Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DESTINATION XL GROUP, INC. | d455415d8k.htm |

Investor Presentation

December 2012

1

Exhibit 99.1

Generating

Value

on

the

Road

to

Destination

XL

® |

2

Safe Harbor

Certain information contained in this presentation, including, but not limited to, cash flows,

operating margins, store counts, earnings expectations for fiscal 2012 and estimates

through fiscal 2016, constitute forward-looking statements under the federal

securities laws. The discussion of forward- looking information requires management

of the Company to make certain estimates and assumptions regarding the Company's

strategic direction and the effect of such plans on the Company's financial results.

Such forward-looking statements are subject to various risks and uncertainties that could cause

actual results to differ materially from those indicated. Such risks and uncertainties may

include, but are not limited to: the failure to implement the Company's business plan

for increased profitability and growth in the Company's retail stores sales and

direct-to-consumer business, the failure to achieve improvement in the

Company's competitive position, changes in or miscalculation of fashion trends, extreme

or unseasonable weather conditions, economic downturns, a weakness in overall consumer

demand, trade and security restrictions and political or financial instability in

countries where goods are manufactured, increases in raw material costs from inflation

and other factors, the interruption of merchandise flow from the Company's distribution

facility, competitive pressures, and the adverse effects of natural disasters, war,

acts of terrorism or threats of either, or other armed conflict, on the United States

and international economies. These, and other risks and uncertainties, are detailed in the

Company's Annual Report on Form 10-K filed with the Securities and Exchange Commission for

the fiscal year ended January 28, 2012 filed on March 16, 2012 and other Company

filings with the Securities and Exchange Commission. Casual Male assumes no duty to

update or revise its forward- looking statements even if experience or future

changes make it clear that any projected results expressed or implied therein will not

be realized. |

Who

is Casual Male Retail Group? 3

Largest multi-channel specialty

retailer in niche men’s big and

tall (B&T) market

Offering unique blend

of wardrobe solutions

Private label & leading

apparel name brands |

CMRG by the Numbers

4

Active customers

Enrolled in loyalty program

Highest rated retailer

in 2011 CSI

Customer Survey

Retail

Direct

Retail Stores

Brands

Customer

Satisfaction |

Who

is Our Customer? 5

Males with a waist size 42”

and

greater (35M men in US).

Determined by physical

characteristic, not demographic.

Not dependent on age, income,

race or nationality

Seeking greater selection in size.

Values convenience, selection

and fit over price. |

6

Attractive Big & Tall Segment

Men’s B&T market annual sales

approximately

Current

CMRG

market

share

of

~

11%

B&T men account for

approximately 11% in U.S.

Growing at nearly twice the rate of the

regular size men’s apparel market

B&T consumers shop 50% more

for apparel on the Internet than

regular size consumers

New CMRG marketing strategy focuses

on direct sales through digital platforms

Highly fragmented market

Opportunity to take share by offering

one-stop shop solution

$3.5

-

$4B |

7

Why Invest in CMRG?

Accelerated conversion to

DXL concept creates

compelling investment

opportunity

Leader in large and growing

B&T market

Strong gross margins; Ability

to greatly improve operating

margins

Three-year $150M investment

in DXL rollout to be

funded by free cash flow,

including use of $47 million

in tax benefits

Significant market

share/sales growth

opportunity

Strong, debt-free balance

sheet |

8

Our Current Casual Male XL Stores |

9

What Our Customer Wants

Large

changing

rooms

More brand

selections

Suggested

wardrobe

solutions

Wide aisles

One-stop

shopping

Bright

atmosphere

On-site

tailoring |

10

Opened 4 DXL

concept stores

Opened 31 DXL stores

Opened 12

DXL stores

Opportunity for accelerated growth and profitability

Responding

with

DestinationXL

® |

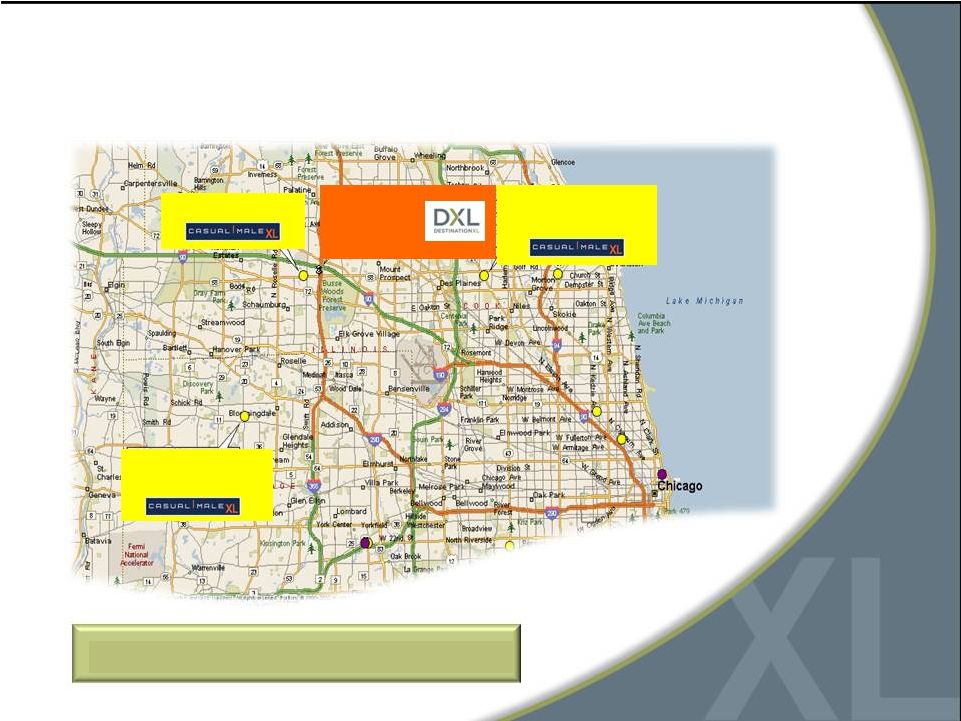

DXL

Schaumburg, IL

0.9 miles

9451 Schaumburg, IL

9183 Niles, IL

11.4 miles

9512 Bloomingdale, IL

11.2 miles

11

Market Consolidation to DXL

Chicago Metro

Chicago Metro

Customers are willing to drive up to 20 miles |

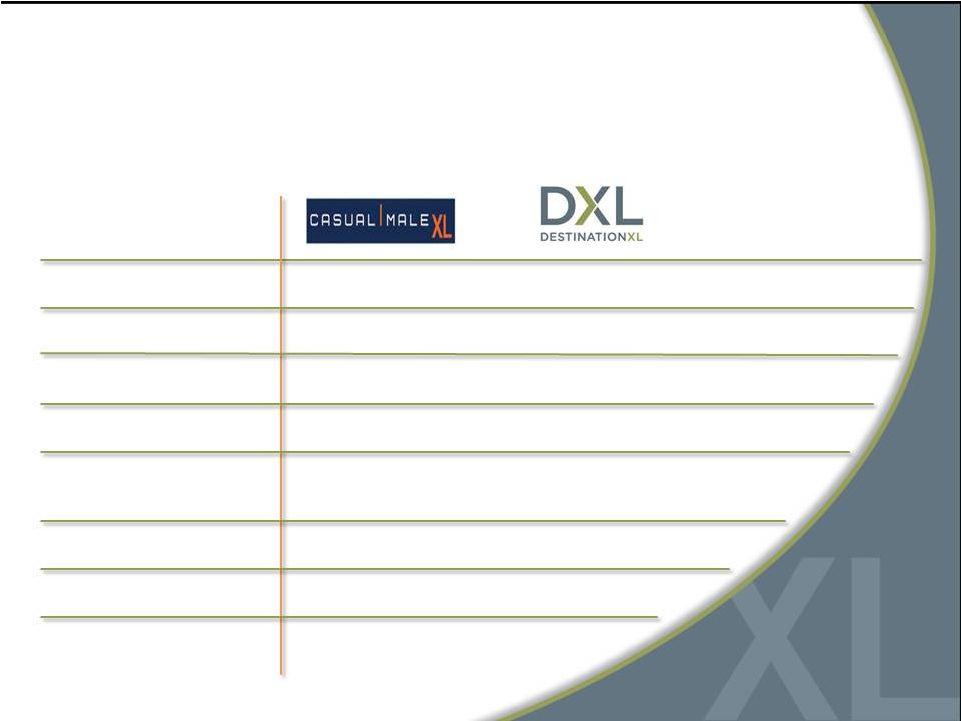

12

Average

Store size

3,400 sq. ft.

8,000 sq. ft.

Sales per sq. ft.

$166

$175 ($229 by 2016)

Build out costs

$50

$70

Occupancy costs

$30

$30

Dollars per

transaction

$101

$142

Style choices

600

2,000

Private label brands

10

15

Name brands

8

30

Casual Male XL vs. DestinationXL

®

|

13

Large Selection of Name Brands |

14

|

15

|

16

|

17

|

18

|

19

|

20

DXL Comps Reflect Growth Opportunity

*Total CMRG Comparables include all stores and direct channel

10 stores

14.5%

14 stores

9.0%

14 stores

12.8%

20 stores

16.3%

29 stores

17.1%

31 stores

13.8%

0.7%

0.8%

2.1%

2.0%

2.0%

1.5%

0.0%

5.0%

10.0%

15.0%

20.0%

Q3 2011

Q4 2011

FY 2011

Q1 2012

Q2 2012

Q3 2012

DXL Comparables

Total CMRG Comparables* |

Comparable Sales Definition

•

Comparable

sales

for

all

periods

include

retail

stores

that

have

been

open for at least one full fiscal year.

•

Stores that have been remodeled, expanded or re-located during the

period also are included in determination of comparable sales.

•

Most DXL stores are considered relocations and comparable to all

closed stores in each respective market area.

•

Direct businesses are included in the calculation since CMRG is a

multi-channel retailer.

21 |

22

Compelling DXL Returns

Better leveraging of expenses --

occupancy, labor productivity and

local/district management

Projecting higher 4-wall profits

than combined profits of individual

stores

Targeting between 25%-30% store

operating margin

Potential to capture additional

market share

Opportunity to improve

operating margins

Expect to significantly increase

margins after the transition to DXL

is complete

Attract new customers

Better cross-selling environment

to capture greater share of apparel

wallet from existing customers

Expect greater store productivity

and profitability |

23

Accelerated DXL Openings

2015 Store Count Target

DestinationXL

®

225-250

Casual Male XL

Outlet

~50

Rochester Clothing

5

Accelerated rollout based on

success of DXL stores in 2011

0

50

100

150

200

250

300

350

400

450

500

2010

2011

2012

2013

2014

2015

Total Stores:

(460)

(450)

(413)

(350)

(309)

(280-305) |

24

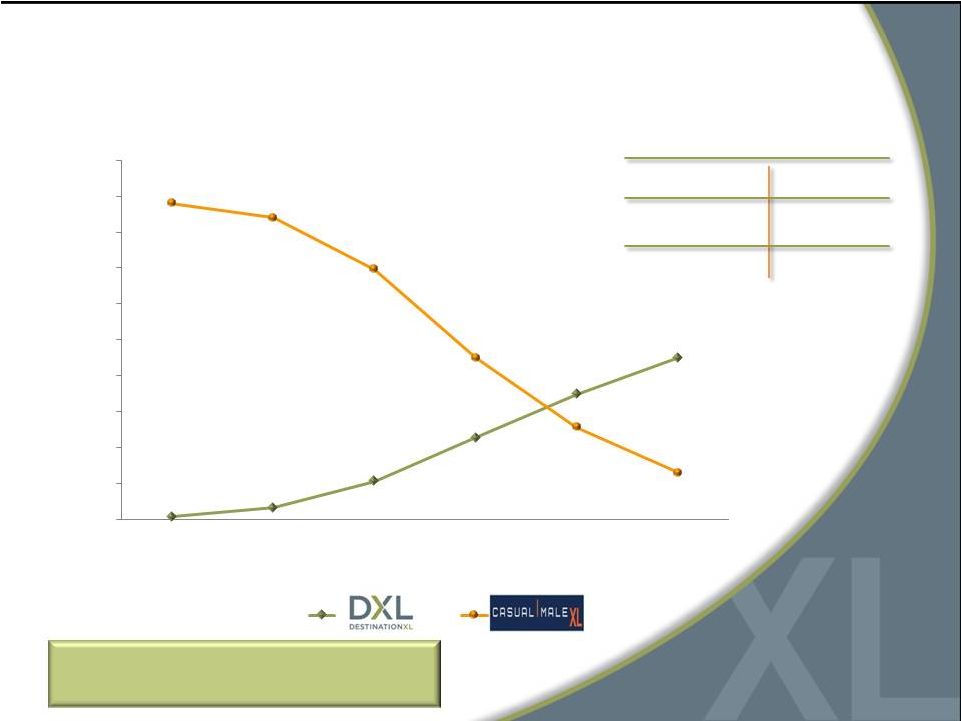

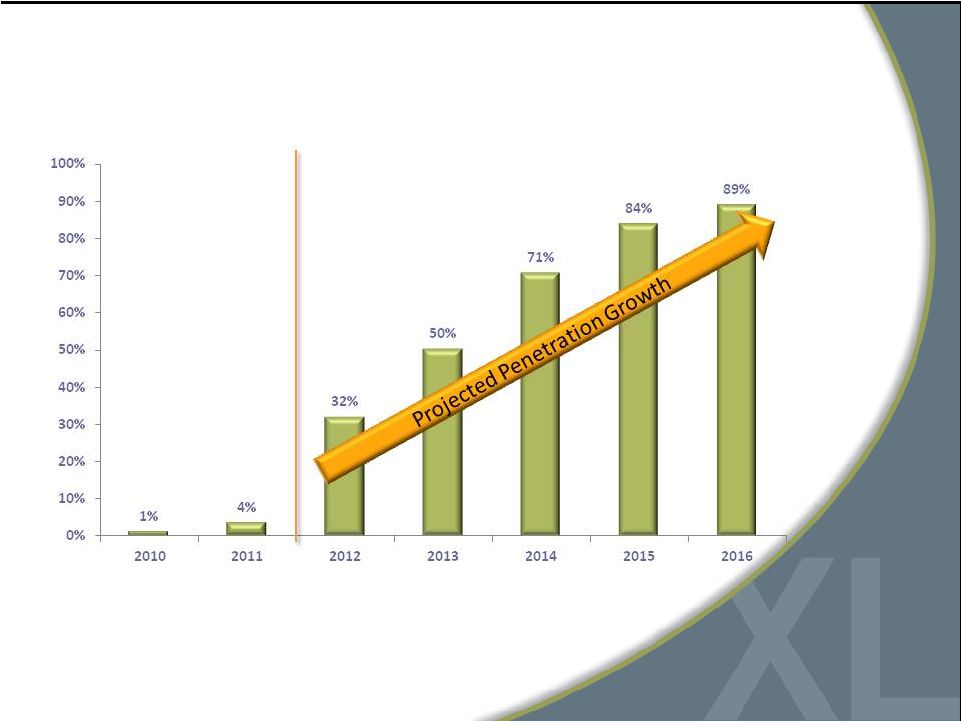

DXL Sales Increase as % of Total Revenue

* DXL sales include direct sales via the DXL website.

|

25

2012

Commence new marketing strategy

Open

32

DXL

stores

/

Close

69

CMXL

stores

Operating

margins

in

the

range

of

4%

-

5%

CapEx expected to be $35M

2013

Open

60

DXL

stores

/

Close

120

CMXL

stores

Operating

margins

in

the

range

of

4%-5%

Lease exit and asset impairment charges in the the

range

of

$8-$12M

CapEx

expected

to

peak

at

$45M

2014

Open

60

DXL

stores

/

Close

100

CMXL

stores

Operating

margins

in

the

range

of

5%

-

6%

Lease exit and asset impairment

charges

in

the

range

of

$5-$7M

CapEx expected to

be $40M

Accelerated Rollout of DXL

* Net of subleases

*

*

2012

2012

-

-

2014

2014 |

26

Accelerated Rollout of DXL

* Net of subleases

2015

Complete

rollout

with

225

-

250

opened

DXL

stores

and

Closure

of

remaining 60

Casual Male XL anchor stores

Operating

margins

gain

traction

and

increase

to

8%

-

9%

(from 4.2% in ‘11)

CapEx expected to be approximately $35M

Lease exit and asset impairment charges in the range

of $2-$4M*

2012

2012

-

-

2014

2014

2015

2015 |

27

2016

Full benefit of DXL concept drives revenue >$600M

Open average of 10 DXL stores per year

Approximately

50

CMXL

outlet

stores

and

5

Rochester Clothing stores remain open

Operating margins >10%

Accelerated Rollout of DXL

Generating

free

cash

flow

in

the

range

of

$55

2016

2016

2015

2015

2012 -

2012 -

2014

2014

-$65M |

28

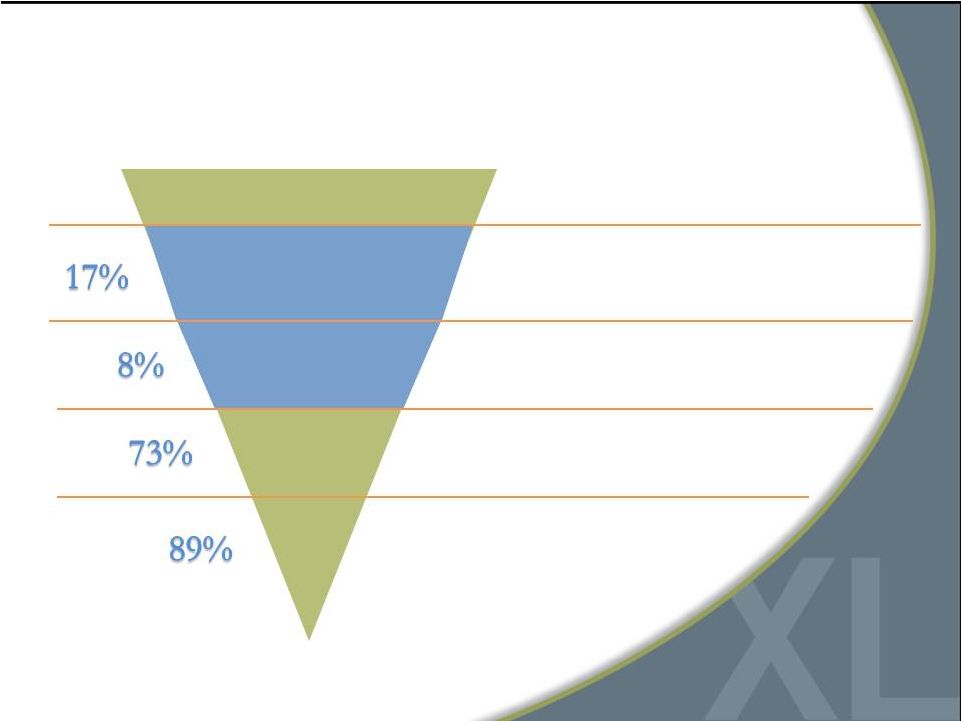

DXL Customer Purchase Funnel*

Addressable Population

Aware of DXL

Visiting DXL

Purchasing

from DXL

Repeat

DXL’s addressable market is primarily men with over 40”

waist

Awareness of DXL is low across its markets, directly impacting

ability to attract new customers

Of those aware of DXL, only 8% are visiting the store

73% of those that visit the store make a purchase

89% of those that make a purchase

intend to return

*Based on consumers’

stated responses per L.E.K’s survey within DXL markets

Source: L.E.K analysis

Increased Awareness = Opportunity |

29

Launched DestinationXL

rebranding initiative

Engaged

advertising firm

Hired Chief Marketing

Officer in June 2012

Identified

target customers

Began developing

marketing strategy

Developed balanced

marketing budget

Raising

DestinationXL

®

Awareness |

Opportunity to Grow Market Share

•

Capture greater wallet share with DXL concept

–

Expansive selection blending private label/name brand apparel

–

Appealing shopping environment

–

Opportunity to grow clothing business with more complete solution

•

Attract a broader customer audience with one-stop-shop

•

Target “end-of-rack”

customers

–

42”-46”

waist size

–

Younger than traditional Casual Male customer

–

65% of B&T market / 20% of current sales

–

Adding regular XL/XLT size in 2013

•

Paradigm shift in marketing improves awareness

•

Improve direct business with new website

30 |

Financial Performance

31 |

32

Sales and Gross Margin

Strong gross margins provide opportunity for

significant sales leverage

$465.4

$464.1

$444.2

$395.2

$390.0

$397.7

$284.8

44.5%

44.4%

42.7%

44.2%

44.9%

47.0%

46.1%

38%

40%

42%

44%

46%

48%

50%

$0

$100

$200

$300

$400

$500

2006

2007

2008

2009

2010

2011

2012 YTD

Revenue ($ mm) |

33

* Before impairment charge of $23.1m

Operating Margin & Comparable Sales

Focus on improving operating margins

through greater DXL sales

2.2%

4.2%

5.5%

2.3%

(1.3)%

2.0%

4.1%

4.2%

2.4%

(15%)

(10%)

(5%)

0%

5%

10%

15%

2004

2005

2006

2007

2008

2009

2010

2011*

2012 YTD

CMRG Annual Historic Operating Margin

4.4%

4.5%

9.0%

2.0%

(1.3)%

(10.8)%

1.5%

2.1%

1.5%

(15%)

(10%)

(5%)

0%

5%

10%

15%

2004

2005

2006

2007

2008

2009

2010

2011

2012

YTD

CMRG Historical Annual Comp Sales |

34

Strict Expense Management

$28.6

$30.9

$34.4

$34.1

$19.1

$19.0

$19.6

$13.6

$151.9

$168.8

$178.1

$178.1

$151.0

$150.9

$154.8

$113.1

36.0%

36.7%

38.4%

42.7%

38.2%

38.3%

38.9%

39.7%

30.0%

33.0%

36.0%

39.0%

42.0%

45.0%

$0

$50

$100

$150

$200

2005

2006

2007

2008

2009

2010

2011

2012 YTD

($ mm)

Marketing Expense

Total SG&A

SG&A as a Percentage of Sales |

2007

2008

2009

2010

2011

Q3

2012

$117.8M

$98.6M

$90.0M

$92.9M

$104.2M

$116.1M

$41.0M

$38.7M

$3.5M

-

-

$7.6M

-

-

-

$4.1M

$10.4M

$5.2M

$17.3M

$12.5M

$7.6M

-

-

-

35

Strong Debt-Free Balance Sheet

Inventory

Borrowing under

revolver

Cash on hand

Fixed term loan |

*Free cash flow is defined as cash flow from operating activities,

less capital expenditures and discretionary store asset acquisitions. 36

$(13.6)

$(9.7)

$7.6

$26.2

$10.0

$5.4

$(12.9)

$22.7

$21.4

$12.6

$4.6

$9.0

$18.0

$21.3

($20)

($10)

$0

$10

$20

$30

($20)

($10)

$0

$10

$20

$30

2006

2007

2008

2009

2010

2011

2012 YTD

($ mm)

Free Cash Flow

CAPEX

Free

Cash

Flow

*

and

CapEx |

Why Invest in CMRG?

•

Accelerated conversion to DXL concept creates compelling

investment opportunity

–

Investment to be funded by operating cash flow

•

Leader in large and growing B&T market

•

Strong gross margins

•

Ability to greatly improve operating margins

•

Three-year $150M investment in DXL rollout to be funded

by free cash flow, including use of $47 million in tax benefits

•

Significant market share/sales growth opportunity

–

Goal of increasing share from 11% to 17.5%-20% by 2015

–

Increasing DXL brand awareness

–

Expanding customers to include “end-of-rack”

–

Improving direct sales business

•

Strong, debt-free balance sheet

37 |

For additional information:

Jeffrey Unger

Casual Male Retail Group, Inc.

V. P. Investor Relations

561-482-9715 Office

561-543-9806 Cell

jeffunger@usa.net

www.destinationxl.com

38 |