Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - STRATEGIC HOTELS & RESORTS, INC | d470929d8k.htm |

Investor

Presentation January 2013

Exhibit 99.1 |

I.

BEE’s Unique Value Proposition

II.

Company Overview

III.

Industry Update

IV.

Operating Trends

V.

Financial Overview

BEE’s Unique Value Proposition

1 |

o

The only pure play high-end lodging REIT

o

High-end outperforms the industry in a recovery

o

Industry leading asset management expertise

o

Assets are in pristine condition

o

Embedded organic growth through revenue growth and ROI opportunities

o

Historically low supply growth environment, particularly in BEE markets

o

Replacement cost, excluding land, approximately $750,000 per key

o

Balance sheet positioned for growth

The

best

investment

proposition

in

the

lodging

space

2

BEE’s Unique Value Proposition |

BEE’s

Unique Value Proposition 3

Proven

Investment

Track Record

Industry Leading

Asset

Management

High-end, Unique

& Irreplaceable

Hotel & Resort

Portfolio |

Highlights

o

Best portfolio in public markets

o

Locations in high-barrier-to-entry markets

o

City-center and resort destinations

o

World-class amenities

o

Historically low supply growth

Westin St. Francis

Ritz-Carlton Laguna Niguel

InterContinental Chicago

BEE’s Unique Value Proposition

4

High-end, Unique

& Irreplaceable

Hotel & Resort

Portfolio |

Highlights

o

Execution of complex and accretive restructurings

o

Assessment and development of ROI projects

o

Recent success in acquiring hotels through

off-market transactions

o

Maximized proceeds through well-timed

asset sales

Hotel del Coronado

Michael Jordan’s Steak House

Fairmont Scottsdale Princess

BEE’s Unique Value Proposition

5

Proven

Investment

Track Record |

112.0

110.8

109.4

112.1

113.7

113.8

100

104

108

112

116

120

2007

2008

2009

2010

2011

TTM

Highlights

o

Highest EBITDA per room in competitive

set

o

Sustained market share penetration

and revenue growth

o

Implemented cost cutting initiatives

in advance of recession

o

Maintaining fixed cost reductions

in recovery

o

Strong relationships with and rigorous

oversight of brand managers

EBITDA Per Available Room

Annual RevPAR Index

BEE’s Unique Value Proposition

Note: All metrics represent full-year 2011 results.

BEE

portfolio

reflects

Total

United

States

portfolio

as

of

12/31/2011.

Source: Public filings

(1)

Data as of October 2012.

Source: Smith Travel Research

6

(1) |

I.

BEE’s Unique Value Proposition

II.

Company Overview

III.

Industry Update

IV.

Operating Trends

V.

Financial Overview

Company Overview

7 |

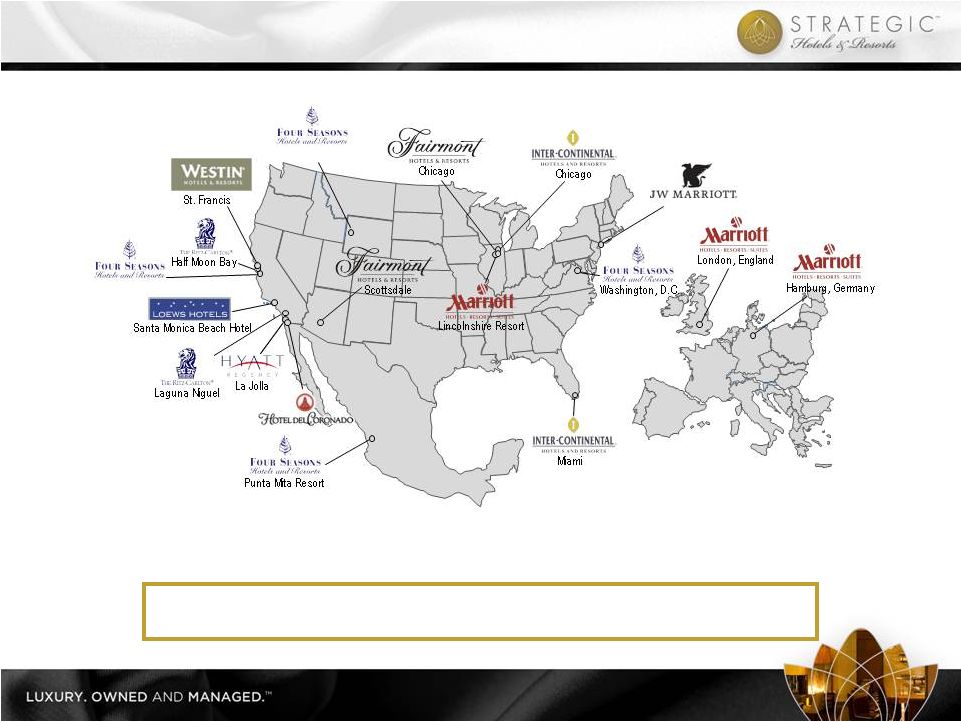

Top-Tier

Market Exposure Jackson Hole

Silicon Valley

8

New York

18 hotels located in primary gateway cities and high barrier to entry markets;

including 8,271 rooms and 851,600 square feet of meeting space |

o

o

o

o

o

o

expansion, new restaurant, 63-room and suite renovation

o

Notable 2009

capital projects

Notable 2010

capital projects

Notable 2011

capital projects

Four Seasons Washington, D.C. Lobby

Westin St. Francis Michael Mina

Bourbon Steak

InterContinental Miami Guestroom

Portfolio Well-Positioned to Enhance Cash Flow Growth

9

o

o

restaurant re-concept

o

Notable 2012

capital projects

Rendering of Fairmont Scottsdale

Princess Ballroom

Fairmont Scottsdale Princess – New Ballroom

InterContinental Miami – Public space revitalization and InterContinental

Miami – Guestroom renovation

InterContinental Chicago – Michael Jordan’s Steak House Four Seasons

Washington, D.C. – Retail outlet renovation

Marriott Lincolnshire Resort – Lobby renovation Westin St.

Francis – Michael Mina Steakhouse conversion

Four Seasons Washington, D.C. – Lobby renovation, 11-room Westin St.

Francis – Clock Bar

Four Seasons Jackson Hole – Restaurant re-concept |

Four Seasons

Washington, D.C. o

o

InterContinental Chicago

o

Westin St. Francis

o

Loews Santa Monica Beach Hotel

o

Potential Capital Projects in the Pipeline

10

Ritz-Carlton Laguna Niguel

o

ENO Wine Room

Meeting space upgrade & expansion

North tower guestroom renovation

Guestroom enhancement

ENO Wine Room

Exterior upgrade

Significant

ROI

capital

investment

opportunities

within

existing

portfolio;

rigorous analysis and approval process for each project |

I.

BEE’s Unique Value Proposition

II.

Company Overview

III.

Industry Update

IV.

Operating Trends

V.

Financial Overview

Industry Update

11 |

o

Lodging demand historically correlates with GDP (~80%) but potential exists for

near-term disconnect, particularly at the high-end

o

Customer

demographics

for

luxury

/

high-end

very

strong

–

corporate

America

and

college

educated

consumers

o

Supply growth remains historically low and development pipeline indicates muted supply for

the next several years

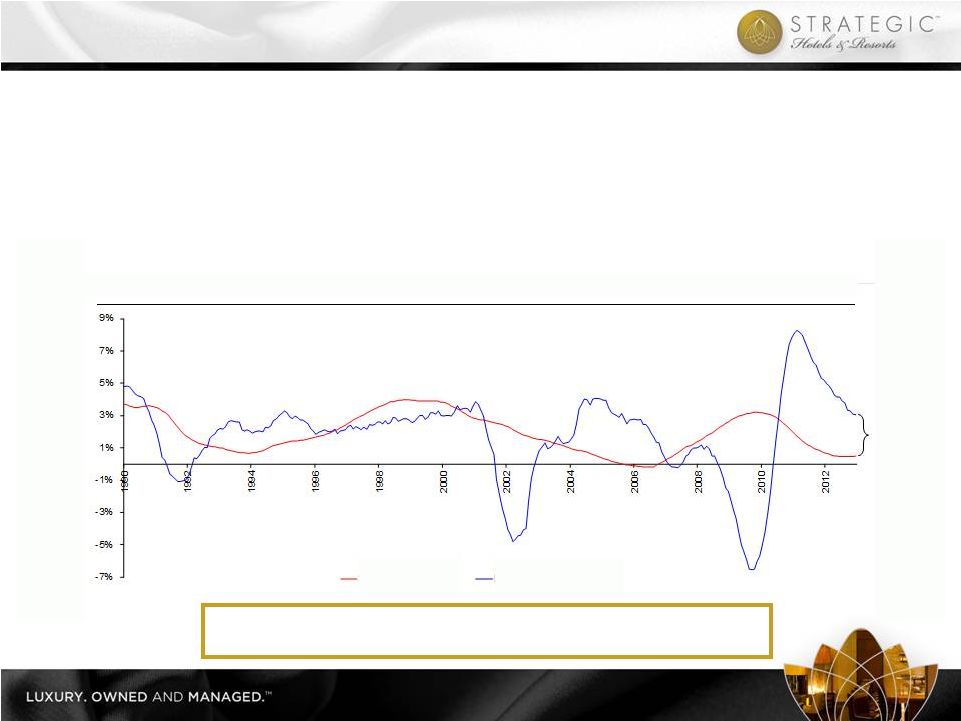

Total U.S. Supply & Demand Change (TTM)

Source: Smith Travel Research

Demand growth exceeds supply growth by 260 bps which should

result in significant ADR growth as recovery continues

Lodging Outlook

+ 2.6%

12

Supply % Change

Demand % Change |

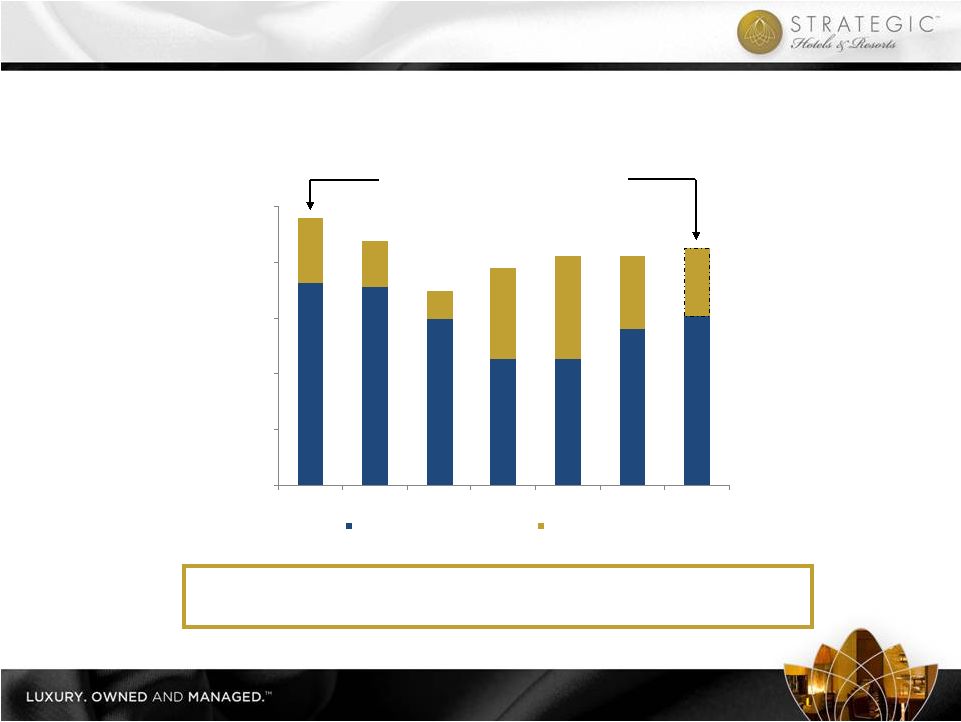

Source: Smith Travel Research

Note: Data represents trends within the United States

o

Luxury supply growth was historically lower leading into the recent recession

o

Projects in planning or under construction have decreased significantly

o

1-2 years estimated time to permit; 3 years estimated time to build a luxury hotel

o

Economic proposition of hotel construction challenging with replacement cost estimated

at over $700,000 per key

Favorable Supply Outlook

Year-Over-Year % Supply Growth

13

1989 –

Q4 2012

Average: 3.9% |

14

Source: Smith Travel Research and PWC

Source: Smith Travel Research

Luxury

Outperformance:

2.2% CAGR

Luxury

Outperformance:

4.1% CAGR

Annual % Change in RevPAR

Quarterly Luxury Room Night Demand (000s)

o

1992 –

2000:

9

consecutive

years

of

annual

luxury

RevPAR

growth

totaling

109%

or

8.5%

annually

o

2002 –

2007:

5

consecutive

years

of

annual

luxury

RevPAR

growth

totaling

48%

or

8.2%

annually

Luxury outperformed Total U.S. hotels

2.0% -

4.0% in previous two downturns

Luxury room night demand

currently above previous cycle peak

Luxury Hotels Outperform in a Recovery

21%

14

o

Luxury hotels have experienced prolonged RevPAR growth following past industry downturns

10,000

15,000

20,000

25,000

30,000

35,000

-20%

-15%

-10%

-5%

0%

5%

10%

15%

20%

Total U.S.

Luxury

o

Overall luxury room nights sold are 21% higher than 2007 |

ADR

RevPAR

EBITDA Per Available Room

Non –

Rooms Revenue Per Available Room

Note: All metrics represent full-year 2011 results

BEE

portfolio

reflects

Total

United

States

portfolio

as

of

12/31/2011

Source: Public filings

BEE delivers industry leading results

BEE Outperforms Competitors

15 |

o

Total RevPAR is key top-line performance metric

o

Focus on maximizing RevPAR, non-rooms revenue, and yield per square foot

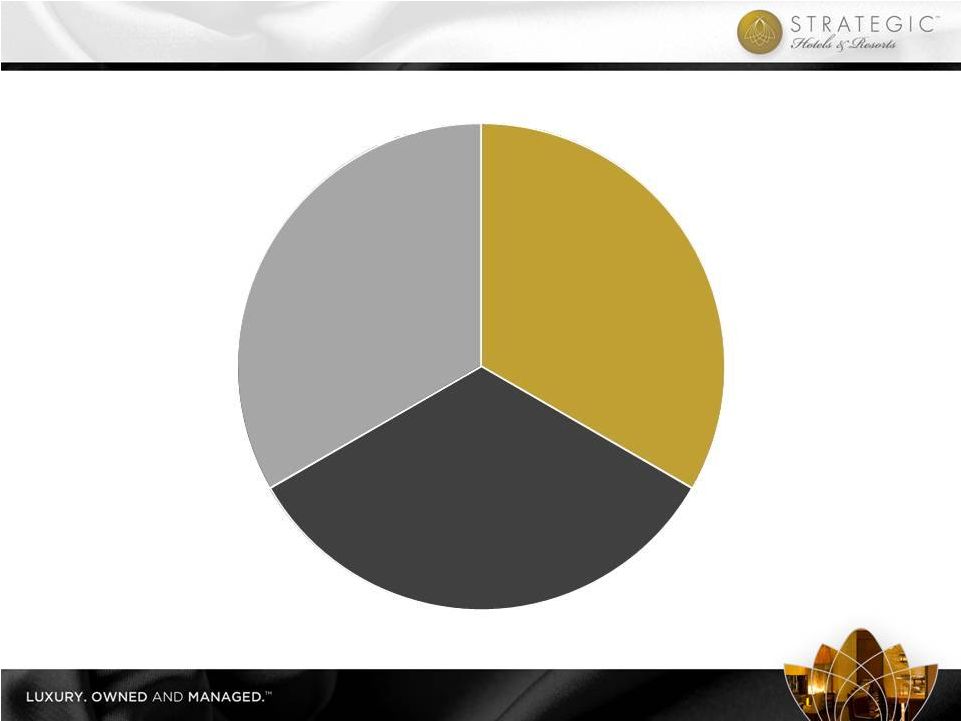

BEE Total Revenue Mix

Peers Total Revenue Mix

Note: All metrics represent the full-year 2011. BEE portfolio reflects the

North America Same Store portfolio Peers include: DRH, HST, LHO, PEB,

SHO Source: Public filings

BEE revenue driven more heavily by non-rooms revenue relative

to peers, maximizing yield per square foot from our hotels

BEE Revenue Mix Compared to Peers

Rooms

Other

Food &

Beverage

Rooms

Other

Food &

Beverage

16

54%

36%

10%

6%

29%

65% |

17

Note: Statistics represent the full year 2011. Portfolio reflects the North America

Same Store portfolio BEE Occupied Room Nights Mix

BEE Room Revenue Mix

o

Targeted mix of business ~50% / 50% group / transient

o

Group business typically yields higher non-rooms revenue than transient business

43% Group

40% Group

57% Transient

60% Transient

BEE total revenue driven heavily by group business and ancillary

group spend; still significant capacity to grow group business

BEE Revenue Mix

17

Transient -

Other

Transient -

Negotiated

Group -

Association

Group -

Corporate

Group -

Other |

3% better

than peers (1) Portfolio includes all North American hotels owned for the

full year 2011 Peers include: DRH, HST, LHO, PEB, & SHO

Source: Public filings

Industry Leading Operating Margins

18

BEE

(1)

Peers

Peer margins

@ BEE

Revenue Mix

Revenue

Rooms

54%

65%

54%

Food & Beverage

36%

29%

36%

Other

10%

6%

10%

Total

100%

100%

100%

Departmental Profit Margin

Rooms

71%

73%

73%

Food & Beverage

26%

27%

27%

EBITDA

21%

24%

18%

BEE’s margins significantly outperform when adjusted for same revenue mix |

I.

BEE’s Unique Value Proposition

II.

Company Overview

III.

Industry Update

IV.

Operating Trends

V.

Financial Overview

Operating Trends

19 |

o

Group pace remains the most reliable forward looking indicator

o

Booking window has shortened forcing more reliance on room nights booked ITYFTY

(“in-the-year-for-the-year”)

Year-Over-Year Group Pace

Group room nights 11% below peak

(1)

(1)

2013 production in the year assumes the historical average from 2007 to 2012

Group room nights on the books for 2013 are up 8% compared to

2012; ADR up 4% compared to 2012 rate

Group Booking Outlook

20

(1)

0

200,000

400,000

600,000

800,000

1,000,000

2007

2008

2009

2010

2011

2012

2013

Definite through December

Production in the year |

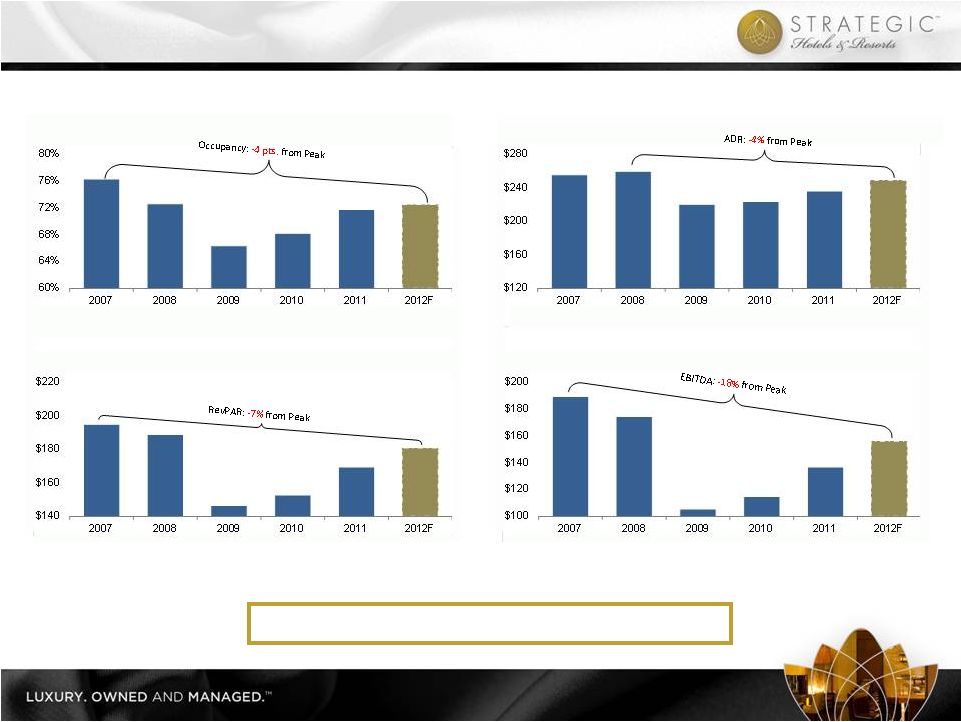

Occupancy

ADR

RevPAR

Property EBITDA (in millions)

Note: North America Same Store portfolio, excludes: Fairmont Scottsdale Princess, Four

Seasons Jackson Hole, Four Seasons Silicon Valley, Hotel del Coronado, and JW Marriott Essex House.

2012 forecast assumes midpoint of guidance range.

Operating performance improving; still below peak

Embedded Portfolio Growth

21 |

I.

BEE’s Unique Value Proposition

II.

Company Overview

III.

Industry Update

IV.

Operating Trends

V.

Financial Overview

Financial Overview

22 |

Raised over

$660 million in equity: o

$333 mm follow-on public offering (May 2010)

o

$145 mm Woodbridge transaction acquiring two Four

Seasons hotels plus PIPE (February 2011)

o

$70 mm equity placement to GIC for share in

InterContinental Chicago (June 2011)

o

$115

mm

overnight

equity

offering

(April

2012)

Asset sales:

o

Sold InterContinental Prague for €110.6mm (December 2010)

o

Sold leasehold position at Marriott Paris Champs-Elysees for

approximately $60 million (April 2011)

o

Sold stake in BuyEfficient for $9mm (January 2011)

Debt repayments:

o

Tendered and fully retired $180mm unsecured convertible

recourse notes (May 2010)

Hotel del Coronado complex restructuring (February 2011):

o

Negotiated new joint-venture with Blackstone and KSL

o

Closed new CMBS mortgage financing totaling $425mm

Accomplishments

Since

January

1 ,

2010

23

Fairmont Scottsdale Princess complex restructuring (June

2011):

o

Negotiated new joint venture structure with Walton Street Capital

o

Negotiated amendment and extension to CMBS debt for four

years at below market terms

New line of credit (June 2011):

o

Reduced lenders in bank syndicate from 21 banks to 10 banks

o

Achieved three year term with one year extension

Debt refinancings:

o

Seven property loans refinanced totaling nearly $900 million

Preferred equity tender (December 2011):

o

Successfully tendered for approximately 22% of outstanding

preferred equity at a 15% discount to par plus accrued preferred

dividends

Reinstatement of preferred equity dividends (June 2012):

o

Paid 14 quarters of preferred equity dividends

Acquired the Essex House in New York City (September

2012):

o

Acquired a 51% interest in the property

o

Closed new mortgage financing totaling $190.0 million

st |

Key Stats

(a)

Net Debt/EBITDA

7.5x

Net Debt+Pref /EBITDA

9.2x

Net Debt/TEV

45.8%

Avg. Maturity (yrs)

4.5

Unencumbered assets

2

Corporate liquidity (MM)

$200.0

Mix of Debt

Bank Debt

42.8%

Life Insurance Co.

28.7%

CMBS

28.5%

$114.9

$130.0

$96.9

$195.0

$359.7

$66.5

$145.8

$145.0

$0.0

$100.0

$200.0

$300.0

$400.0

$500.0

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

Bank

Life Co.

CMBS

Corporate

$300.0

Capacity

$275.8

$456.6

$148.9

$124.9

$220.0

$173.5

$614.5

$194.8

$358.0

$0.0

$200.0

$400.0

$600.0

$800.0

$1,000.0

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

Bank

Life Co.

CMBS

Corporate

$834.5

$875.2

January 1, 2010

September 30, 2012

BEE’s balance sheet is structured for growth

Strong Recapitalized Balance Sheet ($ in millions)

Note: Assumes full extension periods for all loans.

(a)

EBITDA reflects mid-point of 2012 guidance range.

Key Stats

Net Debt/EBITDA

14.3x

Net Debt+Pref /EBITDA

17.4x

Net Debt/TEV

76.9%

Avg. Maturity (yrs)

3.4

Unencumbered assets

0

Corporate liquidity (MM)

$105.0

Mix of Debt

Bank Debt

18.5%

Life Insurance Co.

26.6%

CMBS

54.8%

24 |

3

Quarter

2012

Results

(EBITDA

in

millions)

25

(a)

Portfolio excludes the JW Marriott Essex House hotel.

(b)

Margins exclude a $2.7 million real estate tax charge at the Hotel del

Coronado (a)

(b)

3rd Quarter 2011

3rd Quarter 2012

Operations

(Total United States Portfolio)

ADR

$258

5.2%

$272

RevPAR

$198

5.8%

$209

Total RevPAR

$352

5.7%

$372

EBITDA Margins

24.1%

110 bps

25.2%

Corporate Results

Comparable EBITDA

$43.6

6.7%

$46.6

Comparable FFO / share

$0.06

36.0%

$0.08

rd |

Year to Date

2012 Results (EBITDA in millions) 26

(a)

Portfolio excludes the JW Marriott Essex House hotel.

(a)

YTD 9/30/2011

YTD 9/30/2012

Operations

(Total United States Portfolio)

ADR

$247

5.5%

$260

RevPAR

$178

7.7%

$192

Total RevPAR

$337

6.7%

$360

EBITDA Margins

22.1%

130 bps

23.4%

Corporate Results

Comparable EBITDA

$114.8

13.8%

$130.7

Comparable FFO / share

$0.09

123.6%

$0.21 |

(a)

Portfolio excludes Fairmont Scottsdale Princess, Four Seasons Jackson Hole, Four

Seasons Silicon Valley, and Hotel del Coronado (b)

2011 Comparable FFO / share excludes one-time gain associated with preferred

equity tender 2012 Guidance (EBITDA in millions)

(b)

27

2011 Actual

2012 Guidance

Operations

(Same Store N.A. Portfolio)

(a)

RevPAR

$170

6%-8%

$180-$183

Total RevPAR

$314

5%-7%

$330-$336

EBITDA Margins

21.1%

100 - 175bps

22.1%-22.9%

Corporate Results

Comparable EBITDA

$155

7%-16%

$165-$180

Comparable FFO / share

$0.14

50%-107%

$0.21-$0.29 |

o

The only pure play high-end lodging REIT

o

High-end outperforms the industry in a recovery

o

Industry leading asset management expertise

o

Assets are in pristine condition

o

Embedded organic growth through revenue growth and ROI opportunities

o

Historically low supply growth environment, particularly in BEE markets

o

Replacement cost, excluding land, approximately $750,000 per key

o

Balance sheet positioned for growth

The best investment proposition in the lodging space

BEE’s Unique Value Proposition

28 |

Disclaimer

29

Except for historical information, the matters discussed in this presentation are

forward-looking statements subject to certain risks and uncertainties. Forward-looking statements

relate to expectations, beliefs, projections, future plans and strategies, anticipated

events or trends, and similar expressions concerning matters that are not historical facts. These

forward-looking statements are identified by their use of such terms and phrases such as

“anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,”

“project,” “should,” “will,” “continue” and other

similar terms and phrases, including references to assumptions and forecasts of future results. Forward-looking statements are not

guarantees of future performance. Actual results could differ materially from the

Company’s projections.

Factors that may contribute to these differences include, but are not limited to the

following: the effects of the recent global economic recession upon business and leisure travel

and the hotel markets in which the Company invests; the Company’s liquidity and

refinancing demands; the Company’s ability to obtain or refinance maturing debt; the Company’s

ability to maintain compliance with covenants contained in the Company’s debt

facilities; stagnation or further deterioration in economic and market conditions, particularly

impacting business and leisure travel spending in the markets where the Company’s

hotels operate and in which the Company invests, including luxury and upper upscale product;

general volatility of the capital markets and the market price of the Company’s shares

of common stock; availability of capital; the Company’s ability to dispose of properties in a

manner consistent with its investment strategy and liquidity needs; hostilities and security

concerns, including future terrorist attacks, or the apprehension of hostilities, in each case

that affect travel within or to the United States, Mexico, Germany, England or other

countries where the Company invests; difficulties in identifying properties to acquire and

completing acquisitions; the Company’s failure to maintain effective internal control

over financial reporting and disclosure controls and procedures; risks related to natural

disasters; increases in interest rates and operating costs, including insurance premiums and

real property taxes; contagious disease outbreaks, such as the H1N1 virus outbreak;

delays and cost-overruns in construction and development; marketing challenges

associated with entering new lines of business or pursuing new business strategies; the

Company’s failure to maintain the Company’s status as a REIT; changes in the

competitive environment in the Company’s industry and the markets where the Company invests;

changes in real estate and zoning laws or regulations; legislative or regulatory changes,

including changes to laws governing the taxation of REITS; changes in generally accepted

accounting principles, policies and guidelines; and litigation, judgments or settlements.

Additional risks are discussed in the Company’s filings with the Securities and

Exchange Commission, including those appearing under the heading “Item 1A. Risk Factors” in the

Company’s most recent Form 10-K and subsequent Form 10-Qs. Although the Company

believes the expectations reflected in such forward-looking statements are based on

reasonable assumptions, it can give no assurance that its expectations will be attained. The

forward-looking statements are made as of the date of this presentation, and the

Company undertakes no obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future events or otherwise, except as

required by law.

|

Non-GAAP

to GAAP Reconciliations 30

Reconciliation of Net Debt / TEV

($ in 000s)

YE 2009

(a)

3Q 2012

Consolidated Debt

$1,658,745

$1,309,347

Pro rata share of unconsolidated debt

282,825

212,275

Pro rata share of consolidated debt

(107,065)

(138,648)

Cash and cash equivalents

(116,310)

(82,048)

Net Debt

$1,718,195

$1,300,926

Market Capitalization

$144,966

$1,248,704

Total Debt

1,834,505

1,382,974

Preferred Equity

370,236

289,102

Cash and cash equivalents

(116,310)

(82,048)

Total Enterprise Value

$2,233,397

$2,838,732

Net Debt / Enterprise Value

76.9%

45.8%

(a) All figures taken from year-end 2009 financial statements.

Reconciliation of Net Debt / EBITDA

($ in 000s)

YE 2009

(a)

3Q 2012

(b)

Consolidated debt

$1,658,745

$1,309,347

Pro rata share of unconsolidated debt

282,825

212,275

Pro rata share of consolidated debt

(107,065)

(138,648)

Cash and cash equivalents

(116,310)

(82,048)

Net Debt

$1,718,195

$1,300,926

Comparable EBITDA

$119,953

$172,500

Net Debt / EBITDA

14.3x

7.5x

(a) All figures taken from year-end 2009 financial statements.

(b) Comparable EBITDA reflects mid-point of guidance range.

Reconciliation of Net Debt + Preferred Equity / EBITDA

($ in 000s)

YE 2009

(a)

3Q 2012

(b)

Preferred equity capitalization

$370,236

$289,102

Consolidated debt

1,658,745

1,309,347

Pro rata share of unconsolidated debt

282,825

212,275

Pro rata share of consolidated debt

(107,065)

(138,648)

Cash and cash equivalents

(116,310)

(82,048)

Net Debt + Preferreds

$2,088,431

$1,590,028

Comparable EBITDA

$119,953

$172,500

Net Debt + Preferreds / EBITDA

17.4x

9.2x

(a) All figures taken from year-end 2009 financial statements.

(b) Comparable EBITDA reflects mid-point of guidance range. |

Non-GAAP

to GAAP Reconciliations 31

2012

2011

2012

2011

Net loss attributable to SHR common shareholders

(8,557)

$

(11,902)

$

(43,071)

$

(7,771)

$

Depreciation and amortization

25,649

25,526

76,416

86,222

Interest expense

19,942

21,838

58,627

67,148

Income taxes -

continuing operations

(600)

867

215

279

Income taxes -

discontinued operations

-

-

-

379

Noncontrolling interests

(17)

(16)

(126)

70

Adjustments from consolidated affiliates

(1,879)

(1,248)

(4,382)

(5,431)

Adjustments from unconsolidated affiliates

7,036

7,162

20,606

16,293

Preferred shareholder dividends

6,042

7,721

18,125

23,164

EBITDA

47,616

49,948

126,410

180,353

Realized

portion

of

deferred

gain

on

sale-leaseback

-

continuing

operations

(49)

(42)

(150)

(151)

Realized

portion

of

deferred

gain

on

sale-leaseback

-

discontinued

operations

-

-

-

(1,214)

Gain on sale of assets -

continuing operations

-

-

-

(2,640)

Loss

(gain)

on

sale

of

assets

-

discontinued

operations

-

35

-

(100,930)

Loss on early extinguishment of debt

-

399

-

1,237

Loss on early termination of derivative financial instruments

-

-

-

29,242

Foreign

currency

exchange

loss

(gain)

-

continuing

operations

(a)

996

209

1,169

(77)

Foreign

currency

exchange

loss

(gain)

-

discontinued

operations

(a)

-

-

535

(51)

Adjustment for Value Creation Plan

(2,013)

(6,921)

2,759

9,078

Comparable EBITDA

46,550

$

43,628

$

130,723

$

114,847

$

(a)

Foreign currency exchange gains or losses applicable to

third-party and inter-company debt and certain balance sheet items held by

foreign subsidiaries.

September 30,

September 30,

Reconciliation of Net Loss Attributable to SHR Common Shareholders to

EBITDA and Comparable EBITDA (in thousands)

Three Months Ended

Nine Months Ended |

Non-GAAP

to GAAP Reconciliations 32

2012

2011

2012

2011

Net loss attributable to SHR common shareholders

(8,557)

$

(11,902)

$

(43,071)

$

(7,771)

$

Depreciation and amortization

25,649

25,526

76,416

86,222

Corporate depreciation

(260)

(279)

(789)

(868)

Gain

on

sale

of

assets

-

continuing

operations

-

-

-

(2,640)

Loss

(gain)

on

sale

of

assets

-

discontinued

operations

-

35

-

(100,930)

Realized

portion

of

deferred

gain

on

sale-leaseback -

continuing

operations

(49)

(42)

(150)

(151)

Realized

portion

of

deferred

gain

on

sale-leaseback

-

discontinued

operations

-

-

-

(1,214)

Deferred tax expense on realized portion of deferred gain on

sale-leasebacks -

-

-

379

Noncontrolling interests adjustments

(121)

(134)

(374)

(440)

Adjustments from consolidated affiliates

(859)

(663)

(2,185)

(3,822)

Adjustments from unconsolidated affiliates

3,792

3,770

11,335

8,023

FFO

19,595

16,311

41,182

(23,212)

Redeemable noncontrolling interests

104

118

248

510

FFO -

Fully Diluted

19,699

16,429

41,430

(22,702)

Non-cash mark to market of interest rate swaps

(1,688)

1,146

(4,405)

(487)

Loss on early extinguishment of debt

-

399

-

1,237

Loss on early termination of derivative financial instruments

-

-

-

29,242

Foreign

currency

exchange

loss

(gain)

-

continuing

operations

(a)

996

209

1,169

(77)

Foreign

currency

exchange

loss

(gain)

-

discontinued

operations

(a)

-

-

535

(51)

Adjustment for Value Creation Plan

(2,013)

(6,921)

2,759

9,078

Comparable FFO

16,994

$

11,262

$

41,488

$

16,240

$

Comparable FFO per diluted share

0.08

$

0.06

$

0.21

$

0.09

$

Weighted average diluted shares

(b) 208,696

188,097

201,050

175,974

(a)

Foreign currency exchange gains or losses applicable to

third-party and inter-company debt and certain balance sheet items held by foreign

subsidiaries.

(b)

Excludes

shares

related

to

the

JW

Marriott

Essex

House

Hotel

put

option.

Reconciliation of Loss Attributable to SHR Common Shareholders to

(in thousands, except per share data)

September 30,

September 30,

Three Months Ended

Nine Months Ended

Funds From Operations (FFO), FFO - Fully Diluted and Comparable

FFO |

Non-GAAP

to GAAP Reconciliations 33

Low Range

High Range

North American same store Total RevPAR growth (a)

5.0%

7.0%

North American same store RevPAR growth (a)

6.0%

8.0%

Comparable

EBITDA

Guidance

Low Range

High Range

Net loss attributable to common shareholders

(81.4)

$

(66.4)

$

Depreciation and amortization

112.0

112.0

Interest expense

82.6

82.6

Income taxes

0.9

0.9

Noncontrolling interests

(0.3)

(0.3)

Adjustments from consolidated affiliates

(5.8)

(5.8)

Adjustments from unconsolidated affiliates

28.0

28.0

Preferred shareholder dividends

24.2

24.2

Realized portion of deferred gain on sale-leasebacks

(0.2)

(0.2)

Adjustment for Value Creation Plan

4.8

4.8

Other adjustments

0.2

0.2

Comparable EBITDA

165.0

$

180.0

$

Low Range

High Range

Net loss attributable to common shareholders

(81.4)

$

(66.4)

$

Depreciation and amortization

110.8

110.8

Realized portion of deferred gain on sale-leasebacks

(0.2)

(0.2)

Noncontrolling interests

(0.3)

(0.2)

Adjustments from consolidated affiliates

(2.8)

(2.8)

Adjustments from unconsolidated affiliates

15.4

15.4

Adjustment for Value Creation Plan

4.8

4.8

Other adjustments

(2.5)

(2.5)

Comparable FFO

43.8

$

58.9

$

Comparable FFO per diluted share

0.21

$

0.29

$

December 31, 2012

Year Ended

December 31, 2012

Year Ended

2012 Guidance

(in millions, except per share data)

Year Ended

December 31, 2012

Operational

Guidance

Comparable

FFO

Guidance

(a) Includes North American hotels which are consolidated in our

financial results, but excludes the Four Seasons Jackson Hole

and Four Seasons Silicon Valley hotels, which were acquired in 2011. |

Thank

You |