.9M)

Amount available for borrowing as of December 31, 2012

$125.1M

38

Consolidated

•

Credit facility in place with aggregate loan commitments of $387.5M

•

Interest

rate

is

LIBOR

plus

1.25%

-

1.50%

•

Currently in compliance with all covenants. Key covenants are:

Senior leverage ratio not to exceed 2.75x TTM EBITDA

Total leverage ratio not to exceed 3.5x TTM EBITDA

Interest coverage ratio of at least 3.0

Total cash/debt use for share repurchases of $400M since inception of credit

facility (10/21/2011) * Our borrowing ability can be limited by our debt

covenants each quarter. These covenants may limit our borrowing capacity

depending on our leverage, other indebtedness, such as installment obligations and letters of credit, and

other factors that are outlined in the credit agreement filed as

an exhibit in our Form 8-K filed on October 26, 2011.

|

Q2

FY13 Capital Expenditure Breakdown Q2 CapEx: $27.6M

1

3

2

1 Land,

building

and

construction,

leasehold

improvements,

and

furniture

and

fixtures

2

3 IT infrastructure, software and office equipment

39

Consolidated

52%

32%

17%

Land/Facilities

Mfg & Automation Equipment

Other

equipment, pre-press and post-press equipment such as cutters, and

automation equipment All

manufacturing

and

automation

equipment,

including

offset

and

digital

print

lines,

other

printing |

Appendix

Including a Reconciliation of

GAAP to Non-GAAP Financial

Measures |

About

non-GAAP financial measures

To supplement Vistaprint’s consolidated financial statements presented in

accordance with U.S. generally accepted

accounting principles, or GAAP, Vistaprint has used the following measures defined

as non-GAAP financial measures by Securities and Exchange Commission, or

SEC, rules: non-GAAP adjusted net income, non-GAAP adjusted net income

per diluted share, free cash flow, constant-currency revenue growth, and

constant-currency organic revenue growth. The items excluded from the

non-GAAP adjusted net income measurements are share-based compensation expense and its

related tax effect, amortization of acquisition-related intangibles, and tax

charges related to the alignment of acquisition-

related intellectual property with global operations. Free cash

flow is defined as net cash provided by operating activities

less purchases of property, plant and equipment, purchases of intangible assets,

and capitalization of software and website development costs.

Constant-currency revenue growth is estimated by translating all non-U.S. dollar

denominated revenue generated in the current period using the prior year

period’s average exchange rate for each currency to the U.S. dollar and

excludes the impact of gains and losses on effective foreign currency hedges

recognized in revenue. Constant-currency organic revenue growth

excludes the impact of currency as defined above and revenue from acquired

companies. The presentation of non-GAAP financial

information is not intended to be considered in isolation or as a substitute for the

financial information prepared and presented in accordance with GAAP. For more

information on these non-GAAP financial

measures,

please

see

the

tables

captioned

“Reconciliations

of

Non-GAAP

Financial

Measures”

included

at

the

end of this release. The tables have more details on the GAAP financial measures

that are most directly comparable to non-GAAP financial measures and the

related reconciliation between these financial measures. (continued on next

page) 41 |

About

non-GAAP financial measures

continued…

Vistaprint’s management believes that these non-GAAP financial measures

provide meaningful supplemental information in assessing our performance and

when forecasting and analyzing future periods. These non-GAAP financial

measures also have facilitated management’s internal comparisons to Vistaprint’s historical performance and

our competitors’

operating results.

Management provides these non-GAAP financial measures as a courtesy to

investors. However, to gain a more

complete understanding of the company’s financial performance, management does

(and investors should) rely upon GAAP statements of operations and cash

flow. 42 |

Reconciliation: GAAP to Non-GAAP Results

FY 2003

FY 2004

FY 2005*

FY 2006

FY 2007

FY 2008

FY 2009

FY2010

FY2011

FY2012

GAAP Net Income

$473

$3,440

($16,218)

$19,234

$27,143

$39,831

$55,686

$67,741

$82,109

$43,994

Share-based

compensation and

related tax effect

$0

$0

$0

$4,850

$8,765

$15,275

$20,177

$23,156

$22,400

$26,060

Amortization of

acquired intangible

assets

-

-

-

-

-

-

-

-

-

$5,754

Webs IP transfer

-

-

-

-

-

-

-

-

-

$1,235

Non-GAAP

Adjusted Net Income

$473

$3,440

$4,782

$23,146

$35,908

$55,106

$75,863

$90,897

$104,509

$77,043

Net Income –

Annual

($ in thousands)

*Fiscal 2005 non-GAAP results exclude a contract termination payment of

$21mm Note: share-based compensation expense includes tax effects

43 |

Reconciliation: GAAP to Non-GAAP Results

.

Fiscal Year 2010

Fiscal Year 2011

Fiscal Year 2012

Fiscal Year 2013

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

GAAP Net Income

$16,167

$11,650

$10,781

$34,014

$22,917

$14,397

$8,172

$31,697

$274

$3,851

$(1,696)

$22,960

Share-based

compensation and

related tax effect

$5,315

$5,662

$5,550

$6,435

$5,285

$5,129

$4,876

$5,021

$7,566

$8,596

$8,445

$8,540

Amortization of

acquired

intangible assets

-

-

-

-

-

-

-

$1,148

$2,381

$2,225

$2,178

$2,243

Webs IP Transfer

-

-

-

-

-

-

-

-

$1,017

$218

-

$2,164

Non-GAAP

Adjusted Net

Income

$21,482

$17,312

$16,331

$40,449

$28,202

$19,526

$13,048

$37,866

$11,238

$14,890

$8,927

$35,907

Net Income (Loss) –

Quarterly

($ in thousands)

44 |

Diluted Earnings Per Share -

Annual

Reconciliation: GAAP to Non-GAAP Results

45

FY 2006

FY 2007

FY 2008

FY 2009

FY2010

FY2011

FY2012

GAAP Net Income Per Share

$0.45

$0.60

$0.87

$1.25

$1.49

$1.83

$1.13

Share-based Compensation

Per Share*

$0.09

$0.18

$0.31

$0.43

$0.49

$0.47

$0.65

Amortization of acquired

intangible assets

-

-

-

-

-

-

$0.14

Webs IP Transfer

-

-

-

-

-

-

$0.03

Non-GAAP Adjusted Net

Income Per Share

$0.54

$0.78

$1.18

$1.68

$1.98

$2.30

$1.95

Weighted average shares

used in computing Non-

GAAP EPS

(millions)

42.651

45.825

46.780

45.099

45.989

45.448

39.426

*Note: share-based compensation expense includes tax effects

|

Reconciliation: GAAP to Non-GAAP Results

.

Fiscal Year 2010

Fiscal Year 2011

Fiscal Year 2012

Fiscal Year 2013

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

Q3

Q4

Q1

Q2

GAAP Net Income Per

Share

$0.35

$0.26

$0.24

$0.75

$0.51

$0.32

$0.19

$0.82

$0.01

$0.10

$(0.05)

$0.66

Share-based Compensation

Per Share*

$0.11

$0.12

$0.12

$0.14

$0.12

$0.11

$0.12

$0.12

$0.20

$0.23

$0.24

$0.24

Amortization of acquired

intangible assets

-

-

-

-

-

-

-

$0.03

$0.06

$0.06

$0.06

$0.06

Webs IP Transfer

-

-

-

-

-

-

-

-

$0.02

$0.01

-

$0.06

Non-GAAP Adjusted Net

Income Per Share

$0.46

$0.38

$0.36

$0.89

$0.63

$0.43

$0.31

$0.97

$0.29

$0.40

$0.25

$1.02

Weighted average shares

used in computing Non-

GAAP EPS

(millions)

46.231

46.136

45.704

45.625

45.079

45.156