Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - BLUEFLY INC | k332243_ex99-1.htm |

| 8-K - FORM 8-K - BLUEFLY INC | k332243_8k.htm |

Exhibit 99.2

Forward - Looking Statements 2 This presentation may include statements that constitute “forward - looking statements,” usually containing the words “believe,” “project,” “expect” or similar expressions . These statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 . Forward - looking statements inherently involve risks and uncertainties that could cause actual results to differ materially from the forward - looking statements . The risks and uncertainties are detailed from time to time in reports filed by the Company with the Securities and Exchange Commission, including Forms 8 - K, 10 - Q and 10 - K . These risks and uncertainties include, but are not limited to, the following : the Company’s history of losses and anticipated future losses ; the risk of availability of additional capital, if required, to satisfy the Company’s needs for cash flow, inventory supply and growth of the business ; the Company’s ability to realize benefits from new initiatives such as its members - only web site Belle and Clive ; risks related to the Company’s shift in strategy to emphasize inventory turns over product margin ; the risks that our reduction in spending on offline marketing in favor of online methods will continue to be successful ; risks associated with the new Belle & Clive initiative ; risks associated with the slow recovery from the unfavorable general economic environment ; risks associated with affiliates of Rho Ventures, LP, affiliates of Soros Fund Management, private funds associated with Maverick Capital Ltd . and affiliates of Prentice Capital Management, LP each owning a significant portion of our stock ; the potential failure to forecast revenues and/or to make adjustments to our operating plans necessary as a result of any failure to forecast accurately ; unexpected changes in fashion trends ; cyclical variations in the apparel and e - commerce markets ; risks associated with our dependence on certain concentrations of suppliers for a material portion of our inventory ; the risk of default by us under our credit facility and the consequences that might arise from us having granted a lien on substantially all of our assets under that agreement ; risks of litigation related to the sale of unauthentic or damaged goods and litigation risks related to sales in foreign countries ; our potential exposure to product liability claims in the event that products sold by us are defective ; the dependence on third parties and certain relationships for certain services, including our dependence on UPS and USPS (and the risks of a mail slowdown due to terrorist activity) and our dependence on our third - party web hosting, fulfillment and customer service centers ; online commerce security risks ; our ability to raise additional capital, if needed, to support the growth of our business ; risks related to brand owners’ efforts to limit our ability to purchase products indirectly ; management of potential growth ; the competitive nature of our business and the potential for competitors with greater resources to enter the business ; the availability of merchandise ; the need to further establish brand name recognition ; risks associated with our ability to handle increased traffic and/or continued improvements to our Web Site ; rising return rates ; dependence upon executive personnel who do not have long - term employment agreements ; the successful hiring and retaining of new personnel ; risks associated with expanding our operations ; risks associated with potential infringement of other’s intellectual property ; the potential inability to protect our intellectual property ; government regulation and legal uncertainties ; uncertainties relating to the imposition of sales tax on Internet sales and our ability to utilize our net operating losses .

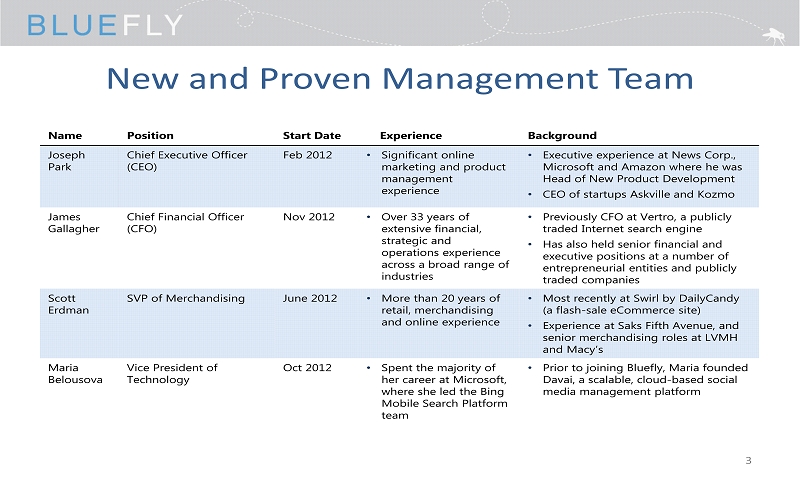

New and Proven Management Team Name Position Start Date Experience Background Joseph Park Chief Executive Officer (CEO) Feb 2012 • Significant online marketing and product management experience • Executive experience at News Corp., Microsoft and Amazon where he was Head of New Product Development • CEO of startups Askville and Kozmo James Gallagher Chief Financial Officer (CFO) Nov 2012 • Over 33 years of extensive financial, strategic and operations experience across a broad range of industries • Previously CFO at Vertro, a publicly traded Internet search engine • Has also held senior financial and executive positions at a number of entrepreneurial entities and publicly traded companies Scott Erdman SVP of Merchandising June 2012 • More than 20 years of retail, merchandising and online experience • Most recently at Swirl by DailyCandy (a flash - sale eCommerce site) • Experience at Saks Fifth Avenue, and senior merchandising roles at LVMH and Macy’s Maria Belousova Vice President of Technology Oct 2012 • Spent the majority of her career at Microsoft, where she led the Bing Mobile Search Platform team • Prior to joining Bluefly, Maria founded Davai, a scalable, cloud - based social media management platform 3

4 Bluefly , I nc . consists of two complementary websites – providing a unique offering of designer, contemporary and private label apparel & accessories Launch Date September 1998 December 2011 Consumer Proposition First off - price e - Commerce retailer to sell brand name apparel and accessories in season, on trend, at a value Most important brands, curated selection, limited time offers, members only pricing

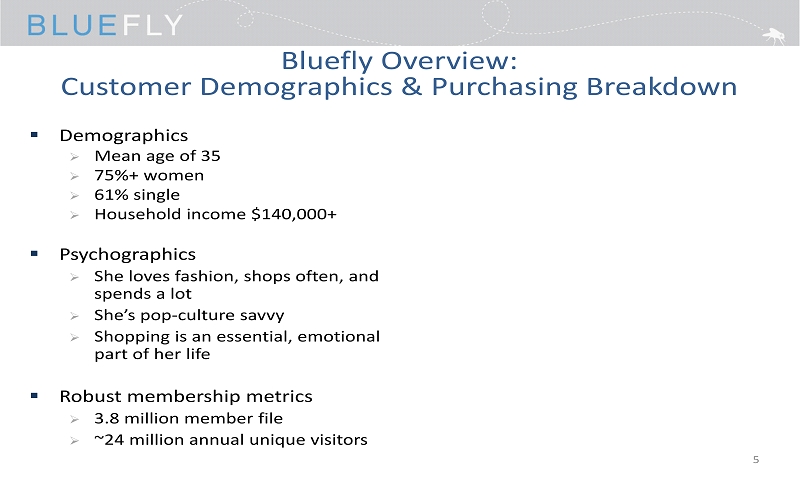

Bluefly Overview: Customer Demographics & Purchasing Breakdown 5 ▪ Demographics » Mean age of 35 » 75%+ women » 61% single » Household income $140,000+ ▪ Psychographics » She loves fashion, shops often, and spends a lot » She’s pop - culture savvy » Shopping is an essential, emotional part of her life ▪ Robust membership metrics » 3.8 million member file » ~24 million annual unique visitors

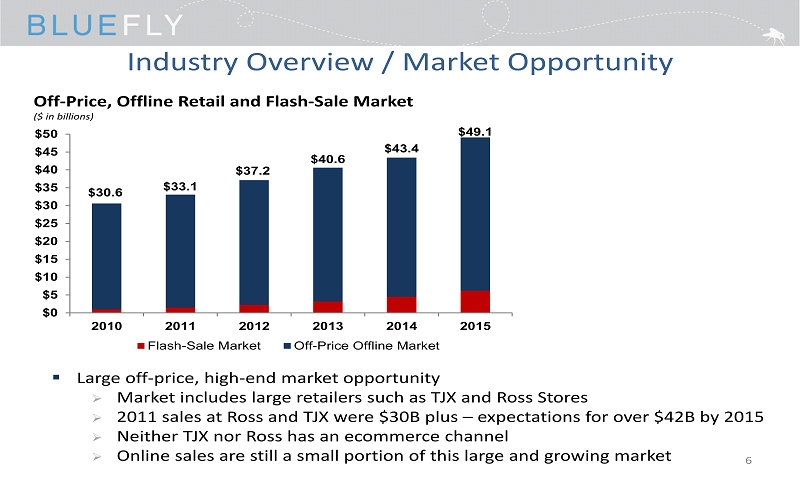

Industry Overview / Market Opportunity ▪ Large off - price, high - end market opportunity » Market includes large retailers such as TJX and Ross Stores » 2011 sales at Ross and TJX were $30B plus – expectations for over $42B by 2015 » Neither TJX nor Ross has an ecommerce channel » Online sales are still a small portion of this large and growing market 6 Off - Price, Offline Retail and Flash - Sale Market ($ in billions) $30.6 $33.1 $37.2 $40.6 $43.4 $49.1 $0 $5 $10 $15 $20 $25 $30 $35 $40 $45 $50 2010 2011 2012 2013 2014 2015 Flash-Sale Market Off-Price Offline Market

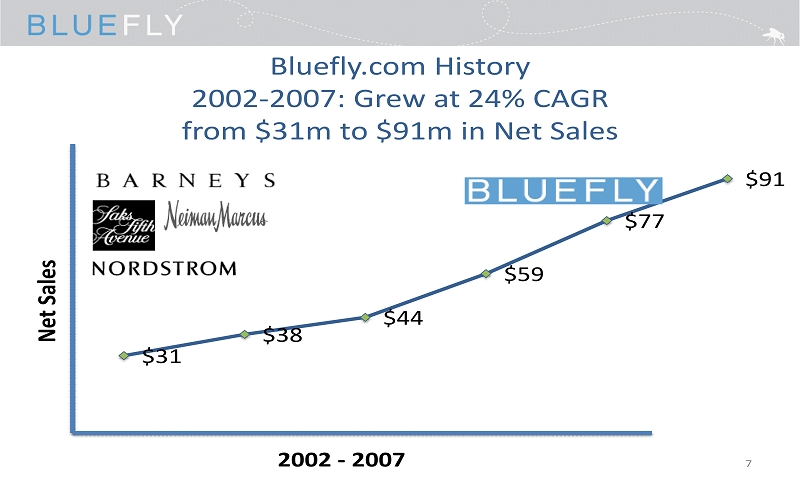

$31 $38 $44 $59 $77 $91 Bluefly.com History 2002 - 2007: Grew at 24% CAGR from $31m to $91m in Net Sales Net Sales 2002 - 2007 7

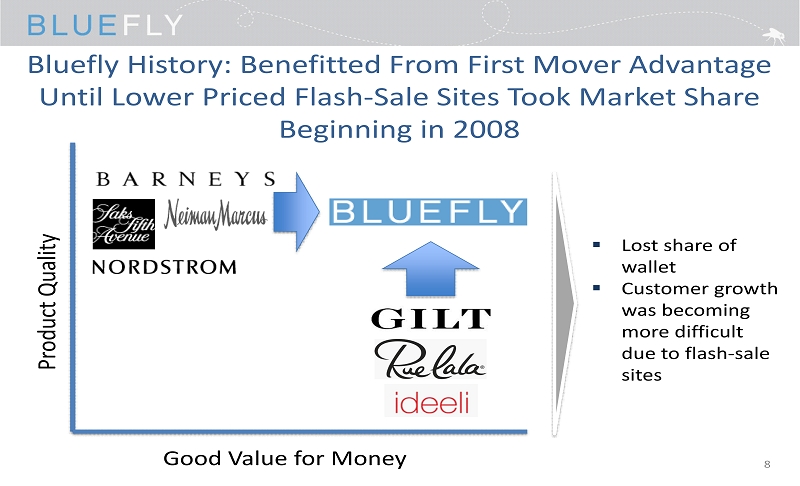

Bluefly History: Benefitted From First Mover Advantage Until Lower Priced Flash - Sale Sites Took Market Share Beginning in 2008 Product Quality Good Value for Money ▪ Lost share of wallet ▪ Customer growth was becoming more difficult due to flash - sale sites 8

Key Operational Initiatives: Management Analysis Inventory mix too luxury heavy Increase share of contemporary and private label inventory Higher conversion rates, rebuy rates and gross margins Analysis Finding Initiative Desired Effect Pricing was not competitive with flash - sale sites Price items more competitively and implement formal markdown strategy Increase inventory turnover through better conversion and rebuy rates Customer LTV and ROI were both too low Revamp marketing strategy leveraging multi - channel synergies Decrease customer acquisition costs by marketing both sites to each member 1) 2) 3) 9

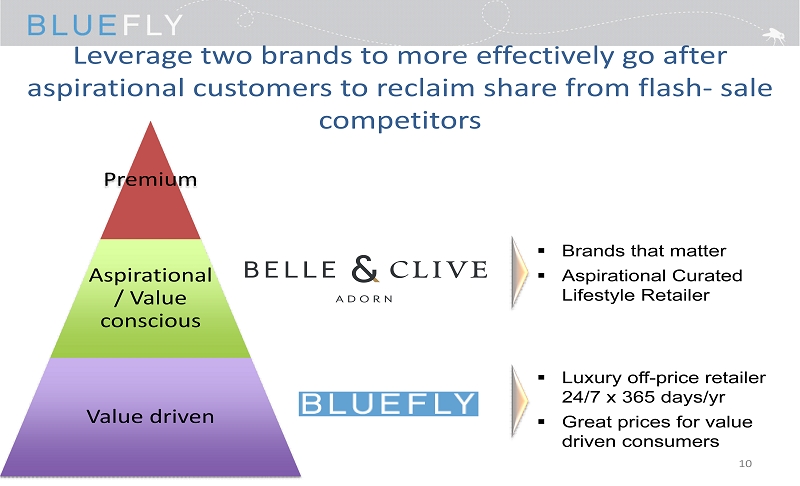

Leverage two brands to more effectively go after aspirational customers to reclaim share from flash - sale competitors Premium Aspirational / Value conscious Value driven 10 ▪ B rands that matter ▪ Aspirational Curated Lifestyle Retailer ▪ Luxury off - price retailer 24/7 x 365 days/yr ▪ Great prices for value driven consumers

# of Events in 1H 2012 Leading Flash - Sale Site Prada 22 0 Gucci 19 0 Fendi 11 0 Salvatore Ferragamo 9 0 Bottega Venetta 8 0 Jimmy Choo 7 0 Rebecca Minkoff 6 0 Hermes 5 0 Yves Saint Laurent 5 0 Christian Louboutin 4 0 Proenza Schouler 2 0 Belle & Clive has more brands that matter to customers 11

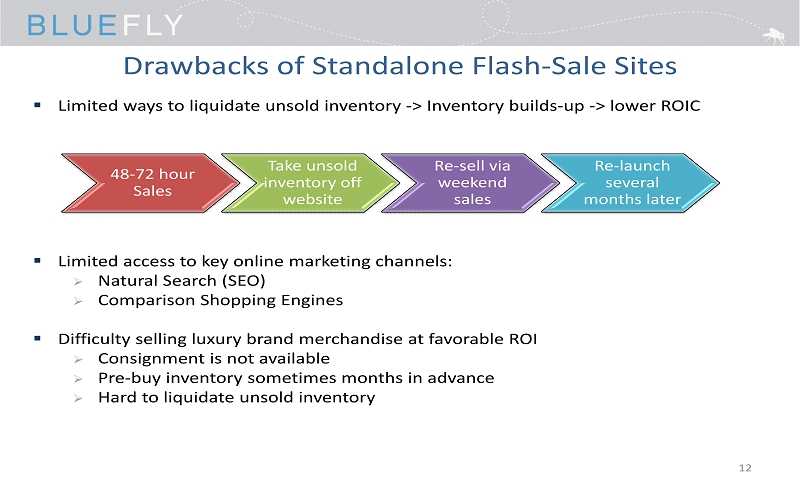

Drawbacks of Standalone Flash - Sale Sites ▪ Limited ways to liquidate unsold inventory - > Inventory builds - up - > lower ROIC ▪ Limited access to key online marketing channels: » Natural Search (SEO) » Comparison Shopping Engines ▪ Difficulty selling luxury brand merchandise at favorable ROI » Consignment is not available » Pre - buy inventory sometimes months in advance » Hard to liquidate unsold inventory 48 - 72 hour Sales Take unsold inventory off website Re - sell via weekend sales Re - launch several months later 12

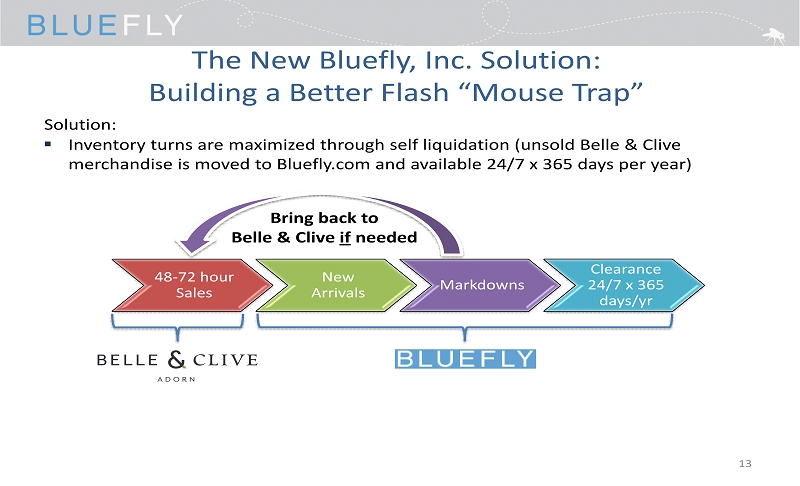

The New Bluefly, Inc. Solution: Building a B etter Flash “Mouse T rap ” 48 - 72 hour Sales New Arrivals Markdowns Clearance 24/7 x 365 days/yr Bring back to Belle & Clive if needed ▪ Inventory turns are maximized through self liquidation (unsold Belle & Clive merchandise is moved to Bluefly.com and available 24/7 x 365 days per year) Solution: 13

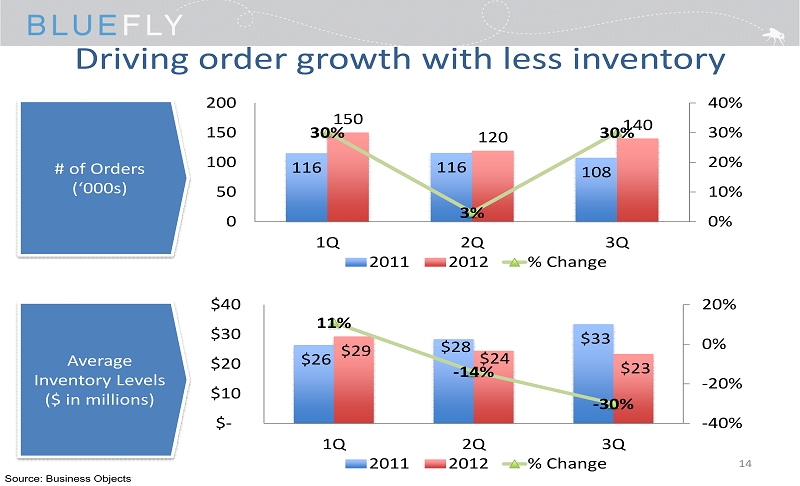

14 116 116 108 150 120 140 30% 3% 30% 0% 10% 20% 30% 40% 0 50 100 150 200 1Q 2Q 3Q 2011 2012 % Change Source: Business Objects Driving order growth with less inventory # of Orders (‘000s) $26 $28 $33 $29 $24 $23 11% - 14% - 30% -40% -20% 0% 20% $- $10 $20 $30 $40 1Q 2Q 3Q 2011 2012 % Change Average Inventory Levels ($ in millions)

15 Selected Market and Financial Highlights ▪ Fiscal year – 12/31 ▪ 52wk range - $0.55 - $2.24 (as of 1/11/2013) ▪ Total shares outstanding (as of 12/31/2012 ) ▪ 28,576,612 shares outstanding ▪ Market Cap of $23.7M as of 1/10/2013 ▪ Significant investors include ▪ Rho Ventures ▪ Soros ▪ Maverick ▪ Prentice ▪ Historical Net Sales ▪ 2010 Annual $ 88.6M ▪ 2011 Annual $ 96.3M ▪ 2012 (YTD through 9/30/2012) $ 68.2M

Thank You! Bluefly, Inc. 42 West 39 th Street New York, NY 10018 www.bluefly.com (212) 944 - 8000 investorkit@bluefly.com 16