Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - FIRST BUSINESS FINANCIAL SERVICES, INC. | a93012ceoletter8-k.htm |

Section 2 - Exhibit 99.1

Dear Shareholders and Friends of First Business:

For more than twenty years, we have charted a simple and clear path for growth at First Business: provide premium service and the highest quality products that meet our clients' financial needs, in an efficient and entrepreneurial manner. First Business' record third quarter performance demonstrates unqualified success in executing this strategic growth model. Breaking our own performance records at every turn, in the third quarter we posted exceptional growth across the franchise - from the top to the bottom-line, on both sides of the balance sheet, and in the growing book value attributed to each share of FBIZ stock. We outperformed ourselves, accelerating our growth even while continuing to invest in new, revenue-producing business development staff.

I could not be more pleased to report that this consistent record of success has allowed First Business to pursue a very important next step on our path to growth: in December we successfully closed the public offering of more than $29 million of FBIZ common stock. We expect that this additional capital will help accelerate our growth and position First Business to fully capitalize on the disruption in the Wisconsin banking market. We now have tremendous flexibility to continue investing in organic growth, while being even better equipped to selectively attract niche lending talent and teams to support our future growth.

As 2012 draws to a close, we have much to celebrate at First Business.

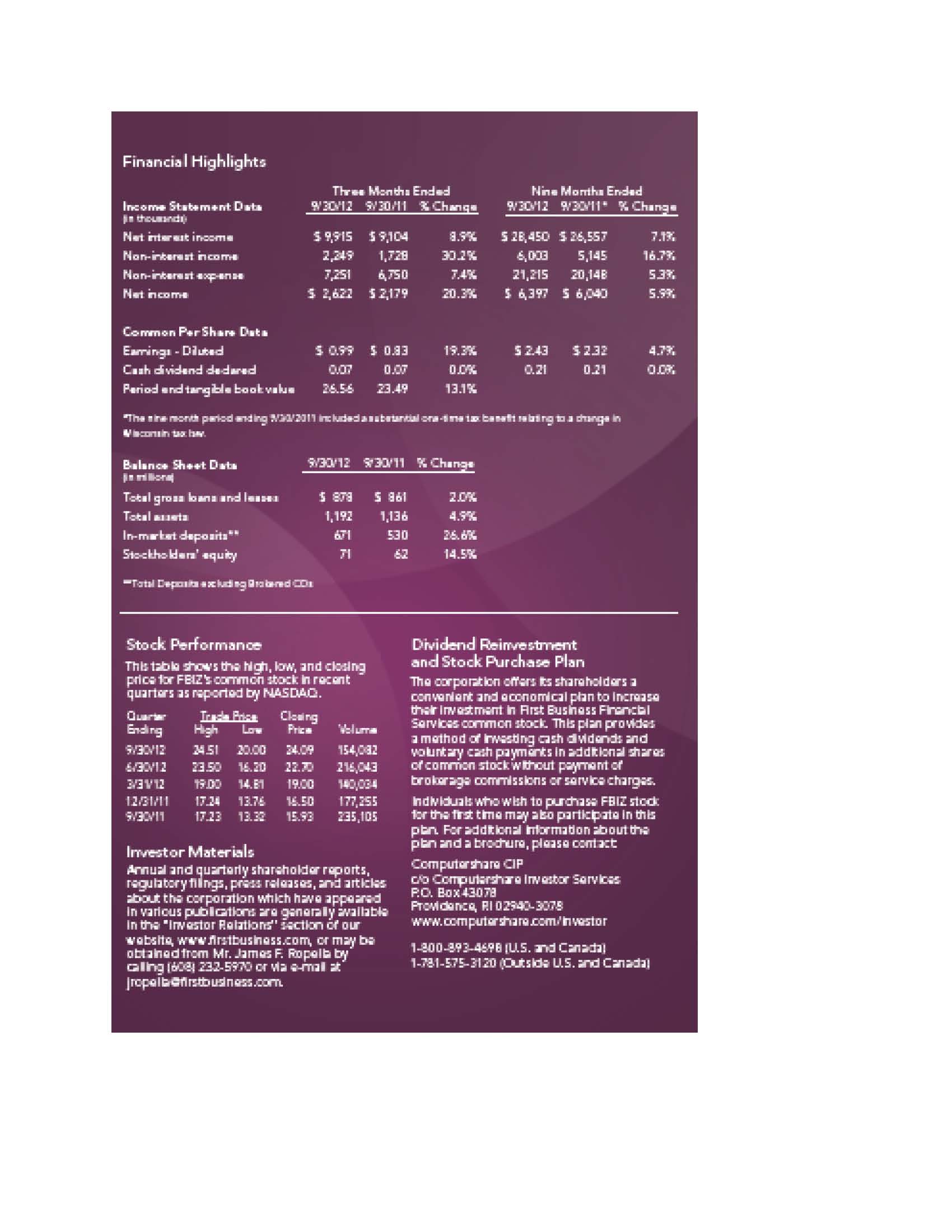

RECORD FINANCIAL PERFORMANCE Revenue growth was a key driver of the third quarter's success. Top line revenue, a combination of net interest income and non-interest income, reached a record $12.2 million during the quarter, growing 6% from the second quarter and 12% from the same quarter of 2011. Despite historic low rates and tough competition, our business development officers (BDOs) delivered improved client profitability by aggressively competing for clients' low-cost relationship deposits while appropriately pricing loans to expand our interest rate spread. These efforts produced record net interest income of $9.9 million in the third quarter, supporting a 3.50% net interest margin - another record in our tenure as a public company. Our BDOs also continued to attract a growing number of commercial and personal trust administration relationships, generating third quarter non-interest income from these relationships which surpassed $2.0 million for the first time, while growing 17% over the previous record posted in the fourth quarter of 2011.

Record revenue production boosted bottom-line results to $2.6 million in the third quarter of 2012, marking the highest level of earnings in our history and 20% growth over net income earned in the same quarter of 2011. Likewise, earnings per share grew to a record $0.99 in the third quarter of 2012, up 19% from the third quarter of 2011. In comparison, consider that the Bureau of Economic Analysis recently reported that the U.S. economy grew just 2.6% during the third quarter of 2012, compared to the prior year. I am exceptionally proud of First Business' record performance.

While earnings have grown to all-time highs, our attention to credit quality improvement has cultivated a healthy balance sheet that is positioned for continued growth. Our pipeline of quality lending opportunities continues to expand, as exhibited by linked quarter growth in net loan balances of $15.8 million, or 7% annualized, from June 30, 2012 to September 30, 2012. Similarly, asset quality has improved measurably as we continue to direct appropriate attention to dealing with problem commercial credits. Non-performing assets declined to a manageable $15.0 million at September 30, 2012, 48% lower than just one year ago. Likewise, our success in addressing credit quality concerns early has helped reduce our loss rate - net charge-offs as a percentage of average loans - to 0.44% in the third quarter of 2012, nearly half the level reported for the third quarter of 2011.

These drivers of our record performance demonstrate the quality, consistency, momentum - and potential - of First Business' earnings power. Of course, these drivers come at a necessary cost: in the third quarter non-interest expenses grew over 7% compared to the prior year. However, combined with our 12% growth in top-line revenue, this expense run-rate resulted in improved operating efficiency. Essentially that means that in this year's third quarter we spent just $0.60 to earn every incremental dollar of revenue, while a year ago the same incremental dollar cost $0.62 to generate.

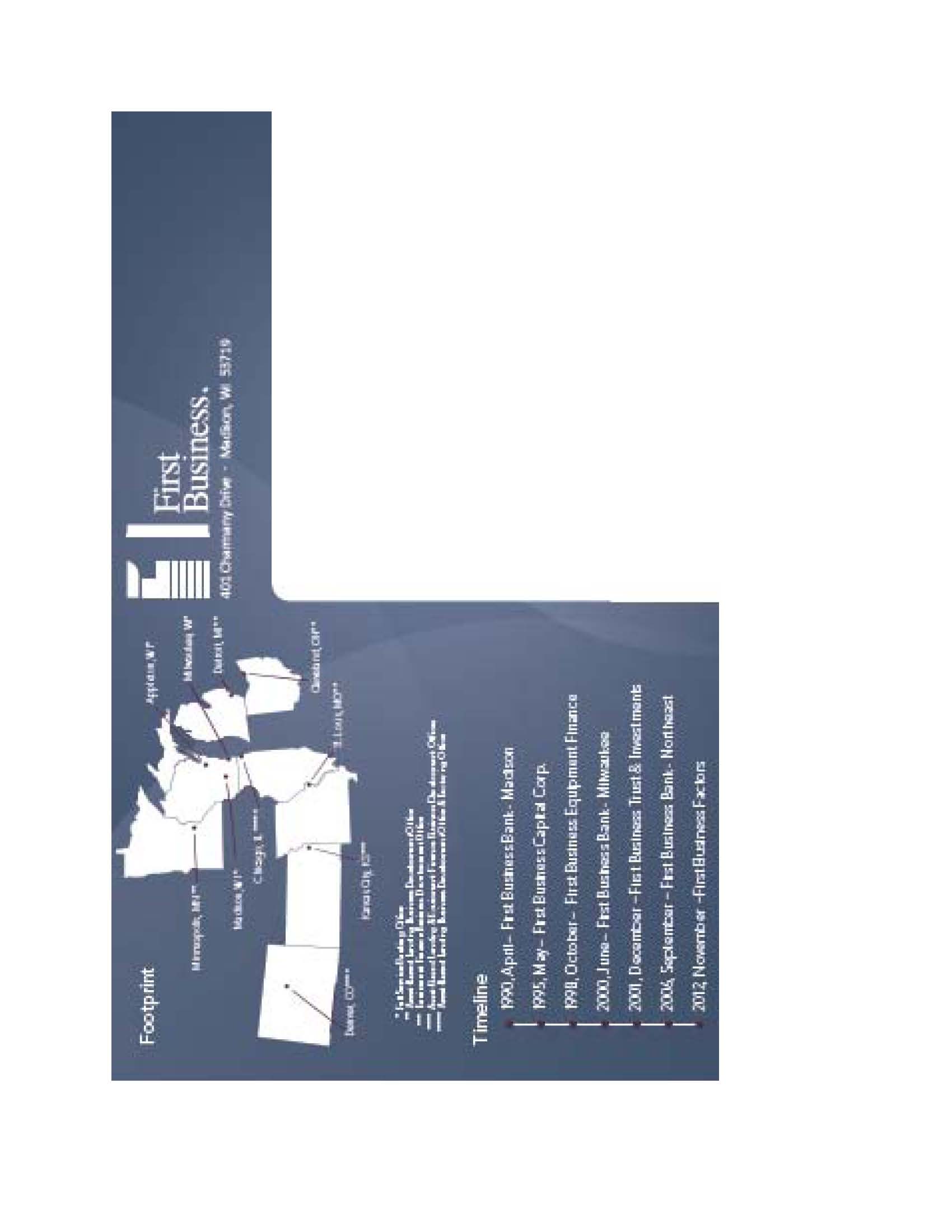

STRATEGIC INVESTMENT IN TALENT CONTINUES To have achieved this momentum while continuing to invest meaningfully in local, experienced talent is noteworthy. As we've said throughout 2012, an essential component of our plans to grow First Business is the pursuit of experienced, local niche banking experts who can quicken our pace of revenue, asset, and deposit generation. For two years we've patiently prepared to take advantage of the talent dispersion that would inevitably stem from the dislocation in Wisconsin's banking market. Today, I am very pleased to report that our sophisticated products, local services, and entrepreneurial culture - not to mention our growth prospects - have proven attractive to some of the Midwest's leading commercial lenders, treasury management experts, and trust administration specialists.

Since December 2011 we've grown our team of 34 BDOs by nearly 30%, to 44. To our commercial lending team, we've welcomed three new BDOs, whose efforts will further support our strategic goals of growing both in-market deposits and commercial and industrial loans, while also increasing fee revenue sources. We've also added three trust services BDOs whose local relationships will amplify our already strong growth in assets under management and related fee income. Another BDO with deep treasury management sales experience has been recruited to further boost fee revenue sources. Two equipment finance BDOs who joined First Business mid-year as part of a team of new employees have already booked approximately $16 million in new equipment loans as of this writing. And I am very excited to report that in November we launched our new First Business Factors division with the hiring of an experienced team of one BDO/division manager and two support professionals. We are thrilled to now be capable of providing an additional financing option for young and growing businesses,

while further enhancing First Business' revenue and balance sheet diversity. As our new BDOs ramp up to full production capacity in 2013, we are excited for this enhanced potential to produce incremental earnings, loans, assets under management and in-market deposit growth.

$29 MILLION CAPITAL RAISE POSITIONS FIRST BUSINESS FOR GROWTH Our consistent and record-breaking success continues to elevate First Business' profile in the capital markets.

In December, we completed the very successful public offering of $29.1 million in common equity capital, selling 1.3 million shares of FBIZ stock, primarily to institutional investors. At $23.00 per share, the capital we raised in the public offering was priced nearly 40% higher than 2011's closing price for FBIZ stock.

Initially we will use this capital to repay a portion of our debt, which will reduce our interest expense and strengthen our capital ratios. We are even more pleased that the strategic flexibility provided by our newly enhanced capital position will support our future growth plans, including accelerated investment in organic growth as well as the potential for future acquisitions of niche lending talent and organizations. We believe this additional capital positions First Business to fully capitalize on the disruption in the Wisconsin banking environment, a phenomenon we've long talked about and prepared for.

As we look ahead to 2013, we are very excited for First Business' growth prospects, especially in light of our recent investments in talent and new business lines. We look forward to sharing our future successes with all our valued stakeholders.

Highlighted by notable peak performance measures, exceptional growth in talent, and a very successful capital raise, our 2012 results to date demonstrate the rich growth potential of our entrepreneurial franchise. This momentum has garnered recognition, and we remain committed to continuing to elevate First Business' profile in the capital markets. As always, we thank you for your continued support of First Business, and we hope you'll continue to spread the word.

Happy Holidays,

Corey Chambas, President and CEO

This report includes “forward-looking” statements related to First Business Financial Services, Inc. (the “Company”) that can generally be identified as describing the Company's future plans, objectives or goals. Such forward-looking statements are subject to risks and uncertainties that could cause actual results or outcomes to differ materially from those currently anticipated. These forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. For further information about the factors that could affect the Company's future results, please see the Company's quarterly reports on Form 10-Q for the third quarter of 2012 and other filings with the Securities and Exchange Commission.