Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - REVA Medical, Inc. | d463847d8k.htm |

Exhibit 99.1

| J.P. Morgan 2013 Healthcare Conference January 10, 2013 |

| Important Notice Not an Offer for Securities This presentation has been prepared by REVA Medical, Inc. ("REVA" or the "Company") solely for its use at presentations to be made by the Company. This presentation does not constitute an offer, invitation, solicitation or recommendation with respect to the purchase or sale of any security in the Company nor does it constitute financial product advice nor take into account your investment objectives, taxation situation, financial situation or needs. An investor must not act on the basis of any matter contained in this presentation but must make its own assessment of the Company and conduct its own investigations and analysis. Information is a Synopsis Only This presentation only contains a synopsis of information on the Company and accordingly no reliance may be placed for any purpose whatsoever on the sufficiency or completeness of such information The information presented in this presentation is subject to change without notice and the Company does not have any responsibility or obligation to inform you of any matter arising or coming to their notice, after the date of this presentation, which may affect any matter referred to in this presentation. Currency References Financial amounts in this presentation are expressed in US Dollars, except where specifically noted. Forward-Looking Statements This presentation contains or may contain forward-looking statements that are based on management's beliefs, assumptions and expectations and on information currently available to management. All statements that are not historical, including those statements that address future operating performance and events or developments that we expect or anticipate will occur in the future, are forward-looking statements. You should not place undue reliance on these forward-looking statements. Although management believes these forward-looking statements are reasonable as and when made, forward-looking statements are subject to a number of risks and uncertainties that may cause our actual results to vary materially from those expressed in the forward-looking statements, including our ability to obtain the regulatory approvals required to market our ReZolve? scaffold, our ability to timely and successfully complete our clinical trials, our ability to protect our intellectual property position, our ability to commercialize our products if and when approved, our ability to develop and commercialize new products, and our estimates regarding our capital requirements and financial performance, including profitability. Other risks and uncertainties that may cause our actual results to vary materially from any forward-looking statements are described in the "Risk Factors" section of our Annual Report on Form 10-K filed with the United States Securities and Exchange Commission (the "SEC") on February 28, 2012. We may update our risk factors from time to time in our periodic reports or other current reports filed with the SEC. Any forward-looking statements in this announcement speak only as of the date when made. REVA does not assume any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise. Disclaimer This presentation has been prepared by the Company based on information that is available to it. The information contained in this presentation is an overview and does not contain all information necessary to make an investment decision. Although reasonable care has been taken to ensure that the facts stated in this presentation are accurate and that the opinions expressed are fair and reasonable, no representation or warranty, express or implied, is made as to the fairness, accuracy, completeness or correctness of the information and opinions contained in this presentation and no reliance should be placed on such information or opinions. To the maximum extent permitted by law, none of the Company, or any of its members, directors, officers, employees or agents, advisers nor any other person accepts any liability whatsoever for any loss, however arising, from the use of the presentation or its contents or otherwise arising in connection with it, including, without limitation, any liability arising from fault or negligence on the part of the Company or any of its directors, officers, employees or agents. |

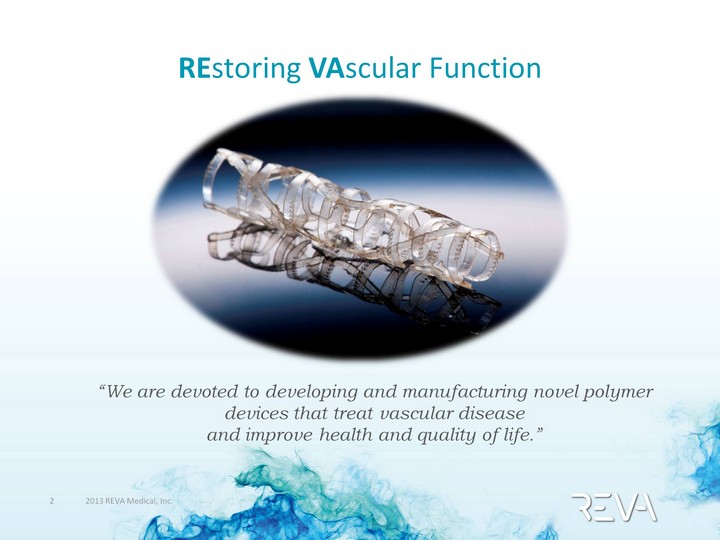

| REstoring VAscular Function "We are devoted to developing and manufacturing novel polymer devices that treat vascular disease and improve health and quality of life." |

| Highlights A$85 million IPO in December 2010 Provided capital to commercialization/CE Mark Near-term milestones and path to market Pilot trial initiated December 2011 CE Marking anticipated late 2014; sales in EU after approval Distribution option with Boston Scientific Highly experienced management team, board and investors CEO and COO monetized six previous companies Investors include Brookside, Cerberus, Domain, Elliott, Saints, Visium Medtronic owns ~8%; prior financial support from Boston Scientific |

| Relationship with Boston Scientific Boston invested $25 million 2004 through 2006 Investment sold to Saints following Guidant acquisition Option to acquire lapsed, replaced by distribution option Parties may negotiate distribution terms in future Transfer price established at 50% of ASP |

| Leading the Way in Coronary Stent Technology REVA's drug-eluting bioresorbable scaffold potentially offers significant benefits for patients Answers a 25-year need Allows natural healing and may reduce long-term drug therapy $4.6 billion* annual worldwide market needs next major advance Abbott is market "bow wave" - investing heavily, demonstrating clinical success, proving safety, establishing market REVA commenced a pilot clinical study in December 2011 RESTORE II trial planned for 2013 * JP Morgan Interventional Cardiology Market Model, Feb 2012 |

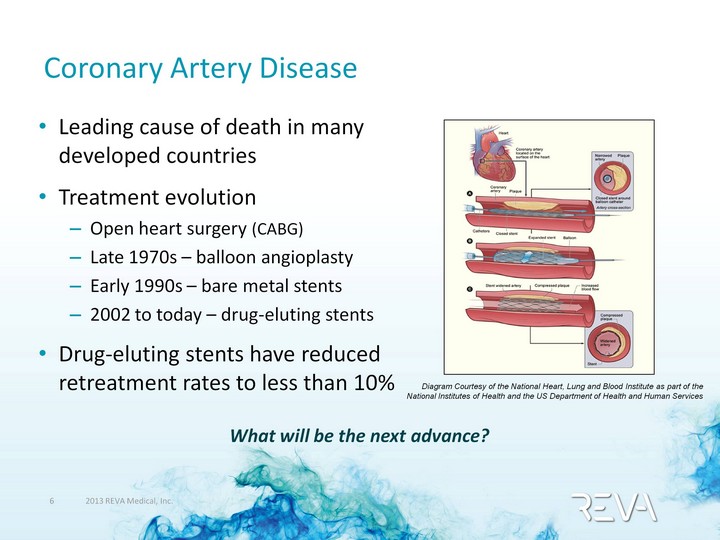

| Coronary Artery Disease Leading cause of death in many developed countries Treatment evolution Open heart surgery (CABG) Late 1970s - balloon angioplasty Early 1990s - bare metal stents 2002 to today - drug-eluting stents Drug-eluting stents have reduced retreatment rates to less than 10% Diagram Courtesy of the National Heart, Lung and Blood Institute as part of the National Institutes of Health and the US Department of Health and Human Services What will be the next advance? |

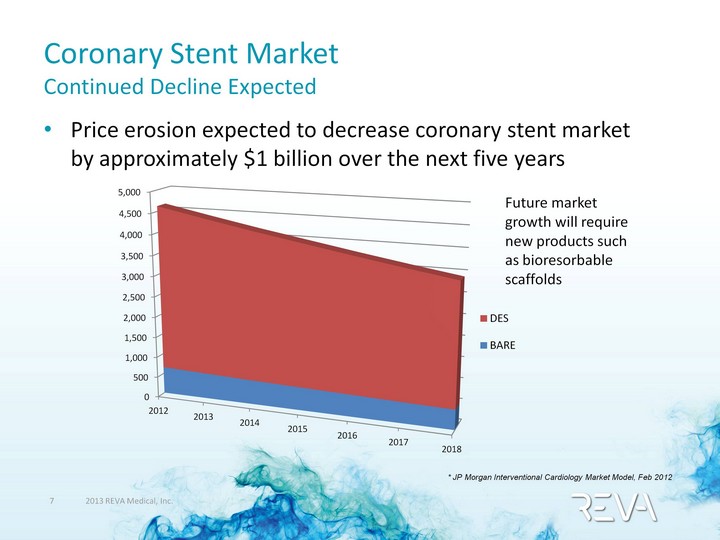

| Coronary Stent Market Continued Decline Expected Price erosion expected to decrease coronary stent market by approximately $1 billion over the next five years Future market growth will require new products such as bioresorbable scaffolds (CHART) * JP Morgan Interventional Cardiology Market Model, Feb 2012 |

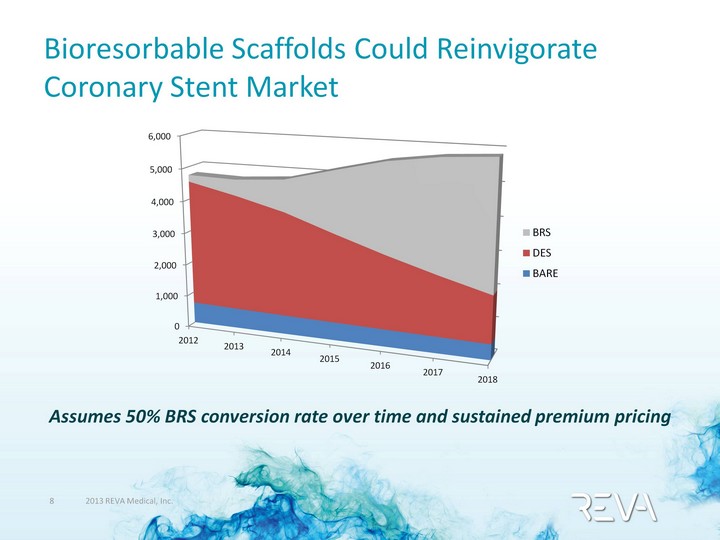

| Bioresorbable Scaffolds Could Reinvigorate Coronary Stent Market Assumes 50% BRS conversion rate over time and sustained premium pricing (CHART) |

| The Appeal of a Bioresorbable Scaffold Restores natural movement of the artery May reduce or eliminate blood clots associated with permanent stents May reduce the need for anti-clotting drugs May delay/stop disease progression Enables easier post-treatment options like CABG Appealing for younger patients A permanently caged vessel is not ideal |

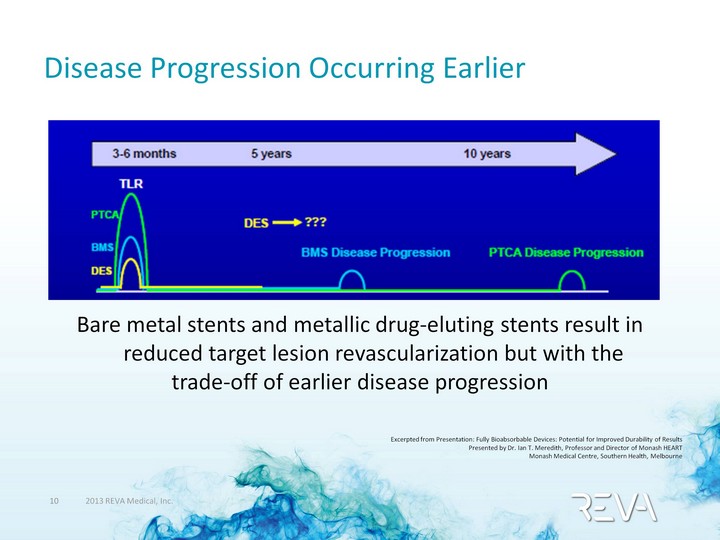

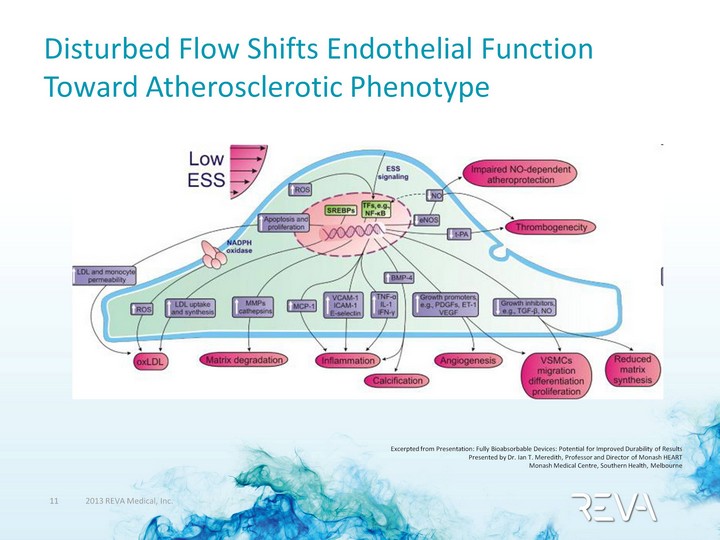

| Disease Progression Occurring Earlier Bare metal stents and metallic drug-eluting stents result in reduced target lesion revascularization but with the trade-off of earlier disease progression Excerpted from Presentation: Fully Bioabsorbable Devices: Potential for Improved Durability of Results Presented by Dr. Ian T. Meredith, Professor and Director of Monash HEART Monash Medical Centre, Southern Health, Melbourne |

| Disturbed Flow Shifts Endothelial Function Toward Atherosclerotic Phenotype Excerpted from Presentation: Fully Bioabsorbable Devices: Potential for Improved Durability of Results Presented by Dr. Ian T. Meredith, Professor and Director of Monash HEART Monash Medical Centre, Southern Health, Melbourne |

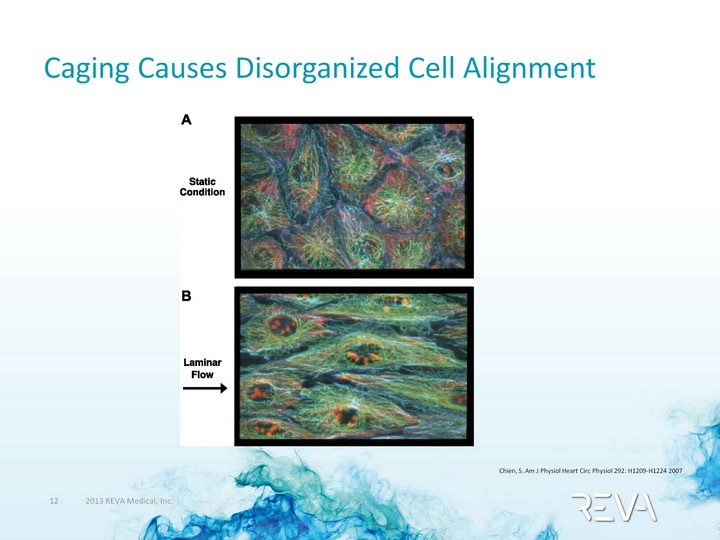

| Caging Causes Disorganized Cell Alignment Chien, S. Am J Physiol Heart Circ Physiol 292: H1209-H1224 2007 |

| ReZolve(r) Scaffold Sirolimus-Eluting (80?g) Radiopaque Unique Slide & Lock Design Strong and Resilient Polymer |

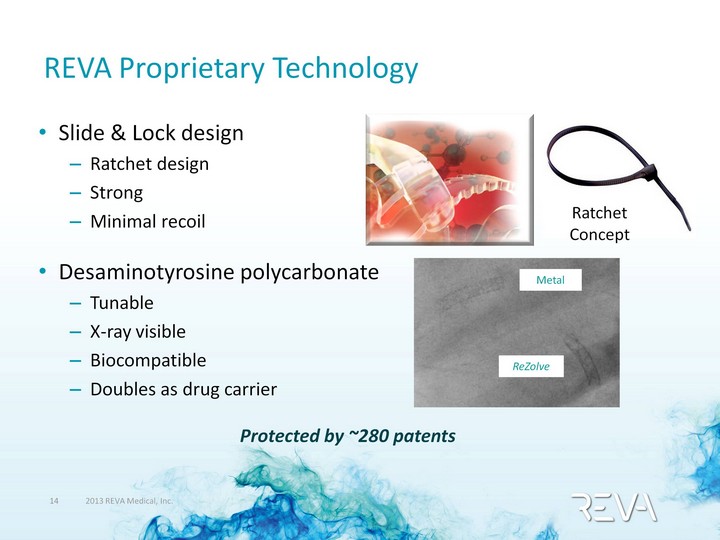

| REVA Proprietary Technology Slide & Lock design Ratchet design Strong Minimal recoil Desaminotyrosine polycarbonate Tunable X-ray visible Biocompatible Doubles as drug carrier Ratchet Concept Metal ReZolve Protected by ~280 patents |

| ReZolve(r) Struts Resorb Over Time 36 Months 6 Months |

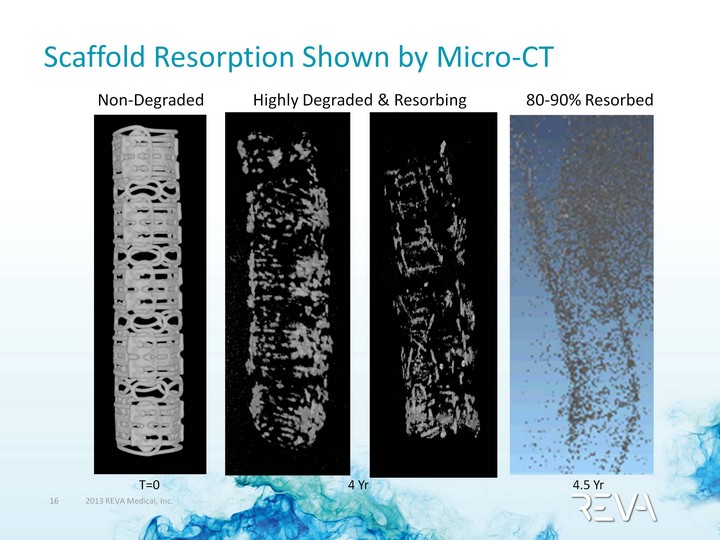

| Scaffold Resorption Shown by Micro-CT Non-Degraded 80-90% Resorbed Highly Degraded & Resorbing T=0 4.5 Yr 4 Yr |

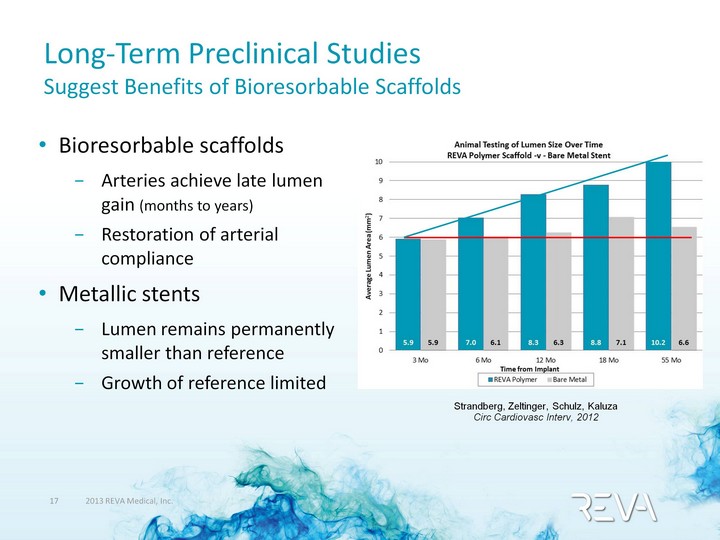

| Long-Term Preclinical Studies Suggest Benefits of Bioresorbable Scaffolds Bioresorbable scaffolds Arteries achieve late lumen gain (months to years) Restoration of arterial compliance Metallic stents Lumen remains permanently smaller than reference Growth of reference limited Strandberg, Zeltinger, Schulz, Kaluza Circ Cardiovasc Interv, 2012 |

| RESTORE Clinical Trial |

| RESTORE Clinical Trial Initiated December 2011 26 patients enrolled 10 sites in Brazil & Europe Principal Investigator Dr. Alexandre Abizaid Primary endpoint(s): Freedom from ischemic-driven target lesion revascularization at 6 months Quantitative measurements at 12 months (QCA/IVUS) |

| Clinical Case Examples |

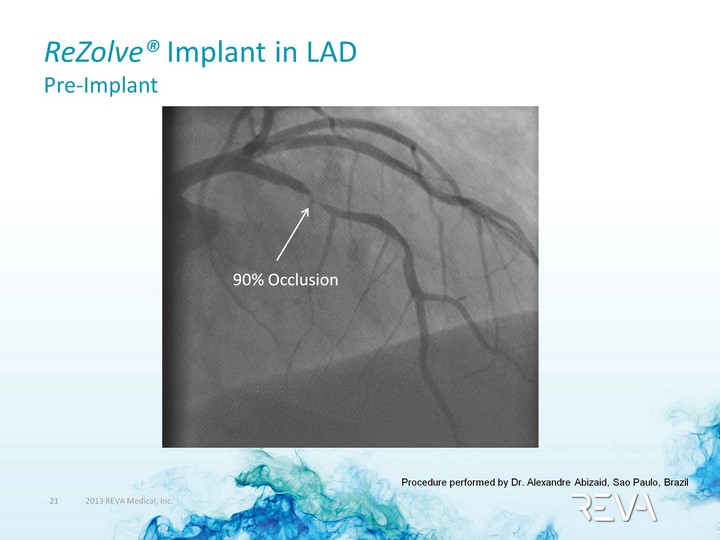

| ReZolve(r) Implant in LAD Pre-Implant 90% Occlusion Procedure performed by Dr. Alexandre Abizaid, Sao Paulo, Brazil |

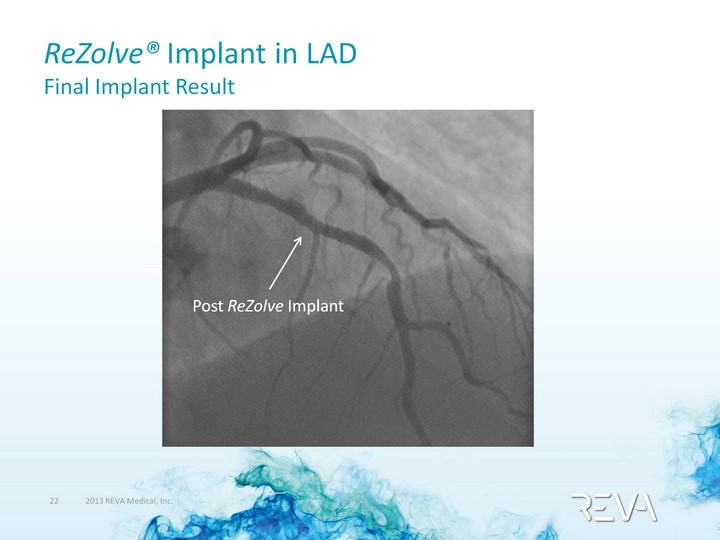

| ReZolve(r) Implant in LAD Final Implant Result Post ReZolve Implant |

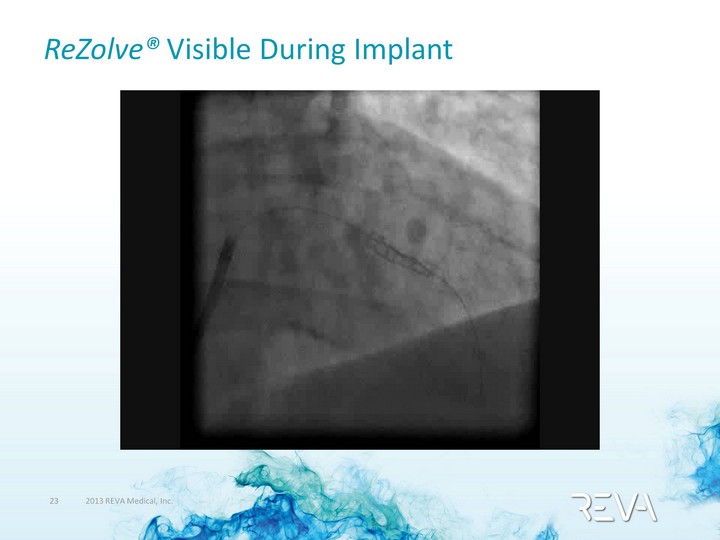

| ReZolve(r) Visible During Implant |

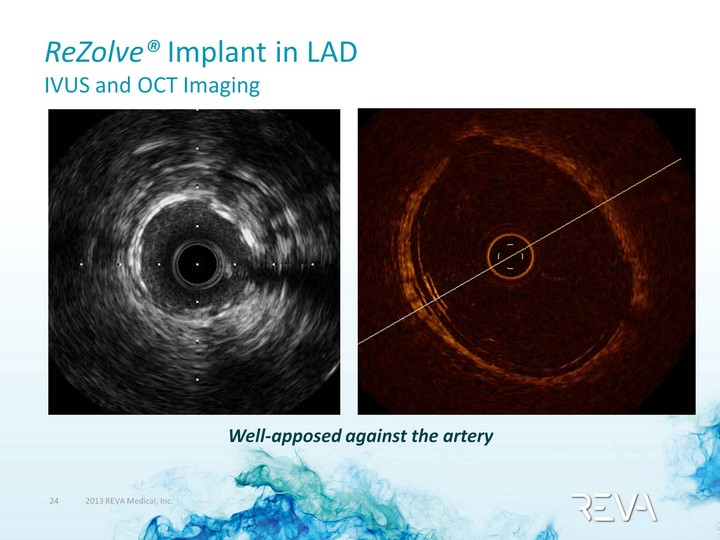

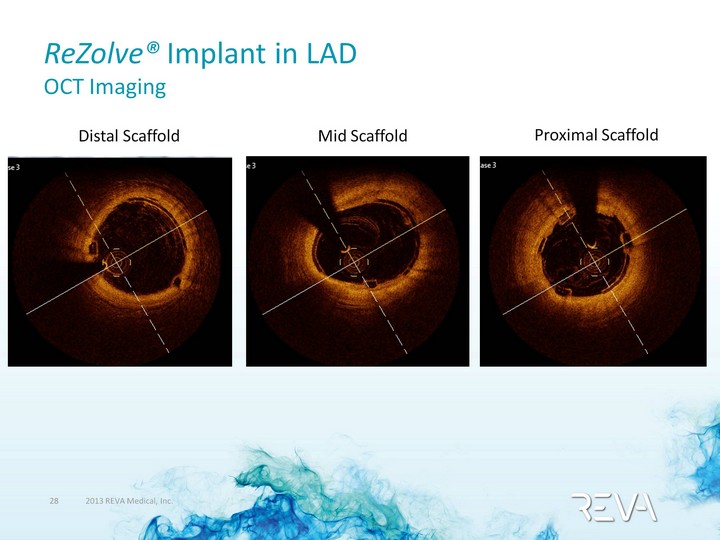

| ReZolve(r) Implant in LAD IVUS and OCT Imaging Well-apposed against the artery |

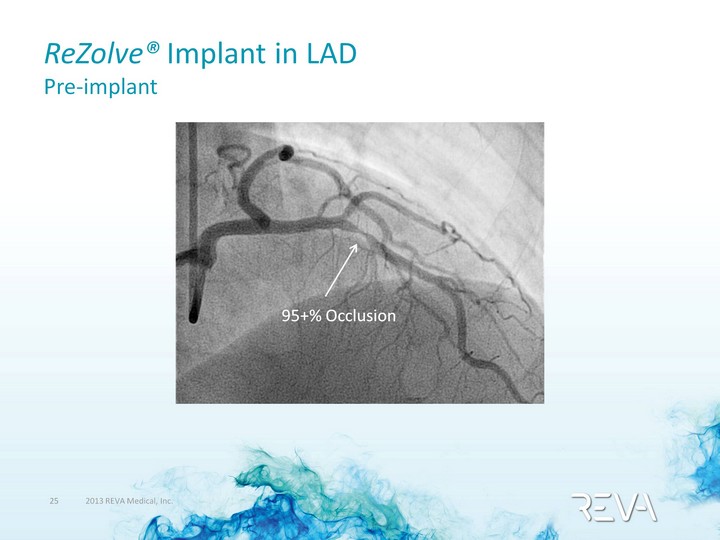

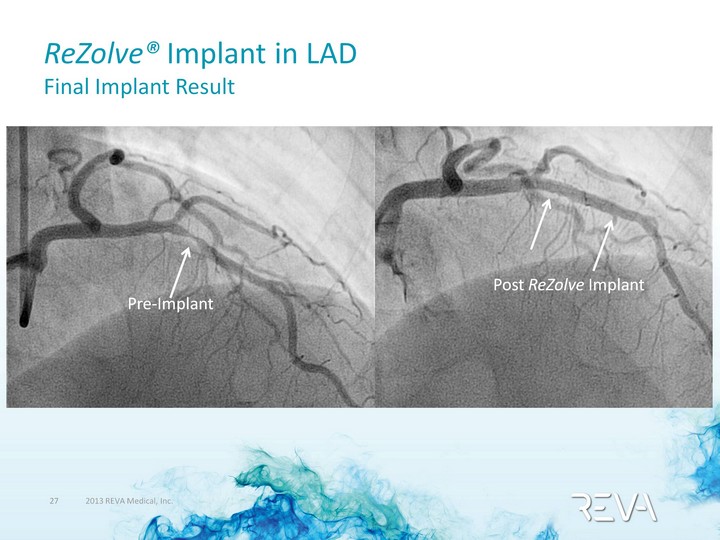

| ReZolve(r) Implant in LAD Pre-implant 90% Occlusion 95+% Occlusion |

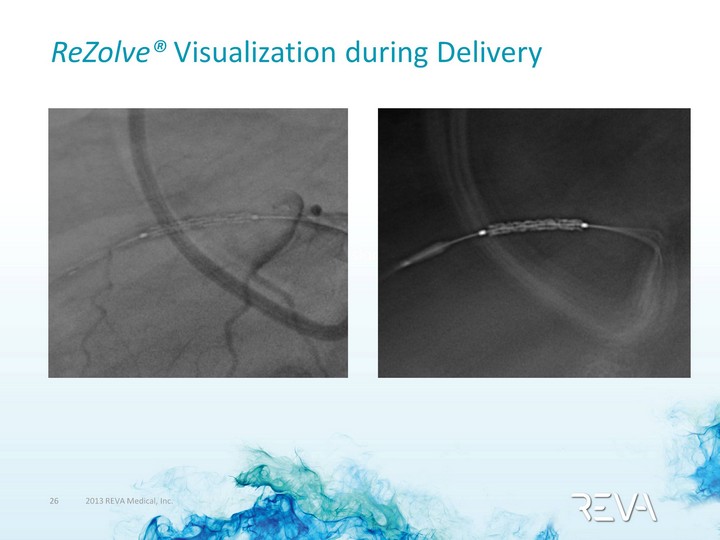

| ReZolve(r) Visualization during Delivery 90% Occlusion 95+% Occlusion |

| ReZolve(r) Implant in LAD Final Implant Result Post ReZolve Implant Pre-Implant |

| ReZolve(r) Implant in LAD OCT Imaging Distal Scaffold Mid Scaffold Proximal Scaffold |

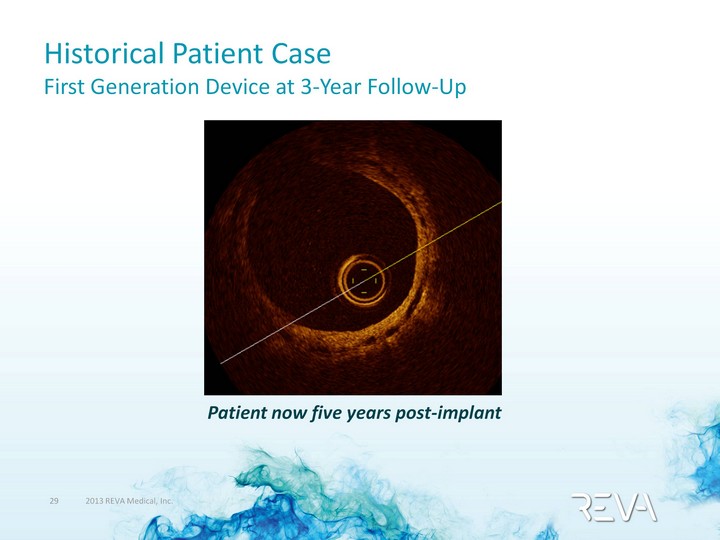

| Historical Patient Case First Generation Device at 3-Year Follow-Up Patient now five years post-implant |

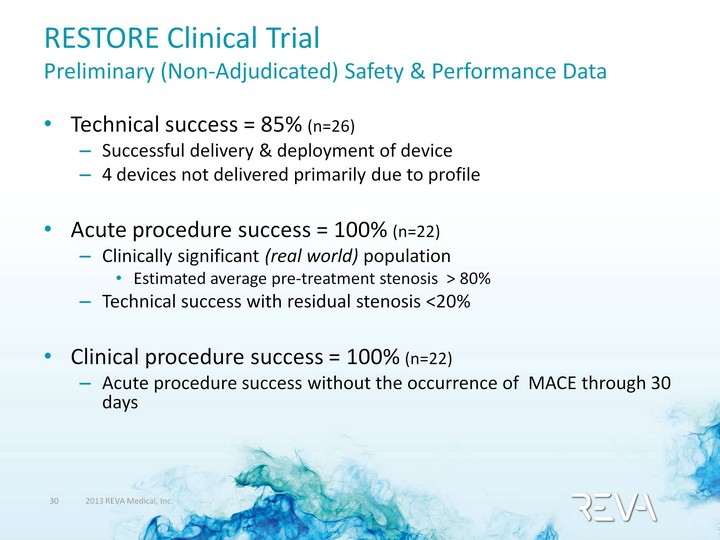

| RESTORE Clinical Trial Preliminary (Non-Adjudicated) Safety & Performance Data Technical success = 85% (n=26) Successful delivery & deployment of device 4 devices not delivered primarily due to profile Acute procedure success = 100% (n=22) Clinically significant (real world) population Estimated average pre-treatment stenosis > 80% Technical success with residual stenosis <20% Clinical procedure success = 100% (n=22) Acute procedure success without the occurrence of MACE through 30 days |

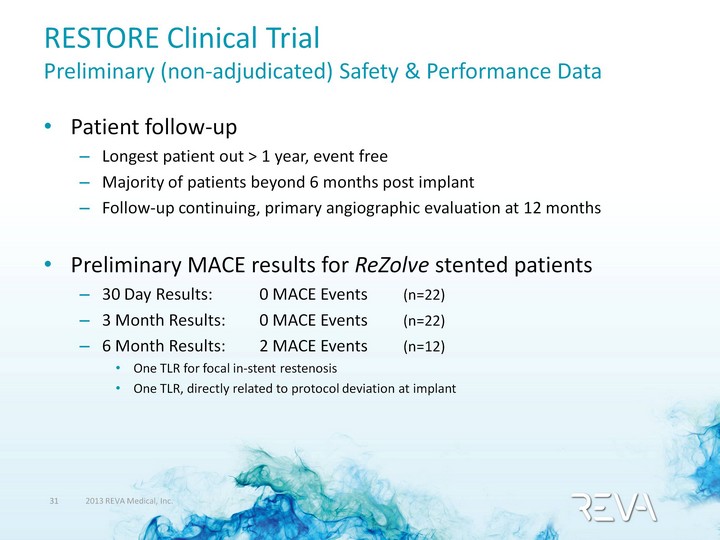

| RESTORE Clinical Trial Preliminary (non-adjudicated) Safety & Performance Data Patient follow-up Longest patient out > 1 year, event free Majority of patients beyond 6 months post implant Follow-up continuing, primary angiographic evaluation at 12 months Preliminary MACE results for ReZolve stented patients 30 Day Results: 0 MACE Events (n=22) 3 Month Results: 0 MACE Events (n=22) 6 Month Results: 2 MACE Events (n=12) One TLR for focal in-stent restenosis One TLR, directly related to protocol deviation at implant |

| RESTORE Clinical Trial Observations Acute result: all patients have widely patent arteries Scaffold is fully visible during procedure ReZolve deployed with continuous inflation pressure Sheathed system limited deliverability to small and tortuous arteries Therefore... |

| ReZolve(r)2 Lower profile (6 Fr.) 20% reduction in profile No sheath No distal cone for sheath support Improved scaffold retention Enhanced polymer formulation Approx. 30% increase in radial strength Go-To-Market Product ReZolve (1.83 mm undeployed) ReZolve2 (1.47 mm undeployed) |

| ReZolve(r)2 Animation |

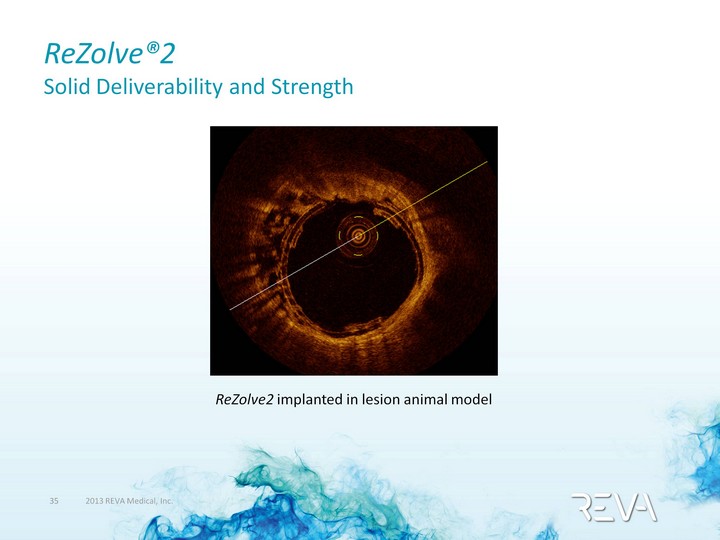

| ReZolve(r)2 Solid Deliverability and Strength ReZolve2 implanted in lesion animal model |

| RESTORE II Trial Multi-center global trial Up to 30 sites in Brazil, Europe, Australia and New Zealand Enrollment planned to begin early 2013 Broadened inclusion criteria Additional sizes (diameter/length) Up to 125 patients Lower profile (6 Fr.) ReZolve2 system |

| Thank you |