Attached files

| file | filename |

|---|---|

| EX-23.1 - American Magna Corp | forms1a1010313ex_23-1.htm |

As filed with the Securities and Exchange Commission on December__, 2012

Registration No. 333-_____

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

S-1/A

Amendment #1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

DAKOTA GOLD CORP.

(Exact name of Registrant as specified in its charter)

|

Nevada

|

|

1040

|

|

20-5859893

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(Primary Standard Industrial Classification Code)

|

|

(I.R.S. Employer Identification No.)

|

Dakota Gold Corp.

701 N. Green Valley Parkway, Suite 200

Henderson, Nevada, 89074

Telephone: (702) 990-3256

(Address, including zip code, and telephone number,

including area code, of registrant's principal executive offices)

Herb Duerr

Dakota Gold Corp.

701 N. Green Valley Parkway, Suite 200

Henderson, Nevada, 89074

Telephone: (702) 990-3256

Facsimile: (702) 990-3001

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copies of all correspondence to:

|

Scott D. Olson, Esq.

274 Broadway, Costa Mesa,

California 92627

Telephone: (310) 985-1034

Facsimile: (310) 564-1912

|

1

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, please check the following box: [x]

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. □

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. □

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. □

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one)

|

Large accelerated filer

|

□

|

|

Accelerated filer

|

□

|

|

|

|

|

|

|

|

Non-accelerated filer

|

□

|

|

Smaller reporting company

|

X

|

2

Calculation of Registration Fee

|

Title of Class of Securities to be Registered

|

Amount to be Registered

|

Proposed Maximum Aggregate Price Per Share

|

Proposed Maximum Aggregate Offering Price

|

Amount of Registration Fee

|

|

Common Stock, $0.001 per share

|

30,000,000

|

$0.01(1)

|

$300,000

|

$34.38

|

|

Total

|

30,000,000

|

$0.01 (1)

|

$300,000

|

$34.38 (2)

|

|

(1)

|

The offering price has been estimated solely for the purpose of computing the amount of the registration fee in accordance with Rule 457(o).

|

|

(2)

|

Previously paid.

|

|

|

In the event of a stock split, stock dividend or similar transaction involving our common stock, the number of shares registered shall automatically be increased to cover the additional shares of common stock issuable pursuant to Rule 416 under the Securities Act of 1933, as amended.

|

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

THE INFORMATION IN THIS PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. WE MAY NOT SELL THESE SECURITIES UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED.

PRELIMINARY PROSPECTUS SUBJECT TO COMPLETION DATED ______ __, 2012

3

PROSPECTUS

DAKOTA GOLD CORP.

Up to 30,000,000 Shares of Common Stock

We are offering up to 30,000,000 shares at a price per share of $0.01 on a best efforts basis. We are making this offering without the involvement of underwriters or broker-dealers. The shares of our common stock to be sold by us will be sold on our behalf by our executive officers and directors. Such officers and directors will not receive any compensation or commission on the proceeds from the sale of our shares on our behalf, if any. We will bear the costs, expenses and fees associated with the registration of the shares in this prospectus. Should we be successful in selling all of the shares offered, we will receive $300,000 in proceeds before expenses but there can be no assurance that all or any of the shares will be sold.

The sale of 30,000,000 shares is intended to be a self-underwritten offering with no minimum purchase requirement. We do not have an arrangement to place the proceeds from this offering, if any, in an escrow, trust or similar account. Any funds raised from the offering will be immediately available to us for our use. Subscriptions for shares are irrevocable once made, and funds will only be returned if the subscription is rejected.

This offering will begin upon the effectiveness of the registration statement of which this prospectus is a part and will terminate on the earlier of: (i) the date when the sale of all 30,000,000 shares is completed, or (ii) 180 days from the effective date of this registration statement, which date may be extended by us in our discretion for an additional 90 days.

Investing in our securities involves significant risks. See “Risk Factors” beginning on page 9.

We are an Emerging Growth Company as defined in the Jumpstart Our Business Startups Act.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THIS PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The information in this prospectus is not complete and may be changed. This prospectus is included in the registration statement that was filed by us with the Securities and Exchange Commission. We may not sell these securities until the registration statement becomes effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

The date of this prospectus is ___________, 2012

4

Table of Contents

|

|

Page

|

|

|

|

|

Prospectus Summary

|

6 |

|

Risk Factors

|

9 |

|

The Offering

|

16 |

|

Use of Proceeds

|

16 |

|

Determination of Offering Price

|

16 |

|

Forward Looking Statements

|

20 |

|

Dilution

|

17 |

|

Plan of Distribution

|

17 |

|

Description of Securities

|

19 |

|

Interest of Named Experts and Counsel

|

19 |

|

Description of Business

|

20 |

|

Description of Property

|

22 |

|

Legal Proceedings

|

28 |

|

Market for Common Equity and Related Stockholder Matters

|

28 |

|

Dividend Policy

|

28 |

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

29 |

|

Changes in and Disagreements with Accountants

|

33 |

|

Directors, Executive Officers, Promoters, and Control Persons

|

33 |

|

Director Independence

|

34 |

|

Executive Compensation

|

34 |

|

Security Ownership of Certain Beneficial Owners and Management

|

36 |

|

Certain Relationships and Related Transactions

|

36 |

|

Expenses of Issuance and Distribution

|

37 |

|

Legal Matters

|

37 |

|

Indemnification for Securities Act Liabilities

|

37 |

|

Experts

|

37 |

|

Where You Can Find More Information

|

37 |

|

Financial Statements

|

38 |

|

Information not Required in Prospectus

|

64 |

You should rely only on the information contained in this prospectus. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these securities in any jurisdiction where an offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

5

PROSPECTUS SUMMARY

As used in this prospectus, references to the “Company,” “we,” “our,” “us,” or “Dakota” refer to Dakota Gold Corp., unless the context otherwise indicates.

The following summary highlights selected information contained in this prospectus. Before making an investment decision, you should read the entire prospectus carefully, including the “Risk Factors” section, the financial statements and the notes to the financial statements.

|

Corporate Background

|

|

We were incorporated under the laws of the State of Florida on October 27, 2006 under the name Coastline Corporate Services, Inc. We were established to provide services to public companies requiring guidance and assistance in converting and filing their documents with the U.S. Securities and Exchange Commission. We were unable to raise sufficient capital to operate this business profitably and underwent a change of control and a number of changes in management.

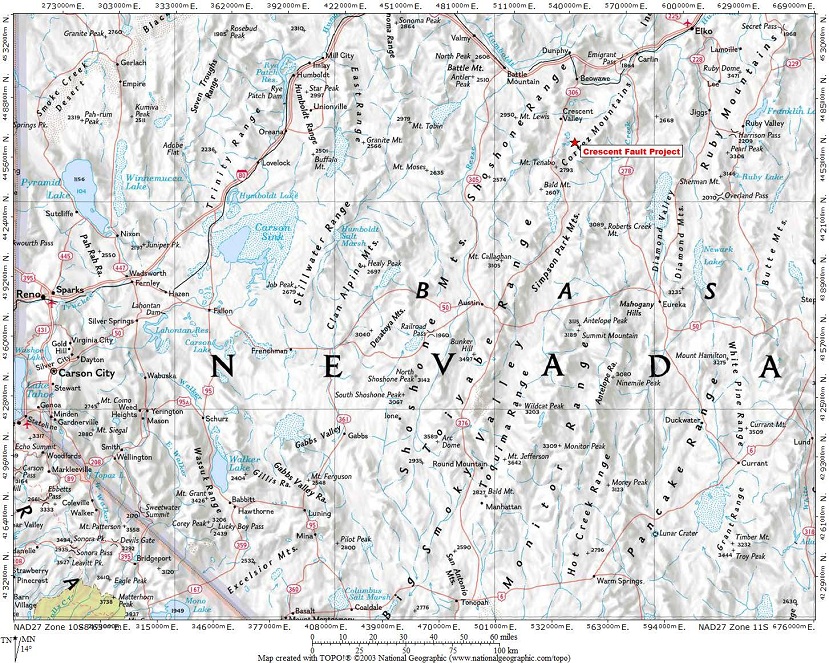

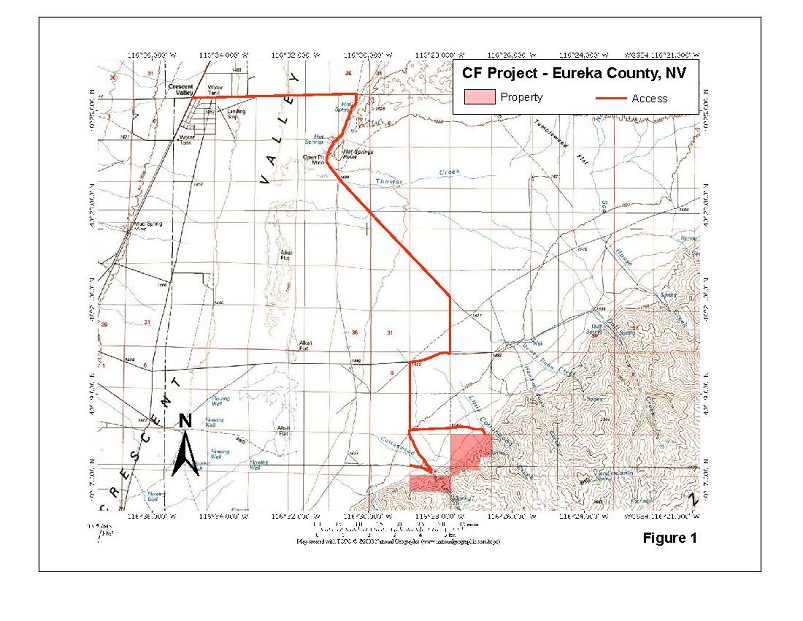

On August 17, 2012 we executed a property option agreement (the “Agreement”) with MinQuest, Inc. (“MinQuest”) granting us the right to acquire 100% of the mining interests of a Nevada mineral exploration property currently controlled by MinQuest. The property known as the Crescent Fault Property is located in Eureka County, Nevada and currently consists of 33 unpatented claims (the “Property”). Under the Agreement we are required to make aggregate option payments of $860,000 and incur certain property exploration expenditures of $3,100,000 by August 17, 2021. Herb Duerr, our principal executive officer, is also a Vice President of MinQuest.

We are currently an exploration-stage company as defined by the U.S. Securities and Exchange Commission (“SEC”) and we are in the business of exploring and if warranted, advancing certain unpatented mineral properties to the discovery point where we believe maximum shareholder returns can be realized. Our auditors have issued an audit opinion which includes a statement describing substantial doubt about our ability to continue as a going concern.

|

|

|

|

|

|

|

We are dependent upon making a gold deposit discovery at the Property for the furtherance of the Company. Should we be able to make an economic find at the Property, we would then be solely dependent upon the Property mining operation for our revenue and profits, if any. The Property claims presently do not have any mineral resources or reserves. There is no mining plant or equipment located within the property boundaries. Currently, there is no power supply to the mineral claims. The probability that ore reserves that meet SEC guidelines will be discovered on an individual hard rock prospect at the Property is undeterminable at this time. A great deal of work is required on the Property before a determination as to the economic and legal feasibility of a mining venture on it can be made. There is no assurance that a commercially viable deposit will be proven through the exploration efforts by us at the Property. We cannot assure you that funds expended on the Property or other properties that we may acquire in the future will be successful in leading to the delineation of ore reserves that meet the criteria established under SEC mining industry reporting guidelines.

|

|

|

|

|

|

|

Current State of Exploration

|

|

The Property claims presently do not have any mineral resources or reserves. We have begun reviewing the results of the historic drilling and sampling. There is no mining plant or equipment located within the Property boundaries. Currently, there is no power supply to the mineral claims. Our planned program includes compilation of all activities to the present with a follow-up reverse circulation drill program. However, this program is exploratory in nature and no minable reserves may ever be found.

|

The Offering:

|

Securities Being Offered

|

Up to 30,000,000 shares of common stock, par value $0.001, with no minimum

|

|

Offering Price

|

$0.01 per share

|

|

Securities Issued

|

2,345,998 shares of our common stock are issued and outstanding as of the date of this prospectus.

|

6

|

Securities Issued After This Offering

|

32,345,998 shares issued and outstanding if we sell all 30,000,000 shares being offered hereby

|

|

Market for the Common Shares

|

Our common stock is traded on the Over The Counter Bulletin Board (“OTCBB”) under the symbol “DAKO.” To date there has only been a very limited trading market for our securities.

There is no assurance that a trading market will develop, or, if developed, that it will be sustained. Consequently, a purchaser of our common stock may find it difficult to resell the securities offered herein should the purchaser desire to do so when eligible for public resale.

|

|

Use of Proceeds

|

We intend to use the net proceeds of this offering for undertaking a drill program on our Property and for general corporate purposes.

|

|

Termination of the Offering

|

The earlier of: (i) the date when the sale of all 30,000,000 shares is completed, or (ii) 180 days from the effective date of this registration statement, which date may be extended by us in our discretion for an additional 90 days.

|

|

Terms of the Offering

|

Our directors and officers will sell our stock upon effectiveness of this prospectus on a self-underwritten basis.

|

Summary Financial Information

The following presents our summary financial information for the periods indicated and should be read in conjunction with the information contained in “Management's Discussion and Analysis or Plan of Operations” and our financial statements and related notes appearing elsewhere in this prospectus.

|

Statement of Operations Data

|

Six Months

Ended

October 31, 2012

(unaudited)

|

Year Ended April 30, 2012 |

Year Ended April 30, 2011

|

Period from August 1, 2010 (inception of exploration stage) to October 31, 2012

(unaudited)

|

||||||||||||

|

Operating revenues

|

$ | - | $ | - | $ | - | $ | - | ||||||||

|

Income (loss) from operations

|

$ | (27,077 | ) | $ | (96,705 | ) | $ | (83,452 | ) | $ | (137,340 | ) | ||||

|

Net income (loss)

|

$ | (34,433 | ) | $ | (96,705 | ) | $ | (83,452 | ) | $ | (202,479 | ) | ||||

|

Balance Sheet Data

|

October 31, 2012

|

April 30, 2012

|

April 30, 2011

|

|||||||||

|

Working capital

|

$ | (82,715 | ) | $ | (48,282 | ) | $ | (51,577 | ) | |||

|

Total assets

|

$ | 27,968 | $ | 39,154 | $ | 31,556 | ||||||

|

Total liabilities

|

$ | 110,683 | $ | 87,346 | $ | 81,133 | ) | |||||

|

Stockholders’ (Deficit) Equity

|

$ | (82,715 | ) | $ | (48,282 | ) | $ | (51,577 | ) | |||

7

Emerging Growth Company

We are an Emerging Growth Company as defined in the Jumpstart Our Business Startups Act.

We shall continue to be deemed an emerging growth company until the earliest of:

(A) the last day of the fiscal year of the issuer during which it had total annual gross revenues of $1,000,000,000 (as such amount is indexed for inflation every 5 years by the Commission to reflect the change in the Consumer Price Index for All Urban Consumers published by the Bureau of Labor Statistics, setting the threshold to the nearest 1,000,000) or more;

(B) the last day of the fiscal year of the issuer following the fifth anniversary of the date of the first sale of common equity securities of the issuer pursuant to an effective registration statement under this title;

(C) the date on which such issuer has, during the previous 3-year period, issued more than $1,000,000,000 in non-convertible debt; or

(D) the date on which such issuer is deemed to be a ‘large accelerated filer’, as defined in section 240.12b-2 of title 17, Code of Federal Regulations, or any successor thereto.

As an emerging growth company we are exempt from Section 404(b) of Sarbanes Oxley. Section 404(a) requires Issuers to publish information in their annual reports concerning the scope and adequacy of the internal control structure and procedures for financial reporting. This statement shall also assess the effectiveness of such internal controls and procedures.

Section 404(b) requires that the registered accounting firm shall, in the same report, attest to and report on the assessment on the effectiveness of the internal control structure and procedures for financial reporting.

As an emerging growth company we are exempt from Section 14A and B of the Securities Exchange Act of 1934 which require the shareholder approval of executive compensation and golden parachutes.

We have irrevocably opted out of the extended transition period for complying with new or revised accounting standards pursuant to Section 107(b) of the Act.

8

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the following factors and other information in this prospectus before deciding to invest in our company. If any of the following risks actually occur, our business, financial condition, results of operations and prospects for growth would likely suffer. As a result, you could lose all or part of your investment.

Risk Factors Relating to Our Company

1. Our independent auditor has issued a going concern opinion after auditing our financial statement. Our ability to continue is dependent on our ability to raise additional capital and our operations could be curtailed if we are unable to obtain required additional funding when needed.

We will be required to expend substantial amounts of working capital in order to explore and develop the Property. We were incorporated on October 27, 2006 but entered the exploration stage on August 1, 2010. Our operations since entering the exploration stage have been funded entirely from capital raised from our private offering of securities from March through September 2011 and from the proceeds from a bridge loan initially issued in August 2010. We will continue to require additional financing to execute our business strategy. We are totally dependent on external sources of financing for the foreseeable future, of which we have no commitments. Our failure to raise additional funds in the future will adversely affect our business operations, and may require us to suspend our operations, which in turn may result in a loss to the purchasers of our common stock. We are entirely dependent on our ability to attract and receive additional funding from either the sale of securities or outside sources such as private investment or a strategic partner. We currently have no firm agreements or arrangements with respect to any such financing and there can be no assurance that any needed funds will be available to us on acceptable terms or at all. The inability to obtain sufficient funding of our operations in the future could restrict our ability to grow and reduce our ability to continue to conduct business operations. As of October 31, 2012, we incurred a net loss of $202,479 from the inception of the exploration stage and used cash in operations from inception of the exploration stage of $152,192. After reviewing our financial statements, our independent auditor issued a going concern opinion and our ability to continue is dependent on our ability to raise additional capital. If we are unable to obtain necessary financing, we will likely be required to curtail our development plans which could cause us to become dormant. Any additional equity financing may involve substantial dilution to our then existing stockholders.

2. We are an exploration stage company, have generated no revenues to date and have a limited operating history upon which we may be evaluated.

We were incorporated on August 27, 2006 in the State of Florida under the name Coastline Corporate Services, Inc. The Company was established to provide services to public companies requiring guidance and assistance in converting and filing their documents with the U.S. Securities and Exchange Commission. In August 2010 the Company initiated the process of changing the name of the Company from Coastline Corporate Services, Inc. to “Dakota Gold Corp.” In connection with the change of the Company’s name to Dakota Gold Corp. the Company intended to change its business to mineral resource exploration and move its domicile to Nevada. In order to undertake the name, business and domicile change, the Company incorporated a wholly-owned subsidiary in Nevada named Dakota Gold Corp. and merged Coastline Corporate Services, Inc. with the new subsidiary. The Company received final regulatory for the name, business, and domicile change on November 26, 2010 and is now a Nevada corporation. As a result of the change of business of the Company, the Company entered the exploration stage on August 1, 2010. The Company optioned its current Property on August 17, 2012 and as a result has not undertaken any exploration on the Property.

The Property we have under option is an early stage mineral property and the Property does not have any known resources or reserves. Our only other meaningful asset is approximately $22,000 in available cash at October 31, 2012. Our limited operating history makes it difficult to evaluate our business on the basis of historical operations. We are an exploration stage company with no known commercially viable deposits, or “resources”, or "reserves" on our Property. Therefore, determination of the existence of a resource or reserve will depend on appropriate and sufficient exploration work and the evaluation of legal, economic, and environmental factors. If we fail to find a commercially viable deposit on any of our property our financial condition and results of operations will suffer. If we cannot generate income from the Property we will have to cease operation which will result in the loss of your investment.

We face all of the risks inherent in a new business and those risks specifically inherent in the exploration stage company, with all of the unforeseen costs, expenses, problems, and difficulties to which such ventures are subject. We cannot assure you that we will be able to generate revenues or profits from operation of our business or that we will be able to generate or sustain profitability in the future.

9

3. We expect losses in the future because we have no revenue to offset losses.

As reflected in our financial statements filed in this registration statement, we are in the exploration stage formed to carry out the activities described in this prospectus. Since inception of the exploration stage on August 1, 2010 to October 31, 2012, we have incurred a net loss of $202,479 and used cash in operations of $152,192. As we have no current revenue, we are expecting losses over the next 12 months because we do not yet have any revenues to offset the expenses associated with the development and implementation of our business plan. We cannot guarantee that we will ever be successful in generating revenues in the future. We recognize that if we are unable to generate revenues, we will not be able to earn profits or continue operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide investors with no assurance that we will generate any operating revenues or ever achieve profitable operations.

4. Our business model is unproven and our success is dependent on our ability to explore and develop our mineral property.

Our business model is to generate revenues from the sale of minerals from our optioned exploration property, located in Eureka County, Nevada. We cannot guarantee that we will ever be successful in doing this in order to generate revenues in the future. The Property is at a very early stage, and our ability to generate revenue is unproven. Therefore, it is not possible for us to predict the future level of production, if any, or if we will be able to effectuate our business plan. We recognize that if we are unable to generate revenues, we will not be able to earn profits or continue operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide investors with no assurance that we will generate any operating revenues or ever achieve profitable operations.

5. Because we anticipate our operating expenses will increase prior to our earning revenues, we may never achieve profitability

Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues. Therefore, we expect to incur significant losses into the foreseeable future. We recognize that if we are unable to generate significant revenues from the exploration of our mineral claims we will not be able to earn profits or continue operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and we can provide investors with no assurance that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

6. The loss of our President and CEO or the failure to hire qualified employees or consultants would damage our business.

Because of the highly technical nature of our business, we depend greatly on attracting and retaining experienced management and highly qualified and trained personnel. We compete with other companies intensely for qualified and well trained professionals in our industry. If we cannot hire or retain, and effectively integrate, a sufficient number of qualified and experienced professionals, this will have a material adverse effect on our capacity to sustain and grow our business. It is anticipated that all of the exploration on our Property will be undertaken either directly by our President and CEO or under his direct supervision. Should our President and CEO by unavailable to perform his duties on behalf of the Company or should he terminate his relationship with the Company, our business operations would be severely impacted and we would have to curtail our operations.

7. Because our President and CEO serves as a director and consultant to other companies engaged in mineral exploration, a potential conflict of interest could negatively impact our ability to acquire properties to explore and to run our business.

Our President and CEO is a director and consultant to other natural resource or mining-related companies, or may be involved in related pursuits that could present conflicts of interest with his roles at Dakota. Since 1996 Herb Duerr has been a Vice President of MinQuest, Inc., since 1989 he has been a co-owner of Nevada Mine Properties II, Inc., and since 1994 he has been Vice President of Desert Pacific Exploration, Inc. All three of these entities are privately-owned mineral exploration companies. Mr. Duerr is also currently a director of Iconic Minerals (since October 2009), Canamex Resources Corporation (since March 2009) and American Consolidated Minerals (since September 2006). All of these entities with whom Mr. Duerr works with are also engaged in mining exploration. These associations may give rise to conflicts of interest from time to time. For example, we may be presented with an opportunity in which Mr. Duerr would have to decide if the opportunity would be more appropriate for us or for another entity. There may be a dispute with another entity, and then Mr. Duerr, our principal executive officer, would have an inherent conflict of interest as to such a situation. In the event that any such conflict of interest arises, a director or officer who has such a conflict is required to disclose the conflict to a meeting of the directors of the company in question and to abstain from voting for or against approval of any matter in which such director may have a conflict. To date there have not been any conflicts of interest.

10

8. If we do not complete the required option payments and capital expenditure requirements mandated in our agreement with MinQuest we will lose our interest in our property and our business may fail.

If we do not make all of the property payments to MinQuest or incur the required expenditures in accordance with the property option agreement we will lose our option to acquire the Property for which we have not made the payments and may not be able to continue to execute our business objectives if we are unable to find an alternate exploration interest. Since our payment obligations are non-refundable, if we do not make any payments, we will lose any payments previously made and all our rights to the Property.

9. Mr. Herb Duerr, our President and CEO, is also a Vice President of MinQuest and the Company has optioned its only property from MinQuest resulting in the potential for a conflict of interest between the Company and MinQuest.

Our Property has been optioned from MinQuest. Our President and CEO is also a Vice President of MinQuest. The fact that Mr. Duerr is an officer of the Company and MinQuest creates the possibility of a conflict of interest. The areas of potential conflict of interest include the amount of time Mr. Duerr dedicates to the Company versus time spent on other MinQuest operations, the assessment of results of exploration may be impacted by Mr. Duerr’s financial interest in both the Company and MinQuest, and the dissemination of drill results may be affected by Mr. Duerr’s management role with the Company and MinQuest. If the relationship with MinQuest were to be damaged or severed, Mr. Duerr would be in a situation where he may have to make a decision that would harm either MinQuest or the Company. In order to mitigate these potential conflicts of interest, the Crescent Fault Property Option Agreement has provisions for dispute resolution under the Arbitration Act of Nevada. To date, there have not been any conflicts between or amongst the Company, Mr. Duerr and MinQuest.

10. Because of the speculative nature of exploration and development, there is a substantial risk that our business will fail.

The search for valuable natural resources on our property is extremely risky as the exploration for natural resources is a speculative venture involving substantial risk. Few properties that are explored are ultimately developed into producing mines. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. Because the probability of an individual prospect ever having reserves is extremely remote, in all probability the Property does not contain any reserves, and any funds we spent on exploration will probably be lost. In such a case, we would be unable to complete our business plan.

Mineral exploration involves a high degree of risk and exploration projects are frequently unsuccessful. To the extent that we continue to be involved in mineral exploration, the long-term success of our operations will be related to the cost and success of our exploration programs. The risks associated with mineral exploration include:

|

·

|

the identification of potential mineralization based on superficial analysis;

|

|

·

|

the quality of our management and our geological and technical expertise; and

|

|

·

|

the capital available for exploration and development.

|

Substantial expenditures are required to determine if a project has economically mineable mineralization. It may take several years to establish proven and probable reserves and to develop and construct mining and processing facilities. Problems such as unusual or unexpected formations and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. In such a case, we would be unable to develop our business.

11. We may not be able to compete with current and potential exploration companies, some of whom have greater resources and experience than we do in developing mineral reserves.

The natural resource market is intensely competitive, highly fragmented and subject to rapid change. We may be unable to compete successfully with our existing competitors or with any new competitors. We compete with many exploration companies which have significantly greater personnel, financial, managerial, and technical resources than we do. This competition from other companies with greater resources and reputations may result in our failure to maintain or expand our business.

12. We may not have the funds to purchase all of the supplies, manpower and materials we need to begin exploration which could cause us to delay or suspend operations.

Competition and unforeseen limited sources of supplies in the industry could result in occasional spot shortages of supplies, manpower and certain equipment such as drill rigs, bulldozers and excavators that we might need to conduct exploration. If there is a shortage or scarcity, we cannot compete with larger companies in the exploration industry for supplies, manpower and equipment. In the event that the prices for such resources rise above our affordability levels, we may have to delay or suspend operations. In the event we are forced to limit our exploration activities, we may not find any minerals, even though our properties may contain mineralized material. Without any minerals we cannot generate revenues and you may lose your investment.

11

13. The prices of metals are highly volatile and a decrease in metals prices could result in us incurring losses.

The profitability of natural resource operations are directly related to the market prices of the underlying commodities. The market prices of metals fluctuate significantly and are affected by a number of factors beyond our control, including, but not limited to, the rate of inflation, the exchange rate of the dollar to other currencies, interest rates, and global economic and political conditions. Price fluctuations in the metals markets from the time development of a mine is undertaken and the time production can commence can significantly affect the profitability of a mine. Accordingly, we may begin to develop a mineral property at a time when the price of the underlying metals make such exploration economically feasible and, subsequently, incur losses because metals prices have decreased. Adverse fluctuations of metals market price may force us to curtail or cease our business operations.

14. Because our business involves numerous operating hazards, we may be subject to claims of a significant size which would cost a significant amount of funds and resources to rectify. This could force us to cease our operations, which will cause you a loss of your investment.

Our proposed business is subject to the usual hazards inherent in exploring for minerals, such as general accidents, explosions, chemical exposure, and craterings. The occurrence of these or similar events could result in the suspension of operations, damage to or destruction of the equipment involved and injury or death to personnel. Operations also may be suspended because of machinery breakdowns, abnormal climatic conditions, failure of subcontractors to perform or supply goods or services or personnel shortages. The occurrence of any such contingency would require us to incur additional costs and force us to cease our operations, which will cause you a loss of your investment.

Difficulties, such as unusual or unexpected rock formations encountered by workers but not indicated on a map, or other conditions may be encountered in the gathering of samples and information, and could delay our exploration program. We do not currently carry insurance to protect against these risks and we may not obtain such insurance in the future. Even if we do obtain insurance, the nature of these risks is such that liabilities could over exceed policy limits or be excluded from coverage. There are also risks against which we cannot, or may not elect to insure. The costs, which could be associated with any liabilities, not covered by insurance or in excess of insurance coverage or compliance with applicable laws and regulations may cause substantial delays and require significant capital outlays, thereby hurting our financial position, future earnings, and/or competitive positions. We may not have enough capital to continue operations and you will lose your investment.

15. Damage to the environment could result from our operations. If our business is involved in one or more of these hazards, we may be subject to claims of a significant size which could force us to cease our operations.

Mineral resource exploration, production and related operations are subject to extensive rules and regulations of federal, state and local agencies. Failure to comply with these rules and regulations can result in substantial penalties. Our cost of doing business may be affected by the regulatory burden on the mineral industry since the rules and regulations frequently are amended or interpreted. We cannot predict the future cost or impact of complying with these laws.

Environmental enforcement efforts with respect to mineral operations have increased over the years, and it is possible that regulation could expand and have a greater impact on future mineral exploration operations. Although our management intends to comply with all legislation and/or actions of local, provincial, state and federal governments, non-compliance with applicable regulatory requirements could subject us to penalties, fines and regulatory actions, the cost of which could harm our results of operations. We cannot be sure that our proposed business operations will not violate environmental laws in the future.

Our operations and property are subject to extensive federal, state, and local laws and regulations relating to environmental protection, including the generation, storage, handling, emission, transportation and discharge of materials into the environment, and relating to safety and health. These laws and regulations may do any of the following: (i) require the acquisition of a permit or other authorization before exploration commences, (ii) restrict the types, quantities and concentration of various substances that can be released into the environment in connection with exploration activities, (iii) limit or prohibit mineral exploration on certain lands lying within wilderness, wetlands and other protected areas, (iv) require remedial measures to mitigate pollution from former operations and (v) impose substantial liabilities for pollution resulting from our proposed operations.

16. Because access to our mineral claims is limited during inclement weather conditions this could result in delays in our exploration

The business of mining for gold and other metals is generally subject to a number of risks and hazards including natural phenomena such as inclement weather conditions, floods, blizzards and earthquakes. Access to our mineral property is restricted during these weather conditions. Furthermore, during the winter months exploration cannot be done on the Property. As a result, any attempt to test or explore the property is largely limited to the times when weather conditions permits such activities. These limitations may result in significant delays in exploration efforts. Such delays may have a significant negative effect on our results of operations.

17. Our principal stockholder, who is also our Secretary and director, owns a controlling interest in our voting stock. Therefore investors will not have any voice in our management, which could result in decisions adverse to our general shareholders.

12

Our principal shareholder beneficially owns approximately 85.3% of our outstanding common stock. As a result, this shareholder will have the ability to control substantially all matters submitted to our stockholders for approval including:

• election of our board of directors;

• removal of any of our directors;

• amendment of our Articles of Incorporation or bylaws; and

• adoption of measures that could delay or prevent a change in control or impede a merger, takeover or other business combination involving us.

As a result of his ownership and position, the principal shareholder who is also our Secretary and a director is able to influence all matters requiring shareholder approval, including the election of directors and approval of significant corporate transactions. In addition, the future prospect of sales of significant amounts of shares held by our principal shareholder could affect the market price of our common stock if the marketplace does not orderly adjust to the increase in shares in the market and the value of your investment in the Company may decrease. Management's stock ownership may discourage a potential acquirer from making a tender offer or otherwise attempting to obtain control of us, which in turn could reduce our stock price or prevent our stockholders from realizing a premium over our stock price.

RISK FACTORS RELATING TO OUR COMMON STOCK

18. We may, in the future, issue additional common shares, which would reduce investors’ percent of ownership and may dilute our share value.

Our Articles of Incorporation authorizes the issuance of 100,000,000 shares of common stock, par value $.001 per share, of which 2,345,998 shares are currently issued and outstanding. The future issuance of common stock may result in substantial dilution in the percentage of our common stock held by our then existing shareholders. We may value any common stock issued in the future on an arbitrary basis. The issuance of common stock for future services or acquisitions or other corporate actions may have the effect of diluting the value of the shares held by our investors, and might have an adverse effect on any trading market for our common stock.

19. Our Secretary who is also a director owns a controlling interest in our voting stock and may take actions that are contrary to your interests, including selling their stock.

Our Secretary, who is also a director, beneficially owns approximately 85.3% of our outstanding common stock. If and when he is able to sell his shares in the market, such sales by our Secretary within a short period of time could adversely affect the market price of our common stock if the marketplace does not orderly adjust to the increase in the number of shares in the market. This will result in a decrease in the value of your investment in the Company. Management's stock ownership may discourage a potential acquirer from making a tender offer or otherwise attempting to obtain control of us, which in turn could reduce our stock price or prevent our stockholders from realizing a premium over our stock price.

20. Our common stock is subject to the "penny stock" rules of the SEC and the trading market in our securities is limited, which makes transactions in our stock cumbersome and may reduce the value of an investment in our stock.

The SEC has adopted Rule 15g-9 which establishes the definition of a "penny stock," for the purposes relevant to us, as any equity security that has a market price of less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. For any transaction involving a penny stock, unless exempt, the rules require: (i) that a broker or dealer approve a person's account for transactions in penny stocks; and (ii) the broker or dealer receive from the investor a written agreement to the transaction, setting forth the identity and quantity of the penny stock to be purchased. In order to approve a person's account for transactions in penny stocks, the broker or dealer must: (i) obtain financial information and investment experience objectives of the person; and (ii) make a reasonable determination that the transactions in penny stocks are suitable for that person and the person has sufficient knowledge and experience in financial matters to be capable of evaluating the risks of transactions in penny stocks.

The broker or dealer must also deliver, prior to any transaction in a penny stock, a disclosure schedule prescribed by the SEC relating to the penny stock market, which, in highlight form: (i) sets forth the basis on which the broker or dealer made the suitability determination; and (ii) that the broker or dealer received a signed, written agreement from the investor prior to the transaction.

Generally, brokers may be less willing to execute transactions in securities subject to the "penny stock" rules. This may make it more difficult for investors to dispose of our common stock and cause a decline in the market value of our stock.

Disclosure also has to be made about the risks of investing in penny stocks in both public offerings and in secondary trading and about the commissions payable to both the broker-dealer and the registered representative, current quotations for the securities and the rights and remedies available to an investor in cases of fraud in penny stock transactions. Finally, monthly statements have to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks.

13

Because we do not intend to pay any cash dividends on our shares of common stock, our stockholders will not be able to receive a return on their shares unless they sell them.

We intend to retain any future earnings to finance the development and expansion of our business. We do not anticipate paying any cash dividends on our common stock in the foreseeable future. Unless we pay dividends, our stockholders will not be able to receive a return on their shares unless they sell them at a price higher than that which they initially paid for such shares.

21. The market for penny stocks has experienced numerous frauds and abuses which could adversely impact investors in our stock.

We believe that the market for penny stocks has suffered from patterns of fraud and abuse. Such patterns include:

|

·

|

Control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer;

|

|

·

|

Manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases;

|

|

·

|

"Boiler room" practices involving high pressure sales tactics and unrealistic price projections by inexperienced sales persons;

|

|

·

|

Excessive and undisclosed bid-ask differentials and markups by selling broker-dealers; and

|

The wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the inevitable collapse of those prices with consequent investor losses.

22. The offering price of our common stock could be higher than the market value, causing investors to sustain a loss of their investment.

The price of our common stock in this offering has not been determined by any independent financial evaluation, market mechanism or by our auditors, and is therefore, to a large extent, arbitrary. Our audit firm has not reviewed management's valuation, and therefore expresses no opinion as to the fairness of the offering price as determined by our management. As a result, the price of the common stock in this offering may not reflect the value perceived by the market. There can be no assurance that the shares offered hereby are worth the price for which they are offered and investors may therefore lose a portion or all of their investment.

23. State securities laws may limit secondary trading, which may restrict the states in which and conditions under which you can sell the shares offered by this prospectus.

Secondary trading in common stock sold in this offering will not be possible in any state until the common stock is qualified for sale under the applicable securities laws of the state or there is confirmation that an exemption, such as listing in certain recognized securities manuals, is available for secondary trading in the state. If we fail to register or qualify, or to obtain or verify an exemption for the secondary trading of, the common stock in any particular state, the common stock could not be offered or sold to, or purchased by, a resident of that state. In the event that a significant number of states refuse to permit secondary trading in our common stock, the liquidity for the common stock could be significantly impacted thus causing you to realize a loss on your investment.

24. Currently there is only a minimal public market for our securities, and there can be no assurances that any active market will ever develop and, even if developed, it is likely to be subject to significant price fluctuations.

Our common stock is traded on the Over The Counter Bulletin Board (“OTCBB”) under the symbol “DAKO.” To date there has only been a very limited trading market for our securities.

There has not been any established trading market for our common stock, and there is currently only a very minimal public market for our securities. There can be no assurances as to whether:

|

·

|

any active trading market for our shares will develop;

|

|

·

|

the prices at which our common stock will trade; or

|

|

·

|

the extent to which investor interest in us will lead to the development of an active, liquid trading market. Active trading markets generally result in lower price volatility and more efficient execution of buy and sell orders for investors.

|

14

In addition, our common stock is unlikely to be followed by any market analysts, and there may be few institutions acting as market makers for our common stock. Either of these factors could adversely affect the liquidity and trading price of our common stock. Until our common stock is fully distributed and an orderly market develops in our common stock, if ever, the price at which it trades is likely to fluctuate significantly. Prices for our common stock will be determined in the marketplace and may be influenced by many factors, including the depth and liquidity of the market for shares of our common stock, developments affecting our business, including the impact of the factors referred to elsewhere in these Risk Factors, investor perception of our company and general economic and market conditions. No assurances can be given that an orderly or liquid market will ever develop for the shares of our common stock.

25. We may be exposed to potential risks resulting from new requirements under Section 404 of the Sarbanes-Oxley Act of 2002.

As a company registered with the SEC, we are required, pursuant to Section 404 of the Sarbanes-Oxley Act of 2002, to include in our annual report our assessment of the effectiveness of our internal control over financial reporting We expect to incur significant continuing costs, including accounting fees and staffing costs, in order to maintain compliance with the internal control requirements of the Sarbanes-Oxley Act of 2002. Development of our business will necessitate ongoing changes to our internal control systems, processes and information systems. Currently, we have no employees, other than our sole officer and director. As we engage in the exploration of our mineral claim, hire employees and consultants, our current design for internal control over financial reporting will not be sufficient to enable management to determine that our internal controls are effective for any period, or on an ongoing basis. Accordingly, as we develop our business, such development and growth will necessitate changes to our internal control systems, processes and information systems, all of which will require additional costs and expenses.

In the future, if we fail to complete the annual Section 404 evaluation in a timely manner, we could be subject to regulatory scrutiny and a loss of public confidence in our internal controls. In addition, any failure to implement required new or improved controls, or difficulties encountered in their implementation, could harm our operating results or cause us to fail to meet our reporting obligations.

27. Because we are not subject to compliance with rules requiring the adoption of certain corporate governance measures, our stockholders have limited protections against interested director transactions, conflicts of interest and similar matters.

The Sarbanes-Oxley Act of 2002, as well as rule changes proposed and enacted by the SEC, the New York and American Stock Exchanges and the Nasdaq Stock Market, as a result of Sarbanes-Oxley, require the implementation of various measures relating to corporate governance. These measures are designed to enhance the integrity of corporate management and the securities markets and apply to securities which are listed on those exchanges or the Nasdaq Stock Market. Because we are not presently required to comply with many of the corporate governance provisions and because we chose to avoid incurring the substantial additional costs associated with such compliance any sooner than necessary, we have not yet adopted these measures.

Because none of our directors are independent, we do not currently have independent audit or compensation committees. As a result, the directors have the ability, among other things, to determine their own level of compensation. Until we comply with such corporate governance measures, regardless of whether such compliance is required, the absence of such standards of corporate governance may leave our shareholders without protections against interested director transactions, conflicts of interest and similar matters and investors may be reluctant to provide us with funds necessary to expand our operations.

28. We are an “emerging growth company” under the JOBS Act of 2012, and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our common stock less attractive to investors.

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012 (“JOBS Act”), and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We cannot predict if investors will find our common stock less attractive because we may rely on these exemptions. If some investors find our common stock less attractive as a result, there may be a less active trading market for our common stock and our stock price may be more volatile. We will remain an “emerging growth company” for up to five years, although we will lose that status sooner if our revenues exceed $1 billion, if we issue more than $1 billion in non-convertible debt in a three year period, or if the market value of our common stock that is held by non-affiliates exceeds $700 million as of any May 30.

29. Our status as an “emerging growth company” under the JOBS Act of 2012 may make it more difficult to raise capital as and when we need it.

Because of the exemptions from various reporting requirements provided to us as an “emerging growth company”, we may be less attractive to investors and it may be difficult for us to raise additional capital as and when we need it. If we are unable to raise additional capital as and when we need it, our financial condition and results of operations may be materially and adversely affected.

15

THE OFFERING

We are offering on a self-underwritten basis, 30,000,000 shares of common stock at a price per share of $0.01. Shares will be offered on a best efforts basis and we do not intend to use an underwriter for this offering. We do not have an arrangement to place the proceeds from this offering, if any, in an escrow, trust or similar account. Any funds raised from the offering will be immediately available to us for our use. This offering will begin upon the effectiveness of the registration statement of which this prospectus is a part and will terminate on the earlier of: (i) the date when the sale of all 30,000,000 shares is completed, or (ii) 180 days from the effective date of this registration statement, which date may be extended by us in our discretion for an additional 90 days.

Subscriptions for shares are irrevocable once made, and funds will only be returned if the subscription is rejected. There will not be an escrow account so the proceeds from the sale will be placed directly into our corporate account and all funds received can be immediately used by us. If you decide to subscribe for any shares in this offering, you will be required to execute a subscription agreement and tender it, together with payment for the shares subscribed for. We have the right to accept or reject subscriptions in whole or in part, for any reason or for no reason. All monies from rejected subscriptions will be returned immediately by us to the subscriber, without interest or deductions.

The offering price of the common stock has been determined arbitrarily and bears no relationship to any objective criterion of value. The price does not bear any relationship to our assets, book value or net worth.

USE OF PROCEEDS

If we sell all of the shares offered, we estimate that the net proceeds from our offering of common stock under this prospectus will be approximately $295,000, after deducting estimated offering expenses payable by us. We intend to use the proceeds of this offering for undertaking a drill program on our Crescent Fault Property and for general corporate purposes. The net proceeds to us from the sale of up to 30,000,000 shares offered at a public offering price of $0.01 per share will vary depending upon the total number of shares sold. Regardless of the number of shares sold, we expect to incur offering expenses estimated at approximately $5,000 for legal, accounting and other costs in connection with this offering.

The table below shows the net proceeds from this offering for scenarios where we sell various amounts of the shares. Since we are making this offering on a no minimum, best-efforts basis, there is no guarantee that we will be successful at even selling 20% of the amount offered hereby. Accordingly, the actual amount of proceeds we will raise in this offering, if any, may differ.

Percent of Net Proceeds Received

|

10%

|

25%

|

50%

|

75%

|

100%

|

|

|

Shares Sold

|

3,000,000

|

7,500,000

|

15,000,000

|

22,500,000

|

30,000,000

|

|

Gross Proceeds

|

$30,000

|

$75,000

|

$150,000

|

$225,000

|

$300,000

|

|

Less Offering Expenses

|

$5,000

|

$5,000

|

$5,000

|

$5,000

|

$5,000

|

|

Net Offering Proceeds

|

25,000

|

$70,000

|

$145,000

|

$220,000

|

$295,000

|

The Use of Proceeds set forth below demonstrates how we intend to use the funds under the various percentages of amounts of the related offering. All amounts listed below are estimates.

|

% of Offering Sold

|

10%

|

25%

|

50%

|

75%

|

100%

|

|

Exploration Expenses

|

-

|

$45,000

|

$120,000

|

$195,000

|

$270,000

|

|

General and Administrative

|

$25,000

|

$25,000

|

$25,000

|

$25,000

|

$25,000

|

|

Total

|

$25,000

|

$70,000

|

$145,000

|

$220,000

|

$295,000

|

Our offering expenses are comprised of legal and accounting expenses, and SEC and EDGAR filing fees, transfer agent fees and any necessary state registration fees. Our officers and directors will not receive any compensation for their efforts in selling our shares.

We intend to use the proceeds of this offering in the manner set forth above. No material amount of the proceeds is to be used to discharge indebtedness or to acquire assets or finance the acquisition of other businesses other than in the ordinary course of business. At present we are not engaged in negotiations or the acquisition of additional technology. At present, no material changes are contemplated. Should there be any material changes in the projected use of proceeds in connection with this offering, we will issue an amended prospectus reflecting the same.

DETERMINATION OF OFFERING PRICE

The offering price of our common stock does not have any relationship to any established criteria of value, such as book value or earnings per share. Because we have no significant operating history, the price of our common stock is not based on past earnings, nor is the price of our common stock indicative of the current market value of the assets owned by us. No valuation or appraisal has been prepared for our business and potential business expansion.

16

DILUTION

Dilution represents the difference between the offering price and the net tangible book value per share immediately after completion of this offering. Net tangible book value is the amount that results from subtracting total liabilities and intangible assets from total assets. Dilution arises mainly as a result of our arbitrary determination of the offering price of the shares being offered. Dilution of the value of the shares you purchase is also a result of the lower book value of the shares held by our existing stockholder.

As at April 30, 2012, our last audited financial statement date, our total net tangible book value was ($48,282), or approximately ($0.0206) per share based on 2,345,998 shares issued and outstanding as of that date. The proceeds from the sale of the new shares being offered (up to a maximum of 30,000,000) will vary depending on the total number of shares actually sold in the offering. If all 30,000,000 shares offered hereunder are sold, there would be a total of 32,345,998 common shares issued and outstanding.

The following table sets forth as of April 30, 2012, the number of shares of common stock purchased from us and the total consideration paid by our existing stockholders and by new investors in this offering if new investors purchase 10%, 25%, 50%, 75% or 100% of the offering, before deducting offering expenses payable by us.

|

Percent of Shares Sold

|

10%

|

25%

|

50%

|

75%

|

100%

|

|

Number of shares sold

|

3,000,000

|

7,500,000

|

15,000,000

|

22,500,000

|

30,000,000

|

|

Anticipated net offering proceeds

|

$25,000

|

$70,000

|

$145,000

|

$220,000

|

$295,000

|

|

Total shares issued and outstanding post offering

|

5,345,998

|

9,845,998

|

17,345,998

|

24,845,998

|

32,345,998

|

|

Offering price per share

|

$0.01

|

$0.01

|

$0.01

|

$0.01

|

$0.01

|

|

Pre-offering net tangible book value/share

|

($.0206)

|

($.0206)

|

($.0206)

|

($.0206)

|

($.0206)

|

|

Post offering net tangible book value

|

($23,282)

|

$21,718

|

$96,718

|

$171,718

|

$246,718

|

|

Post offering net tangible book value/share

|

($0.0044)

|

$0.0022

|

$0.0056

|

$0.0069

|

$0.0076

|

|

Increase (Decrease) in net tangible book value per share after offering

|

$0.0162

|

$0.0228

|

$0.0262

|

$0.0275

|

$0.0282

|

|

Dilution per share to new shareholders

|

$0.0144

|

$0.0078

|

$0.0044

|

$0.0031

|

$0.0024

|

|

New shareholders percentage of ownership after offering

|

56.1%

|

76.2%

|

86.5%

|

90.1%

|

92.7%

|

|

Existing stockholders percentage of ownership after offering

|

43.9%

|

23.8%

|

13.5%

|

9.9%

|

7.3%

|

PLAN OF DISTRIBUTION

The Offering will be Managed by Our Officer and Director

This is a self-underwritten offering. We are offering to the public 30,000,000 shares of common stock on a “$300,000 maximum” basis at a purchase price of $0.01 per share. This Prospectus is part of a prospectus that permits Bobby Nijjar and Herb Duerr, to sell the shares directly to the public, with no commission or other remuneration payable to them. There are no definitive plans or arrangements to enter into any contracts or agreements to sell the shares with a broker or dealer. Bobby Nijjar and Herb Duerr will sell the shares and intends to offer them to friends, family members, acquaintances, and business associates. In offering the securities on our behalf, they will rely on the safe harbor from broker dealer registration set out in Rule 3a4-1 under the Securities Exchange Act of 1934.

Bobby Nijjar and Herb Duerr, will not register as broker-dealers pursuant to Section 15 of the Securities Exchange Act of 1934, in reliance upon Rule 3a4-1, which sets forth those conditions under which a person associated with an issuer may participate in the offering of the issuer’s securities and not be deemed to be a broker-dealer.

|

1.

|

Bobby Nijjar and Herb Duerr are not subject to a statutory disqualification, as that term is defined in Section 3(a)(39) of the Act, at the time of their participation; and,

|

|

2.

|

Neither Bobby Nijjar nor Herb Duerr will be compensated in connection with their participation by the payment of commissions or other remuneration based either directly or indirectly on transactions in securities; and

|

|

3.

|

Bobby Nijjar and Herb Duerr are not, nor will they be at the time of participation in the offering, an associated person of a broker-dealer; and

|

|

4.

|

Both Bobby Nijjar and Herb Duerr meet the conditions of paragraph (a)(4)(ii) of Rule 3a4-1 of the Exchange Act, in that they (A) primarily perform, or are intended primarily to perform at the end of the offering, substantial duties for or on behalf of our company, other than in connection with transactions in securities; and (B) are not a broker or dealer, or been an associated person of a broker or dealer, within the preceding twelve months; and (C) have not participated in selling and offering securities for any issuer more than once every twelve months other than in reliance on Paragraphs (a)(4)(i) or (a)(4)(iii).

|

17

Neither Bobby Nijjar, Herb Duerr, nor any affiliates intend to purchase any shares in this offering.

We will not use public solicitation or general advertising in connection with the offering. We will use our efforts to find purchasers for the shares offered by this prospectus within a period of 180 days from the date of the prospectus, subject to an extension for an additional period not to exceed 90 days.

We have no intention of inviting broker-dealer participation in this Offering.

Offering Period and Expiration Date

This Offering will commence on the effective date of the registration statement of which this prospectus is a part, as determined by the Securities and Exchange Commission, and will continue for a period of 180 days. We may extend the Offering for an additional 90 days, at our sole discretion, unless the offering is completed or otherwise terminated by us at an earlier date.

Procedures for Subscribing

If you decide to subscribe for any shares in Offering, you must deliver a check or certified funds for acceptance or rejection. There are no minimum share purchase requirements for individual investors. All checks for subscriptions must be made payable to "Dakota Gold Corp."

Right to Reject Subscriptions

We maintain the right to accept or reject subscriptions in whole or in part, for any reason or for no reason. All monies from rejected subscriptions will be returned immediately by us to the subscriber, without interest or deductions. Subscriptions for securities will be accepted or rejected within 48 hours of our having received them.

Penny Stock Rules

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system).

The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from those rules, to deliver a standardized risk disclosure document prepared by the SEC which:

|

·

|

contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading;

|

|

·

|

contains a description of the broker's or dealer's duties to the customer and of the rights and remedies available to the customer with respect to violations of such duties or other requirements of federal securities laws;

|

|

·

|

contains a brief, clear, narrative description of a dealer market, including "bid" and "ask" prices for penny stocks and the significance of the spread between the bid and ask prices;

|

|

·

|

contains the toll-free telephone number for inquiries on disciplinary actions;

|

|

·

|

defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and

|

|

·

|

contains such other information, and is in such form (including language, type size, and format) as the SEC shall require by rule or regulation.

|

Prior to effecting any transaction in a penny stock, a broker-dealer must also provide a customer with:

|

·

|

the bid and ask prices for the penny stock;

|

|

·

|

the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock;

|

|

·

|

the amount and a description of any compensation that the broker-dealer and its associated salesperson will receive in connection with the transaction; and

|

|

·

|

a monthly account statement indicating the market value of each penny stock held in the customer's account.

|

18

In addition, the penny stock rules require that prior to effecting any transaction in a penny stock not otherwise exempt from those rules, a broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive (i) the purchaser's written acknowledgment of the receipt of a risk disclosure statement, (ii) a written agreement to transactions involving penny stocks, and (iii) a signed and dated copy of a written suitability statement. These disclosure requirements may have the effect of reducing the trading activity in the secondary market for our securities, and therefore our stockholders may have difficulty selling their shares.

DESCRIPTION OF SECURITIES

The following description of our capital stock is a summary and is qualified in its entirety by the provisions of our Articles of Incorporation which has been filed as an exhibit to our registration statement of which this prospectus is a part.

Common Stock

We are authorized to issue 100,000,000 shares of common stock, par value $0.001, of which 2,345,998 shares are issued and outstanding as of December 31, 2012. Each holder of shares of our common stock is entitled to one vote for each share held of record on all matters submitted to the vote of stockholders, including the election of directors. The holders of shares of common stock have no pre-emptive, conversion, subscription or cumulative voting rights. There is no provision in our Articles of Incorporation or By-laws that would delay, defer, or prevent a change in control of our Company.

Preferred Stock

There is no preferred stock authorized.

Warrants and Options

Currently, there are no warrants, options or other convertible securities outstanding.

Limitation of Liability and Indemnification of Officers and Directors

Under our Articles of Incorporation we may indemnify an officer or director who is made a party to any proceeding, including a law suit, because of his position, if he acted in good faith and in a manner he reasonably believed to be in our best interest. We may advance expenses incurred in defending a proceeding. To the extent that the officer or director is successful on the merits in a proceeding as to which he is to be indemnified, we must indemnify him against all expenses incurred, including attorney’s fees. With respect to a derivative action, indemnity may be made only for expenses actually and reasonably incurred in defending the proceeding, and if the officer or director is judged liable, only by a court order. The indemnification is intended to be to the fullest extent permitted by the laws of the State of Nevada.

Disclosure of Commission Position on Indemnification of Securities Act Liabilities

Nevada law provides that we may indemnify our directors and officers to the fullest extent.

The general effect of the foregoing is to indemnify a control person, officer or director from liability, thereby making us responsible for any expenses or damages incurred by such control person, officer or director in any action brought against them based on their conduct in such capacity, provided they did not engage in fraud or criminal activity.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to our directors, officers or control persons pursuant to the foregoing provisions, we have been informed that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

Transfer Agent

The transfer agent for our common stock is Madison Stock Transfer Inc. located at 1688 E. 16th Street, Brooklyn, NY, 11229. Their telephone number is 718-627-4453.

INTEREST OF NAMED EXPERTS AND COUNSEL