Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - AVNET INC | d472238d8k.htm |

| EX-99.1 - PRESS RELEASE - AVNET INC | d472238dex991.htm |

Exhibit 99.2

| Avnet, Inc. Q2 Fiscal Year 2013 | ||

| $ in millions - except per share data January 24, 2013 |

CFO Review of Fiscal 2013 Second Quarter Results

| 2Q’ FY12 | 1Q’ FY13 | 2Q’ FY13 | Y/Y Chg | Seq. Chg | ||||||||||||||||

| Sales |

$ | 6,693.6 | $ | 5,870.1 | $ | 6,699.5 | $ | 5.9 | $ | 829.4 | ||||||||||

| Gross Profit |

$ | 784.1 | $ | 684.4 | $ | 768.5 | ($ | 15.7 | ) | $ | 84.1 | |||||||||

| GP Margin |

11.7 | % | 11.7 | % | 11.5 | % | (24 | )bps | (19 | )bps | ||||||||||

| SG&A Expenses |

$ | 518.7 | $ | 547.0 | $ | 548.0 | $ | 29.2 | $ | 1.0 | ||||||||||

| SG&A as % of Sales |

7.8 | % | 9.3 | % | 8.2 | % | 43 bps | (114bps | ) | |||||||||||

| SG&A as % of GP |

66.2 | % | 79.9 | % | 71.3 | % | 516bps | (862bps | ) | |||||||||||

| GAAP Operating Income |

$ | 230.9 | $ | 100.0 | $ | 195.6 | ($ | 35.3 | ) | $ | 95.6 | |||||||||

| Adjusted Operating Income (1) |

$ | 265.4 | $ | 137.4 | $ | 220.5 | ($ | 44.9 | ) | $ | 83.1 | |||||||||

| Adjusted Operating Income Margin (1) |

4.0 | % | 2.3 | % | 3.3 | % | (67 | ) bps | 95 bps | |||||||||||

| GAAP Net Income (Loss) |

$ | 147.0 | $ | 100.3 | $ | 137.5 | ($ | 9.5 | ) | $ | 37.2 | |||||||||

| Adjusted Net Income (1) |

$ | 172.0 | $ | 83.9 | $ | 140.0 | ($ | 32.0 | ) | $ | 56.1 | |||||||||

| GAAP Diluted EPS |

$ | 0.98 | $ | 0.70 | $ | 0.99 | 1.0 | % | 41.4 | % | ||||||||||

| Adjusted EPS (1) |

$ | 1.15 | $ | 0.59 | $ | 1.01 | -12.2 | % | 71.2 | % | ||||||||||

| Return on Working Capital (ROWC) (1) |

26.0 | % | 14.5 | % | 22.1 | % | (391 | )bps | 761 bps | |||||||||||

| Return on Capital Employed (ROCE) (1) |

14.3 | % | 7.8 | % | 11.8 | % | (245 | )bps | 403 bps | |||||||||||

| Working Capital Velocity (1) |

6.57 | 6.20 | 6.72 | 0.15 | 0.52 | |||||||||||||||

| (1) | A reconcilliation of non-GAAP financial measures is presented in the Non-GAAP Financial Information section at the end of this document. |

K e y H i g h l i g h t s

| • | Sales exceeded expectations at both operating groups in the second quarter fiscal 2013, increasing 14.1% sequentially to $6.70 billion; pro forma revenue (defined later in this document) was up 10.4% sequentially and 9.4% excluding the translation impact of changes in foreign currency exchange rates (also referred to as “constant dollars” or “constant currency” and referenced as “CC” in the graphs that follow). |

| • | Adjusted operating income decreased 16.9% year over year to $220.5 million; however, it grew 60.5% sequentially due primarily to the better than expected growth and the impact of cost reduction actions that have recently been implemented. |

| • | TS operating income grew 213.9% and operating margin increased 202 basis points sequentially. |

| • | Adjusted diluted earnings per share increased 71.2% sequentially but declined 12.2% year over year to $1.01 due to the decline in operating income partially offset by the benefit of the accretion related to the share repurchase program. |

| • | Cash from operations was $326 million in the December 2012 quarter and $690 million over the trailing twelve months due to improved earnings and disciplined working capital management. |

| • | During the quarter, 2.5 million shares were repurchased under the Company’s $750 million stock repurchase program at an average price of $28.12 per share, bringing the cumulative total of repurchased shares to 17.9 million shares. As of the end of the second quarter of fiscal 2013, the Company may repurchase up to an additional $224.5 million of the Company’s common stock under the program. |

1

| Avnet, Inc. Q2 Fiscal Year 2013 | ||

| $ in millions - except per share data January 24, 2013 |

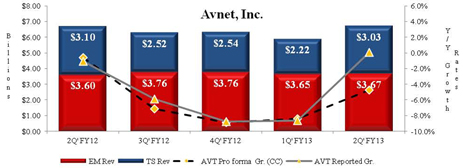

R e v e n u e

| Year-over-Year Growth Rates | ||||||||||||||||||||||||||||

| 2Q’ FY12 | 3Q’ FY12 | 4Q’ FY12 | 1Q’ FY13 | 2Q’ FY13 | Reported (1) | Pro forma (2) | ||||||||||||||||||||||

| Avnet, Inc. |

6,693.6 | 6,280.6 | 6,307.4 | 5,870.1 | 6,699.5 | 0.09 | % | -5.65 | % | |||||||||||||||||||

| Excluding FX (1) |

— | — | — | — | — | 1.03 | % | -4.77 | % | |||||||||||||||||||

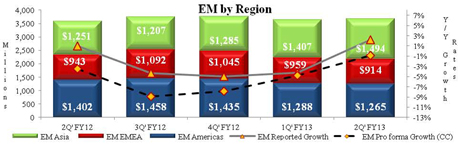

| Electronics Marketing (EM) Total |

3,595.6 | 3,756.9 | 3,764.4 | 3,653.2 | 3,673.5 | 2.17 | % | -2.18 | % | |||||||||||||||||||

| Excluding FX (1) |

— | — | — | — | 3.49 | % | -0.91 | % | ||||||||||||||||||||

| Americas |

1,401.8 | 1,458.4 | 1,435.4 | 1,287.8 | 1,264.9 | -9.77 | % | -12.77 | % | |||||||||||||||||||

| EMEA |

943.3 | 1,091.7 | 1,044.5 | 958.5 | 914.3 | -3.07 | % | -4.53 | % | |||||||||||||||||||

| Excluding FX (1) |

0.87 | % | -0.65 | % | ||||||||||||||||||||||||

| Asia |

1,250.5 | 1,206.8 | 1,284.6 | 1,406.9 | 1,494.3 | 19.50 | % | 10.88 | % | |||||||||||||||||||

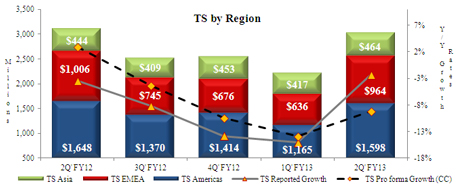

| Technology Solutions (TS) Total |

3,098.0 | 2,523.7 | 2,543.0 | 2,216.9 | 3,026.0 | -2.32 | % | -9.55 | % | |||||||||||||||||||

| Excluding FX (1) |

— | — | — | — | — | -1.84 | % | -9.10 | % | |||||||||||||||||||

| Americas |

1,648.3 | 1,369.6 | 1,414.4 | 1,164.6 | 1,598.3 | -3.03 | % | -6.12 | % | |||||||||||||||||||

| EMEA |

1,006.2 | 744.8 | 676.1 | 635.5 | 963.8 | -4.21 | % | -19.65 | % | |||||||||||||||||||

| Excluding FX (1) |

— | — | — | — | — | -2.23 | % | -17.99 | % | |||||||||||||||||||

| Asia |

443.5 | 409.3 | 452.5 | 416.8 | 463.9 | 4.58 | % | 4.58 | % | |||||||||||||||||||

| (1) | Year-over-year revenue growth rate excluding the impact of changes in foreign currency exchange rates. |

| (2) | Pro forma revenues as defined in this document. |

| • | Sequential growth returned to normal seasonal levels after two quarters of below normal trends as reported sales of $6.7 billion grew 14.1% (13.1% in constant dollars) |

| • | On a sequential basis, pro forma sales increased 10.4% (9.4% in constant dollars), which represents a return to normal seasonality of approximately +8% to +12%. |

2

| Avnet, Inc. Q2 Fiscal Year 2013 | ||

| $ in millions - except per share data January 24, 2013 |

| • | Year-over-year pro forma sales decreased 5.7% (4.8% in constant dollars), primarily due to the revenue decline in TS. |

| • | Sequentially, EM revenue grew 0.6% (-0.2% in constant dollars) to $3.7 billion and pro forma revenue declined 1.7% in constant dollars. Growth was within normal seasonality of 0% to—3% and was due to better than expected volumes in Asia. |

| • | Asia increased 10.9% year over year on a pro forma basis and 2.7% sequentially, as double digit sales in its high-volume, low-margin fulfillment business drove incremental top line strength. Asia now represents 41% of the EM business as compared with 35% in the year ago period. |

| • | America’s pro forma revenue declined 12.8% year over year, primarily due to a decision to exit the commercial components business in Latin America. |

| • | EMEA revenue, which was down double-digits in fiscal 2012, was down less than 1% year over year in constant currency in the December quarter. |

| • | TS reported revenue increased 36.5% sequentially (35.0% in constant dollars) to $3.0 billion, due to a better than anticipated year end IT budget spend. |

| • | Pro forma revenue increased 28.0% sequentially (26.6% in constant dollars), with all three regions reporting double digit growth and the Americas region pushing TS growth to slightly above the high end of normal seasonality of +20% to +26%. In particular, projects that were delayed in the September quarter helped TS achieve the higher than expected seasonal growth this quarter. |

| • | Pro forma revenue decreased 9.6% year over year (9.1% in constant dollars). |

3

| Avnet, Inc. Q2 Fiscal Year 2013 | ||

| $ in millions - except per share data January 24, 2013 |

| • | Software, storage and services grew over 35% sequentially while storage and services led the portfolio elements that increased year over year. |

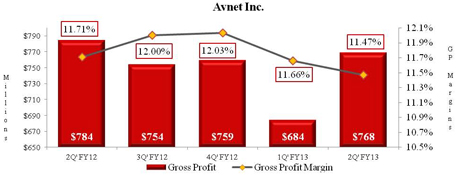

G r o s s P r o f i t

| 2Q’ FY12 | 3Q’ FY12 | 4Q’ FY12 | 1Q’ FY13 | 2Q’ FY13 | Y/Y Change | |||||||||||||||||||

| Gross Profit |

$ | 784.1 | $ | 753.8 | $ | 759.0 | $ | 684.4 | $ | 768.5 | ($ | 15.7 | ) | |||||||||||

| Gross Profit Margin |

11.7 | % | 12.0 | % | 12.0 | % | 11.7 | % | 11.5 | % | (24 | )bps | ||||||||||||

| • | At the enterprise level, gross profit dollars of $768.5 million, improved 12.3% sequentially and gross profit margin declined 19 basis points to 11.5%. |

| • | EM gross profit margin declined 80 basis points year over year primarily due to the combination of the temporary benefit from the hard disk drive shortages in the year ago quarter and the impact of the geographic mix shift to the lower margin Asia region combined with higher sales in Asia of low margin fulfillment business. |

| • | TS gross profit margin improved 32 basis points year over year, driven primarily by the better than expected year end IT spend in the Americas region. |

4

| Avnet, Inc. Q2 Fiscal Year 2013 | ||

| $ in millions - except per share data January 24, 2013 |

O p e r a t i n g E x p e n s e s

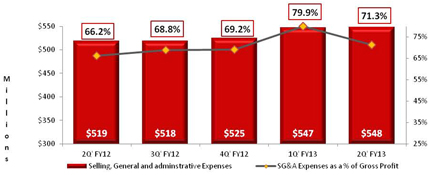

| 2Q’ FY12 | 3Q’ FY12 | 4Q’ FY12 | 1Q’ FY13 | 2Q’ FY13 | Y/Y Change | |||||||||||||||||||

| Selling, General and Adminstrative Expenses |

$ | 518.7 | $ | 518.4 | $ | 525.1 | $ | 547.0 | $ | 548.0 | $ | 29.2 | ||||||||||||

| SG&A Expenses as a % of Gross Profit |

66.2 | % | 68.8 | % | 69.2 | % | 79.9 | % | 71.3 | % | 516bps | |||||||||||||

| • | Selling, general and administrative expenses (“SG&A expenses”) were up 5.6% year over year and 0.2% sequentially to $547 million. |

| • | The $29.2 million year-over-year increase consisted of an increase of approximately $65 million due to operating expenses of acquired businesses, partially offset by a decrease of approximately $28 million related to cost reduction actions and a decrease of approximately $7 million due to the translation impact of changes in foreign currency exchange rates. |

| • | The Company took actions in the first and second quarters of fiscal 2013 to reduce expenses in both operating groups by approximately $100 million annualized, most of which have been realized in the current quarter. |

| • | SG&A expenses as a percentage of gross profit increased 516 basis points to 71.3% from the year ago quarter. |

| • | TS SG&A expense as a percent of gross profit increased 410 basis points from the year ago quarter due primarily to the impact of recent acquisitions as the planned cost synergies are targeted to be achieved over the next several quarters. |

| • | EM SG&A expense as a percent of gross profit increased 595 basis points from the year ago quarter due primarily to the decline in gross profit dollars. |

5

| Avnet, Inc. Q2 Fiscal Year 2013 | ||

| $ in millions - except per share data January 24, 2013 |

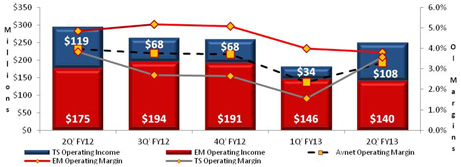

O p e r a t i n g I n c o m e

| 2Q’ FY12 | 3Q’ FY12 | 4Q’ FY12 | 1Q’ FY13 | 2Q’ FY13 | Y/Y Chg | |||||||||||||||||||

| Avnet, Inc. GAAP Operating Income |

$ | 230.9 | $ | 216.8 | $ | 213.4 | $ | 100.0 | $ | 195.6 | ($ | 35.3 | ) | |||||||||||

| Adjusted Operating Income (1) |

$ | 265.4 | $ | 235.4 | $ | 233.9 | $ | 137.4 | $ | 220.5 | ($ | 44.9 | ) | |||||||||||

| Adjusted Operating Margin (1) |

3.96 | % | 3.75 | % | 3.71 | % | 2.34 | % | 3.29 | % | (67 | )bps | ||||||||||||

| Electronics Marketing (EM) Total |

||||||||||||||||||||||||

| Operating Income |

$ | 174.9 | $ | 194.3 | $ | 191.1 | $ | 146.3 | $ | 140.1 | ($ | 34.8 | ) | |||||||||||

| Operating Income Margin |

4.86 | % | 5.17 | % | 5.08 | % | 4.00 | % | 3.81 | % | (105 | )bps | ||||||||||||

| Technology Solutions (TS) Total |

||||||||||||||||||||||||

| Operating Income |

$ | 118.9 | $ | 67.9 | $ | 67.5 | $ | 34.4 | $ | 108.0 | ($ | 11.0 | ) | |||||||||||

| Operating Income Margin |

3.84 | % | 2.69 | % | 2.65 | % | 1.55 | % | 3.57 | % | (27 | )bps | ||||||||||||

| (1) | A reconciliation of GAAP to non-GAAP financial measures is presented in the Non-GAAP Financial Information section at the end of this document. |

| • | Adjusted enterprise operating income of $220.5 million declined 16.9% year over year due to the decline in revenue at TS and the impact of the higher relative growth of the lower margin EM Asia business as compared the higher-margin western regions. |

| • | Adjusted operating income margin of 3.3% at the enterprise level improved 95 basis points sequentially and declined 67 basis points year over year. |

| • | EM operating income margin decreased 19 basis points sequentially and 105 basis points from the year ago quarter to 3.81%. The year over year decline was primarily due to the temporary benefit from the hard disk drive shortages in the year ago quarter and the impact of the geographic mix shift to the lower margin Asia region combined with higher sales in Asia of low margin fulfillment business in the current quarter, partially offset by the benefit from the recent cost reduction actions. |

6

| Avnet, Inc. Q2 Fiscal Year 2013 | ||

| $ in millions - except per share data January 24, 2013 |

| • | EM operating income declined 4.2% sequentially and 19.9% year over year. |

| • | Sequentially, TS operating income and operating income margin improved 213.9% and 202 basis points, respectively, due primarily to double digit growth across all three regions. |

I n t e r e s t E x p e n s e , O t h e r I n c o m e a n d I n c o m e T a x e s

| 2Q’ FY12 | 3Q’ FY12 | 4Q’ FY12 | 1Q’ FY13 | 2Q’ FY13 | Y/Y Change | |||||||||||||||||||

| Interest Expense |

($ | 22.2 | ) | ($ | 23.6 | ) | ($ | 23.2 | ) | ($ | 23.9 | ) | ($ | 27.8 | ) | $ | 5.6 | |||||||

| Other Income (Expense) |

$ | 0.7 | $ | 3.2 | ($ | 4.1 | ) | $ | 1.5 | $ | 1.1 | $ | 0.3 | |||||||||||

| GAAP Income Taxes |

$ | 61.0 | $ | 53.4 | $ | 52.6 | $ | 8.6 | $ | 31.4 | ($ | 29.6 | ) | |||||||||||

| Adjusted Income Taxes (1) |

$ | 72.0 | $ | 63.4 | $ | 61.4 | $ | 31.0 | $ | 53.8 | ($ | 18.2 | ) | |||||||||||

| GAAP Effective Tax Rate |

29.33 | % | 26.56 | % | 28.28 | % | 7.86 | % | 18.60 | % | (1,073 | )bps | ||||||||||||

| Adjusted Effective Tax Rate (1) |

29.50 | % | 29.50 | % | 29.69 | % | 27.00 | % | 27.75 | % | (175 | )bps | ||||||||||||

| (1) | A reconciliation of GAAP to non-GAAP financial measures is presented in the Non-GAAP Financial Information section at the end of this document. |

| • | Interest expense for the December 2012 quarter was $27.8 million, up $5.6 million over the prior year quarter due to higher average debt outstanding and the impact of the November 2012 issuance of long term senior notes that have a higher interest rate than the short term debt they replaced. |

| • | The Company recognized $1.1 million of other income in the December quarter, as compared with other income of $0.7 million in the prior year. |

| • | The GAAP effective tax rate of 18.6% in the second quarter was significantly lower than the year ago quarter due to the favorable impact of an audit settlement for an acquired company and a US tax benefit recognized on the closure of a foreign operation. |

7

| Avnet, Inc. Q2 Fiscal Year 2013 | ||

| $ in millions - except per share data January 24, 2013 |

N e t I n c o m e a n d E P S

| 2Q’ FY12 | 3Q’ FY12 | 4Q’ FY12 | 1Q’ FY13 | 2Q’ FY13 | Y/Y Change | |||||||||||||||||||

| GAAP Net Income |

$ | 147.0 | $ | 147.6 | $ | 133.4 | $ | 100.3 | $ | 137.5 | -6.5 | % | ||||||||||||

| Adjusted Net Income (1) |

$ | 172.0 | $ | 151.6 | $ | 145.3 | $ | 83.9 | $ | 140.0 | -18.6 | % | ||||||||||||

| GAAP EPS |

$ | 0.98 | $ | 1.00 | $ | 0.91 | $ | 0.70 | $ | 0.99 | 1.0 | % | ||||||||||||

| Adjusted EPS (1) |

$ | 1.15 | $ | 1.03 | $ | 0.99 | $ | 0.59 | $ | 1.01 | -12.2 | % | ||||||||||||

| (1) | A reconciliation of GAAP to non-GAAP financial measures is presented in the Non-GAAP Financial Information section at the end of this document. |

| • | GAAP net income for the second quarter of fiscal 2013 was $137.5 million, or $0.99 per share on a diluted basis which improved sequentially by 37.1% and 41.4%, respectively, primarily due to the improvement in profitability discussed above offset somewhat by the impact of restructuring, integration and other charges. |

| • | Adjusted net income for the second quarter of fiscal 2013 was $140.0 million, or $1.01 per share on a diluted basis. |

| • | On an adjusted basis, sequential net income and diluted earnings per share increased 66.8% and 71.2%, respectively, primarily due to the improvement in profitability by TS. |

| • | Adjusted earnings per share of $1.01 declined $0.14 or 12.2% from a year ago quarter due to the factors noted above. |

8

| Avnet, Inc. Q2 Fiscal Year 2013 | ||

| $ in millions - except per share data January 24, 2013 |

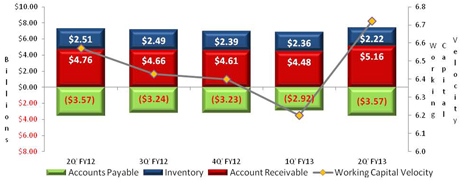

W o r k i n g C a p i t a l

| 2Q’ FY12 | 3Q’ FY12 | 4Q’ FY12 | 1Q’ FY13 | 2Q’ FY13 | Y/Y Change | |||||||||||||||||||

| Account Receivable |

$ | 4,755.6 | $ | 4,658.8 | $ | 4,607.3 | $ | 4,477.9 | $ | 5,161.5 | $ | 405.9 | ||||||||||||

| Inventory |

$ | 2,513.9 | $ | 2,490.3 | $ | 2,388.7 | $ | 2,360.5 | $ | 2,223.8 | ($ | 290.1 | ) | |||||||||||

| Accounts Payable |

($ | 3,567.7 | ) | ($ | 3,237.5 | ) | ($ | 3,230.8 | ) | ($ | 2,920.6 | ) | ($ | 3,565.4 | ) | $ | 2.3 | |||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Working Capital |

$ | 3,701.8 | $ | 3,911.6 | $ | 3,765.2 | $ | 3,917.8 | $ | 3,819.9 | $ | 118.1 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Working Capital Velocity |

6.57 | 6.43 | 6.40 | 6.20 | 6.72 | 0.15 | ||||||||||||||||||

| • | Working capital (receivables plus inventory less accounts payable) increased $118.1 million, or 3.2%, year over year and decreased 2.7% when adjusted for acquisitions and the translation impact of changes in foreign currency exchange rates. |

| • | Working capital velocity improved by 0.15 turns when compared with the year ago quarter and 0.52 turns sequentially. |

| • | Inventory declined 11.5% year over year and 5.8% sequentially due to effective inventory management and higher than expected sales. |

9

| Avnet, Inc. Q2 Fiscal Year 2013 | ||

| $ in millions - except per share data January 24, 2013 |

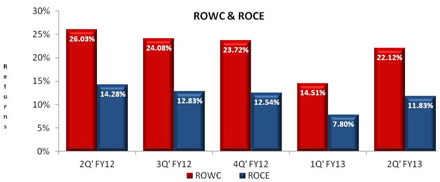

R e t u r n s

| 2Q’ FY12 | 3Q’ FY12 | 4Q’ FY12 | 1Q’ FY13 | 2Q’ FY13 | Y/Y Change | |||||||||||||||||||

| Return on Working Capital (ROWC) (1) |

26.03 | % | 24.08 | % | 23.72 | % | 14.51 | % | 22.12 | % | (391 | ) bps | ||||||||||||

| Return on Capital Employed (ROCE) (1) |

14.28 | % | 12.83 | % | 12.54 | % | 7.80 | % | 11.83 | % | (245 | ) bps | ||||||||||||

| (1) | A reconciliation of non-GAAP financial measures to GAAP financial measures is presented in the Non-GAAP Financial Information section at the end of this document. |

| • | ROWC for the quarter was 22.12%, a sequential improvement of 761 basis points. |

| • | The sequential improvement was primarily due to an increase in operating income as noted above. |

| • | ROCE of 11.83% was up 403 basis points in the December quarter. |

10

| Avnet, Inc. Q2 Fiscal Year 2013 | ||

| $ in millions - except per share data January 24, 2013 |

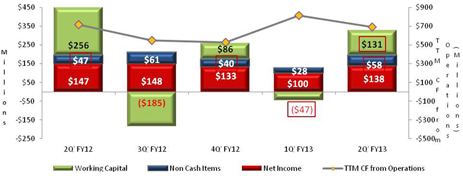

C a s h F l o w

| 2Q’ FY12 | 3Q’ FY12 | 4Q’ FY12 | 1Q’ FY13 | 2Q’ FY13 | Y/Y Change | |||||||||||||||||||

| Net Income |

$ | 147.0 | $ | 147.6 | $ | 133.4 | $ | 100.3 | $ | 137.5 | ($ | 9.5 | ) | |||||||||||

| Non Cash Items |

$ | 47.1 | $ | 60.7 | $ | 39.8 | $ | 27.9 | $ | 57.6 | $ | 10.5 | ||||||||||||

| Working Capital |

$ | 255.9 | ($ | 184.7 | ) | $ | 86.1 | ($ | 47.2 | ) | $ | 131.3 | ($ | 124.5 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Cash Flow from Operations |

$ | 450.0 | $ | 23.6 | $ | 259.3 | $ | 81.0 | $ | 326.4 | ($ | 123.5 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| TTM CF from Operations |

$ | 715.4 | $ | 550.9 | $ | 528.7 | $ | 813.8 | $ | 690.3 | ($ | 25.1 | ) | |||||||||||

| • | During the second quarter of fiscal 2013, cash flow from operations was $326.4 million and over the trailing twelve months was $690.3 million. |

| • | Strong cash flow improvement during the quarter is primarily due to growth in income and the benefits of working capital reductions noted above. |

| • | During the quarter, the Company purchased 2.5 million shares of its common stock under the $750 million stock repurchase program at an average purchase price of $28.12 per share for a total cost of $68.9 million. Since the repurchase program began in August 2011 through the end of the second quarter of fiscal 2013, the Company had repurchased 17.9 million shares for an aggregate purchase price of $525.5 million. |

| • | Cash and cash equivalents at the end of the quarter were $815 million, of which $730 million was held outside the United States; net debt (total debt less cash and cash equivalents) was $1.2 billion. |

11

| Avnet, Inc. Q2 Fiscal Year 2013 | ||

| $ in millions - except per share data January 24, 2013 |

Forward-Looking Statements

This document contains certain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements are based on management’s current expectations and are subject to uncertainty and changes in facts and circumstances. The forward-looking statements herein include statements addressing future financial and operating results of Avnet and may include words such as “will,” “anticipate,” “estimate,” “forecast,” “expect,” believe,” and “should,” and other words and terms of similar meaning in connection with any discussions of future operating or financial performance, business prospects or market conditions. Actual results may vary materially from the expectations contained in the forward-looking statements.

The following factors, among others, could cause actual results to differ materially from those described in the forward-looking statements: the Company’s ability to retain and grow market share and to generate additional cash flow, risks associated with any acquisition activities and the successful integration of acquired companies, declines in sales, changes in business conditions and the economy in general, changes in market demand and pricing pressures, any material changes in the allocation of product or product rebates by suppliers, allocations of products by suppliers, other competitive and/or regulatory factors affecting the businesses of Avnet generally.

More detailed information about these and other factors is set forth in Avnet’s filings with the Securities and Exchange Commission, including the Company’s reports on Form 10-K, Form 10-Q and Form 8-K. Except as required by law, Avnet is under no obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise.

Non-GAAP Financial Information

In addition to disclosing financial results that are determined in accordance with generally accepted accounting principles in the United States (“GAAP”), the Company also discloses in this document certain non-GAAP financial information including adjusted operating income, adjusted net income and adjusted diluted earnings per share, as well as revenue adjusted for the impact of acquisitions and other items (as defined in the Pro forma (Organic) Revenue section of this document). Management believes pro forma revenue is a useful measure for evaluating current period performance as compared with prior periods and for understanding underlying trends.

Management believes that operating income adjusted for restructuring, integration and other items is a useful measure to help investors better assess and understand the Company’s operating performance, especially when comparing results with previous periods or forecasting performance for future periods, primarily because management views the excluded items to be outside of Avnet’s normal operating results. Management analyzes operating income without the impact of these items as an indicator of ongoing margin performance and underlying trends in the business. Management also uses these non-GAAP measures to establish operational goals and, in some cases, for measuring performance for compensation purposes.

12

| Avnet, Inc. Q2 Fiscal Year 2013 | ||

| $ in millions - except per share data January 24, 2013 |

Management believes net income and EPS adjusted for the impact of the items described above is useful to investors because it provides a measure of the Company’s net profitability on a more comparable basis to historical periods and provides a more meaningful basis for forecasting future performance. Additionally, because of management’s focus on generating shareholder value, of which net profitability is a primary driver, management believes net income and EPS excluding the impact of these items provides an important measure of the Company’s net results of operations for the investing public.

Other metrics management monitors in its assessment of business performance include return on working capital (ROWC), return on capital employed (ROCE) and working capital velocity (WC velocity).

| • | ROWC is defined as annualized operating income, excluding restructuring, integration and other items, divided by the sum of the monthly average balances of receivables and inventory less accounts payable. |

| • | ROCE is defined as annualized, tax effected operating income, excluding restructuring, integration and other items, divided by the monthly average balances of interest-bearing debt and equity (including the impact of restructuring, integration, impairment charges and other items) less cash and cash equivalents. |

| • | WC velocity is defined as annualized sales divided by the sum of the monthly average balances of receivable and inventory less accounts payable. |

Any analysis of results and outlook on a non-GAAP basis should be used as a complement to, and in conjunction with, data presented in accordance with GAAP.

Second Quarter Fiscal 2013

| Second Quarter Ended Fiscal 2013 | ||||||||||||||||

| Op Income | Pre-tax | Net Income | Diluted EPS |

|||||||||||||

| $ in thousands, except per share data | ||||||||||||||||

| GAAP results |

$ | 195,573 | $ | 168,894 | $ | 137,481 | $ | 0.99 | ||||||||

| Restructuring, integration and other charges |

24,906 | 24,906 | 19,885 | 0.14 | ||||||||||||

| Gain on bargain purchase and other |

(59 | ) | (23 | ) | 0.00 | |||||||||||

| Income tax adjustments |

(17,366 | ) | (0.12 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total adjustments |

24,906 | 24,847 | 2,496 | 0.02 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Adjusted results |

$ | 220,479 | $ | 193,741 | $ | 139,977 | $ | 1.01 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

Items impacting the second quarter of fiscal 2013 consisted of the following:

| • | Restructuring, integration and other charges of $24.9 million pre-tax consisted of $8.5 million for facility exit-related costs, $7.6 million for integration-related costs, $7.3 million for severance, $3.0 million for transaction costs associated with recent acquisitions, $0.3 million for other charges, and a credit of $1.8 million to adjust prior year restructuring reserves no longer required; |

13

| Avnet, Inc. Q2 Fiscal Year 2013 | ||

| $ in millions - except per share data January 24, 2013 |

| • | A net gain consisting of an adjustment of $1.7 million pre-tax to increase the gain on bargain purchase recorded in the first quarter of fiscal 2013 to adjust the net assets acquired, partially offset by a loss on divestiture of $1.7 million pre-tax related to a small business in TS Asia; and |

| • | An income tax adjustment of $17.4 million primarily related to a favorable settlement of a U.S. income tax audit for an acquired company. |

Second Quarter Fiscal 2012

| Second Quarter Ended Fiscal 2012 | ||||||||||||||||

| Op Income | Pre-tax | Net Income | Diluted EPS |

|||||||||||||

| $ in thousands, except per share data | ||||||||||||||||

| GAAP results |

$ | 230,889 | $ | 208,038 | $ | 147,023 | $ | 0.98 | ||||||||

| Restructuring, integration and other charges |

34,505 | 34,505 | 23,563 | 0.16 | ||||||||||||

| Other |

— | 1,399 | 854 | 0.01 | ||||||||||||

| Income tax adjustments |

— | — | 539 | — | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total adjustments |

34,505 | 35,904 | 24,956 | 0.17 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Adjusted results |

$ | 265,394 | $ | 243,942 | $ | 171,979 | $ | 1.15 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

Items impacting the second quarter of fiscal 2012 consisted of the following:

| • | Restructuring, integration and other charges of $34.5 million pre-tax related to cost reduction actions initiated during the second quarter and acquisition and integration charges associated with acquired businesses. The charges consisted of $19.8 million for severance, $7.4 million for facility exit costs, $3.4 million for integration costs, $3.1 million for transaction costs, $1.7 million for other restructuring charges, and a reversal of $0.9 million to adjust prior year restructuring reserves; |

| • | $1.4 million pre-tax related to the write-down of a small investment and the write-off of deferred financing costs associated with the early retirement of a credit facility; and |

| • | An income tax adjustment of $0.5 million primarily related to the combination of a favorable audit settlement and release of a valuation allowance on certain deferred tax assets which were determined to be realizable, mostly offset by changes to existing tax positions primarily for transfer pricing. |

14

| Avnet, Inc. Q2 Fiscal Year 2013 | ||

| $ in millions - except per share data January 24, 2013 |

Pro Forma (Organic) Revenue

Pro forma or Organic revenue is defined as reported revenue adjusted for (i) the impact of acquisitions by adjusting Avnet’s prior periods to include the sales of businesses acquired as if the acquisitions had occurred at the beginning of fiscal 2012 and (ii) the impact of the transfer of a business from TS Americas to EM Americas, which did not have an impact to Avnet on a consolidated basis but did impact the pro forma sales for the groups by approximately $6 million in the second quarter of fiscal 2012. Sales taking into account the combination of these adjustments are referred to as “pro forma sales” or “organic sales.”

| Revenue as Reported |

Acquisition

/ Divested Revenue |

Pro forma Revenue |

||||||||||

| (in thousands) | ||||||||||||

| Q1 Fiscal 2013 |

$ | 5,870,057 | $ | 203,666 | $ | 6,073,723 | ||||||

| Q2 Fiscal 2013 |

6,699,465 | 3,530 | 6,702,995 | |||||||||

|

|

|

|

|

|

|

|||||||

| Fiscal year 2013 |

$ | 12,569,522 | $ | 207,196 | $ | 12,776,718 | ||||||

|

|

|

|

|

|

|

|||||||

| Q1 Fiscal 2012 |

$ | 6,426,006 | $ | 403,319 | $ | 6,829,325 | ||||||

| Q2 Fiscal 2012 |

6,693,573 | 411,077 | 7,104,650 | |||||||||

| Q3 Fiscal 2012 |

6,280,557 | 313,469 | 6,594,026 | |||||||||

| Q4 Fiscal 2012 |

6,307,386 | 229,990 | 6,537,376 | |||||||||

|

|

|

|

|

|

|

|||||||

| Fiscal year 2012 |

$ | 25,707,522 | $ | 1,357,855 | $ | 27,065,377 | ||||||

|

|

|

|

|

|

|

|||||||

“Acquisition Revenue” as presented in the preceding table includes the acquisitions listed below.

| Acquired Business |

Operating Group | Acquisition Date |

||||

| Tekdata Interconnections, Limited |

EM | October 2012 | ||||

| Magirus AG |

TS | October 2012 | ||||

| Brightstar Partners, Inc. and BPS Software |

TS | November 2012 | ||||

| Genilogix |

TS | November 2012 | ||||

15

| Avnet, Inc. Q2 Fiscal Year 2013 | ||

| $ in millions - except per share data January 24, 2013 |

ROWC, ROCE and WC Velocity

The following table presents the calculation for ROWC, ROCE and WC velocity (dollars in thousands).

| Q2 FY 13 | Q2 FY 12 | |||||||||||

| Sales |

$ | 6,699,465 | $ | 6,693,573 | ||||||||

| Sales, annualized |

(a | ) | 26,797,859 | 26,774,293 | ||||||||

| Adjusted operating income (1) |

220,479 | 265,394 | ||||||||||

| Adjusted operating income, annualized |

(b | ) | 881,917 | 1,061,576 | ||||||||

| Adjusted effective tax rate (2) |

27.47 | % | 29.43 | % | ||||||||

| Adjusted operating income, net after tax |

(c | ) | $ | 639,654 | $ | 749,154 | ||||||

| Average monthly working capital |

||||||||||||

| Accounts receivable |

$ | 4,662,211 | $ | 4,565,435 | ||||||||

| Inventory |

2,362,990 | 2,622,126 | ||||||||||

| Accounts payable |

(3,037,915 | ) | (3,109,372 | ) | ||||||||

|

|

|

|

|

|||||||||

| Average working capital |

(d | ) | $ | 3,987,286 | $ | 4,078,189 | ||||||

|

|

|

|

|

|||||||||

| Average monthly total capital |

(e | ) | $ | 5,405,464 | $ | 5,246,036 | ||||||

|

|

|

|

|

|||||||||

| ROWC = (b) / (d) |

22.12 | % | 26.03 | % | ||||||||

| WC Velocity = (a) / (d) |

6.72 | 6.57 | ||||||||||

| ROCE = (c ) / (e) |

11.83 | % | 14.28 | % | ||||||||

| (1) | See reconciliation to GAAP amounts in the preceding tables in this Non-GAAP Financial Information Section. |

| (2) | Adjusted effective tax rate is based upon a year-to-date (full fiscal year rate for FY12) calculation excluding restructuring, integration and other charges and tax adjustments as described in the reconcilation to GAAP amounts in this Non-GAAP Financial Information Section. |

16