Attached files

| file | filename |

|---|---|

| EX-2.2 - FORM ACCEPTANCE AND AUTHORITY (SHARES) - EMULEX CORP /DE/ | d457225dex22.htm |

| EX-99.1 - PRESS RELEASE - EMULEX CORP /DE/ | d457225dex991.htm |

| 8-K - FORM 8-K - EMULEX CORP /DE/ | d457225d8k.htm |

| EX-2.3 - FORM OF LETTER TO OPTIONHOLDERS AND ACCEPTANCE FOR OPTIONS - EMULEX CORP /DE/ | d457225dex23.htm |

Exhibit 2.1

IMPORTANT: If you are in doubt as to any aspect of this Offer, you should consult your financial or legal adviser.

If you have sold all of your shares (or depositary interests representing such shares) or options in Endace to which this offer applies, you should immediately hand this offer document but not any accompanying personalised acceptance form to the purchaser or the agent (eg the broker) through whom the sale was made, to be passed to the purchaser. If you have sold or otherwise transferred only part of your shares (or depositary interests representing such shares) or options in Endace, you should retain these documents and consult the purchaser or agent through whom the sale was made. If you have recently purchased or otherwise acquired shares (or depositary interests representing such shares) or options in Endace, notwithstanding receipt of this document and any accompanying documents from the transferor, you should immediately contact Capita Registrars to obtain personalised documents.

Endace’s target company statement, together with an independent adviser’s report on the merits of this offer and another independent adviser’s report on the fairness and reasonableness of the consideration and terms of this offer as between classes of securities accompanies this offer and should be read in conjunction with this offer.

The release, publication or distribution of this document in, into or from jurisdictions other than the United Kingdom and New Zealand may be restricted by the laws of those jurisdictions and therefore persons into whose possession this document comes should inform themselves about, and observe, such restrictions. Any failure to comply with the restrictions may constitute a violation of the securities laws of any such jurisdiction.

Recommended Cash Offer

by

Emulex Corporation

(through its wholly owned subsidiary El Dorado Research Ventures Limited (“Emulex Bidco”))

to acquire the entire issued and to be issued share capital of

Endace Limited

Shareholders, Depositary Interest Holders and Optionholders should read carefully the whole of this document. Your attention is drawn to the letter from the Chairman of the Independent Board of Endace, which contains the unanimous recommendation of the Independent Endace Directors that you accept the Offer, and which is set out on pages 55 to 57 of this document. If you hold Shares in certificated form or Options, this document should be read in conjunction with the relevant accompanying Form of Acceptance, the terms of which are deemed to form part of the Offer.

The procedure for acceptance of the Offer is set out on pages 12 to 15 of this document and, in respect of Shares in certificated form, in the Form of Acceptance for Shares and, in respect of Options, in the Form of Acceptance for Options. To accept the Offer in respect of Shares in certificated form, you must complete and return the Form of Acceptance for Shares as soon as possible and, in any event, so as to be received by the Receiving Agent, by post, or by hand (during normal business hours only) at Capita Registrars, Corporate Actions, The Registry, 34 Beckenham Road, Beckenham, Kent BR3 4TU by no later than 1.00 p.m. (London time) on 29 January 2013 (which is 2.00 a.m. New Zealand time the next day). To accept the Offer in respect of Shares represented by Depositary Interests (that is, in CREST), you must instruct the Depositary to accept the Offer on your behalf in respect of the Shares represented by your Depositary Interests by following the procedure for Electronic Acceptance through CREST so that the TTE Instruction settles no later than 1.00 p.m. (London time) on 29 January 2013 (which is 2.00 a.m. New Zealand time the next day). If you are a CREST sponsored member, you should refer to your CREST sponsor as only your CREST sponsor will be able to send the necessary TTE instruction to Euroclear. To accept the Offer in respect of Options, you must complete and return the Form of Acceptance for Options as soon as possible and, in any event, so as to be received by David Flacks at Bell Gully, Vero Centre, 48 Shortland Street, PO Box 4199, Auckland 1140, New Zealand no later than 1.00 p.m. (London time) on 29 January 2013 (which is 2.00 a.m. New Zealand time the next day). An Optionholder may also fax or email a completed Form of Acceptance for Options to David Flacks at Bell Gully, on +649 9168801 or david.flacks@bellgully.com.

Except where specified, capitalised words and phrases used in this document shall have the meanings given to them in Part 4 of this document.

IMPORTANT NOTICE

This document does not constitute a prospectus or prospectus equivalent document.

Further Information

This document is not intended to and does not constitute or form part of any offer to sell or to subscribe for or an invitation to purchase or subscribe for any securities in any jurisdiction pursuant to the Offer or otherwise, nor shall there be any sale, issuance or transfer of securities by Endace in any jurisdiction in contravention of applicable law. This document is not intended to and does not constitute or form part of any offer by Emulex Bidco to purchase or otherwise acquire Depositary Interests in respect of the Shares.

New Zealand Offer

The Offer is for the securities of a corporation organised under the laws of New Zealand and is subject to the procedure and disclosure requirements of New Zealand. Since this document has been prepared in accordance with New Zealand law and the Takeovers Code (New Zealand), the information disclosed may not be the same as that which would have been prepared in accordance with the laws of jurisdictions outside New Zealand.

Cautionary note regarding forward-looking statements

This document, including information included or incorporated by reference in this document, may contain “forward-looking statements” concerning the Offer, Emulex and Endace. Generally, the words “will”, “may”, “should”, “could”, “would”, “can”, “continue”, “opportunity”, “believes”, “expects”, “intends”, “anticipates”, “estimates” or words or terms of similar substance or the negative thereof are forward-looking statements. These statements are based on assumptions and assessments made by the boards of directors of Endace, and/or Emulex in light of their experience and their perception of historical trends, current conditions, future developments and other factors they believe appropriate. The forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those expressed in the forward-looking statements. Forward-looking statements include statements relating to the following: (i) future capital expenditures, expenses, revenues, earnings, synergies, economic performance, indebtedness, financial condition, dividend policy, losses and future prospects; (ii) business and management strategies and the expansion and growth of Emulex’s or Endace’s operations and potential synergies resulting from the Offer; and (iii) the effects of government regulation on Emulex’s or Endace’s business. Many of these risks and uncertainties relate to factors that are beyond the companies’ abilities to control or estimate precisely, such as future market conditions and the behaviours of other market participants, and therefore undue reliance should not be placed on such statements. There are several factors which could cause actual results to differ materially from those expressed or implied in forward-looking statements. Among the factors that could cause actual results to differ materially from those described in the forward-looking statements are changes in the global, political, economic, business, competitive, market and regulatory forces, future exchange and interest rates, changes in tax rates, tax regimes and future business combinations or dispositions.

All subsequent oral or written forward-looking statements attributable to Emulex or Endace or any of their respective members, directors, officers or employees or any persons acting on their behalf are expressly qualified in their entirety by the cautionary statement above. Emulex and Endace disclaim any obligation in respect of, and do not intend to update or correct the information contained in this document (whether as a result of new information, future events or otherwise), except as required pursuant to applicable law.

Nothing in this document is intended, or is to be construed, as a profit forecast or to be interpreted to mean that the earnings per Emulex share or Share for the current or future financial years will necessarily match or exceed the historical published earnings per Emulex share or Share (as the case may be).

2

NEW ZEALAND TAKEOVERS CODE

Endace is a company incorporated and registered in New Zealand, which is its principal country of operation, and is subject to the Takeovers Code (New Zealand). The Offer by Emulex Bidco for the entire issued and to be issued share capital of Endace is therefore subject to the Takeovers Code (New Zealand). All references to the Takeovers Code in this document refer to the Takeovers Code (New Zealand) approved by the Takeovers Code Approval Order 2000 (SR 2000/210), and include any applicable exemption granted by the New Zealand Takeovers Panel.

For avoidance of doubt, this offer is not subject to the UK City Code on Takeovers and Mergers.

EXPECTED TIMETABLE OF PRINCIPAL EVENTS

The dates and times set forth in the table below in connection with the Offer may change in accordance with the terms and conditions of the Offer, as described in this document.

| Event | Time and/or Date | |

| Takeover Notice sent to Endace and announced on the London Stock Exchange | 6 December 2012 | |

| (New Zealand time) | ||

| Publication of this document | 21 December 2012 | |

| Latest time and date for receipt of Forms of Acceptances and TTE messages | 1.00 p.m. on 29 January 2013 | |

| Anticipated date for the Offer being declared unconditional (assuming all conditions have been met) | 7 February 2013 | |

| Anticipated date for the consideration to be paid to each Shareholder and Depositary Interest Holder who accepts or procures the acceptance of the Offer prior to 7 February 2013 | 14 February 2013 | |

Each of the times and dates referred to in this document and the Form of Acceptance are to London time (unless otherwise stated).

3

ACTION TO BE TAKEN

You should read the whole of this document, the applicable Form of Acceptance (if your Shares are held in certificated form or if you hold Options) and the other documents and information incorporated into them by reference. Detailed instructions on the action to be taken are set out on pages 12 to 15 of this document and in the Form of Acceptance for Shares (in respect of Shares in certificated form) and in the Form of Acceptance for Options (in respect of Options) and are summarised below.

Shareholders, Depositary Interest Holders and Optionholders are recommended to seek financial advice from their stockbroker, bank manager, solicitor, accountant or other independent financial adviser authorised under UK FSMA if they are resident in the United Kingdom or, if not, from another appropriately authorised independent financial adviser in the relevant jurisdiction.

TO ACCEPT THE OFFER:

| (A) | If you hold Shares in certificated form (that is, not in CREST), you should read paragraph 14.1 of Part 1 of this document and complete the accompanying Form of Acceptance for Shares in accordance with the instructions printed thereon. The completed Form of Acceptance for Shares, together with your share certificate(s) and/or other document(s) of title, should be returned as soon as possible and in any event so as to be received by the Receiving Agent, by post or by hand (during normal business hours only) at Capita Registrars, Corporate Actions, The Registry, 34 Beckenham Road, Beckenham, Kent BR3 4TU, no later than 1.00 p.m. (London time) on 29 January 2013 (which is 2.00 a.m. New Zealand time the next day). A reply-paid envelope is enclosed. |

| (B) | If you hold Depositary Interests (that is, in CREST) representing Shares, you should read paragraph 14.2 of Part 1 of this document in respect of Electronic Acceptance. You should ensure that you instruct the Depositary to accept the Offer on your behalf in respect of the Shares represented by your Depositary Interest as soon as possible so that settlement is made no later than 1.00 p.m. (London time) on 29 January 2013 (which is 2.00 a.m. New Zealand time the next day). If you hold your Depositary Interests as a CREST sponsored member, you should refer to your CREST sponsor as only your CREST sponsor will be able to send the necessary instruction to Euroclear. |

| (C) | If you hold Options, you should read paragraph 16 of Part 1 of this document and the accompanying Optionholder Letter and complete the accompanying Form of Acceptance for Options in accordance with the instructions printed thereon. The completed Form of Acceptance for Options, together with your option certificate(s) and/or other document(s) of title, should be returned as soon as possible and in any event so as to be received by David Flacks at Bell Gully, Vero Centre, 48 Shortland Street, PO Box 4199, Auckland 1140, New Zealand no later than 1.00 p.m. (London time) on 29 January 2013 (which is 2.00 a.m. New Zealand time the next day). An Optionholder may also fax or email a completed Form of Acceptance for Options to David Flacks at Bell Gully, on +649 9168801 or david.flacks@bellgully.com. |

4

|

If you own Shares or Depositary Interests and require assistance in completing your Form of Acceptance for Shares (or wish to obtain an additional Form of Acceptance for Shares) or have questions in relation to making an Electronic Acceptance in respect of the Shares represented by Depositary Interests, please contact Capita Registrars between 9.00 a.m. and 5.30 p.m. (London time) Monday to Friday on 0871 664 0321 from within the UK or +44 20 8639 3399 if calling from outside the UK. Calls to the 0871 664 0321 number cost 10 pence per minute (including VAT) plus your service provider’s network extras. Calls to the helpline from outside the UK will be charged at applicable international rates. Different charges may apply to calls from mobile telephones and calls may be recorded and randomly monitored for security and training purposes. The helpline cannot provide advice on the merits of the Offer nor give any financial, legal or tax advice.

All references to time in this document and in the Form of Acceptance for Shares are to London time (unless otherwise stated).

|

SETTLEMENT

Subject to the Offer becoming or being declared unconditional in all respects, settlement for those Shareholders and Optionholders who have validly accepted the Offer and for those Depositary Interest Holders who have validly instructed the Depositary to accept the Offer in respect of the Shares represented by their Depositary Interests (as the case may be), by that date will be effected within seven calendar days of the Offer becoming or being declared unconditional in all respects or, in relation to valid acceptances received after this date, within seven calendar days of receipt of that acceptance.

|

ACCEPTANCES OF THE OFFER SHOULD BE RECEIVED BY NO LATER THAN 1.00 P.M. (LONDON TIME) ON 29 JANUARY 2013 (WHICH IS 2.00 A.M. NEW ZEALAND TIME THE NEXT DAY)

|

5

CONTENTS

| Page | ||||||

| PART 1: |

LETTER FROM EMULEX BIDCO | 7 | ||||

| PART 2: |

TERMS AND CONDITIONS OF THE OFFER | 19 | ||||

| PART 3: |

INFORMATION REQUIRED BY SCHEDULE 1 OF THE NEW ZEALAND TAKEOVERS CODE | 39 | ||||

| PART 4: |

DEFINITIONS | 48 | ||||

| PART 5: |

TARGET COMPANY STATEMENT | 53 | ||||

| comprising | ||||||

| LETTER FROM CHAIRMAN OF INDEPENDENT BOARD | 55 | |||||

| TARGET COMPANY STATEMENT (TAKEOVERS CODE DISCLOSURES) | 58 | |||||

| APPENDIX 1: INDEPENDENT ADVISER’S REPORT | 80 | |||||

| APPENDIX 2: CLASS REPORT | 124 | |||||

| APPENDIX 3: ENDACE’S HALF-YEARLY REPORT FOR THE SIX MONTHS ENDED 30 SEPTEMBER 2012 | 140 | |||||

6

PART 1

LETTER FROM EMULEX BIDCO

(Incorporated and registered in New Zealand with company number 4116578)

| Directors of Emulex Bidco: |

Registered Office: | |

| James Michael McCluney | El Dorado Research Ventures Limited | |

| Michael James Rockenbach | c/- Quigg Partners | |

| Randall Glenn Wick | 7th Floor, Bayleys Building | |

| 36 Brandon Street | ||

| Wellington | ||

| New Zealand

| ||

| 21 December 2012 | ||

To Shareholders, Depositary Interest Holders and Optionholders and, for information only, to persons with information rights

Dear Shareholder and/or Optionholder,

Recommended Cash Offer by Emulex Bidco for Endace

| 1. | INTRODUCTION |

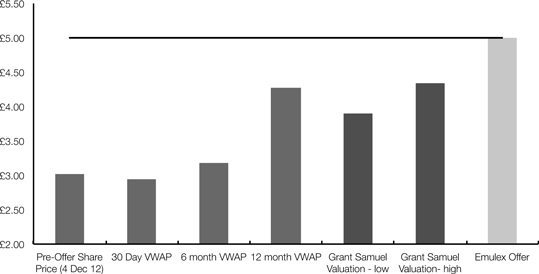

On 6 December 2012, Emulex Bidco gave a notice of takeover to Endace indicating an intention to make a cash offer for the entire issued and to be issued share capital (including Options) of Endace. The Offer values the entire issued and to be issued share capital of Endace at approximately £80.7 million and each Share at 500 pence.

Your attention is drawn to the letter of recommendation from the Chairman of the Independent Board of Endace in Part 5 of this document, which sets out the Independent Board’s assessment of the Offer and in which the Independent Board unanimously recommends that Shareholders and Optionholders accept the Offer and that Depositary Interest Holders instruct the Depositary to accept the Offer on their behalf in respect of the Shares represented by their Depositary Interests.

Your attention is also drawn to the Independent Adviser’s Report which is also set out in Part 5 of this document. The Independent Endace Directors recommend that Shareholders, Depositary Interest Holders and Optionholders read the Independent Adviser’s Report in its entirety.

Please read this letter carefully and, in particular, paragraph 14 below which sets out the procedures for acceptance of the Offer with respect to Shares (and in particular, paragraph 14.2 which sets out the procedure for Electronic Acceptance in respect of the Shares represented by Depositary Interests) and paragraph 16 below which sets out the procedures for acceptance of the Offer with respect to Options. Your attention is drawn, in particular, to the conditions and further terms of the Offer set out in Part 2 of this document and (in the case of Shares held in certificated form and Options) in the relevant Form of Acceptance.

The attention of Shareholders, Depositary Interest Holders and Optionholders who are not resident in the United Kingdom or New Zealand or who are citizens or nationals of other countries is drawn to paragraph 13 below and to paragraph 11 of Part A of Part 2 of this document and (in the case of Shares held in certificated form and the Options) to the relevant provisions of the Form of Acceptance.

This document and, in the case of Shares held in certificated form and Options, the applicable Form of Acceptance contain the formal terms and conditions of the Offer for the Shares and/or Options.

To accept the Offer (if you hold your Shares in certificated form) you must complete, sign and return the Form of Acceptance for Shares or (if you hold Depositary Interests, that is, in CREST) you must make an Electronic Acceptance through CREST to instruct the Depositary to accept the Offer in respect of the Shares represented by those Depositary Interests (as appropriate), and/or if you hold

7

Options you must complete, sign and return the Form of Acceptance for Options as soon as possible and, in any event, so as to be received or settled (as the case may be) by no later than 1.00 p.m. (London time) on 29 January 2013 (which is 2.00 a.m. New Zealand time the next day).

| 2. | THE OFFER |

Emulex Bidco hereby offers to acquire, on the terms and subject to the conditions set out in this document and, in the case of Shares held in certificated form, the Form of Acceptance for Shares, and in the case of Options, the Form of Acceptance for Options, all of the issued and to be issued Shares on the following basis:

| for each Share | 500 pence in cash | |||

| for each Option | 500 pence in cash less the relevant exercise price payable by the Optionholder to convert the Option to a Share | |||

The Offer, which is wholly in cash, values the entire issued and to be issued share capital of Endace (including Options) at approximately £80.7 million and represents a premium of approximately 65 per cent. to the mid-market Closing Price on 5 December 2012, being the last business day prior to the announcement of the Takeover Notice.

The Shares and Options will be acquired by Emulex Bidco pursuant to the Offer fully paid with full title guarantee and free from all liens, charges, equities, encumbrances, options, rights of pre-emption and other third party rights and interests of any nature whatsoever and together with all rights attaching or accruing to them as at 6 December 2012, or subsequently attaching or accruing to them, including, without limitation, voting rights and the right to receive and retain in full all dividends and other distributions (if any) declared, made or paid on or after that date. The Offer extends to all Shares and Options unconditionally allotted or issued and fully paid on the date of the Offer and any Shares and Options which are unconditionally allotted or issued and fully paid after the date of the Offer.

The Offer is conditional, inter alia, upon valid acceptances being received by no later than 1.00 p.m. on 29 January 2013 (or such later date as Emulex Bidco may decide) in respect of not less than 90 per cent. (or such lesser percentage as Emulex Bidco may decide provided the minimum acceptances received confer more than 50 per cent. of the voting rights in Endace as required by the Takeovers Code (New Zealand)) of the Shares to which the Offer relates and the voting rights attaching to those Shares as set out in paragraph 5 of Part A of Part 2 of this document.

The Offer is not subject to any merger control clearances in any jurisdiction, but is subject to the conditions and further terms of the Offer set out and referred to in Part 2 of this document and (if you hold your Shares in certificated form) the Form of Acceptance for Shares.

| 3. | IRREVOCABLE UNDERTAKINGS |

Emulex Bidco has received irrevocable undertakings from Dr. Ian Graham, the Endace Chairman, to accept (or procure the acceptance of) the Offer in respect of his jointly held beneficial holdings of, in aggregate, 1,133,705 Shares representing approximately 7.45 per cent. of the existing issued share capital of Endace as at 18 December 2012. Mike Riley, the Chief Executive Officer of Endace has also irrevocably undertaken to accept the Offer in respect of 593,953 Options.

Emulex Bidco has also received irrevocable undertakings to accept the Offer from certain other shareholders in respect of, in aggregate, a further 1,465,000 Shares representing approximately 9.63 per cent. of the existing issued share capital of Endace as at 18 December 2012. These undertakings are conditional on no superior offer (in particular, an offer for all the Shares with an offer price at least 10 per cent. greater than the Offer) commencing prior to such person accepting this Offer.

In total, Emulex Bidco has received irrevocable undertakings to accept, or procure the acceptance of, the Offer from Shareholders in respect of, in aggregate, 2,598,705 Shares representing approximately 17.08 per cent. of the existing issued share capital of Endace.

8

Emulex Bidco has received separate letters from Mark Rowan and John Scott, both of whom are directors of Endace, which confirm they will use all reasonable efforts to accept or procure the acceptance of the Offer for 323,459 Shares and 131,110 Shares respectively, subject to various conditions, and which combined represent 2.99 per cent. of the existing issued share capital of Endace.

Emulex Bidco has also received a non-binding letter of intent from Majedie Asset Management Limited, indicating that its current intention is to accept the Offer in respect of 645,478 Shares, representing 4.24 per cent. of the existing issued share capital of Endace.

Further details of the irrevocable undertakings are set out in Part 3 to this document.

| 4. | BACKGROUND TO AND REASONS FOR THE OFFER |

Emulex is a leader in the converged networking market for enterprise and cloud/Telco data centres, providing converged networking services on 10Gb/40Gb Ethernet and 16Gb Fibre Channel networks that connect servers, networks, and storage devices. Endace is a network performance management company that provides 100 per cent. accurate network monitoring appliances, network analytics software and ultra-high speed network access switching. Emulex views the acquisition of Endace as an opportunity to enhance its network product offerings through its market-leading network visibility and recording solutions.

Endace has a history of innovation and development, and Emulex is particularly attracted by its ability to provide 100 per cent. accurate network recording at speeds of up to 100Gb in a rapidly evolving network convergence market, as well as its unique products that converge hardware based network visibility with software storage routing technology. Emulex values the strength of Endace’s relationships with its customers, which include a number of blue chip names, and the opportunity to significantly increase its available market. Furthermore, Emulex believes that no one else in the market can deliver the accuracy, scalability and performance of Endace products. Accordingly, the Emulex Directors consider Endace to be a transformational addition to its existing operations. Together Endace and Emulex will create the next generation of Network Performance Management solutions.

| 5. | INTENTIONS REGARDING ENDACE AND ENDACE’S MANAGEMENT, EMPLOYEES AND LOCATIONS |

Emulex intends to retain and respect the organisational culture, history and achievements of Endace. Accordingly, Emulex’s intention is to retain and enhance the existing Endace brand and businesses in New Zealand and to support and enhance the direction of Endace’s existing business strategy.

Emulex values the technical expertise and capabilities of Endace, its management and its employees. To that end, Emulex intends to support the employment policies of Endace, and exert its best efforts to retain key personnel consistent with business needs as well as retaining in New Zealand the existing Endace research and development activities. This will include the promotion of Endace in New Zealand as an International Centre of Excellence for ongoing research and development into Intelligent Network Monitoring and Recording. It is Emulex’s intention to maintain Endace’s office in New Zealand.

If Emulex Bidco does not receive sufficient acceptances under this Offer to enable it to invoke the compulsory acquisition provisions of the Takeovers Code (New Zealand), but nevertheless declares this Offer unconditional, Emulex Bidco will seek appropriate board representation on the Endace board and will participate in decisions relating to Endace and its future.

| 6. | INFORMATION RELATING TO EMULEX AND THE EMULEX GROUP |

Emulex Bidco is a company recently formed at the direction of Emulex for purposes of making this Offer and is a wholly-owned subsidiary of Emulex.

Emulex is a US-based global provider of a broad range of enterprise-class connectivity solutions for servers, networks and storage devices within enterprise and cloud data centres. Emulex product portfolio of Fibre Channel (FC) Host Bus Adapters (HBAs), 10Gb Ethernet (10GbE) Network Interface Cards (NICs), Ethernet-based Converged Network Adapters (CNAs), controllers, embedded bridges and switches, and connectivity management solutions are proven, tested and trusted by the world’s largest and most demanding Information Technology (IT) environments.

9

Emulex solutions are used and offered by the industry’s leading server and storage providers including Cisco Systems, Inc., Dell Inc., EMC Corporation, Fujitsu Ltd., Hewlett-Packard Co., Hitachi Limited, Hitachi Data Systems, Huawei Technologies Company Ltd., International Business Machines Corporation, NEC Corporation, Network Appliance, Inc., Oracle Corporation and Xyratex, Ltd. Emulex is headquartered in Costa Mesa, California and has offices and research facilities in North America, Asia and Europe. Emulex’s common stock trades on the New York Stock Exchange (NYSE) under the symbol ELX.

Emulex’s consolidated revenue for the year ended 1 July 2012 was US$501.8 million and it had an operating loss of US$9.9 million. As at 1 July 2012, Emulex had consolidated net assets of US$575.1 million.

| 7. | INFORMATION RELATING TO THE ENDACE GROUP |

Endace is a New-Zealand based network performance management company that provides 100 per cent. accurate network monitoring appliances, network analytics software and ultra-high speed network access switching. It provides network data recording systems and services to global clients including government security agencies, international telecommunication companies, investment banks and other financial institutions, some of the world’s largest ISPs, and other Global 2000 enterprises. Endace’s shares are quoted on London’s AIM market.

Endace’s revenue for the year ended 31 March 2012 was US$41.2 million and it had an operating profit of US$0.5 million with profit before tax of US$2.2 million. As at 31 March 2012, Endace had net assets of US$31.3 million.

| 8. | FINANCIAL EFFECTS OF THE OFFER |

As a result of and following completion of the Offer, Emulex expects to consolidate Endace’s earnings, assets and liabilities. A fair value assessment of Endace’s assets and liabilities will be carried out under Emulex’s accounting policies following completion of the Offer to determine the initial carrying values at which Endace’s assets and liabilities will be recognised on Emulex’s balance sheet.

| 9. | FINANCING OF THE OFFER AND CASH CONFIRMATION |

Full acceptance of the Offer is expected to require the payment by Emulex Bidco of up to approximately £80.7 million in cash, representing the aggregate Offer Price for Endace’s existing issued and to be issued share capital and the Offer Price less the exercise price for the Options as at 18 December 2012.

Emulex Bidco expects to fund the aggregate consideration payable under the Offer from Emulex’s existing cash resources. Emulex Bidco confirms that resources will be available to it sufficient to meet the consideration to be provided on full acceptance of this Offer and to pay any debts incurred in connection with this Offer (including the debts arising under Rule 49 of the Takeovers Code (New Zealand)).

| 10. | OPTIONS |

Optionholders are advised to read the accompanying Optionholder Letter, which explains, inter alia, the consideration offered to Optionholders, the choices that are available to Optionholders in response to the Offer, the procedure for accepting the Offer in respect of Options, and the terms for settlement of consideration.

| 11. | OFFER ARRANGEMENTS |

Emulex, Endace and the Independent Endace Directors have entered into a Mutual Confidentiality and Exclusivity Agreement dated 17 September 2012, as amended by Addendum thereto dated 5 November 2012. The exclusivity provisions of this agreement expired upon the Notice of the Takeover Offer.

Emulex, Endace and the Independent Endace Directors entered into the Letter Agreement whereby in consideration for Emulex sending the Notice of Takeover, Endace agreed, amongst other things, not to solicit

10

or initiate an alternative proposal, subject to the Endace Directors being able to comply with legal and fiduciary obligations, including responding to an alternative proposal and engaging with a person making a bona fide alternative proposal.

The Independent Endace Directors confirmed that they were supportive of the proposed Offer and now that the Offer Price has been confirmed as being above the valuation range provided by the Independent Adviser, they have recommended to Shareholders that they accept the Offer.

In the event that a cash offer at a price greater than the Offer Price is made, the Independent Endace Directors have granted Emulex the right to match the higher offer before ceasing to recommend the Offer to Shareholders.

In the event that a cash offer at a price greater than the Offer Price is made during the Offer Period or within three months after the Closing Date, and that offer is declared unconditional, or if there is a material breach of the terms of the Letter Agreement, Endace has agreed to reimburse Emulex for reasonable costs and expenses incurred by Emulex in connection with this Offer. Any such amount payable may be set off against monies payable by Emulex under Rule 49 of the Takeovers Code (New Zealand), and any amount payable by Endace, after the setting off, is agreed to be US$1,000,000.

Emulex Bidco is obliged under the Letter Agreement to use all reasonable endeavours to procure the satisfaction of conditions relating to consent under the Overseas Investment Act and from the Ministry of Business Innovation and Employment (New Zealand) in respect of certain financial grants.

Pursuant to the Letter Agreement, each of the Independent Endace Directors has agreed to resign from Endace and its related companies within three business days of the consideration under the Offer having been first sent to Shareholders.

| 12. | COMPULSORY ACQUISITION, CANCELLATION OF AIM ADMISSION AND DE-LISTING |

If Emulex Bidco receives acceptances under the Offer in respect of, and/or otherwise becomes the holder or controller of 90 per cent. or more of the voting rights in Endace, and assuming that all of the other Conditions have been satisfied or waived (if capable of being waived), Emulex Bidco intends to exercise its rights in accordance with the Takeovers Code (New Zealand) to acquire compulsorily the remaining Shares and Options on the same terms as the Offer. In these circumstances, any outstanding Options will only be acquired under the compulsory acquisition process if they have not expired. The Options will expire on the date falling 10 days after the date that the Offer goes unconditional, which may (under the Takeovers Code (New Zealand)) occur after the Closing Date.

If the Offer becomes or is declared unconditional in all respects and Emulex Bidco receives acceptances of the Offer which result in Emulex Bidco holding or controlling in aggregate more than 75 per cent. of the voting rights in Endace, Emulex Bidco intends to procure that Endace applies to the London Stock Exchange for the admission of the Shares to trading on AIM to be cancelled. Not less than 20 business days notice of cancellation will be given, commencing either on the date Emulex Bidco acquires or agrees to acquire 75 per cent. of the voting rights attaching to the issued ordinary share capital of Endace or on the first date of the issue of acquisition notice under rule 54 of the Takeovers Code (New Zealand).

Cancellation of the admission of the Shares to trading on AIM would significantly reduce the liquidity and marketability of any Shares in respect of which acceptances of the Offer are not submitted.

| 13. | OVERSEAS SHAREHOLDERS |

The availability of the Offer to Shareholders or Depositary Interest Holders who are not resident in the United Kingdom or New Zealand may be affected by the laws of their relevant jurisdiction. Such persons should inform themselves of, and observe, any applicable legal or regulatory requirements of their jurisdiction, and should carefully read paragraph 11 of Part A of Part 2 of this document. If you remain in any doubt, you should consult your professional adviser in the relevant jurisdiction without delay.

11

The attention of Shareholders and/or Depositary Interest Holders who are citizens or residents of jurisdictions outside the United Kingdom and New Zealand or who are holding shares or depositary interests for such citizens or residents and any person (including, without limitation, any custodian, nominee or trustee) who may have an obligation to forward any document in connection with the Offer outside the United Kingdom and New Zealand is drawn to paragraph 11 of Part A of Part 2 of this document and to the relevant provisions of the applicable Form of Acceptance, which they should read before taking any action.

| 14. | PROCEDURE FOR ACCEPTANCE OF THE OFFER IN RESPECT OF SHARES |

Different procedures for acceptance apply depending on whether you hold Shares in certificated form or Depositary Interests through CREST. Shareholders who hold their Shares in certificated form (that is, not in CREST) should read paragraph 14.1 below in conjunction with the Form of Acceptance for Shares and Part B of Part 2 of this document. Depositary Interest Holders who hold Depositary Interests (that is, in CREST) representing Shares, should read paragraph 14.2 below in conjunction with Part C of Part 2 of this document. In respect of Shareholders who hold their Shares in certificated form, the instructions on the Form of Acceptance for Shares are deemed to form part of the terms of the Offer.

| 14.1 | Shares Held in Certificated Form (i.e. not in CREST) |

| 14.1.1 | Completion of the Form of Acceptance |

To accept the Offer in respect of Shares held in certificated form (that is, not in CREST), you must complete and sign the Form of Acceptance for Shares in accordance with the instructions set out below and on the Form of Acceptance for Shares. You should complete separate Forms of Acceptance for Shares for Shares held in certificated form but under different designations. If you have any queries as to how to complete the Form of Acceptance for Shares, please telephone the Receiving Agent between 9.00 a.m. and 5.30 p.m., Monday to Friday on 0871 664 0321 from within the UK or +44 20 8639 3399 if calling from outside the UK. Calls to the 0871 664 0321 number cost 10 pence per minute (including VAT) plus your service provider’s network extras. Calls to the helpline from outside the UK will be charged at applicable international rates. Different charges may apply to calls from mobile telephones and calls may be recorded and randomly monitored for security and training purposes. The helpline cannot provide advice on the merits of the Offer nor give any financial, legal or tax advice. Additional Forms of Acceptance for Shares are available from the Receiving Agent upon request.

| (a) | To accept the Offer in respect of all your Shares in certificated form — you must complete Box 1 and sign Box 2 of the enclosed Form of Acceptance for Shares. In all cases, if you are an individual, you must sign Box 2 on the Form of Acceptance for Shares in the presence of a witness who should also sign in accordance with the instructions printed on it. Any Shareholder which is a company should execute Box 2 of the Form of Acceptance for Shares in accordance with the instructions printed on it. If you do not insert a number in Box 1 of the Form of Acceptance for Shares, or if you insert in Box 1 a number which is greater than the number of Shares in certificated form that you hold and you have signed Box 2, your acceptance will be deemed to be in respect of all the Shares in certificated form which are held by you. |

| (b) | To accept the Offer in respect of less than all your Shares in certificated form — you must insert in Box 1 on the enclosed Form of Acceptance for Shares such lesser number of Shares in certificated form in respect of which you wish to accept the Offer in accordance with the instructions printed thereon. You should then follow the procedure set out in paragraph (a) above in respect of such lesser number of Shares in certificated form and which are held by you. If you do not insert a number in Box 1 of the Form of Acceptance for Shares, or if you insert in Box 1 a number which is greater than the number of Shares in certificated form that you hold and you have signed Box 2, your acceptance will be deemed to be in respect of all the Shares held by you in certificated form. |

12

| 14.1.2 | Return of the Form of Acceptance for Shares |

To accept the Offer in respect of Shares held in certificated form, the completed, signed and (where applicable) witnessed Form of Acceptance for Shares should be returned to the Receiving Agent by post or by hand (during normal business hours only) at Capita Registrars, Corporation Actions, The Registry, 34 Beckenham Road, Beckenham, Kent BR3 4TU, together (subject to paragraph 14.1.3 below) with the relevant share certificate(s) and/or other document(s) of title, as soon as possible and, in any event, so as to be received by the Receiving Agent no later than 1.00 p.m. on 29 January 2013 (which is 2.00 a.m. New Zealand time the next day). A reply-paid envelope is enclosed for your convenience. No acknowledgement of receipt of documents will be given and documents will be sent at your own risk.

| 14.1.3 | Share certificates not readily available or lost |

If your Shares are in certificated form, a completed, signed and (where applicable) witnessed Form of Acceptance for Shares should be accompanied by the relevant share certificate(s) and/or other document(s) of title. If for any reason the relevant share certificate(s) and/or other document(s) of title is/are not readily available or is/are lost, you should nevertheless complete, sign and lodge the Form of Acceptance for Shares as stated above so as to be received by the Receiving Agent by post or by hand (during normal business hours only) at Capita Registrars, Corporation Actions, The Registry, 34 Beckenham Road, Beckenham, Kent BR3 4TU so as to be received by no later than 1.00 p.m. on 29 January 2013 (which is 2.00 a.m. New Zealand time the next day). You should send with the Form of Acceptance for Shares any share certificate(s) and/or other document(s) of title which you may have available, accompanied by a letter stating that the remaining documents will follow as soon as possible or that you have lost one or more of your share certificate(s) and/or other document(s) of title. You should then arrange for the relevant share certificate(s) and/or other document(s) of title to be forwarded as soon as possible.

If you have lost your share certificate(s) and/or other document(s) of title, you should contact as soon as possible Endace’s registrars, Capita Registrars (in its capacity as registrar to Endace), at The Registry, 34 Beckenham Road, Beckenham, Kent BR3 4TU requesting a letter of indemnity for the lost share certificate(s) and/or other document(s) of title which, when completed in accordance with the instructions given, should be returned by post or by hand to the Receiving Agent at their address given above. Indemnities will only be accepted at the discretion of the Receiving Agent.

| 14.1.4 | Validity of acceptances |

Without prejudice to Parts A and B of Part 2 of this document, Emulex Bidco reserves the right to treat as valid in whole or in part any acceptance of the Offer which is not entirely in order or which, in relation to Shares held in certificated form, is not accompanied by the relevant share certificate(s) and/or other document(s) of title. Any invalid acceptance may be rejected at Emulex Bidco’s discretion within the period before payment is required under the Takeovers Code (New Zealand).

| 14.2 | Depositary Interests (that is, in CREST) representing Shares |

| 14.2.1 | General |

If you hold Depositary Interests (that is, in CREST) representing Shares, to instruct the Depositary to accept the Offer on your behalf in respect of the Shares represented by your Depositary Interests, you should take (or procure the taking of) the action set out below to transfer the dematerialised Depositary Interests representing the Shares in respect of which you wish to instruct the Depositary to accept the Offer to the appropriate escrow balance(s), specifying Capita Registrars (in its capacity as a CREST participant under the Escrow Agent’s participant ID referred to below) as the Escrow Agent, as soon as possible and in any event so that the TTE instruction settles not later than 1.00 p.m. (London time) on 29 January

13

2013 (which is 2.00 a.m. New Zealand time the next day). Note that settlement cannot take place on weekends or bank holidays (or other times at which the CREST system is non-operational) — you should therefore ensure you time the input of any TTE instructions accordingly.

The input and settlement of a TTE instruction in accordance with this paragraph 14.2.1 will (subject to satisfying the requirements set out in Parts A and C of Part 2 of this document) constitute an irrevocable instruction to the Depositary to accept the Offer on your behalf in respect of the number of Shares equal to the number of dematerialised Depositary Interests so transferred to escrow.

If you are a CREST sponsored member, you should refer to your CREST sponsor before taking any action. Only your CREST sponsor will be able to send the TTE instructions(s) to Euroclear in relation to your Depositary Interests.

After settlement of a TTE instruction, you will not be able to access the Depositary Interests concerned in CREST (or call for the Shares which the Depositary Interests represent) for any transaction or charging purposes. If the Offer becomes or is declared unconditional in all respects, the Escrow Agent will cancel the Depositary Interests concerned and the Depositary will process the acceptance of the Offer in respect of the Shares represented by those Depositary Interests and transfer such Shares to Emulex Bidco in accordance with paragraph 1.4 of Part C of Part 2 of this document.

You should note that Euroclear does not make available special procedures in CREST for any particular corporate action. Normal system timings and limitations will therefore apply in connection with a TTE instruction and its settlement. You should therefore ensure that all necessary action is taken by you (or by your CREST sponsor) to enable a TTE instruction relating to the Shares represented by your Depositary Interests to settle prior to 1.00 p.m. (London time) on 29 January 2013 (which is 2.00 a.m. New Zealand time the next day). In this connection, you are referred in particular to those sections of the CREST manual concerning the practical limitations of the CREST system and timings.

| 14.2.2 | To procure the acceptance of the Offer in respect of the Shares represented by Depositary Interests |

To procure the acceptance of the Offer in respect of the Shares represented by your Depositary Interests you should send (or, if you are a CREST sponsored member, procure that your CREST sponsor sends) to Euroclear a TTE instruction in relation to Depositary Interests. A TTE instruction to Euroclear must be properly authenticated in accordance with Euroclear’s specifications for transfers to escrow and must contain the following details:

| • | the ISIN number for the Depositary Interests. This is NZNPVE0001S2; |

| • | the number of Depositary Interests representing Shares in respect of which you wish to instruct the Depositary to accept the Offer on your behalf (i.e. the number of Depositary Interests to be transferred to escrow); |

| • | your member account ID; |

| • | your participant ID; |

| • | the participant ID of the Escrow Agent. This is RA10; |

| • | the member account ID of the Escrow Agent for the Offer. This is EMUEND01; |

| • | the intended settlement date. This should be as soon as possible and, in any event, no later than 1.00 p.m. (London time) on 29 January 2013 (which is 2.00 a.m. New Zealand time the next day); |

14

| • | the corporate action number of the Offer. This is allocated by Euroclear and will be available on screen from Euroclear; |

| • | input with a standard delivery instruction priority of 80; and |

| • | a contact name and telephone number in the shared note field. |

| 14.2.3 | Validity of acceptances |

Depositary Interest Holders who wish to instruct the Depositary to accept the Offer in respect of the Shares represented by their Depositary Interests should note that a TTE instruction will only be a valid instruction to the Depositary to accept the Offer on their behalf as at the Closing Date if it has settled on or before 1.00 p.m. (London time) on that date (which is 2.00 a.m. New Zealand time the next day). For the avoidance of doubt, no offer is being made in respect of the Depositary Interests. A Form of Acceptance which is received in respect of Depositary Interests will be treated as an invalid acceptance and will be disregarded.

Without prejudice to Parts A and C of Part 2 of this document, Emulex Bidco reserves the right to treat as valid in whole or in part any acceptance of the Offer which is not entirely in order or which is not accompanied by the relevant TTE instruction. Any invalid acceptance may be rejected at Emulex Bidco’s discretion within the period before payment is required under the Takeovers Code (New Zealand).

| 14.2.4 | Overseas Depositary Interest Holders |

The attention of Depositary Interest Holders and who are citizens or residents of jurisdictions outside the UK and New Zealand is drawn to paragraph 13 above and to paragraph 11 of Part A of Part 2 of this document.

| 14.2.5 | General |

Normal CREST procedures (including timings) apply in relation to any Depositary Interests that are, or are to be, converted from uncertificated Depositary Interests to certificated Shares, or from certificated Shares to uncertificated Depositary Interests, during the course of the Offer (whether any such conversion arises as a result of a transfer of Shares or otherwise). Holders of Shares or Depositary Interests who are proposing so to convert any such Shares or Depositary Interests are recommended to ensure that the conversion procedures are implemented in sufficient time to enable the person holding or acquiring the Shares or Depositary Interests (as the case may be) as a result of the conversion to take all necessary steps in connection with an acceptance of the Offer (in particular, as regards delivery of share certificate(s) and/or other documents of title or transfers to an escrow balance as described above), or to procure the acceptance of the Offer by the Depositary on their behalf, prior to 1.00 p.m. (London time) on 29 January 2013 (which is 2.00 a.m. New Zealand time the next day),

If you are in any doubt as to the procedure for acceptance of the Offer, please contact the Receiving Agent, between 9.00 a.m. and 5.30 p.m. (London time) Monday to Friday on 0871 664 0321 from within the UK or +44 20 8639 3399 if calling from outside the UK or at either of the addresses referred to in paragraph 14.1.2 above. Calls to the 0871 664 0321 number cost 10 pence per minute (including VAT) plus your service provider’s network extras. Calls to the helpline from outside the UK will be charged at applicable international rates. Different charges may apply to calls from mobile telephones and calls may be recorded and randomly monitored for security and training purposes. You are reminded that, if you are a CREST sponsored member, you should contact your CREST sponsor before taking any action.

Emulex Bidco will make an appropriate announcement if any of the details contained in this paragraph 14 alter for any reason.

15

| 15. | SETTLEMENT IN RESPECT OF SHARES |

Subject to the Offer becoming or being declared unconditional, settlement of the consideration to which any Shareholder or Depositary Interest Holder (or the first-named shareholder or depositary interest holder in the case of joint holders) is entitled under the Offer will be effected: (i) in the case of acceptances received from any Shareholder, or from the Depositary on behalf of Depositary Interest Holder in respect of the Shares represented by their Depositary Interests, valid and complete in all respects, by the date on which the Offer becomes unconditional in all respects, within seven calendar days of such date; and (ii) in the case of any such acceptances received, complete in all respects, after such date but while the Offer remains open for acceptance, within seven calendar days of such receipt, in the following manner:

| 15.1 | Shares in certificated form (that is, not in CREST) |

Where an acceptance relates to Shares in certificated form, settlement of any cash due will be despatched by first class post to accepting Shareholders or their appointed agents. All such cash payments will be made in British pounds by cheque drawn on a branch of a United Kingdom clearing bank; and

| 15.2 | Depositary Interests (that is, in CREST) representing Shares |

Where an acceptance relates to Shares represented by Depositary Interests , the cash consideration to which the accepting Depositary Interest Holder is entitled will be paid by means of a CREST payment in favour of the accepting Depositary Interest Holder’s payment bank in respect of the cash consideration due, in accordance with CREST payment arrangements. Emulex Bidco reserves the right to settle all or any part of the consideration referred to in this paragraph 15.2, for all or any Depositary Interest Holder(s) who instruct the Depositary to accept the Offer on their behalf, in the manner referred to in paragraph 15.1 above, if, for any reason, it wishes to do so.

| 16. | PROCEDURE FOR ACCEPTANCE AND SETTLEMENT IN RESPECT OF OPTIONS |

To accept the Offer in respect of Options, you must complete and sign the Form of Acceptance for Options in accordance with the instructions set out in the Optionholder Letter and on the Form of Acceptance for Options.

The completed Form of Acceptance for Options, together with your option certificate(s) and/or other document(s) of title, should be returned as soon as possible and in any event so as to be received by David Flacks at Bell Gully, Vero Centre, 48 Shortland Street, PO Box 4199, Auckland 1140, New Zealand no later than 1.00 p.m. (London time) on 29 January 2013 (which is 2.00 a.m. New Zealand time the next day). An Optionholder may also fax or email a completed Form of Acceptance for Options to David Flacks at Bell Gully, on +649 9168801 or david.flacks@bellgully.com.

Endace, as agent for Emulex Bidco, has agreed to facilitate payment under the Offer to Optionholders through usual payroll processes for Optionholders that are existing employees where practicable, and otherwise by cheque or electronic transfer to a nominated bank account. Optionholders will be paid in the currency selected on the Form of Acceptance for Options, net of taxes required to be withheld under applicable law. If no currency is selected, Optionholders will be paid in the currency in which they are paid as an employee of Endace and otherwise in British pounds.

Further information regarding the procedure for acceptance and settlement in respect of Options is set out in Part D of Part 2 of this document.

| 17. | GENERAL |

If the Offer does not become or is not declared unconditional in all respects:

| 17.1. | in the case of Shares held in certificated form, the relevant Form of Acceptance, share certificate(s) and/or other document(s) of title will be returned by post (or by such other method as may be approved by the Takeovers Panel (New Zealand)) within 14 calendar days of the Offer lapsing to the person or agent whose name and address is set out in the Form of Acceptance or, if none is set out, to the first-named holder at his or her registered address; |

16

| 17.2. | in the case of Shares represented by Depositary Interests, the Escrow Agent will, immediately after the lapsing of the Offer (or within such longer period as the Takeovers Panel (New Zealand) may permit, not exceeding 14 calendar days of the lapsing of the Offer), give TFE instructions to Euroclear to transfer all Depositary Interests held in escrow balances and in relation to which it is the Escrow Agent for the purposes of the Offer to the original available balances of the Depositary Interest Holders concerned; and |

| 17.3. | in the case of Options, acceptances will be null and void and of no effect and option certificate(s) and/or other document(s) of title will be returned to Optionholders by post (or by such other method as may be approved by the Takeovers Panel (New Zealand)) within 14 calendar days of the Offer lapsing. |

All remittances, communications, notices, certificates and documents of title sent by, to or from Shareholders, Depositary Interest Holders or Optionholders or their appointed agents will be sent at their own risk.

| 18. | FURTHER INFORMATION |

Your attention is drawn to the further information in this document and, if your Shares are held in certificated form, to the accompanying Form of Acceptance for Shares which should be read in conjunction with this document.

If you own Options, your attention is also drawn to the accompanying Optionholder Letter and the Form of Acceptance for Options, which should be read in conjunction with this document.

| 19. | ACTION TO BE TAKEN TO ACCEPT THE OFFER |

To accept the Offer:

| • | If your Shares are held in certificated form (that is, not in CREST), the Form of Acceptance for Shares must be completed, signed and returned (together with your share certificate(s) and/or other document(s) of title) as soon as possible, and in any event so as to be received by the Receiving Agent, by post or by hand (during normal business hours only) at Capita Registrars, Corporate Actions, The Registry, 34 Beckenham Road, Beckenham, Kent BR3 4TU, no later than 1.00 p.m. (London time) on 29 January 2013 (which is 2.00 a.m. New Zealand time the next day). A reply-paid envelope is enclosed for your convenience. |

| • | If you hold Depositary Interests (that is, in CREST) representing Shares, you should NOT return the Form of Acceptance but instead ensure that an Electronic Acceptance is made by you or on your behalf to instruct the Depositary to accept the Offer on your behalf in respect of such Shares and that settlement is no later than 1.00 p.m. (London time) on 29 January 2013 (which is 2.00 a.m. New Zealand time the next day). |

| • | For Options, the Form of Acceptance for Options must be completed, signed and returned together with your option certificate(s) and/or other document(s) of title, as soon as possible, but in any event so as to be received by David Flacks at Bell Gully, Vero Centre, 48 Shortland Street, PO Box 4199, Auckland 1140, New Zealand no later than 1.00 p.m. (London time) on 29 January 2013 (which is 2.00 a.m. New Zealand time the next day). An Optionholder may also fax or email a completed Form of Acceptance for Options to David Flacks at Bell Gully, on +649 9168801 or david.flacks@bellgully.com. |

If you have any questions relating to accepting the Offer in respect of Shares or Shares represented by Depositary Interests, please telephone Capita Registrars between 9.00 a.m. and 5.30 p.m. (London time) Monday to Friday on 0871 664 0321 from within the UK or +44 20 8639 3399 if calling from outside the UK. Calls to the 0871 664 0321 number cost 10 pence per minute (including VAT) plus your service

17

provider’s network extras. Calls to the helpline from outside the UK will be charged at applicable international rates. Different charges may apply to calls from mobile telephones and calls may be recorded and randomly monitored for security and training purposes. The helpline cannot provide advice on the merits of the Offer nor give any financial, legal or tax advice.

If you have any questions relating to accepting the Offer in respect of Options, please email david.flacks@bellgully.com

Your decision as to whether to accept the Offer, or to instruct the Depositary to accept the Offer on your behalf, will depend on your individual circumstances. If you are in any doubt as to the action you should take, you are recommended to seek your own personal financial advice from an independent financial adviser authorised under the UK Financial Services and Markets Act 2000 (as amended) if you are in the UK or, if you are outside the UK, from an appropriately authorised independent financial adviser, without delay.

| Yours faithfully, |

|

for and on behalf of |

| Emulex Bidco |

18

PART 2

TERMS AND CONDITIONS OF THE OFFER

Part A: Terms and Conditions

Emulex Bidco offers to purchase all Shares (including, for the avoidance of doubt, all Shares represented by Depositary Interests) and all Options on the terms and conditions contained in this Offer and the accompanying Form of Acceptance (and in respect of Options, the Optionholder Letter).

| 1. | THIS OFFER |

| 1.1 | Emulex Bidco offers to acquire the Shares and Options, including all rights, benefits, and entitlements attached thereto on, after, or by reference to the Notice Date. |

| 1.2 | This Offer will remain open for acceptance until 1.00 p.m. (London time) on the Closing Date (which is 2.00 a.m. New Zealand time the next day). |

| 2. | CONSIDERATION |

| 2.1 | The consideration offered by Emulex Bidco for each Share is 500 pence in cash SUBJECT TO any adjustment in accordance with paragraph 7.1 and/or paragraph 7.4 below. |

| 2.2 | The consideration offered by Emulex Bidco for each Option is the Offer Price LESS the relevant exercise price payable by the Optionholder to convert the Option to a Share pursuant to the terms of the Option. Where the Offer Price is equal to or less than the exercise price payable by the Optionholder, the consideration offered for such an Option is zero. These details are set out in the accompanying Optionholder Letter and the Form of Acceptance for Options. |

| 2.3 | The consideration payable to each Acceptor in respect of Shares will be paid by cheque sent by ordinary mail, or to each Depositary Interest Acceptor in respect of the Shares represented by Depositary Interests, will be paid by the crediting of CREST accounts, or as otherwise agreed between the Acceptor or the Depositary Interest Acceptor (as the case may be) and Emulex Bidco and, in respect of Options, paid in accordance with the final paragraph of Part D of Part 2 of this document, and in respect of both Shares (including, for the avoidance of doubt, Shares represented by Depositary Interests) and Options, payment will be made (in accordance with paragraph 8.1 below) no later than seven days after the later of: |

| (a) | the date on which that Acceptor’s or the Depositary’s (as the case may be) acceptance is received by Emulex Bidco; and |

| (b) | the date on which this Offer is declared unconditional. |

| 2.4 | If the consideration payable to an Acceptor or to a Depositary Interest Acceptor is not sent to that Acceptor or Depositary Interest Acceptor (as the case may be) within the period specified in paragraph 2.3 above, that Acceptor may withdraw their acceptance of this Offer by notice in writing to Emulex Bidco, or the Depositary Interest Acceptor may instruct the Depositary to withdraw its acceptance of this Offer on their behalf (as the case may be), but only: |

| (a) | after the expiration of seven days’ written notice to Emulex Bidco of that Acceptor’s or Depositary Interest Acceptor’s intention to do so; and |

| (b) | if that Acceptor or Depositary Interest Acceptor has not received the consideration to which they are entitled during the seven day period referred to in paragraph 2.3. |

| 3. | ACCEPTANCES |

| 3.1 | Acceptance of this Offer by each Acceptor, or by the Depositary on behalf of a Depositary Interest Acceptor, constitutes a contract between that Acceptor or the Depositary on behalf of that Depositary |

19

| Interest Acceptor (as the case may be) and Emulex Bidco on the terms and subject to the conditions of this Offer. Other than in the circumstances set out in paragraph 2.4 above, an Acceptor may not withdraw their acceptance, and a Depositary Interest Acceptor may not instruct the Depositary to withdraw its acceptance on their behalf, whether or not there has been any permitted variation of this Offer. Emulex Bidco, every Acceptor and the Depositary on behalf of each Depositary Interest Acceptor, shall be released from their obligations under this Offer, and arising from acceptance of this Offer, if this Offer: |

| (a) | is withdrawn with the consent of the Takeovers Panel (New Zealand); or |

| (b) | lapses as a result of any Condition in paragraph 5 or paragraph 6 below not being satisfied or waived by the latest date that Emulex Bidco may declare this Offer unconditional. |

| 4. | CERTAIN FURTHER TERMS OF THE OFFER |

| 4.1 | The Offer is made on 21 December 2012 and is capable of acceptance from and after that date. Unless this Offer is withdrawn in its entirety with the consent of the Takeovers Panel (New Zealand) in accordance with the Takeovers Code (New Zealand) and every person is released from every obligation incurred under the terms of this Offer, or unless this Offer lapses in accordance with its terms, this Offer remains open for acceptance until and including the Closing Date. |

| 4.2 | Under the Takeovers Code (New Zealand), the latest date on which Emulex Bidco can declare this Offer unconditional is 30 days after the Closing Date (excluding, for the purposes of this paragraph 4.2, an extension of the Closing Date beyond 1 March 2013 under Rule 24B of the Takeovers Code (New Zealand)). If this Offer is not extended and the Offer Period ends on 29 January 2013, then the latest date under the Takeovers Code (New Zealand) by which Emulex Bidco can declare this Offer unconditional is 1 March 2013. This Offer may be extended by Emulex Bidco to any date up to 20 March 2013, in which case the latest date which Emulex Bidco can declare this Offer unconditional is 19 April 2013. If this Offer is not declared unconditional, or the Conditions to it are not waived by Emulex Bidco (to the extent waivable), by the latest date contemplated by this paragraph 4.2, this Offer will lapse and Emulex Bidco and every Acceptor will be released from their obligations under this Offer (and the contract arising from their acceptance of it). Emulex Bidco shall be under no obligation to waive or treat as satisfied any Condition by a date earlier than the latest date specified in this paragraph 4.2 for the satisfaction thereof notwithstanding that the other Conditions may at such earlier date have been waived or satisfied and that there are, at such earlier date, no circumstances indicating that any such Conditions may not be capable of satisfaction. |

| 4.3 | If the Offer lapses for any reason: |

| (a) | it will not be capable of further acceptance; |

| (b) | Acceptors, Depositary Interest Acceptors and Emulex Bidco will cease to be bound by, (a) in the case of Shares held in certificated form, Forms of Acceptance for Shares submitted; (b) in the case of Shares represented by Depositary Interests, Electronic Acceptances inputted and settled and the Shares represented by such Depositary Interests, in each case before the time the Offer lapses; and (c) in the case of Options, Forms of Acceptance for Options submitted; |

| (c) | in respect of Shares held in certificated form, Forms of Acceptance, share certificate(s) and other documents of title will be returned by post within 14 calendar days of the Offer lapsing, at the risk of the Shareholder in question, to the person or agent whose name and address is set out in the relevant box on the Form of Acceptance or, if none is set out, to the first-named holder at his registered address; |

| (d) | in respect of Depositary Interests, the Receiving Agent will immediately after the Offer lapses (or within such longer period as the Takeovers Panel (New Zealand) may permit, not exceeding 14 calendar days of the Offer lapsing) give TFE instructions to Euroclear to transfer all Depositary Interests held in escrow balances and in relation to which it is the Escrow Agent for the purposes of the Offer to the original available balances of the relevant Depositary Interest Holders; and |

20

| (e) | in respect of Options, Forms of Acceptance, option certificate(s) and other documents of title will be returned by post within 14 calendar days of the Offer lapsing, at the risk of the Optionholder in question, to the person or agent whose name and address is set out in the relevant box on the Form of Acceptance or, if none is set out, to the first-named holder at his registered address. |

| 4.4 | This Offer is open for acceptance by any person who holds Shares or Options, whether acquired before, on or after the date of this Offer, upon production of evidence satisfactory to Emulex Bidco of such person’s entitlement to those Shares or Options. A holder of Shares or Options may accept this Offer in respect of all or any of their Shares or Options. Each acceptance must be free of all conditions of acceptance of any nature whatsoever. |

| 4.5 |

(a) | Each Acceptor represents and warrants that: | ||||

| (i) |

it is the sole legal and beneficial owner of the Shares and/or Options in respect of which it accepts this Offer or it is the legal owner and has the necessary capacity and authority to accept the Offer, in respect of those Shares, and/or Options; and | |||||

| (ii) |

that legal and beneficial title to all such Shares and Options will pass to Emulex Bidco free of all liens, charges, mortgages, encumbrances and other adverse interests or claims of any nature whatsoever, but together with all rights, benefits and entitlements attaching to them, including the right to all dividends, bonuses and other payments and distributions of any nature arising on, after, or by reference to, the Notice Date on payment of the consideration pursuant to paragraph 2. | |||||

| (b) | Each Depositary Interest Acceptor represents and warrants that it is the sole legal and beneficial owner of the Depositary Interests representing Shares in respect of which it instructs the Depositary to accept this Offer on its behalf, or it is the legal owner and has the necessary capacity and authority to instruct the Depositary to accept the offer on its behalf, in respect of those Depositary Interests representing Shares in respect of which it instructs the Depositary to accept this Offer on its behalf. | |||||

| 4.6 | Acceptance of this Offer constitutes a representation and warranty by the Acceptor to Emulex Bidco that title to their Shares and/or Options to which the acceptance relates will pass to Emulex Bidco on the basis described in paragraph 4.5 above and that the Acceptor has full power, capacity and authority to sell and transfer all their Shares and Options. An instruction by a Depositary Interest Acceptor to the Depositary to accept the Offer on their behalf constitutes a representation and warranty by the Depositary Interest Acceptor that title to the Shares represented by their Depositary Interests to which the instruction to the Depositary relates will pass to Emulex Bidco on the basis described in paragraph 4.5 above and that the Depositary Interest Acceptor has full power, capacity and authority to instruct the Depositary to accept the Offer on their behalf and to sell and transfer all the Shares represented by their Depositary Interests. |

| 5. | MINIMUM ACCEPTANCE CONDITION |

| 5.1 | This Offer, and any contract arising from acceptance of it, are conditional upon Emulex Bidco receiving acceptances by no later than the Closing Date in respect of that number of Shares that would, upon this Offer being declared unconditional and the relevant Shares being transferred to Emulex Bidco, result in Emulex Bidco, holding or controlling 90 per cent. or more of the voting rights in Endace PROVIDED THAT Emulex Bidco may waive this condition where the minimum acceptances received confer more than 50 per cent. of the voting rights in Endace as prescribed by Rule 23(1) of the Takeovers Code (New Zealand). |

21

| 6. | FURTHER CONDITIONS OF THIS OFFER |

| 6.1 | This Offer and any contract arising from acceptance of it is conditional on Emulex Bidco obtaining all consents required under the Overseas Investment Act 2005 and Overseas Investment Regulations 2005 for the acquisition by Emulex Bidco of up to and including 100 per cent. of the Shares and Options in accordance with the Offer on terms which are usual for the granting of such consents. |

| 6.2 | This Offer, and any contract arising from acceptance of it, are subject to the following conditions that, except as otherwise agreed in writing by Emulex Bidco, during the period from the Effective Date until the date on which the conditions in paragraph 5 and 6.1 are satisfied or waived: |

| (a) | no dividends, bonuses or other payments or distributions (including, without limitation, any share buybacks) of any nature have been or will be declared, paid, or made, upon or in respect of, any of the Shares; |

| (b) | no further shares, convertible securities, other securities of any nature (including options, rights or interests in any ordinary shares) of the Endace Group have been or will be by any member of the Endace Group issued, agreed to be issued or made the subject of any option or right to subscribe (excluding the exercise of employee share options, on issue as at the Effective Date which may have been converted to Shares post the Effective Date); |

| (c) | there has been and will be no alteration of the rights, benefits, entitlements and restrictions attaching to any of the Shares, or any other securities on issue by any member of the Endace Group other than securities held by one member of the Endace Group in another wholly owned member of the Endace Group; |

| (d) | no action, claim, litigation or other form of proceedings that, as at the Effective Date, was not publicly notified, or, as at the Notice Date, the possibility or existence of which was not fully and fairly disclosed to Emulex Bidco in writing by Endace Group, are notified or commenced against or by, any member of Endace Group and, in each case, such action, claim, litigation or other form of proceeding is material or could reasonably be expected to be material to the Endace Group, taken as a whole; |

| (e) | no government, quasi-governmental, statutory, regulatory, or administrative, authority (including any national anti-trust, merger control) or any Court, or other person or body whatsoever has decided to take, institute, or threaten in writing, any action, proceeding, suit, investigation, or made, proposed or enacted any statute, regulation, order, decision or otherwise which would or might reasonably be expected to, make the Offer or its implementation void, unenforceable, or prohibited, directly or indirectly materially restrain, restrict, prohibit, delay or otherwise materially interfere with the Offer or its implementation; |

| (f) | the businesses of each member of the Endace Group are carried on in the normal and ordinary course, including without limitation: |

| (i) | no unusual or abnormal payments, commitments or liabilities (including contingent liabilities) which are material or could reasonably be expected to be material to the Endace Group, taken as a whole, are made or incurred (or agreed to be made or incurred) by any of those entities; |

| (ii) | other than the completion of transactions that have prior to the Notice Date been disclosed in public announcements or public disclosures by Endace or transactions fully and fairly disclosed to Emulex Bidco in writing by Endace prior to the Notice Date, no member of the Endace Group disposes of, purchases, transfers, leases, licences, charges, mortgages, grants a lien or other encumbrance over, grants an option or legal or equitable interest in respect of, or otherwise deals with a legal or equitable interest in a material asset, business, operation, property or subsidiary (or agrees, including agreeing to materially vary any agreement, to do any of these things or makes an announcement in respect of any of them), that is or could reasonably be expected to be material to the Endace Group, taken as a whole; |

22

| (iii) | other than expenditure or divestment fully and fairly disclosed to Emulex Bidco in writing by Endace prior to the Notice Date, no member of the Endace Group (separately or together) undertakes or commits to any capital expenditure or divestment (other than of trading stock in the ordinary course of business) over NZ$500,000 (in aggregate) that, as at the Effective Date, had not been approved by the Board of Directors of Endace or committed to by that member of the Endace Group; |

| (iv) | no onerous, long term or material contracts, commitments or arrangements, or any major transactions (as defined in section 129(2) of the Companies Act 1993), are entered into, or, materially varied, by any member of the Endace Group that are or could reasonably be expected to be material to the Endace Group, taken as a whole; |

| (v) | no variation is made in respect of the normal course of treatment of receivables (e.g. no acceleration of the collection of the same) or payables (e.g. no slowing down in the payment of the same); |

| (g) | there is no alteration to the constitutional documents of any member of the Endace Group or to any trust deed (or similar document) under which any securities have been issued by any member of the Endace Group, other than amendments that are of a formal or technical, and not substantive nature; |