Attached files

| file | filename |

|---|---|

| EX-99.2 - FRANKLIN RESOURCES, INC. FIRST QUARTER RESULTS PDF - FRANKLIN RESOURCES INC | franklinresources123112.pdf |

| 8-K - FORM 8-K - FRANKLIN RESOURCES INC | form8kq1fy13.htm |

| EX-99.1 - PRESS RELEASE - FRANKLIN RESOURCES INC | exhibit991q12013.htm |

FRANKLIN RESOURCES, INC. Franklin Resources, Inc. First Quarter Results February 1, 2013 Exhibit 99.2

FRANKLIN RESOURCES, INC. Forward-Looking Statements Statements in this presentation regarding Franklin Resources, Inc. (“Franklin”) and its subsidiaries, which are not historical facts, are "forward-looking statements" within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. When used in this presentation, words or phrases generally written in the future tense and/or preceded by words such as “will,” “may,” “could,” “expect,” “believe,” “anticipate,” “intend,” “plan,” “seek,” “estimate” or other similar words are forward-looking statements. Forward-looking statements involve a number of known and unknown risks, uncertainties and other important factors, some of which are listed below, that could cause actual results and outcomes to differ materially from any future results or outcomes expressed or implied by such forward-looking statements. Forward-looking statements are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. We caution you therefore against relying on any of these forward-looking statements. They are neither statements of historical fact nor guarantees or assurances of future performance. These and other risks, uncertainties and other important factors are described in more detail in Franklin’s recent filings with the U.S. Securities and Exchange Commission, including, without limitation, in Risk Factors and Management’s Discussion and Analysis of Financial Condition and Results of Operations in Franklin’s Annual Report on Form 10-K for the fiscal year ended September 30, 2012 and Franklin’s subsequent Quarterly Report on Form 10-Q: (1) volatility and disruption of the capital and credit markets, and adverse changes in the global economy, may significantly affect our results of operations and may put pressure on our financial results; (2) the amount and mix of our assets under management (“AUM”) are subject to significant fluctuations; (3) we are subject to extensive and complex, overlapping and frequently changing rules, regulations and legal interpretations; (4) regulatory and legislative actions and reforms have made the regulatory environment in which we operate more costly and future actions and reforms could adversely impact our AUM, increase costs and negatively impact our profitability and future financial results; (5) failure to comply with the laws, rules or regulations in any of the non-U.S. jurisdictions in which we operate could result in substantial harm to our reputation and results of operations; (6) changes in tax laws or exposure to additional income tax liabilities could have a material impact on our financial condition, results of operations and liquidity; (7) any significant limitation, failure or security breach of our software applications, technology or other systems that are critical to our operations could constrain our operations; (8) our business operations are complex and a failure to properly perform operational tasks or the misrepresentation of our products and services, or the termination of investment management agreements representing a significant portion of our AUM, could have an adverse effect on our revenues and income; (9) we face risks, and corresponding potential costs and expenses, associated with conducting operations and growing our business in numerous countries; (10) we depend on key personnel and our financial performance could be negatively affected by the loss of their services; (11) strong competition from numerous and sometimes larger companies with competing offerings and products could limit or reduce sales of our products, potentially resulting in a decline in our market share, revenues and income; (12) changes in the third-party distribution and sales channels on which we depend could reduce our income and hinder our growth; (13) our increasing focus on international markets as a source of investments and sales of investment products subjects us to increased exchange rate and other risks in connection with our revenues and income generated overseas; (14) harm to our reputation or poor investment performance of our products could reduce the level of our AUM or affect our sales, potentially negatively impacting our revenues and income; (15) our future results are dependent upon maintaining an appropriate level of expenses, which is subject to fluctuation; (16) our ability to successfully integrate widely varied business lines can be impeded by systems and other technological limitations; (17) our inability to successfully recover should we experience a disaster or other business continuity problem could cause material financial loss, loss of human capital, regulatory actions, reputational harm, or legal liability; (18) certain of the portfolios we manage, including our emerging market portfolios, are vulnerable to significant market-specific political, economic or other risks, any of which may negatively impact our revenues and income; (19) regulatory and governmental examinations and/or investigations, litigation and the legal risks associated with our business, could adversely impact our AUM, increase costs and negatively impact our profitability and/or our future financial results; (20) our ability to meet cash needs depends upon certain factors, including the market value of our assets, operating cash flows and our perceived creditworthiness; (21) our business could be negatively affected if we or our banking subsidiaries fail to satisfy capital and other regulatory standards, and liquidity needs could affect our banking services; and (22) we are dependent on the earnings of our subsidiaries. Any forward-looking statement made by us in this presentation speaks only as of the date on which it is made. Factors or events that could cause our actual results to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law. The information in this presentation is provided solely in connection with this presentation, and is not directed toward existing or potential investment advisory clients or fund shareholders. 2

FRANKLIN RESOURCES, INC. Audio Commentary and Conference Call Details Pre-recorded audio commentary on the results from Franklin Resources, Inc.’s President and Chief Executive Officer Greg Johnson and Executive Vice President and Chief Financial Officer Ken Lewis will be available today at approximately 8:30 a.m. Eastern Time. Due to the Friday release date and related scheduling issues, this quarter they will also lead a live teleconference today at 11:00 a.m. Eastern Time to answer questions of a material nature. Analysts and investors are encouraged to review the Company’s recent filings with the U.S. Securities and Exchange Commission and to contact Investor Relations before the live teleconference for any clarifications or questions related to the earnings release, this presentation or pre-recorded audio commentary. Access to the pre-recorded audio commentary and accompanying slides are available at franklinresources.com. The pre-recorded audio commentary can also be accessed by dialing (888) 843-7419 in the U.S. and Canada or (630) 652-3042 internationally using access code 34052662, any time through March 2, 2013. Access to the live teleconference will be available at franklinresources.com or by dialing (888) 895-5271 in the U.S. and Canada or (847) 619-6547 internationally. A replay of the call can also be accessed by calling (888) 843-7419 in the U.S. and Canada or (630) 652-3042 internationally using access code 34052665, after 1:30 p.m. Eastern Time on February 1, 2013 through March 2, 2013. Questions regarding the pre-recorded audio commentary or live teleconference should be directed to Franklin Resources, Inc., Investor Relations at (650) 312- 4091 or Corporate Communications at (650) 312-2245. 3

FRANKLIN RESOURCES, INC. Highlights • Relative investment performance remains strong over the 1-, 3-, 5- and 10-year periods and improved by most measures • Successfully deployed the Riva Transfer Agent solution across the Company’s international transfer agency operations • Assets under management ended the quarter at a new high and long-term net new flows were $1 billion • The Company’s Board of Directors increased the regular dividend for the 32nd consecutive year, and declared a special cash dividend of $3.00 per share 4

FRANKLIN RESOURCES, INC. Investment Performance

FRANKLIN RESOURCES, INC. 66% 79% 86% 82% 65% 77% 86% 82% 1-YEAR 3-YEAR 5-YEAR 10-YEAR Investment Performance – Lipper Rankings of U.S.-Registered Long-Term Mutual Funds1 Franklin Templeton 6 By Category Percentage of Assets in the Top Two Quartiles As of December 31, 2012 1. Lipper rankings for Franklin Templeton U.S.-registered mutual funds are based on Class A shares. Franklin Templeton funds are compared against a universe of all share classes. Performance rankings for other share classes may differ. Lipper calculates averages by taking all the funds and share classes in a peer group and averaging their total returns for the periods indicated. Lipper tracks 158 peer groups of U.S. retail mutual funds, and the groups vary in size from 8 to 981 funds. Lipper total return calculations include reinvested dividends and capital gains, but do not include sales charges or expense subsidization by the manager. Results may have been different if these or other factors had been considered. Performance quoted above represents past performance, which cannot predict or guarantee future results. December 31, 2012 September 30, 2012 Franklin Equity Taxable Fixed Income Mutual Series Equity Templeton Equity Tax-Free Fixed Income 10-Year 5-Year 3-Year 1-Year 67% 89% 14% 80% 58% 84% 86% 70% 83% 71% 87% 89% 63% 83% 92% 84% 38% 62% 83% 100%

FRANKLIN RESOURCES, INC. Assets Under Management and Flows

FRANKLIN RESOURCES, INC. Assets Under Management End of Period 8 Simple Monthly Average (in US$ billions, for the three months ended) 670.3 725.7 707.1 749.9 781.8 12/11 3/12 6/12 9/12 12/12 675.0 706.9 710.7 726.7 763.6 12/11 3/12 6/12 9/12 12/12

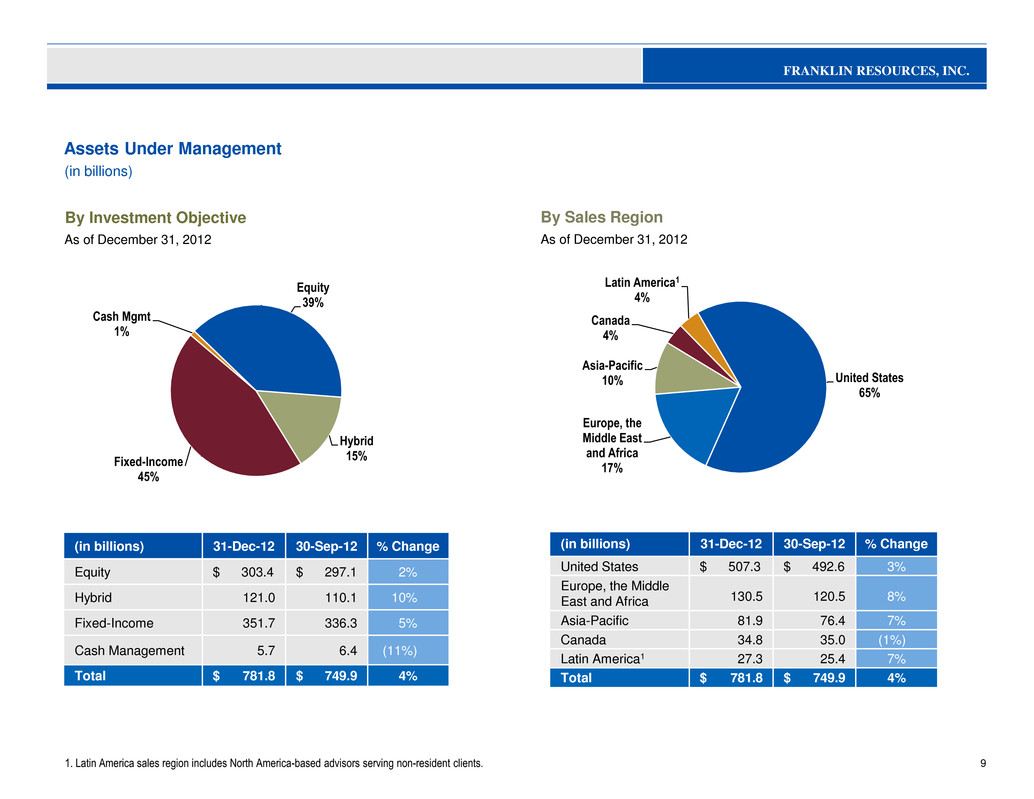

FRANKLIN RESOURCES, INC. United States 65% Europe, the Middle East and Africa 17% Asia-Pacific 10% Canada 4% Latin America1 4% Equity 39% Hybrid 15% Fixed-Income 45% Cash Mgmt 1% Assets Under Management By Investment Objective 9 By Sales Region As of December 31, 2012 As of December 31, 2012 (in billions) 1. Latin America sales region includes North America-based advisors serving non-resident clients. (in billions) 31-Dec-12 30-Sep-12 % Change Equity $ 303.4 $ 297.1 2% Hybrid 121.0 110.1 10% Fixed-Income 351.7 336.3 5% Cash Management 5.7 6.4 (11%) Total $ 781.8 $ 749.9 4% (in billions) 31-Dec-12 30-Sep-12 % Change United States $ 507.3 $ 492.6 3% Europe, the Middle East and Africa 130.5 120.5 8% Asia-Pacific 81.9 76.4 7% Canada 34.8 35.0 (1%) Latin America1 27.3 25.4 7% Total $ 781.8 $ 749.9 4%

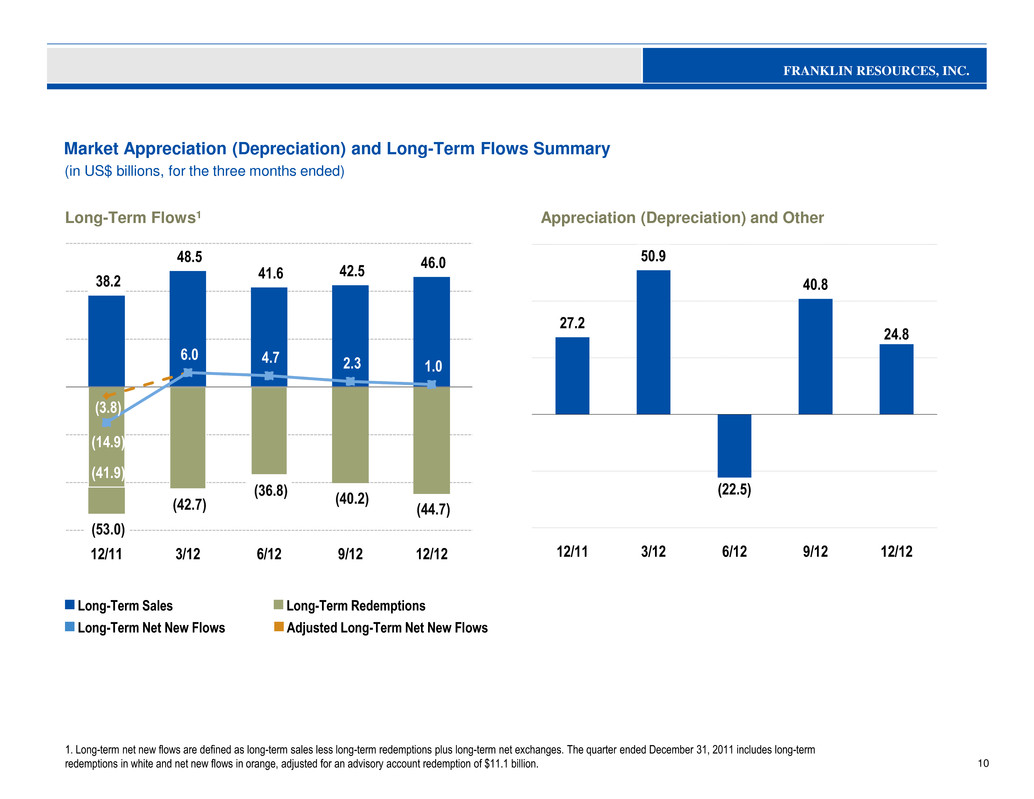

FRANKLIN RESOURCES, INC. 27.2 50.9 (22.5) 40.8 24.8 12/11 3/12 6/12 9/12 12/12 Market Appreciation (Depreciation) and Long-Term Flows Summary 10 (in US$ billions, for the three months ended) Appreciation (Depreciation) and Other 1. Long-term net new flows are defined as long-term sales less long-term redemptions plus long-term net exchanges. The quarter ended December 31, 2011 includes long-term redemptions in white and net new flows in orange, adjusted for an advisory account redemption of $11.1 billion. Long-Term Net New Flows Long-Term Sales Long-Term Redemptions Adjusted Long-Term Net New Flows Long-Term Flows1 (14.9) 38.2 48.5 41.6 42.5 46.0 (53.0) (42.7) (36.8) (40.2) (44.7) (41.9) (3.8) (14.9) 6.0 4.7 2.3 1.0 12/11 3/12 6/12 9/12 12/12

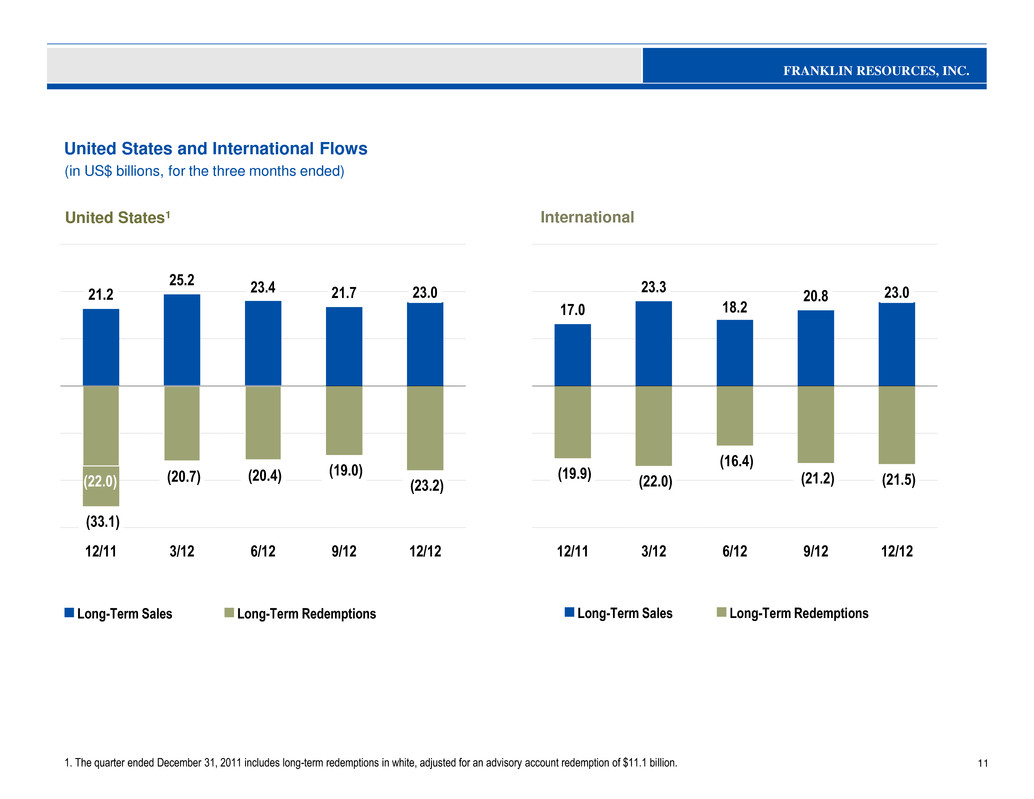

FRANKLIN RESOURCES, INC. 21.2 25.2 23.4 21.7 23.0 (33.1) (20.7) (20.4) (19.0) (23.2) (22.0) 12/11 3/12 6/12 9/12 12/12 United States and International Flows United States1 11 (in US$ billions, for the three months ended) International 1. The quarter ended December 31, 2011 includes long-term redemptions in white, adjusted for an advisory account redemption of $11.1 billion. Long-Term Sales Long-Term Redemptions Long-Term Sales Long-Term Redemptions 17.0 23.3 18.2 20.8 23.0 (19.9) (22.0) (16.4) (21.2) (21.5) 12/11 3/12 6/12 9/12 12/12

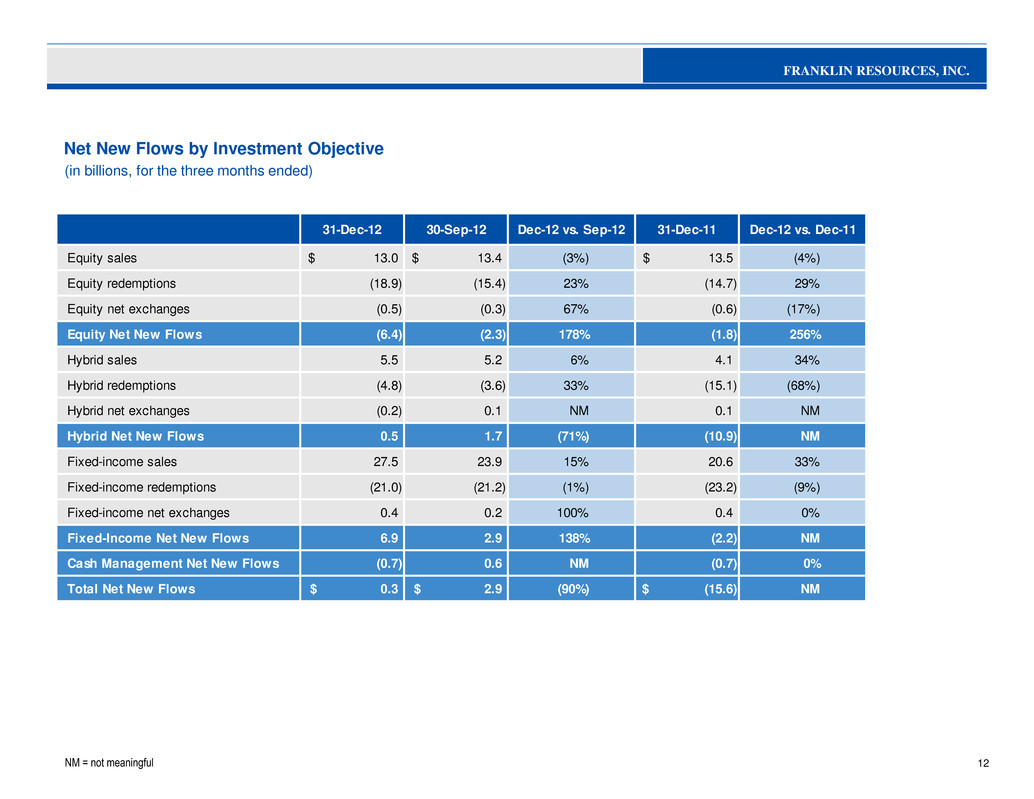

FRANKLIN RESOURCES, INC. Net New Flows by Investment Objective (in billions, for the three months ended) 12 NM = not meaningful 31-Dec-12 30-Sep-12 Dec-12 vs. Sep-12 31-Dec-11 Dec-12 vs. Dec-11 Equity sales 13.0$ 13.4$ (3%) 13.5$ (4%) Equity redemptions (18.9) (15.4) 23% (14.7) 29% Equity net exchanges (0.5) (0.3) 67% (0.6) (17%) Equity Net New Flows (6.4) (2.3) 178% (1.8) 256% Hybrid sales 5.5 5.2 6% 4.1 34% Hybrid redemptions (4.8) (3.6) 33% (15.1) (68%) Hybrid net exchanges (0.2) 0.1 NM 0.1 NM Hybrid Net New Flows 0.5 1.7 (71%) (10.9) NM Fixed-income sales 27.5 23.9 15% 20.6 33% Fixed-income redemptions (21.0) (21.2) (1%) (23.2) (9%) Fixed-income net exchanges 0.4 0.2 100% 0.4 0% Fixed-Income Net New Flows 6.9 2.9 138% (2.2) NM Cash Management Net New Flows (0.7) 0.6 NM (0.7) 0% Total Net New Flows 0.3$ 2.9$ (90%) (15.6)$ NM

FRANKLIN RESOURCES, INC. Operating Results and Capital Management

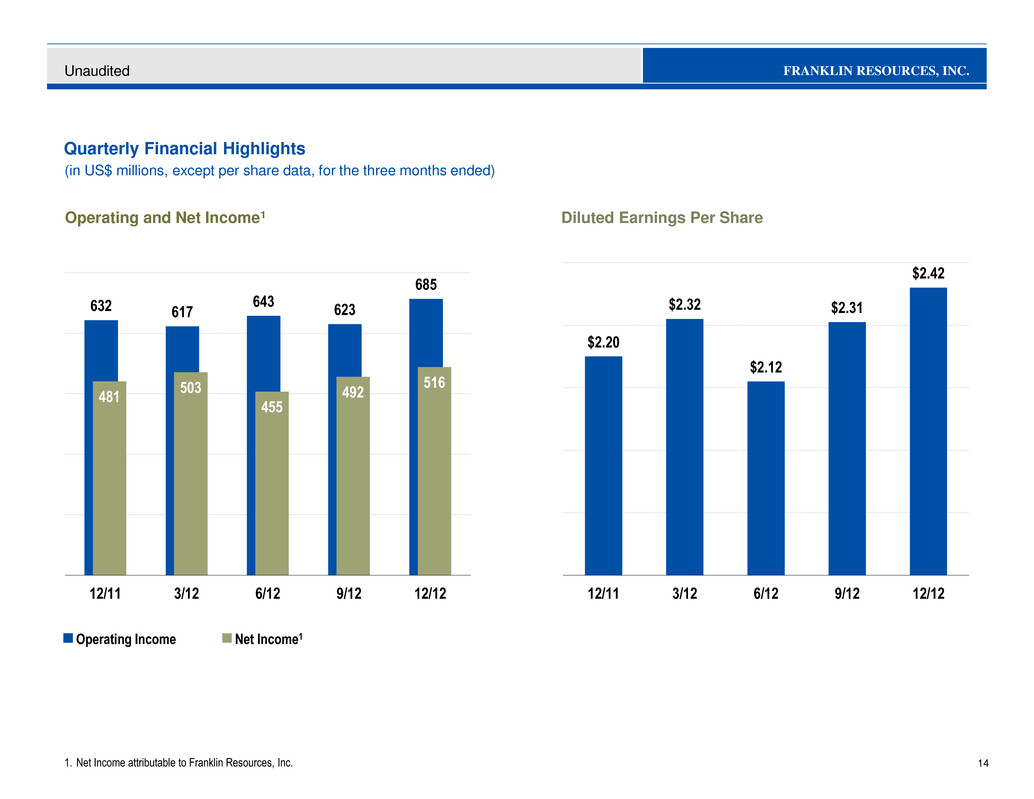

FRANKLIN RESOURCES, INC. Quarterly Financial Highlights Operating and Net Income1 14 Unaudited Diluted Earnings Per Share (in US$ millions, except per share data, for the three months ended) 1. Net Income attributable to Franklin Resources, Inc. Operating Income Net Income1 632 617 643 623 685 481 503 455 492 516 12/11 3/12 6/12 9/12 12/12 $2.20 $2.32 $2.12 $2.31 $2.42 12/11 3/12 6/12 9/12 12/12

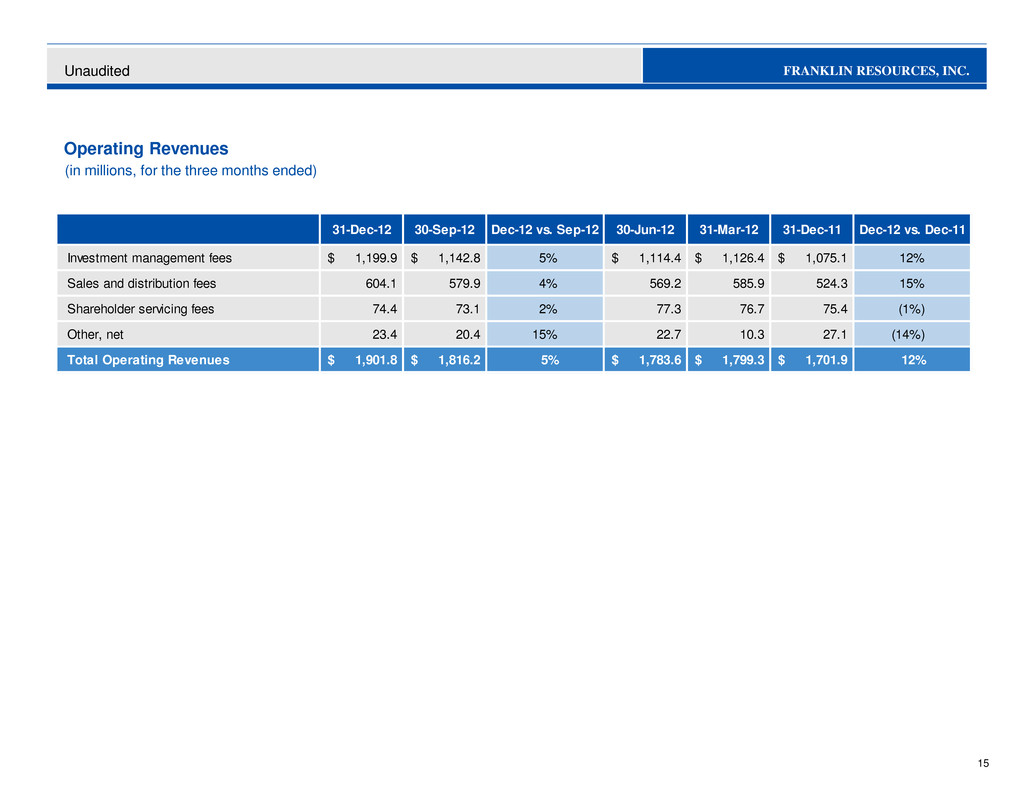

FRANKLIN RESOURCES, INC. Operating Revenues (in millions, for the three months ended) 15 Unaudited 31-Dec-12 30-Sep-12 Dec-12 vs. Sep-12 30-Jun-12 31-Mar-12 31-Dec-11 Dec-12 vs. Dec-11 Inv stment management fees 1,199.9$ 1,142.8$ 5% 1,114.4$ 1,126.4$ 1,075.1$ 12% Sales and distribution fees 604.1 579.9 4% 569.2 585.9 524.3 15% Shareholder servicing fees 74.4 73.1 2% 77.3 76.7 75.4 (1%) Other, net 23.4 20.4 15% 22.7 10.3 27.1 (14%) Total Operating Revenues 1,901.8$ 1,816.2$ 5% 1,783.6$ 1,799.3$ 1,701.9$ 12%

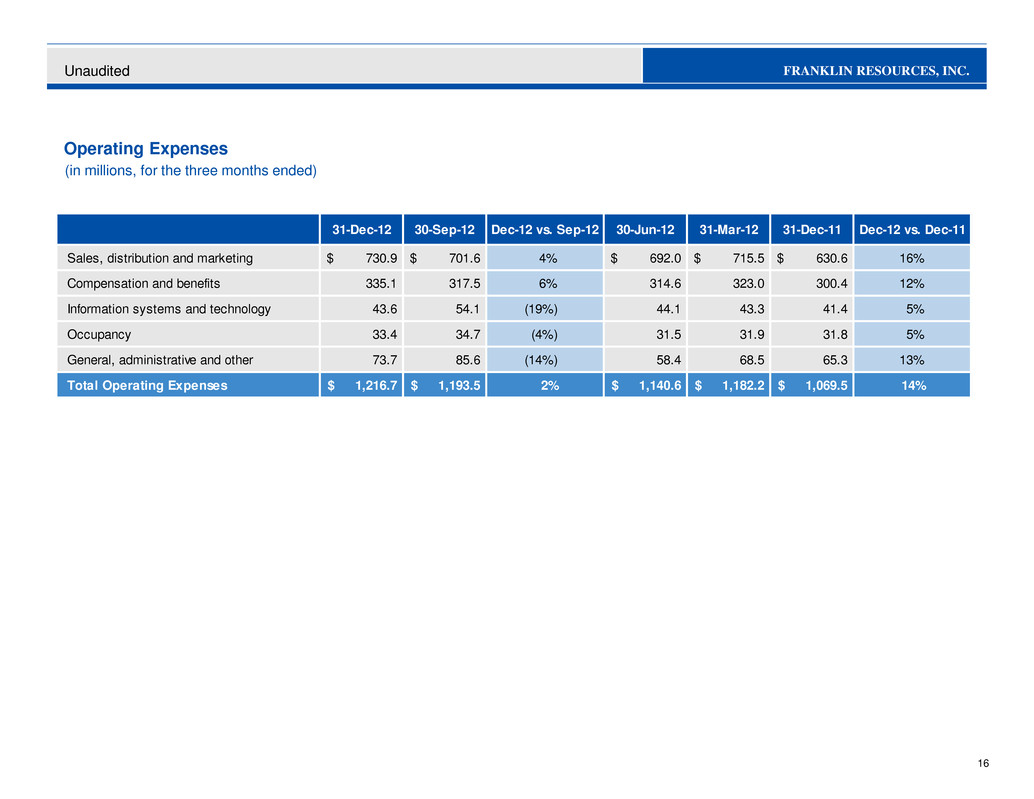

FRANKLIN RESOURCES, INC. Operating Expenses (in millions, for the three months ended) 16 Unaudited 31-Dec-12 30-Sep-12 Dec-12 vs. Sep-12 30-Jun-12 31-Mar-12 31-Dec-11 Dec-12 vs. Dec-11 Sales, distribution and marketing 730.9$ 701.6$ 4% 692.0$ 715.5$ 630.6$ 16% C mpensation and benefits 335.1 317.5 6% 314.6 323.0 300.4 12% Information systems and technology 43.6 54.1 (19%) 44.1 43.3 41.4 5% Occupancy 33.4 34.7 (4%) 31.5 31.9 31.8 5% General, administrative and other 73.7 85.6 (14%) 58.4 68.5 65.3 13% Total Operating Expenses 1,216.7$ 1,193.5$ 2% 1,140.6$ 1,182.2$ 1,069.5$ 14%

FRANKLIN RESOURCES, INC. 5.9 21.8 20.9 5.3 (14.5) (10.2) 20.9 (19.1) 31.0 14.9 45.9 Associated Financial Statement Components $29.2 Million2 $1.8 Million Cash and cash equivalents, investment securities, available-for- sale and investment securities, trading Investments in equity method investees Investment securities, available-for- sale Investment securities, trading Debt and deferred taxes Miscellaneous non-operating income, including foreign exchange revaluations of cash and cash equivalents held by subsidiaries with a non-USD functional currency Investments of consolidated SIPs Investments of consolidated VIEs Related noncontrolling interests attributable to third-party investors Other Income – U.S. GAAP (in US$ millions, for the three months ended December 31, 2012) 17 1. Reflects the portion of noncontrolling interests related to consolidated SIPs and VIEs included in Other income. 2. Net of the impact of consolidating SIPs and VIEs as summarized on slide 18. Unaudited Dividend and interest income Equity method investments Available- for-sale investments Trading investments Interest expense Other Consolidated sponsored investment products (SIPs) Consolidated variable interest entities (VIEs) Total other income Noncontrolling interests1 Other income, net of noncontrolling interests

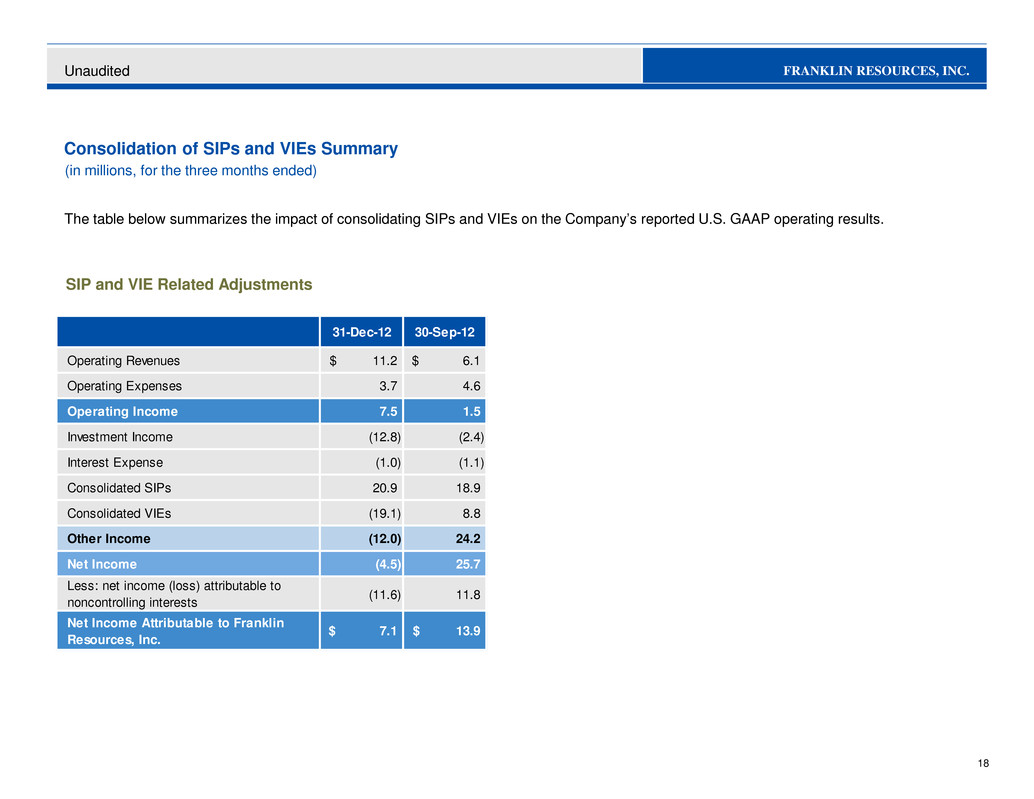

FRANKLIN RESOURCES, INC. Consolidation of SIPs and VIEs Summary 18 SIP and VIE Related Adjustments (in millions, for the three months ended) The table below summarizes the impact of consolidating SIPs and VIEs on the Company’s reported U.S. GAAP operating results. Unaudited 31-Dec-12 30-Sep-12 Operating Revenues 11.2$ 6.1$ Operating Expenses 3.7 4.6 Operating Income 7.5 1.5 Investment Income (12.8) (2.4) Interest Expense (1.0) (1.1) Consolidated SIPs 20.9 18.9 Consoli ated VIEs (19.1) 8.8 Other Income (12.0) 24.2 Net Income (4.5) 25.7 Less: net income (loss) attributable to noncontrolling interests (11.6) 11.8 Net Income Attributable to Franklin Resources, Inc. 7.1$ 13.9$

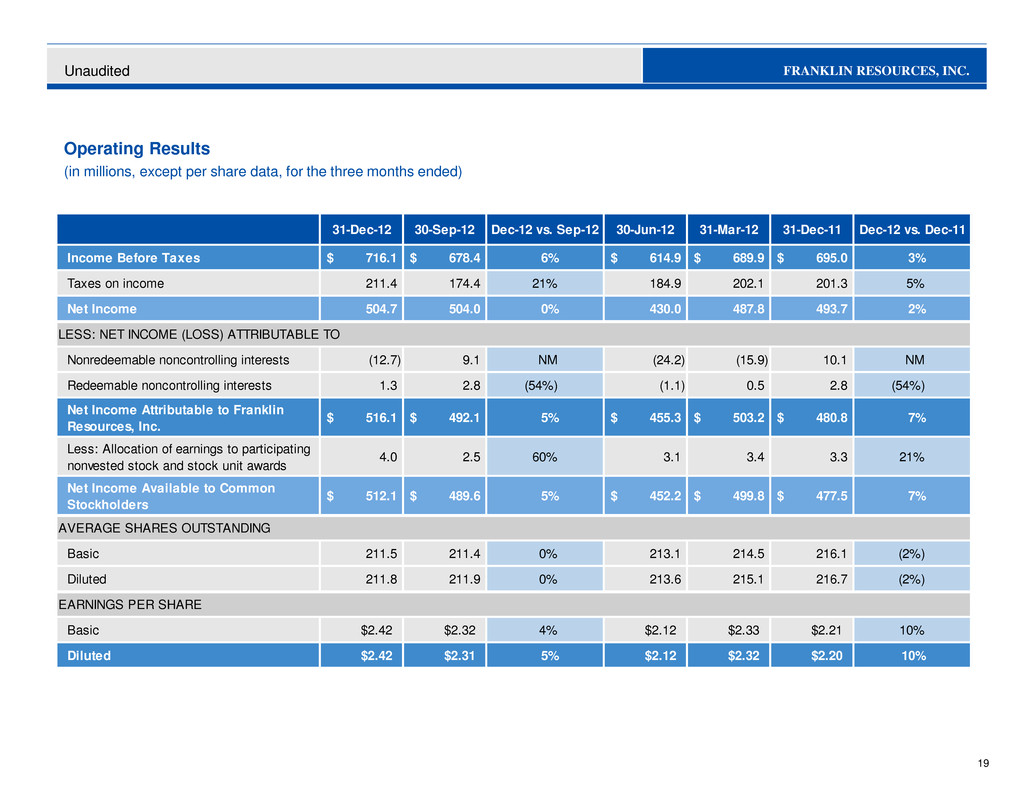

FRANKLIN RESOURCES, INC. Operating Results (in millions, except per share data, for the three months ended) 19 Unaudited 31-Dec-12 30-Sep-12 Dec-12 vs. Sep-12 30-Jun-12 31-Mar-12 31-Dec-11 Dec-12 vs. Dec-11 Income Before Taxes 716.1$ 678.4$ 6% 614.9$ 689.9$ 695.0$ 3% Taxes on income 211.4 174.4 21% 184.9 202.1 201.3 5% Net Income 504.7 504.0 0% 430.0 487.8 493.7 2% LESS: NET INCOME (LOSS) ATTRIBUTABLE TO Nonredeemable noncontrolling interests (12.7) 9.1 NM (24.2) (15.9) 10.1 NM Redeemable noncontrolling interests 1.3 2.8 (54%) (1.1) 0.5 2.8 (54%) Net Income Attributable to Franklin Resources, Inc. 516.1$ 492.1$ 5% 455.3$ 503.2$ 480.8$ 7% Less: Allocation of earnings to participating nonvested stock and stock unit awards 4.0 2.5 60% 3.1 3.4 3.3 21% Net Income Available to Common Stockholders 512.1$ 489.6$ 5% 452.2$ 499.8$ 477.5$ 7% AVERAGE SHARES OUTSTANDING Basic 211.5 211.4 0% 213.1 214.5 216.1 (2%) Diluted 211.8 211.9 0% 213.6 215.1 216.7 (2%) EARNINGS PER SHARE Basic $2.42 $2.32 4% $2.12 $2.33 $2.21 10% Diluted $2.42 $2.31 5% $2.12 $2.32 $2.20 10%

FRANKLIN RESOURCES, INC. Profitability Operating Margin 20 (for the fiscal period) Unaudited 28.7% 33.5% 37.3% 35.4% 36.0% FY 2009 FY 2010 FY 2011 FY 2012 FYTD 2013

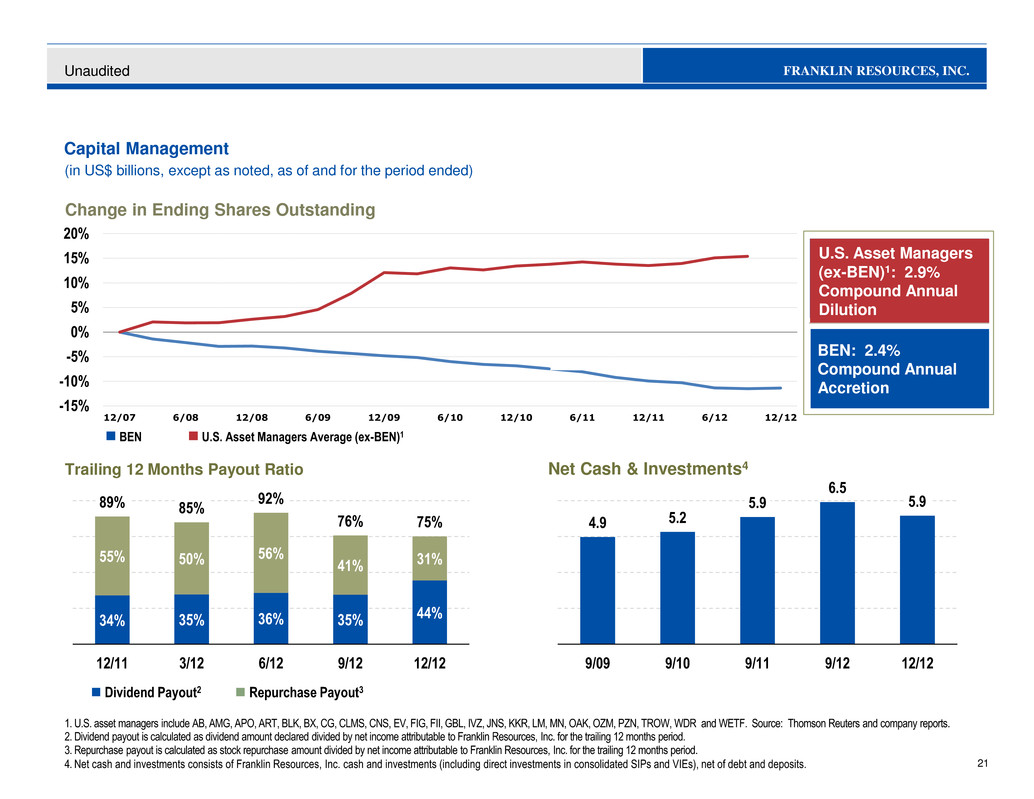

FRANKLIN RESOURCES, INC. Capital Management 21 (in US$ billions, except as noted, as of and for the period ended) 1. U.S. asset managers include AB, AMG, APO, ART, BLK, BX, CG, CLMS, CNS, EV, FIG, FII, GBL, IVZ, JNS, KKR, LM, MN, OAK, OZM, PZN, TROW, WDR and WETF. Source: Thomson Reuters and company reports. 2. Dividend payout is calculated as dividend amount declared divided by net income attributable to Franklin Resources, Inc. for the trailing 12 months period. 3. Repurchase payout is calculated as stock repurchase amount divided by net income attributable to Franklin Resources, Inc. for the trailing 12 months period. 4. Net cash and investments consists of Franklin Resources, Inc. cash and investments (including direct investments in consolidated SIPs and VIEs), net of debt and deposits. Unaudited Change in Ending Shares Outstanding Trailing 12 Months Payout Ratio Net Cash & Investments4 BEN U.S. Asset Managers Average (ex-BEN)1 U.S. Asset Managers (ex-BEN)1: 2.9% Compound Annual Dilution Dividend Payout2 Repurchase Payout3 BEN: 2.4% Compound Annual Accretion -15% -10% -5% 0% 5% 10% 15% 20% 12/07 6/08 12/08 6/09 12/09 6/10 12/10 6/11 12/11 6/12 12/12 4.9 5.2 5.9 6.5 5.9 9/09 9/10 9/11 9/12 12/12 34% 35% 36% 35% 44% 55% 50% 56% 41% 31% 89% 85% 92% 76% 75% 12/11 3/12 6/12 9/12 12/12