Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NATURAL RESOURCE PARTNERS LP | d472207d8k.htm |

| EX-99.1 - PRESS RELEASE - NATURAL RESOURCE PARTNERS LP | d472207dex991.htm |

OCI

Wyoming Acquisition Trona Interests

January 23, 2013

Exhibit 99.2 |

Forward Looking Statements

The statements made by representatives of Natural Resource Partners L.P.

(“NRP”) during the course of this presentation that are not

historical facts are forward- looking statements. Although NRP believes

that the assumptions underlying these statements are reasonable, investors are

cautioned that such forward-looking statements are inherently uncertain

and necessarily involve risks that may affect NRP’s business prospects

and performance, causing actual results to differ from those discussed during

the presentation. Such risks and uncertainties include, by way of example and

not of limitation: all financial projections; general business and economic

conditions; decreases in

demand for trona, soda ash, coal, aggregates, and oil & gas; changes in our

lessees’ operating conditions and costs; operating costs and risks

associated with the trona mining business; changes in the level of costs

related to environmental protection and operational safety; unanticipated

geologic problems; problems related to force majeure; potential labor

relations problems; changes in the legislative or regulatory environment; and

lessee production cuts. These and other applicable risks and uncertainties have

been described more fully in NRP’s most recent Annual Report on Form

10-K or Quarterly Report on Form 10-Q. NRP undertakes no obligation to

publicly update any forward-looking statements, whether as a result of new

information or future events. 2 |

Acquisition of Trona / Soda Ash Operations and Assets

3 |

Transaction

•

NRP acquired Anadarko Petroleum Corporation’s (APC) ~49% equity interest in

OCI Wyoming, consisting of trona ore mining operations and a soda ash refinery

located in the Green River Basin, Wyoming

•

NRP acquired APC’s interest for a price of $292.5 million plus an earn-out

of up to a net present value of $50 million based on OCI performance in 2013,

2014 and 2015

•

Transaction financed through the following:

–

$200 million 3-year term loan

–

$76.5 million from equity issuance and GP contribution

–

$16.5 million cash

4 |

Strategic Rationale

•

Further diversification of NRP’s revenue

–

Soda ash revenue tied to broad and diverse set of industrial markets

–

Favorable supply / demand fundamentals

–

Trona mining and processing operations not a focus of environmental or

geopolitical concerns •

Stable to increasing distributions and income based on long-life assets

–

Increasing income and annual distribution potential

–

Substantial trona ore reserves: 60+ year reserve life

–

Cash flow accretion to NRP of $0.18 to $0.22 per unit in 2013

•

OCI Partnership in good financial condition

–

Invested over past 15 years for expansion, efficiency, and sustainability (funded

with cash from operations) raising production capacity

–

Rated production capacity of 3.25 million tons annually

–

Balance sheet with room for levering future expansion capex

5

2009

2010

2011

2012

2013E

27.5

20.5

25.2

35.0

~35-40

38.0

33.8

55.0

N/A

N/A

Cash received on acquired interests, $mm

Revenue derived from acquired interests, $mm |

Key

Operating Metrics – OCI Wyoming

•

Sales and Pricing:

–

Historical annual sales of refined soda ash: 2.3-2.5 mm tons (approximately

2/3rds exported) –

90% of export sales arranged by ANSAC (three member co-op: OCI, FMC, and

Tata); ANSAC is the largest soda ash exporter at ~4 mm metric tons of

natural soda ash –

OCI negotiates pricing with domestic companies each October for following year

(customers have rolling 1-yr contract terms)

•

Currently mining 2 trona beds:

–

#24 is 11.3’

thick, contains 89.6% trona, at a depth of 913’

–

#25 is 10.2’

thick, contains 88.6% trona, at a depth of 796’

–

Room-and-pillar mining using continuous miners

•

Natural soda ash has competitive cost advantage over

synthetic manufacturing

–

Natural soda ash cash costs are less than half the cost

of synthetics

6 |

Pro

Forma Ownership Structure and Distributions •

NRP is due a preferred return of $4.7 million per year from OCI Wyoming Co.(accruing

interest at 9% per annum in the event not paid)

•

In addition, NRP receives 20% of distributions (net of tax) to OCI Wyoming Co. in

excess of the preferred return •

Finally, NRP is due 48.51% of any distributions from OCI Wyoming

L.P. after priority return is paid

7

NRP Operating

NRP Trona LLC

OCI Wyoming L.P.

OCI Wyoming

Holding Co.

OCI Wyoming Co.

OCI Chemical

Corporation

100% |

OCI

Company Ltd. (Korean Parent) •

Headquartered

in

Seoul,

Korea,

OCI

Company

Ltd.

(OCI

Korea)

is

a

global

company

with a market capitalization of ~$4.5 billion

•

OCI Korea’s product portfolio spans the fields of inorganic chemicals, petro and

coal chemicals, fine chemicals, renewable energy and insulation

materials •

OCI is today the world’s fifth-largest producer of soda ash, having acquired

the Green River soda ash operations from Rhone Poulenc in 1996

•

OCI Enterprises, Inc., based in Atlanta, GA, is the North American subsidiary of

OCI Korea

8 |

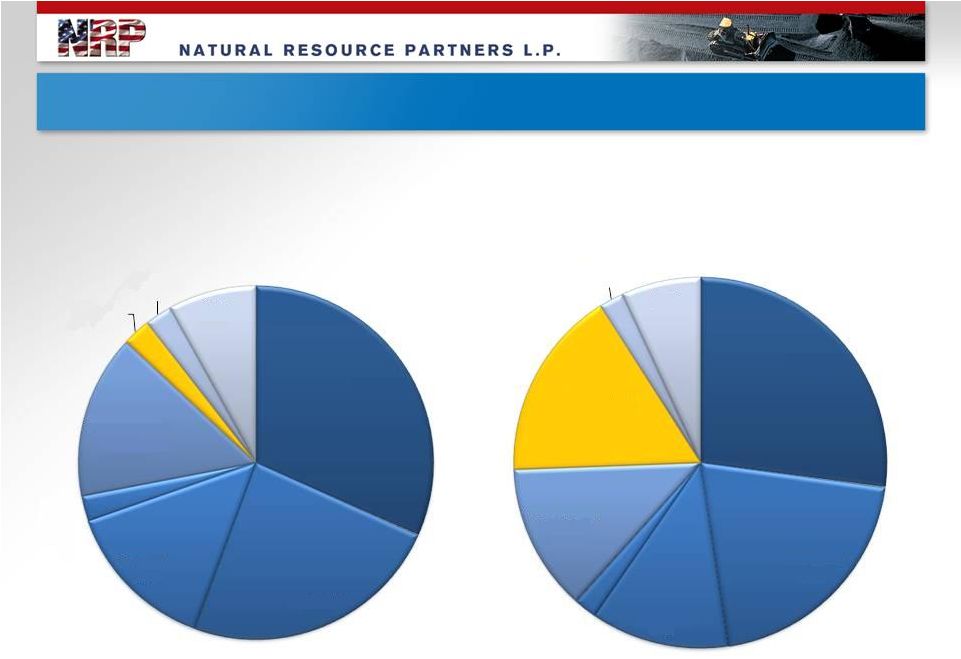

2012

Diversity of Revenue Proforma for Acquisition 9

2012 Revenues

2012 Revenues

Nine Months Actual, Three Months Forecast

Pro Forma for OCI Acquisition

Met Coal

32%

Steam -

APP

24%

Steam

-

ILB

14%

Steam

-

NPRB

2%

Coal I/structure,

ORR, Mins

15%

Aggregates

4%

Oil & Gas

2%

Other

8%

Met Coal

27%

Steam

-

APP

20%

Steam

-

ILB

12%

Steam

-

NPRB

2%

Coal I/structure,

ORR, Mins

13%

Aggregates &

Industrial

Minerals

17%

Oil & Gas

2%

Other

7% |

Trona/Soda Ash Fundamentals and Markets

10 |

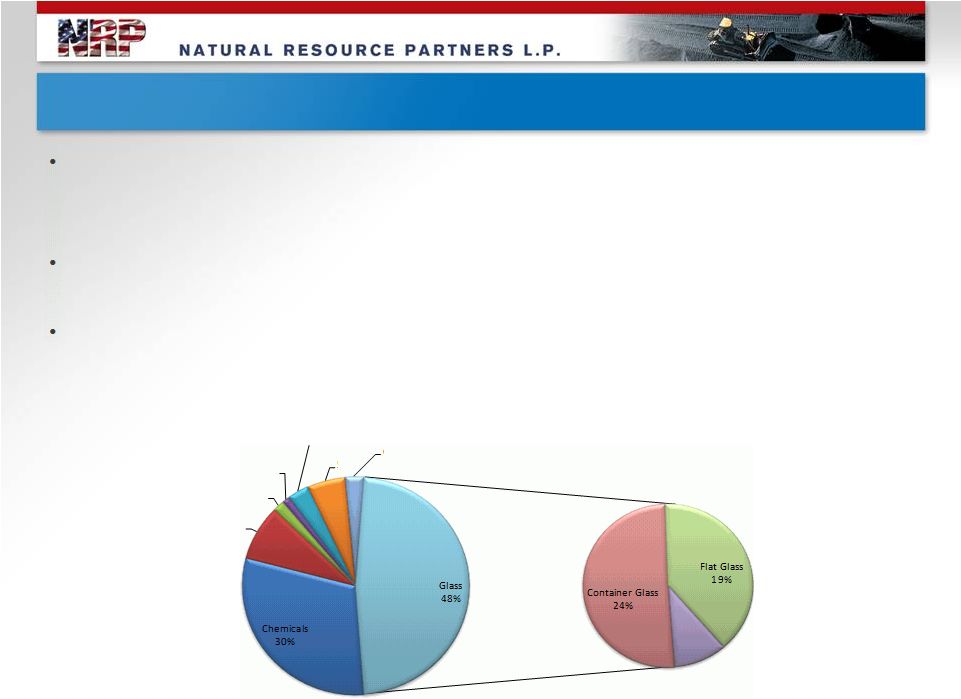

Trona / Soda Ash Fundamentals

Trona ore is a naturally occurring form of soda ash, used worldwide in

manufacturing a variety of consumer products, primarily including glass,

chemicals, soap, and paper

Soda ash can also be produced synthetically from limestone, and even though

synthetic capacity is growing, it comes at a significantly higher cost

differential World demand for soda ash has been growing for the past three

decades, driven particularly by Asia, Middle East and Africa, while U.S.

demand has generally been stable at 6-7 million tons annually

11

Source: USGS

Soaps and

Detergents

8%

Pulp and Paper

2%

Water Treatment

1%

Flue Gas Desulfurization

3%

Distributors

5%

Other

3%

Fiber and Other Glass

5%

2011 US Consumers of Soda Ash |

Global Production Capacity and Demand

Growing global demand for soda ash

Demand increased substantially in 2011 but slowed to an estimated 1.9% in 2012, with

an increase of 3.8% projected for 2013

Capacity additions and production levels continue to outpace demand, though capacity

utilization remains relatively high at 87.5%

Source: Santini & Associates, Inc.

2011

TOTAL

2012 Est.

TOTAL

2013 Fcst.

TOTAL

Nameplate Capacity

63,000

65,000

68,000

Effective Capacity

58,000

60,000

64,000

Production Estimate

52,000

53,000

56,000

Demand

52,000

53,000

55,000

Year-over-Year Growth

7.7%

1.9%

3.8%

Capacity Utilization

89.7%

88.3%

87.5%

12 |

Competitive Landscape

Five producers of natural soda ash in the U.S., four located in Green

River, Wyoming and one, Searles Valley, in California

OCI Wyoming produces approximately 20% of the total U. S. production

of natural soda ash

13

FMC

32%

General

21%

Solvay

19%

SVM

8%

OCI

20% |

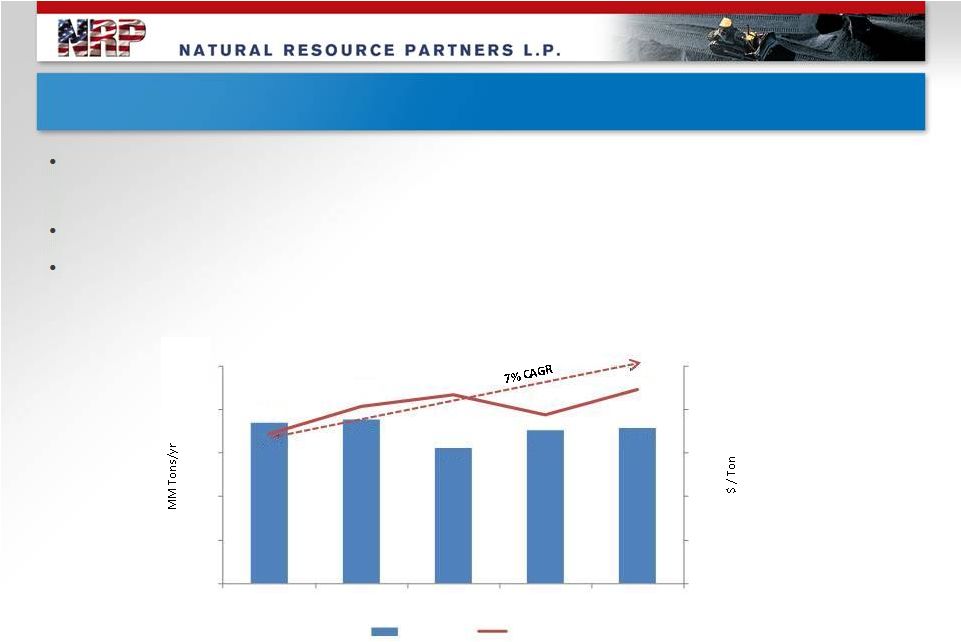

U.S. Production and Demand

U.S. domestic demand and supply is fairly stable with almost 100%

capacity utilization

The export market is a key profit growth opportunity for U.S. producers

Prices increased at a CAGR of 7% from 2007 through 2011

14

Source: USGS: 2011 Minerals Yearbook, November 2012

11.1

11.3

9.3

10.6

10.7

104

122

130

116

134

0

30

60

90

120

150

0.0

3.0

6.0

9.0

12.0

15.0

2007

2008

2009

2010

2011

WY Historical Soda Ash Output

Production

Price |

Financing of Transaction & Liquidity

Purchase Price of $292.5 million, plus an earn-out of up to $50 million

based on OCI performance criteria for 2013, 2014, and 2015

Financing:

–

$200 million funded with new 3-year term loan

–

$76.5

million

in

equity

issued

to

Sponsors

at

closing,

including

a

$1.5million general partner contribution

–

$16 million cash

Liquidity

following

transaction

-

$285

million

–

Adjusted Cash at 12/31/12 of $133 million following cash used for

transaction

–

Available on credit facility -

$152 million

15 |

Term Loan Component

16

NRP (Operating LLC)

Borrower:

Partial funding of OCI Wyoming Acquisition

Purpose:

Size / Tenor / Type:

Interest Coverage 3.5x

Leverage Ratio 4.0x

Financial Covenants:

$200 mm / 3-Year / Senior Unsecured Term Loan Facility

Guarantors:

All existing and future Material Subsidiaries

Year 1: $10 mm due January 2014

Year 2: $20 mm due January 2015

Year 3: $170 mm due January 2016

Amortization:

Interest Rate:

LIBOR + 200bps |

Equity Component

Raised $76.5 million

Issued $75 million in private placement equity to affiliates of NRP’s

general partner:

–

Corbin J. Robertson, Jr, Chairman and CEO of NRP, and members of

his family

–

Chris Cline

–

S. Reed Morian

–

W. W. Scott, Jr.

–

3,784,572 units issued at a discount rate of 4.5% to the volume-

weighted average price for the prior 15 trading days.

NRP (GP) L.P., the general partner of Natural Resource Partners L.P.,

contributed $1.5 million to maintain its 2% interest in Natural Resource

Partners L.P.

17 |

Conclusions

The acquisition represents a significant step in NRP’s efforts to diversify

its portfolio of revenues

OCI has a long production and sales history in a relatively stable, slow

growth market

–

OCI is a low cost producer with high quality reserves that have an

estimated life in excess of 60 years

–

Natural soda ash production has competitive cost advantages over

synthetic soda ash

Investment is immediately accretive under the financing structure, adding

cash flow of ~$0.18 -

$0.22 per unit in 2013

18 |