Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - AVEO PHARMACEUTICALS, INC. | d461381d8k.htm |

2013 J.P. Morgan

Healthcare Conference

NASDAQ: AVEO

JANUARY 2013

1

Exhibit 99.1 |

Forward-Looking Statements

This presentation contains forward-looking statements that involve substantial

risks and uncertainties, including among other things, statements

about: –

our planned development, commercialization and manufacturing plans, timelines and

strategies for tivozanib;

–

the potential therapeutic advantages and benefits of tivozanib and our other

product candidates; –

the timing and results of our ongoing and planned preclinical studies and clinical

trials; –

the potential benefits of our strategic partnership agreements, including our

agreement with Astellas, our ability to achieve additional payments under

these arrangements and our ability to enter into additional

arrangements;

–

our

plans

to

leverage

our

Human

Response

Platform™

to

inform

clinical

development;

–

our intellectual property position and strategies;

–

the expected RCC market and potential of tivozanib to obtain regulatory approval

and enter this market; –

our projections with respect to our achievement of corporate milestones, including

our anticipated plans for success in the oncology markets; and

–

AVEO having sufficient capital to fund its operations through 2013 and AVEO’s

estimates for 2012 expected yearend cash balance and cost savings from its

strategic restructuring. Actual

results

or

events

could

differ

materially

from

the

plans,

intentions

and

expectations

disclosed

in

the

forward-

looking

statements

we

make

due

to

a

number

of

important

factors,

including

risks

and

uncertainties

relating

to:

our

ability to successfully develop, test and gain regulatory approval of our

product candidates, including regulatory approval of tivozanib to

treat advanced RCC; our ability to obtain, maintain and enforce intellectual property rights;

competition; our dependence on our alliance partners and other third parties; our

ability to obtain necessary financing;

adverse

economic

conditions;

and

those

risk

factors

discussed

in

the

“Risk

Factors”

and

elsewhere

in

our most recent Form 10-Q and other periodic filings we make with the

Securities and Exchange Commission. All forward-looking statements

contained in this presentation speak only as of the date of this presentation, and we

undertake no obligation to update any of these statements, except as required by

law. 2 |

Investment Thesis

3

•

Tivozanib in development for multiple

cancer indications

–

Successful TIVO-1 trial in 1

-line RCC

–

Target PDUFA date in July 2013

–

World-class partnership with Astellas

–

BATON Phase 2 studies in CRC & BC

•

Human Response Platform

™

supporting discovery and clinical

development

•

Significant commercial rights to all

oncology programs

•

Capital through 2013

Founded:

2002

HQ:

Cambridge, MA

Employees: ~225

NASDAQ:

AVEO

Tivozanib

is

an

investigational

compound

and

it

has

not

received

regulatory

approval

for

sale.

st |

Anticipated Approval of Tivozanib

4 |

Basic

Criteria for Approval of New Anticancer Drug •

Positive outcome in adequate and well-controlled trials

–

Phase 3 TIVO-1 trial: superiority over sorafenib on primary endpoint of

PFS •

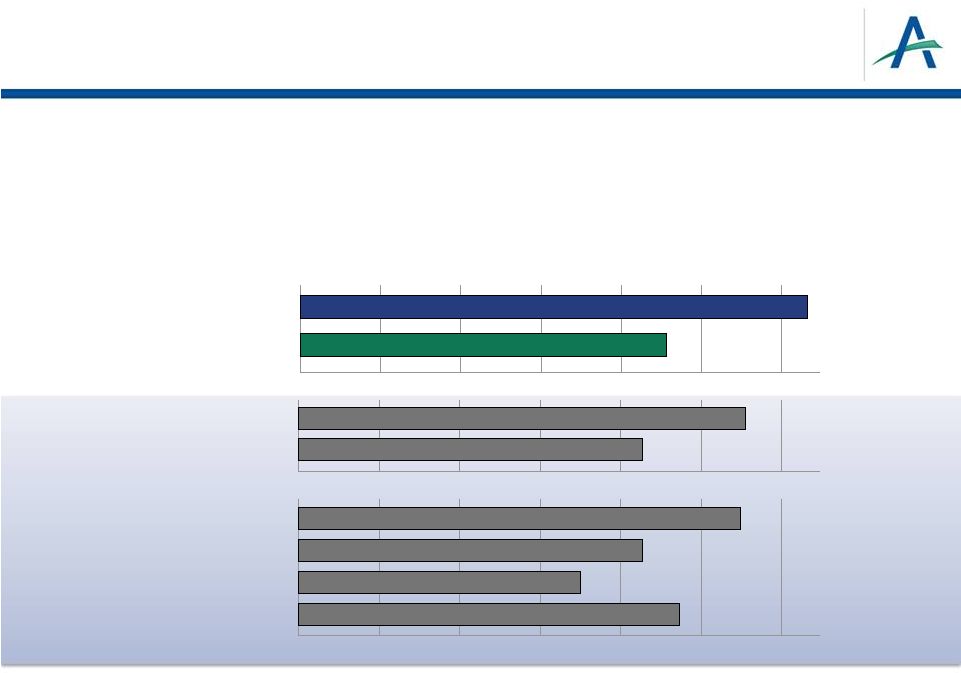

Median PFS (mos): 11.9 vs 9.1 in ITT; 12.7 vs 9.1 in treatment-naïve

subpopulation –

Phase 2 randomized discontinuation study: superiority over placebo

January 4, 2013

5

TIVO-1 Study

PFS in Treatment Naïve RCC Patients

Sunitinib

Pazopanib

Tivozanib

Sorafenib

0

12.7 months

9.1 months

2

8

10

12

4

6

Phase 3 Study

2

COMPARZ Study

5

11.1 months

8.4 months

0

4

6

8

10

12

2

Phase 3 Study

2

Standard Dose

4

Novel Dose

4

5

0

11

months

9.5 months

8.5 months

7 months

2

10

12

4

6

8

4. Motzer, et al. 2011 ASCO GU Symposium, Abstract

308. Standard dose (4/2), novel dose (continuous).

5. Motzer, et al. 2012 ESMO Congress, Abstract LBA8

1. Motzer et al, ASCO 2012

2. Votrient PI.

3. Sutent PI.

COMPARZ Study

1 |

Basic

Criteria for Approval of New Anticancer Drug •

Positive outcome in adequate and well-controlled trials

–

Phase 3 TIVO-1 trial: superiority over sorafenib on primary endpoint of

PFS •

Median PFS (mos): 11.9 vs 9.1 in ITT; 12.7 vs 9.1 in treatment-naïve

subpopulation –

Phase 2 randomized discontinuation study: superiority over placebo

6

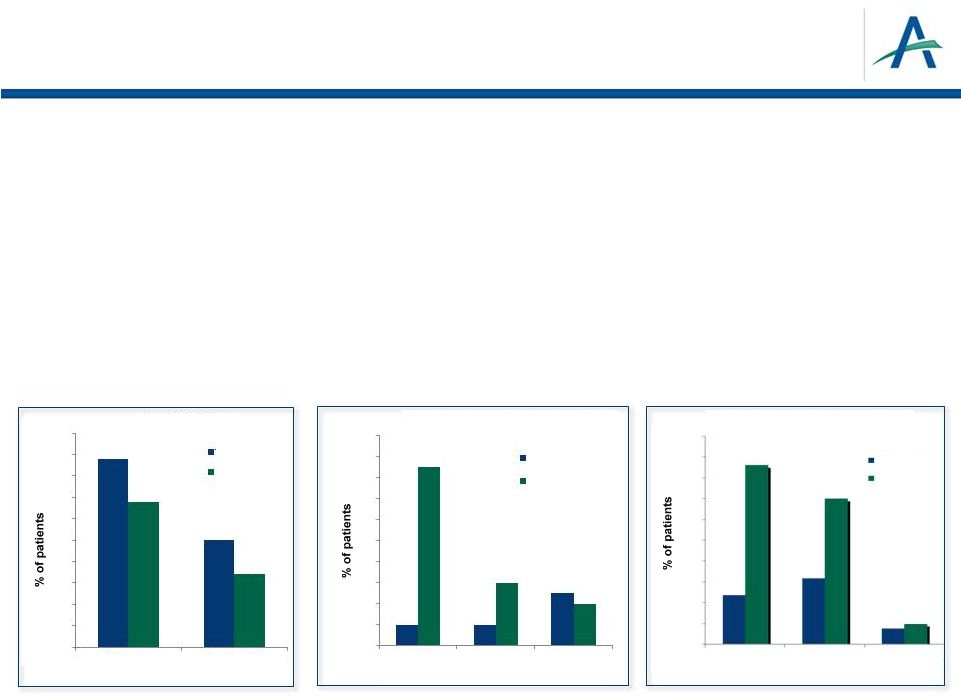

•

Acceptable safety profile

–

>1,000 subjects treated with tivozanib

–

Lower rates than sorafenib for common adverse events and dose

modifications –

Rate of fatal AEs consistent with reports from past pivotal RCC trials

tivozanib

sorafenib

50

45

40

35

30

25

20

15

10

5

0

44

34

25

17

All Grades

Grades 3/4

tivozanib

sorafenib

20

18

16

14

12

10

8

6

4

2

0

Hand-Foot

Syndrome

Diarrhea

Fatigue

17

2

2

6

5

4

50

45

40

35

30

25

20

15

10

5

0

tivozanib

sorafenib

43

35

12

16

Dose Reductions

Dose

Interruptions

4

5

Discontinuations

Hypertension

Other Common AEs (Grades 3/4)

Dose Adjustments Due to AEs

Motzer, et al., ASCO 2012 |

Basic

Criteria for Approval of New Anticancer Drug •

Positive outcome in adequate and well-controlled trials

–

Phase 3 TIVO-1 trial: superiority over sorafenib on primary endpoint of

PFS •

Median PFS (mos): 11.9 vs 9.1 in ITT; 12.7 vs 9.1 in treatment-naïve

subpopulation –

Phase 2 randomized discontinuation study: superiority over placebo

January 4, 2013

7

•

Acceptable safety profile

–

>1,000 subjects treated with tivozanib

–

Lower rates than sorafenib for common adverse events and dose

modifications –

Rate of fatal AEs consistent with reports from past pivotal RCC trials

•

Established dose and regimen

–

Multiple

studies

conducted

using

1.5

mg/d

for

21

days,

repeating

every

28

days |

Basic

Criteria for Approval of New Anticancer Drug •

Positive outcome in adequate and well-controlled trials

–

Phase 3 TIVO-1 trial: superiority over sorafenib on primary endpoint of

PFS •

Median PFS (mos): 11.9 vs 9.1 in ITT; 12.7 vs 9.1 in treatment-naïve

subpopulation –

Phase 2 randomized discontinuation study: superiority over placebo

January 4, 2013

8

•

Acceptable safety profile

–

>1,000 subjects treated with tivozanib

–

Lower rates than sorafenib for common adverse events and dose

modifications –

Rate of fatal AEs consistent with reports from past pivotal RCC trials

•

Established dose and regimen

–

Multiple

studies

conducted

using

1.5

mg/d

for

21

days,

repeating

every

28

days

•

Favorable benefit-risk profile |

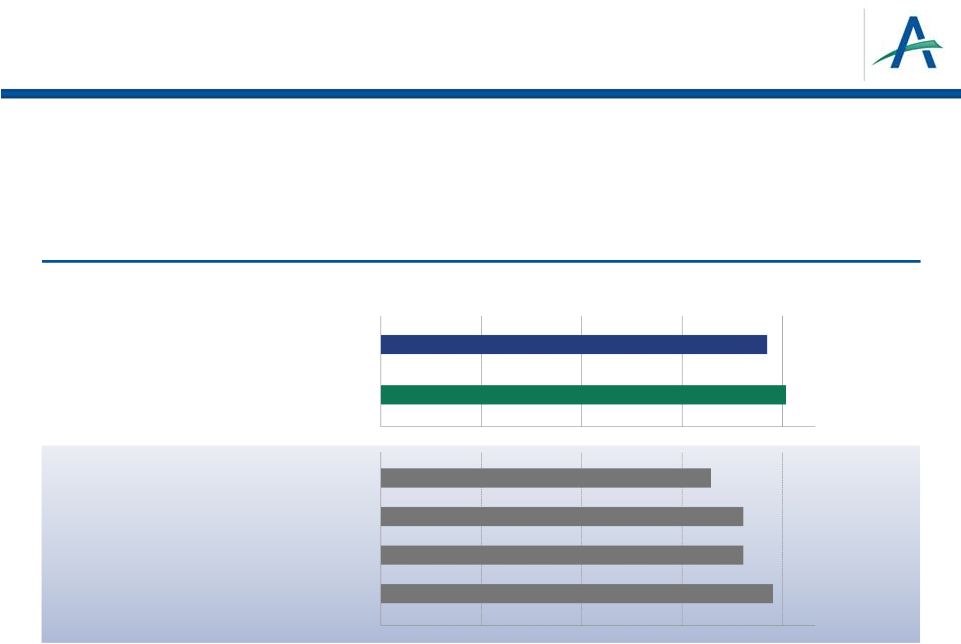

What About Overall

Survival? •

PFS is accepted registration endpoint in advanced RCC

•

OS is secondary endpoint in TIVO-1

–

Results not statistically significant

January 4, 2013

9

Pivotal Studies

for Currently

Available

Therapies

TIVO-1 Study

Sorafenib (TARGET): Escudier B, et al. J Clin Oncol 2009; 27:3312-8.

Bevacizumab: Escudier B, et al. J Clin Oncol 2010; 28: 2144-50.

Pazopanib: CHMP Assessment Report, 2010.

Sunitinib: Motzer RJ et al. J. Clin Oncol 2009; 27:3584-90.

Overall Survival Estimates at One Year (% of Pts)

Tivozanib (TIVO-1 Study)

Sorafenib (TIVO-1 Study)

0

20

40

60

80

77

81

Nexavar (TARGET

Study)

Votrient

Sutent

65

73

73

78

0

20

40

60

80

Avastin + Interferon |

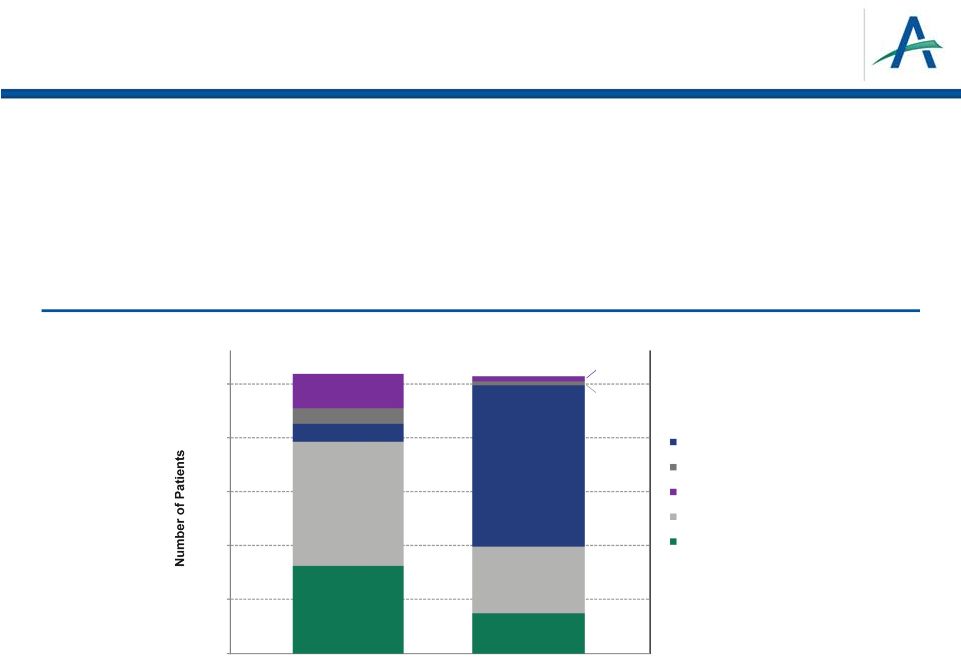

What About Overall

Survival? •

PFS is accepted registration endpoint in advanced RCC

•

OS is secondary endpoint in TIVO-1

–

Results not statistically significant

•

High use of one-way crossover confounded OS data

–

Patients on sorafenib able to receive tivozanib 2

-line

January 4, 2013

10

*Based on May 2012 data sweep in overall population

Use of 2

-Line Therapy in TIVO-1

nd

nd

0

50

100

150

200

250

Tivozanib Arm (n=260)

Sorafenib Arm (n=257)

Received radiotherapy or cytokine 2nd-line

Received mTOR inhibitor 2nd-line

Received VEGF inhibitor 2nd-line

Discontinued 1st-line, no 2nd-line

Still on 1st-line

81

116

16

15

32

37

62

(148 received

tivozanib)

150

4

4

* |

Regulatory Status of Tivozanib in Advanced RCC

•

NDA submission included final OS analysis

–

Analysis conducted at 2 years after last patient enrolled

–

Final OS data to be presented at ASCO GU

•

NDA accepted for filing November 2012

•

ODAC anticipated 1H 2013

•

Target PDUFA action date set for July 28, 2013

11 |

Addressing Medical Need in RCC

January 3, 2013

12 |

Global RCC

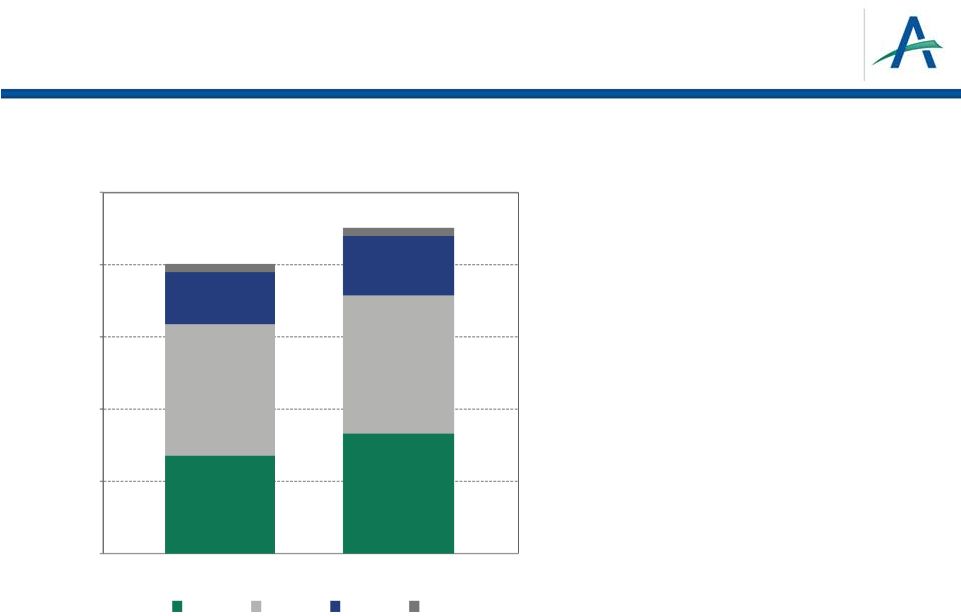

Sales Estimates for 12 Months Ending 9-30-12 RCC is Large and Growing Market

•

Global RCC sales grew 17% from MAT

Sep11 to MAT Sep12

•

US growth of 33% in same period

•

Growth drivers include

•

Expanded treatment options

•

Price increases (US)

•

Population growth

•

Increase in incidence

13

MAT = Moving Annual Total

Sources:

US

Wolters

Kluwer

/

Ex-US

IMS

Health

-

All

adjusted

for

estimated

%

of

sales

for

RCC

per

IMS.

Ex-US

adjustment

factor

triangulated

with

Decision

Resources

product

sales

estimates

for

2011.

Sorafenib

adjusted

for

IMS

and

WK

data

capture

based

on

reported

sales

0

500

$1,000

$1,500

$2,000

$2,500

MAT Sept 11

MAT Sept 12

$2.2B

$1.9B

ASIA

ROW

EU

US |

Toxicities Impact Daily Living

Development of 1

-Line RCC Therapies

Targeted Therapies Approved: Focus on Efficacy

No

Targeted

Therapies

2013

14

•

>50%

of

patients

taking

sorafenib

experienced

hand-foot

syndrome

•

>50%

of

patients

taking

sunitinib

or

pazopanib

experienced

fatigue

•

>50%

of

patients

taking

sunitinib

or

pazopanib

experienced

diarrhea

1. Esudier, et al. J Clin Oncol. 2009;27(20):3312-3318

2. Sutent prescribing information revised 05.2011.

3. Votrient prescribing information revised 01.2012.

2005

2006

2007

2008

2009

2010

2011

2012

st

2

2

3

3

1 |

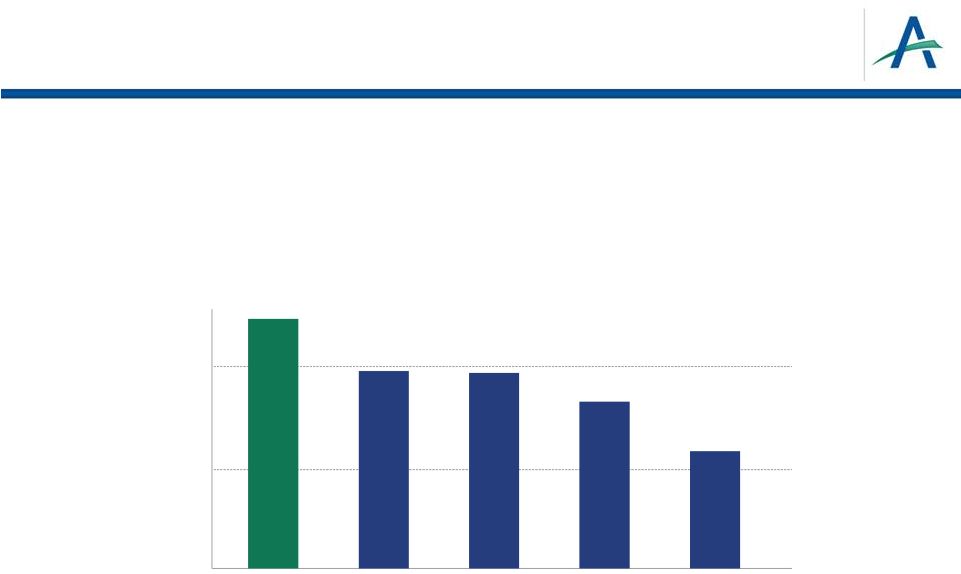

Patient Perspectives on

Toxicities: 272 Patient KCA Survey Reference: Wong MKK, Mohamed AF, Hauber AB, et al. Selecting

renal cell carcinoma therapy: Ranking of patient perspective on toxicities. J Clin Oncol 30,

2012 (suppl; abstr 4608). Patients report stomach problems, fatigue, mouth sores and

hand-foot syndrome as most troublesome side effects

15

Relative Importance for RCC Therapies

(10=most important)

10

8

6

4

2

0

PFS

Stomach

Problems

Fatigue

Mouth Sores

Hand-Foot

Syndrome |

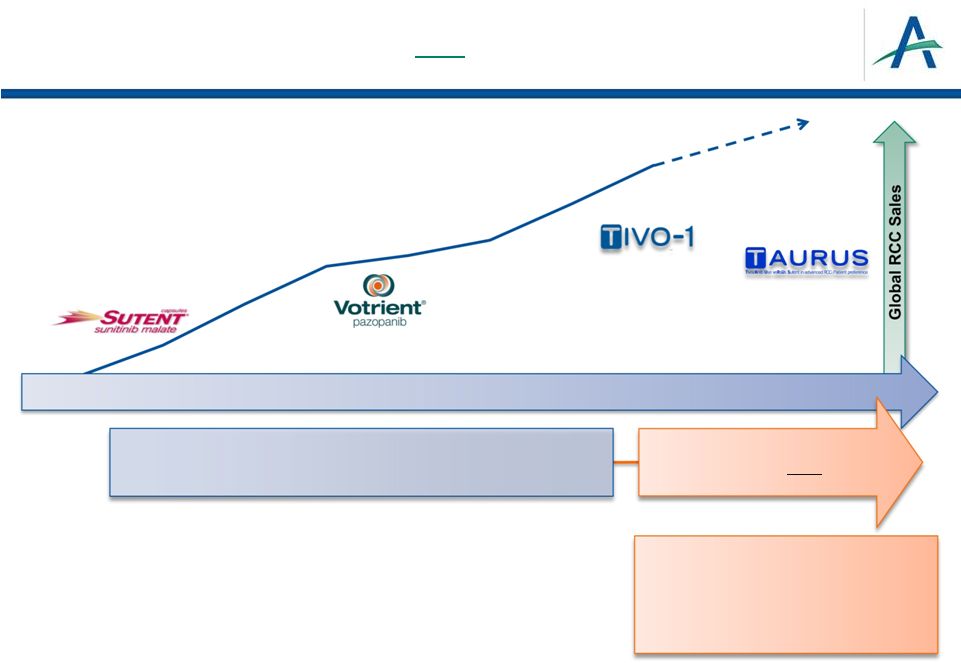

2012 was

transformational year for 1 -line RCC:

EFFICACY

Today, 1 -Line RCC Market in Flux

16

January 4, 2013

st

st

•

TIVO-1

data

demonstrate

tivozanib

is

only

agent

with

•

COMPARZ

data showed pazopanib PFS non-inferior to sunitinib

•

Median PFS (mos) of 8.4 vs 9.5

•

AGILE 1051

results report axitinib did not meet PFS superiority endpoint

compared

to

sorafenib

in

1

-line

st

>

profile distinguished from other agents

1 yr

of

PFS

and

safety |

2012 was

transformational year for 1 -line RCC:

TOLERABILITY

Today, 1 -Line RCC Market in Flux

•

TIVO-1

data

demonstrate

low

rates

of

dose

reductions

(12%)

and

•

COMPARZ

data

showed

pazopanib

PFS

non-inferior

to

sunitinib

•

PISCES

data

reinforce

tolerability

matters

•

TAURUS

Phase

2

study

initiated

evaluating

patient

preference

for

tivozanib vs

sunitinib

17

January 4, 2013

st

st

•

Safety profile distinguished from other agents

•

45% and 60% dose

reductions

and

interruptions

by

both

agents,

respectively

•

70% of patients preferred pazopanib over sunitinib

•

61% of physicians preferred pazopanib over sunitinib

•

Randomized, double-blind cross-over study in 160 patients in US and Europe

interruptions (18%) with tivozanib

>

> |

Future Focuses on Efficacy and

Tolerability

Targeted Therapies Approved: Focus on Efficacy

18

PISCES

COMPARZ

2005

2006

2007

2008

2009

2010

2011

2012

2014

2013

New Data:

Focus on Efficacy AND

Tolerability

•

Patient tolerability

•

Safety profile

•

Minimal dose modifications

•

Convenient dose and regimen |

Launch Plan in RCC

19

19 |

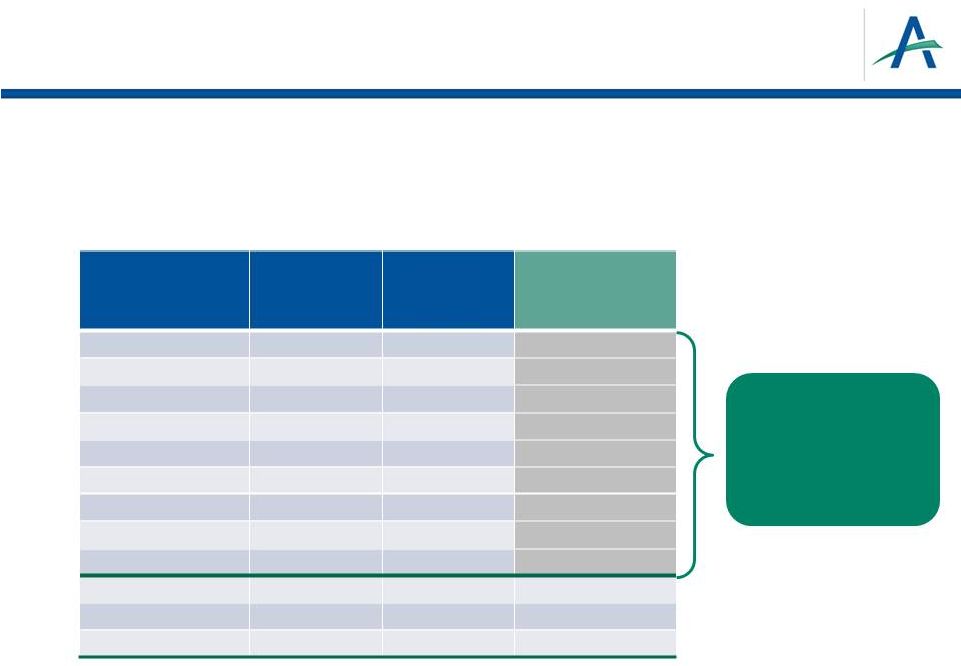

Key

Pre-Launch Commercial Objectives •

Refine understanding of RCC marketplace and opportunity for tivozanib

–

Comprehensive advisory board and market research plan

–

Customer targeting plan for launch

20

Analysis

supports ~80

Sales Reps can

cover top 85%

customers

RCC Decile

Customers

Total FTEs

Estimated

Patients per

Annual RCC

Customer

10

(10%)

7

(40%)

8

(30%)

9

(20%)

4

(70%)

5

(60%)

6

(50%)

3

(80%)

2a

(85%)

2b

(90%)

1a

(95%)

1b

(100%)

16

49

83

126

181

260

374

543

375

493

723

2,235

86.4

28.0

17.0

11.6

8.2

5.8

4.0

2.8

2.0

1.5

1.0

0.3

3.8

5.1

5.2

6.7

8.8

10.3

13.2

16.3

11.3

14.8

21.7

67.1 |

Key

Pre-Launch Commercial Objectives •

Refine understanding of RCC marketplace and opportunity for tivozanib

–

Comprehensive advisory board and market research plan

–

Customer targeting plan for launch

•

Optimize brand platform and positioning

–

Distinct global positioning and differentiated messaging for launch

21

Selective inhibition

of VEGFR 1,2,3

Potent inhibition

of VEGFR 1,2,3

Long half-life

Efficacy:

PFS

1

year

in

treatment-naïve patients

Safety:

Low rates of dose

reductions and interruptions

Dosing:

One tablet, once a

day

> |

Key

Pre-Launch Commercial Objectives •

Refine understanding of RCC marketplace and opportunity for tivozanib

–

Comprehensive advisory board and market research plan

–

Customer targeting plan for launch

•

Optimize brand platform and positioning

–

Distinct global positioning and differentiated messaging for launch

•

Increase awareness of clinical unmet needs in RCC

–

Highlight challenges of disease and emphasize importance of communication

around patient concerns

22 |

Key

Pre-Launch Commercial Objectives 23 |

Key

Pre-Launch Commercial Objectives Refine understanding of RCC marketplace and opportunity for tivozanib

–

Comprehensive advisory board and market research plan

–

Customer targeting plan for launch

Optimize brand platform and positioning

–

Distinct global positioning and differentiated messaging for launch

Increase awareness of clinical unmet needs in RCC

–

Highlight challenges of disease and emphasize importance of communication

around patient concerns

Optimize patient access offerings

–

Patient services programs

–

Best-in-class reimbursement support

24

Medicaid

6%

Uninsured

7%

Medicare

26%

Commercial

Insurance

61%

•

•

•

• |

Key

Pre-Launch Commercial Objectives Refine understanding of RCC marketplace and opportunity for tivozanib

–

Comprehensive advisory board and market research plan

–

Customer targeting plan for launch

Optimize brand platform and positioning

–

Distinct global positioning and differentiated messaging for launch

Increase awareness of clinical unmet needs in RCC

–

Highlight challenges of disease and emphasize importance of communication

around patient concerns

Optimize patient access offerings

–

Patient services programs

–

Best-in-class reimbursement support

Ensure launch readiness

–

Finalize distribution capabilities

–

Establish sales force infrastructure

25

Vice President, U.S. Sales

Brad Bailey, AVEO

Hired 3Q12

Area Directors

1Q13

Regional Managers

1Q13

Sales Specialists

2Q13

Sales Force Structure

•

•

•

•

• |

Looking beyond RCC

26 |

BATON: Biomarker Assessment of Tivozanib in ONcology

•

Phase 2 in

1

colorectal cancer (n=252)

•

Tivozanib

+ mFOLFOX6

vs

bevacizumab

+ mFOLFOX6

•

Primary endpoint: PFS

•

Assess predictive biomarkers

•

LDH; hypoxia-inducible factor

signature; VEGF A, C and D levels;

myeloid-specific markers (CD68)

•

Data anticipated in 2014

•

Phase 2 in 1

-line in metastatic triple

negative breast cancer (n=147)

•

Tivozanib + paclitaxel vs placebo +

paclitaxel

•

Primary endpoint: PFS

•

Assess predictive biomarkers

•

Hypoxia-inducible factor signature,

VEGF-A, VEGF-C, soluble VEGFR-1 and

-2; myeloid-specific markers (CD68)

•

Data anticipated in 2014

27

Biomarker Driven Approach to Tivozanib Development

st

st

-line metastatic |

Financial Resources

Strategic restructuring conducted in October 2012

–

Expected to provide ~$100M in cost savings over 3 years, including

~$37M in 2013

Estimated

4Q12

cash

and

securities

of

~$160M*

Sufficient capital to fund operations through 2013

28

*Unaudited 4Q12 financial results as of 12/31/12

•

•

• |

AVEO

Investment Thesis Tivozanib

approval

anticipated

in

2013

–

Anticipated ODAC in 1H13

–

Target PDUFA action date of July 28, 2013

–

MAA led by Astellas; anticipated submission in 2H13

BATON

studies

ongoing

Human

Response

Platform

supporting

development

Commercial

rights

to

all

oncology

programs

Capital

through

2013

29

•

•

•

•

•

™ |