Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SBA COMMUNICATIONS CORP | d458653d8k.htm |

| EX-99.2 - PRES RELEASE - SBA COMMUNICATIONS CORP | d458653dex992.htm |

Exhibit 99.1

SBA Communications Corporation

New Market Overview: Brazil

December 26, 2012

Forward Looking Statements

Certain statements and information included in this presentation are “forward-looking statements” under the Federal Private Securities Litigation Reform Act of 1995, including our expectations regarding (1) levels of anticipated infrastructure investment in Brazil in the next three years, (2) the future growth of the Brazilian telecommunications industry in general, and the demand for wireless towers in specific, (3) the competitive environment for wireless towers in Brazil and the barriers to entry, (4) the opportunity and ability to construct new towers in Brazil, (5) the returns on investment that the Company would realize on any Brazilian new builds, (6) the financial impact of the acquisition on the Company, including the impact of the transactions on the Company’s adjusted funds from operations per share, (7) the quality and characteristics of the acquired towers, and (8) our expectations regarding the future financial performance of the acquired towers and the new operations in Brazil, including 2013 tower cash flow and adjusted EBITDA. Accordingly, these forward-looking statements should be evaluated with consideration given to the many risks and uncertainties inherent in our business that could cause actual results and events to differ materially from those in the forward-looking statements. Important factors that could cause such differences include, among others, (1) the Company’s ability to accurately estimate the future financial performance of the acquired towers based on the diligence conducted prior to the execution of the agreement, (2) the Company’s ability to successfully integrate the acquired towers, (3) the ability and willingness of Brazilian wireless service providers to maintain or increase their capital expenditures, (4) the Company’s ability to secure and retain as many Brazilian site leasing tenants as planned at anticipated lease rates, (5) the cost of establishing operations in a new country, (6) the economic climate for the wireless communications industry in Brazil in general and the wireless communications infrastructure providers in particular, (7) new builds opportunities in Brazil, (8) our ability to build new towers in Brazil, including zoning and other legal restrictions and (9) those additional risk factors set forth in the Company’s 10-K and its other filings with the SEC. The risks included here are not exhaustive. New risks emerge from time to time and it is not possible for management to predict all such risk factors or to assess the impact of such risks on our business. Accordingly, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

2

New Market Overview: Brazil

?Population of approximately 193 million

?Sixth largest economy in the world

?Significant expansion of the middle class over the last ten years

?Material investment expected ahead of 2014 World Cup and 2016 Olympics

3

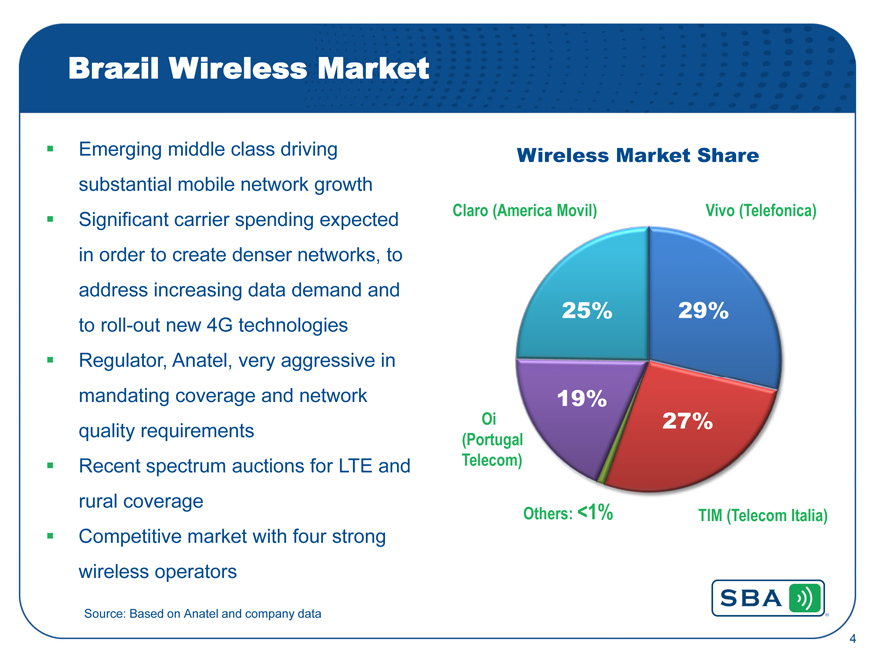

Brazil Wireless Market

?Emerging middle class driving substantial mobile network growth

?Significant carrier spending expected in order to create denser networks, to address increasing data demand and to roll-out new 4G technologies

?Regulator, Anatel, very aggressive in mandating coverage and network quality requirements

?Recent spectrum auctions for LTE and rural coverage

?Competitive market with four strong wireless operators

Source: Based on Anatel and company data

Wireless Market Share

Claro (America Movil) Vivo (Telefonica)

25% 29%

19%

27%

Oi (Portugal Telecom)

Others: <1%

TIM (Telecom Italia)

4

Transaction Overview

?Closed December 20, 2012, on the acquisition of 800 free-standing, ground-based towers (no rooftops) from Vivo S.A., a subsidiary of Telefonica

?Total purchase consideration was R$362.8 million

?Vivo initial lease term of ten years provides long-term stability to anchor tenant cash flows

?Portfolio consists of existing revenues from all major wireless carriers

?Average tenants of 1.33 per tower

?Anticipated 2013 portfolio TCF estimated to be between R$19 and R$23 million

?Portfolio establishes SBA as a substantial independent tower owner in Brazil with a presence in all Brazil states

?Average portfolio tower height of 48 meters, with remaining structural capacity

?Expected to be immediately accretive to AFFO per share

5

Transaction Rationale

?Very attractive, high growth, competitive wireless market with appropriate land-use restrictions and immediate need for substantial additional tower infrastructure

?Brazil is the largest opportunity for new tower builds of any of the countries in which SBA operates

?Additional acquisition opportunities in Brazil

?Transaction provides substantial starting platform with positive adjusted EBITDA to support additional in-country investment

?Assets acquired are high quality with substantial remaining capacity

?Substantial existing relationships with Brazilian wireless carriers Vivo (Telefonica) and Claro (America Movil) through SBA’s Central America operations

6