Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Troika Media Group, Inc. | t75132_8k.htm |

Exhibit 99.1

|

LD Micro Fifth Annual Conference

December 2012

Michael S. Wasik, CEO and Chairman

|

|

Forward-Looking Statements

This Presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements included herein that address activities, events or developments that the Company expects, believes, estimates, plans, intends, projects or anticipates will or may occur in the future, including statements regarding (i) the Company’s beliefs and expectations with respect to the Hyatt contract, (ii) the Company’s assumptions and beliefs with respect to expected revenue per room, and (iii) the Company’s growth strategy, are forward-looking statements. Actual events may differ materially from those anticipated in the forward-looking statements. These statements are based upon current expectations and beliefs and are subject to a number of factors and uncertainties including, without limitation, the effectiveness of the Company’s growth strategies and sales efforts, competitive factors, legal disputes, and other risks described in the Company’s Annual Report on Form 10-K for the year ended December 31, 2011 and other filings the Company makes with the SEC from time to time. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by the Company that the objectives and expectations of the Company will be achieved.

|

|

Presentation Highlights

• Roomlinx is a leading developer of intelligent interactive entertainment systems for the hospitality industry

• Interactive, dynamic digital media today versus layers of static content historically

Superior Product and

• Seamless connectivity with the guest’s digital life

Technology Platform

• Platform can evolve with ever-changing technology and media trends

Large Market • 4.5 million US hotel rooms located in more than 50,000 properties Opportunity • Multi-billion dollar market opportunity

Crossing Inflection • Hyatt agreement drives significant revenue ramp with a clear path to profitability Point • Hyatt validation has elevated Roomlinx’s visibility throughout the hospitality industry

• Scalable service model fits any hotel size and/or class

Strong Business

• Multiple revenue streams – Internet, entertainment, advertising, and e-Commerce

Model

• Flexible fee structure provides incremental revenue opportunity to hotel and Roomlinx

|

|

Roomlinx Delivers Three Network Based Services

• Proprietary Interactive TV Platform

• High Speed Internet Network (wired and wireless)

• High Definition Satellite TV Programming

A single source provider simplifies processes and provides cost savings

4

|

|

Value to the Hotel Guest

MORE ACCESS MORE CONTENT

High Speed Internet Access on 4 devices

Streaming Media &

Video-on-Demand

B B

Take & Go

Best of TV and Internet

Integration with property & 3rd party Intuitive, easy to use interface apps provides direct guest access to:

Transparent pricing model based on o Hotel services guests’ desired features and functionality o Travel services Premium package delivers unparalleled value relative to o Business tools competitors

MORE FEATURES MORE VALUE

Guest experience is better than being at home

5

|

|

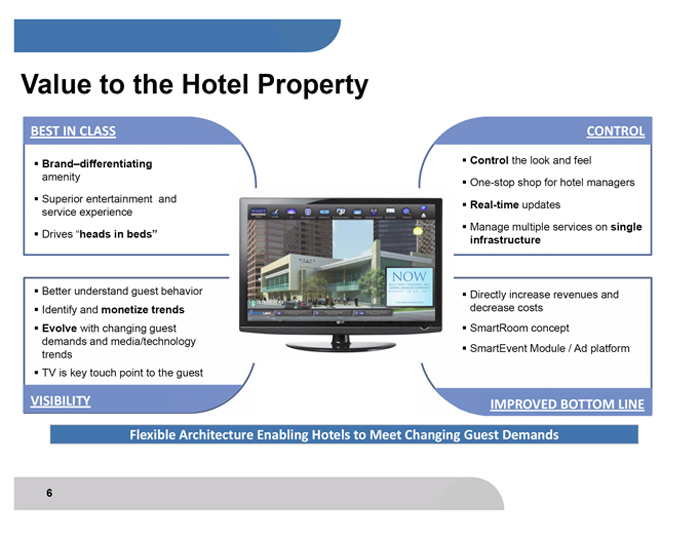

Value to the Hotel Property

BEST IN CLASS CONTROL

Brand–differentiating Control the look and feel amenity

B One-stop shop for hotel managers B

Superior entertainment and

Real-time updates service experience

Manage multiple services on single

Drives “heads in beds” infrastructure

Better understand guest behavior Directly increase revenues and

Identify and monetize trends decrease costs

Evolve with changing guest SmartRoom concept demands and media/technology

SmartEvent Module / Ad platform trends

TV is key touch point to the guest

VISIBILITY IMPROVED BOTTOM

LINE Flexible Architecture Enabling Hotels to Meet Changing Guest Demands

6

|

|

Value to the Marketing Partners/Providers

Better Brand Awareness Interactive contact with guests Affinity Programs

Let guests know they’re using while their enjoying our services Sign new customers while premium services they’re experiencing your

Simplified guest experience and product/service

Emotional brand building ability to conduct interactive brand marketing

Consumer Marketing Local Services

Market local services and events

Desirable demographic

Known location

Leisure time to explore

Connecting Guests to Their Brands and Services

7

|

|

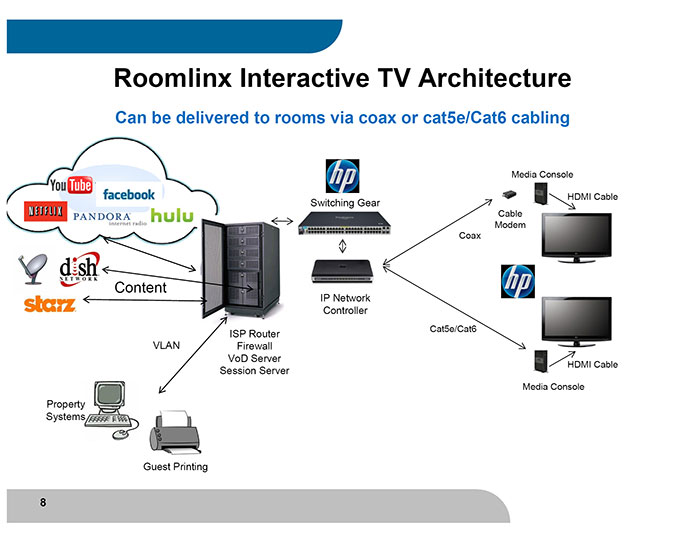

Roomlinx Interactive TV Architecture

Can be delivered to rooms via coax or cat5e/Cat6 cabling

Media Console

HDMI Cable

Switching Gear

Cable Modem Coax

Content

IP Network Controller

Cat5e/Cat6

ISP Router VLAN Firewall VoD Server

HDMI Cable

Session Server

Media Console

Property Systems

Guest Printing

8

|

|

|

|

|

|

|

|

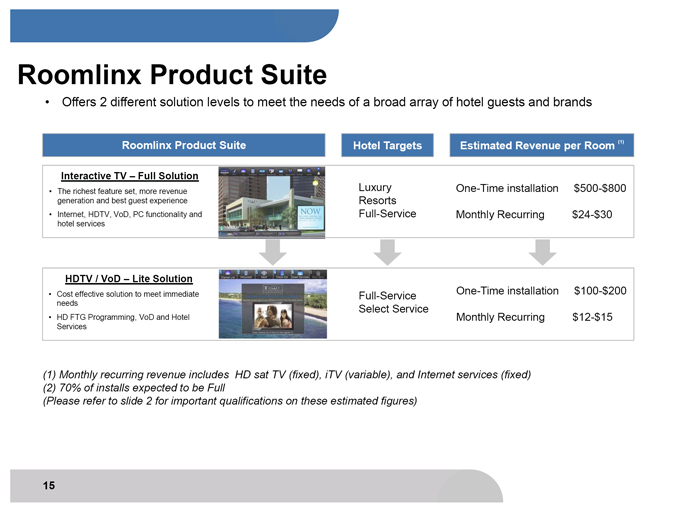

Roomlinx Product Suite

• Offers 2 different solution levels to meet the needs of a broad array of hotel guests and brands

Roomlinx Product Suite Hotel Targets Estimated Revenue per Room (1)

Interactive TV – Full Solution

•The richest feature set, more revenue Luxury One-Time installation $500-$800

generation and best guest experience Resorts

•Internet, HDTV, VoD, PC functionality and hotel Full-Service Monthly Recurring $24-$30

services

HDTV / VoD – Lite Solution

•Cost effective solution to meet immediate needs Full-Service One-Time installation $100-$200 •HD FTG Programming, VoD and Hotel Services Select Service

Monthly Recurring $12-$15

(1) Monthly recurring revenue includes HD sat TV (fixed), iTV (variable), and Internet services (fixed) (2) 70% of installs expected to be Full (Please refer to slide 2 for important qualifications on these estimated figures)

|

|

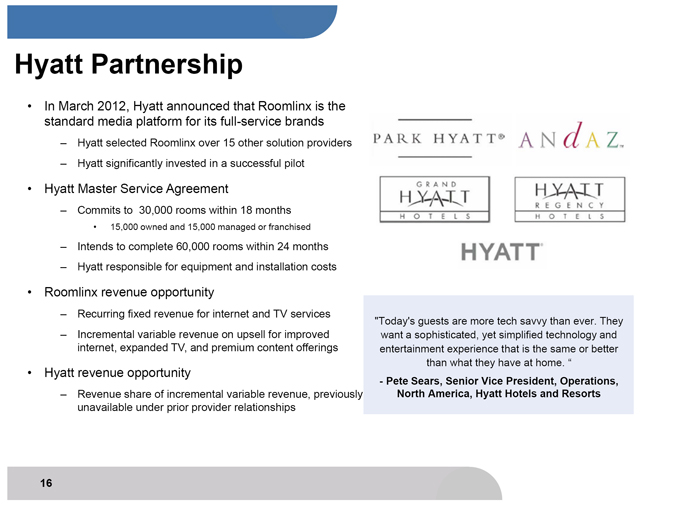

Hyatt Partnership

• In March 2012, Hyatt announced that Roomlinx is the standard media platform for its full-service brands

– Hyatt selected Roomlinx over 15 other solution providers

– Hyatt significantly invested in a successful pilot

• Hyatt Master Service Agreement

– Commits to 30,000 rooms within 18 months

• 15,000 owned and 15,000 managed or franchised

– Intends to complete 60,000 rooms within 24 months

– Hyatt responsible for equipment and installation costs

• Roomlinx revenue opportunity

– Recurring fixed revenue for internet and TV services

“Today’s guests are more tech savvy than ever. They

– Incremental variable revenue on upsell for improved want a sophisticated, yet simplified technology and internet, expanded TV, and premium content offerings entertainment experience that is the same or better than

• Hyatt revenue opportunity what they have at home. “

- Pete Sears, Senior Vice President, Operations,

– Revenue share of incremental variable revenue, previously North America, Hyatt Hotels and Resorts unavailable under prior provider relationships

|

|

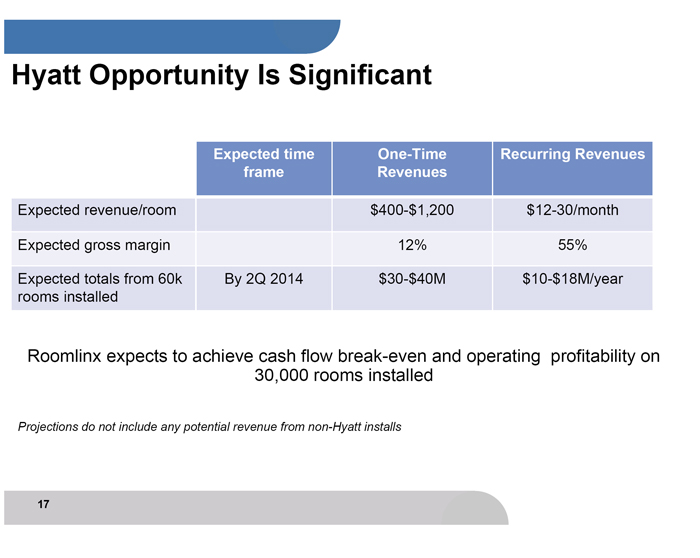

Hyatt Opportunity Is Significant

Expected time One-Time Recurring Revenues frame Revenues

Expected revenue/room $400-$1,200 $12-30/month

Expected gross margin 12% 55%

Expected totals from 60k By 2Q 2014 $30-$40M $10-$18M/year rooms installed

Roomlinx expects to achieve cash flow break-even and operating profitability on 30,000 rooms installed

Projections do not include any potential revenue from non-Hyatt installs

17

|

|

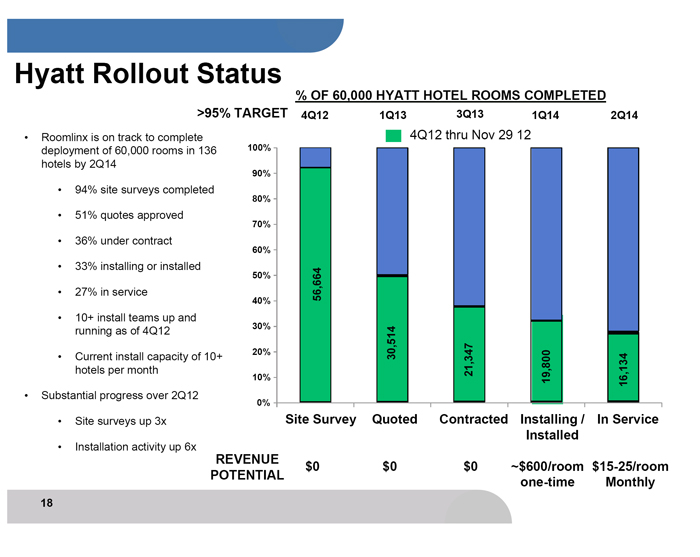

Hyatt Rollout Status

% OF 60,000 HYATT HOTEL ROOMS COMPLETED >95% TARGET 4Q12 1Q13 3Q13 1Q14 2Q14

• Roomlinx is on track to complete 4Q12 thru Nov 29 12 deployment of 60,000 rooms in 136 100% hotels by 2Q14

90%

• 94% site surveys completed

80%

• 51% quotes approved

70%

• 36% under contract

60%

• 33% installing or installed

50%

• 27% in service 56,664

40%

• 10+ install teams up and running as of 4Q12 30%

• Current install capacity of 10+ 20% 30,514 hotels per month 21,347

10% 19,800 16,134

• Substantial progress over 2Q12

0%

• Site surveys up 3x Site Survey Quoted Contracted Installing / In Service Installed

• Installation activity up 6x

REVENUE $0 $0 $0 ~$600/room $15-25/room POTENTIAL one-time Monthly

18

|

|

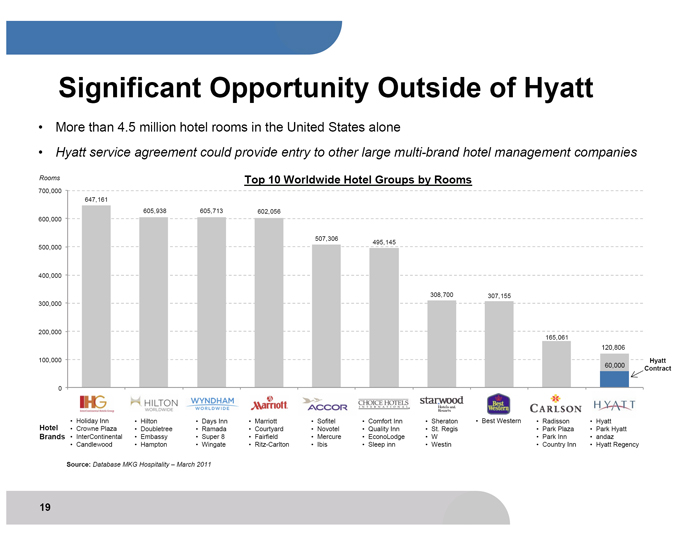

Significant Opportunity Outside of Hyatt

• More than 4.5 million hotel rooms in the United States alone

• Hyatt service agreement could provide entry to other large multi-brand hotel management companies

Rooms Top 10 Worldwide Hotel Groups by Rooms

700,000

647,161

605,938 605,713 602,056 600,000

507,306

495,145 500,000

400,000

308,700 307,155 300,000

200,000

165,061

120,806

100,000 Hyatt

60,000

Contract

0

Wyndham Choice Starwood Best Carlson Hyatt

• Holiday Inn • Hilton • Days Inn • Marriott • Sofitel • Comfort Inn • Sheraton • Best Western • Radisson • Hyatt Hotel • Crowne Plaza • Doubletree • Ramada • Courtyard • Novotel • Quality Inn • St. Regis • Park Plaza • Park Hyatt Brands • InterContinental • Embassy • Super 8 • Fairfield • Mercure • EconoLodge • W • Park Inn • andaz

• Candlewood • Hampton • Wingate • Ritz-Carlton • Ibis • Sleep inn • Westin • Country Inn • Hyatt Regency

Source: Database MKG Hospitality – March 2011

19

|

|

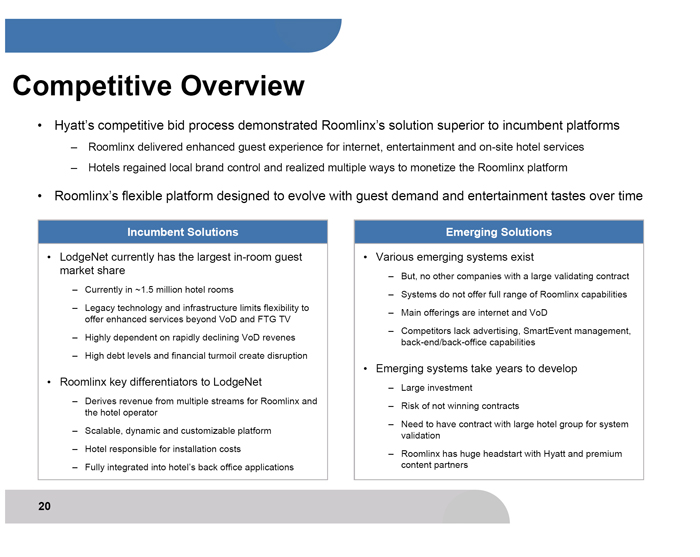

Competitive Overview

• Hyatt’s competitive bid process demonstrated Roomlinx’s solution superior to incumbent platforms

– Roomlinx delivered enhanced guest experience for internet, entertainment and on-site hotel services

– Hotels regained local brand control and realized multiple ways to monetize the Roomlinx platform

• Roomlinx’s flexible platform designed to evolve with guest demand and entertainment tastes over time

Incumbent Solutions Emerging Solutions

• LodgeNet currently has the largest in-room guest • Various emerging systems exist market share

– But, no other companies with a large validating contract

– Currently in ~1.5 million hotel rooms

– Systems do not offer full range of Roomlinx capabilities

– Legacy technology and infrastructure limits flexibility to

– Main offerings are internet and VoD offer enhanced services beyond VoD and FTG TV

– Competitors lack advertising, SmartEvent management,

– Highly dependent on rapidly declining VoD revenes back-end/back-office capabilities

– High debt levels and financial turmoil create disruption

• Emerging systems take years to develop

• Roomlinx key differentiators to LodgeNet

– Large investment

– Derives revenue from multiple streams for Roomlinx and

– Risk of not winning contracts the hotel operator

– Need to have contract with large hotel group for system

– Scalable, dynamic and customizable platform validation

– Hotel responsible for installation costs

– Roomlinx has huge headstart with Hyatt and premium

– Fully integrated into hotel’s back office applications content partners

20

|

|

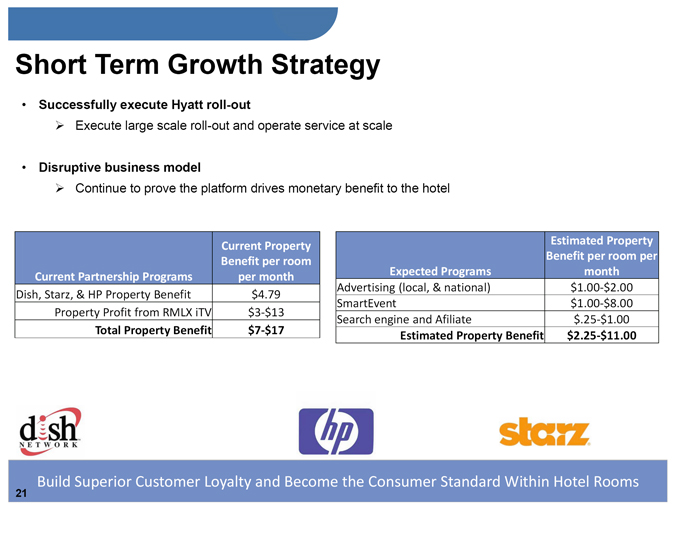

Short Term Growth Strategy

• Successfully execute Hyatt roll-out

Execute large scale roll-out and operate service at scale

• Disruptive business model

Continue to prove the platform drives monetary benefit to the hotel

Estimated Current Property Property Benefit Benefit per room per room per Current Partnership Programs per month Expected Programs month

Advertising (local, & national) $1.00-$2.00 Dish, Starz, & HP Property Benefit $4.79 SmartEvent $1.00-$8.00 Property Profit from RMLX iTV $3-$13 Search engine and Afiliate $.25-$1.00

Total Property Benefit $7-$17 Estimated Property Benefit $2.25-$11.00

Build Superior Customer Loyalty and Become the Consumer Standard Within Hotel

21 Rooms

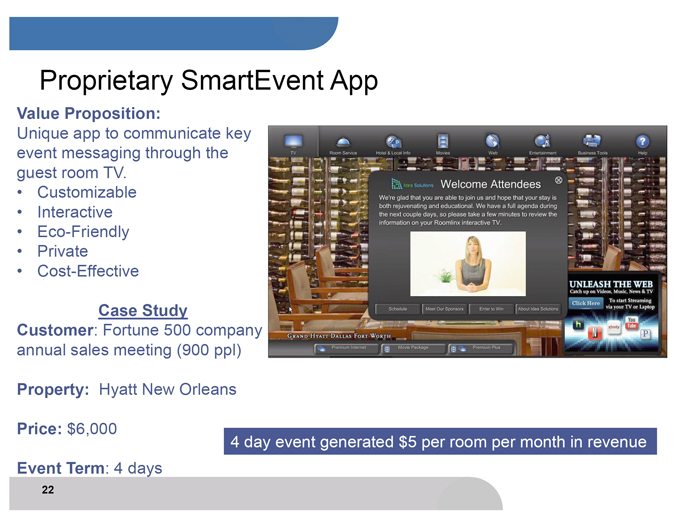

Proprietary SmartEvent App

Value Proposition:

Unique app to communicate key event messaging through the guest room TV. •Customizable •Interactive •Eco-Friendly •Private •Cost-Effective

Case Study

Customer: Fortune 500 company annual sales meeting (900 ppl)

Property: Hyatt New Orleans

Price: $6,000

4 day event generated $5 per room per month in revenue

Event Term: 4 days

22

|

|

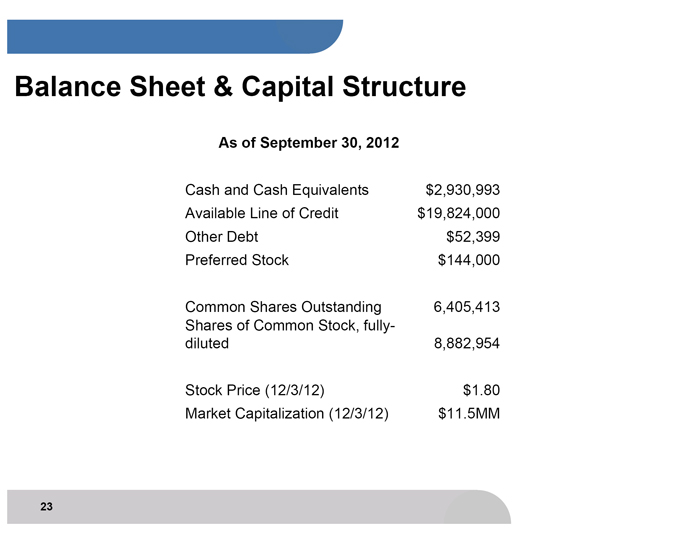

Balance Sheet & Capital Structure

As of September 30, 2012

Cash and Cash Equivalents $2,930,993 Available Line of Credit $19,824,000 Other Debt $52,399 Preferred Stock $144,000

Common Shares Outstanding 6,405,413 Shares of Common Stock, fully-diluted 8,882,954

Stock Price (12/3/12) $1.80 Market Capitalization (12/3/12) $11.5MM

23

|

|

Key Takeaways

• Roomlinx iTV is an evolutionary technology platform

• Current market leader is in financial distress

• Roomlinx proving system can more than pay for itself

• Hyatt contract represents up to $10MM of recurring gross margin per year

• Hyatt agreement is just the tip of the iceberg!

24

|

|

Thank You!

25

|

|

Thank You!

25

|