Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PRICE T ROWE GROUP INC | a8-k1.htm |

1 Contacts: Brian Lewbart 410.345.2242 Bill Benintende 410.345.3482 Robert Benjamin 410.345.2205 Heather McDonold 410.345.6617 T. ROWE PRICE GROUP REPORTS FOURTH QUARTER AND ANNUAL 2012 RESULTS Assets Under Management Increase to $576.8 Billion BALTIMORE (January 29, 2013) - T. Rowe Price Group, Inc. (NASDAQ-GS: TROW) today reported its fourth quarter of 2012 results, including net revenues of $787.3 million, net income of $232.0 million, and diluted earnings per common share of $.88. On a comparable basis, net revenues were $671.6 million, net income was $188.4 million, and diluted earnings per common share was $.73 in the fourth quarter of 2011. Investment advisory revenues for the fourth quarter of 2012 increased $107.1 million to $677.6 million from the comparable 2011 period, as average assets under management were up $86.2 billion, or 18%. Assets under management at December 31, 2012 totaled a record $576.8 billion, an increase of $2.4 billion from $574.4 billion at September 30, 2012. Market appreciation and income during the fourth quarter of 2012 of $6.6 billion were partially offset by net cash outflows of $4.2 billion. Year-end assets under management of $576.8 billion increased $87.3 billion from $489.5 billion at the end of 2011, and include $346.9 billion in T. Rowe Price mutual funds distributed in the United States, and $229.9 billion in other managed investment portfolios. Net cash inflows from investors in 2012 totaled $17.2 billion, including $10.1 billion originating in the target-date retirement portfolios. Market appreciation and income, net of distributions not reinvested, increased assets under management by $70.1 billion from the end of 2011. The firm’s target-date retirement portfolios had assets under management at December 31, 2012 of $88.9 billion, including $80.2 billion in target-date retirement funds and $8.7 billion in target-date retirement trusts. Investors domiciled outside the United States accounted for 9.5% of the firm’s assets under management at December 31, 2012. Annual results for 2012 include net revenues of $3.0 billion, net income of $883.6 million, and diluted earnings per common share of $3.36, an increase of 15% from the $2.92 per share earned in 2011. From an investment performance standpoint, 78% of the T. Rowe Price mutual funds across their share classes outperformed their comparable Lipper averages on a total return basis for the three- year period ended December 31, 2012, 84% outperformed for the five-year period, 78% outperformed for the 10-year period, and 74% outperformed for the one-year period. In addition,

2 T. Rowe Price stock, bond and blended asset funds that ended the quarter with an overall rating of four or five stars from Morningstar account for 76% of the firm's rated funds' assets under management. The firm’s target-date retirement funds – which are designed to provide straight- forward investment and retirement planning solutions for clients – continue to deliver very attractive long-term performance, with 97% of these funds outperforming their comparable Lipper averages on a total return basis for the three- and five-year periods ended December 31, 2012. Financial Highlights Investment advisory revenues earned in the fourth quarter of 2012 from the T. Rowe Price mutual funds distributed in the United States were $472.0 million, an increase of $80.8 million, or 21%, from the comparable 2011 quarter. Average mutual fund assets under management in the fourth quarter of 2012 were $343.0 billion, an increase of 20% from the average for the fourth quarter of 2011. Money market advisory fees voluntarily waived by the firm to maintain positive yields for fund investors in the fourth quarter of 2012 were $9.5 million, a decrease of $.9 million from the comparable 2011 quarter. During 2012, the firm waived $35.0 million in such fees compared with $36.4 million in the 2011 year. The firm expects that these fee waivers will continue in 2013. Mutual fund assets at December 31, 2012 were $346.9 billion, an increase of $4.0 billion from September 30, 2012. Market appreciation and income of $4.4 billion was partially offset by net cash outflows of $.4 billion during the fourth quarter of 2012. Net cash inflows of $.7 billion into the bond funds and $.3 billion into the money market funds were more than offset by $1.4 billion in net cash outflows from the stock and blended asset funds. Investment advisory revenues earned in the fourth quarter of 2012 on the other investment portfolios increased $26.3 million compared to the 2011 quarter to $205.6 million, as average assets under management increased $28.7 billion, or 14%, to $228.0 billion. Ending assets in these portfolios at December 31, 2012 were $229.9 billion, a decrease of $1.6 billion from the end of September 2012. Market appreciation and income of $2.2 billion during the fourth quarter of 2012 was more than offset by net cash outflows of $3.8 billion. These net outflows were primarily from certain institutional separate account portfolios outside the United States that have experienced investment performance challenges, or changes in clients’ investment objectives. Operating expenses were $426.1 million in the fourth quarter of 2012, up $48.1 million from the 2011 quarter due primarily to increases in compensation and related costs, distribution and servicing costs, occupancy and facility costs and depreciation. The increase in compensation and related costs of $35.1 million is primarily attributable to higher bonus compensation, salaries,

3 and the cost of employee benefits. The firm has increased its average staff size by 1.9% from the fourth quarter of 2011, and employed 5,372 associates at December 31, 2012. Advertising and promotion expenditures were $26.7 million in the fourth quarter of 2012 compared to $25.8 million in the comparable 2011 period. The firm currently expects that its advertising and promotion expenditures for the full year 2013 will be similar to 2012 levels. The firm varies its level of spending based on market conditions and investor demand as well as its efforts to expand its investor base in the United States and abroad. Distribution and servicing costs paid to third-party intermediaries that source assets into the Advisory, R, and variable annuity classes of the firm's sponsored portfolios in the fourth quarter of 2012 increased $5.6 million over the comparable 2011 quarter, as higher distribution expenses were recognized on greater fund assets under management. These costs offset the same increase in distribution and servicing fees earned from 12b-1 plans of the same share classes noted above. Occupancy and facility costs together with depreciation and amortization expense were $53.5 million in the fourth quarter of 2012, up $5.3 million compared to the fourth quarter of 2011. The change includes the added costs incurred to expand our facilities around the world as well as update our technology capabilities to meet increasing business demands. Net non-operating investment income in the fourth quarter of 2012 increased $4.0 million from the 2011 quarter due primarily to higher gains recognized on our other investment portfolio. The provision for income taxes as a percentage of pretax income for the fourth quarter of 2012 is 38.6%, slightly higher than the 38.4% effective tax rate for the full year 2012. The firm’s effective rate for 2013 is expected to be 38.5%. T. Rowe Price remains debt-free with ample liquidity, including cash and sponsored portfolio investment holdings of $2.0 billion. During 2012, the firm paid a regular annual dividend of $1.36 per share to our stockholders, expended $135.2 million to repurchase 2.3 million shares of its common stock and invested $76.9 million in capitalized technology and facilities. In addition, the firm paid a $1.00 per share special dividend on December 28, 2012. The firm currently expects total capital expenditures for property and equipment for 2013 to be approximately $125 million, which will be funded from operating resources. Management Commentary James A.C. Kennedy, the company’s chief executive officer and president, commented: “Most equity and fixed income markets performed well in 2012, especially in the emerging markets. This was despite another year of relatively subdued global economic growth and

4 persistently high unemployment in many developed economies. Consumer and corporate confidence ebbed and flowed through the year, mostly in response to varying hopes that political leadership might move from dysfunction to logical decision making. The fourth quarter was no exception to the volatility of expectations. Most world markets produced negative returns in the quarter – at least until the last week of the year, when negotiations in Washington gained momentum and the U.S. ‘fiscal cliff’ was temporarily sidestepped. “Meanwhile, we remain cautiously optimistic on the fundamentals of many corporations around the globe. Company balance sheets are generally in good shape, and many corporations are generating strong cash flow. Political, economic and growth uncertainties remain, so volatility should be expected. However, expectations and valuations in the equity markets remain reasonable. The fixed income markets are less appealing, with yields driven to near record lows by a series of governmental stimulus programs. Savers have been hurt by these low rates, and risk-takers rewarded. Opportunities still exist in the fixed income markets, but risks are now rising; consequently, credit research and selectivity will be more and more important. “In closing, we remain proud of our firm’s continued strong investment and client service performance. As we reflect back on 2012, our 75th year, we believe our guiding principle of always doing what is right for our clients will continue to benefit our clients, associates, and stockholders alike.” Other Matters The financial results presented in this release are unaudited. KPMG is currently completing its audits of the company’s 2012 financial statements and internal controls over financial reporting at December 31, 2012. The company expects that KPMG will complete its work in early February and it will then file its Form 10-K Annual Report for 2012 with the U.S. Securities and Exchange Commission. The Form 10-K will include additional information, including the firm’s audited financial statements, management’s report on internal controls over financial reporting at December 31, 2012, and the reports of KPMG. Certain statements in this press release may represent “forward-looking information,” including information relating to anticipated changes in revenues, net income and earnings per common share, anticipated changes in the amount and composition of assets under management, anticipated expense levels, estimated tax rates, and expectations regarding financial results, future transactions, investments, capital expenditures, and other market conditions. For a discussion concerning risks and other factors that could affect future results, see the firm’s Form 10-K and Form 10-Q reports.

5 Founded in 1937, Baltimore-based T. Rowe Price (troweprice.com) is a global investment management organization that provides a broad array of mutual funds, subadvisory services, and separate account management for individual and institutional investors, retirement plans, and financial intermediaries. The organization also offers a variety of sophisticated investment planning and guidance tools. T. Rowe Price’s disciplined, risk-aware investment approach focuses on diversification, style consistency, and fundamental research.

6 UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF INCOME (in millions, except per-share amounts) Three months ended Year ended Revenues 12/31/2011 12/31/2012 12/31/2011 12/31/2012 Investment advisory fees $ 570.5 $ 677.6 $ 2,349.0 $ 2,592.0 Administrative fees 80.3 83.6 321.2 332.6 Distribution and servicing fees 20.2 25.8 74.6 96.1 Net revenue of savings bank subsidiary .6 .3 2.3 1.8 Net revenues 671.6 787.3 2,747.1 3,022.5 Operating expenses Compensation and related costs 226.5 261.6 969.8 1,047.6 Advertising and promotion 25.8 26.7 90.8 89.8 Distribution and servicing costs 20.2 25.8 74.6 96.1 Depreciation and amortization of property and equipment 19.0 21.3 72.0 80.9 Occupancy and facility costs 29.2 32.2 115.0 124.7 Other operating expenses 57.3 58.5 198.0 219.1 Total operating expenses 378.0 426.1 1,520.2 1,658.2 Net operating income 293.6 361.2 1,226.9 1,364.3 Non-operating investment income 12.9 16.9 23.7 70.8 Income before income taxes 306.5 378.1 1,250.6 1,435.1 Provision for income taxes 118.1 146.1 477.4 551.5 Net income $ 188.4 $ 232.0 $ 773.2 $ 883.6 Net income allocated to common stockholders Net income $ 188.4 $ 232.0 $ 773.2 $ 883.6 Less: net income allocated to outstanding restricted stock and stock unit holders (.9) (2.1) (3.5) (5.5) Net income allocated to common stockholders $ 187.5 $ 229.9 $ 769.7 $ 878.1 Earnings per share on common stock Basic $ .74 $ .90 $ 3.01 $ 3.47 Diluted $ .73 $ .88 $ 2.92 $ 3.36 Dividends declared per share, including $1.00 per share special dividend paid on December 28, 2012 $ .31 $ 1.34 $ 1.24 $ 2.36 Weighted average common shares Outstanding 252.0 254.2 255.6 253.4 Outstanding assuming dilution 258.2 262.0 263.3 261.0

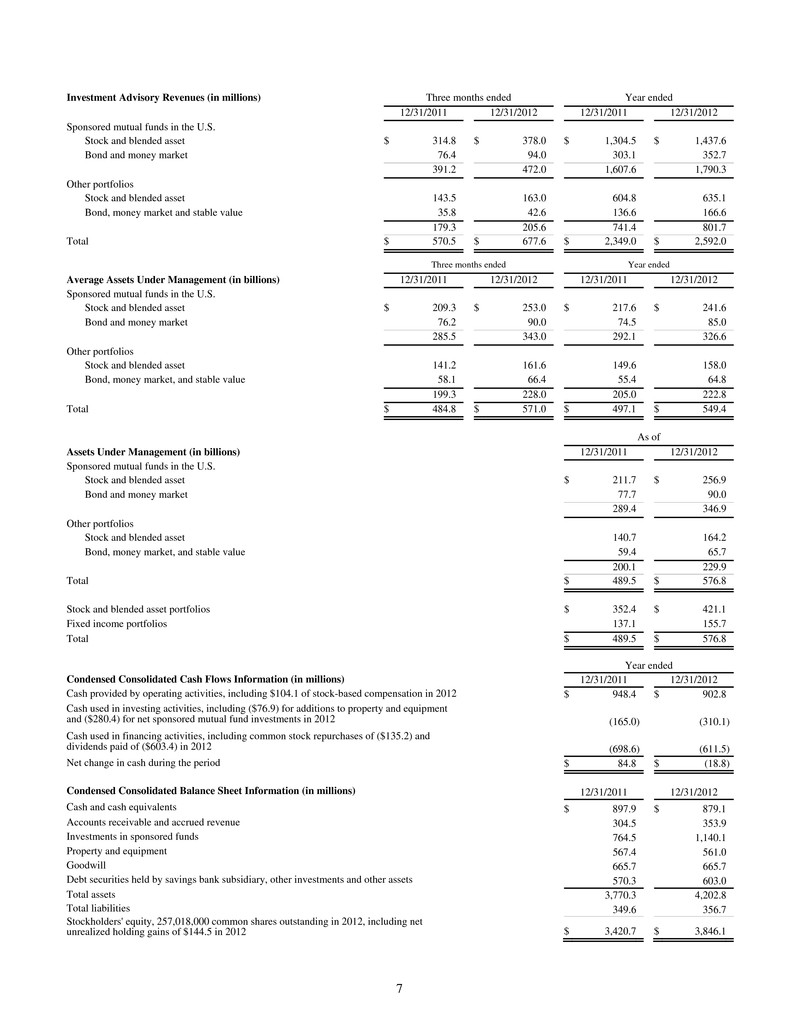

7 Investment Advisory Revenues (in millions) Three months ended Year ended 12/31/2011 12/31/2012 12/31/2011 12/31/2012 Sponsored mutual funds in the U.S. Stock and blended asset $ 314.8 $ 378.0 $ 1,304.5 $ 1,437.6 Bond and money market 76.4 94.0 303.1 352.7 391.2 472.0 1,607.6 1,790.3 Other portfolios Stock and blended asset 143.5 163.0 604.8 635.1 Bond, money market and stable value 35.8 42.6 136.6 166.6 179.3 205.6 741.4 801.7 Total $ 570.5 $ 677.6 $ 2,349.0 $ 2,592.0 Three months ended Year ended Average Assets Under Management (in billions) 12/31/2011 12/31/2012 12/31/2011 12/31/2012 Sponsored mutual funds in the U.S. Stock and blended asset $ 209.3 $ 253.0 $ 217.6 $ 241.6 Bond and money market 76.2 90.0 74.5 85.0 285.5 343.0 292.1 326.6 Other portfolios Stock and blended asset 141.2 161.6 149.6 158.0 Bond, money market, and stable value 58.1 66.4 55.4 64.8 199.3 228.0 205.0 222.8 Total $ 484.8 $ 571.0 $ 497.1 $ 549.4 As of Assets Under Management (in billions) 12/31/2011 12/31/2012 Sponsored mutual funds in the U.S. Stock and blended asset $ 211.7 $ 256.9 Bond and money market 77.7 90.0 289.4 346.9 Other portfolios Stock and blended asset 140.7 164.2 Bond, money market, and stable value 59.4 65.7 200.1 229.9 Total $ 489.5 $ 576.8 Stock and blended asset portfolios $ 352.4 $ 421.1 Fixed income portfolios 137.1 155.7 Total $ 489.5 $ 576.8 Year ended Condensed Consolidated Cash Flows Information (in millions) 12/31/2011 12/31/2012 Cash provided by operating activities, including $104.1 of stock-based compensation in 2012 $ 948.4 $ 902.8 Cash used in investing activities, including ($76.9) for additions to property and equipment and ($280.4) for net sponsored mutual fund investments in 2012 (165.0) (310.1) Cash used in financing activities, including common stock repurchases of ($135.2) and dividends paid of ($603.4) in 2012 (698.6) (611.5) Net change in cash during the period $ 84.8 $ (18.8) Condensed Consolidated Balance Sheet Information (in millions) 12/31/2011 12/31/2012 Cash and cash equivalents $ 897.9 $ 879.1 Accounts receivable and accrued revenue 304.5 353.9 Investments in sponsored funds 764.5 1,140.1 Property and equipment 567.4 561.0 Goodwill 665.7 665.7 Debt securities held by savings bank subsidiary, other investments and other assets 570.3 603.0 Total assets 3,770.3 4,202.8 Total liabilities 349.6 356.7 Stockholders' equity, 257,018,000 common shares outstanding in 2012, including net unrealized holding gains of $144.5 in 2012 $ 3,420.7 $ 3,846.1