Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HALOZYME THERAPEUTICS, INC. | a8-kinvestorslidesjan072013.htm |

Halozyme Therapeutics, Inc. Thinking Outside the Cell™ J.P. Morgan Healthcare Conference January 10, 2013 Gregory I. Frost, Ph.D. President and Chief Executive Officer Exhibit 99.1

2 Safe Harbor All of the statements in this presentation that are not statements of historical facts constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements and all references to financial estimates are based upon management’s current plans and expectations and are subject to a number of risks and uncertainties which could cause actual results to differ materially from such statements. While the Company believes that the assumptions concerning future events are reasonable, it cautions that there are inherent difficulties in anticipating or predicting certain important factors. A discussion of these factors, including risks and uncertainties, is set forth in the Company’s annual and quarterly reports filed from time to time with the Securities and Exchange Commission. The Company disclaims any intention or obligation to revise or update any forward-looking statements, whether as a result of new information, future events, or otherwise. 2

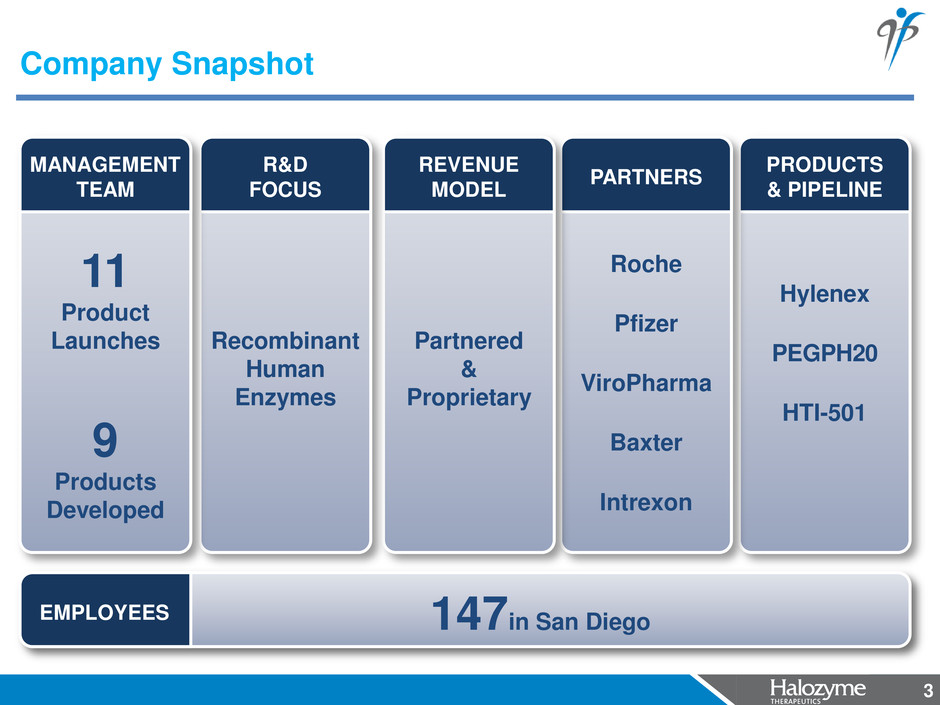

3 PRODUCTS & PIPELINE Hylenex PEGPH20 HTI-501 PARTNERS Roche Pfizer ViroPharma Baxter Intrexon REVENUE MODEL Partnered & Proprietary R&D FOCUS Recombinant Human Enzymes Company Snapshot 3 MANAGEMENT TEAM 11 Product Launches 9 Products Developed 147in San Diego EMPLOYEES

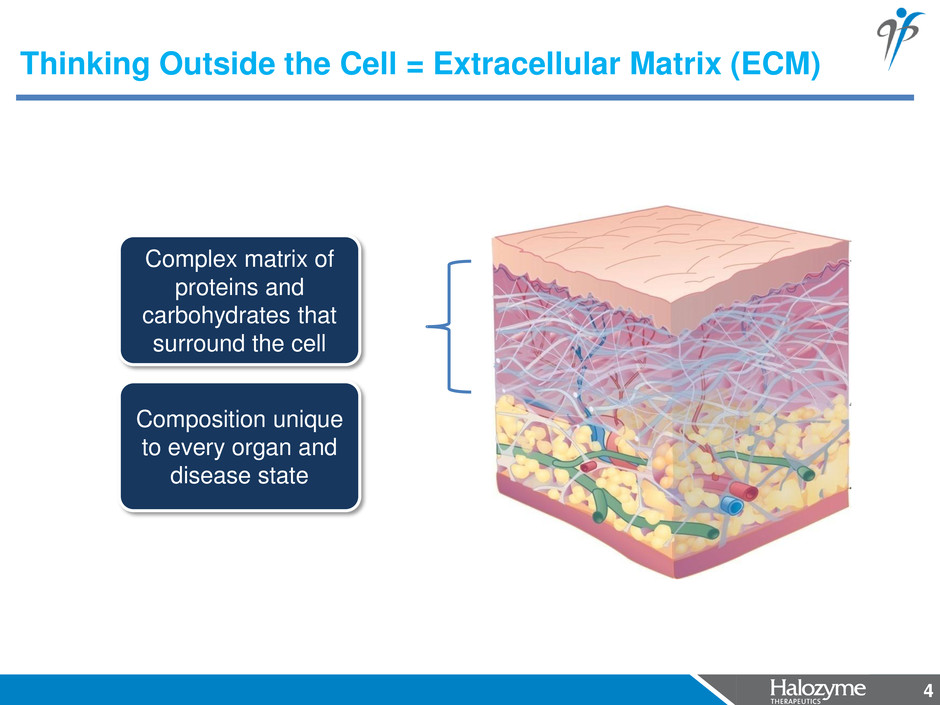

4 Complex matrix of proteins and carbohydrates that surround the cell Composition unique to every organ and disease state Thinking Outside the Cell = Extracellular Matrix (ECM) 4

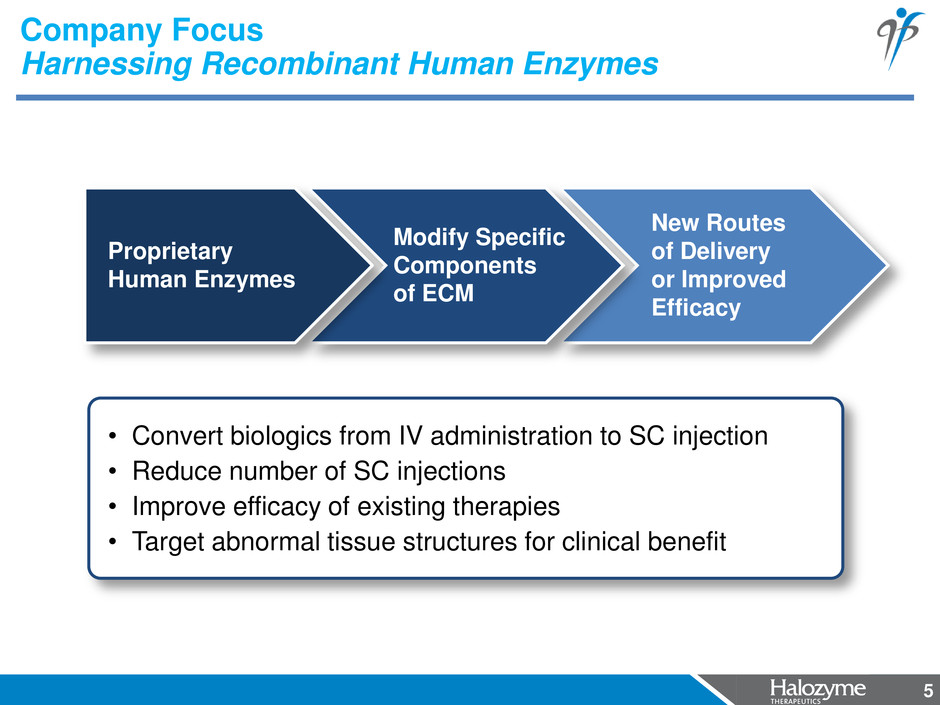

5 New Routes of Delivery or Improved Efficacy Company Focus Harnessing Recombinant Human Enzymes 5 Modify Specific Components of ECM Proprietary Human Enzymes • Convert biologics from IV administration to SC injection • Reduce number of SC injections • Improve efficacy of existing therapies • Target abnormal tissue structures for clinical benefit

6 Why Halozyme? Diversified Pipeline Strong Financial Position Securing Sustained Growth 6

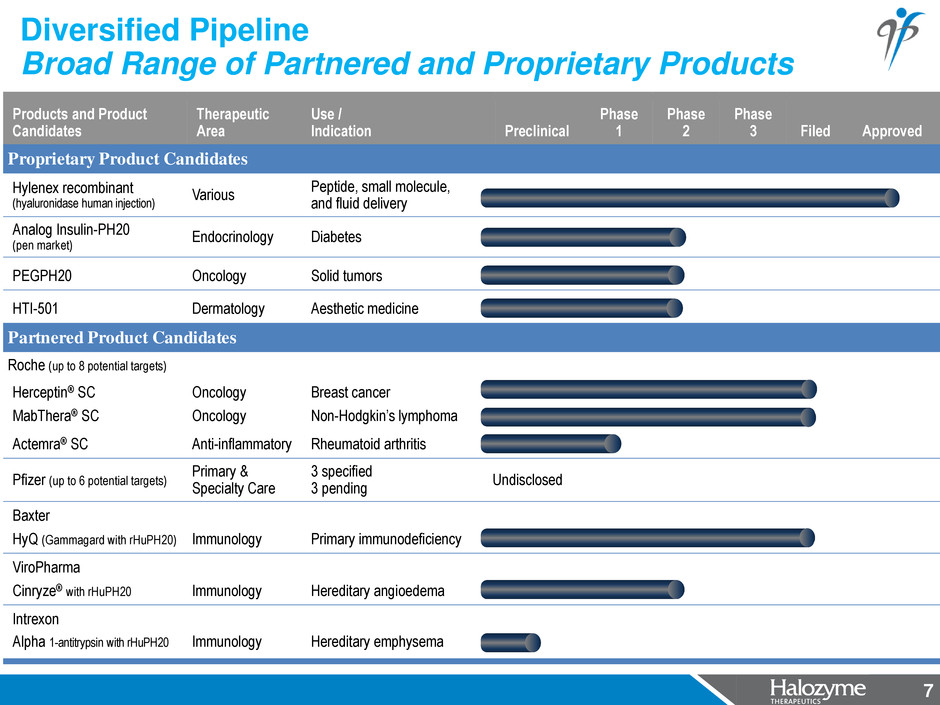

7 Products and Product Candidates Therapeutic Area Use / Indication Preclinical Phase 1 Phase 2 Phase 3 Filed Approved Proprietary Product Candidates Hylenex recombinant (hyaluronidase human injection) Various Peptide, small molecule, and fluid delivery Analog Insulin-PH20 (pen market) Endocrinology Diabetes PEGPH20 Oncology Solid tumors HTI-501 Dermatology Aesthetic medicine Partnered Product Candidates Roche (up to 8 potential targets) Herceptin® SC Oncology Breast cancer MabThera® SC Oncology Non-Hodgkin’s lymphoma Actemra® SC Anti-inflammatory Rheumatoid arthritis Pfizer (up to 6 potential targets) Primary & Specialty Care 3 specified 3 pending Undisclosed Baxter HyQ (Gammagard with rHuPH20) Immunology Primary immunodeficiency ViroPharma Cinryze® with rHuPH20 Immunology Hereditary angioedema Intrexon Alpha 1-antitrypsin with rHuPH20 Immunology Hereditary emphysema Diversified Pipeline Broad Range of Partnered and Proprietary Products 7

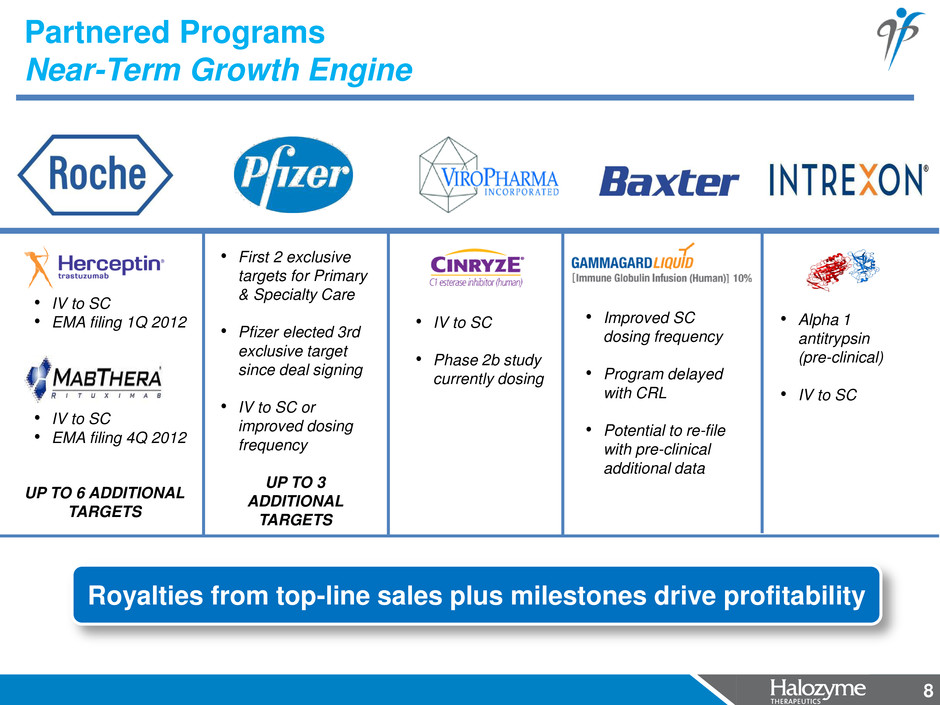

8 Partnered Programs Near-Term Growth Engine • Alpha 1 antitrypsin (pre-clinical) • IV to SC • IV to SC • Phase 2b study currently dosing • First 2 exclusive targets for Primary & Specialty Care • Pfizer elected 3rd exclusive target since deal signing • IV to SC or improved dosing frequency UP TO 3 ADDITIONAL TARGETS Royalties from top-line sales plus milestones drive profitability • IV to SC • EMA filing 1Q 2012 • IV to SC • EMA filing 4Q 2012 UP TO 6 ADDITIONAL TARGETS • Improved SC dosing frequency • Program delayed with CRL • Potential to re-file with pre-clinical additional data 8

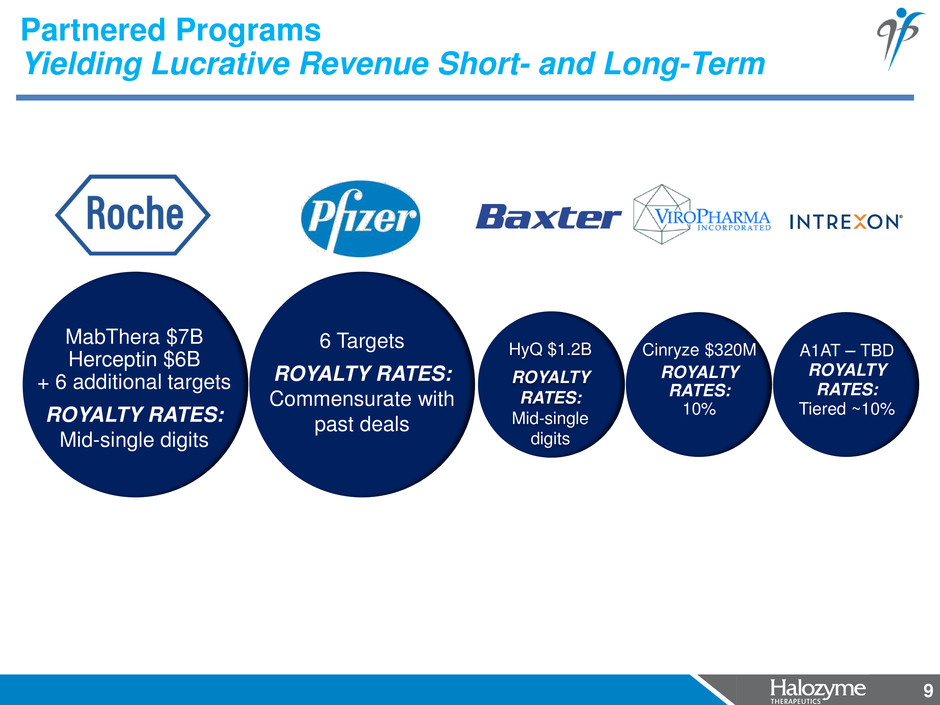

9 Partnered Programs Yielding Lucrative Revenue Short- and Long-Term 9 6 Targets ROYALTY RATES: Commensurate with past deals MabThera $7B Herceptin $6B + 6 additional targets ROYALTY RATES: Mid-single digits HyQ $1.2B ROYALTY RATES: Mid-single digits Cinryze $320M ROYALTY RATES: 10% A1AT – TBD ROYALTY RATES: Tiered ~10%

10 Novel matrix-remodeling enzyme targeting collagen for aesthetics and scarring HTI-501 (rHuCathepsin-L) Systemically acting enzyme for targeting HA-expressing tumors PEGPH20 (pegylated rHuPH20) FDA approved (150U) for the dispersion and absorption of other injected drugs and fluids Hylenex Recombinant Proprietary Programs Long-Term Value Growth Drivers 10

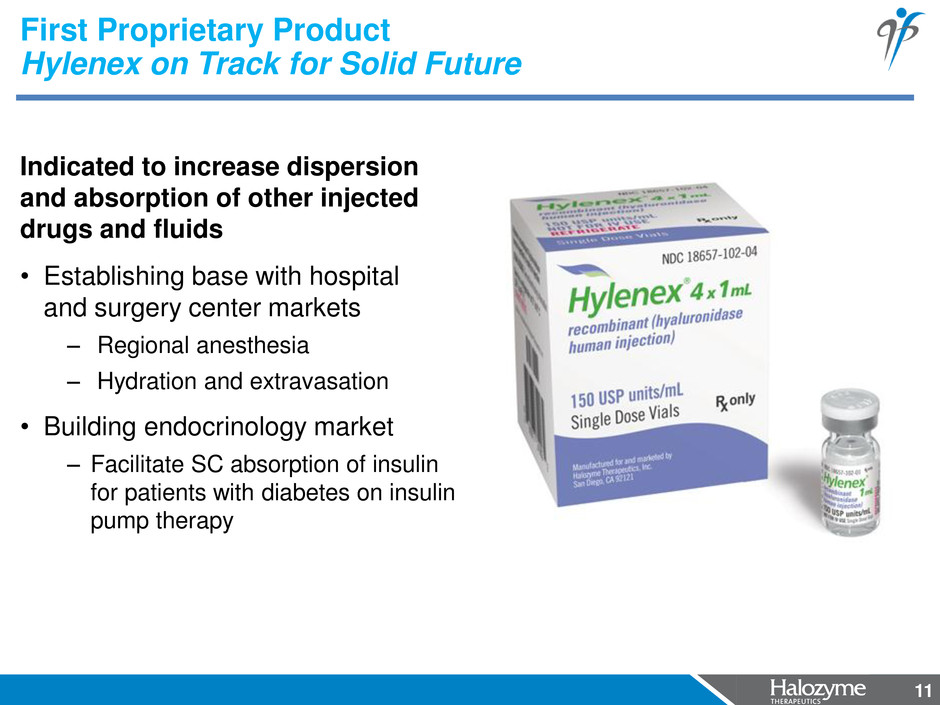

11 Indicated to increase dispersion and absorption of other injected drugs and fluids • Establishing base with hospital and surgery center markets – Regional anesthesia – Hydration and extravasation • Building endocrinology market – Facilitate SC absorption of insulin for patients with diabetes on insulin pump therapy First Proprietary Product Hylenex on Track for Solid Future 11

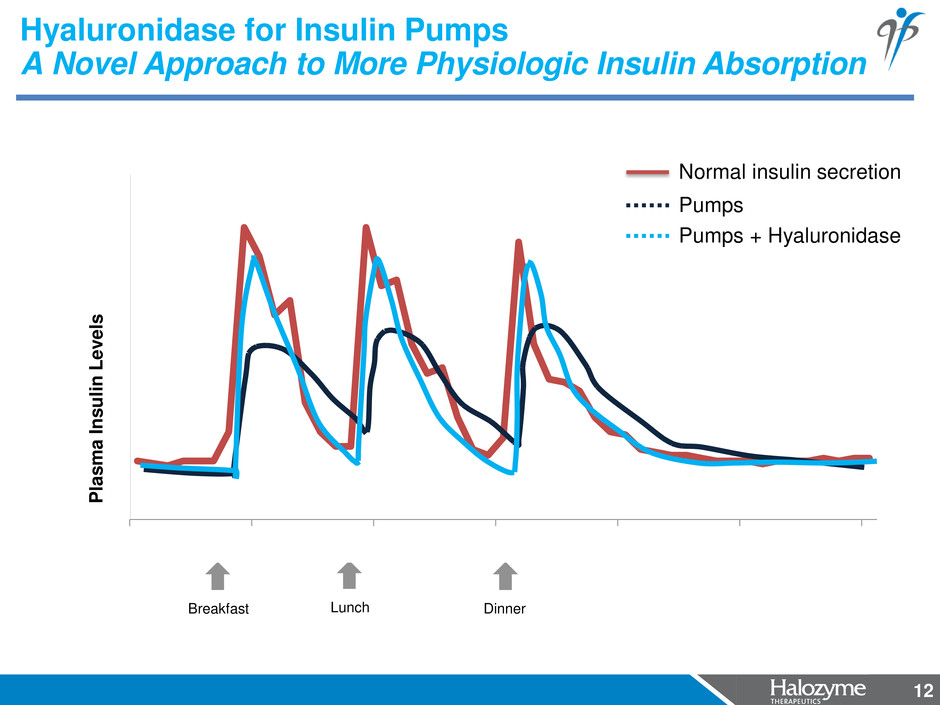

12 6:00 10:00 14:00 18:00 22:00 2:00 6:00 Hyaluronidase for Insulin Pumps A Novel Approach to More Physiologic Insulin Absorption 12 P lasma I n s u li n L e v e ls Pumps Pumps + Hyaluronidase Normal insulin secretion Breakfast Lunch Dinner

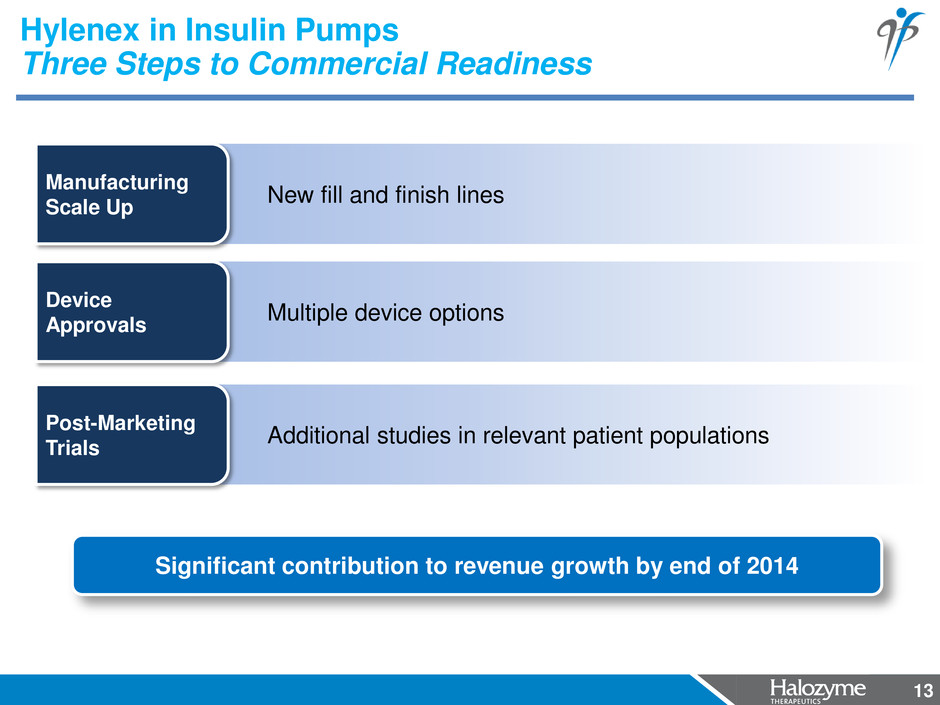

13 Additional studies in relevant patient populations Post-Marketing Trials Multiple device options Device Approvals New fill and finish lines Manufacturing Scale Up Hylenex in Insulin Pumps Three Steps to Commercial Readiness Significant contribution to revenue growth by end of 2014 13

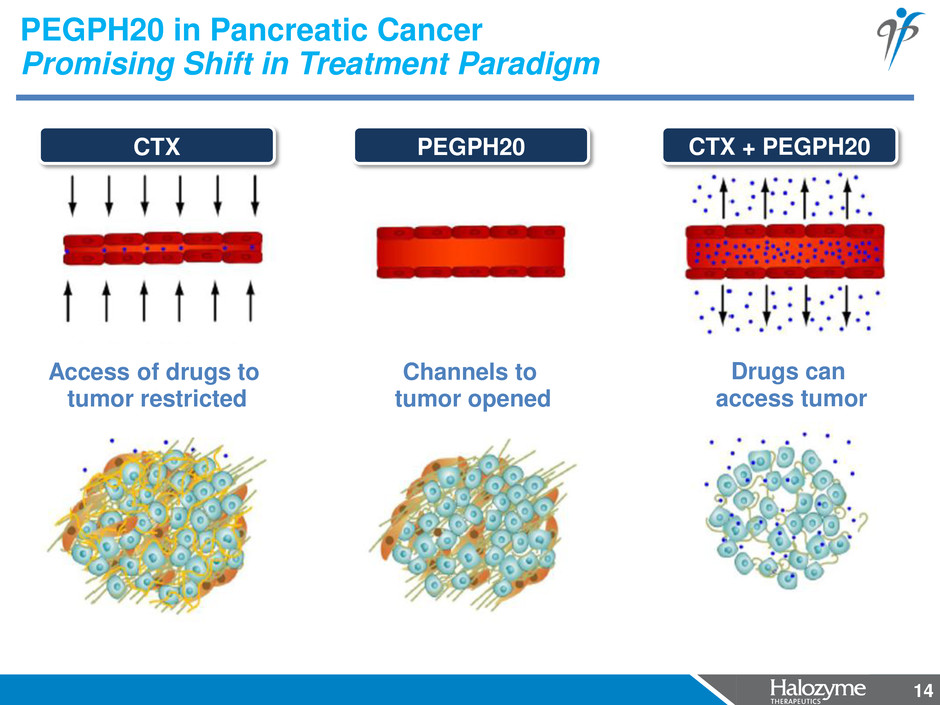

14 PEGPH20 in Pancreatic Cancer Promising Shift in Treatment Paradigm Drugs can access tumor CTX + PEGPH20 Channels to tumor opened PEGPH20 Access of drugs to tumor restricted CTX 14

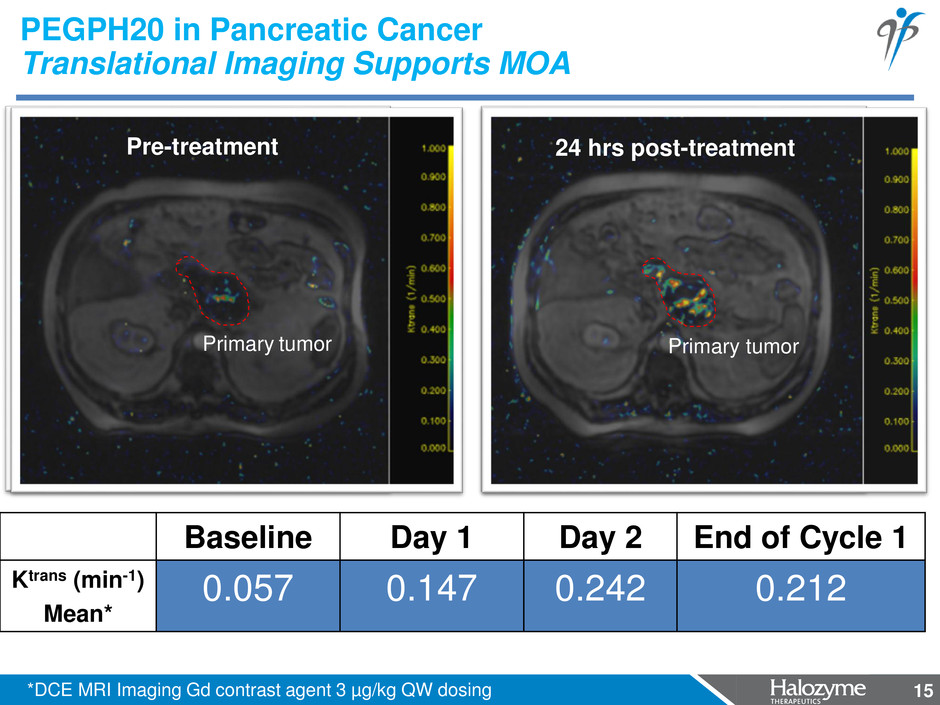

15 PEGPH20 in Pancreatic Cancer Translational Imaging Supports MOA Baseline Day 1 Day 2 End of Cycle 1 Ktrans (min-1) Mean* 0.057 0.147 0.242 0.212 Pre-treatment 24 hrs post-treatment *DCE MRI Imaging Gd contrast agent 3 µg/kg QW dosing Primary tumor 15 Primary tumor

16 PEGPH20 in Pancreatic Cancer 16

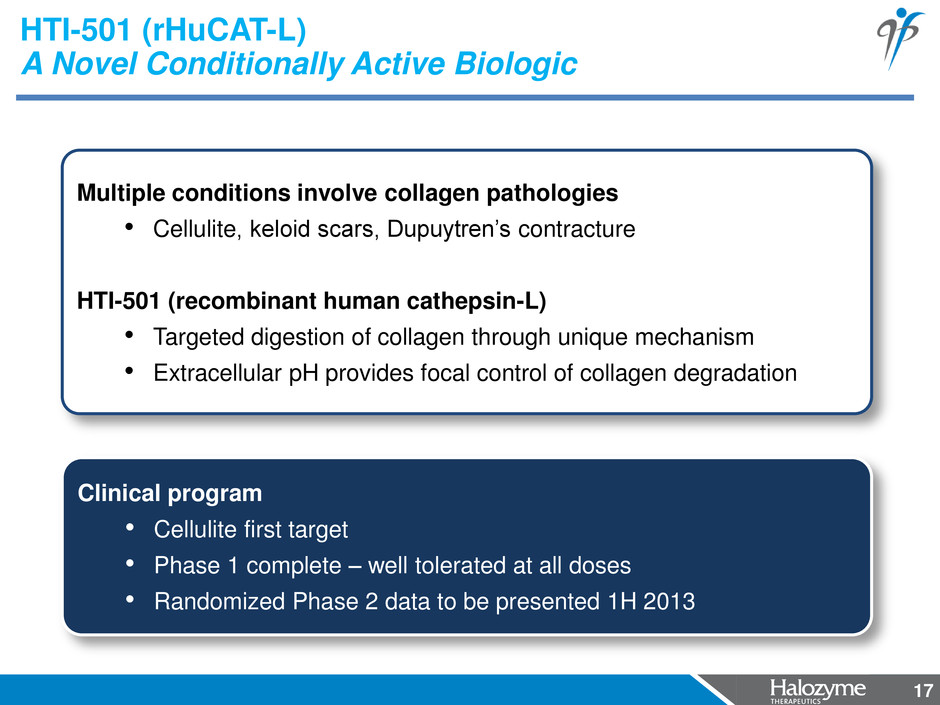

17 HTI-501 (rHuCAT-L) A Novel Conditionally Active Biologic 17 Clinical program • Cellulite first target • Phase 1 complete – well tolerated at all doses • Randomized Phase 2 data to be presented 1H 2013 Multiple conditions involve collagen pathologies • Cellulite, keloid scars, Dupuytren’s contracture HTI-501 (recombinant human cathepsin-L) • Targeted digestion of collagen through unique mechanism • Extracellular pH provides focal control of collagen degradation

18 Why Halozyme? 18 Diversified Pipeline Strong Financial Position Securing Sustained Growth

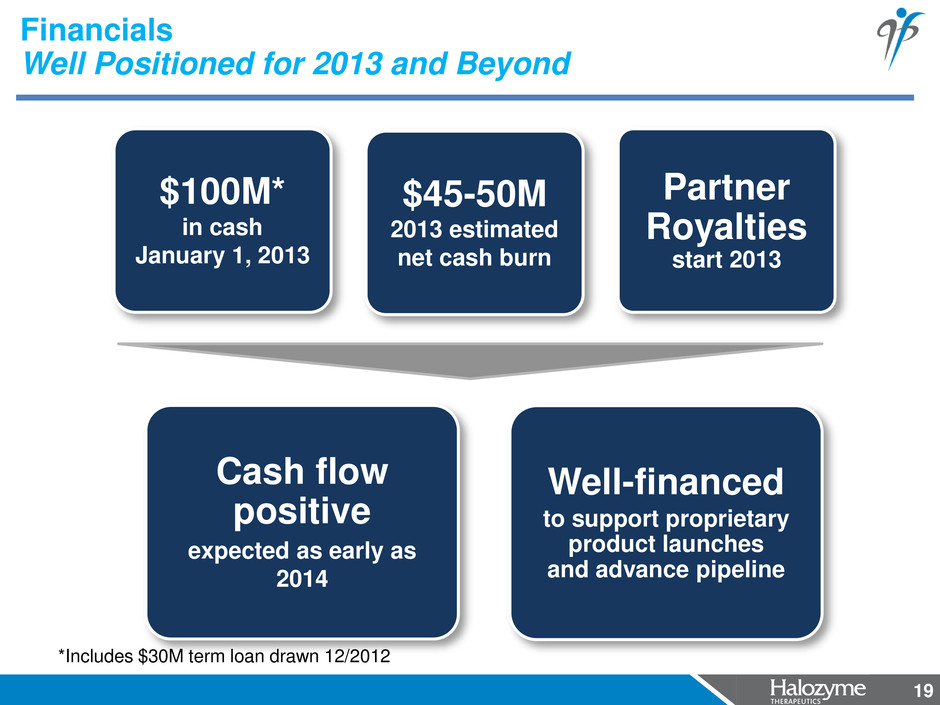

19 Financials Well Positioned for 2013 and Beyond 19 2012 2013 2014+ $100M* in cash January 1, 2013 $45-50M 2013 estimated net cash burn Partner Royalties start 2013 Cash flow positive expected as early as 2014 Well-financed to support proprietary product launches and advance pipeline *Includes $30M term loan drawn 12/2012

20 Why Halozyme? 20 Diversified Pipeline Strong Financial Position Securing Sustained Growth

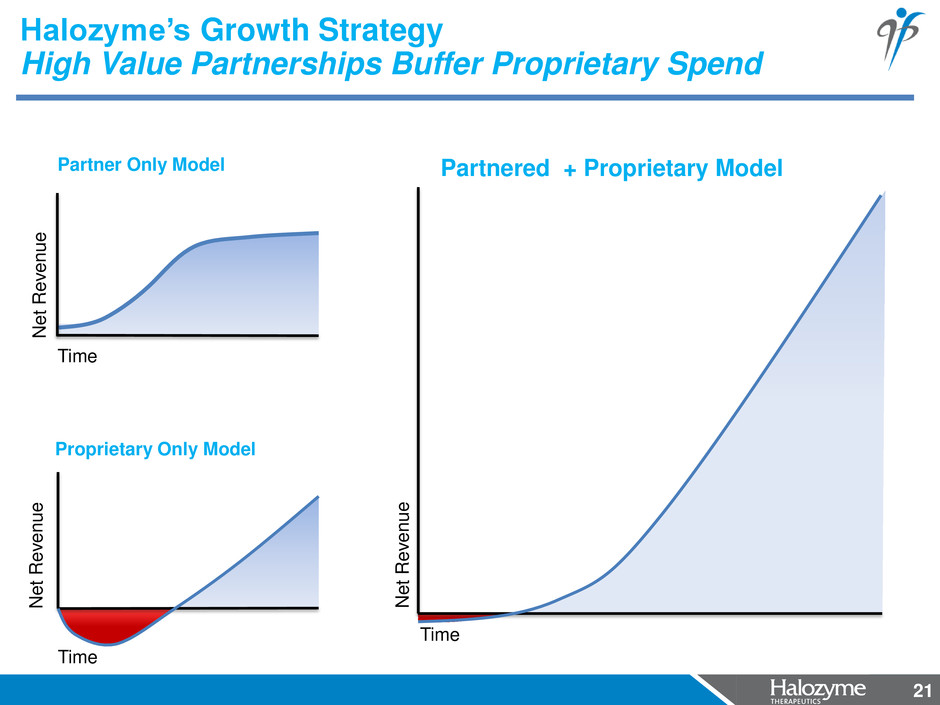

21 Halozyme’s Growth Strategy High Value Partnerships Buffer Proprietary Spend 21 Proprietary Only Model Partner Only Model Time N e t R e venue Partnered + Proprietary Model N e t R e venue Time N e t R e venue Time

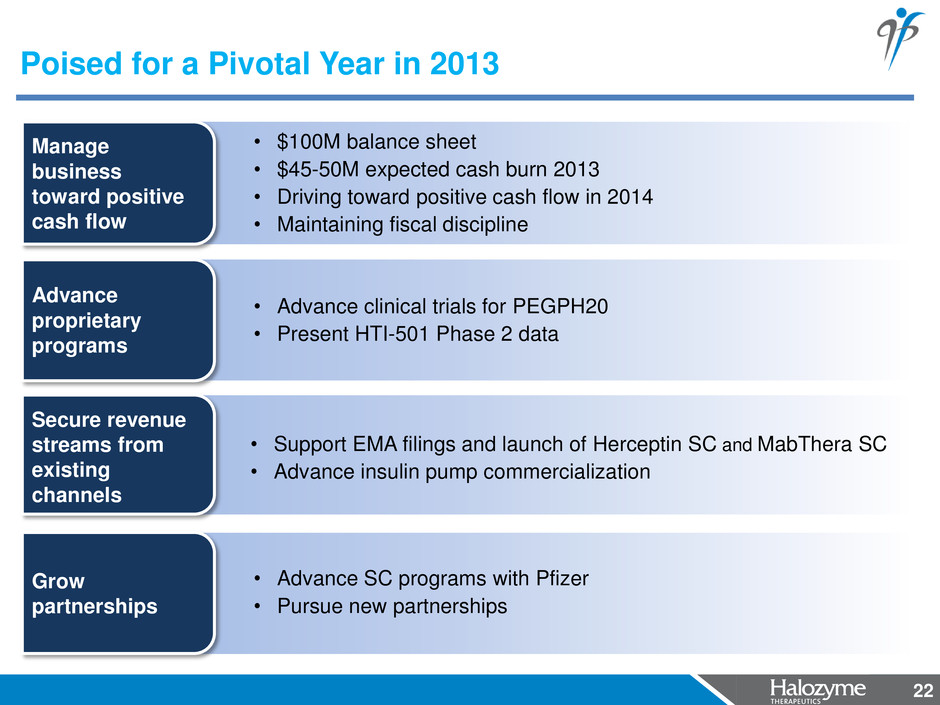

22 Advance proprietary programs • Advance clinical trials for PEGPH20 • Present HTI-501 Phase 2 data Secure revenue streams from existing channels • Support EMA filings and launch of Herceptin SC and MabThera SC • Advance insulin pump commercialization Poised for a Pivotal Year in 2013 22 Grow partnerships • Advance SC programs with Pfizer • Pursue new partnerships • $100M balance sheet • $45-50M expected cash burn 2013 • Driving toward positive cash flow in 2014 • Maintaining fiscal discipline Manage business toward positive cash flow

23 Manage business toward positive cash flow Advance proprietary programs Secure revenue streams from existing channels Grow partnerships Securing Sustainable Growth Strategies to Ensure Success 23