Attached files

| file | filename |

|---|---|

| 8-K - 8-K - DEX ONE Corp | d474353d8k.htm |

Integration Plans

and Progress

January 23, 2013

Exhibit 99.1 |

2

Important Information for Investors and

Security Holders

This communication does not constitute an offer to sell or the solicitation of an offer to buy any

securities or a solicitation of any vote or approval. The proposed merger transaction between SuperMedia Inc. (“SuperMedia”)

and Dex One Corporation (“Dex”) will be submitted to the respective stockholders of

SuperMedia and Dex. In connection with the proposed transaction, Newdex, Inc., a subsidiary of Dex (“Newdex”) has filed with the

Securities and Exchange Commission (“SEC”) a registration statement on Form S-4,

as amended, that includes a joint proxy statement/prospectus to be used by SuperMedia and Dex to solicit the required approval of their

stockholders and that also constitutes a prospectus of Newdex. INVESTORS AND SECURITY HOLDERS OF

SUPERMEDIA AND DEX ARE ADVISED TO CAREFULLY READ THE REGISTRATION STATEMENT AND JOINT PROXY

STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS) AND OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE

THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTION, THE PARTIES TO THE TRANSACTION AND THE

RISKS ASSOCIATED WITH THE TRANSACTION. A definitive joint proxy statement/prospectus will

be sent to security holders of SuperMedia and Dex seeking their approval of the proposed transaction. Investors and security holders may obtain a free copy of the joint proxy statement/prospectus

(when available) and other relevant documents filed by SuperMedia and Dex with the SEC from the

SEC’s website at on SuperMedia’s website

at under the tab

“Investors” or by contacting SuperMedia’s Investor Relations Department at (877) 343-3272. Copies of the documents filed by

SuperMedia and Dex and their respective directors, executive officers and certain other

members of management may be deemed to be participants in the solicitation of proxies from their respective security holders with

respect to the transaction. Information about these persons is set forth in SuperMedia’s

proxy statement relating to its 2012 Annual Meeting of Shareholders and Dex’s proxy statement relating to its 2012 Annual Meeting of

Stockholders, as filed with the SEC on April 11, 2012 and March 22, 2012, respectively, and subsequent

statements of changes in beneficial ownership on file with the SEC. These documents can be obtained free of charge

from the sources described above. Security holders and investors may obtain additional

information regarding the interests of such persons, which may be different than those of the respective companies’ security holders

generally, by reading the joint proxy statement/prospectus and other relevant documents regarding the

transaction (when available), which will be filed with the SEC.

Forward-Looking

Statements

Certain statements contained in this document are “forward-looking

statements” subject to the safe harbor created by the Private Securities Litigation Reform Act of 1995, including but not limited to, statements about the

benefits of the proposed transaction and combined company, including future financial and operating

results and synergies, plans, objectives, expectations and intentions and other statements relating to the proposed

transaction and the combined company that are not historical facts. Where possible, the words

“believe,” “expect,” “anticipate,” “intend,” “should,” “will,” “would,” “planned,” “estimated,” “potential,” “goal,” “outlook,”

“may,” “predicts,” “could,” or the negative of such terms, or

other comparable expressions, as they relate to Dex, SuperMedia, the combined company or their respective management, have been used to identify such forward-looking

statements. All forward-looking statements reflect only Dex’s and SuperMedia’s current

beliefs and assumptions with respect to future business plans, prospects, decisions and results, and are based on information currently

available to Dex and SuperMedia. Accordingly, the statements are subject to significant risks,

uncertainties and contingencies, which could cause Dex’s, SuperMedia’s or the combined company’s actual operating results,

performance or business plans or prospects to differ materially from those expressed in, or implied by,

these statements.

Factors that could cause actual results to differ materially from current expectations

include risks and other factors described in Dex’s and SuperMedia’s publicly available reports filed with the SEC, which contain discussions

of various factors that may affect the business or financial results of Dex, SuperMedia or the combined

company. Such risks and other factors, which in some instances are beyond either company’s control, include: the

continuing decline in the use of print directories; increased competition, particularly from existing

and emerging digital technologies; ongoing weak economic conditions and continued decline in advertising sales; the

companies’ ability to collect trade receivables from customers to whom they extend credit; the

companies’ ability to generate sufficient cash to service their debt; the companies’ ability to comply with the financial covenants

contained in their debt agreements and the potential impact to operations and liquidity as a result of

restrictive covenants in such debt agreements; the companies’ ability to refinance or restructure their debt on reasonable

terms and conditions as might be necessary from time to time; increasing interest rates; changes in the

companies’ and the companies’ subsidiaries credit ratings; changes in accounting standards; regulatory changes and

judicial rulings impacting the companies’ businesses; adverse results from litigation,

governmental investigations or tax related proceedings or audits; the effect of labor strikes, lock-outs and negotiations; successful realization

of the expected benefits of acquisitions, divestitures and joint ventures; the companies’ ability

to maintain agreements with major Internet search and local media companies; the companies’ reliance on third-party vendors for

various services; and other events beyond their control that may result in unexpected adverse operating

results.

With respect to the proposed merger, important factors could cause actual results to

differ materially from those indicated by forward-looking statements included herein, including, but not limited to, the ability of Dex and

SuperMedia to consummate the transaction on the terms set forth in the merger agreement; the risk that

anticipated cost savings, growth opportunities and other financial and operating benefits as a result of the transaction

may not be realized or may take longer to realize than expected; the risk that benefits from the

transaction may be significantly offset by costs incurred in integrating the companies; potential adverse impacts or delay in

completing the transaction as a result of obtaining consents from lenders to Dex or SuperMedia; failure

to receive the approval of the stockholders of either Dex or SuperMedia for the transaction; the bankruptcy court failing to

confirm the pre-packaged plan of reorganization if cases are filed under Chapter 11 of the U.S.

bankruptcy code; and difficulties in connection with the process of integrating Dex and SuperMedia, including: coordinating

geographically separate organizations; integrating business cultures, which could prove to be

incompatible; difficulties and costs of integrating information technology systems; and the potential difficulty in retaining key officers

and personnel. These risks, as well as other risks associated with the merger, will be more fully

discussed in the proxy statement/prospectus included in the registration statement on Form S-4 that Newdex has filed with the

SEC in connection with the proposed transaction. None of

Dex, SuperMedia or the combined company is responsible for updating the information contained in this document beyond the publication date, or for changes made to this document by wire services or Internet

service providers.

www.supermedia.com

Dex with the SEC will be available free of charge on Dex’s website at

under the tab “Investors”

or by contacting Dex’s Investor Relations Department at (800)

497-6329. www.dexone.com

Copies of the documents filed by SuperMedia with the SEC will be

available free of charge

www.sec.gov

. |

3

Table of Contents

Summary Synergy Assessment

Integration Governance and Process

Phase 1

Phase 2

Synergies

Digital Integration

Current Situation |

Summary Synergy

Assessment |

5

Synergy Assessment

Numerous assessments of synergy opportunities from

the merger over the last six months established and

confirmed expected synergies of $150m -

$175m over

the next three years

SuperMedia management’s and DexOne management’s estimates

and diligence processes

Alvarez & Marsal reviewed management’s estimates in detail

John Mieske, Independent Integration Lead with much experience

in the industry

Integration teams

As part of the negotiation process, the Steering

Committee retained FTI Consulting, who completed

due diligence on management’s plans and

assessment of synergies |

6

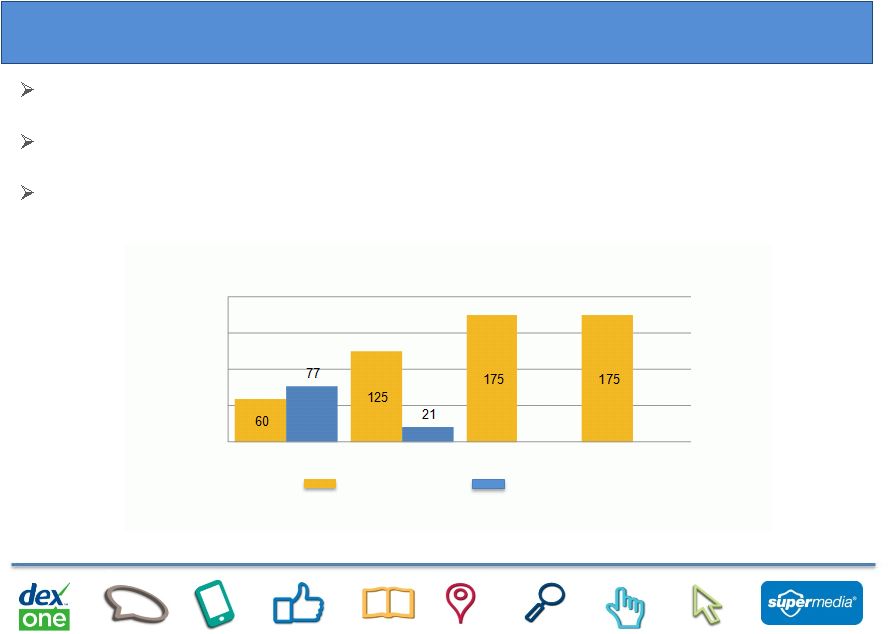

Cost to Achieve

Synergies

Expense

synergies

actions

are

expected

to

be

implemented

in

2013

and

~70%

of

the

run rate synergies expected to be realized in 2014

Total cost to achieve synergies of $100-120 million offset by realization of

synergy benefit over the same time period

The combined company will benefit from the increased scale and cost

efficiencies. We have not modeled any revenue synergies

Expense Synergies

Cumulative Net Synergies

-17

87

262

437

Cumulative Gross Synergies

60

185

360

535

Expected cumulative gross synergies of $535MM through 2016

0

50

100

150

200

2013E

2014E

2015E

2016E

2013E-2016E Expense Synergies Summary |

7

Vast majority of the synergies are associated with overhead and support

functions

Alvarez & Marsal Transaction Advisory Group, LLC (“A&M”) was

retained by SuperMedia to evaluate management’s expense synergy

estimates and the one-time costs to achieve.

The companies have made significant progress towards developing an

integration plan over the past several months and anticipate being able to

begin implementing this plan immediately upon close

Expense Synergies –

Prior View

Category

Low

High

Description

Print Product, Publishing

25

30

Paper, printing and distribution economies of scale & process/vendor

management redundancies

Digital Product Costs

20

25

Traffic acquisition efficiencies and fulfillment redundancies

Sales, Marketing, Advertising

40

45

Channel management redundancies, training efficiencies, expense and

headcount redundancies

IT

20

25

Platform consolidation, vendor consolidation and support efficiencies

Corporate, Operational Overhead

45

50

Headcount and occupancy redundancies, best practices efficiencies,

additional outsourcing opportunities, management redundancies

Total

150

175

|

Integration Governance

and Process |

9

Integration Planning and Implementation

Process

4 Phase Approach

A well thought out, disciplined and proven approach.

Phase 1:

Evaluate current processes, organization and performance

Phase 2:

Agree upon strategy, priorities and objectives to drive

transformation and growth of the combined company post-merger;

creating an integration plan with preliminary organizational design and

targets and action plans to get to the end state

Phase 3:

Refine integration plan and organizational design; begin staffing

process to support the plans

Phase

4:

Execution

of

the

integration

plan

This process is being guided by an independent consultant who is

an

experienced financial executive with deep knowledge of the dynamics of the

local media industry and the operations of our businesses

Completed

Under

review and

subject to

further

revisions |

10

Integration Governance

Functional Teams –

2 Leaders

from each Company

•

Local Sales

•

National Sales

•

Sales Training

•

Sales Planning/Operations

•

Marketing

Central/Field/Communications

•

Digital Marketing

•

Information Technology

•

Billing, Credit and Collections

•

Print and Distribution

•

Customer Care

•

Publishing/Graphics/Digital

operations

•

Human Resources

•

Legal

•

Accounting/Tax/Internal Audit

•

FP&A/Business Support

•

Treasury/Investor Relations

•

Strategy/Business

Planning/Business development

•

Real Estate/Procurement

Core Integration

Team

John Mieske -

Lead

Tad Doering

Mike Tracy

Stephen Setian

Paul Bonzagni

Doug Heatherly

Greg Gulden

Pat Bradford

Satish Shetty

Josh Mohr

Angelo Marchese

Comprehensive, collaborative and cross functional review and

accountability.

Dex Media

Leadership

Peter McDonald

Dee Jones

Functional and Core team

members are leaders and

experts (Directors and

above) from each function

in each company with a

variety of backgrounds and

experiences to assess,

review and develop

recommendations. Define

and design the best way to

meet customer

requirements and provide

operational efficiency

Executive Committee and

Leadership Team |

Phases 1 and 2 |

12

Integration Planning and Implementation

Process –

Phase 1 Summary

Focus

Functional teams to share information and develop a deep understanding

of

the

current

organizations,

cultures,

processes

and

systems

of

each

company

Align organizations as best as possible in terms of tasks performed and

resources required.

Main Deliverables

Current (as is) organization structure and responsibilities

Goals, metrics and operational and financial performance of current

organizations

Work processes –

similarities and differences |

13

Integration Planning and Implementation

Process –

Phase 2 Summary

Focus

Recommend functional organizations (not names) for Day 1, interim and

end state.

Create a plan of action to achieve end state

Develop job descriptions

Quantify new organization and compare to expense reduction target

Main Deliverables

New organizational charts

Timeline

Preliminary financial estimates

Best practices for the new organization

Actions relative to people, process and technology to achieve end state

Identify risks, concerns, opportunities

Identify system decision points and recommendations

Preliminary assessment of cost to achieve/implement |

14

We continue to believe that:

We can achieve the $150 million to $175 million in cost synergies over the

next three years and that the cost to achieve/implement are within $100

million to $120 million

SuperMedia and Dex One face similar business challenges and

opportunities

Each company brings industry-leading best practices to Dex Media that will

benefit our customers and improve operational effectiveness and

efficiency.

We see these opportunities across a broad range of functions (e.g. Sales,

Marketing, Technology, Administrative functions)

SuperMedia and Dex One's different strengths in digital solutions will enable us

to

select

the

social,

mobile

and

local

products

that

provide

the

best

results

for

customers and offer them in all markets, while improving our efficiency in

sourcing and fulfilling the solutions.

Current Synergy Assessment |

Synergies |

16

Expense Synergies

Initial View

Category

Low

High

Description

Print Product, Publishing

25

30

Paper, printing and distribution economies of scale and process/vendor

management redundancies

Digital Product Costs

20

25

Traffic acquisition efficiencies and fulfillment redundancies

Sales, Marketing, Advertising

40

45

Channel management redundancies, training efficiencies, expense and

headcount redundancies

IT

20

25

Platform consolidation, vendor consolidation and support efficiencies

Corporate, Operational Overhead

45

50

Headcount and occupancy redundancies, best practices efficiencies,

additional outsourcing opportunities, management redundancies

Total

150

175

Current View

Category

Low

High

Description

Print Product, Publishing

25

30

Paper, printing and distribution economies of scale and process/vendor

management redundancies

Digital Product Costs

15

20

Traffic acquisition efficiencies and fulfillment redundancies

Sales, Marketing, Advertising

30

35

Channel management redundancies, training efficiencies, expense and

headcount redundancies

IT

25

30

Platform consolidation, vendor consolidation and support efficiencies

Corporate, Operational Overhead

55

60

Headcount and occupancy redundancies, best practices efficiencies,

additional outsourcing opportunities, management redundancies

Total

150

175

|

17

2013 –

2015 Print Product and Publishing

Consolidation

and

rationalization

of

operations

functions

yields

an

approximate 35% reduction in headcount

Reduction in print, paper, and delivery through rationalization of suppliers to

achieve scale, standardization of product formats and distribution

processes Examples include standardizing trim sizes, moving to common color

tinting, aggressive consumer choice initiatives, standardizing column

approach, managing

secondary

distribution,

minimizing

multiple

directories

in

a

market

Optimization and rationalization of distribution strategy and print volumes

Costs to achieve primarily associated with severance, relocation, recruiting

and system conversion/integration

Current View

Category

Low

High

Description

Print Product, Publishing

25

30

Paper, printing and distribution economies of scale and

process/vendor management redundancies

Digital Product Costs

15

20

Traffic acquisition efficiencies and fulfillment redundancies

Sales, Marketing, Advertising

30

35

Channel management redundancies, training efficiencies, expense and headcount

redundancies

IT

25

30

Platform consolidation, vendor consolidation and support efficiencies

Corporate, Operational Overhead

55

60

Headcount and occupancy redundancies, best practices efficiencies, additional

outsourcing opportunities, management redundancies

Total

150

175

|

18

2013 –

2015 Digital Product Costs

Reductions and efficiencies gained through a common product portfolio

Examples include standardization of platforms and tools, selection of suppliers,

distribution partners and SEM networks.

Costs to achieve primarily associated with severance, relocation, recruiting

and implementation of platform and network conversions/integration.

Current View

Category

Low

High

Description

Print Product & Publishing

25

30

Paper, printing and distribution economies of scale and process/vendor management

redundancies

Digital Product Costs

15

20

Traffic acquisition efficiencies and fulfillment redundancies

Sales, Marketing, Advertising

30

35

Channel management redundancies, training efficiencies, expense and headcount

redundancies

IT

25

30

Platform consolidation, vendor consolidation and support efficiencies

Corporate, Operational Overhead

55

60

Headcount and occupancy redundancies, best practices efficiencies, additional

outsourcing opportunities, management redundancies

Total

150

175

|

19

2013 –

2015 Sales, Marketing and Advertising

Application of most effective segmentation, channel management and

productivity models yielding an anticipated headcount reduction of 20%.

Rationalization of contiguous and overlap markets

Elimination of duplicate resources in reporting, market research, barter,

compensation, ad agency fees, vendors (e.g., call tracking)

Aligning sales leadership with new footprint and sales office configuration,

reducing national sales marketing support

Best in class go to market and consulting approach, common recruiting and

training practices.

Alignment of sales compensation plans

Costs to achieve is primarily severance, relocation and branding.

Current View

Category

Low

High

Description

Print Product, Publishing

25

30

Paper, printing and distribution economies of scale and process/vendor management

redundancies

Digital Product Costs

15

20

Traffic acquisition efficiencies and fulfillment redundancies

Sales, Marketing, Advertising

30

35

Channel management redundancies, training efficiencies, expense

and headcount redundancies

IT

25

30

Platform consolidation, vendor consolidation and support efficiencies

Corporate, Operational Overhead

55

60

Headcount and occupancy redundancies, best practices efficiencies, additional

outsourcing opportunities, management redundancies

Total

150

175

|

20

Reduction in IT costs through rationalization of platforms, systems and

operations

Consolidation of Distribution, Enterprise Resource Planning (ERP) and HR

systems; streamlining risk management and security systems; and other ancillary

systems

Consolidation

of

production

support

and

outsourcing;

consolidate

architecture,

R/D and Program Management Office (PMO) groups.

Costs to achieve primarily associated with severance, relocation, recruiting

and various system and platform conversions/consolidations.

2013 –

2015 IT

Current View

Category

Low

High

Description

Print Product, Publishing

25

30

Paper, printing and distribution economies of scale and process/vendor management

redundancies

Digital Product Costs

15

20

Traffic acquisition efficiencies and fulfillment redundancies

Sales, Marketing, Advertising

30

35

Channel management redundancies, training efficiencies, expense and headcount

redundancies

IT

25

30

Platform consolidation, vendor consolidation and support efficiencies

Corporate, Operational Overhead

55

60

Headcount and occupancy redundancies, best practices efficiencies, additional

outsourcing opportunities, management redundancies

Total

150

175

|

21

2013 –

2015 Corporate, Operational Overhead

Consolidation and rationalization of duplicative corporate functions such as

Finance, Legal, HR, etc. along with Operational functions.

Reduction in G&A functions and in real estate through elimination of

facilities and efficiencies in real estate management

Operational overhead will be reduced through streamlining processes, handle

times and driving to new KPI’s.

Savings

in

billing

and

collection

processes

via

consolidation

of

vendors

and

other

best practices

Costs to achieve primarily associated with severance, relocation, recruiting,

system consolidations, facility closures and lease impairments.

Current View

Category

Low

High

Description

Print Product, Publishing

25

30

Paper, printing and distribution economies of scale and process/vendor management

redundancies

Digital Product Costs

15

20

Traffic acquisition efficiencies and fulfillment redundancies

Sales, Marketing, Advertising

30

35

Channel management redundancies, training efficiencies, expense and headcount

redundancies

IT

25

30

Platform consolidation, vendor consolidation and support efficiencies

Corporate, Operational Overhead

55

60

Headcount and occupancy redundancies, best practices efficiencies,

additional outsourcing opportunities, management redundancies

Total

150

175

|

Digital Integration |

23

Digital Integration Objectives

Achieve an integrated, comprehensive, defined

approach to the marketplace

Achieve an integrated set of offerings and solutions

Create a migration path, timeline and process for

supporting the above

Purpose is to define and create a product portfolio that

meets or exceeds customer needs in a profitable and

efficient manner |

24

Digital Product Rationalization Principles

Providing products that meet customer requirements by delivering

sustainable and measurable results.

Providing products that are better or equal to those offered by competitors

in terms of performance, ease of use and results.

Providing

products

that

deliver

acceptable

financial

performance

for

the

company (in terms of revenue growth, contribution margin, customer

acquisition and customer retention).

Retaining and growing customers of both companies that use current digital

products.

Consolidating product sets where possible to simplify go-to-market

approach, achieve operational efficiencies and capture synergies, while

taking into account transition costs and customer impact.

|

25

2012 -

Products

Digital

Digital

Products

Products

Description

Description

Solutions

Solutions

Solutions

Solutions

Presence

Creating Online Visibility

iYP Placement

Placement of a business listing and

content on an iYP site

Identity Bundles, Orange,

SuperMatch

DSP and DEP Bundles, Prime

Display

Website

Templated desktop site

Web.com (new), Hostopia, and

Netopia

Hostopia

Mobile Site

Mobile optimized site with similar

content to desktop

GoMobi

Hostopia (part of Websites)

Reputation

Monitoring of client reputation,

social, and reviews online

Yext

Boostability/YellowBot

Social Media

Creation and management of

Social Presence

Internal Supermedia –

Facebook

N/A -

Trialing Solutions

YPH (YP.com)

YP.com iYP Products

Nationwide

Illinois

Online Listings

Listings on Local/Vertical Engines

including Google+

Yext and Internal

Boostability

Video

Custom Shoot or Montage Videos

bieMedia

BieMedia, StudioNow

Promotion

Aggressive Promotion Techniques

Bundles

Bundles of Print and/or Online

Products as a single package

Orange and Top 5%

DGA

SEM

Search Engine Marketing/Pay per

Click/Pay per Call

Internal Supermedia

Internal, OrangeSoda, Kenshoo

Display

Online Banner Ads in various

formats

Banners sold and delivered to

Superpages.com only

PaperG

SEO

Organic methods of increasing

Search Engine Rankings

OrangeSoda

Boostability |

26

Product Sets Offered

Combined companies offer broad marketing

opportunities for customers on different platforms

SEM/Lead Generation

IYP/Presence (Web and Mobile)

SEO

Sites (Web and Mobile)

Display

Video

Reputation Management and Listings

Social Media |

27

SEM/Lead Generation

Dex Media will offer a SEM/Lead Generation Product

Evaluated each company’s offering to best understand

differences. Next steps are:

Complete commercial evaluation of:

Commercial model concepts (explicit vs. embedded management fee)

Financial performance

Value delivered to customers

Traffic purchasing and network efficiency

Operational support requirements

Define next generation product functionality

Assess DexNet and Merchant Platform technologies to determine how

to best support the product direction, with best client/traffic and cost

performance, while capturing available synergies and efficiencies

Define migration options, assess impact of migration options on client

retention and growth, transition costs and speed of implementation and final

recommendations on platform approach integration plan.

|

28

IYP/Presence (Desktop and Mobile)

DexMedia’s presence products will include IYP sites (DexKnows/SuperPages)

including

distribution

to

an

extended

network

of

Tier

1

and

Tier

2

engines

Recommendations

Future IYP products should maintain the existing IYP brands and DNS structure to

maintain SEO validity as well as recognition in the marketplace that can

help retain usage (approach may differ for mobile)

IYP/Presence products should be standardized over time with publication in terms of

content, advertising units, distribution, and commercial (monetization)

approach A single back-end platform should retain content for utilization

on all owned desktop and mobile site/app versioning

Next Step

Determine the commercial model and supporting product set

Evaluate and agree upon the post-merger integration path/consolidation path for

the platforms that will support the agreed common content, product set and

commercial model

Recommend web technology platforms for future scalability to existing desktop

owned presence, with separate evaluation of mobile site and application

technology structure. Recommendation should be separated by platform/mode

of usage. |

29

Search Engine Optimization (SEO)

DexMedia should offer SEO products to meet a range of

SMB requirements

Recommendation:

Offer basic and high end products

Select a single provider

Product Managers will complete product definitions and

a vendor to recommend based on profitability |

30

Websites (Desktop and Mobile)

DexMedia should offer a set of website products, basic

and custom, including mobile optimized sites

Recommendation:

Generate common product definition criteria

Select a single provider for all sites or single providers for each site

product (basic, custom and mobile)

Do not force migration of client sites created by former vendors

should

the providing vendor change from the current vendor providing the client

site |

31

Display, Video, Reputation

Management/Listings and Social

Display

Should offer a product that that provides similar contribution margins comparable

to other company products

Delivers sustainable measurable results for customers

Performs well in terms of customer retention and acquisition

Establish product and distribution criteria and recommend vendor

Video

With the rise in bandwidth, smartphones, tablets and enhanced SEO ranking for

video, sale of a la carte and bundled video should be increased

Define the products and recommend a vendor

Reputation Management / Listing Claiming

Standardize onto one product solution

Define product and recommend a vendor or vendors

Social

Evolve the product to include management for other social applications and

communities (e.g Include LinkedIn, Twitter, Foursquare, Pinterest)

Agree on a single product and approach |

32

Digital Work in Progress and Next Steps

People:

Plans submitted for both organizational structure and scope of

responsibility Focused

on

market

demand

for

growth,

internal

company

synergies,

and

internal

profitability

Products -

Plans underway as summarized:

Determine market criteria

Determine product features needed for market demand

Determine potential vendors and profitability

Determine consolidation, migration, and new launch criteria for combined

DexMedia footprint

Systems -

Plans underway as summarized:

Determine functionality required to support product criteria

Determine system framework to support product and process direction

Determine architecture and infrastructure for transition to future long last

state Processes:

This will be an output of the Product and Systems discussions

Focus being the most efficient and complete use of processes to grow and retain

clients |

Current Situation |

34

Continue to refine Phase 2 based on changes in the

business and learnings to date

Align stand-alone budgets into the 18 functional teams and assess

against preliminary expense reduction targets

Refine expense reduction targets based on phase 2 work

Complete job descriptions for new organizational charts

Continue to assess the potential impact of timing

Phase 3

Identification and placement of qualified candidates into key

leadership positions

Create timelines and dependencies in preparation for Day 1

Refined estimates on cost to achieve/implement

Ongoing Activities |

35

Maintain focus on continuing to manage these

companies as separate and independent enterprises

thereby impeding our ability to take full advantage of

our combined scope prior to close

The companies are adhering to SEC and Anti-Trust regulations related

to operating as a combined company

Doing as much as possible in preparation for Day 1 without incurring risk

Executive Leadership not named yet thereby slowing

recommendations and decision making

Naming executives too soon may jeopardize current stand-alone

company’s performance and ability to achieve stand alone budgets

Identification and retention of key contributors

Companies still have individual 2013 commitments to

achieve

Challenges |

Q

& A? |