Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AGILYSYS INC | form8-kxagysq3fy13pressrel.htm |

| EX-99.1 - EXHIBIT99.1 PRESS RELEASE Q3 FY13 - AGILYSYS INC | exhibit991pressreleaseq3fy.htm |

TECHNOLOGY | INNOVATION | SOLUTIONS Agilysys, Inc. (Nasdaq: AGYS) Fiscal 2013 Third Quarter Results January 31, 2013

TECHNOLOGY | INNOVATION | SOLUTIONS Forward-looking statements & non-GAAP financial information Forward-Looking Language This presentation and other publicly available documents, including the documents incorporated herein and therein by reference, contain, and our officers and representatives may from time to time make, "forward-looking statements" within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as: "anticipate," "intend," "plan," "goal," "seek," "believe," "project," "estimate," "expect," "strategy," "future," "likely," "may," "should," "will" and similar references to future periods. These statements are not guarantees of future performance and involve risks, uncertainties, and assumptions that are difficult to predict. These statements are based on management’s current expectations, intentions, or beliefs and are subject to a number of factors, assumptions, and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. Factors that could cause or contribute to such differences or that might otherwise impact the business include the risk factors set forth in Item 1A of our Annual Report for the fiscal year ended March 31, 2012. We undertake no obligation to update any such factor or to publicly announce the results of any revisions to any forward-looking statements contained herein whether as a result of new information, future events, or otherwise. Use of Non-GAAP Financial Information To supplement the unaudited condensed consolidated financial statements presented in accordance with U.S. GAAP in this press release, certain non-GAAP financial measures as defined by the SEC rules are used. These non-GAAP financial measures include adjusted operating loss, adjusted net loss and adjusted cash flow from operations. Management believes that such information can enhance investors' understanding of the company's ongoing operations. See the accompanying tables below for reconciliations of adjusted operating income (loss) and adjusted net income (loss), and adjusted cash flow from operations, to the comparable GAAP measures. NOTE: Results presented herein are unaudited. 2

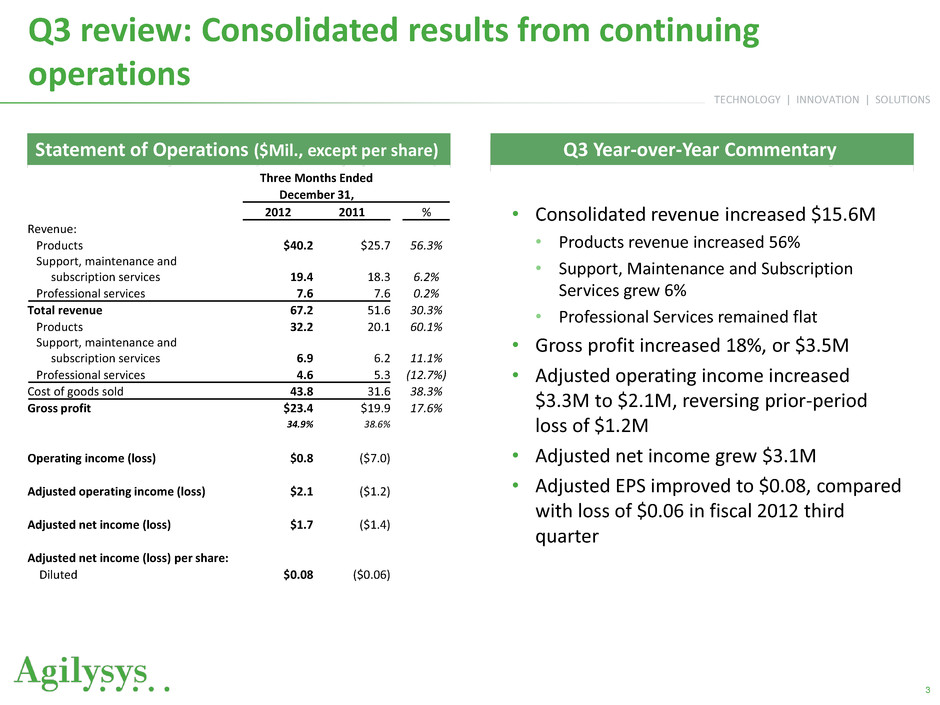

TECHNOLOGY | INNOVATION | SOLUTIONS Q3 review: Consolidated results from continuing operations 3 Q3 Year-over-Year Commentary Statement of Operations ($Mil., except per share) • Consolidated revenue increased $15.6M • Products revenue increased 56% • Support, Maintenance and Subscription Services grew 6% • Professional Services remained flat • Gross profit increased 18%, or $3.5M • Adjusted operating income increased $3.3M to $2.1M, reversing prior-period loss of $1.2M • Adjusted net income grew $3.1M • Adjusted EPS improved to $0.08, compared with loss of $0.06 in fiscal 2012 third quarter Three Months Ended December 31, 2012 2011 % Revenue: Products $40.2 $25.7 56.3% Support, maintenance and subscription services 19.4 18.3 6.2% Professional services 7.6 7.6 0.2% Total revenue 67.2 51.6 30.3% Products 32.2 20.1 60.1% Support, maintenance and subscription services 6.9 6.2 11.1% Professional services 4.6 5.3 (12.7%) Cost of goods sold 43.8 31.6 38.3% Gross profit $23.4 $19.9 17.6% 34.9% 38.6% Operating income (loss) $0.8 ($7.0) Adjusted operating income (loss) $2.1 ($1.2) Adjusted net income (loss) $1.7 ($1.4) Adjusted net income (loss) per share: Diluted $0.08 ($0.06)

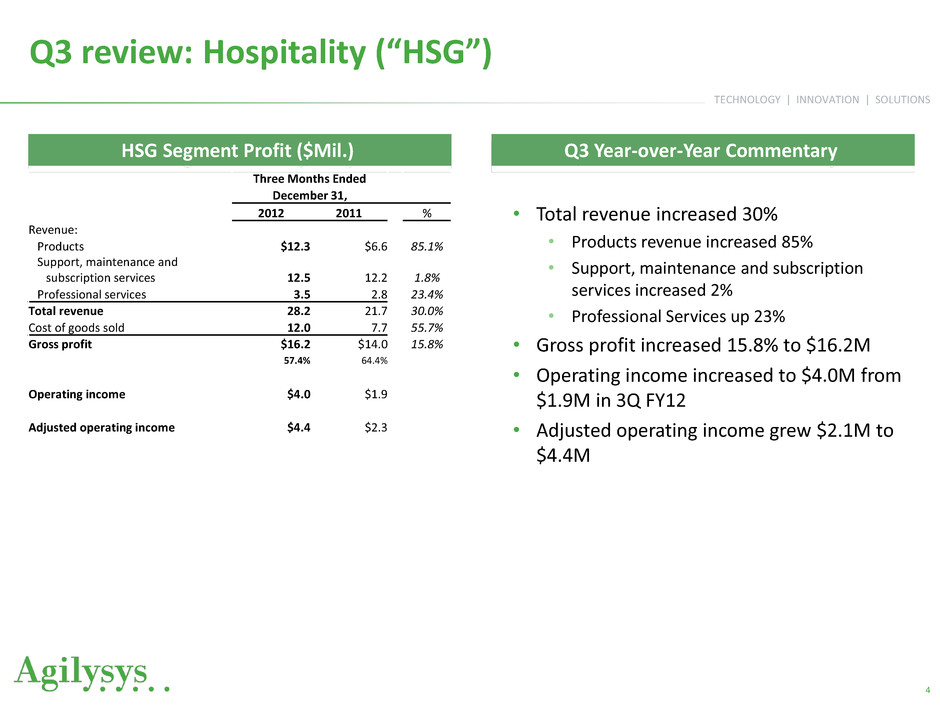

TECHNOLOGY | INNOVATION | SOLUTIONS Q3 review: Hospitality (“HSG”) • Total revenue increased 30% • Products revenue increased 85% • Support, maintenance and subscription services increased 2% • Professional Services up 23% • Gross profit increased 15.8% to $16.2M • Operating income increased to $4.0M from $1.9M in 3Q FY12 • Adjusted operating income grew $2.1M to $4.4M 4 HSG Segment Profit ($Mil.) Q3 Year-over-Year Commentary Three Months Ended December 31, 2012 2011 % Revenue: Products $12.3 $6.6 85.1% Support, maintenance and subscription services 12.5 12.2 1.8% Professional services 3.5 2.8 23.4% Total revenue 28.2 21.7 30.0% Cost of goods sold 12.0 7.7 55.7% Gross profit $16.2 $14.0 15.8% 57.4% 64.4% Operating income $4.0 $1.9 Adjusted operating income $4.4 $2.3

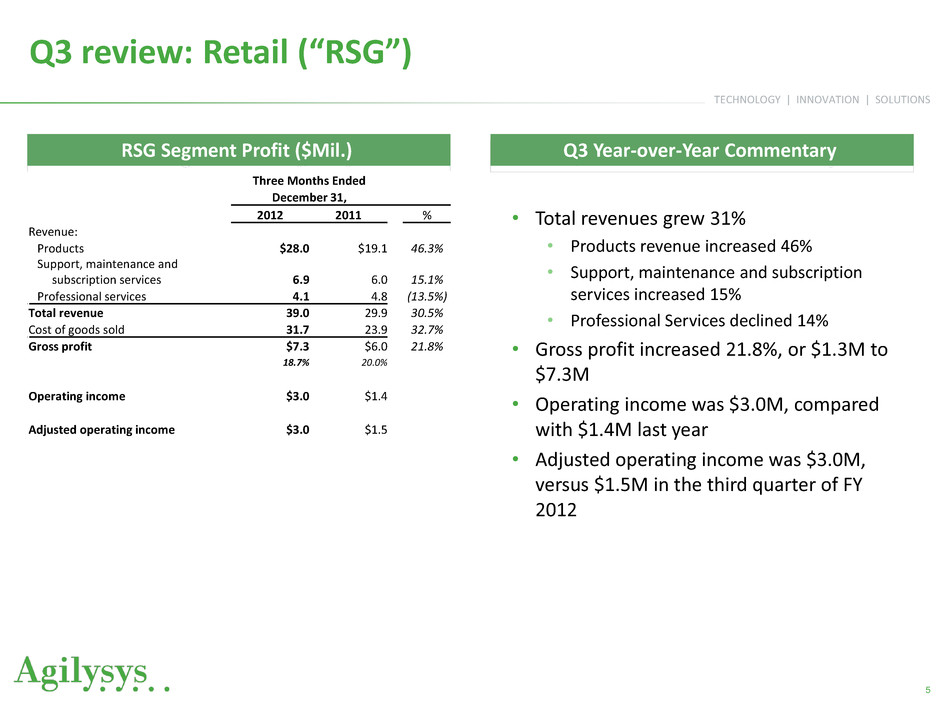

TECHNOLOGY | INNOVATION | SOLUTIONS Q3 review: Retail (“RSG”) • Total revenues grew 31% • Products revenue increased 46% • Support, maintenance and subscription services increased 15% • Professional Services declined 14% • Gross profit increased 21.8%, or $1.3M to $7.3M • Operating income was $3.0M, compared with $1.4M last year • Adjusted operating income was $3.0M, versus $1.5M in the third quarter of FY 2012 5 RSG Segment Profit ($Mil.) Q3 Year-over-Year Commentary Three Months Ended December 31, 2012 2011 % Revenue: Products $28.0 $19.1 46.3% Support, maintenance and subscription services 6.9 6.0 15.1% Professional services 4.1 4.8 (13.5%) Total revenue 39.0 29.9 30.5% Cost of goods sold 31.7 23.9 32.7% Gross profit $7.3 $6.0 21.8% 18.7% 20.0% Operating income $3.0 $1.4 Adjusted operating income $3.0 $1.5

TECHNOLOGY | INNOVATION | SOLUTIONS Q3 review: Corporate and consolidated adjusted operating expenses Excluding stock-based compensation: • Non-capitalized product development expenses increased $0.9M, or 12%; • Sales and marketing expenses remained flat at $5.4M; and, • General and administrative expenses decreased $0.1M, or 1%. 6 Q3 Year-over-Year Commentary Three Months Ended December 31, 2012 2011 Total revenue $0.0 $0.0 Cost of goods sold 0.0 0.0 Gross profit $0.0 $0.0 Operating loss ($6.2) ($10.4) Adjusted operating loss ($5.4) ($5.0) Three Months Ended December 31, 2012 2011 Consolidated operating expenses as reported: Product development $8.6 $7.7 Sales and marketing 5.4 5.4 General and administrative 7.2 7.3 Depreciation 0.6 1.1 Total $21.8 $21.5 Share-based compensation: Product development $0.1 $0.1 Sales and marketing - - General and administrative 0.3 0.3 Total $0.4 $0.4 Adjusted operating expense: Product development $8.5 $7.6 Sales and marketing 5.4 5.4 General and administrative 6.9 7.0 Depreciation 0.6 1.1 Total $21.4 $21.1 Consolidated adjusted operating expenses ($Mil.) Corporate continuing operations ($Mil.)

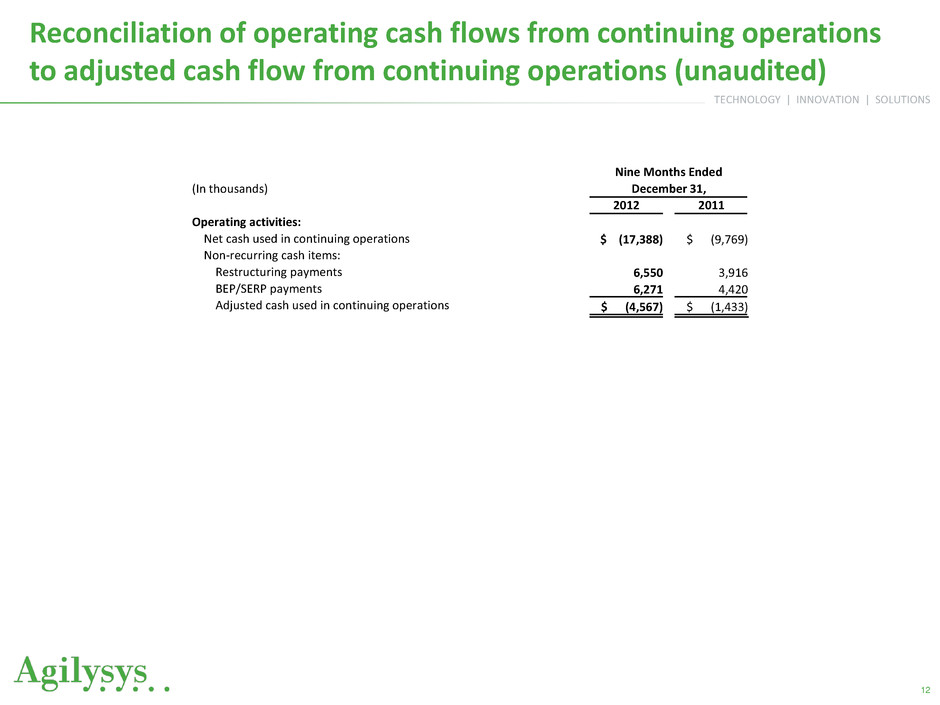

TECHNOLOGY | INNOVATION | SOLUTIONS Fiscal 2013 nine months review: summary cash flow performance and key balance sheet metrics • Cash and liquid investments on hand decreased $17.8M to $79.8M from $97.6M • Fully valued federal net operating losses of approximately $170.0M • Fiscal 2013 nine months uses of cash included: • $6.3M in BEP/SERP payments • $6.6M in cash expenses related to restructuring activities • Generated adjusted cash flow from operations of $5.0M in the fiscal 2013 third quarter 7

TECHNOLOGY | INNOVATION | SOLUTIONS Fiscal 2013 nine months review: Consolidated results from continuing operations • Consolidated revenue up 10% • Products revenue grew 11% • Support, maintenance and subscription services revenue increased 7% • Professional services revenue up 16% • Gross profit expanded 40 basis points • GAAP operating loss contracted to $1.3M, versus $21.2M in prior year • Adjusted operating income improved $8.7M, reversing prior-year loss • Adjusted net income improved $9.6M to $3.8M, or $0.17 per diluted share 8 Statement of Operations ($Mil., except per share) Fiscal Year-over-Year Commentary Nine Months Ended December 31, 2012 2011 % Revenue: Products $89.3 $80.4 11.0% Support, maintenance and subscription services 57.3 53.7 6.8% Professional services 26.5 22.8 16.4% Total revenue 173.1 156.9 10.4% Products 70.1 63.7 10.0% Support, maintenance and subscription services 20.8 19.3 7.8% Professional services 16.3 14.8 9.9% Cost of goods sold 107.2 97.8 9.6% Gross profit $65.9 $59.0 11.7% 38.1% 37.6% Operating loss ($1.3) ($21.2) Adjusted operating income (loss) $4.3 ($4.4) Adjusted net income (loss) $3.8 ($5.8) Adjusted net income (loss) per share: Diluted $0.17 ($0.26)

TECHNOLOGY | INNOVATION | SOLUTIONS ($8) ($4) $0 $4 $8 FY 12 FY 13E Original FY 13E Revised Adjusted Operating Income (Loss) (in millions) ($0.40) ($0.30) ($0.20) ($0.10) $0.00 $0.10 $0.20 $0.30 FY 12 FY 13E Original FY 13E Revised Adjusted Income (Loss) Per Share $185 $210 $235 FY 12 FY 13E Original FY 13E Revised Revenue (in millions) 9 Fiscal 2013 Outlook $209M $230M $232M ($7.9)M $6.0M $6.5M ($0.39) $0.24 $0.26 $208M $211M $3.5M $4.5M $0.16 $0.21

TECHNOLOGY | INNOVATION | SOLUTIONS Agilysys, Inc. (Nasdaq: AGYS) Fiscal 2013 Third Quarter Results Questions & Answers January 31, 2013

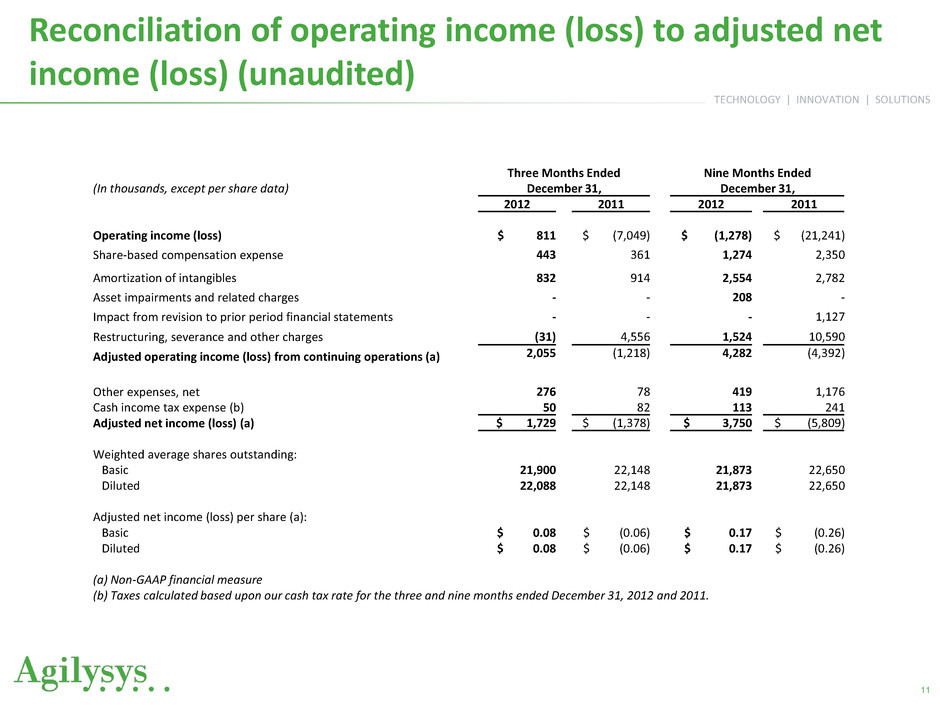

TECHNOLOGY | INNOVATION | SOLUTIONS Reconciliation of operating income (loss) to adjusted net income (loss) (unaudited) 11 (In thousands, except per share data) Three Months Ended Nine Months Ended December 31, December 31, 2012 2011 2012 2011 Operating income (loss) $ 811 $ (7,049) $ (1,278) $ (21,241) Share-based compensation expense 443 361 1,274 2,350 Amortization of intangibles 832 914 2,554 2,782 Asset impairments and related charges - - 208 - Impact from revision to prior period financial statements - - - 1,127 Restructuring, severance and other charges (31) 4,556 1,524 10,590 Adjusted operating income (loss) from continuing operations (a) 2,055 (1,218) 4,282 (4,392) Other expenses, net 276 78 419 1,176 Cash income tax expense (b) 50 82 113 241 Adjusted net income (loss) (a) $ 1,729 $ (1,378) $ 3,750 $ (5,809) Weighted average shares outstanding: Basic 21,900 22,148 21,873 22,650 Diluted 22,088 22,148 21,873 22,650 Adjusted net income (loss) per share (a): Basic $ 0.08 $ (0.06) $ 0.17 $ (0.26) Diluted $ 0.08 $ (0.06) $ 0.17 $ (0.26) (a) Non-GAAP financial measure (b) Taxes calculated based upon our cash tax rate for the three and nine months ended December 31, 2012 and 2011.

TECHNOLOGY | INNOVATION | SOLUTIONS Reconciliation of operating cash flows from continuing operations to adjusted cash flow from continuing operations (unaudited) 12 Nine Months Ended (In thousands) December 31, 2012 2011 Operating activities: Net cash used in continuing operations $ (17,388) $ (9,769) Non-recurring cash items: Restructuring payments 6,550 3,916 BEP/SERP payments 6,271 4,420 Adjusted cash used in continuing operations $ (4,567) $ (1,433)