Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ModivCare Inc | d462853d8k.htm |

Exhibit 99.1

Providence Services Corporation Human services without walls NASDAQ: PRSC January 2013

Safe Harbor Certain statements made in this presentation, such as any statements about Providence’s confidence or strategies or its expectations about revenues, results of operations, profitability, earnings per share, contracts, collections, award of contracts, acquisitions and related growth, growth resulting from initiatives in certain states, effective tax rate or market opportunities, constitute “forward-looking statements” within the meaning of the private Securities Litigation Reform Act of 1995. Such forward-looking statements involve a number of known and unknown risks, uncertainties and other factors which may cause Providence’s actual results or achievements to be materially different from those expressed or implied by such forward-looking statements. These factors include, but are not limited to, reliance on government-funded contracts, risks associated with government contracting, risks involved in managing government business, legislative or policy changes, challenges resulting from growth or acquisitions, adverse media and legal, economic and other risks detailed in Providence’s filings with the Securities and Exchange Commission. Words such as “believe,” “demonstrate,” “continue,” “expect,” “estimate,” “forecast,” “anticipate,” “should,” “potential,” and “likely” and similar expressions identify forward-looking statements. Readers are cautioned not to place undue reliance on those forward-looking statements, which speak only as of the date the statement was made. No inference should be drawn that Providence undertakes any obligation to update any forward-looking statement contained herein.

Positioned for a Changing Healthcare Environment Leading provider home and community based social services; transportation services management History delivering cost savings, improved efficiency and effectiveness for government social programs Favorable healthcare trends Affordable Care Act increases Medicaid population Integrated Healthcare, Dual Eligibles and Accountable Care Organization (ACO) Model Restructured management team committed to deliver improved shareholder value: operating efficiencies organic growth acquisitive growth performance driven management

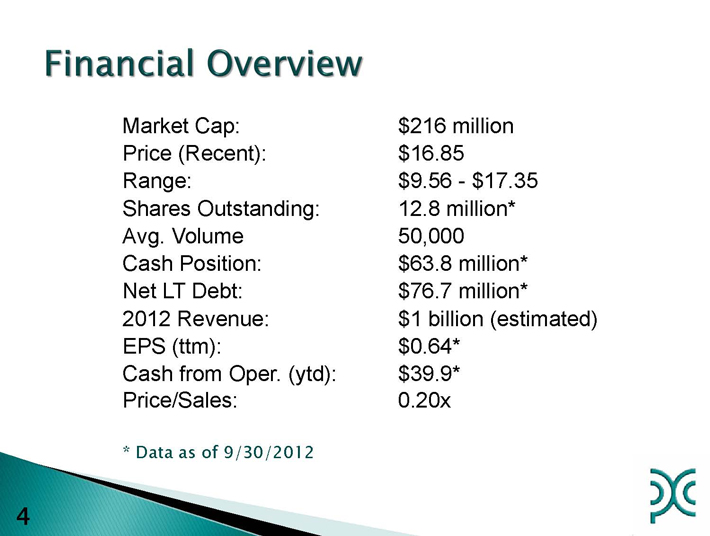

Financial Overview

Market Cap: $216 million

Price (Recent): $16.85

Range: $9.56—$17.35

Shares Outstanding: 12.8 million*

Avg. Volume 50,000

Cash Position: $63.8 million*

Net LT Debt: $76.7 million*

2012 Revenue: $1 billion (estimated)

EPS (ttm): $0.64*

Cash from Oper. (ytd): $39.9*

Price/Sales: 0.20x

| * |

Data as of 9/30/2012 |

Providence Today Tackling two of the most challenging pieces of the Medicaid benefit, transportation and mental health Social Services .Home and community based .Counseling, psychiatric services, case management, substance abuse treatment, school-based services, private probation, workforce development/job training, foster care and developmental disabilities .Payers primarily state Medicaid programs, local government agencies Non-Emergency Transportation (NET) Services .Innovative solutions for health care recipients’ transportation needs .Develops, manages transportation networks and reduces cost, risk for fraud and abuse .Utilizes centralized call processing, proprietary technologies .Payers include state Medicaid programs, local government agencies, hospital systems, HMOs

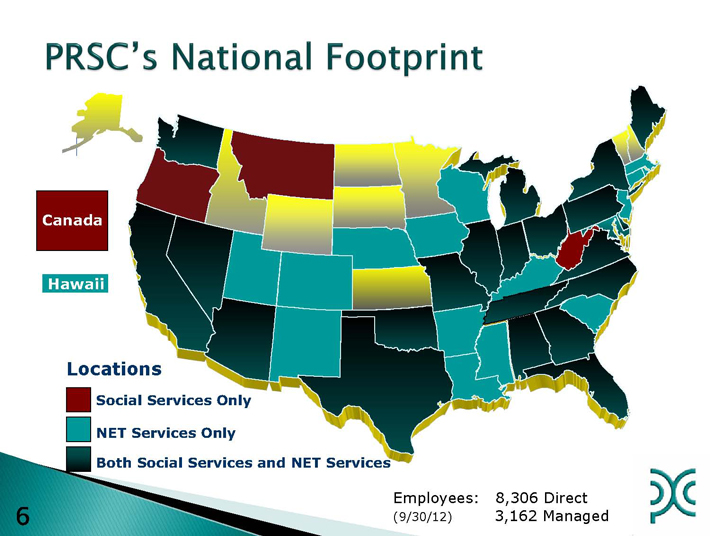

PRSC’S National Footprint Canada Hawaii Locations Social Services Only NET Services Only Both Social Services and NET Services Employees: 8,306 Direct (9/30/12) 3,162 Managed

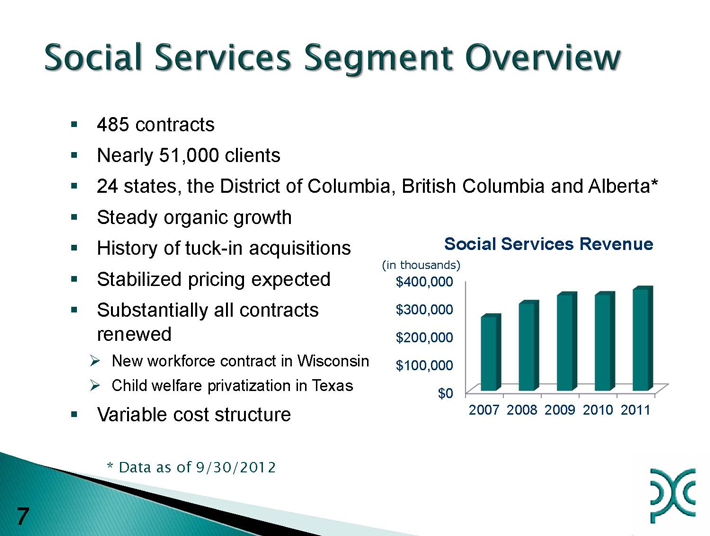

Social services Segment overview 485 contracts Nearly 51,000 clients 24 states, the District of Columbia, British Columbia and Alberta* Steady organic growth History of tuck-in acquisitions Stabilized pricing expected Substantially all contracts renewed New workforce contract in Wisconsin Child welfare privatization in Texas Variable cost structure Social Services Revenue * Data as of 9/30/2012

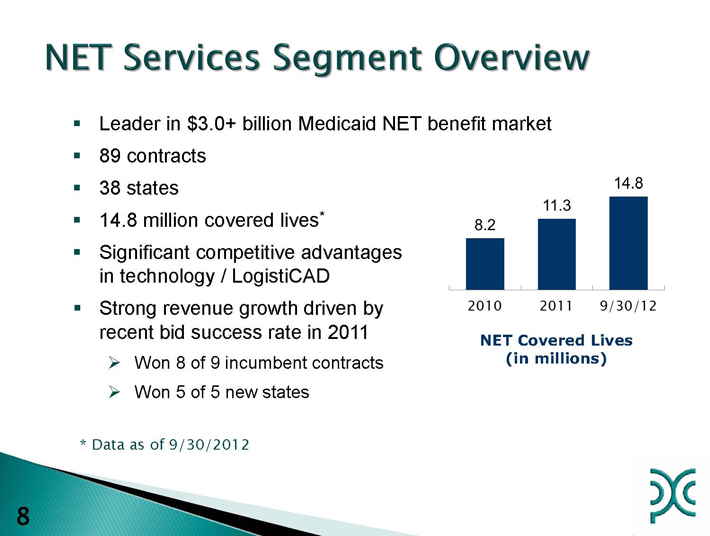

Social Services Segment overview Leader in $3.0+ billion Medicaid NET benefit market 89 contracts 38 states 14.8 million covered lives* Significant competitive advantages in technology / LogistiCAD Strong revenue growth driven by recent bid success rate in 2011 Won 8 of 9 incumbent contracts Won 5 of 5 new states * Data as of 9/30/2012 NET Covered Lives (in millions)

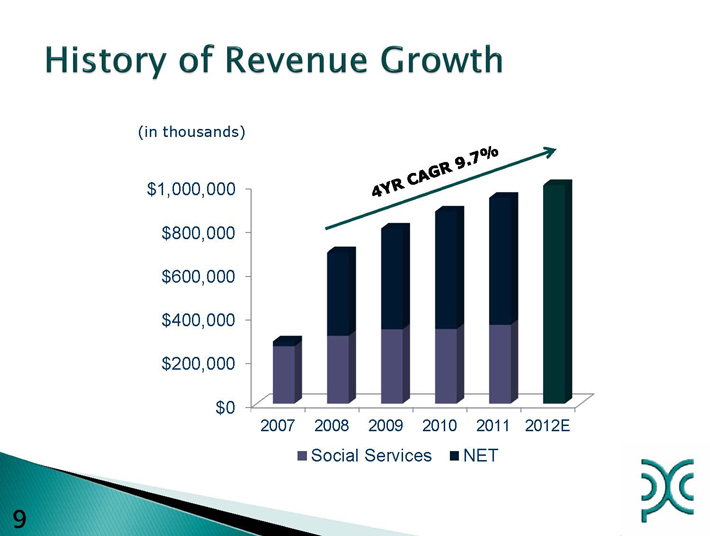

History of revenue Growth (in thousands) $1,000,000 $800,000 $600,000 $400,000 $200,000 0 2007 2008 2009 2010 2011 2012 E Social Services NET

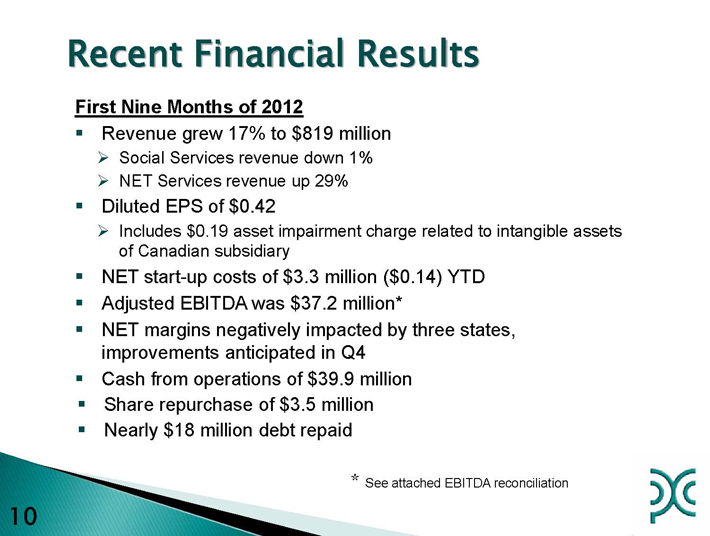

Recent Financial Results First Nine Months of 2012 .Revenue grew 17% to $819 million Social Services revenue down 1% NET Services revenue up 29% Diluted EPS of $0.42 Includes $0.19 asset impairment charge related to intangible assets of Canadian subsidiary NET start-up costs of $3.3 million ($0.14) YTD Adjusted EBITDA was $37.2 million* .NET margins negatively impacted by three states, improvements anticipated in Q4 .Cash from operations of $39.9 million .Share repurchase of $3.5 million .Nearly $18 million debt repaid * See attached EBITDA reconciliation

Providence’s Core Competencies .Social Service payer relationships .Geographic reach, breadth of services and experience .Management of populations, covered lives and provider networks .RFP bidding infrastructure .Managed care contracting experience .Technology platform development – LogistiCAD and EHR system

Favorable Healthcare Trends .Affordable Care Act .Focus on Cost: “Bending the Cost Curve” .60% of Medicaid dollars still spent on institutional care1 .Additional states contemplating transportation outsourcing

Favorable Healthcare Trends .Affordable Care Act Expected Medicaid enrollment to increase by 41%, 21.3 million enrollees, by 20221 • Medicaid enrollment increases fully funded by the federal government • NET could benefit as early as 2014 • Social Services to have an incremental increase of clients Emphasis on home and community based services

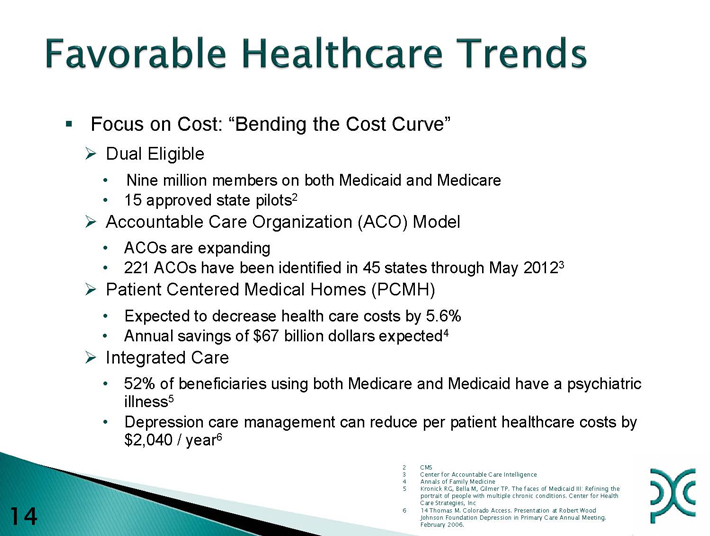

Favorable Healthcare Trends . Focus on Cost: “Bending the Cost Curve” Dual Eligible • Nine million members on both Medicaid and Medicare • 15 approved state pilots2 Accountable Care Organization (ACO) Model • ACOs are expanding • 221 ACOs have been identified in 45 states through May 20123 Patient Centered Medical Homes (PCMH) • Expected to decrease health care costs by 5.6% • Annual savings of $67 billion dollars expected4 Integrated Care • 52% of beneficiaries using both Medicare and Medicaid have a psychiatric illness5 • Depression care management can reduce per patient healthcare costs by $2,040 / year6 1 2 CMS Open Minds 3 4 Center Annals for of Family Accountable Medicine Care Intelligence 5 Kronick portrait of RG, people Bella M, with Gilmer multiple TP. The chronic faces conditions. of Medicaid Center III: Refining for Health the 6 14 Care Thomas Strategies, M. Colorado Inc Access. Presentation at Robert Wood Johnson February Foundation 2006. Depression in Primary Care Annual Meeting.

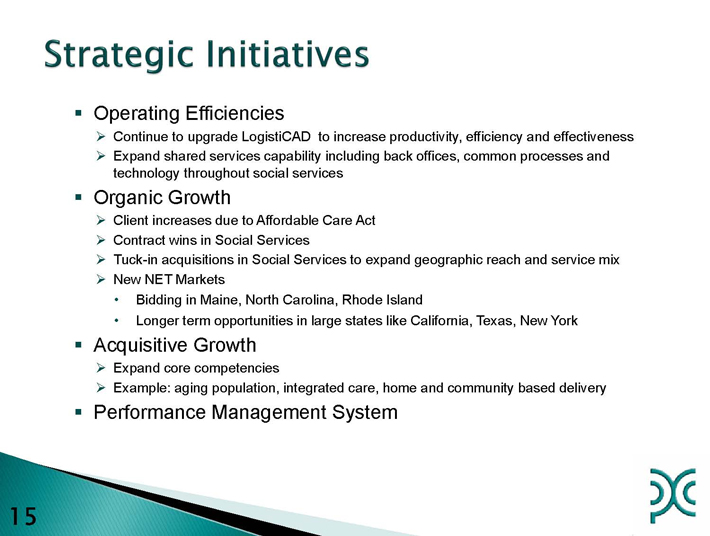

strategic Initiatives . Operating Efficiencies Continue to upgrade LogistiCAD to increase productivity, efficiency and effectiveness Expand shared services capability including back offices, common processes and technology throughout social services . Organic Growth Client increases due to Affordable Care Act Contract wins in Social Services Tuck-in acquisitions in Social Services to expand geographic reach and service mix New NET Markets • Bidding in Maine, North Carolina, Rhode Island • Longer term opportunities in large states like California, Texas, New York . Acquisitive Growth Expand core competencies Example: aging population, integrated care, home and community based delivery . Performance Management System

Revenue Growth Target of 10% Annually Longer Term Adjusted EBITDA* Margin Goal of 6.5% Includes both Social Services and NET Assumes expanded payer base beyond Medicaid Performance Management Goals 16 1 * See attached EBITDA reconciliation

providence: Competitively Positioned . Attractive Business with Track Record of Success . Positioned to Benefit from Current Health Care Trends . Affordable Care Act and Increased Medicaid Enrollment . Trend toward Home and Community Based Care . Focus on Cost: Dual Eligible, ACO Model, PCMH, and Integrated Health Care . Continued Growth Expected from Both Social Services and Transportation Businesses . Potential to Diversify Into New Service Lines through Organic and/or Acquisitive Growth . Increased Focus on Operational Efficiencies . Strong Cash Flow and Commitment to Deleverage . Restructured Management Team Charged with Increasing Shareholder Returns

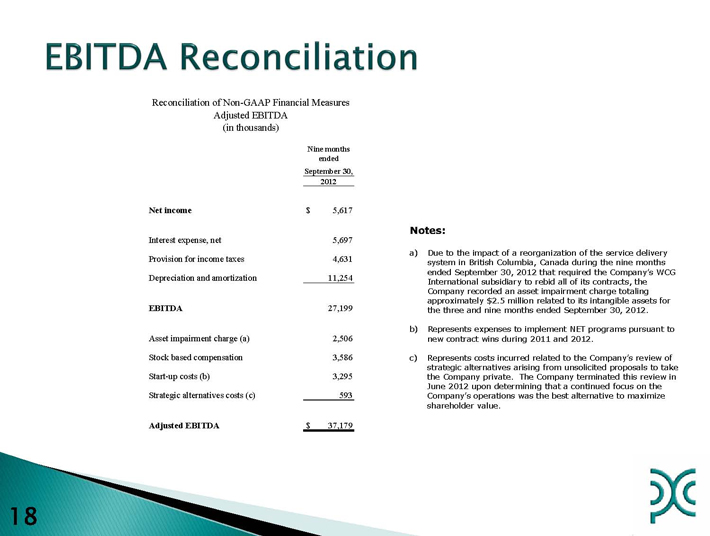

EBITA RECONCILIATION

Reconciliation of Non-GAAP Financial Measures Adjusted EBITDA (in thousands) Nine months ended September 30, 2012 Notes: a) Due to the impact of a reorganization of the service delivery system in British Columbia, Canada during the nine months ended September 30, 2012 that required the Company’s WCG International subsidiary to rebid all of its contracts, the Company recorded an asset impairment charge totaling approximately $2.5 million related to its intangible assets for the three and nine months ended September 30, 2012. b) Represents expenses to implement NET programs pursuant to new contract wins during 2011 and 2012. c) Represents costs incurred related to the Company’s review of strategic alternatives arising from unsolicited proposals to take the Company private. The Company terminated this review in June 2012 upon determining that a continued focus on the Company’s operations was the best alternative to maximize shareholder value. Net income $ 5,617 Interest expense, net 5,697 Provision for income taxes 4,631 Depreciation and amortization 11,254 EBITDA 27,199 Asset impairment charge (a) 2,506 Stock based compensation 3,586 Start-up costs (b) 3,295 Strategic alternatives costs (c) 593 Adjusted EBITDA $ 37,179