Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SPARTON CORP | d477616d8k.htm |

| EX-99.2 - PRESS RELEASE - SPARTON CORP | d477616dex992.htm |

Onyx

Acquisition Update Conference Call

February 1, 2012

Exhibit 99.1 |

2

Safe Harbor Statement

Safe Harbor Statement

Certain statements herein constitute forward-looking statements within the

meaning of the Securities Act

of

1933,

as

amended

and

the

Securities

Exchange

Act

of

1934,

as

amended.

When

used

herein,

words

such

as

“believe,”

“expect,”

“anticipate,”

“project,”

“plan,”

“estimate,”

“will”

or

“intend”

and similar words or expressions as they relate to the Company or its management

constitute forward-looking statements. These forward-looking

statements reflect our current views with respect to

future

events

and

are

based

on

currently

available

financial,

economic

and

competitive

data

and

our current business plans. The Company is under no obligation to, and expressly

disclaims any obligation to, update or alter its forward-looking

statements whether as a result of such changes, new information, subsequent

events or otherwise. Actual results could vary materially depending on

risks

and

uncertainties

that

may

affect

our

operations,

markets,

prices

and

other

factors.

Important

factors that could cause actual results to differ materially from those

forward-looking statements include

those

contained

under

the

heading

of

risk

factors

and

in

the

management’s

discussion

and

analysis contained from time-to-time in the Company’s filings with the

Securities and Exchange Commission.

The

reconciliation

and

adjusted

EBITDA

presented

here

represents

operating

income

before

depreciation and amortization as adjusted for pro forma incremental corporate cost

savings under Sparton ownership and elimination of inventory and accounts

receivable write-downs relating to Augustine,

a

customer

excluded

from

the

acquisition.

The

Company

believes

Adjusted

EBITDA

is

commonly

used

by

financial

analysts

and

others

in

the

industries

in

which

the

Company

operates

and,

thus,

provides

useful

information

to

investors.

The

Company

does

not

intend,

nor

should

the

reader

consider,

Adjusted

EBITDA

an

alternative

to

operating

income,

net

income,

net

cash

provided by operating activities or any other items calculated in accordance with

GAAP. The Company's definition of Adjusted EBITDA may not be comparable with

Adjusted EBITDA as defined by other companies. Accordingly, the measurement

has limitations depending on its use. |

3

•

Strategic Rationale

•

Financial Discussion

•

Outlook

•

Schedules

•

Q & A

Today’s Agenda

Today’s Agenda |

4

•

Regional expansion into the Minneapolis medical device corridor.

•

Diversifies our customer base and continues to increase the number of

complex sub-assembly and full device programs within Sparton.

•

Strong business development pipeline.

•

Sparton’s Viet Nam facility is an viable option for some of Onyx’s

customers.

•

Sparton can provide full engineering design capabilities to Onyx’s

customers.

•

Sparton can provide design, engineering, integration, and

manufacturing capabilities of highly complex & sophisticated large

devices.

Strategic Rationale

Strategic Rationale |

5

•

$43.25 million purchase price, all-cash transaction

•

Working capital adjustment of $2.2 million

–

Should not be included as consideration

–

Elevated days of working capital at closing: days normalized by 12/31/12

•

As of September 30, 2012

–

$51 million of revenue at 17% gross profit (TTM as of Sept. 30, 2012)

–

Add backs of $1,169k:

•

$745k: Customer write-down (not part of the deal)

•

$424k: Previous parent corporate charges

–

Depreciation and amortization of $1,348k

–

Purchase multiple of 7.3x EBITDA

•

Medical device contract manufacturing businesses typically have higher

multiples than traditional contract manufacturing businesses

•

Sparton’s internal IRR hurdle rate for acquisitions is no less than 20%

on a 5-year discounted cash flow

Financial Discussion

Financial Discussion |

6

•

The Onyx facility has higher gross margins than Sparton’s current

medical segment

•

Estimated annual earnings growth:

–

$500k-$1,000k in earnings from increased sales growth

–

$250k-$500k in earnings from yet to be realized operational synergies

•

Sales

backlog

at

$30.5

million

(firm

orders

as

of

December

31,

2012)

•

New business development funnel

–

Acquired a solid funnel of near and long term opportunities

–

Expect funnel enhancements based on the interest shown towards Sparton’s full

offering of capabilities in recent Onyx customer visits

Outlook

Outlook |

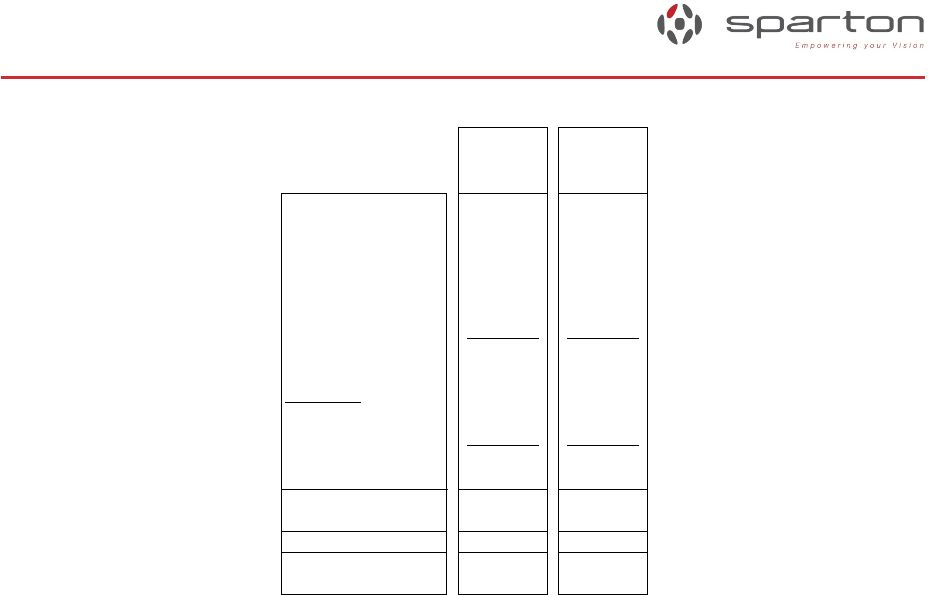

7

Financial Schedules

Financial Schedules

Onyx Fiscal

TTM

Year Ended

Ended

11/30/2011

9/30/2012

Sales

52,000

50,680

O.I.

3,711

3,376

O.I. %

7.1%

6.7%

Depr

1,149

1,348

EBITDA

4,860

4,724

Add-backs

Augustine

745

745

Corp

388

424

1,133

1,169

Adjusted EBITDA

5,993

5,893

11.5%

11.6%

Acquisition Price

43,250

43,250

Multiple

7.2

7.3

|

8

Q & A |