Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Gold Merger Sub, LLC | d457889d8k.htm |

| EX-2.1 - AGREEMENT AND PLAN OF MERGER - Gold Merger Sub, LLC | d457889dex21.htm |

| EX-99.1 - PRESS RELEASE - Gold Merger Sub, LLC | d457889dex991.htm |

| EX-10.1 - DEBT COMMITMENT LETTER - Gold Merger Sub, LLC | d457889dex101.htm |

Pinnacle

Entertainment’s Acquisition of Ameristar Casinos

December 21, 2012

Exhibit 99.2 |

Safe

Harbor/Non-GAAP Financial Disclosures 2

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. These forward-looking statements are based on Pinnacle’s

and Ameristar’s current expectations and are subject to uncertainty and changes in

circumstances. These forward-looking statements include, among others, statements regarding the expected

synergies and benefits of a potential combination of Pinnacle and Ameristar, including the

expected accretive effect of the merger on Pinnacle’s financial results and profile (e.g., free cash flow,

earnings per share and Consolidated Adjusted EBITDA); the anticipated benefits of geographic

diversity that would result from the merger and the expected results of Ameristar’s gaming

properties; expectations about future business plans, prospective performance and

opportunities; required regulatory approvals; the expected timing of the completion of the transaction; and

the anticipated financing of the transaction. These forward-looking statements may

be identified by the use of words such as “expect,” “anticipate,” “believe,” “estimate,” “potential,” “should”,

“will” or similar words intended to identify information that is not historical in

nature. The inclusion of such statements should not be regarded as a representation that such plans, estimates or

expectations will be achieved. There is no assurance that the potential transaction will

be consummated, and there are a number of risks and uncertainties that could cause actual results to

differ materially from the forward-looking statements made herein. These risks and

uncertainties include (a) the timing to consummate a potential transaction between Pinnacle and Ameristar;

(b) the ability and timing to obtain required regulatory approvals (including approval from

gaming regulators) and satisfy or waive other closing conditions; (c) the ability to obtain the approval

of Ameristar’s stockholders; (d) the possibility that the merger does not close when

expected or at all; or that the companies may be required to modify aspects of the merger to achieve

regulatory approval; (e) Pinnacle’s ability to realize the synergies contemplated by a

potential transaction; (f) Pinnacle’s ability to promptly and effectively integrate the business of Pinnacle and

Ameristar; (g) the requirement to satisfy closing conditions to the merger as set forth in the

merger agreement, including expiration of the waiting period under the Hart-Scott-Rodino Antitrust

Improvements Act of 1976; (h) uncertainties in the global economy and credit markets and its

potential impact on Pinnacle’s ability to finance the transaction; (i) the outcome of any legal

proceedings that may be instituted in connection with the transaction; (j) the ability to

retain certain key employees of Ameristar; (k) that there may be a material adverse change affecting

Pinnacle or Ameristar, or the respective businesses of Pinnacle or Ameristar may suffer as a

result of uncertainty surrounding the transaction; (l) Pinnacle’s ability to obtain financing on the

terms expected, or at all; and (m) the risk factors disclosed in Pinnacle’s most recent

Annual Report on Form 10-K/A, which Pinnacle filed with the Securities and Exchange Commission on May

16, 2012 and the risk factors disclosed in Ameristar’s most recent Annual Report on Form

10-K, which Ameristar filed with the Securities and Exchange Commission on February 28, 2012,3 and in

all reports on Forms 10-K, 10-Q and 8-K filed with the Securities and Exchange

Commission by Pinnacle and Ameristar subsequent to the filing of their respective Form 10-Ks for the year ended

December 31, 2011. Forward-looking statements reflect Pinnacle’s and Ameristar’s

management’s analysis as of the date of this release. Pinnacle and Ameristar do not undertake to revise these

statements to reflect subsequent developments, except as required under the federal securities

laws. Readers are cautioned not to place undue reliance on any of these forward-looking

statements.

Non-GAAP Financial Measures

As used in this presentation, Consolidated Adjusted EBITDA, Consolidated Adjusted EBITDA

margin, Free Cash Flow and Adjusted EBITDA are non-GAAP measurements. Pinnacle defines

Consolidated Adjusted EBITDA as earnings before interest income and expense, income taxes,

depreciation, amortization, pre-opening and development expenses, non-cash share-based

compensation, asset impairment costs, write-downs, reserves, recoveries,

corporate-level litigation settlement costs, gain (loss) on sale of certain assets, loss on early extinguishment of debt,

gain (loss) on sale of equity security investments, minority interest and discontinued

operations. Pinnacle defines Consolidated Adjusted EBITDA margin as Consolidated Adjusted EBITDA divided

by revenues. Pinnacle defines Free Cash Flow as Consolidated Adjusted EBITDA less

maintenance capital expenditures, cash taxes and cash interest expense. Ameristar

defines Adjusted EBITDA as earnings before interest, taxes, depreciation, amortization, other non-operating income and expenses, stock-based compensation, deferred compensation

plan expense, non-operational professional fees and river flooding expenses and

reimbursements. As shown below, the Combined Adjusted EBITDA is shown on a

combined basis of Pinnacle’s Consolidated Adjusted EBITDA and Ameristar’s Adjusted EBITDA for the period ended September 30,

2012, taking into account synergies Pinnacle expects to achieve.

|

Transformative Transaction

3

•

Combines two best in market and complementary asset portfolios

•

Enhanced geographical and financial diversification

•

Increased scale and distribution

•

Accretive to EPS and free cash flow, following the closing

•

Combination expected to drive at least $40 million of annual synergies

•

Significant margin opportunities by applying each company’s best practices across

combined enterprise

•

Shared culture of operational excellence, including a focus on guest experience and

team members

Transformative transaction creates a best in class gaming platform

Transformative transaction creates a best in class gaming platform

|

Transaction Overview

Per Share Consideration

$26.50 in cash per ASCA share

45% premium over the average closing price of ASCA

shares for the 90 days ending 12/20/12

Enterprise Value

$2.8 billion, reflecting $1.9 billion debt and $116 million

cash on hand (9/30/12)

Ameristar Valuation

7.6x LTM Adjusted EBITDA (excluding synergies)

Sources of Financing

Committed debt financing

Approval Process

Approval by ASCA shareholders

Regulatory approvals

Expected Closing

By the end of 3Q13, subject to customary closing

conditions

4 |

Ameristar Current Operations

5 |

Ameristar Profile

6

Ameristar Stand-Alone Adjusted EBITDA and Margin Performance ($M)

Ameristar Stand-Alone Adjusted EBITDA and Margin Performance ($M)

Ameristar Adjusted EBITDA Margin vs. Peers (LTM at 9/30/12)

Ameristar Adjusted EBITDA Margin vs. Peers (LTM at 9/30/12)

Source: Company documents and filings

Notes:

1.

Pro Forma for Harrah’s St. Louis acquisition; excls. $19.2 million of Maryland

lobbying expenses 2.

Pro Forma for the Peninsula acquisition

3.

LTM as of October 28, 2012

307.1

346.5

323.5

365.1

364.5

24.2%

28.5%

27.2%

30.1%

30.3%

22%

24%

26%

28%

30%

32%

34%

36%

200

220

240

260

280

300

320

340

360

380

400

2008

2009

2010

2011

LTM at

9/30/2012

30.3%

28.7%

25.7%

24.3%

22.7%

21.0%

10%

15%

20%

25%

30%

35%

ASCA

stand-alone

PENN (1)

Peer

Average

PNK stand-

alone

BYD (2)

ISLE (3) |

Merging

of Two Great Companies 7

•

8 properties, plus one

under development

•

~2,400 rooms

•

~12,700 slot machines

•

~320 table games

•

~7,200 team members

•

LTM Net Revenues of

$1.2 billion

•

9 properties, including

two race tracks

•

~2,600 rooms

•

~10,800 slot machines

•

~320 table games

•

~8,700 team members

•

LTM Net Revenues of

$1.2 billion

Pro Forma Combined

A leading gaming company in the U.S.

Combined LTM Revenues of $2.4 billion

Combined LTM Adjusted EBITDA of $689

million, including $40 million of synergies

17 properties in 13 distinct geographies

~5,000 rooms

~23,500 slot machines

~640 table games |

Enhances

Footprint in Attractive Markets 8 |

Diversified Revenue Platform

9

•

Significantly de-risks portfolio by doubling gaming markets of operation from 6 to

12 •

Balanced portfolio decreases Pro Forma revenue reliance on two largest gaming

markets by 23 percentage points

Pinnacle LTM 9/30/12 Net Revenue Diversification

Pinnacle LTM 9/30/12 Net Revenue Diversification

Pro Forma Net Revenue Diversification

Pro Forma Net Revenue Diversification

Lake Charles,

33.3%

St. Louis, 33.5%

New Orleans,

10.6%

So. Indiana /

Cincinnati,

14.5%

Bossier City,

7.0%

Baton Rouge,

1.1%

St. Louis, 27.9%

Lake Charles,

16.4%

Kansas City,

9.1%

Greater Chicago,

9.0%

So. Indiana /

Cincinnati, 7.1%

Council Bluffs,

7.0%

Black Hawk,

6.7%

New Orleans,

5.2%

Vicksburg, 5.1%

Bossier City,

3.5%

Nevada

Regional, 2.5%

Baton

Rouge, 0.6% |

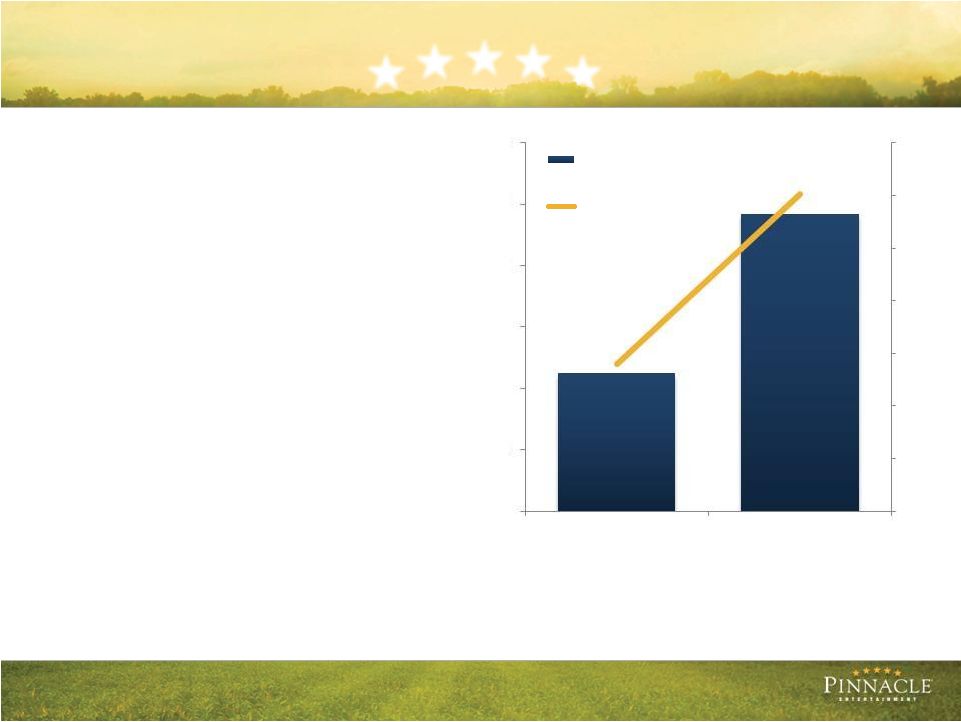

EBITDA

Pro Forma Financials 10

Notes:

1.

Pro Forma represents the sum of Pinnacle and Ameristar's reported LTM at 9/30/2012

Combined Adjusted EBITDA plus $40 million of expected synergies 2.

2008 through LTM 9/30/2012 data represents PNK stand-alone Consolidated Adjusted

EBITDA Pinnacle Historic Consolidated Adj. EBITDA and Combined Adj. EBITDA ($ In

Millions) Pinnacle Historic Consolidated Adj. EBITDA and Combined Adj. EBITDA ($ In

Millions) 157.2

163.2

213.6

252.1

284.1

688.8

0

100

200

300

400

500

600

700

800

2008

2009

2010

2011

LTM at 9/30/2012

Pro Forma incl.

Synergies (1)

Consolidated Adj. EBITDA (1,2) |

Enhanced Scale

11

Notes:

1.

LTM as of 9/30/2012

2.

Pro Forma for the acquisition of Harrah’s St. Louis; EBITDA excls. $19.2 million

of Maryland lobbying expenses 3.

Represents the sum of Pinnacle and Ameristar's LTM at 9/30/2012 results. Combined

Adjusted EBITDA includes $40 million of synergies 4.

Pro Forma for the Peninsula acquisition

5.

LTM as of October 28, 2012

Source: Company documents and filings

Net

Revenue,

$

in

Million

1

Net

Revenue,

$

in

Million

1

EBITDA,

$

in

Millions

1

EBITDA,

$

in

Millions

1

2,832

2,642

2,374

1,203

1,171

968

778

0

500

1,000

1,500

2,000

2,500

3,000

PENN (2)

BYD (4)

PNK + ASCA (3)

ASCA

PNK

ISLE (5)

CHDN

813

689

601

364

284

204

172

0

200

400

600

800

1,000

PENN (2)

PNK + ASCA (3)

BYD (4)

ASCA

PNK

ISLE (5)

CHDN |

Earnings and Cash Flow Accretion

12

•

Increases free cash flow generation to

fund growth projects and accelerate

future leverage reduction

•

Adds more than $150 million in annual

free cash flow

•

Total annual free cash flow increases

to approximately $285 million

$2.25

$4.84

16.8%

36.2%

0%

6%

12%

18%

24%

30%

36%

42%

$-

$1

$2

$3

$4

$5

$6

PNK stand-alone LTM at 9/30/12

Pro Forma (3)

Free Cash Flow Per Share

(LHS) (1,4)

Free Cash Flow Per Share /

Share Price Yield (RHS) (2,4)

Notes:

1.

Free cash flow defined as trailing 12-month Combined Adjusted EBITDA less

maintenance cap ex, cash taxes and cash interest expense

2.

Free cash flow yield is based upon PNK closing stock price on 12/20/12

3.

Pro Forma represents the addition of Pinnacle and Ameristar free cash flow, as defined

in note 1, plus additional cash interest expense from new debt and the impact of $40 million

of synergies Pinnacle expects to achieve

4.

Based upon a fully diluted PNK share count of 59.4 million

|

Attractive Margin Opportunity

13

•

Combined platform margins to benefit from efficiencies of scale and synergies

•

Additional margin opportunities from leveraging best practices from both companies and

applying them across the combined enterprise

Combination With Ameristar Is Significantly Accretive To Pinnacle’s EBITDA Margins; +470

bps vs. PNK’s Stand-Alone LTM Combination With Ameristar Is Significantly

Accretive To Pinnacle’s EBITDA Margins; +470 bps vs. PNK’s Stand-Alone LTM

Notes:

16.8%

17.2%

20.2%

22.1%

24.3%

29.0%

0%

5%

10%

15%

20%

25%

30%

35%

2008

2009

2010

2011

LTM at 9/30/2012

Pro Forma incl.

Synergies (1)

Consolidated Adj. EBITDA Margin (1,2)

1.

Pro Forma represents the sum of Pinnacle and Ameristar's reported LTM at 9/30/2012 Combined

Adjusted EBITDA plus $40 million of expected synergies, divided by the sum of

Pinnacle and Ameristar's LTM at 9/30/2012 Net Revenue

2.

2008 through LTM 9/30/2012 data represents PNK stand-alone Consolidated Adjusted EBITDA

margin |

Financing Overview

14

•

Fully committed debt financing

•

New debt financing will mainly consist of pre-payable bank debt

•

Near-

to medium-term focus will be on integration and reducing leverage

•

Ample liquidity profile to fulfill combined company’s obligations

Sources

Amount

%

Uses

Amount

%

Bank Debt

$1,995

45%

Purchase Ameristar Equity @ $26.50

$959

21%

Existing Ameristar Bonds

1,040

23%

Assume Existing Ameristar Bonds

1,040

23%

Existing Pinnacle Bonds

1,125

25%

Assume Existing Pinnacle Bonds

1,125

25%

Other Debt

315

7%

Refinance Ameristar and Pinnacle Bank Debt

1,201

27%

Estimated fees and expenses

150

3%

Total Sources

$4,475

100

%

Total Uses

$4,475

100%

Estimated Sources & Uses ($ in Millions) |

Synergies and Integration Strategy

15

•

Synergies of at least $40 million annually

Efficiencies of scale

Margin opportunities from applying best practices of both companies across the combined

enterprise

Redundant public company expenses

Purchasing power and supply chain management

•

Integration Plan

“Best

in

class”:

Jointly

developed

integration

plan,

with

best

practices

taken

from

both

companies and applied across the enterprise

Seamless: During integration, focused on continuing to operate all properties with no

impact on guest experience or operational performance |

Strategically Compelling Transaction

16

•

Delivers lasting value to shareholders

•

Increased operational and geographical diversification

•

Strong fit with Pinnacle’s business strategy, operational philosophy and culture

•

Accretive to EPS and free cash flow, following the closing

•

Meaningful synergies and efficiencies of scale

Transformative transaction creates a best in class gaming platform

Transformative transaction creates a best in class gaming platform

|

Additional Information/Participants in the Solicitation

17

Additional information and Where to Find It In connection

with the proposed merger, Ameristar plans to file a proxy statement with the SEC and mail the proxy statement to

its stockholders. INVESTORS AND STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT AND

OTHER PROXY MATERIALS WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT

INFORMATION ABOUT PINNACLE, AMERISTAR, THE PROPOSED MERGER AND RELATED MATTERS.

The proxy statement, as well as other filings containing information about Pinnacle and

Ameristar will be available, free of charge, from the SEC’s web site (www.sec.gov). Pinnacle’s SEC filings in connection with

the transaction also may be obtained, free of charge, from Pinnacle’s web site

(www.pnkinc.com) under the tab “Investor Relations” and then under the

heading “SEC Filings,” or by directing a request to Pinnacle, 8918 Spanish Ridge Ave., Las Vegas,

Nevada, 89148, Attention: Investor Relations or (702) 541-7777. Ameristar’s SEC

filings in connection with the transaction also may be obtained, free of charge,

from Ameristar’s web site (www.ameristar.com) under the tab “About Us,” “Investor Relations”

and then under the heading “Ameristar SEC Reports & Filings,” or by directing a

request to Ameristar, 3773 Howard Hughes Parkway, Suite 490 South, Las Vegas, Nevada,

89169, Attention: Investor Relations or (702) 567-7000. Participants in the Merger Solicitation Pinnacle and

Ameristar and their respective directors and executive officers and other persons may be deemed to be participants

in the solicitation of proxies in connection with the proposed merger. Information about

Pinnacle’s directors and executive officers is included in Pinnacle’s Annual

Report on Form 10-K/A for the year ended December 31, 2011, filed with the SEC on May

16, 2012 and the proxy statement for Pinnacle’s 2012 Annual Meeting of Stockholders,

filed with the SEC on April 9, 2012. Information about Ameristar’s directors

and executive officers is included in Ameristar’s Annual Report on Form 10-K for the year

ended December 31, 2011, filed with the SEC on February 28, 2012 and the proxy statement for

Ameristar’s 2012 Annual Meeting of Stockholders, filed with the SEC on April 30,

2012. Additional information regarding these persons and their interests in the

merger will be included in the proxy statement relating to the merger when it is filed with

the SEC. These documents can be obtained free of charge from the sources indicated

above. |