Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ARRIS GROUP INC | d457255d8k.htm |

| EX-2.1 - EX-2.1 - ARRIS GROUP INC | d457255dex21.htm |

| EX-99.2 - EX-99.2 - ARRIS GROUP INC | d457255dex992.htm |

Transformative Combination Creates

Global Player In Innovative End-To-

End Broadband Video Solutions

December 19, 2012

ARRIS to Acquire

Motorola Home Business

from Google

Exhibit 99.1 |

Speaking Today

1

Bob Stanzione, ARRIS

Chairman of the Board of

Directors, President and CEO

Marwan Fawaz,

EVP, Motorola Mobility

David Potts, ARRIS

CFO, EVP

Bruce McClelland, ARRIS

Group President,

Products and Services

ARRIS to Acquire Motorola Home |

Safe

Harbor 2

ARRIS to Acquire Motorola Home

This presentation contains forward looking statements. These statements include, among others,

statements concerning projections of revenues, income and other financial items; plans for future

performance of ARRIS following the completion of the Motorola Home Business acquisition,

ARRIS’ ability to drive the strategic benefits outlined; and the time frame during which the

acquisition will close. Statements regarding future events are based on the parties’

current expectations. Actual results may differ materially from those contained in any

forward-looking statement. Forward-looking statements are necessarily subject to

associated risks related to, among other things, successful outcome of the acquisition process,

regulatory approval of the acquisition, the potential impact on the business of Motorola Home

Business due to uncertainty about the acquisition, the retention of employees of Motorola Home

Business and the ability of ARRIS to successfully integrate Motorola Home’s opportunities,

technology, personnel and operations. Other factors that could cause results to differ from

current expectations include: the uncertain current economic climate and financial markets, and their

impact on our customers’ plans and access to capital: the impact of rapidly changing technologies;

the impact of competition on product development and pricing; the ability of ARRIS to react to

changes in general industry and market conditions; rights to intellectual property and the current

trend toward increasing patent litigation, market trends and the adoption of industry standards;

possible acquisitions and dispositions; and consolidations within the telecommunications industry

of both the customer and supplier base. These factors are not intended to be an

all-encompassing list of risks and uncertainties that may affect the Company’s business. Additional

information regarding these and other factors can be found in ARRIS’ reports filed with the

Securities and Exchange Commission, including its Form 10-Q for the quarter ended September

30, 2012. In providing forward- looking statements, the Company expressly disclaims any

obligation to update publicly or otherwise these statements, whether as a result of new

information, future events or otherwise. |

ARRIS Announces Agreement

to Acquire the Motorola Home Business

ARRIS has announced an agreement to acquire all of the outstanding stock of

Motorola Home from Google for $2,350 million of cash and stock consideration

Motorola Home is a leading global supplier of digital video and IPTV hardware and

software

solutions

for

the

cable,

telecom,

broadcast

&

satellite

markets

-

Strong fit with ARRIS business and strategy

-

Significantly grows customer base

-

Strengthens relationships with Service Providers

Transforms ARRIS into a video / broadband player with global footprint

-

Enhanced product suite creates an industry leader

-

Increased relevance in the marketplace drives future growth

Materially enhances shareholder value, both immediate and long-term

-

Meaningful accretion to EPS in the first full year on a Non-GAAP basis

Transaction is expected to close by Q2 2013, subject to customary regulatory

approval

3

3

ARRIS to Acquire Motorola Home |

Key

Transaction Terms Transaction Structure:

Acquisition of 100% of the shares of General Instrument Corporation from Motorola

Mobility

Acquisition

of

approximately

1,000

patents

and

license

to

a

wide

array

of

Motorola

Mobility patents

Provisions to cap potential liability from certain existing IP infringement

litigation, including TiVo

Transaction

Consideration:

Total consideration to Google of $2,350 million (cash-free / debt-free,

normalized net working capital basis)

-

$2,050 million Cash consideration: funded with existing cash on hand and new

acquisition financing

-

21.3 million shares

-

$300

million

Equity

consideration

based

on

share

price

of

$14.11

(20

day-trading trailing closing average)

-

New equity issued to be passive investment in common stock, subject to

customary lockup and standstill provisions and voting restrictions

Source of Financing:

$2,175 million aggregate financing commitment received from Bank of America

Merrill Lynch and Royal Bank of Canada

-

~$1,000 million Term Loan A

-

~$925 million Term Loan B

-

~$250 million revolving credit facility (unfunded at close)

Closing Conditions:

Customary regulatory approvals

Expected Closing:

By Q2 2013

4

ARRIS to Acquire Motorola Home |

ARRIS Overview

High tech, leading provider of voice, high-speed data,

and video solutions to the global broadband industry

Product Portfolio Overview

Key Highlights

Quick Facts

•

$1.3B Revenue last 4 quarters

•

Market Cap: ~$1.6 B

1

•

$134M Cash from Operating Activities last 4

quarters

•

Headquarters: Suwanee, GA ~2,100 Employees

•

Profitable business with solid cash generation

•

Significant organic investment and focused M&A

•

Technological strength in key product categories

•

Strong customer relationships based on close

collaborations

5

ARRIS to Acquire Motorola Home

Network Infrastructure

CPE

Media Services

Platform (MSP)

C4 CMTS

E6000 Converged

Edge Router

Voice & Data

Wi-Fi Routers

Triple Play

Note:

1.

Based on closing share price on 12/18/2012 |

Motorola Home Overview

Positioned to Be at the Forefront of the IP Transformation

in the Home and the Network

ARRIS to Acquire Motorola Home

6

Product Portfolio Overview

Home Devices

Providing a range of user-oriented

multiscreen, home solutions, and

integration solutions

Network Infrastructure Solutions

Converged Experiences

Delivering next-gen broadband

solutions

Enabling rich media experiences

and IP services

Key Highlights

Quick Facts

•

Headquartered in Horsham, PA, with a global

presence including 18 major sites

•

~5,000 employees

•

500+ customers in 70 countries

•

~$3.4B Revenue last 4 quarters, ~37% international

•

50+ years of leading the industry evolution

•

Recognized industry leader with record of innovation

•

Global, broad and deep customer relationships with

major Telcos and MSOs

•

Comprehensive product suite for entire video delivery

value chain

•

Proven technical and product leadership

•

Strong cash flow generation and long-term growth

opportunities |

ARRIS and Motorola Home

A Video and Broadband Leader

7

ARRIS to Acquire Motorola Home

~$4.7B annual revenues (last 4 quarters)

~35% international sales mix

~7,000 employees worldwide

Expanded Intellectual Property portfolio |

Acquisition Transforms ARRIS into

Player with Global Footprint

Significant Earnings

Accretion

Enhanced Relevance in the

Marketplace

Accelerated Time to Market

Expanded Customer Base

and Global Customer

Diversification

Materially

Enhanced

Shareholder

Value

•

Expanded Product / Service

Portfolio

•

Greatly Enhanced Video

Capabilities and Expertise

•

Exposure to New Growth

Areas in Converged

Experiences

•

Strong Positions in Key

Product Areas

•

Strong Projected Free Cash

Flow from Operations

•

Increased Intellectual

Property and Video DNA

8

ARRIS to Acquire Motorola Home |

ARRIS + Motorola Home Customer Diversification

More Diversified Customer Base

Top 5 = 51% of revenue *

* Trailing 4 quarters ended September 30, 2012

9

ARRIS to Acquire Motorola Home |

Complementary ARRIS/Motorola Solution Set

Opportunity for synergy , growth and market expansion

10

ARRIS to Acquire Motorola Home |

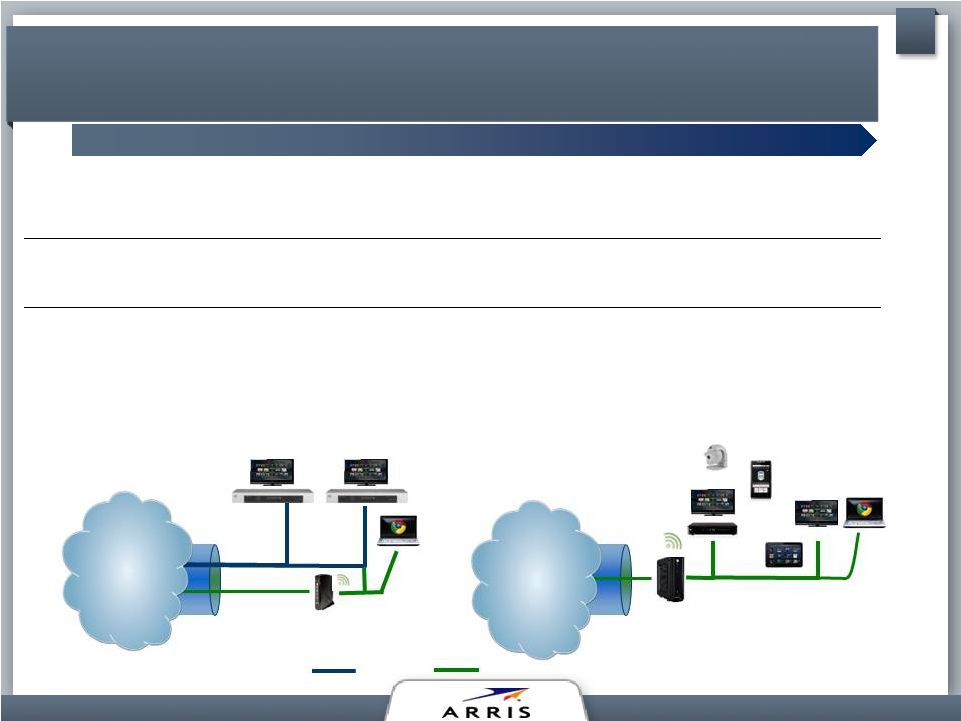

Hardware

SD / HD / HD-DVR STB

QAM/IP

DOCSIS / DSL Gateways

Converged IP Video Gateway

Thin client boxes/software

Monitors / sensors

Services

Linear Content, VOD, HD, DVR

Home Networking

Linear Content, VOD, HD, DVR / nDVR,

Multiscreen, OTT, Home Networking, Monitoring,

Automation

Today’s set top boxes will be essential as

the industry evolves to Home Gateways

Connected TVs will play a role in Pay-TV

services and will drive network (IP) traffic

Economic inertia dictates an evolutionary

approach, not revolutionary

‘Over-the-top’

entertainment highly integrated

into Service Provider offerings

The Evolution of Home Entertainment

and Services

QAM

IP Link

IP

Triple

Play

Services

IP

QAM

Bundled

Offerings

Cloud Services

e.g. Multi-Screen,

Home Mgmt, etc.

Current

Future

11

ARRIS to Acquire Motorola Home |

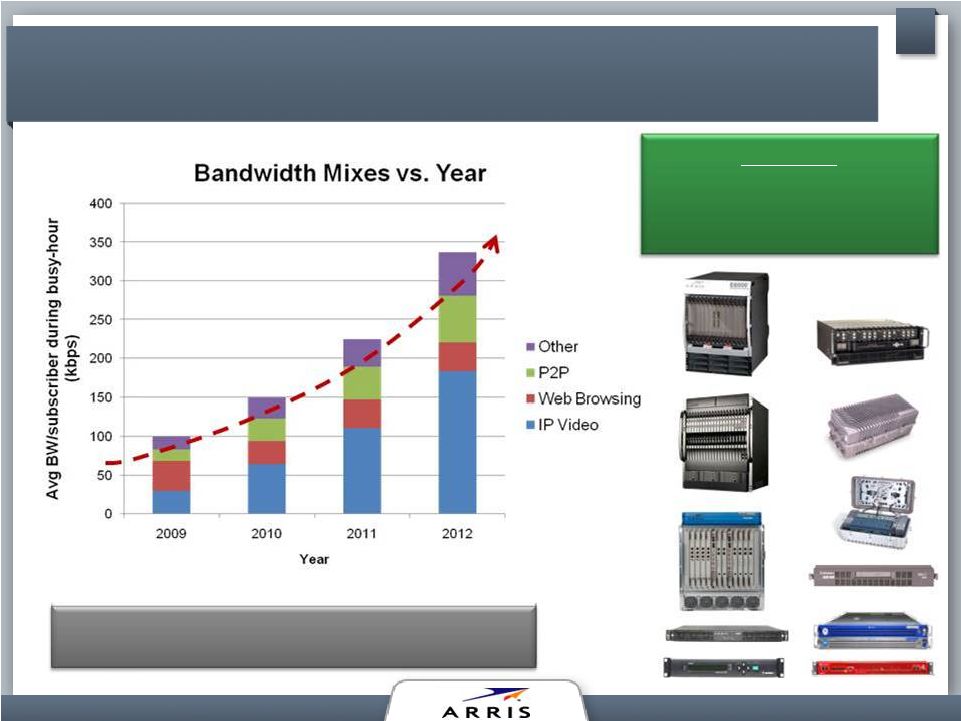

Bandwidth Demand Creates Strong

Network Product Opportunities

IP Video (Streaming Media) Is Driving The

Growing Bandwidth Trends!

Calculated from MSO Data & Sandvine Statistics

Products

CMTS, CCAP, Edge-QAM,

Optics, RF Amplifiers,

Encoding / Transcoding

12

ARRIS to Acquire Motorola Home

17%

15%

38%

30%

16%

19%

16%

49%

17%

18%

11%

54%

18%

19%

20%

43% |

Increased Intellectual Property Portfolio

Transaction includes a transfer of certain patents

-

Combined company will have approximately 2,000 granted and in-

process patents

-

Emphasis on Video Processing, Networking, Security/DRM, and User

Experience

Important License Agreement for Additional IPR

-

License to wide array of Motorola Mobility patents

Exposure to Certain Pending Lawsuits Addressed

-

Provisions to cap potential liability from certain existing IP

infringement litigation, including TiVo

13

ARRIS to Acquire Motorola Home |

David Potts

EVP and CFO, ARRIS Group, Inc.

Financial Highlights

ARRIS to Acquire Motorola Home

14 |

Financially Compelling Transaction

Accelerates revenue scale and growth profile

-

Pro forma Revenues of $4.7 billion for the trailing four quarter

period ended September 30, 2012

-

Significant R&D scale enhances growth potential

Meaningful synergy potential

-

Run-rate synergy potential to be achieved within ~12 months

Significant shareholder value creation

-

Immediately accretive to Non-GAAP EPS

(1)

ARRIS maintains strong balance sheet post-transaction with

available liquidity of ~$655 million (prior to anticipated repayment

of existing $232 million convertible notes in Q4 2013)

(1)

Non-GAAP EPS exclude stock based compensation, amortization of acquired

intangibles, acquisition costs, restructuring 15

ARRIS to Acquire Motorola Home |

Transaction Structuring

($ in millions)

Notes:

(1)

Pro Forma 2012 Leverage multiples include $232 million of convertible notes

(anticipated repayment in 2013) (2)

Estimated Pro Forma 2012 Non-GAAP EBITDA excludes stock based compensation,

synergies and deal costs (3)

Estimated Gross Interest Expense includes interest on existing convertible notes;

Assumes 12/31/12 close for illustrative purposes (4)

Estimated liquidity anticipates funds needed for repayment of existing ARRIS

convertible notes due in 2013 (5)

Includes cash and cash equivalents, including short-term and long-term

investments; Assumes 12/31/12 close for illustrative purposes Sources

Cash from ARRIS Balance Sheet

$195

Revolver ($250mm)

0

Term Loan A

1,000

Term Loan B

925

Stock Consideration

300

Total Sources

$2,420

Estimated Liquidity at Close

(4)

Expected Cash at 12/31/12

(5)

$600

Less: Cash to Fund Transaction

(195)

Cash at Closing

$405

Plus: Revolver Capacity at Close

250

Available Liquidity

$655

Uses

Purchase Price

$2,350

Estimated Fees

70

Total Uses

$2,420

16

ARRIS to Acquire Motorola Home

Estimated Pro Forma '12 Credit Metrics

(1) (2)

CY12E

Secured Debt / '12 PF EBITDA

(2)

3.4x

Total Debt / '12 PF EBITDA

(2)

3.8x

Net Debt / '12 PF EBITDA

(2)

3.1x

'12 PF EBITDA

(2)

/Gross Interest Expense

(3)

6.9x |

$2,175

million

aggregate

financing

commitment

received

from

Bank

of

America

Merrill

Lynch

and Royal Bank of Canada

Financing will consist of:

-

~$1,000 million five-year Term Loan A

-

~$925 million seven-year Term Loan B

-

~$250 million unfunded revolving credit facility

Customary covenants:

-

Maximum total net leverage

-

Minimum interest coverage

Amortization:

-

Term Loan A: back-end weighted amortization

-

Term Loan B: 1% per annum

Closing and funding in conjunction with acquisition closing

Source of Financing

17

ARRIS to Acquire Motorola Home |

Historical Revenues

($ in millions)

(1) Financials for 2012 –

9 Mos. represent unaudited results

2011

2012 - 9 Mos.

(1)

ARRIS

$1,089

$1,010

Motorola Home

3,533

2,527

Pro Forma

$4,622

$3,537

18

ARRIS to Acquire Motorola Home |

Target Annual Model Post-Integration

Estimated GAAP and Non-GAAP Earnings

(1)

Target model assumes integration and synergies complete

(2)

Operating expenses includes stock based compensation and depreciation; does not

include amortization of acquired intangibles (3)

Assumes no share repurchases and normal course equity grants

(4)

Non-GAAP EPS excludes stock based compensation, amortization of acquired

intangibles; see reconciliation of Non-GAAP measures Model Yields

Significant Non-GAAP EPS Accretion ($ in millions)

19

ARRIS to Acquire Motorola Home

Pro Forma Combined

Full Year Target Range

(1)

Revenue

$4,800

<->

$5,100

% Gross Margin

29%

<->

30%

Operating Expenses

(2)

930

<->

980

Interest Expense

75

75

% Tax Rate

38%

38%

Shares Outstanding

(3)

145

<->

145

GAAP EPS

$0.48

<->

$0.63

Non-GAAP EPS

(4)

$2.00

<->

$2.15

Capex

$60

<->

$70 |

Target Annual Model Post-Integration

Estimated Non-GAAP EBITDA and Free Cash Flow

($ in millions)

(1)

Target model assumes integration and synergies complete

(2)

Non-GAAP EBITDA excludes stock based compensation; see reconciliation of

Non-GAAP measures 20

ARRIS to Acquire Motorola Home

Strong EBITDA Profile

Significant Ability to Pay Down Debt

Estimated Free Cash Flow

Pro Forma Combined

Full Year Target Range

(1)

Non-GAAP EBITDA

(2)

$608

<->

$643

Interest Expense

75

<->

75

Cash Taxes

160

<->

170

Capex

70

<->

60

Free Cash Flow

$303

<->

$338 |

Expect ~$100 -

$125 million annual cost synergies

-

Supply chain

-

R&D

-

SG&A

Anticipate costs to achieve synergies of ~$80 -

$100 million

Expect ~12 months to achieve full run-rate benefit

Estimated Annual Cost Synergies

($ in millions)

Cost Synergies Reflective of Conservative View

21

ARRIS to Acquire Motorola Home |

Target Annual Model Post-Integration

GAAP to Non-GAAP EPS Reconciliation

(1)

Purchase accounting impacts reflect current estimates. Amortization and other items

may change (2)

Assumes no share repurchases and normal course equity grants

(3)

Non-GAAP EPS excludes stock based compensation, amortization of acquired

intangibles ($ in millions)

22

ARRIS to Acquire Motorola Home

Combined

Business

Yields

Significant

Non-GAAP

EPS

Accretion

GAAP to Non-GAAP EPS

Reconciliation

GAAP Net Income

$70

<->

$92

Amortization

(1)

295

295

Stock Based Compensation

60

60

Tax Effect on Above Items

(135)

(135)

Estimated Non-GAAP Net Income

$290

<->

$312

Shares Outstanding

(2)

145

145

GAAP EPS

$0.48

<->

$0.63

Non-GAAP EPS

(3)

$2.00

<->

$2.15 |

Target Annual Model Post-Integration

GAAP to Non-GAAP EBITDA Reconciliation

(1)Purchase accounting impacts reflect current estimates. Amortization and other

items may change (2)Non-GAAP EBITDA excludes stock based

compensation ($ in millions)

GAAP to Non-GAAP EBITDA

Reconciliation

GAAP Net Income

$70

<->

$92

Tax Expense

43

<->

56

Interest Expense

75

75

Amortization

(1)

295

295

Depreciation

65

65

EBITDA

$548

<->

$583

Stock Based Compensation

60

60

Non-GAAP EBITDA

(2)

$608

<->

$643

23

ARRIS to Acquire Motorola Home |

Summary

24

ARRIS to Acquire Motorola Home

Bob Stanzione

Chairman and CEO, ARRIS Group, Inc. |

Increasing Shareholder Value

25

ARRIS to Acquire Motorola Home

Significant Earnings Accretion

Enhanced Relevance in the Marketplace

Rapid Debt Paydown

Increased Customer Diversification and Installed Base

Increase Intellectual Property and Video DNA |

Questions? |

27

ARRIS to Acquire Motorola Home |