Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - AXESSTEL INC | d449596d8k.htm |

| EX-99.1 - PRESS RELEASE - AXESSTEL INC | d449596dex991.htm |

©

2012 Axesstel, Inc.

5

th

Annual LD Micro Conference

December 6, 2012

Axesstel, Inc.

OTCQB: AXST

Exhibit 99.2 |

©

2012 Axesstel, Inc.

2

Safe Harbor Statement

This presentation contains forward looking statements. These statements relate to

future events or our future financial performance and involve known and

unknown risks,

uncertainties

and

other

factors

that

may

cause

our

actual

results,

levels

of

activity, performance or achievements to differ materially from any future results,

levels of activity, performance or achievements expressed or implied by

these forward-looking statements. You can identify forward-looking

statements by terminology such as “may,”

“will,”

“should,”

“expects,”

“intends,”

“plans,”

“anticipates,”

“believes,”

“estimates,”

“predicts,”

“potential,”

“continues”

or the negative of these

terms or other comparable terminology. These risks and other factors include those

listed under “Risk Factors”

in Axesstel’s filings with the Securities and Exchange

Commission. Although we believe that the expectations reflected in the

forward- looking statements are reasonable, we cannot guarantee future

results, levels of activity, performance or achievements. You should not

place undue reliance on any forward-looking statements that reflect our

management’s view only as of the date of this presentation. We will not

update any forward-looking statements to reflect events or circumstances

that occur after the date on which such statement is made. |

©

2012 Axesstel, Inc.

3

Cord Cutting Pure Play:

Voice, Data & Wireless Alerts

“Cutting the Cord All Over the World” |

©

2012 Axesstel, Inc.

AXST Transformed!

4

Completed in mid-2011

Cut OpEx from $26M in 2007 to $10M in 2011

Diversified manufacturing to produce lower

cost products & improve gross margins

Wire-line replacement terminals into US

markets (Sprint & Verizon)

450MHz gateway product into Europe featuring

4G data speeds & VoIP application

HSPA gateway devices into MEA

Two year initiative to

restructure the company

Reorganized company

Repositioned ODM

& manufacturing to China

Utilized internal R&D resources

& launched key new products |

©

2012 Axesstel, Inc.

Executing on Plan: Q312 Accomplishments

5

•

Restructured $8.2M in past due accounts payable into

short-

& long-term debt

•

Positioned company to become working capital positive in 2013

•

Current interest rates of 6% to 7% per annum vs. 16% to 24%

under prior facility

•

Further improves profitability

Expect to achieve consistent quarterly profitability &

year-over-year revenue growth

•

Reported five consecutive profitable quarters

Delivering consistent

profitability

Significantly improved

Balance sheet

Secured financing facility

at substantially lower

Interest rates |

©

2012 Axesstel, Inc.

Product

Target Market

Applications

Details

TTM % of Rev.

3G & 4G Gateways

Specializes in rural 450

MHz market

Wireless devices bring

high-speed internet into

residential & business

locations

•

Based on CDMA 1xEV-

DO Rev A & Rev B, &

HSPA technology

•

Key customers include

Net1, Orange & STC

58% of business

Wire-line Replacement

Terminals

Urban & rural

Affordable voice

alternative to landline

networks

•

Launched Sprint’s

“Phone Connect”

product in 3Q11 &

shipped >250K units

•

Other customers

include Verizon,

Cellcom & C-Spire

38% of business

Fixed Wireless

Phones

Developing countries

Voice & data usage in

homes, businesses &

retail locations

Offered in standard &

enhanced models, in

both traditional &

cordless models

4% of business

Wireless Alert

Urban & rural

New market for AXST

From basic alert

functions to “All in

One”

device combining

voice, data & “smart-

home”

applications

Alert device

for North American, Latin

American, Europe & MEA

markets

•

Basic Alert device

launching late 2012

•

More sophisticated

versions released

throughout 2013

Product Portfolio

6 |

7

Competitive Advantages

•

Customized products for specific customer needs

•

Majority of revenue comes from sole source customers

•

Ideal for rural areas

•

Low frequency travels farther and lowers network investment

to operators

•

Expanding from voice & data to include wireless alert products

•

Overall growth trend toward wireless solutions & fixed wire-line

networks will become less profitable as more people cut the cord

•

Regulatory regime moving in favor of wireless with governments

removing requirements to offer fixed lines to everyone

Only company focused

exclusively on cord cutting

opportunities

Strong relationships with

current customers

Recognized leader in

CDMA 450MHz telecom

gateway products

•

Testing & design process can take three to fifteen months

High barrier to entry

©

2012 Axesstel, Inc. |

©

2012 Axesstel, Inc.

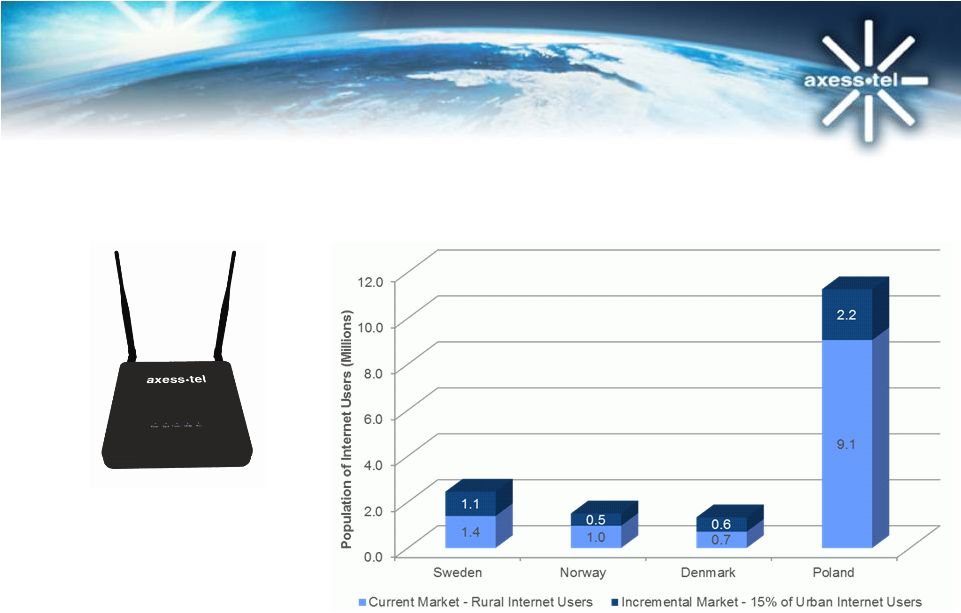

Tomorrow’s Opportunities –

Dual Mode Gateway

8

Expect to launch early 2013

Specialized dual-mode

(GSM & CDMA) gateway

device for Europe market

Additional Addressable Market

(15% of urban population)

Incremental to current devices

•

Addressable market increases by 36%

•

2011-2012 annual revenue $25M |

©

2012 Axesstel, Inc.

•

These

products

are

expected

to

be

“first

to

market”

allowing

wireless

operators

access

to home alert market, resulting in additional revenue without further incremental

investment

•

Expect first shipments into MEA and Latin American markets to begin in

Q4’12/Q1’13 •

Expect

Sprint

&

Boost

Mobile

to

be

first

North

American

sales

in

Q1’13/Q2’13

•

Continued

expansion

of

wire-line

replacement

roll-out

and

migration

to

“all-in”

device

with 4G data speeds, combining voice, data, wireless alert and

“smart-home” applications

Tomorrow’s Opportunities –

Home Alert Products

9

Wireless alert device

for North American, Latin American,

Europe and MEA markets |

©

2012 Axesstel, Inc.

Home Alert Product Roadmap

10

Series

Availability

Initial Markets

Features

Applications

AG50 / AX50

Q4 2012

MEA

Latin America

Wireless Alert

Apartments

Cabins

Storage Units

Mobile Homes

AG100 / AX100

Q1 2013

United States

Latin America

Wireless Alert

Smart Home Aps

Homes

Small Offices

AG200 / AX200

Q2 2013

United States

Wireless Alert

Smart Home Aps

Voice Terminal

Homes

Small Offices

AG300 / AX300

Q3 2013

Europe

Wireless Alert

Smart Home Aps

Voice Capable

HSPA+ Data

Homes

Small Offices

AL400

Q4 2013

United States

Wireless Alert

Smart Home Aps

Voice Capable

LTE Data

Homes

Small Offices |

©

2012 Axesstel, Inc.

Home Alert Global Market Potential

11

•

$20.64 Billion (2011)

•

9.1% CAGR (2012-2017)

•

$34.46 Billion (2017 estimated)

•

$0.5 Billion (2% in 2013)

•

$1.1 Billion (4% in 2014)

•

$1.8 Billion (6% in 2015)

•

$2.5 Billion (8% in 2016)

•

$3.5 Billion (10% in 2017)

•

$3.7 Billion (40% of 2013-2017 carrier total)

•

$29.4 Million (2013)

•

$64.1 Million (2014)

•

$104.9 Million (2015)

•

$152.4 Million (2016)

•

$207.7 Million (2017)

•

Over $550 Million for 5-year span

Global Home Security Market

What if Carriers could obtain 10%

of this market by 2017

Assume 40% of this market

is from devices

What if Axesstel (being first to market)

captured 15% of the device revenue

each year? |

©

2012 Axesstel, Inc.

12

Year Ended

12/31/08

Year Ended

12/31/09

Year Ended

12/31/10

Year Ended

12/31/11

Revenues

$ 109.6

$ 50.8

$ 45.4

$ 54.1

Gross profits

26.3

8.3

7.5

12.9 Gross

margins 24%

16%

17%

24%

Operating expense

23.1

17.1

12.6

10.3

Operating income

(loss)

3.2

(8.8)

(5.1)

2.6

Net income (loss)

1.4

(10.1)

(6.3)

1.1

EPS (loss)

$ 0.06

$ (0.43)

$ (0.27)

$ 0.05

Ave. diluted shares

23.6

23.4

23.6

23.7

Annual Operating Results

$ in millions |

©

2012 Axesstel, Inc.

13

3 Months

Ended

09/30/12

3 Months

Ended

09/30/11

9 Months

Ended

09/30/12

9 Months

Ended

09/30/11

Revenues

$ 16.3

$ 17.1

$ 43.9

$ 37.2

Gross profits

4.5

4.2

11.3

8.6

Gross margins

28%

24%

26%

23%

Operating expense

2.9

2.4

7.5

7.4

Operating income

1.6

1.7

3.8

1.2

Net income*

2.1

1.3

3.5

.1

EPS diluted

$ 0.08

$ 0.05

$ 0.13

$ 0.00

Ave. diluted shares

26.9

24.4

26.3

23.9

Operating Results

$ in millions

*3Q12 net income positively impacted by one-time note payable discount of

$791,000 in connection with restructuring of certain accounts payable. |

©

2012 Axesstel, Inc.

14

Balance Sheet Highlights

9/30/12

12/31/11

Cash and cash equivalents

$ 1.618

$ 0.850

Accounts receivable

$ 11.709

$ 8.901

Total assets

$ 14.887

$ 11.497

Accounts payable

$ 6.199

$ 12.466

Note payable

$ 6.923

$

--

Accrued expenses

$ 4.604

$ 4.563

Bank financings

$ 4.982

$ 6.100

Total liabilities

$ 22.708

$ 23.129

Stockholders’

deficit

$

(7.820) $ (11.631)

Total liabilities & stockholders’

deficit

$ 14.887

$

11.497

Working capital

$ (2.778)

$ (11.804)

$ in millions |

©

2012 Axesstel, Inc.

15

Investor Highlights

Reorganization effort

set foundation for growth

Traction in achieving

financial milestones

Recognized product

superiority

Significant operating

leverage to grow EPS

•

Major turnaround completed

•

Outstanding shares of 24.1M largely unchanged since 2008

•

Management has purchased 1M+ shares since May 2011

•

Reduced OPEX from $26M (2007) to $10M (2011)

•

Favorably restructured debt

•

Significantly reduced cost of capital to further improve

profitability

•

Leader in CDMA 450 MHz telecom gateway products

•

Introducing three key products in late 2012/2013:

•

Anticipate consistent, quarterly profitability & year-over-year

revenue growth

•

Goal: Surpass previous record annual revenue of $110M

New product portfolio of wireless alert and smart-

home products

New dual mode gateway product

Next generation of wire-line replacement terminals |

©

2012 Axesstel, Inc.

16

Target Model

Revenues

$100.0

$200.0

Gross Margins as % of

Revenue

mid-

20% range

mid-

20% range

Operating Expenses as % of

Revenue

10%-11%

10%-11%

Operating Income

$10.0+

$20.0+

Target Operating Model

$ in millions

Maximize operating leverage (grow revenue while containing OpEx)

Representative of a target operating model only. These figures to not constitute

management’s projection for any future operating period. |

©

2012 Axesstel, Inc.

17

Thank You |