Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DUNKIN' BRANDS GROUP, INC. | d467735d8k.htm |

| EX-99.1 - PRESS RELEASE - DUNKIN' BRANDS GROUP, INC. | d467735dex991.htm |

Dunkin’

Brands Group, Inc.

Investor Presentation

January 2013

Exhibit 99.2 |

2

YEARS OF BRAND

HERITAGE

SIGNIFICANT U.S.

& GLOBAL GROWTH

OPPORTUNITY

ASSET-LIGHT, NEARLY

60

+

100

%

FRANCHISED BUSINESS |

1

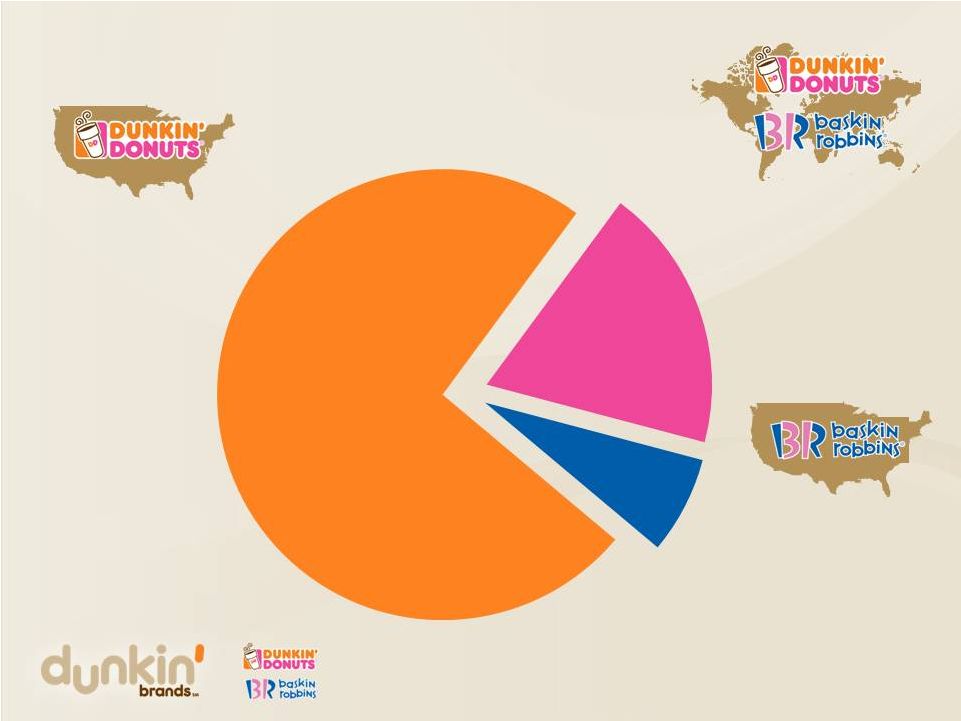

As of 9/29/2012

3

74

%

19

%

7

%

OF LTM

REVENUE

1

OF LTM

REVENUE

1

OF LTM

REVENUE

1 |

Focused growth strategies across each segment

4

INCREASE COMPARABLE

STORE SALES

AND PROFITABILITY

IN DD U.S.

INCREASE COMPARABLE

STORE SALES GROWTH

OF BR U.S.

CONTINUE DD U.S.

CONTIGUOUS STORE

EXPANSION

DRIVE ACCELERATED

INTERNATIONAL GROWTH

ACROSS BOTH BRANDS |

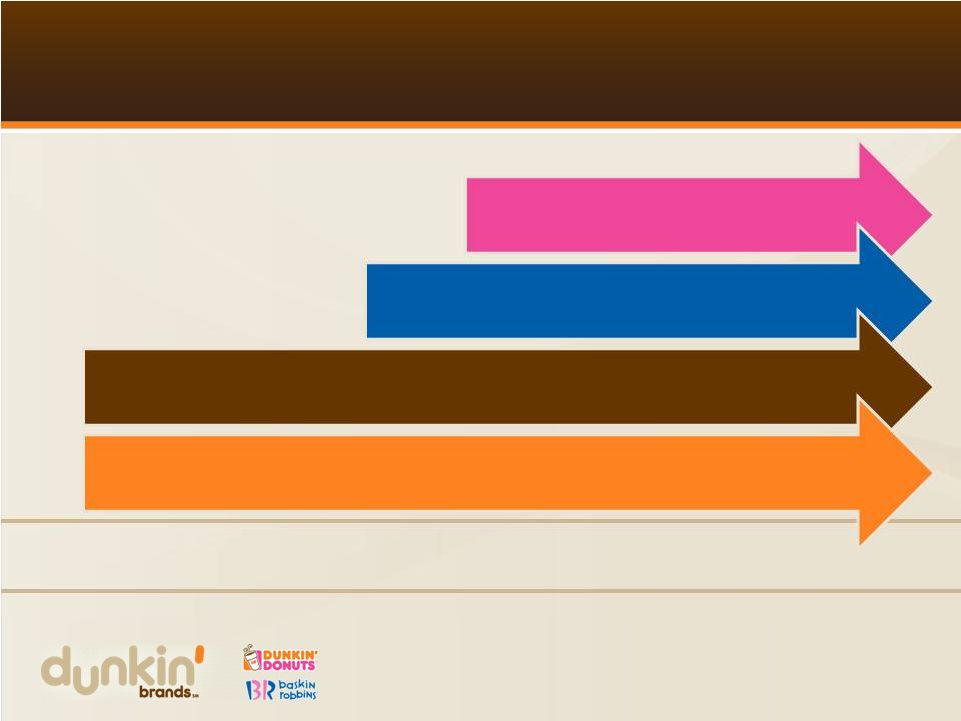

Capitalizing on near-term growth;

laying groundwork for future

5

GROW

comp

store

sales

growth

of

BR

U.S.

DRIVE

accelerated

international

growth

across

both

brands

ACCELERATE

DD

U.S.

contiguous

store

expansion

GROW

comp

store

sales

and

profitability

in

DD

U.S.

SHORT-TERM

GROWTH DRIVER

MEDIUM-TERM

GROWTH DRIVER

LONG-TERM

GROWTH DRIVER |

Strong

performance YTD through Q3 6

8

%

15

%

4.5

%

DUNKIN’

DONUTS U.S.

COMP STORE SALES GROWTH

7.3

%

GLOBAL SYSTEM-WIDE

SALES GROWTH

REVENUE GROWTH

ADJUSTED OPERATING

INCOME GROWTH |

Opportunity to double DD US footprint

7

1

As of end of fiscal year 2012

REGION

POPULATION

(MM)

STORES

(1)

PENETRATION

Core

36.0

3,845

1:9,400

Established

53.8

2,348

1:23,000

Emerging

88.7

959

1:92,000

West

130.0

154

1:840,000 |

Significant long-term expansion opportunity

for Dunkin’

Donuts U.S.

8

~15,000+

7,306

1:9,200

1:20,000

1:23,000

1:25,000

1:20,000

DD pro forma long-term penetration

154

~5,000

959

~3,900

2,349

~2,700

3,844

~3,900

~100

~350

~3,000

~ 5,000

2012

Core

Established

Emerging

West

Long-term

West

Emerging

Established

Core |

Portfolio of contemporary, convenient

Dunkin’

Donuts U.S. restaurants

9

OF RESTAURANTS INCLUDE DRIVE-THRU

OF TRADITIONAL NEW RESTAURANTS INCLUDE DRIVE THRU

REMODELS LAST THREE YEARS

OF RESTAURANTS IN NEWEST IMAGE

AVERAGE AGE OF RESTAURANT IMAGE IS LESS THAN

50%

70%

1,700+

70%

5

YEARS

24-HR RESTAURANTS

TRADITIONAL

STORES

~2,000

85%

ALTERNATIVE POINTS

OF DISTRIBUTION

15% |

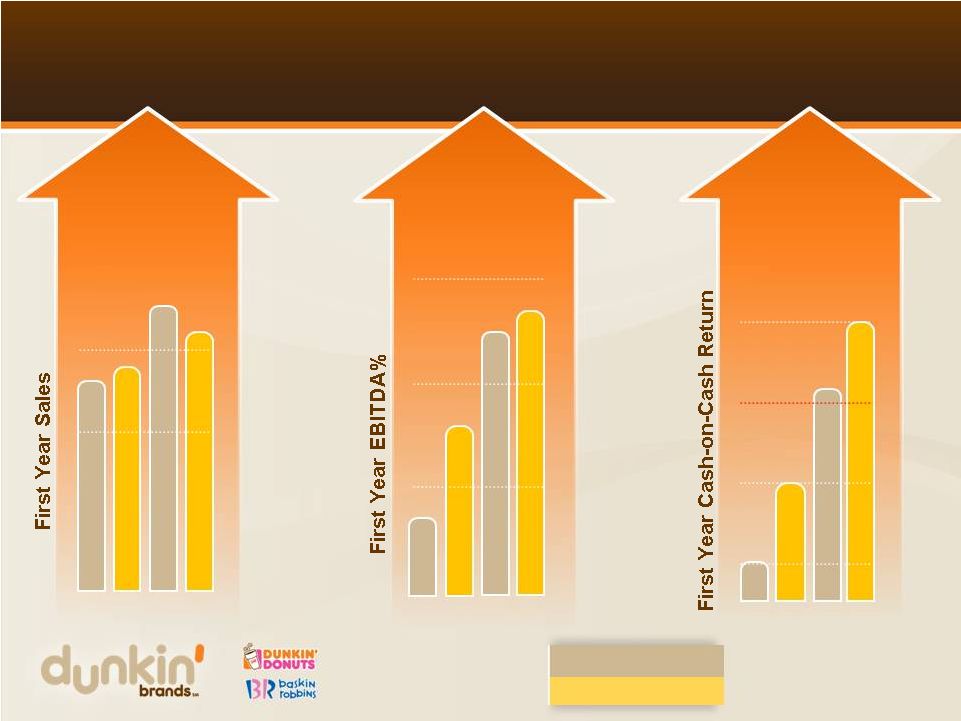

10

Compelling unit economics

driving accelerated growth

2011 COHORT STORE-LEVEL ECONOMICS –

TRADITIONAL STORES

1

AVERAGE UNIT VOLUMES

$858,000

CASH-ON-CASH RETURNS

25-30%

AVERAGE INITIAL CAPEX

$461,000

1

Data

for

Standalone

Traditional

Dunkin’

Donuts

restaurants

only |

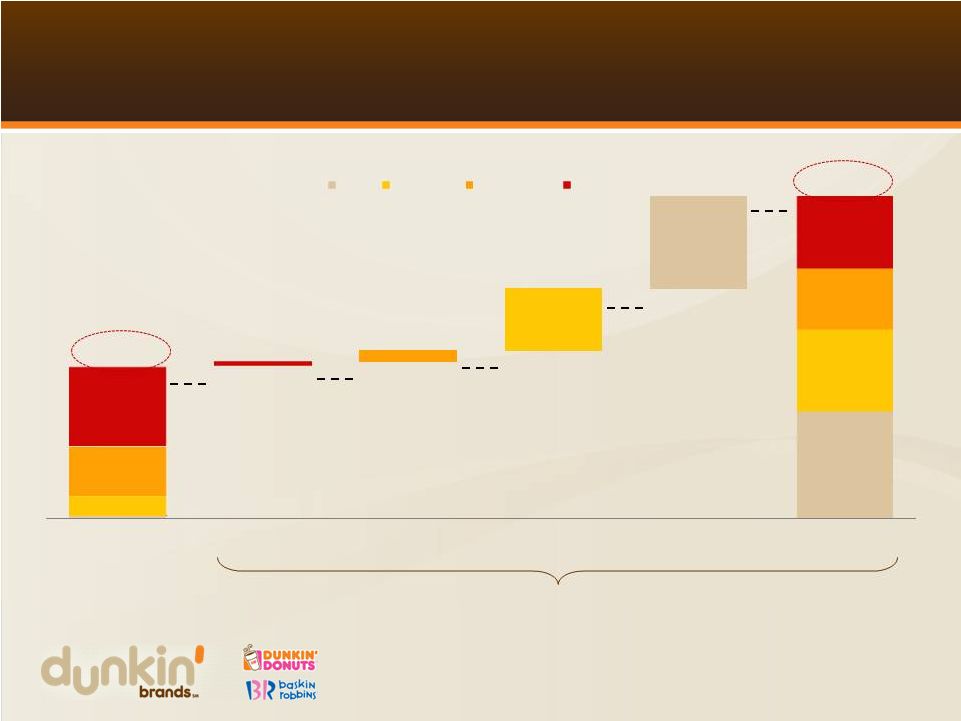

Strong growth in restaurant profitability since 2008

11

2011

$10K

$15K

2008

10%

15%

5%

2011

2008

5%

30%

Growth in W&E

15%

25%

35%

2011

2008

17%

Growth in C&E

9pt

increase in W&E

6pt

increase in C&E

22pt

increase in W&E

20pt

increase in C&E

West & Emerging

Core & Established |

Unlocking tremendous westward

expansion opportunity

RIGOROUS REAL-ESTATE & FRANCHISEE SELECTION

OPERATIONS-FOCUSED CULTURE

NATIONAL MEDIA FOCUSED ON BEVERAGES

1

2

3

4

5

PORTFOLIO OF HIGH-MARGIN PRODUCTS

FLAT NATIONAL COST OF GOODS BY 2015

12 |

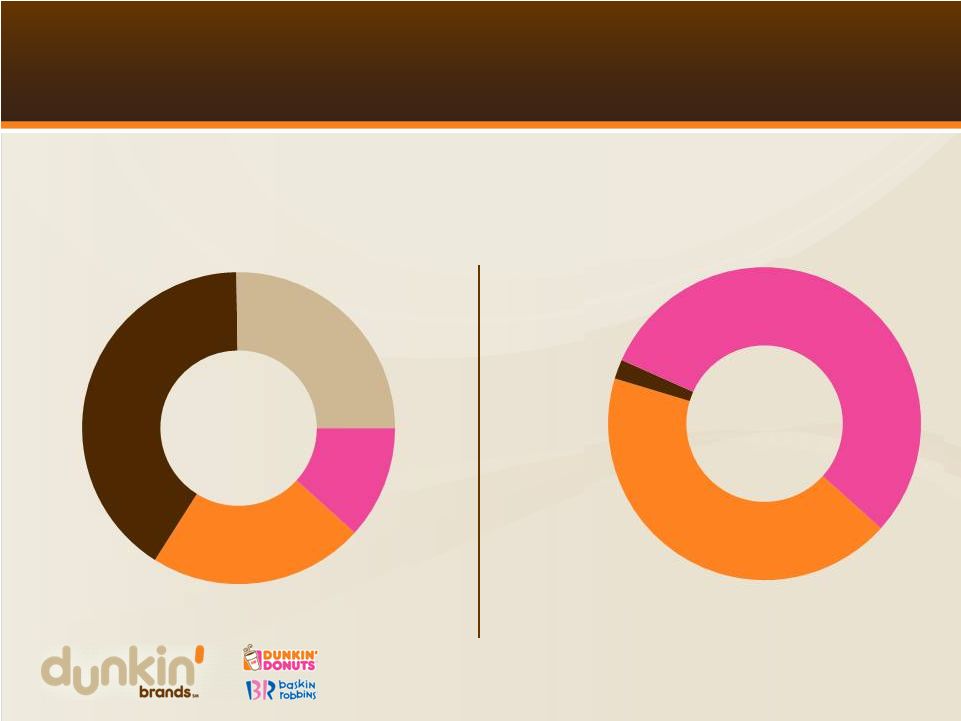

291

net new restaurants in 2012 for 4% net unit growth rate

2012 Net Openings

by Market Type

2012 SDA Sales

by Market Type

13

Emerging

23%

Established

42%

West

9%

Core

26%

Emerging

43%

Established

2%

West

55% |

Compelling unit economics driving

high-quality franchise demand

Background of

Dunkin’

Donuts U.S. 2012 SDA Purchasers

14

Existing

65%

New

35%

G&C/Retail

5%

Restaurant

-

80%

Other

15%

QSR |

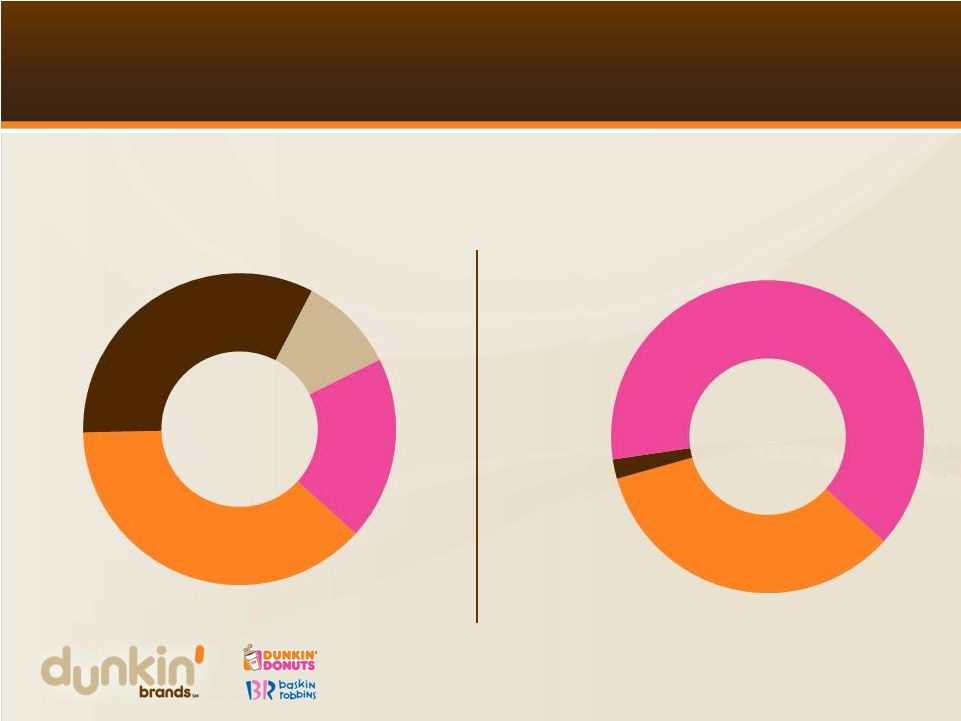

Targeting 330 –

360 net new restaurants in 2013 for

4.5% to 5% net unit growth rate

Forecasted 2013 Net Openings

by Market Type

Forecasted 2013 SDA Sales

by Market Type

15

Emerging

38%

Established

33%

West

19%

Core

10%

Emerging

34%

Established

2%

West

64% |

Contiguous, Strategic Growth Westward

Selling in-fill

locations & SDAs to

existing franchisees

Selling SDAs to new

and existing

franchisees

Future markets

16

SOLD MULTI-STORE

AGREEMENTS IN

2012 |

Bringing Dunkin’

to Southern California

SELLING LA, RIVERSIDE, SAN DIEGO, SAN

BERNADINO, VENTURA & ORANGE COUNTIES

FIRST RESTAURANT

OPENING IN

17 |

18

Driving the growth of Dunkin’

Brands

OPPORTUNITY TO DOUBLE

FOOTPRINT OF DD U.S.

COMPELLING UNIT

ECONOMICS

HIGH-QUALITY

FRANCHISEE DEMAND

CONTIGUOUS,

STRATEGIC APPROACH |