Attached files

| file | filename |

|---|---|

| EX-10.3 - CONVERTIBLE DEBENTURE - Ocata Therapeutics, Inc. | advancedcell_8k-ex1003.htm |

| EX-10.2 - CONVERTIBLE DEBENTURE - Ocata Therapeutics, Inc. | advancedcell_8k-ex1002.htm |

| EX-10.4 - REGISTRATION RIGHTS AGREEMENT - Ocata Therapeutics, Inc. | advancedcell_8k-ex1004.htm |

| EX-10.1 - SETTLEMENT AGREEMENT AND MUTUAL RELEASE - Ocata Therapeutics, Inc. | advancedcell_8k-ex1001.htm |

| EX-99.1 - PRESS RELEASE - Ocata Therapeutics, Inc. | advancedcell_8k-ex9901.htm |

| 8-K - CURRENT REPORT ON FORM 8-K - Ocata Therapeutics, Inc. | advancedcell_8k.htm |

Exhibit 10.5

Office lease agreement

This Lease Agreement made on January 11, 2013 by and between, Wendy Jolles and Linda Olstein, Trustees of The Janelon Trust under Declaration of Trust dated January 28, 1975 and recorded with the Suffolk County Registry of Deeds in Book 8766, Page 558, as amended by instrument dated January 7, 1988 and recorded in Book 14432, Page 267, (hereinafter called “Landlord”), and Advanced Cell Technology, Inc., a Delaware corporation (hereinafter called “Tenant”).

WITNESSETH:

THAT in consideration of the rents and covenants herein set forth, Landlord hereby leases to Tenant, and Tenant hereby rents from Landlord premises containing approximately 17,696 +/- rentable square feet of office and laboratory space, including laboratory animal storage and use, on the First Floor (right hand side off main lobby) in the Office Building (hereinafter collectively called “Leased Premises”), as shown on Schedule “A”, a copy of which is attached hereto, located in the office building known as 33 Locke Drive, Marlborough, Massachusetts (hereinafter called “Office Building”), which is situated on that certain parcel of land (hereinafter called “Office Building Area”) more particularly described in Schedule “A-1” attached hereto. This lease shall be for the term, upon the rentals and subject to the terms and conditions set forth in this lease agreement and Schedules hereto.

Landlord represents that the Office Building, excluding the intended use of the Leased Premises by Tenant, complies in all respects with all applicable laws, regulations, ordinances, codes and bylaws, including without limitation, the American with Disabilities Act and all laws, rules or regulations regarding any hazardous waste, substance or materials or other environmental laws and life safety laws. Landlord further represents that it has good and legal title to the Office Building and has full authority to enter into this Lease and demise the Leased Premises to Tenant. Landlord represents that no party will be in tenancy, use or occupancy or the Leased Premises on the Commencement Date, and that the Leased Premises shall be delivered to the Tenant in good condition and repair, broom clean and free of all debris.

Landlord hereby warrants that Tenant shall have peaceful and quiet use and possession of the Leased Premises without hindrance on the part of Landlord, or anyone claiming by, through and under the Landlord. Subject to the non-disturbance provisions set forth in the immediately following paragraph, Tenant's rights under this lease agreement are and shall always be subordinate to the operation and effect of any mortgage, deed of trust or other security instrument now or hereafter placed upon the Office Building, or any part thereof, by Landlord, and Tenant will, upon Landlord's request, execute and deliver such instrument as may be appropriate to effect such subordination provided the same is in form and substance reasonably acceptable to Tenant.

| 1 |

Tenant will, upon the request of Landlord or of the mortgagee or trustees, under any such mortgage or deed of trust, execute an attornment instrument and attorn to such mortgagee or trustees and become its Tenant on the terms herein contained for the unexpired residue of the term of this lease agreement, provided such attornment instrument shall contain a provision that this lease shall not be terminated so long as Tenant continues to pay rent and otherwise complies with the terms and provision hereof and Tenant’s occupancy shall continue in full force and effect on the terms contained herein. Concurrent with the execution of this Lease, and as a pre-condition to the effectiveness of the Lease, Landlord shall obtain a Subordination, Non-disturbance and Attornment Agreement for the benefit of Tenant from the current mortgagee, in form and substance reasonably acceptable to Tenant.

Use

1. The Leased Premises shall be used by Tenant solely for general office and laboratory use, including laboratory animal storage and use, and for no other purpose.

Term

2. The term of this lease agreement shall commence on January 1, 2013, provided the Leased Premises are “ready for occupancy” (as that term is defined in Section 4), and shall expire on the later of (i) March 31, 2018 or (ii) 63 months from the date the Leased Premises are delivered to Tenant in ready for occupancy condition. Notwithstanding anything in this paragraph to the contrary, Tenant shall be allowed access to the Leased Premises from the date of execution of this Lease by all parties, for the purposes of installation of a modular clean room, furniture systems, telephone/data systems, and cubicles. Tenant shall not be required to pay any rent or other charges during said early access period, as long as Tenant is not conducting its business operations in the Leased Premises.

Rent

3. Tenant covenants and agrees to pay to Landlord, as rental for the Leased Premises, rent according to the attached Schedule “B” in advance on the first day of each full calendar month during the term. All rentals payable by Tenant to Landlord under this lease agreement shall be paid to Landlord at the office of Landlord herein designated by it for notices. Tenant will promptly pay all rentals herein prescribed when and as the same shall become due and payable. If Landlord shall pay any monies or incur any expenses in correction of violation of covenants herein set forth which has not been corrected by Tenant within thirty (30) days after written notice, the reasonable amounts so paid or incurred shall, at Landlord's option, and on notice to Tenant, be considered additional rentals, payable by Tenant with the first installment of rental thereafter becoming due and payable, and may be collected or enforced as by law provided in respect of rentals.

| 2 |

Tenant shall deposit with Landlord the sum of $21,382.67 as security for the faithful performance and observance by Tenant of the terms, provisions and conditions of this lease agreement upon Landlord’s notice to Tenant that the contingency identified in Section 41 has been satisfied. It is agreed that in the event Tenant defaults in respect of any of the terms, provisions and conditions of this lease agreement, including, but not limited to, the payment of rent and additional rent and fails to cure such default after the expiration of any applicable grace or cure period, Landlord may use, apply or retain the whole or any part of the security so deposited to the extent required for the payment of any rent and additional rent, or any other sum as to which Landlord may expend or may be required to expend by reason of Tenant's default in respect of any of the terms, covenants and conditions of this lease agreement, including but not limited to, any damages or deficiency in the reletting of the Leased Premises, whether such damages or deficiency accrued before or after summary proceedings or other reentry by Landlord. If Landlord applies any part of said deposit to cure any default of Tenant, Tenant shall within five (5) days of demand deposit with Landlord the amount so applied so that Landlord shall have the full deposit on hand at all times during the term of this Lease.

The security (or any remaining balance thereof after deduction as provided above) shall be returned to Tenant, without interest, within thirty (30) days after the date fixed as the end of the lease agreement and after delivery of the entire possession of the Leased Premises to Landlord. In the event of a sale or lease of the Office Building, of which the Leased Premises form a part, Landlord shall transfer the security to the vendee and Landlord shall thereupon be released by Tenant from all liability for the return of such security, and Tenant agrees to look to the new Landlord solely for the return of said security, and it is agreed that the provisions hereof shall apply to every transfer or assignment made of the security to a new Landlord. Tenant further covenants that it will not assign or encumber or attempt to assign or encumber the monies deposited herein as security and that neither Landlord nor its successors or assigns shall be bound by any such assignment, encumbrance, attempted assignment or attempted encumbrance.

| 3 |

Improvements

4. Landlord shall deliver the Leased Premises to the Tenant in “ready for occupancy” condition, which shall mean that landlord has performed, at its sole cost and expense, the “Initial Landlord Improvements” outlined on Exhibit C attached hereto. Tenant shall provide to Landlord, within six months from the date hereof a list of desired “Additional Landlord Improvements” relating to carpeting, painting, reconfiguration of walls, etc., which shall be designed, provided and installed by Landlord at Landlord’s expense and which Landlord will not unreasonably withhold, condition or delay, provided that all such Additional landlord Improvements shall be completed by Landlord within 90 days of Landlord’s acceptance of Tenant’s request. Tenant and Landlord agree that the total budget for all such improvements requested by Tenant shall be $250,000, which amount shall be reduced by up to a maximum amount of up to $100,000 for the cost of the acquisition and installation of the make-up air HVAC system as set forth in Section 41 hereof (with any costs incurred by Landlord in excess of $100,000 for the HVAC system being at Landlord’s sole expense and such expense shall not be reduced from the initial $250,000 budget). Landlord represents that all agreed upon work shall be completed in a good and workmanlike manner and in compliance with all laws and regulations.

All improvements to be provided by Tenant shall be provided at Tenant’s sole expense and shall be subject to Landlord's approval, not to be unreasonably withheld, delayed or conditioned.

Common Areas

5. Tenant shall have the right to nonexclusive use, in common with others, of, (a) automobile parking areas (on a first come first served basis based upon 3.0 parking spaces for each 1,000 square feet leased) and driveways and footways, and (b) such loading facilities, elevators, lobbies, common hallways and restrooms, and other facilities as may exist or be constructed, from time to time, by Landlord in the Office Building Area for use by tenants of the Office Building, all to be subject to the terms and conditions of this lease agreement and to reasonable rules and regulations for the use thereof as prescribed from time to time by Landlord. Landlord agrees that the rules and regulations will be applied to all tenants in the Office Building in a non-discriminatory manner.

Landlord shall have the right to make changes or revisions in the common areas of the Office Building and the Office Building Area, and Landlord shall have the right to construct additional buildings in the Office Building Area for such purposes as Landlord may deem appropriate; provided that Tenant is not deprived of access to or use of the Leased Premises.

| 4 |

Tenant shall have the right to maintain a generator outside the Office Building in a mutually acceptable location for Tenant’s exclusive use, at no additional cost to Tenant, except Tenant shall be responsible for the cost of purchasing and installing such generator. Subject to Tenant and Landlord agreeing upon the cost to install the same, Landlord agrees to perform such installation if requested by Tenant. Tenant shall have the right to remove the generator at the end of the Term and the generator shall remain Tenant’s property at all times.

6. Landlord shall furnish during “normal operating hours” (which shall include the hours from 8:00 A.M. to 9:00 P.M. on weekdays and 8:00 A.M. to 1:00 P.M. on Saturdays) heat and air conditioning for the common areas (consistent with other office buildings in the same geographic as the Office Building), hot and cold water, toilet facilities for the use of the employees, customers and other invitees of tenants; janitor service for the common areas; and electricity for lighting purposes to the common areas. In the event Tenant makes use of these services at hours other than normal operating hours, Landlord may make additional charges for such services (the current rate for these services is $40.00/hour). Landlord shall not be required to furnish services on Sundays or on the following holidays: New Year's Day, Memorial Day, Independence Day, Labor Day, Thanksgiving Day, Christmas and other days designated as holidays in labor contracts with trades furnishing such services. Landlord shall not be liable for full or partial stoppage or interruption of the above services or utilities unless negligence on the part of Landlord shall be shown and Landlord shall not be liable for consequential damages in any event.

Tenant shall have access to the Leased Premises twenty-four (24) hours a day, seven (7) days a week, fifty-two (52) weeks per year. Landlord, at the sole expense of the Tenant, shall provide heat, air conditioning, hot and cold water, electricity and all other necessary utilities to the Leased Premises on a twenty-four (24) hours a day, seven (7) days a week, fifty-two (52) weeks per year basis. The Leased Premises shall be separately metered for electricity use, which Tenant shall pay for directly to the utility provider, except with regard to the make-up air HVAC system as set forth in Section 42. It is expressly agreed that Tenant shall pay for all utilities provided to the Leased Premises.

Notwithstanding the above, Tenant shall be entitled to an abatement of all rent in the event such interruption of services for more than five (5) consecutive days.

7. Commencing January 1, 2014, Tenant shall pay, as additional rent hereunder, its proportionate share, as hereinafter determined, of any increase in “operating costs” as of the Office Building and the Office Building Area over and above operating costs for calendar year 2013 (the “Base Year”). As of the date of this Lease’s execution Tenant’s proportionate share is twenty-nine and 26/1000 percent (29.26%).

| 5 |

Landlord's “operating costs” shall refer to expenses incurred in operating and maintaining the Office Building and Office Building Area in a manner deemed by Landlord reasonable and appropriate and for the best interests of the tenants in the Office Building, including, without limitation, the following:

A. All costs and expense directly related to the Office Building and Office Building Area of operating, repairing, lighting, cleaning, insuring, removing snow, ice and debris, policing and regulating traffic in the area immediately adjacent to the Office Building.

B. All costs and expense, other than those of a capital nature, of replacing paving, curbs, walkways, landscaping (including replanting and replacing flowers and other planting), drainage and lighting facilities in the Office Building and Office Building Area.

C. Electricity and fuel used in lighting, heating, ventilating and air conditioning the Office Building.

D. Maintenance of mechanical and electrical equipment including heating, ventilating and air conditioning equipment in the Office Building.

E. Window cleaning and janitor service, including janitor equipment and supplies.

F. Maintenance of elevators, rest rooms, lobbies, hallways and other common areas of the Office Building.

G. Painting and decoration of all common areas in the Office Building and the Office Building Area.

H. All other reasonable expenses which would be considered as an expense of maintaining, operating or repairing the Office Building and the Office Building Area under sound accounting principles.

I. Management fees (provided that such fees do not exceed the Tenant’s Proportionate Share of the same as included in the Base Year), commercially reasonable commissions, wages and salaries of all persons engaged in the maintenance, leasing and operation of the Office Building and Office Building Area.

| 6 |

The following items shall not be included in Landlord's “operating costs”: (i) Depreciation; (ii) Judgments paid by Landlord as a result of personal injury liability; (iii) Costs which are reimbursable to Landlord; (iv) costs of capital expenditures; (v) costs of correcting defects in design and/or construction of the Office Building, or costs in constructing any additional buildings or improvements on the Office Area; (vi) interest and principal payments on mortgages and other debt costs and ground lease payments, if any, and any penalties assessed as a result of Landlord's late payments of such amounts; (vii) Any cost relating to the marketing, solicitation, negotiation and execution of leases of space in the Office Building or Office Building Area including without limitation, promotional and advertising expenses, commissions, finders fees, and referral fees, accounting, legal and other professional fees and expenses relating to the negotiation and preparation of any lease, license, sublease or other such document; (viii) costs of design, plans, permits, licenses, inspection, utilities, construction and clean up of tenant improvements to the Leased Premises or the premises of other tenants or other occupants, the amount of any allowances or credits paid to or granted to tenants or other occupants of any such design or construction; (ix) attorneys' fees, costs, disbursements, and other expenses incurred in connection with the disputes with existing tenants; (x) all costs or expenses (including fines, penalties and legal fees) incurred due to the violation by Landlord, its employees, agents, contractors or assigns of the terms and conditions of the Lease, or costs of complying with any valid, applicable building code, governmental rule, regulation or law; (xi) costs incurred in detoxification or other cleanup of the Office Building or Office Building Area required as the result of hazardous substances on or about the Office Building or Office Building Area, unless due to any acts or omissions of the Tenant; (xii) contingency or replacement reserves; and (xiii) costs, other than those incurred in ordinary maintenance and repair, for sculptures, paintings, fountains or other objects of art or the display of such item.

Tenant's proportionate share of said increase in operating costs for any calendar year of Landlord shall be determined as follows: (a) the difference between the amount of said operating costs for the calendar year in question and the amount of operating costs for calendar year 2013 and (b) the amount of the difference shall then be multiplied by a fraction, the numerator of which is the total number of square feet of the Leased Premises and the denominator of which is the total number of square feet of leasable area in the Office Building, and (c) the result shall be the increase, if any, in operating costs payable by Tenant. Landlord shall provide a good faith estimate of the amounts due from Tenant on account of increases in operating costs and taxes at the beginning of each calendar year, and Tenant shall pay 1/12th of such estimate at the time that Base Rent is paid. In no event shall Tenant be required to pay more than a 3% increase in operating expenses per year over the prior calendar year. At the end of each calendar year, Landlord shall provide the actual charges for which Tenant is responsible on account of such operating costs and taxes, and an adjustment shall be made for overpayment or underpayment. Operating expenses are currently estimated at approximately $3.50 per square foot

| 7 |

Not later than one hundred and twenty (120) days after the end of the first calendar year or fraction thereof ending December 31 and of each succeeding calendar year during the Term or fraction thereof at the end of the Term, Landlord shall render Tenant a statement in reasonable detail and according to usual accounting practices certified by a representative of Landlord, showing for the preceding calendar year or fraction thereof, as the case may be, the Operating Costs. Tenant shall have one hundred twenty (120) days in which to dispute the statement of Operating Costs, in which case Tenant shall give Landlord written notice (“Review Notice”) that Tenant intends to review Landlord’s records of the Operating Costs for that calendar year. Within a reasonable time after receipt of the Review Notice, Landlord shall make all pertinent records available for inspection that are reasonably necessary for Tenant to conduct its review. Within sixty (60) days after the records are made available to Tenant, Tenant shall have the right to give Landlord written notice (an “Objection Notice”) stating in reasonable detail any objection to Landlord’s statement of the Operating Costs for that year. If Tenant provides Landlord with a timely Objection Notice, Landlord and Tenant shall work together in good faith to resolve any issues raised in Tenant’s Objection Notice. If Landlord and Tenant determine that the Operating Expenses for the calendar year are more than reported, Tenant shall pay its share of the additional amount to Landlord and if less than reported, Landlord shall provide Tenant with a credit against the next installment of rent in the amount of the overpayment by Tenant (or refund the same if at the end of the Term). The records obtained by Tenant shall be treated as confidential. If there is an overcharge of Landlord’s Operating Costs by Landlord of more than seven percent (7%), Landlord shall pay the reasonable costs incurred by Tenant in reviewing Landlord’s records.

Real Estate Taxes

8. Tenant shall pay, as additional rent, its proportionate share, as hereinafter determined, of any increase in real estate taxes due and payable with respect to the Office Building and Office Building Area for each calendar year which commences during the term of this lease agreement over and above the amount of real estate taxes due and payable against the Office Building and the Office Building Area for the fiscal year 2013. The increase in real estate taxes for any fiscal year payable by Tenant shall be determined as follows: (a) the difference between the amount of real estate taxes due and payable with respect to the Office Building and the Office Building Area for the fiscal year in question and the amount of real estate taxes assessed against the Office Building and the Office Building Area for the fiscal year 2013 shall be ascertained, and (b) the amount of such difference shall then be multiplied by a fraction, the numerator of which is the total number of square feet of the Leased Premises and the denominator of which is the total number of square feet of leasable area in the Office Building, and (c) the result shall be the proportionate share of the increase in real estate taxes payable by the Tenant (such amount to be prorated with respect to any partial fiscal year falling within the term). Real Estate Taxes shall not include any income, estate, succession, inheritance and transfer taxes, or any interest or penalties for late payment of any real estate taxes (provided, as applicable to interest and/or penalties for late payment) the Tenant has timely paid its proportional share of said real estate taxes.

| 8 |

Termination

9. This lease agreement and the tenancy hereby created shall cease and determine at the end of the original term hereof, or any extension or renewal thereof, without the necessity of any notice from either Landlord or Tenant to terminate the same, and Tenant hereby waives notice to vacate the Leased Premises and agrees that Landlord shall be entitled to the benefit of all provisions of law respecting the summary recovery of possession of Leased Premises from a Tenant holding over to the same extent as if statutory notice had been given. For the period of four (4) months prior to the expiration of the original term of this Lease Agreement or any renewal or extension thereof, Landlord shall have the right to display on the exterior of the Leased Premises the customary sign “For Rent”, and during such period Landlord may show, provided that reasonable prior notice is given, the Leased Premises and all parts thereof to prospective tenants during normal business hours.

At the expiration or earlier termination of this lease agreement, Tenant shall, at Tenant's expense, remove all of Tenant's personal property, and repair all injury done by or in connection with the installation or removal of said property, and surrender the Leased Premises, broom clean and in as good condition as they were at the beginning of the term, reasonable wear and tear and damage by fire or other casualty excepted. All property of Tenant remaining on the Leased Premises after the expiration or earlier termination of this lease agreement shall be conclusively deemed abandoned and at Landlord's option, may be retained by Landlord, or may be removed by Landlord, and Tenant shall reimburse Landlord for the reasonable cost of such removal. Landlord may have any such property stored at Tenant's risk and expense.

Operation by Tenant

10. Tenant will replace promptly at its own expense with glass of like kind and quality any plate glass of the Leased Premises which may become broken or cracked due to any negligence or willful misconduct, of Tenant, its agents, employees, invitees and licensees, unless damaged by fire, or act of Landlord, its agents or employees. Tenant will maintain the Leased Premises at its own expense in a clean, orderly and sanitary condition. Tenant will not use or permit the use of any apparatus or musical instruments for sound reproduction or transmission in such manner that the sounds so reproduced, transmitted or produced shall be audible beyond the interior of the Leased Premises. Tenant will keep all of Tenant’s mechanical apparatus free of vibration and noise which may be transmitted beyond the confines of the Leased Premises. Tenant will comply with (i) all laws and ordinances, all rules and regulations of governmental authorities, and all regulations and recommendations of the Fire Underwriters Rating Bureau applicable to the Leased Premises provided the same are applicable to the Leased Premises due to the particular use made thereof by Tenant (as opposed to generally applicable to the Leased Premises regardless of the particular use made thereof) and (ii) such commercially reasonable rules and regulations as Landlord may prescribe on written notice to Tenant with respect to the use or occupancy of the Leased Premises, Office Building or Office Building Area by Tenant. Tenant will not receive or ship articles of any kind, other than letters and small packages typically delivered by the United States Postal Service carriers, except through facilities provided for that purpose by Landlord. Notwithstanding the foregoing, Tenant shall have the right to deliver and receive packages from other carriers in connection with its business operations through the loading dock serving the Leased Premises.

| 9 |

Repairs

11. Landlord will keep the exterior and common areas of the Office Building, including without limitation, the structure, roof, load bearing walls and foundation, and all heating, ventilating and air conditioning equipment, all plumbing, life/safety, electrical, wiring and other mechanical systems serving the Leased Premises in good order and repair and in compliance with all applicable laws, ordinances and regulations, provided that Tenant shall give Landlord written notice of the necessity for such repairs to the extent within the Leased Premises, provided that if the damage thereto shall have been caused by the negligence of Tenant, its agents, employees, or servants, Tenant shall be responsible for the cost thereof, subject to the waiver of claims and subrogation contained herein. In addition, Landlord shall maintain the Office Building Area, including parking areas and landscaping in good condition, and shall promptly perform snow and ice removal as necessary. Tenant will keep the interior of the Leased Premises in substantially the same repair as existed on the commencement date and will surrender the Leased Premises at the expiration of the term or at such other time as it may vacate the Leased Premises in as good condition as when received, excepting ordinary wear and tear and damage by fire, unavoidable accident or Act of God. Tenant will not overload the electrical wiring serving the Leased Premises or within the Leased Premises, and will install at its own expense, but only after obtaining Landlord's written approval, any additional electrical wiring which may be required in connection with Tenant's apparatus.

| 10 |

Landlord shall warrant the roof, windows and all structural elements of the Building shall be delivered in good working order and have a useful life of at least the term of the initial Lease Term. Should any of these capital items fail and need replacement during this time, the Landlord, at its sole cost and expense, shall be responsible for the cost of the replacement and shall not pass any of these costs on to the Tenant.

Existing HVAC equipment shall be in good working order, repair and condition with controls for the gas/electric rooftop units serving the ELased Premises under Tenant’s sole control. The HVCAC shall be separately metered. Should any of the HVAC units fail and need replacement during the Term, the Landlord, at its sole cost and expense, shall be responsible for the cost of the replacement and shall not pass any of these costs on to Tenant.

Alterations by Tenant

12. Tenant will not make any alteration to the Leased Premises or any part thereof without first obtaining Landlord's written approval of such alteration, which approval shall not be unreasonably withheld or delayed; and Tenant agrees that any improvements made by it shall immediately become the property of Landlord and shall remain upon the Leased Premises in the absence of agreement to the contrary (the parties agree that Tenant may remove the modular clean room installed by Tenant during or at the end of the Term). Tenant will not cut or drill into or secure any fixtures, apparatus or equipment of any kind to any part of the Leased Premises without first obtaining Landlord's written consent, which consent shall not be unreasonably withheld.

Tenant shall within ten (10) days after notice from Landlord discharge or bond over any mechanic's lien for materials or labor claimed to have been furnished to the Premises on Tenant's behalf (other than in connection with Landlord’s work under Schedule C).

Signs and Advertising

13. Tenant will not place or suffer to be placed or maintained on the exterior of the Leased Premises any sign, advertising matter or other thing of any kind, and will not place or maintain any decoration, lettering or advertising matter on the glass of any window or door of the Leased Premises without first obtaining Landlord's written approval thereof; and Tenant further agrees to maintain such sign, decoration, lettering, advertising matter or other thing as may be approved in good condition and repair at all times. Notwithstanding the foregoing, Tenant shall have the right to place identification signage at the entrance to the Leased Premises and in any interior or exterior directory or monuments, subject to Landlord’s reasonable approval of design.

| 11 |

Public Liability Insurance

14. Tenant will keep in force at its own expense so long as this Lease Agreement remains in effect, public liability insurance with respect to the Leased Premises with minimum limits of $1,000,000.00 per occurrence, and $2,000,000.00 annual aggregate; and property damage insurance with minimum limits of $1,000,000.00; and Tenant will further deposit certificates of insurance, with Landlord. Such policies shall name Landlord and, at the request of Landlord its mortgagee, as an additional insured.

Landlord covenants and agrees that, during the term of the Lease, it shall obtain all risk insurance against damage by fire or other casualty in an amount at least equal to the replacement cost of the Office Building.

No Liability

15. Tenant agrees to take such steps as it may deem necessary and adequate for the protection of itself, and its agents, employees, and invitees, and the property of the foregoing, against injury, damage or loss, by insurance, as a self-insurer, or otherwise. The Landlord, its agents and employees shall not be liable for any damage to property of the Tenant entrusted to employees of the Office Building or to any property, goods, or things contained in the Leased Premises or stored in the basement, or other part of the Office Building, unless due to negligence of the Landlord and its agents, contractors or employees.

Tenant shall not be entitled to claim a constructive eviction from the Leased Premises unless Tenant shall have first notified Landlord in writing of the condition or conditions giving rise thereto, and, if the complaints be justified, unless Landlord shall have failed within thirty (30) days after receipt of said notice to remedy such conditions.

Tenant and Landlord each waive all claims against the other to the extent covered by insurance (or would have been covered by insurance had all insurance required hereunder been maintained) and each shall obtain, for each policy of property insurance secured by it, a waiver of subrogation with respect to any claim against the other or loss or damage within the scope of the insurance. Nothing herein shall be construed to vary the force and effect of the first paragraph of this Section 15.

Indemnity by Tenant

16. Tenant will indemnify Landlord and save it harmless from and against any and all claims, actions, damages, liability and expense in connection with loss of life, personal injury and/or damage to property arising (i) within the Leased Premises (except to the extent arising out of the negligence or willful misconduct of Landlord) or (ii) outside the Leased Premises on any other part of Landlord's property, to the extent occasioned by any negligence or willful misconduct of Tenant, its agents, contractors or employees.

| 12 |

Fire or Other Casualty

17. In the event the Leased Premises shall be damaged by fire, or other casualty, the Tenant shall give prompt notice thereof to the Landlord, and after such notice, an equitable reduction of rent shall be allowed by Tenant for the time such part or parts of the Leased Premises shall remain untenantable or incapable of use and occupancy, and this lease agreement shall, unless notice is given as set forth below, continue in full force and effect, and the Landlord shall, at its own expense, with reasonable promptness, subject to force majeure as defined in Section 25, and delays in making of insurance adjustments by Landlord, repair the Premises. Landlord need not restore fixtures and improvements owned by Tenant or floor coverings, furnishings and other decorative features furnished by Tenant. In the event the Leased Premises or the Office Building shall before or after the commencement of the term, be so damaged that it shall be reasonably estimated to take more than 180 days to repair from the date of the casualty, either party may, upon notice to the other, terminate this lease, and upon exercise of such right, the term of this lease shall cease and terminate, effective as of the time of the damage, and the accrued rent, if any, shall be paid up to the time of the damage. All proceeds of insurance payable as a result of fire or other casualty shall be the sole property of the Landlord. Landlord agrees that if the repairs provided for herein cannot be made within four (4) months from the date of the casualty, subject to force majeure as defined in Section 25 (but in no event more than 180 days from the date of the casualty), then in such event Tenant shall have the right, after said four (4) months period but prior to substantial completion, to terminate this lease on thirty (30) days written notice to Landlord.

Condemnation

18. If the Leased Premises or any part thereof shall be taken by eminent domain, this Lease Agreement shall terminate on the date when title vests pursuant to such taking, and the rent and additional rent shall be apportioned as of said date. Tenant shall not be entitled to any part of the award or any payment in lieu thereof; excepting that Tenant shall be entitled to any separate award rendered for trade fixtures installed by Tenant at its own cost and expense and which are not part of the realty.

| 13 |

Inspection by Landlord

19. Tenant will permit Landlord, its agents, employees and contractors, upon reasonable prior notice and permitting the presence of Tenant (except in the case of emergency) to enter the Leased Premises and all parts thereof during business hours to inspect the same and to enforce or carry out any provision of this lease agreement.

No Assignments or Subletting

20. Tenant will not assign this lease agreement in whole or in part, nor sublet all or any part of the Leased Premises or permit the use of any part of the Leased Premises by any other person, firm or entity without the written consent of Landlord first obtained. Notwithstanding the foregoing, Landlord hereby consents to co-occupancy of the Leased Premises by Stem Cell & Regenerative Medicine International, Inc. Consent by Landlord to any assignment or subletting shall not constitute a waiver of the necessity for such consent to any subsequent assignment or subletting. This prohibition against assigning or subletting shall be construed to include a prohibition against any assignment or subletting by operation of law. The consent of Landlord referred to herein shall not be withheld, conditioned or delayed unreasonably. Any profit resulting from any sublease shall be divided evenly between the Landlord and Tenant, but only after deducting any costs incurred by Tenant in connection with the assignment or sublet, including brokerage commissions, legal fees and any tenant improvement cost.

Notwithstanding anything to the contrary contained herein, Tenant shall have the right to assign this Lease or sublet the Leased Premises or any part thereof without the prior consent of Landlord to either (x) an entity into or with which Tenant is merged or consolidated, or to which all or substantially all of Tenant’s assets are transferred, or (y) any entity which controls or is controlled by Tenant or is under common control with Tenant (“Affiliate”)(an Affiliate or any successor entity pursuant to subsection (x) of this Section 20 shall be referred to as a “Permitted Assignee”), provided that in any such event (i) the successor to Tenant in the case of a transaction described in subsection (x) has a net worth, computed in accordance with generally accepted accounting principles consistently applied, at least equal to the net worth of Tenant immediately prior to such merger, consolidation or transfer; (ii) proof satisfactory to Landlord of such net worth shall have been delivered to Landlord at least ten (10) days prior to the effective date of any such transaction, and (iii) the assignee agrees directly with Landlord, by written instrument in form reasonably satisfactory to Landlord in its reasonable discretion, to be bound by all the obligations of Tenant hereunder, including, without limitation, the covenant against further assignment and subletting.

| 14 |

Performance by Tenant

21. Tenant covenants and agrees that it will perform all agreements herein expressed on its part to be performed.

Distraint; Other Remedies of Landlord

22A. If Tenant defaults in the payment of rent or additional rent or defaults in the performance of any of the covenants or conditions hereof, Landlord may give to Tenant notice of such default and if Tenant does not cure any rent or additional rent default within seven (7) days, or other default, within thirty (30) days, after the giving of such notice (or, if such other default is of such nature that it cannot be completely cured within such thirty (30) days, if Tenant does not commence such curing within such thirty (30) days and thereafter proceed with reasonable diligence and in good faith to cure such default), or if the Tenant shall make an assignment for the benefit of creditors, or if a receiver or trustee is applied for or appointed for the Tenant, or if there be filed a petition in bankruptcy or insolvency, or for an arrangement for reorganization by or against the Tenant, or if the Tenant is adjudicated a bankrupt or is adjudged to be insolvent, or if there is advertised any sale of Tenant's property under process of law, or if the assets or property of the Tenant in the Premises shall be attached or levied upon, then Landlord may terminate this lease agreement on not less than three (3) days' notice to Tenant, and on the date specified in said notice the term of this lease agreement shall terminate and Tenant shall then quit and surrender the Leased Premises to Landlord, but Tenant shall remain liable as hereinafter provided. If this lease agreement shall have been so terminated by Landlord, Landlord may at any time thereafter resume possession of the Premises by any lawful means and remove Tenant or other occupants and their effects.

22B. In any case where Landlord has recovered possession of the Premises by reason of Tenant's default, Landlord may at Landlord's option occupy the Premises or cause the Leased Premises to be redecorated, altered, divided, consolidated with other adjoining premises, or otherwise changed or prepared for reletting, and may relet the Leased Premises or any part thereof as agent of Tenant or otherwise, for a term or terms to expire prior to, at the same time as or subsequent to, the original expiration date of this lease agreement, at Landlord's option, and receive the rent therefor, applying the same first to the payment of such expense as Landlord may have reasonably incurred in connection with the recovery of possession, redecorating, altering, dividing, consolidating with other adjoining premises, or otherwise changing or preparing for reletting and the reletting, including brokerage and reasonable attorney's fees, and then to the payment of damages in amounts equal to the rent hereunder and to the cost and expense of performance of the other covenants of Tenant as herein provided; and Tenant agrees, whether or not Landlord has relet, to pay to Landlord damages equal to the rent and other sums herein agreed to be paid by Tenant, less the net proceeds of the reletting, if any, as ascertained from time to time, and the same shall be payable by Tenant on the several rent days above specified. In reletting the Leased Premises as aforesaid, Landlord may grant rent concessions, and Tenant shall not be credited therewith. No such reletting shall constitute a surrender and acceptance or be deemed evidence thereof. The Tenant shall not be entitled to any surplus accruing as a result of any reletting. If Landlord elects pursuant hereto to occupy and use the Leased Premises or any part thereof during any part of the balance of the term as originally fixed or since extended, there shall be allowed against Tenant's obligation for rent or damages as herein defined, during the period of Landlord's occupancy, the reasonable value of such occupancy, not to exceed in any event the rent herein reserved and such occupancy shall not be construed as a release of Tenant's liability hereunder. Landlord agrees to use commercially reasonably efforts to mitigate its damages in the event of a default by Tenant under this Lease.

| 15 |

22.C. Anything in this lease agreement to the contrary notwithstanding, at Landlord's option, Tenant shall pay a “late charge” of five percent (5%) of any installment of rental (or any such other charge or payment as may be considered additional rental under this lease agreement) when paid more than seven (7) days after the due date thereof, to cover the extra expense involved in handling delinquent payments.

Remedies Cumulative

23. No mention in this lease agreement of any specific right or remedy shall preclude Landlord from exercising any other right or from having any other remedy, or from maintaining any action to which it may otherwise be entitled either at law or equity; and the failure of Landlord to insist in any one or more instance upon a strict performance of any covenant of this lease agreement or to exercise any option or right herein contained shall not be construed as a waiver or relinquishment for the future of such covenant, right or option, but the same shall remain in full force and effect unless the contrary is expressed in writing by Landlord.

Successors and Assigns

24. This lease agreement and the covenants and conditions herein contained shall inure to the benefit of and be binding upon Landlord, its successors and assigns and shall be binding upon Tenant, its successors and assigns, and shall inure to the benefit of Tenant and only such assigns of Tenant to whom the assignment by Tenant has been consented to in writing by Landlord, to the extent Landlord consent is required hereunder. It is agreed that if any rent received from an assignee or sublessee of Tenant that is higher than the base rent as set forth herein, the amount above the base rent shall be split evenly between Landlord and Tenant.

| 16 |

Force Majeure

25. Each party shall be excused for the period of any delay in the performance of any obligation hereunder when prevented from so doing by cause or causes beyond such party’s control which shall include, without limitation, all labor disputes not specifically related to Landlord, civil commotion, war, war-like operations, invasion, rebellion, hostilities, military or usurped power sabotage, governmental regulations or controls, fire or other casualty, inability to obtain any material, services or financing or through Acts of God.

Notices

26. All notices from Tenant to Landlord required or permitted by any provisions of this lease agreement, shall be directed to Landlord care of WRT Management Corp. 1 Main Street, Whitinsville, MA 01588 with a copy to Shocket Law Office LLC, 13 Tech Circle, Natick, MA 01776. All notices from Landlord to Tenant so required or permitted shall be directed to Tenant at the Premises, attention of William Caldwell. Either party may, at any time or from time to time, designate in writing a substitute address for that above set forth, and thereafter notices shall be directed to such substitute address.

Estoppel Certificates

27. Tenant shall, from time to time, upon not less than twenty (20) days' prior written request by Landlord execute, acknowledge and deliver to Landlord a written statement certifying that this lease agreement is unmodified and in full force and effect (or that same is in full force and effect as modified, listing the instruments of modification), the dates to which the rent and other charges have been paid, and whether or not to the best of Tenant's knowledge Landlord is in default hereunder (and if so, specifying the nature of the default), it being intended that any such statement delivered pursuant to this Paragraph may be relied upon by a prospective purchaser of Landlord's interest or mortgagee of Landlord's interest or assignee of any mortgage Landlord's interest in any underlying lease or in the Office Building or the Office Building Area.

Applicable Law

28. This lease agreement shall be construed under the laws of the Commonwealth of Massachusetts.

| 17 |

Captions and Headings

29. The captions and headings throughout this lease agreement are for convenience and reference only, and the words contained therein shall in no way be held or deemed to define, limit, describe, explain, modify, amplify or add to the interpretation, construction or meaning of any provision or the scope or intent of this lease agreement nor in any way affect this lease agreement.

Short Lease Recording

30. The parties hereto agree that they will execute, acknowledge and deliver a short form of lease to the end that the same may be recorded among the Land Records of the county wherein the Leased Premises are situated. Recording and like charges, shall be paid by Tenant.

Joint and Several Liability

31. In the event that two (2) or more individuals, corporations, partnerships or other business associations (or any combination of two (2) or more thereof) shall sign this lease agreement as Tenant, the liability of each such individual, corporation, partnership or other business association to pay rent and perform all other obligations hereunder shall be deemed to be joint and several.

Understanding of Parties

32. It is expressly understood and agreed that this lease agreement shall be binding upon both parties from the date hereof , provided, however, that if the Leased Premises shall not be “ready for occupancy” (as defined in Section 4), by the deadline set forth in Section 4, this lease agreement shall become void and of no further force and effect at the option of Tenant exercised by written notice as set forth in Section 2 above. If this lease agreement shall terminate as provided in this Section, both Landlord and Tenant shall be relieved of all obligations in connection herewith and all claims, rights or causes of action hereunder, except that Landlord shall return the deposits made by Tenant. If this lease agreement shall become void, as provided in this Section, Tenant will, upon demand, execute a written instrument in recordable form containing a release and surrender of all right, title and interest in, or to, the Leased Premises under the provisions of this lease agreement or otherwise.

No Option

33. The submission of this lease agreement for examination does not constitute a reservation of, or option for, the Premises, and this lease agreement becomes effective as a lease agreement only upon execution and delivery thereof by Landlord and Tenant.

| 18 |

Broker

34. Tenant represents and warrants to Landlord that R.W. Holmes Realty Co., Inc. is the sole broker with whom Tenant has negotiated in bringing about this lease agreement and Tenant agrees to indemnify and hold Landlord harmless from any and all claims of other brokers arising out of or in connection with the negotiation of or the entering into of this lease agreement between Landlord and Tenant, if such broker claims that he acted through or on behalf of the Tenant. R.W. Holmes Realty Co., Inc.shall be paid a standard brokerage fee by Landlord.

Rider

35. The attached Rider To Office Lease Agreement is attached hereto and incorporated herein by reference.

In Witness Whereof, the parties hereto have executed this lease agreement under their respective seals as of the day and year first above written.

| ATTEST: | |

| Tenant: | Landlord: |

| Advanced Cell Technology, Inc. | The Janelon Trust |

| By: /s/ Wendy Jolles | |

| Wendy Jolles, Trustee | |

| By: /s/ Gary Rabin | By: /s/ Linda Olstein |

| Chief Executive Officer | Linda Olstein, Trustee |

| 19 |

RIDER TO Office lease agreement

THIS RIDER is annexed to and forms a part of the lease agreement dated January 11, 2013, executed by and between Wendy Jolles and Linda Olstein, Trustees of The Janelon Trust (hereinafter called “Landlord”), and Advanced Cell Technology, Inc. (hereinafter called “Tenant”).

SECTION 36. Provided Tenant is not in default under any of the terms and conditions of the lease agreement (after the expiration of any applicable grace or cure period), Tenant is hereby given the option to extend this Lease, as same may be amended, from time to time, for one (1) additional five (5) year term commencing upon the expiration of the term thereof , upon the same terms, covenants and conditions as are set forth for the original term, except that the rental shall be at the then prevailing rate for the Office Building.

In order to exercise this extension option, Tenant shall notify Landlord by registered mail, return receipt requested, no later than two hundred and seventy (270) days prior to the expiration of the original term.

If Tenant exercises the option as provided for herein, the extension term shall commence immediately upon expiration of the original term, subject to the provisions hereof. In the event Tenant does not exercise the extension option, as provided herein, the term shall expire as provided in the said lease agreement.

For purposes of this paragraph the “then prevailing rate” shall be as agreed upon by the Landlord and Tenant provided however that in the event the parties can not so agree to the prevailing rate within thirty (30) days form the date Tenant exercises its option to extend the term (the “Negotiation Period”), then either (i) Tenant may rescind its exercise of the option to extend the term by written notice submitted within five (5) days after the expiration the Negotiation Period, whereby the term shall expire as provided in the said lease agreement, or (ii) if Tenant does not send a notice rescinding its exercise of the option to extend the term, the parties shall submit the matter to the American Arbitration Association for determination of the “then prevailing rate” and the costs of same shall be divided equally by the parties.

SECTION 37. Telephone Service. Intentionally deleted.

SECTION 38. Parking. Tenant shall have the right to use the parking lot serving the Office Building on a first come, first serve basis for its employees and visitors as hereinbefore set forth.

| 20 |

SECTION 39. Holdover Tenant. In the event that Tenant remains in possession of the Leased Premises after the expiration or termination of the Lease Term without any express written agreement as to such holding over, then such holding over shall be deemed to be a tenancy at sufferance at a rental equal to one hundred fifty percent (150%) of the base rent payable during the last month of the Lease Term together with any Additional Rent, plus all additional rent and upon all of the terms and conditions contained in this Lease. Nothing contained herein shall be construed as obligating Landlord to accept any rental tendered by Tenant after the expiration of the Lease term hereof or as relieving Tenant of its liability to surrender the Premises as provided in this Lease.

SECTION 40. Right of First Refusal. Provided that Tenant is not indefault under this Lease beyond applicable notice and cure periods,Landlord agrees that it will not lease the 1,410 square feet of second floor space previously leased to Sepracor (hereinafter the “Sepracor space”) unless (a) Landlord has received a bona fide offer or letter of intent to lease the Sepracor space; (b) Landlord has given Tenant written notice stating the terms and conditions of said bona fide offer or letter of intent and containing an offer by Landlord to lease the same to Tenant on the same terms and conditions as said bona fide offer or letter of intent; and (c) Tenant has not, within ten (10) days after the giving of such notice, mailed or otherwise given Landlord written notice that Tenant elects to lease the same in accordance with said offer or letter of intent. In the event that Tenant so elects to lease, the Sepracor space shall be leased to Tenant as stated in said bona fide offer or letter of intent on or before the thirtieth (30th) day or next business day after the date of the giving of such notice of election to lease. In the event that Tenant shall not give such notice of election to lease within the time above specified ten (10) day period, or in the event Tenant shall, after giving such notice, fail to complete the lease arrangement within said thirty (30) days after giving notice as hereinabove provided, then Landlord shall be free thereafter to lease the Sepracor space to the party named in offer or letter of intent at a rental not lower than that specified therein, but Landlord shall not lease the Sepracor space or any part thereof to any other person or at any lower price without again offering the same to Tenant. If Landlord shall make an affidavit stating (1) that a lease by it is made pursuant to a bona fide offer or letter of intent to lease (2) that it has given notice to said Tenant in connection with such lease as required by the provisions of this paragraph; (3) that it has not received written notice of election to lease given by Tenant in accordance with the provisions of this instrument, or that Tenant who has given notice of election to lease has failed to complete the same in accordance with said provisions; and (4) that the lease is made to the person named in such offer or notice of intent at a rental not lower than that therein stated, then such affidavit shall be conclusive evidence of compliance with the requirements of this instrument with respect to such lease in favor of the Landlord and all persons claiming through or under him. The provisions hereof shall not be construed to apply to bona fide mortgages to recognized lending institutions of the premises, or any part thereof, or sales or other proceedings for the foreclosure thereof.

| 21 |

41. HVAC System. Landlord shall replace the make-up air HVAC system with a new cost efficient model to be approved by Tenant, which approval will not be unreasonably withheld or delayed, which make-up air HVAC system will accommodate Tenant’s intended biological and GMP manufacturing use of the space. Tenant acknowledges that the total cost of this capital improvement, up to a maximum of $100,000 shall be deducted from the $250,000.00 renovation budget set forth in Section 4, with any additional cost in excess of $100,000 to be borne by Landlord at its sole expense.

42. Utilities. The make-up air unit shall be separately metered for tracking the cost of utility consumption. Landlord shall be responsible for the payment of the cost of such utility consumption to the utility provider, and Landlord shall bill Tenant and Glyco Solutions for their respective proportionate share of such cost. If Landlord decides to replace the make-up HVAC with two individual units serving Advanced Cell Technology, Inc. and Glyco Solutions then Tenant will be responsible for the payment of all costs directly to the utility provider.

43. Right of First Offer. Landlord shall keep Tenant aware of any available space that becomes available in the Building during the Term of the Lease.

| ATTEST: | |

| Tenant: | Landlord: |

| Advanced Cell Technology, Inc. | The Janelon Trust |

| By: /s/ Gary H. Rabin | By: Wendy Jolles |

| Name: Gary Rabin | Wendy Jolles, Trustee |

| Title: Chief Executive Officer | |

| By: Linda Olstein | |

| Linda Olstein, Trustee |

| 22 |

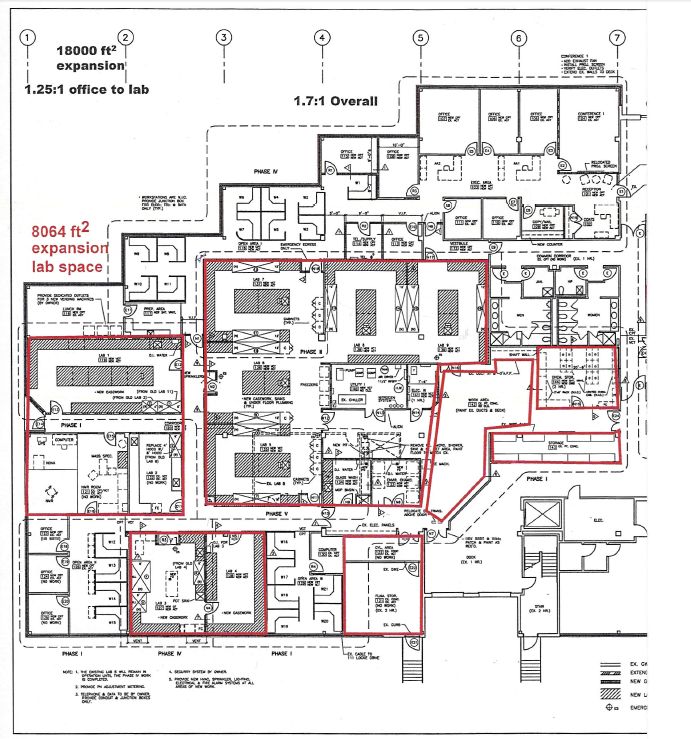

Schedule “A” – Leased Premises

| 23 |

Schedule “B” – Base Rent Schedule

Months 01-03: $0.0/sq.ft./yr. - $0 per month

Months 04-27: $14.50/sq.ft./yr. - $21,382.67 per month

Months 28-39: $15.00/sq.ft./yr. - $22,120.00 per month

Months 40-51: $15.25/sq.ft./yr. - $22,488.67 per month

Months 52-63: $15.50/sq.ft./yr. - $22,857.33 per month

Except as otherwise set forth in the Lease, Tenant shall also be responsible for paying all charges for utilities to the Leased Premises which are separately metered. Landlord shall pay for any reasonable costs necessary to separately meter or sub-meter the leased premises.

| 24 |

Exhibit C

Landlord shall deliver the Leased Premises to the Tenant in “ready for occupancy” condition, which shall mean that landlord has performed, at the Landlords sole expense, the “Initial Landlord Improvements”:

| 1. | Professional Cleaning |

| 2. | Missing ceiling tiles to be replaced |

| 3. | Electrical in working order in front office area |

| 4. | Paint in tenant’s choice of colors in front office area |

| 5. | Carpeting in front office area |

| 25 |