Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - AEROJET ROCKETDYNE HOLDINGS, INC. | d466246d8k.htm |

| EX-10.1 - THIRD AMENDMENT TO SECOND AMENDED AND RESTATED CREDIT AGREEMENT - AEROJET ROCKETDYNE HOLDINGS, INC. | d466246dex101.htm |

| EX-99.2 - PRESS RELEASE, DATED JANUARY 14, 2013 - AEROJET ROCKETDYNE HOLDINGS, INC. | d466246dex992.htm |

Exhibit 99.1

EXCERPTS FROM PRELIMINARY OFFERING MEMORANDUM

This summary highlights selected information contained elsewhere in this offering memorandum. This summary is not complete and does not contain all of the information that you should consider before investing in the Notes. For a more complete understanding of our company and this offering, we encourage you to read this entire document, including “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations—GenCorp,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Rocketdyne,” the financial information included and incorporated by reference in this offering memorandum and the documents to which we have referred. Unless otherwise indicated or required by the context, as used in this offering memorandum, the terms “GenCorp,” “Company,” “we,” “our,” and “us” refer to GenCorp Inc. and all of its subsidiaries that are consolidated in conformity with GAAP, excluding Rocketdyne for periods prior to the consummation of the Acquisition and including Rocketdyne for periods following the consummation of the Acquisition, and the term “Rocketdyne” refers to Pratt & Whitney Rocketdyne, Inc., P&W Power Generation, Inc. and their respective consolidated businesses, together with the assets comprising the Pratt & Whitney Rocketdyne division of United Technologies Corporation. References to the “combined company” refer to the Company following the consummation of the Acquisition.

Unless otherwise indicated or required by the context, information identified in this offering memorandum as “pro forma” or “on a pro forma basis” gives effect to the consummation of the Transactions as described under “—The Transactions.”

GenCorp’s fiscal year ends on November 30 of each year. When we refer to a fiscal year of GenCorp, such as fiscal 2011, we are referring to the fiscal year of GenCorp ended on November 30 of that year. Rocketdyne’s fiscal year ends on December 31 of each year. When we refer to a fiscal year of Rocketdyne, such as fiscal 2011, we are referring to the fiscal year of Rocketdyne ended on December 31 of that year.

GenCorp Business

Through our wholly-owned subsidiary, Aerojet-General Corporation (“Aerojet”), we are a leading technology-based designer, developer and manufacturer of aerospace and defense products and systems for the U.S. Government, specifically the Department of Defense (“DoD”) and the National Aeronautics and Space Administration (“NASA”), and major aerospace and defense prime contractors. We believe we are the only domestic provider of all four propulsion types (solid, liquid, air-breathing and electric) for space and defense applications and we maintain strong positions in a number of the market segments that apply these technologies. Aerojet is a world-recognized specialized engineering and manufacturing company that develops and produces propulsion systems for defense and space applications, and armament systems for precision tactical systems and munitions applications. Through Aerojet, we design, develop, and produce propellant systems ranging in size from a few grams to several hundred thousand pounds. For more than 70 years, Aerojet has been a trusted supplier of highly sophisticated products and systems for military, civil and commercial space customers and we maintain a strong market position across various businesses that are mission-critical to national defense and U.S. access to space. Our revenues are highly diversified across multiple programs, prime contractors and end users and as of August 31, 2012, we had approximately 270 contracts, most of which were long-term contracts. As of August 31, 2012, we had a total contract backlog of $1,463 million, including a funded backlog of $1,033 million. In addition, we also have a real estate segment that includes activities related to the re-zoning, entitlement, sale, and leasing of our real estate assets. For the twelve months ended August 31, 2012, our net sales and Adjusted EBITDA were $948.9 million and $115.7 million, respectively. Our Aerospace and Defense segment, which includes the operations of Aerojet, accounted for 99% of our total net sales for this period.

1

Our capabilities and resources are aligned with our customers and markets and position us for long-term growth with improved efficiency and profitability. The market segments we serve are:

Space and Launch Systems. Aerojet is a leader in human-rated systems with 100% mission success for national and commercial requirements. Aerojet propulsion systems have flown prominently on manned and unmanned missions for NASA and the DoD since the inception of the U.S. Space Program. Aerojet develops and produces liquid propellant rocket engines and solid propellant rocket motors that power commercial and government launch vehicles. In addition, Aerojet is the leading supplier of high performance, highly reliable spacecraft propulsion products for low thrust engines and systems. Aerojet’s key spacecraft propulsion capabilities include requirements definition and trade studies, design and development, fabrication and assembly, test and post-delivery support. Current programs include Orion, Atlas V, Antares, Geostationary Satellite Systems, Global Positioning and Advanced Extremely High Frequency satellites.

Tactical Systems. Aerojet is a leader in the design, development, and production of propulsion and warhead systems for tactical missile systems. Aerojet’s dedication to researching and developing safe, effective and affordable products keeps us at the forefront of providing our customers with optimal tactical propulsion and warhead solutions. Current programs include Standard Missile (“SM-3”), Guided Multiple Launch Rocket Systems (“GMLRS”), Patriot Systems (“PAC-3”), Javelin and Tomahawk. Aerojet’s proven and reliable products have been successfully fielded on multiple active U.S. and international weapon systems.

Missile Defense Systems. Aerojet serves the missile defense markets as a manufacturer of propulsion control systems and boosters. These systems power and provide directional control for critical missile defense applications. Current programs include SM-3, Exoatmospheric Kill Vehicle/Ground Based Interceptor (“EKV/GBI”), Terminal High Altitude Area Defense (“THAAD”) and Hawk. Aerojet manufactures content for two of the three phases of ballistic missile flight (boost, mid-course and terminal) in support of the Missile Defense Agency’s (“MDA”) priorities to develop and field an integrated, layered, ballistic missile defense system in defense against all ranges of enemy ballistic missiles in all phases of flight.

Force Projection and Protection Systems. We believe Aerojet is a leader in hypersonic propulsion and provides critical systems and technology for the nation’s strategic deterrence posture. Current programs include Minuteman III 4th Stage, Trident II Post Boost (“D-5”) and Supersonic Sea-Skimming Target (“SSST”).

Our Real Estate segment includes the activities of Easton Development Company, LLC (“Easton”) related to the entitlement, sale, and leasing of GenCorp’s excess real estate assets. We own approximately 12,000 acres of land adjacent to U.S. Highway 50 between Rancho Cordova and Folsom, California east of Sacramento (the “Sacramento Land”). Acquired in the 1950s for our aerospace and defense operations, large portions of the Sacramento Land were used solely to provide safe buffer zones for propulsion testing. Modern changes in propulsion technology, coupled with the relocation of certain propulsion operations, led us to determine that large portions of the Sacramento Land were no longer needed for Aerojet’s operations. Approximately 6,000 acres have been deemed excess, and we are currently in the process of seeking zoning changes and other governmental approvals on a portion of the Sacramento Land to optimize its value. Easton and any future direct and indirect subsidiaries formed for the purpose of holding, managing, developing or monetizing real estate assets will be unrestricted subsidiaries under the indenture governing the Notes (the “Indenture”) and will not guarantee the Notes.

2

Rocketdyne Business

Rocketdyne is the largest liquid rocket propulsion designer, developer, and manufacturer in the United States. As the primary propulsion system provider to the U.S. Government, specifically NASA and the DoD through the United Launch Alliance, which is a commercial joint venture of Boeing and Lockheed Martin (“ULA”), Rocketdyne is considered to be the market leader in liquid launch propulsion and hypersonic systems. For more than 50 years, Rocketdyne has set the standard in space propulsion design, development and manufacturing. Rocketdyne has powered nearly all of NASA’s human-rated launch vehicles to date and has recorded more than 1,600 space launches. Rocketdyne propulsion systems have powered missions to nearly every planet in the solar system and have been a cornerstone to the U.S. Space Program since its inception. Additionally, Rocketdyne propulsion systems are vital to the launch of astronauts and cargo required for space exploration and for U.S. military and commercial satellites. Rocketdyne’s business is driven by a team of approximately 1,500 highly educated employees and a history and culture of technological innovation, as evidenced by the company’s 200 active patents and over 60 annual patent disclosures.

Large, multi-year contracts, many of which are structured with cost-reimbursable contract terms, drive stability in Rocketdyne’s projected sales and margins. For the twelve months ended September 30, 2012, Rocketdyne’s net sales and Adjusted EBITDA were $745 million and $144 million, respectively. During this time period, Rocketdyne’s launch revenues accounted for approximately 77% of net sales, and its missile defense and other product lines accounted for the remaining approximately 23% of net sales.

Rocketdyne’s decades of experience and demonstrated reliability, coupled with its management’s deep industry relationships, position the company well across all of its major market segments. Rocketdyne serves the following key market segments:

Launch Systems. Rocketdyne has a broad product offering that has powered every major NASA architecture and nearly all of NASA’s man-rated launch vehicles since the inception of the U.S. Space Program. The launch business also has a long, successful history with the DoD and currently sees strong demand related to high priority intelligence, surveillance, and reconnaissance (“ISR”) activities specifically through the launch of critical payload DoD satellites into space. Rocketdyne currently provides liquid upper stage and booster propulsion products for NASA’s Space Launch System (“SLS”) and ULA’s Delta IV and Atlas V programs.

Small Thruster Systems. Over the past 50 years, Rocketdyne has developed over 200 integrated small thruster systems including over 70 different propulsion system designs and over 40 different engine thrusters. Rocketdyne is considered the industry leader in the design, development, and production of high performance bi-propellant components, and systems. Rocketdyne’s missile defense products play a critical role in the MDA’s missile defense shield by providing the Divert and Attitude Control System (“DACS”) propulsion for the THAAD interceptor. Rocketdyne is also developing thruster systems for Boeing’s Commercial Space Transportation (“CST”)-100 spacecraft. The CST-100 spacecraft, designed to transport people to the International Space Station (“ISS”) and other low Earth orbit destinations, is in development under NASA’s Commercial Crew Program.

Hypersonics Systems. Rocketdyne has a highly skilled hypersonic propulsion team with decades of experience that is pioneering the development of liquid-fueled propulsion technologies for hypersonic systems. Rocketdyne maintains a key position on key government hypersonic propulsion programs such as the Air Force Research Laboratory’s (“AFRL”) X-51A and Robust Scramjet programs. Continued technology development is also expected through Rocketdyne’s association with Defense Advanced Research Projects Agency (“DARPA”).

3

Our Competitive Strengths

Market Leadership in Propulsion. Aerojet’s success is due in part to its ability to design, develop and manufacture products utilizing innovative technology. For over 70 years, Aerojet has developed a legacy of successfully meeting the most challenging missions by producing some of the world’s most technologically advanced propulsion systems for its customers. For example, Aerojet propulsion systems have flown on every NASA Discovery mission as well as every manned space mission since the inception of the U.S. Space Program. In addition, Aerojet has been a major supplier of a wide range of propulsion products to the DoD since the 1940s when it successfully developed and produced the first jet-assisted take off rockets for U.S. aircraft during World War II. We believe that Aerojet is the only domestic provider of all four propulsion types (solid, liquid, air-breathing and electric) for space and defense applications and Aerojet maintains strong positions in a number of the market segments that apply these technologies. Aerojet’s legacy of innovation has continued with significant recent defense and space system contract awards, including the U.S. Air Force/DARPA Triple Target Terminator contracts (“T3”) with Boeing and Raytheon, Standard Missile MK-125 warhead production for years 2011-13, the Griffin missile propulsion upgrade development, several multi-million dollar awards for the Standard Missile-3 Block IIB missile defense interceptor for Part IV of the Phased Adaptive Approach, the Iridium Next Propulsion program and the U.S. Air Force Upper Stage Technology Risk Reduction program.

Rocketdyne, which is the largest liquid rocket propulsion company in the U.S., has an equally well-demonstrated history of over 50 years of product innovation and technological leadership that is highly complementary to Aerojet. Rocketdyne has powered nearly all of NASA’s human-rated launch vehicles to date and has recorded over 1,600 space launches, 157 of which were human launches. Rocketdyne propulsion systems have powered space probes to nearly every planet in the solar system and have been a cornerstone to the U.S. space program since its inception. Rocketdyne’s technological leadership has led to its achievement of multiple industry firsts, including the invention of the first liquid hydrogen rocket engine, the carriage of the first humans to the moon, achieving the longest-ever supersonic combustion ramjet-powered flight and the first testing of a Russian rocket engine in the U.S. Recent significant contract awards for Rocketdyne include the selection of the RS-25 as the booster engine for the SLS program, the F-1 engine for the SLS advanced booster contract, Rocketdyne’s solution for Boeing’s CST-100 and selection for NASA’s Commercial Crew Integrated Capability (“CCiCap”) program, and the combined THAAD Foreign Military Sales (“FMS”)/Lot 4 award.

Diversified and Well Balanced Portfolio. Aerojet has been a pioneer in the development of many crucial technologies and products that have strengthened multiple branches of the U.S. military and enabled the exploration of space. We believe Aerojet maintains a unique competitive position due to a strategic focus on creating and maintaining a broad spectrum of propulsion and energetic products assisted by the growing market demand for its innovative energy management technologies. Aerojet’s resulting product line diversity has enabled it to continue to grow while avoiding significant revenue reductions experienced by concentrated portfolios. Aerojet has further capitalized on this foundation by bringing together its “solid” and “liquid” propulsion teams and “cross-pollinating” critical product features and capabilities, thus exploiting potential product line synergies and thereby offering customers innovative and advanced solutions. As of August 31, 2012, Aerojet was a mission-critical supplier on approximately 270 contracts, most of which were long-term contracts.

The acquisition of Rocketdyne adds additional diversity and significantly strengthens Aerojet’s existing contract portfolio, particularly with respect to the NASA, DoD and commercial launch markets. Rocketdyne propulsion systems power almost all of today’s medium and large payload rocket systems. It is the sole provider of both the liquid upper and boost stage engines on the SLS, Delta IV and Atlas V rocket systems. The charts below highlight Aerojet’s and Rocketdyne’s highly complementary contract portfolios and show the well balanced nature of the combined business.

4

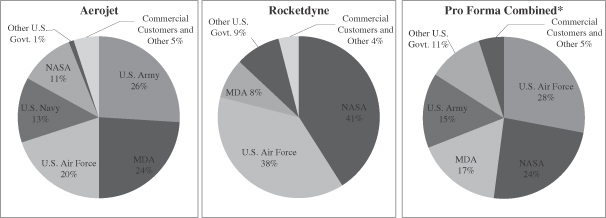

The following charts set forth the percentages of net sales by principal end user of Aerojet and Rocketdyne for the twelve months ended August 31, 2012 and September 30, 2012, respectively, as well as on a pro forma combined basis.

| * | Represents the percentages of pro forma net sales by principal end user of Aerojet and Rocketdyne for the twelve months ended August 31, 2012 and September 30, 2012 on a pro forma combined basis, after giving effect to adjustments relating to revenue recognition policy conformance, but without giving effect to any other revenue adjustments described in the accompanying notes to the unaudited pro forma condensed combined financial information included elsewhere in this offering memorandum. |

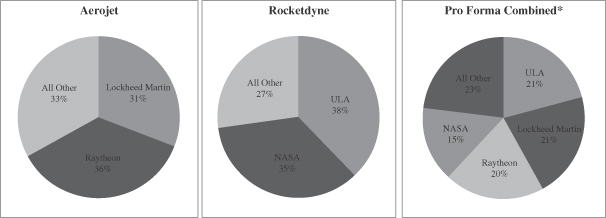

The following charts set forth the percentages of net sales by customers of Aerojet and Rocketdyne that represented more than 10% of net sales for the twelve months ended August 31, 2012 and September 30, 2012, respectively, as well as on a pro forma combined basis.

| * | Represents the percentages of pro forma net sales by customers of Aerojet and Rocketdyne that represented more than 10% of net sales for the twelve months ended August 31, 2012 and September 30, 2012 on a pro forma combined basis, after giving effect to adjustments relating to revenue recognition policy conformance, but without giving effect to any other revenue adjustments described in the accompanying notes to the unaudited pro forma condensed combined financial information included elsewhere in this offering memorandum. |

5

High Visibility of Revenue with Multi-year Contracts and Sizable Backlog. The highly visible nature of Aerojet’s revenue comes from the long-term nature of the programs with which it is involved, its diverse and attractive contract base and its deep customer relationships. A substantial portion of Aerojet’s sales are derived from multi-year contract awards from major aerospace and defense prime contractors. In many cases, Aerojet operates under sole source contracts—some are follow-on contracts to contracts initially completed years ago and others have been sole source contracts since inception. High renewal rates, driven by our leading technology and significant requalification costs, provide Aerojet with a highly stable business base from which to grow. Aerojet’s total contract backlog (funded and unfunded) was $1,463 million as of August 31, 2012 and its funded backlog, which includes only amounts for which money has been directly appropriated by the U.S. Congress or for which a purchase order has been received from a commercial customer, totaled $1,033 million.

Rocketdyne’s high revenue visibility is anchored in its significant sole source positions, large backlog and in the case of its launch business, multiple-year satellite constellation forecasts from its customers. Rocketdyne was the sole source provider of products representing more than 79% of net sales for the twelve-month period ended September 30, 2012. Its total contract backlog (funded and unfunded) and funded backlog were $1,003 million and $506 million, respectively, as of September 30, 2012. Existing launch manifests, for both the replenishment and the addition of new platforms to the satellite constellations of the DoD, provide Rocketdyne with revenue visibility in its launch business out to 2017.

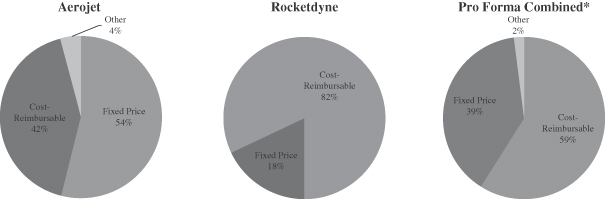

On a pro forma basis, as of August 31, 2012, total contract backlog (funded and unfunded) was $2,575 million and total funded backlog was $1,648 million. The high revenue visibility and sizeable backlogs of Aerojet and Rocketdyne are complemented by the high proportion of cost-reimbursable contracts in their portfolio mixes as shown in the charts below. These charts set forth the percentages of net sales by contract type of Aerojet and Rocketdyne for the twelve months ended August 31, 2012 and September 30, 2012, respectively, as well as on a pro forma combined basis.

| * | Represents the percentages of pro forma net sales by contract type of Aerojet and Rocketdyne for the twelve months ended August 31, 2012 and September 30, 2012 on a pro forma combined basis, after giving effect to the adjustments described in the accompanying notes to the unaudited pro forma condensed combined financial information included elsewhere in this offering memorandum. |

Significant Barriers to Entry. Both Aerojet’s and Rocketdyne’s businesses are characterized by significant barriers to entry, which include specialized technologies, customer emphasis on risk avoidance and a resulting reliance on existing, proven products, highly skilled workforces, the necessary infrastructure for potentially hazardous and technically sensitive work, long research and development periods, and considerable capital costs for necessary facilities and equipment. In conjunction with these barriers to entry, the long-term nature of their programs and associated requalification costs incurred if a program is moved limit the ability for their customers to easily change suppliers.

6

Additionally, both companies benefit from significant customer funding of their research and development expenditures, which helps position them for long-term production contracts on products they develop. A substantial portion of their businesses, including many of their contracts with major prime contractors to the U.S. government, the DoD and NASA, also requires lengthy customer certification and qualification processes, which creates significant obstacles for potential competitors. As a result, Aerojet and Rocketdyne are the sole providers on the vast majority of their contracts. In addition, new programs and platforms favor suppliers such as Aerojet and Rocketdyne that have extensive industry experience and a reputation for superior performance.

Exceptional Long-Term Industry Relationships. Aerojet and Rocketdyne serve a broad set of customers and are major suppliers of propulsion products to top original equipment manufacturers such as Boeing, Lockheed Martin, Raytheon and ULA, as well as to the DoD, NASA and other U.S. government agencies. Both companies have a long history of partnering with their respective customers and have developed close relationships with key decision-makers while working for a combined total of more than a century in the rocket and missile propulsion markets. Aerojet and Rocketdyne are, in many instances, approached by multiple prime contractors in bidding processes, which is a testament to the strength of their relationships and their technological leadership. Aerojet has served its two largest customers, Lockheed Martin and Raytheon, for more than 35 and 25 years, respectively. Rocketdyne has served its two largest customers, NASA and ULA (and its predecessor companies), for more than 50 years. We believe these long-term relationships and the reputation of both companies for performance enhance customer loyalty and provide them with key competitive advantages in winning new contracts for new programs as well as follow-on and derivative contracts for existing programs.

Significant Real Estate Holdings. Modern changes in propulsion technology, coupled with the relocation of certain of Aerojet’s propulsion operations, led GenCorp to determine that large portions of the Sacramento Land were no longer needed for Aerojet’s operations. As a result, approximately 6,000 acres are undergoing entitlement for new development opportunities under the brand name “Easton”. We believe Easton has numerous competitive advantages over other areas, including several miles of freeway accessible frontage, one of the largest single-owner land tracts suitable for development in the Sacramento region, and a desirable “in-fill” location surrounded by residential and business properties. The Easton development plan includes a broad range of housing, office, industrial, retail, and recreation uses.

Management Team with a Successful Track Record. GenCorp’s operations are led by an experienced management team with a demonstrated focus on operating performance and the implementation of financial policies to support the business. This team has established a track record of increasing revenue and backlog, improving contract performance, reducing overhead expenses, and increasing free cash flow. The management team includes seasoned executives with extensive defense and aerospace industry experience, relationships and knowledge. The addition of Rocketdyne’s highly talented employee base and its leadership team that averages 25 years with the company will further add to the experience and expertise of the combined company’s management team.

Our Business Strategy

Deliver Excellent Performance on Our Programs. Aerojet has capitalized on its strong technical capabilities to become a critical provider of components and systems for major propulsion programs. We believe that Aerojet offers its customers the most innovative and advanced solutions in the markets in which it operates. Aerojet is in a unique competitive position due to the diversity of its propulsion technologies, complete warhead capabilities, composites and metallic structures expertise, and the synergy between the product lines it offers its customers. Aerojet places a high priority on delivering high levels of performance on its existing contracts, which enables it to continue to take advantage of new program opportunities and respond to its customers’ increasing

7

demand for its products. For example, Aerojet’s AJ10 engine recently helped propel the 149th launch of the Delta II vehicle for NASA’s Aquarius research satellite to orbit. This launch extends Aerojet’s track record of 100% mission success for the Delta II rocket since its first use in 1999. The AJ10 engine has also delivered payloads for NASA’s space explorations such as MESSENGER, Phoenix Mars Lander, Fermi Gamma Ray Space Telescope, Deep Impact and the Mars Explorations Rovers (both Spirit and Opportunity), as well as the U.S. Air Force Global Positioning System Block IIR fleet. Similar to Aerojet, Rocketdyne will continue to capitalize on its technical capabilities, particularly as they relate to its strong association with NASA and leadership in the development of the next generation of heavy space launch vehicle architecture. Rocketdyne has an unprecedented history in the launch market and has, over a more than 50-year period, demonstrated a reliability of 0.998. Rocketdyne’s recent launch and other key program success include the successful completion of the SSME program with 100% mission success over 30 years and more than 400 flights, full power and full duration testing on the J-2X engine, which was accomplished earlier in the test program than any past large booster or upper stage engine, and 100% mission success for THAAD DACS on its test flights.

Focus on Operational Excellence. Aerojet has maintained a strong focus on continued improvement in operational performance across all areas of its business. In 2010, Aerojet took additional steps to improve efficiency and quality by beginning to establish common systems, shared services and lean principles across its business. Aerojet management has allowed for increased autonomy within each division and restructured and aligned incentives at both the division and corporate level to drive improvements in operating performance and customer service. These operational changes have led to an intense focus by GenCorp’s business leaders on improving contract profitability, reducing operating expenses, increasing free cash flow generation and maintaining high levels of customer service. Rocketdyne brings with it an equally strong focus on operational excellence, which is reflected in the company being able to grow Adjusted EBITDA and Adjusted EBITDA margins during the period from 2009 through August 31, 2012, despite the declines in its net sales as a result of the winding down of NASA’s space shuttle program. The addition of Rocketdyne will also allow for the capture of cost savings and increases in operating efficiencies through reduced redundancies and the implementation of the best practices of each business across the combined company.

Expand Our Technologies and Product Offerings. Aerojet’s research and development activities have enabled it to provide its customers with more comprehensive, value added solutions and to expand content on existing platforms and programs. Designing and producing both liquid and solid propulsion systems has allowed Aerojet to transfer technology between these broad product areas and to spawn innovation for a wider range of applications. We expect the addition of Rocketdyne and its approximately 850 skilled engineers, approximately 400 of whom have advanced degrees, to further accelerate innovation by enhancing technology transfer across an even broader product portfolio. Rocketdyne also provides GenCorp re-entry into the large space launch engine market at a critical inflection point in the industry and further strengthens Aerojet’s existing positions in the missile defense and hypersonics markets.

Optimize the Value of Our Real Estate Holdings. We intend to continue to seek zoning changes and other government approvals on a portion of the Sacramento Land in order to optimize its value. Located 15 miles east of downtown Sacramento, California along U.S. Highway 50, a key growth corridor in the region, the master development plan reflects our efforts to make Easton one of the finest master-planned communities in the U.S. Upon completion, we believe that Easton will include a broad range of housing, office, industrial, retail and recreational space, which we believe will ensure long-term value enhancement of the property.

8

Industry Overview

For the Government Fiscal Year (“GFY”) ended September 30, 2012 and beyond, federal department/agency budgets are expected to remain under pressure due to the financial impacts from spending cap agreements contained in the Budget Control Act of 2011 or the “Budget Control Act” (Public Law 112-25) (the debt-ceiling and deficit-reduction compromise agreement signed into law on August 2, 2011), as well as from on-going military operations and the cumulative effects of annual federal budget deficits and rising U.S. federal debt. As a result, the DoD GFY 2013 budget request submitted to Congress on February 13, 2012 is $525.4 billion for the base budget, $45 billion below the amount planned for GFY 2013 a year ago and $5.2 billion below the final GFY 2012 appropriated amount. The DoD budget request also includes cuts and other initiatives that will reduce DoD spending by $259 billion over the next five years and $487 billion over ten years, consistent with the Budget Control Act. The NASA GFY 2013 budget request is $17.7 billion. In addition, pursuant to the Budget Control Act, as amended by the American Taxpayer Relief Act of 2012, additional mandatory spending caps will be triggered, potentially beginning in March 2013 if Congress and the Administration do not reach agreement on means to reduce the deficit by $1.2 trillion, approximately half of which is expected to impact the defense budget.

Despite overall defense spending pressures, we believe that Aerojet and Rocketdyne are well-positioned to benefit from spending in DoD priority areas. This view reflects the DoD’s strategic guidance report released in January 2012. This report affirms support for many of the core programs of both Aerojet and Rocketdyne and points towards continued DoD investment in: space defense—in order to ensure access to this highly congested and contested “global commons”; missile defense—in order to protect the homeland and counter weapons of mass destruction; and power projection—by improving missile defense systems and enhancing space-based capabilities. Rocketdyne’s critical role in launching DoD satellites into space also aligns with the overall focus and increased spending by the DoD on ISR and cyber, precision strike and communications capabilities. Finally, Aerojet and Rocketdyne have limited direct exposure to in-theater spending in Iraq and Afghanistan and so we expect the revenue impact on both businesses from the continued withdrawal of forces from these regions to be muted.

In 2010, the NASA Authorization Act took effect impacting GFYs 2011-2013. The Authorization Act aimed to: safely retire the Space Shuttle; extend the ISS through 2020; continue the development of the multipurpose crew exploration vehicle; build a new heavy lift launch vehicle; invest in new space technologies; and sustain and grow the science and aeronautics programs at NASA. Aerojet and Rocketdyne have strong positions of incumbency and are well aligned with the long-term budget priorities of NASA. Aerojet is the main propulsion provider for the multi-purpose crew vehicle and Rocketdyne is the leader in NASA’s development efforts of a new heavy lift launch vehicle through its work on the J2-X and RS-25 programs.

The Transactions

Stock and Asset Purchase Agreement

On July 22, 2012, we entered into a Stock and Asset Purchase Agreement (the “Acquisition Agreement”) with United Technologies Corporation (“UTC”), a Delaware corporation. Upon and subject to the terms and conditions of the Acquisition Agreement, we have agreed to purchase Rocketdyne, including all of the issued and outstanding shares of common stock of Pratt & Whitney Rocketdyne, Inc., a Delaware corporation and wholly owned subsidiary of UTC, and P&W Power Generation, Inc., a Delaware corporation and wholly owned subsidiary of UTC, along with certain other assets relating to Rocketdyne (the “Acquisition”).

The purchase price we have agreed to pay for Rocketdyne is $550 million in cash, subject to adjustment for net assets and other specified items.

9

The Acquisition Agreement contains customary representations and warranties and covenants by each party. Both parties are obligated, subject to certain limitations, to indemnify the other under the Acquisition Agreement for certain customary and other specified matters, including breaches of representations and warranties, nonfulfillment or breaches of covenants and for certain liabilities and third-party claims.

We are obligated to pay to UTC a termination fee of $20 million in the event that the Acquisition Agreement is terminated in certain circumstances. The consummation of the Acquisition is subject to customary conditions to closing, including the receipt of certain government approvals, such as the expiration or termination of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Act”). The Acquisition Agreement was amended on October 16, 2012 to, among other things, extend to May 1, 2013 the date on or after which UTC may terminate the Acquisition Agreement for failure to obtain governmental approval under the HSR Act. As a result of the review under the HSR Act and pursuant to the Acquisition Agreement, we may be required to dispose of businesses, product lines or assets representing, in the aggregate, less than or equal to $100 million of annual revenue.

Rationale for the Acquisition

GenCorp believes that the acquisition of Rocketdyne will improve our position as a leading rocket propulsion company. Combined, both companies have over a century of experience designing and supplying highly sophisticated propulsion and other technologies to government, military, and commercial customers. The combined company will be well positioned to capitalize on the complementary capabilities of both businesses to create additional growth opportunities and value for their customers.

Rocketdyne is the leading liquid rocket propulsion company in the U.S., with more than 50 years of design, development, and manufacturing experience. Rocketdyne provides GenCorp re-entry into the large space launch engine market at a critical inflection point in the industry and further strengthens Aerojet’s existing positions in the missile defense and hypersonics markets.

The increased scale and scope of our combined businesses will allow us to capture cost savings and increase operating efficiencies through, among other things, reduced redundancies, more efficient management of our lower-tier supply base and better and more focused expenditure on internal and customer funded research and development. We also expect to benefit from the implementation of the best practices of each business across the combined company following the acquisition.

New Term Loan

The Second Amendment (as defined elsewhere in this offering memorandum) to our existing senior secured credit facility (the “Senior Credit Facility”) provided for, among other things, a delayed draw term loan (the “New Term Loan”) to us in an amount of up to $50 million. Subject to certain conditions, the New Term Loan is available in a single draw until 360 days after August 16, 2012 to fund the Acquisition (or to be deposited in an account held by the administrative agent under our Senior Credit Facility in anticipation of the Acquisition). To the extent that the Acquisition is not consummated, we may use the proceeds from the New Term Loan either (i) to prepay the New Term Loan in its entirety without premium or penalty, subject to certain conditions, or, in certain circumstances, (ii) for general corporate purposes.

The borrowing of the New Term Loan is subject to customary conditions, including the requirement that at the time of issuance of the New Term Loan, (i) no default or event of default under the Senior Credit Facility shall have occurred and be continuing and (ii) after giving effect to the New Term Loan, we shall not have exceeded the amounts we are permitted to borrow under the Senior Credit Facility. If drawn, the New Term Loan would initially bear interest at a rate equal to the LIBOR plus 350 basis points (subject to downward adjustment), or the base rate as it is defined in the credit agreement governing the Senior Credit Facility plus 250 basis points (subject to downward adjustment). Amounts repaid or prepaid on the New Term Loan may not be reborrowed.

10

Escrow of Proceeds

If this offering is completed prior to the consummation of the Acquisition, concurrently with the closing of this offering, we will deposit the gross proceeds from this offering of the Notes (after deducting underwriting discounts) plus an amount sufficient to fund a special mandatory redemption of the Notes (as described below) on February 28, 2013, including accrued interest on the Notes, into an escrow account pursuant to an escrow agreement (the “Escrow Agreement”) and will continue to deposit accrued interest on the Notes on a monthly basis until the release of the escrow funds upon satisfaction of certain conditions or until a special mandatory redemption. The release of the escrow proceeds will be subject to the satisfaction of certain conditions, including the closing of the Acquisition. If the Acquisition is not consummated on or prior to July 21, 2013, subject to a one-month extension as described herein (which we refer to as the “Escrow End Date”), or we fail to make the aforementioned deposits into the escrow account, or upon the occurrence of certain other events, the Notes will be subject to a special mandatory redemption. The special mandatory redemption price will be a price equal to 100% of the initial issue price of the Notes, plus accrued and unpaid interest from the issue date of the Notes up to, but not including, the payment date of such special mandatory redemption. The funds that we deposit into the escrow account will be pledged as collateral to the escrow agent for the benefit of the holders of the Notes. See “Description of Notes—Escrow of Proceeds; Release Conditions” and “Description of Notes—Special Mandatory Redemption.”

Upon release of the proceeds from escrow, the net proceeds of this offering will be used to finance the Acquisition as described in this offering memorandum under the caption “Use of Proceeds.”

We refer to the Acquisition, this offering, the performance of our obligations under the Escrow Agreement, the borrowing of the New Term Loan, the payment of related fees and expenses and the other transactions described above as the “Transactions.”

Recent Developments

Potential Divestiture of LDACS Business

Following discussions with the U.S. Federal Trade Commission (the “FTC”) after the filing of a notification with respect to the Acquisition pursuant to the HSR Act and after receiving on January 7, 2013 a modification to the FTC’s request for additional information (commonly referred to as a “second request”) which at this time limits the scope of the FTC’s investigation of the Acquisition under such second request to the Liquid Divert and Attitude Control Systems (“LDACS”) businesses of Aerojet and Rocketdyne, we have decided to seek to divest Aerojet’s LDACS business in order to facilitate obtaining clearance of the Acquisition pursuant to the HSR Act. If we proceed with the divestiture, we expect that such divestiture will consist of all of Aerojet’s assets needed for the design, development and production of its LDACS business, which includes but is not limited to the EKV/GBI program. The net sales for the LDACS program for the twelve-month period ended August 31, 2012 was $37.7 million. For more information regarding Aerojet’s LDACS business, see the description under the caption “Assets Held For Sale” under Note 1 to the unaudited pro forma condensed combined financial statements included elsewhere in this offering memorandum.

Accordingly, we are in the process of offering the LDACS business for sale to potential buyers, discussing the terms of the sale with the FTC and seeking to enter into an asset purchase agreement with a potential buyer expeditiously. Once a purchaser is identified, we will present the purchaser to the FTC for approval, which we expect to be memorialized in a consent decree. However, there can be no assurance that we will find a purchaser for Aerojet’s LDACS business, that we will be able to negotiate an asset purchase agreement with any such purchaser expeditiously, that the FTC will approve the proposed purchaser or the terms of such divestiture, or that the FTC will not require the divestiture of additional assets or similar alternative remedies. The consummation of the proposed divestiture is subject to FTC review and approval. If we are unable to complete a divestiture of Aerojet’s LDACS business or enter into a definitive agreement with a buyer providing for such divestiture, or reach an alternative remedy, we may not receive final FTC clearance for, and will not be able to consummate, the Acquisition. In the event that the FTC does not approve of the divestiture or the Acquisition, or the divestiture is no longer required, we may not be able to, or may elect not to, proceed with the divestiture of Aerojet’s LDACS business.

11

GenCorp Preliminary Fiscal Year 2012 Financial Results

We have not yet finalized our financial statement preparation and audit for the fourth quarter and fiscal year ended November 30, 2012. In connection with the finalization process, we may identify items that would require us to make adjustments to our preliminary financial results set forth below. As a result, our financial results could be different from those set forth below and those differences could be material. Our consolidated financial statements for the three months and fiscal year ended November 30, 2012 will not be available until after this offering is completed, and consequently, will not be available to you prior to investing in the Notes. Results for historical periods are not necessarily indicative of future results and therefore investors should not place undue reliance on our financial results for the quarter ended November 30, 2012.

Based on our preliminary results, we currently expect to report consolidated net sales for the fourth quarter ended November 30, 2012 of between $290 million and $305 million and consolidated net sales for the fiscal year ended November 30, 2012 of between $987 million and $1,002 million. We also expect to report Adjusted EBITDAP for the fourth quarter ended November 30, 2012 of at least $32 million (or Adjusted EBITDA of at least $33 million after further adjusting for approximately $1 million in stock-based compensation expense) and Adjusted EBITDAP for the fiscal year ended November 30, 2012 of at least $109 million (or Adjusted EBITDA of at least $115 million after further adjusting for approximately $6 million in stock-based compensation expense). In addition, we expect to report that, as of November 30, 2012, we had cash and cash equivalents of between $155 million and $165 million and net debt of between $80 million and $90 million. We also expect to report that, as of November 30, 2012, Aerojet’s total contract backlog (funded and unfunded) was between $1,518 million and $1,533 million, its funded backlog was between $1,010 million and $1,025 million, and its contract awards were between $1,074 million and $1,104 million.

In addition, we expect that a decline in the discount rate used to measure pension liabilities from our fiscal year-end 2011 to our fiscal year-end 2012 will result in a significant increase in the unfunded pension obligation for our “tax-qualified” defined benefit pension plan. Based on our preliminary results, we currently estimate the unfunded pension obligation for our pension plan to be between $450 million and $500 million as of November 30, 2012 with total defined benefit pension assets of between $1,175 million and $1,275 million as of such date. However, as a result of the Moving Ahead for Progress in the 21st Century Act (“MAP-21”), which was signed into law on July 6, 2012 and provides temporary relief for employers who sponsor defined benefit pension plans, we do not expect to make any cash contributions to our “tax-qualified” defined benefit pension plan until fiscal 2015 or later. In addition, under the Office of Federal Procurement Policy rules, we will recover portions of any required pension funding through our government contracts and we estimate that approximately 84% of our unfunded pension obligation as of November 30, 2012 is related to our government contracting business.

The above amounts are subject to the finalization of our fourth quarter and fiscal year ended November 30, 2012 results. Because of the recent conclusion of the quarter ended November 30, 2012, this information is, by necessity, preliminary in nature and based only upon preliminary information available to us as of the date of this offering memorandum. The above preliminary financial data have been prepared by, and are the responsibility of, our management. PricewaterhouseCoopers LLP, our independent registered public accounting firm, has not audited, reviewed, compiled or performed any procedures with respect to such preliminary financial data. Accordingly, PricewaterhouseCoopers LLP does not express an opinion or any other form of assurance with respect thereto. Investors should exercise caution in relying on this information and should not draw any inferences from this information regarding financial or operating data not provided or our performance in future periods.

12

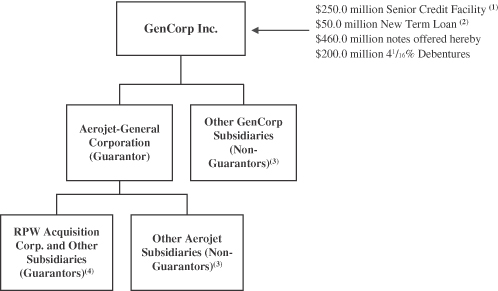

Summary Corporate Organization

The following chart summarizes our organizational structure and our principal outstanding debt obligations after giving effect to the Transactions, which include the Acquisition and the issuance and sale of the Notes offered hereby, as well as the applicable obligors under the Notes offered hereby.

All entities shown below are 100% wholly owned unless otherwise indicated. For a summary of debt obligations identified in this diagram, please see “Description of Notes” and “Description of Other Indebtedness.”

| (1) | Includes (i) a revolving credit facility in an aggregate principal amount of up to $150.0 million (with a $100.0 million subfacility for standby letters of credit and a $5.0 million subfacility for swingline loans), of which $44.8 million in letters of credit was outstanding as of August 31, 2012, (ii) a term loan in an aggregate principal amount of $50.0 million, of which $48.1 million was outstanding as of August 31, 2012 and (iii) an incremental facility in an aggregate principal amount of up to $50.0 million for increases in revolving credit facility or term loan borrowings, none of which was outstanding as of August 31, 2012. Does not include $50.0 million in a delayed draw term loan under the Senior Credit Facility in respect of the New Term Loan (see Footnote 2). |

| (2) | Represents the full principal amount of the delayed draw term loan under the Senior Credit Facility. |

| (3) | Represents subsidiaries of GenCorp and Aerojet that will not guarantee our obligations under the notes, including Easton Development Company, LLC, which is 95% owned by GenCorp Inc. and 5% owned by Aerojet. After giving effect to the Transactions, including this offering and the use of proceeds therefrom as described under the caption “Use of Proceeds,” on a pro forma basis, our non-guarantor subsidiaries would have generated approximately 2% of our net sales for the twelve months ended August 31, 2012, and would have accounted for approximately 3% of our total assets, excluding all intercompany balances, and 1% of our total liabilities as of August 31, 2012. |

| (4) | Includes Pratt & Whitney Rocketdyne, Inc. and P&W Power Generation, Inc. |

Our principal executive offices are located at 2001 Aerojet Road, Rancho Cordova, CA 95742. Our mailing address is P.O. Box 537012, Sacramento, CA 95853-7012 and our telephone number is (916) 355-4000. Our common stock is listed on the New York Stock Exchange and the Chicago Stock Exchange under the symbol “GY.” We maintain a website at www.gencorp.com; however, the information on our website is not part of this offering memorandum.

13

Summary Unaudited Pro Forma Financial Information

The following summary unaudited pro forma condensed combined financial information was derived from the unaudited pro forma condensed combined financial information included elsewhere in this offering memorandum. The unaudited pro forma condensed combined financial information is based on the historical financial statements of GenCorp and Rocketdyne after giving effect to the Transactions and the assumptions and adjustments described in the accompanying notes to the unaudited pro forma condensed combined financial information included elsewhere in this offering memorandum. See “Unaudited Pro Forma Condensed Combined Financial Information.”

GenCorp and Rocketdyne have different fiscal year ends and have different interim period ending dates for each quarter. GenCorp’s fiscal year ends on November 30 while Rocketdyne’s fiscal year ends on December 31. The unaudited pro forma condensed combined balance sheet data as of August 31, 2012 gives effect to the Transactions as if they had occurred on August 31, 2012. The unaudited pro forma condensed combined statement of operations for the fiscal year ended November 30, 2011 and the nine months ended August 31, 2012 and August 31, 2011 give effect to the Transactions as if they had occurred on December 1, 2010, the first day of GenCorp’s 2011 fiscal year.

The unaudited pro forma condensed combined balance sheet data as of August 31, 2012 combines the unaudited historical balance sheet of GenCorp as of August 31, 2012 and the unaudited historical balance sheet of Rocketdyne as of September 30, 2012. The unaudited pro forma condensed combined statement of operations for the fiscal year ended November 30, 2011 combines the audited historical results of GenCorp for the fiscal year ended November 30, 2011 and the audited historical results of Rocketdyne for fiscal year ended December 30, 2011. The unaudited pro forma condensed combined statement of operations for the nine months ended August 31, 2012 and August 31, 2011 combines the unaudited historical results of GenCorp for the nine months ended August 31, 2012 and August 31, 2011 and the unaudited historical results of Rocketdyne for the nine months ended September 30, 2012 and September 30, 2011. The unaudited pro forma financial information presented for the twelve months ended August 31, 2012 has been derived by taking the unaudited pro forma condensed combined statement of operations for the fiscal year ended November 30, 2011, less the unaudited pro forma condensed combined statement of operations for the nine months ended August 31, 2011, plus the unaudited pro forma condensed combined statement of operations for the nine months ended August 31, 2012.

The summary unaudited pro forma condensed combined financial information is based on estimates and assumptions that we believe are reasonable; however, we can provide no assurance that the estimates and assumptions used in the preparation of the unaudited pro forma condensed combined financial information are correct. These estimates and assumptions are preliminary and may change materially between the date of this offering memorandum and the consummation of the Transactions. The unaudited pro forma condensed combined financial information is for informational purposes only and does not purport to represent what GenCorp’s results of operations or financial data would actually have been had the Transactions occurred on the dates specified, nor does it purport to project our results of operations or financial position for any future period or at any future date. We therefore caution you not to place undue reliance on the summary unaudited pro forma condensed combined financial information.

14

The following summary unaudited pro forma condensed combined financial information should be read in conjunction with “—The Transactions,” “Unaudited Pro Forma Condensed Combined Financial Statements,” “Selected Historical Consolidated Financial and Other Data—GenCorp Selected Historical and Other Financial Data,” “Selected Historical Consolidated Financial and Other Data—Rocketdyne Selected Historical and Other Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations—GenCorp,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Rocketdyne” and GenCorp’s and Rocketdyne’s historical consolidated financial statements and the related notes thereto included elsewhere or incorporated by reference in this offering memorandum.

| Pro Forma Year Ended November 30, |

Pro Forma Nine Months Ended August 31, |

Pro Forma Twelve Months Ended August 31, |

||||||||||||||

| 2011 | 2011 | 2012 | 2012 | |||||||||||||

| (Unaudited) | ||||||||||||||||

| (in millions) | ||||||||||||||||

| Net sales |

$ | 1,541.9 | $ | 1,117.1 | $ | 1,195.0 | $ | 1,619.8 | ||||||||

| Operating costs and expenses: |

||||||||||||||||

| Cost of sales (exclusive of items shown separately below) |

1,283.9 | 923.9 | 1,007.5 | 1,367.5 | ||||||||||||

| Selling, general and administrative |

74.9 | 55.9 | 60.0 | 79.0 | ||||||||||||

| Depreciation and amortization |

57.5 | 42.6 | 40.5 | 55.4 | ||||||||||||

| Other expense, net(1) |

10.5 | 1.9 | 10.4 | 19.0 | ||||||||||||

| Goodwill impairment |

279.0 | — | — | 279.0 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| 1,705.8 | 1,024.3 | 1,118.4 | 1,799.9 | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating (loss) income |

(163.9 | ) | 92.8 | 76.6 | (180.1 | ) | ||||||||||

| Non-operating (income) expense: |

||||||||||||||||

| Interest expense |

69.0 | 52.1 | 44.6 | 61.5 | ||||||||||||

| Interest income |

(1.0 | ) | (0.8 | ) | (0.5 | ) | (0.7 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total non-operating expense, net |

68.0 | 51.3 | 44.1 | 60.8 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (Loss) income from continuing operations before income taxes |

(231.9 | ) | 41.5 | 32.5 | (240.9 | ) | ||||||||||

| Income tax (benefit) provision |

(84.2 | ) | 16.9 | 15.2 | (85.9 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| (Loss) income from continuing operations |

$ | (147.7 | ) | $ | 24.6 | $ | 17.3 | $ | (155.0 | ) | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Other Data: |

||||||||||||||||

| Pro Forma Adjusted EBITDA(2) |

$ | 233.8 | $ | 176.9 | $ | 159.6 | $ | 216.5 | ||||||||

| Balance Sheet Data (at end of period): |

||||||||||||||||

| Cash, cash equivalents and marketable securities |

$ | 112.6 | ||||||||||||||

| Property, plant and equipment, net |

294.1 | |||||||||||||||

| Total assets |

1,818.7 | |||||||||||||||

| Total debt |

759.4 | |||||||||||||||

| Shareholders’ equity |

16.5 | |||||||||||||||

| Selected Pro Forma Credit Statistics: |

||||||||||||||||

| Net debt(3) |

$ | 646.8 | ||||||||||||||

| Ratio of net debt to Pro Forma Adjusted EBITDA(2)(3) |

3.0 | x | ||||||||||||||

| Net secured debt(4) |

$ | 445.5 | ||||||||||||||

| Ratio of net secured debt to Pro Forma Adjusted EBITDA(2)(3)(4) |

2.1x | |||||||||||||||

| Cash interest expense(5) |

$ | 55.1 | ||||||||||||||

| Ratio of Pro Forma Adjusted EBITDA to cash interest expense(2)(5) |

3.9 | x | ||||||||||||||

15

| (1) | Includes unusual items, which consist primarily of legal matters and debt repurchase and refinance costs. See Note 13 to our audited consolidated financial statements for the fiscal year ended November 30, 2011 and Note 13 to our unaudited condensed consolidated financial statements for the quarterly period ended August 31, 2012, both of which are incorporated by reference in this offering memorandum, as well as the “Management’s Discussion and Analysis of Financial Condition and Results of Operations—GenCorp” section located elsewhere in this offering memorandum, for information on unusual items included in our financial results. |

| (2) | Pro Forma Adjusted EBITDA is defined as Pro Forma Adjusted EBITDAP adjusted for stock-based compensation expense. Pro Forma Adjusted EBITDAP is defined as GAAP income (loss) from continuing operations before income taxes for the periods presented, adjusted by interest expense, interest income, depreciation and amortization and retirement benefit plan expense (pension and postretirement benefits), goodwill impairment and excluding the unusual items referred to in footnote (1) above, in each case, as further adjusted to give effect to the Transactions, including this offering and the application of the net proceeds therefrom as described in “Use of Proceeds,” and the assumptions and adjustments described in the accompanying notes to the unaudited pro forma condensed combined financial information included elsewhere in this offering memorandum. Pro Forma Adjusted EBITDA and Pro Forma Adjusted EBITDAP are non-GAAP measures that are presented in this offering memorandum because we believe it is a useful financial measurement for assessing operating performance as it provides investors with an additional basis to evaluate our performance. In addition, we use this metric to further our understanding of the historical and prospective consolidated core operating performance of our segments, net of expenses incurred by our corporate activities in the ordinary, ongoing and customary course of our operations. Further, we believe that to effectively compare this core operating performance metric from period to period on a historical and prospective basis, the metric should exclude items relating to retirement benefits (pension and postretirement benefits), significant other non-cash expenses, the impacts of financing decisions on the earnings, and items incurred outside the ordinary, ongoing and customary course of our operations. Pro Forma Adjusted EBITDA and Pro Forma Adjusted EBITDAP do not represent, and should not be considered an alternative to, net income, as determined in accordance with GAAP. Pro Forma Adjusted EBITDA and Pro Forma Adjusted EBITDAP as presented in this offering memorandum may not be comparable to other similarly titled measures disclosed by other companies. The following table provides a reconciliation of income (loss) from continuing operations before income taxes, the most directly comparable GAAP measure, to Pro Forma Adjusted EBITDA and Pro Forma Adjusted EBITDAP for the periods presented: |

| Pro Forma Year Ended November 30, |

Pro Forma Nine Months Ended August 31, |

Pro Forma Twelve Months Ended August 31, |

||||||||||||||

| 2011 | 2011 | 2012 | 2012 | |||||||||||||

| (Unaudited) (in millions) |

||||||||||||||||

| (Loss) income from continuing operations before income taxes |

$ | (231.9 | ) | $ | 41.5 | $ | 32.5 | $ | (240.9 | ) | ||||||

| Interest expense |

69.0 | 52.1 | 44.6 | 61.5 | ||||||||||||

| Interest income |

(1.0 | ) | (0.8 | ) | (0.5 | ) | (0.7 | ) | ||||||||

| Depreciation and amortization |

57.5 | 42.6 | 40.5 | 55.4 | ||||||||||||

| Retirement benefit expense |

48.9 | 36.8 | 34.4 | 46.5 | ||||||||||||

| Unusual items |

5.6 | 0.4 | 1.0 | 6.2 | ||||||||||||

| Goodwill impairment |

279.0 | — | — | 279.0 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Pro Forma Adjusted EBITDAP |

$ | 227.1 | $ | 172.6 | $ | 152.5 | $ | 207.0 | ||||||||

| Stock-based compensation expense |

6.7 | 4.3 | 7.1 | 9.5 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Pro Forma Adjusted EBITDA |

$ | 233.8 | $ | 176.9 | $ | 159.6 | $ | 216.5 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

16

| (3) | Net debt is defined as the principal amount of current and long-term debt less cash and cash equivalents, as adjusted to give effect to the Transactions, including this offering and the application of the net proceeds therefrom as described in “Use of Proceeds,” and the assumptions and adjustments described in the accompanying notes to the unaudited pro forma condensed combined financial information included elsewhere in this offering memorandum. Net debt is a non-GAAP measure that is presented in this offering memorandum because we believe it is a useful alternative method of assessing our indebtedness. In addition, we use net debt as a measure of our outstanding debt obligations that would not be readily satisfied by our cash and cash equivalents on hand. The following table sets forth the components of net debt as of the dates presented: |

| Pro Forma As of August 31, |

||||

| 2012 | ||||

| (Unaudited) (in millions) |

||||

| Total debt |

$ | 759.4 | ||

| Cash and cash equivalents |

(112.6 | ) | ||

|

|

|

|||

| Net debt |

$ | 646.8 | ||

|

|

|

|||

| (4) | Net secured debt is defined as “net debt” as defined in footnote (3) above that is secured by a lien on the assets of the Company. |

| (5) | Represents cash interest expense, as adjusted to give effect to the Transactions, including this offering and the application of the net proceeds therefrom as described in “Use of Proceeds,” and the assumptions and adjustments described in the accompanying notes to the unaudited pro forma condensed combined financial information included elsewhere in this offering memorandum. |

17

GenCorp Summary Historical Financial Information

The following table presents summary historical consolidated financial information for GenCorp and its consolidated subsidiaries for the periods indicated. The historical information as of November 30, 2010 and 2011 and for each of the three years in the period ended November 30, 2011 has been derived from, and should be read together with, our audited consolidated financial statements, and the related notes, which are incorporated by reference in this offering memorandum. The historical consolidated financial information as of November 30, 2009 has been derived from portions of our Annual Report on Form 10-K for the year ended November 30, 2010. The summary historical consolidated financial information for GenCorp and its consolidated subsidiaries as of August 31, 2012 and for the nine months ended August 31, 2011 and 2012 has been derived from, and should be read together with, our unaudited condensed combined financial statements and the related notes, which are incorporated by reference in this offering memorandum. The summary historical consolidated financial information as of August 31, 2011 has been derived from portions of our Quarterly Report on Form 10-Q for the fiscal quarter ended August 31, 2011. In the opinion of management, all adjustments considered necessary for a fair presentation of our interim results and financial position have been included in our results and financial position as of August 31, 2011 and 2012 and for the nine months ended August 31, 2011 and 2012. Interim results are not necessarily indicative of the results that can be expected for a full fiscal year. The financial information presented about us for the twelve months ended August 31, 2012 has been derived by taking the historical audited consolidated financial statements for the year ended November 30, 2011, less the historical unaudited consolidated financial statements for the nine months ended August 31, 2011, plus the historical unaudited consolidated financial statements for the nine months ended August 31, 2012. Historical results are not necessarily indicative of the results to be expected for future periods and financial results for the nine month period ended August 31, 2012 are not necessarily indicative of the results that can be expected for the fiscal year ending November 30, 2012.

18

The following summary historical financial information should be read in conjunction with “Selected Historical Consolidated Financial and Other Data—GenCorp Selected Historical and Other Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations—GenCorp” and GenCorp’s historical consolidated financial statements and the related notes thereto incorporated by reference in this offering memorandum.

| Year Ended November 30, |

Nine Months Ended August 31, |

Twelve Months Ended August 31, |

||||||||||||||||||||||

| 2009 | 2010 | 2011 | 2011 | 2012 | 2012 | |||||||||||||||||||

| (Unaudited) | (Unaudited) | |||||||||||||||||||||||

| (in millions, except ratios) | ||||||||||||||||||||||||

| Income Statement Data: |

||||||||||||||||||||||||

| Net sales |

$ | 795.4 | $ | 857.9 | $ | 918.1 | $ | 665.9 | $ | 696.7 | $ | 948.9 | ||||||||||||

| Operating costs and expenses: |

||||||||||||||||||||||||

| Cost of sales (exclusive of items shown separately below) |

674.0 | 753.9 | 799.3 | 581.1 | 608.3 | 826.5 | ||||||||||||||||||

| Selling, general and administrative |

10.2 | 26.7 | 40.9 | 30.0 | 31.9 | 42.8 | ||||||||||||||||||

| Depreciation and amortization |

25.7 | 27.9 | 24.6 | 18.2 | 16.1 | 22.5 | ||||||||||||||||||

| Other expense, net |

2.9 | 8.5 | 8.9 | 6.5 | 10.4 | 12.8 | ||||||||||||||||||

| Unusual items(1) |

4.6 | 3.4 | 5.6 | 0.4 | 5.1 | 10.3 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| 717.4 | 820.4 | 879.3 | 636.2 | 671.8 | 914.9 | |||||||||||||||||||

| Operating income |

78.0 | 37.5 | 38.8 | 29.7 | 24.9 | 34.0 | ||||||||||||||||||

| Non-operating (income) expense: |

||||||||||||||||||||||||

| Interest expense |

38.6 | 37.0 | 30.8 | 23.4 | 16.6 | 24.0 | ||||||||||||||||||

| Interest income |

(1.9 | ) | (1.6 | ) | (1.0 | ) | (0.8 | ) | (0.5 | ) | (0.7 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total non-operating expense, net |

36.7 | 35.4 | 29.8 | 22.6 | 16.1 | 23.3 | ||||||||||||||||||

| Income from continuing operations before income taxes |

41.3 | 2.1 | 9.0 | 7.1 | 8.8 | 10.7 | ||||||||||||||||||

| Income tax provision (benefit) |

(17.6 | ) | (3.9 | ) | 6.1 | 3.4 | 13.8 | 16.5 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income (loss) from continuing operations |

58.9 | 6.0 | 2.9 | 3.7 | (5.0 | ) | (5.8 | ) | ||||||||||||||||

| (Loss) income from discontinued operations, net of income taxes |

(6.7 | ) | 0.8 | — | (1.3 | ) | (0.4 | ) | 0.9 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net income (loss) |

$ | 52.2 | $ | 6.8 | $ | 2.9 | $ | 2.4 | $ | (5.4 | ) | $ | (4.9 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Other Data: |

||||||||||||||||||||||||

| Adjusted EBITDAP(2) |

$ | 96.4 | $ | 110.7 | $ | 115.4 | $ | 83.1 | $ | 76.9 | $ | 109.2 | ||||||||||||

| Adjusted EBITDA(2) |

99.3 | 111.1 | 119.1 | 85.4 | 82.0 | 115.7 | ||||||||||||||||||

| Ratio of net debt to Adjusted EBITDA(2)(3) |

3.1 | x | 1.7 | x | 1.2 | x | 0.8 | x | ||||||||||||||||

| Free cash flow(4) |

36.0 | 131.2 | 55.7 | 38.2 | 44.2 | 61.7 | ||||||||||||||||||

| Capital expenditures |

14.3 | 16.9 | 21.1 | 12.2 | 18.8 | 27.7 | ||||||||||||||||||

| Depreciation and amortization |

25.7 | 27.9 | 24.6 | 18.2 | 16.1 | 22.5 | ||||||||||||||||||

| Net cash provided by operating activities |

50.3 | 148.1 | 76.8 | 50.4 | 63.0 | 89.4 | ||||||||||||||||||

| Net cash (used in) provided by investing activities |

(14.3 | ) | (43.5 | ) | 5.6 | 14.5 | (18.2 | ) | (27.1 | ) | ||||||||||||||

| Net cash (used in) financing activities |

(2.4 | ) | (49.4 | ) | (75.9 | ) | (8.7 | ) | (77.1 | ) | (144.3 | ) | ||||||||||||

| Balance Sheet Data (at end of period): |

||||||||||||||||||||||||

| Cash, cash equivalents and marketable securities |

$ | 126.3 | $ | 208.2 | $ | 188.0 | $ | 237.7 | $ | 155.7 | $ | 155.7 | ||||||||||||

| Property, plant and equipment, net |

129.9 | 126.4 | 126.9 | 124.7 | 133.7 | 133.7 | ||||||||||||||||||

| Total assets |

934.9 | 991.5 | 939.5 | 994.2 | 908.1 | 908.1 | ||||||||||||||||||

| Total debt(5) |

438.6 | 396.7 | 326.4 | 389.0 | 249.4 | 249.4 | ||||||||||||||||||

| Shareholders’ deficit |

(278.9 | ) | (200.2 | ) | (211.6 | ) | (147.9 | ) | (168.4 | ) | (168.4 | ) | ||||||||||||

19

| (1) | Includes legal matters, executive severance costs and debt repurchase and refinance costs. See Note 13 to our audited consolidated financial statements for the fiscal year ended November 30, 2011 and Note 13 to our unaudited condensed consolidated financial statements for the quarterly period ended August 31, 2012, both of which are incorporated by reference in this offering memorandum, as well as the “Management’s Discussion and Analysis of Financial Condition and Results of Operations—GenCorp” section located elsewhere in this offering memorandum, for information on unusual items included in our financial results. |

| (2) | Adjusted EBITDAP is defined as GAAP income (loss) from continuing operations before income taxes for the periods presented, adjusted by interest expense, interest income, depreciation and amortization and retirement benefit plan (income) expense (pension and postretirement benefits), and excluding the unusual items referred to in footnote (1) above. Adjusted EBITDA is defined as Adjusted EBITDAP adjusted for stock-based compensation expense. Adjusted EBITDA and Adjusted EBITDAP are non-GAAP measures that are presented in this offering memorandum because we believe they are useful financial measurements for assessing operating performance as they provide investors with an additional basis to evaluate our performance. In addition, we use these metrics to further our understanding of the historical and prospective consolidated core operating performance of our segments, net of expenses incurred by our corporate activities in the ordinary, ongoing and customary course of our operations. Further, we believe that to effectively compare these core operating performance metrics from period to period on a historical and prospective basis, these metrics should exclude items relating to retirement benefits (pension and postretirement benefits), significant other non-cash expenses, the impacts of financing decisions on the earnings, and items incurred outside the ordinary, ongoing and customary course of our operations. Adjusted EBITDA and Adjusted EBITDAP do not represent, and should not be considered an alternative to, net income, as determined in accordance with GAAP. Adjusted EBITDA and Adjusted EBITDAP as presented in this offering memorandum may not be comparable to other similarly titled measures disclosed by other companies. The following table provides a reconciliation of income (loss) from continuing operations before income taxes, the most directly comparable GAAP measure, to Adjusted EBITDA and Adjusted EBITDAP for the periods presented: |

| Year Ended November 30, |

Nine Months Ended August 31, |

Twelve Months Ended August 31, |

||||||||||||||||||||||

| 2009 | 2010 | 2011 | 2011 | 2012 | 2012 | |||||||||||||||||||

| (Unaudited) | (Unaudited) | |||||||||||||||||||||||

| (in millions) | ||||||||||||||||||||||||

| Income from continuing operations before income taxes |

$ | 41.3 | $ | 2.1 | $ | 9.0 | $ | 7.1 | $ | 8.8 | $ | 10.7 | ||||||||||||

| Interest expense |

38.6 | 37.0 | 30.8 | 23.4 | 16.6 | 24.0 | ||||||||||||||||||

| Interest income |

(1.9 | ) | (1.6 | ) | (1.0 | ) | (0.8 | ) | (0.5 | ) | (0.7 | ) | ||||||||||||

| Depreciation and amortization |

25.7 | 27.9 | 24.6 | 18.2 | 16.1 | 22.5 | ||||||||||||||||||

| Retirement benefit (income) expense |

(11.9 | ) | 41.9 | 46.4 | 34.8 | 30.8 | 42.4 | |||||||||||||||||

| Unusual items |

4.6 | 3.4 | 5.6 | 0.4 | 5.1 | 10.3 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Adjusted EBITDAP |

$ | 96.4 | $ | 110.7 | $ | 115.4 | $ | 83.1 | $ | 76.9 | $ | 109.2 | ||||||||||||

| Stock-based compensation expense |

2.9 | 0.4 | 3.7 | 2.3 | 5.1 | 6.5 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Adjusted EBITDA |

$ | 99.3 | $ | 111.1 | $ | 119.1 | $ | 85.4 | $ | 82.0 | $ | 115.7 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

20

| (3) | Net debt is defined as the principal amount of current and long-term debt less cash and cash equivalents and marketable securities. Net debt is a non-GAAP measure that is presented in this offering memorandum because we believe it is a useful alternative method of assessing our indebtedness. In addition, we use net debt as a measure of our outstanding debt obligations that would not be readily satisfied by our cash and cash equivalents on hand. The following table sets forth the components of net debt as of the dates presented: |

| As of November 30, | As of August 31, | |||||||||||||||||||

| 2009 | 2010 | 2011 | 2011 | 2012 | ||||||||||||||||

| (Unaudited) | ||||||||||||||||||||

| (in millions) | ||||||||||||||||||||

| Total debt (excluding debt discount) |

$ | 438.6 | $ | 396.7 | $ | 326.4 | $ | 389.0 | $ | 249.4 | ||||||||||

| Cash and cash equivalents |

(126.3 | ) | (181.5 | ) | (188.0 | ) | (237.7 | ) | (155.7 | ) | ||||||||||

| Marketable securities |

— | (26.7 | ) | — | — | — | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net debt |

$ | 312.3 | $ | 188.5 | $ | 138.4 | $ | 151.3 | $ | 93.7 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||