Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - ZIPCAR INC | d446313d8k.htm |

Exhibit 10.1

OFFICE LEASE AGREEMENT

BETWEEN

FARNSWORTH STILLINGS L.P.

(“LANDLORD”)

AND

ZIPCAR, INC.

(“TENANT”)

TABLE OF CONTENTS

| 1. | Basic Lease Information | 1 | ||||

| 2. | Lease Grant | 4 | ||||

| 3. | Delivery Date; Possession | 5 | ||||

| 4. | Rent | 6 | ||||

| 5. | Compliance with Laws; Use | 6 | ||||

| 6. | Security Deposit | 7 | ||||

| 7. | Building Services | 8 | ||||

| 8. | Leasehold Improvements | 10 | ||||

| 9. | Repairs and Alterations | 11 | ||||

| 10. | Entry by Landlord | 12 | ||||

| 11. | Assignment and Subletting | 13 | ||||

| 12. | Liens | 14 | ||||

| 13. | Indemnity and Waiver of Claims | 15 | ||||

| 14. | Insurance | 16 | ||||

| 15. | Subrogation | 18 | ||||

| 16. | Casualty Damage | 18 | ||||

| 17. | Condemnation | 19 | ||||

| 18. | Events of Default | 19 | ||||

| 19. | Remedies | 20 | ||||

| 20. | Limitation of Liability | 21 | ||||

| 21. | Intentionally Omitted | 22 | ||||

| 22. | Holding Over | 22 | ||||

| 23. | Subordination to Mortgages; Estoppel Certificate | 22 | ||||

| 24. | Notice | 23 | ||||

| 25. | Surrender of Premises | 23 | ||||

| 26. | Miscellaneous | 23 | ||||

| 27. | OFAC Compliance | 27 | ||||

| 28. | Parking | 28 |

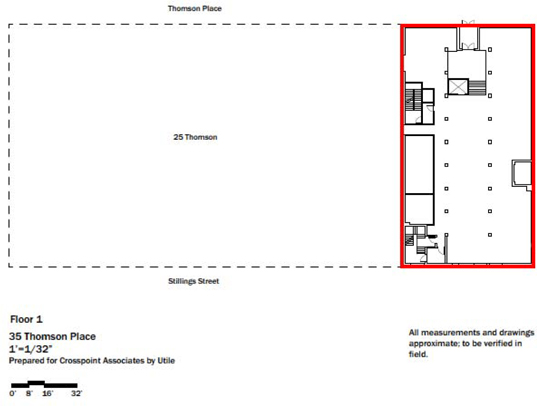

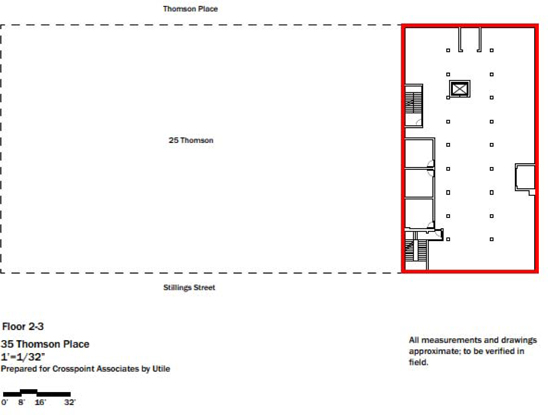

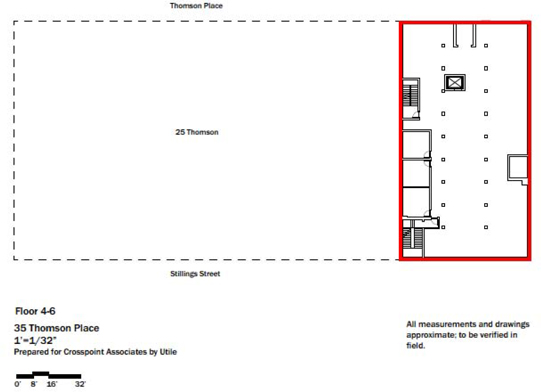

Exhibit A - Outline and Location of Premises

Exhibit B - Expenses and Taxes

Exhibit C - Work Letter

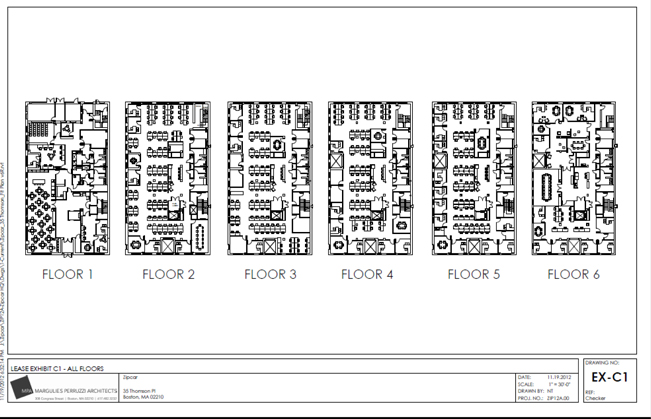

Exhibit C-1 – Tenant’s Preliminary Plans

Exhibit D - Form of Commencement Date Certificate

Exhibit E - Building Rules and Regulations

Exhibit F - Additional Provisions

Exhibit G – Demising Specification

Exhibit H - Form of Subordination, Non-disturbance and Attornment Agreement

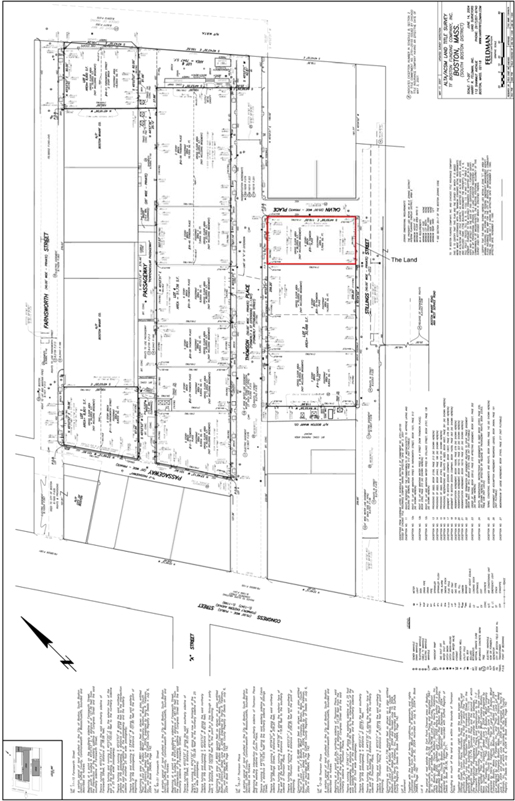

Exhibit I – Plan showing the Land

Exhibit J – Cleaning Specifications

Exhibit K – Escrow Agreement

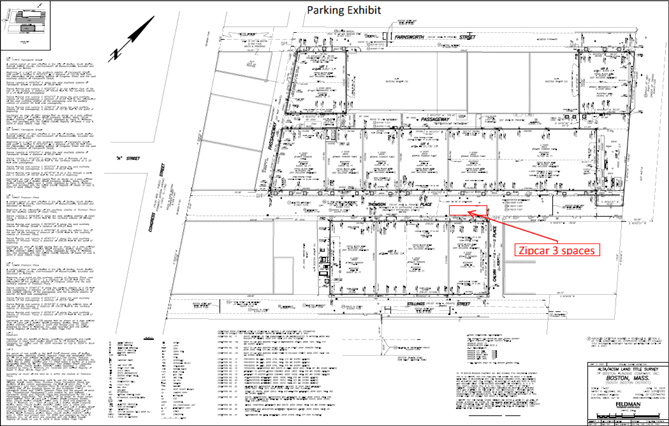

Exhibit L – Zipcar Parking Space Area

i

OFFICE LEASE AGREEMENT

THIS OFFICE LEASE AGREEMENT (the “Lease”) is made and entered into as of November 30, 2012 (the “Execution Date”), by and between FARNSWORTH STILLINGS L.P., a Delaware limited partnership (“Landlord”) and ZIPCAR, INC., a Delaware corporation (“Tenant”).

The following exhibits and attachments are incorporated into and made a part of the Lease: Exhibit A (Outline and Location of Premises), Exhibit B (Expenses and Taxes), Exhibit C (Work Letter, if required), Exhibit D (Form of Commencement Date Certificate), Exhibit E (Building Rules and Regulations), Exhibit F (Additional Provisions), Exhibit G (List of Furniture), Exhibit H (Form of Subordination, Non-disturbance and Attornment Agreement), Exhibit I (Plan showing the Land), and Exhibit J (Cleaning Specifications).

| 1. | Basic Lease Information. |

1.01 “Building” shall mean the six (6) story building located at 35 Thomson Place, Boston, Massachusetts 02210. “Rentable Square Footage of the Building” is deemed to be 46,200 square feet.

1.02 “Premises” shall mean the entire interior space within the Building, excluding the basement thereof, as shown on Exhibit A to this Lease. The “Rentable Square Footage of the Premises” is deemed to be 46,200 square feet. Landlord and Tenant stipulate and agree that the Rentable Square Footage of the Building and the Rentable Square Footage of the Premises are correct.

1.03 “Base Rent”:

| Period |

Annual Rate Per Square Foot |

Annual Base Rent |

Monthly Base Rent |

|||||||||

| Commencement Date – 8/31/13 |

$ | 0 | $ | 0 | $ | 0 | ||||||

| 9/1/13 - 12/31/14 |

$ | 30.00 | $ | 1,386,000.00 | * | $ | 115,500.00 | |||||

| 1/1/15 - 12/31/15 |

$ | 36.00 | $ | 1,663,200.00 | $ | 138,600.00 | ||||||

| 1/1/16 - 12/31/16 |

$ | 37.00 | $ | 1,709,400.00 | $ | 142,450.00 | ||||||

| 1/1/17 - 12/31/17 |

$ | 38.00 | $ | 1,755,600.00 | $ | 146,300.00 | ||||||

| 1/1/18 - 12/31/18 |

$ | 39.00 | $ | 1,801,800.00 | $ | 150,150.00 | ||||||

| 1/1/19 - 12/31/19 |

$ | 40.00 | $ | 1,848,000.00 | $ | 154,000.00 | ||||||

| 1/1/20 - 12/31/20 |

$ | 41.00 | $ | 1,894,200.00 | $ | 157,850.00 | ||||||

| 1/1/21 - 12/31/21 |

$ | 42.00 | $ | 1,940,400.00 | $ | 161,700.00 | ||||||

| 1/1/22 - 12/31/22 |

$ | 43.00 | $ | 1,986,600.00 | $ | 165,550.00 | ||||||

| 1/1/23 - 12/31/23 |

$ | 44.00 | $ | 2,032,800.00 | $ | 169,400.00 | ||||||

| * | Annualized |

1.04 “Tenant’s Pro Rata Share”: 100%.

1

1.05 “Base Year” for Taxes: The sum of seven-twelfths (7/12th) of Taxes payable for Fiscal Year (defined below) 2013 (i.e., July 1, 2012 to June 30, 2013) plus five-twelfths (5/12th) of Taxes payable for Fiscal Year 2014. For purposes hereof, “Fiscal Year” shall mean the Base Year for Taxes and each period of July 1 to June 30 thereafter.

1.06 “Base Year” for Expenses (defined in Exhibit B): The Twelve (12) calendar month period commencing on the first day of the calendar month in which the earlier of the following two (2) dates occurs: (i) the Rent Commencement Date and (ii) the date on which Tenant commences beneficial use and occupancy of the Premises (as opposed to preparing the Premises for Tenant’s use and occupancy).

1.07 “Term”: A period of time commencing on the date (the “Commencement Date”) on which Landlord delivers possession of the Premises to Tenant in its as-is condition and free and clear of all occupants, tenancies, and personal property that is not to be used by Tenant pursuant to the terms of this Lease, which date is estimated to occur on the Execution Date, and terminating on December 31, 2023 (the “Termination Date”), unless early terminated or extended pursuant to Section 1 of Exhibit F. The “Rent Commencement Date” shall be September 1, 2013.

1.08 “Improvement Allowance(s)”: An amount equal to $1,155,000.00, as further described in the attached Exhibit C.

1.09 “Security Deposit”: $894,201.00, as the same may be reduced as set forth in Article 6.

1.10 “Guarantor(s)”: None.

1.11 “Broker(s)”: Cresa Boston.

1.12 “Permitted Use”: General Office Use and uses customarily accessory thereto.

1.13 “Notice Address(es)”:

| Landlord’s Notice Address: | ||||

| Farnsworth Stillings L.P. | ||||

| c/o Crosspoint Associates, Inc. | ||||

| 217 West Central Street | ||||

| Natick, MA 01760 | ||||

| With a copy to: | ||||

| Goulston & Storrs, P.C. | ||||

| 400 Atlantic Avenue | ||||

| Boston, MA 02110 | ||||

| Attn: Crosspoint | ||||

2

| Landlord’s Rent Address: | ||||

| Farnsworth Stillings L.P. | ||||

| c/o Crosspoint Associates, Inc. | ||||

| 217 West Central Street | ||||

| Natick, MA 01760 | ||||

| Attn: Accounts Receivable | ||||

| Tenant’s Notice Address: | ||||

| Prior to Rent Commencement Date: | ||||

| 25 First Street, Fourth Floor | ||||

| Cambridge, MA 02141 | ||||

| Attention: General Counsel | ||||

| After Rent Commencement Date: | ||||

| 35 Thomson Place | ||||

| Boston, MA 02210 | ||||

| Attn: General Counsel | ||||

| With a copy to: | ||||

| Brennan, Dain, Le Ray, Wiest, Torpy & Garner, P.C. | ||||

| 129 South Street, 3rd floor | ||||

| Boston, MA 02111 | ||||

| Attn: Joseph R. Torpy | ||||

1.14 “Business Day(s)” are Monday through Friday of each week, exclusive of New Year’s Day, Martin Luther King Day, Presidents’ Day, Memorial Day, Independence Day, Labor Day, Columbus Day, Veterans’ Day, Thanksgiving Day and Christmas Day (the “Holidays”). Landlord may designate additional Holidays that are commonly recognized by other office buildings in the area where the Building is located. “Building Service Hours” are 8:00 A.M. to 6:00 P.M. on Business Days and 8:00 A.M. to 1:00 P.M. on Saturdays, exclusive of Holidays.

1.15 “Initial Improvements” means the work that Tenant may perform in the Premises pursuant to a separate agreement (the “Work Letter”) attached to this Lease as Exhibit C.

1.16 “Property” means the Building and the parcel of land on which it is located owned by Landlord and as shown on the plan attached hereto as Exhibit I (the “Land”).

1.17 “Storage Space”: Approximately six thousand five hundred (6,500) square feet of storage space in the basement of the Building.

1.18 “Storage Space Rent”: Twenty Thousand Dollars ($20,000) per year payable in equal monthly installments of One Thousand Six Hundred Sixty-Six and 67/100 Dollars ($1,666.67), such monthly amount to be paid with monthly installments of Base Rent commencing on the same date as Base Rent commences hereunder.

3

| 2. | Lease Grant. |

2.01 The Premises are hereby leased to Tenant from Landlord, together with the right to use all other portions of the Property (the “Common Areas”) and the exclusive right to use the Storage Space. Tenant shall have the right to reactivate the loading dock in the Building and to use the same in common with the occupant, if any, of the basement of the Building. All work to reactivate the loading dock shall be performed in accordance with the provisions of Section 9.03 below and in accordance with plans and specifications approved by Landlord, which approval shall not be unreasonably withheld, delayed, or conditioned and shall be further subject to approval by the City of Boston and any other governmental agency with authority over the Property. Landlord agrees to cooperate with Tenant, at no out of pocket cost to Landlord, in Tenant’s efforts to reactivate the loading dock. Upon completion of such work, the loading dock shall constitute part of the Common Areas.

2.02 Subject to the requirements of all Laws (defined below), Tenant may install a bicycle rack on a portion of the Property (or, subject to the requirements of Section 3.2 of the Street Agreement, any land immediately adjacent to the Property) in a location approved in writing by Landlord, which approval shall not be unreasonably withheld, delayed or conditioned. Tenant shall be solely responsible for obtaining, at its expense, such permits and approvals as may be required for the installation and use of any such bicycle rack. Landlord agrees to cooperate with Tenant, at no out of pocket cost to Landlord, in Tenant’s endeavors to obtain any required permit or approval for such bicycle rack. Tenant shall be solely responsible for the operation, maintenance, and repair of any such bicycle rack. Notwithstanding anything to the contrary contained in this Lease, Landlord shall have no liability to Tenant or anyone claiming by, through, or under Tenant for any loss or damage, however caused, to any bicycle or other personal property placed in any such rack.

2.03 Subject to the requirements of all Laws, Tenant shall have the right to construct a roof deck on the roof of the Building in a location and of a size designed by Tenant and approved in writing by Landlord, which approval shall not be unreasonably withheld, delayed or conditioned (the “Roof Deck”). The Roof Deck shall be constructed in accordance with plans and specifications therefor that have been approved in advance, in writing by Landlord, which approval shall not be unreasonably withheld, conditioned or delayed, and otherwise in accordance with the provisions of Article 8 hereof. Without limiting the foregoing, Landlord may require that Tenant employ Landlord’s roofing contractor to perform the affixation of the Roof Deck to the roof of the Building (provided such contractor agrees to perform on commercially reasonable terms and rates), and in any event Tenant and its contractors shall strictly comply with the requirements of Landlord’s roof warranty. Tenant shall be solely responsible for obtaining, at its expense, such permits and approvals as may be required for the installation of the Roof Deck. Landlord agrees to cooperate with Tenant, at no out of pocket cost to Landlord, in Tenant’s endeavors to obtain any required permit or approval for the Roof Deck. The Roof Deck shall be considered part of the Premises for all purposes of this Lease, including, without limitation, the provisions of Sections 13 and 14 hereof, but no Rent shall be payable for or with respect to the Roof Deck. Tenant shall have no obligation to remove the Roof Deck at the expiration or earlier termination of the Term.

4

2.04 Pursuant to Section 4.1 of the Street Agreement (as defined in Section 9.02 below), all parking spaces located in the Common Areas (as defined in the Street Agreement) adjacent to the Building belong to the owner of the Building. Further, Section 4.1 permits the owner of the Building to seek public approvals to add one or more horizontal parking spaces in the portions of the Common Areas abutting the Building. Landlord agrees that Tenant shall have a revocable license, on the terms and conditions set forth below (the “Parking License”) to place up to three (3) Zipcars and appropriate signage in either the area shown on Exhibit L attached hereto or, to the extent three (3) parking spaces do not exist in such area, in such other portion of the Common Areas as may be permitted under the Street Agreement. The Parking License shall run for the Term of this Lease, except that Landlord may elect to terminate the Parking License at any time by giving Tenant written notice of such election at least six (6) months before the effective date of such termination, which effective date shall be set forth in Landlord’s termination notice. Landlord shall not terminate the Parking License if Landlord has granted parking rights (i) for the purpose of parking rental vehicles in the Common Areas to any other entity in the business of renting automobiles to the public (“Competing Rights”) or (ii) to any other tenant of the Complex (as that term is defined in Section 11.01 below) that leases, in the aggregate, less than 47,000 rentable square feet of space in the Complex (a “Smaller Tenant”), unless Landlord, reasonably simultaneously therewith, terminates all such other rights. After any termination of the Parking License, Landlord shall not grant Competing Rights or parking rights to a Smaller Tenant in the Common Areas unless and until Landlord reinstates the Parking License.

Landlord shall cooperate with Tenant’s efforts to obtain (and to act on Tenant’s behalf if necessary, to obtain, at Tenant’s cost) public approvals so that Tenant may add such additional horizontal parking spaces in such Common Areas so that Tenant may have three (3) Zipcars in parking spaces in the Common Areas adjacent to the Building. In any event, such parking spaces shall be in a location approved in writing by Landlord, which approval shall not be unreasonably withheld, delayed or conditioned. Landlord shall cooperate with Tenant’s efforts to identify such parking spaces for “Zipcar Use Only”. Tenant shall be responsible for obtaining such permits and approvals as may be required by Law or by the Street Agreement for the use of such parking spaces.

Commencing on the date Tenant first uses any of such parking spaces and thereafter throughout the term of the Parking License, Tenant shall pay Landlord, as additional rent, a monthly charge for each of the three (3) parking spaces covered by the Parking License in an amount equal to the average monthly charge for surface parking spaces in the Fort Point Channel area of Boston as reasonably determined by Landlord from time to time based upon actual charges for such facilities as documented to Tenant. Such charge may be adjusted by Landlord from time to time to reflect actual increases in the fair market rate for such spaces in such area, but not more frequently than one (1) time per calendar year.

| 3. | Delivery Date; Possession. |

3.01 Notwithstanding anything to the contrary herein contained, Tenant shall take the Premises in its “as-is”, condition as of the Execution Date; provided, however, Landlord agrees to demise the Building from the building having an address of 25 Thomson Place prior to the Commencement Date in accordance with the demising specification attached hereto as Exhibit G.

5

Except as expressly otherwise provided herein, there shall be no obligation on the part of Landlord to prepare or construct the Premises for Tenant’s occupancy, and without any representations or warranties by Landlord to Tenant as to the condition of the Premises or the Building.

3.02 Promptly after the determination of the Commencement Date, Landlord and Tenant shall enter into a commencement letter agreement in the form attached hereto as Exhibit D. By taking possession of the Premises, Tenant agrees that the Premises are in good order and satisfactory condition, except as may be set forth on a punchlist delivered to Landlord not later than thirty (30) days after the Commencement Date.

| 4. | Rent. |

4.01 Tenant shall pay Landlord, without any setoff or deduction, unless expressly set forth in this Lease, all Base Rent, Storage Space Rent and Additional Rent due for the Term (collectively referred to as “Rent”). All payments of Rent shall be made by wire transfer of immediately available United States Dollars in accordance with wire transfer instructions provided by Landlord from time to time by written notice to Tenant thereof. “Additional Rent” means all sums (exclusive of Base Rent) that Tenant is required to pay Landlord under this Lease. Tenant shall pay and be liable for all rental, sales and use taxes (but excluding income taxes), if any, imposed upon or measured by Rent. Base Rent and recurring monthly charges of Additional Rent shall be due and payable in advance on the first day of each calendar month without notice or demand. All other items of Rent shall be due and payable by Tenant on or before thirty (30) days after billing by Landlord. Rent shall be made payable to the entity, and sent to the address, Landlord designates by written notice to Tenant given at least fifteen (15) days in advance of the next payment and shall be made by wire transfer of current U.S. funds to an account designated by Landlord by written notice to Tenant from time to time or by other means acceptable to Landlord. Tenant shall pay Landlord an administration fee equal to five percent (5%) of all past due Rent, provided that Tenant shall be entitled to a grace period of five (5) days after receipt of notice from Landlord specifying such failure to pay for the first (1st) two (2) late payments of Rent in a calendar year. In addition, past due Rent that is not paid within five (5) days of its due date shall accrue interest at eight percent (8%) per annum from the due date until actually paid. Landlord’s acceptance of less than the correct amount of Rent shall be considered a payment on account of the earliest Rent due. Rent for any partial month during the Term shall be prorated. No endorsement or statement on a check or letter accompanying payment shall be considered an accord and satisfaction. Each party’s covenants are independent of every other covenant of the other party in this Lease.

Tenant shall pay Tenant’s Pro Rata Share of Taxes and Expenses in accordance with Exhibit B of this Lease.

| 5. | Compliance with Laws; Use. |

The Premises shall be used for the Permitted Use and for no other use whatsoever. Tenant shall comply with all statutes, codes, ordinances, orders, rules and regulations of any municipal or governmental entity whether in effect now or later, including the Americans with Disabilities Act (the “Law(s)”), regarding the operation of Tenant’s business and the use,

6

condition, configuration, and occupancy of the Premises. Notwithstanding the foregoing, if compliance with Law requires the making of any alteration, addition or installation in or to the Premises, Tenant shall be responsible for performing such work only if the same is made necessary by reason of Tenant’s particular manner of use of the Premises, i.e. as opposed to office uses generically, or by any leasehold improvements performed in the Premises by Tenant, its agents, contractors or employees; and otherwise Landlord shall be responsible for performing such work, the cost of which may be included in Expenses to the extent permitted under Exhibit B hereto. In addition, Tenant shall, at its sole cost and expense, promptly comply with any Laws that relate to the “Base Building” (defined below), but only to the extent such obligations are triggered by Tenant’s use of the Premises other than for general office use, or Alterations or improvements in the Premises performed or requested by Tenant, otherwise, Landlord shall be responsible for promptly complying with Laws relating to the Base Building. In the event a violation of Law is identified in the course of performing any Alteration (or any inspections related thereto), and the Alteration was not the cause of the violation, then Landlord shall be responsible for promptly correcting such violation of Law at Landlord’s expense, except that such cost may be included in Expenses to the extent permitted under Exhibit B hereto, and to the extent the Initial Alterations are delayed as a result of such violation and/or the correction thereof, the Rent Commencement Date shall be delayed on a day-for-day basis. By way of clarification of the foregoing, Tenant shall not be responsible for curing any violation that Tenant merely discovers in the course of performing any Alteration, but if Tenant’s performance of any Alteration or other work causes a condition in the Building that previously complied with Law not to comply, then Tenant shall be responsible, at its expense, for bringing such condition into compliance with Law and the Rent Commencement Date shall not be delayed by reason thereof. “Base Building” shall include the roof and roofing system, structural portions of the Building, the public restrooms, and the Building mechanical, electrical and plumbing systems and equipment. Tenant shall promptly provide Landlord with copies of any notices it receives regarding an alleged violation of Law. Tenant shall comply with the rules and regulations of the Building attached as Exhibit E and such other reasonable rules and regulations adopted by Landlord from time to time, including rules and regulations for the performance of Alterations (defined in Article 9). As of the date hereof, Landlord has not received notice from any governmental agencies that the Building is in violation of Title III of the Americans with Disabilities Act or any other Laws that, in any such case, remain uncured.

| 6. | Security Deposit. |

The Security Deposit shall be delivered to Landlord on or before the date that is two (2) Business Days after the Execution Date and shall be held by Landlord without liability for interest (unless required by Law) as security for the performance of Tenant’s obligations. The Security Deposit is not an advance payment of Rent or a measure of damages. Landlord may use all or a portion of the Security Deposit to cure any Default (defined in Article 18) by Tenant. If Landlord uses any portion of the Security Deposit, Tenant shall, within five (5) days after demand, restore the Security Deposit to its original amount. Landlord shall return any unapplied portion of the Security Deposit to Tenant within forty-five (45) days after the later to occur of the Termination Date or the date Tenant surrenders the Premises to Landlord in compliance with Article 25 (provided that Landlord may retain therefrom Landlord’s reasonable estimate of the amount of Expense Excess and Tax Excess (as those terms are defined in Exhibit B hereto) that would be payable by Tenant upon reconciliation of accounts for the year in which the

7

Termination Date occurs, and which retained amount shall be accounted for when Landlord makes such reconciliation for such year). Landlord shall deliver the Security Deposit to a successor or transferee and, following such delivery, Landlord shall have no further liability for the return of the Security Deposit. Landlord shall not be required to keep the Security Deposit separate from its other accounts.

Provided (i) that Tenant is not in Default (i.e., after notice thereof and expiration of the applicable cure period) of any of its obligations under this Lease on the effective date of any reduction (the “Effective Date of Reduction”) and (ii) that no notice of default is outstanding on the Effective Date of Reduction (i.e., notice has been given but the default has not been cured and the cure period has not expired) provided however that if a notice of default is outstanding as of the Effective Date of Reduction, such reduction shall merely be deferred until the date such default is cured (as opposed to such reduction being forfeited), Landlord shall refund to Tenant such portion of the Security Deposit which it is then holding so as to cause the total Security Deposit to be reduced as of the Effective Date of Reduction to the amount shown in the following schedule:

| Effective Date of Reduction |

New Reduced Amount of Security Deposit |

|||

| September 1, 2018 |

$ | 596,134.00 | ||

| September 1, 2019 |

$ | 298,067.00 | ||

Notwithstanding the foregoing, if Landlord has validly given a notice of monetary default to Tenant within the twelve (12) month period immediately preceding any Effective Date of Reduction (including any postponed Effective Date of Reduction), then such Effective Date of Reduction shall be postponed until the first day of the calendar month following the one year anniversary of the date on which Tenant cures such monetary default. If Tenant is in Default of its covenants and obligations under the Lease as of such Effective Date of Reduction, then there shall be no further reduction of the Security Deposit. If Tenant is entitled to a reduction in the Security Deposit, Tenant shall have the right to provide Landlord with written notice requesting that the Security Deposit be reduced as provided above (the “Reduction Notice”). Landlord shall refund the applicable portion of the Security Deposit to Tenant within forty-five (45) days after the later to occur of (i) Landlord’s receipt of the Reduction Notice or (ii) the applicable Effective Date of Reduction.

In no event shall the Security Deposit ever be less than Two Hundred Ninety-Eight Thousand Sixty-Seven and 00/100 Dollars ($298,067.00). The balance of the Security Deposit, (i.e., $298,067.00) shall continue to be held by Landlord throughout the Term of the Lease, as it may be extended.

| 7. | Building Services. |

7.01 Landlord shall furnish Tenant with the following services: (a) water and sewer service; (b) heat and air conditioning in season during Building Service Hours, and at all others times upon demand of Tenant, sufficient to maintain the entire Premises within a range of 72-74 degrees Fahrenheit when outdoor conditions are 91 degrees or lower Fahrenheit drybulb and

8

73 degrees or lower Fahrenheit wetbulb, and sufficient to minimum room temperature of 72 degrees Fahrenheit when outdoor conditions are 6 degrees or higher Fahrenheit drybulb. If Tenant uses HVAC service to the Premises at times other than Building Service Hours, Tenant shall pay Landlord, as additional rent, an hourly fee in an amount reasonably determined by Landlord to compensate Landlord for any additional maintenance, repairs, or wear and tear to the HVAC system serving the Premises caused by such after-hour usage. Such hourly fee shall initially be $40.00 per hour, which amount shall be increased annually by the annual percentage increase in the Consumer Price Index for all Urban Consumers (CPI-U) specified for All Items (1982-84=100) for Boston-Brockton-Nashua, MA-NH-ME-CT and issued by the Bureau Labor Statistics of the United States Department of Labor. Tenant shall have the right to control overtime HVAC usage, and Landlord and Tenant shall cooperate in good faith to establish a mechanism by which Tenant’s overtime HVAC usage can be ascertained and recorded (and, at a minimum, Tenant shall maintain accurate records showing all of Tenant’s overtime HVAC usage and shall provide copies of same to Landlord semi-annually); (c) janitorial service on Business Days in accordance with the specifications set forth in Exhibit J attached hereto; (d) elevator service; (e) electricity in accordance with the terms and conditions in Section 7.02; and (f) snow and ice removal from the streets and sidewalks serving and/or adjacent to the Property to the extent the same is not provided by the City of Boston, and (g) such other services as Landlord reasonably determines are necessary or appropriate for the Property. Access to the Building for Tenant and its employees shall be available twenty-four (24) hours per day, seven (7) days per week, subject to the terms of this Lease. On or before the Commencement Date, Landlord shall install at its expense an electronic card access security system at the main entrance to the Premises to allow Tenant and its authorized employees access to the Building during non-Building Service Hours. After the installation thereof, Tenant shall have the sole responsibility for operating, maintaining, repairing, and, as necessary, replacing such card access system. Except for the installation of such card access system, Landlord shall have no responsibility for providing any security service with respect to the Property.

7.02(a) Electricity of not less than ten (10) watts per rentable square foot of the Premises (for lights, plugs, and HVAC service) shall be provided to the Premises by Landlord. Landlord represents that the Premises are separately metered for electrical service. From and after delivery of possession of the Premises to Tenant, Tenant shall, as additional rent, pay Landlord the actual amount paid by Landlord for all electric service to the Premises, including, without limitation, electricity used for the operation of the heating, ventilating, and air-conditioning system serving the Premises. Such additional rent shall be payable within thirty (30) days after delivery to Tenant of Landlord’s invoice therefor, which invoice shall be accompanied by copies of the invoice(s) from the utility provider evidencing such cost.

Without the consent of Landlord, Tenant’s use of electrical service shall not exceed the capacity of the electrical distribution systems and equipment serving the Building, which Landlord represents to be ten (10) watts per rentable square foot of the Premises (for lights, plugs, and HVAC service).

(b) Gas service to the Premises, including, without limitation, gas used for the operation of the heating, ventilating, and air-conditioning system serving the Premises shall be provided by Landlord. Landlord represents that the Premises are separately metered for gas service. From and after delivery of possession of the Premises to Tenant, Tenant shall, as

9

additional rent, pay Landlord the actual amount paid by Landlord for gas service to the Premises. Such additional rent shall be payable within thirty (30) days after delivery to Tenant of Landlord’s invoice therefor, which invoice shall be accompanied by copies of the invoice(s) from the utility provider evidencing such cost.

7.03 Provided Landlord, diligently after becoming aware of same, pursues the cure of any condition causing an interruption, diminishment or termination of service, Landlord’s failure to furnish, or any interruption, diminishment or termination of services due to the application of Laws, the failure of any equipment, the performance of repairs, improvements or alterations, utility interruptions or the occurrence of an event of Force Majeure (defined in Section 26.03) shall not render Landlord liable to Tenant, constitute a constructive eviction of Tenant, give rise to an abatement of Rent, nor relieve Tenant from the obligation to fulfill any covenant or agreement, except as expressly provided herein. Notwithstanding the foregoing, in the event Landlord is unable to furnish any utility or services required under this Lease such that the Premises or any portion thereof become untenantable or Tenant is denied a reasonable means of access to the Premises and in either such case Tenant ceases to occupy the Premises (or the affected portion thereof), and such condition continues for a period of more than five (5) days after Tenant gives Landlord notice thereof, the Base Rent and Additional Rent due hereunder shall abate in proportion to the portion of the Premises affected thereby commencing on the sixth (6th) day until such inability or failure is resolved. Except in the case of emergency, Landlord shall not intentionally interrupt any services to the Premises during Building Service Hours, and Landlord shall provide not less than 48 hours advance notice of any scheduled interruption of any services to the Premises.

| 8. | Leasehold Improvements. |

All improvements in and to the Premises excluding Tenant’s Property (as that term is defined in Section 14 below), including the Initial Improvements and any Alterations (collectively, “Leasehold Improvements”) shall remain upon the Premises at the end of the Term without compensation to Tenant. Landlord, however, by written notice to Tenant given concurrently with Landlord’s approval of the applicable Leasehold Improvements to the extent such approval is required hereunder (and otherwise within thirty (30) days after Tenant’s request for such determination with respect to any work for which Landlord’s approval is not required hereunder), may require Tenant, at its expense, to remove any Initial Improvements or Alterations, other than Cable (defined below), that, in Landlord’s reasonable judgment, are of a nature that would require removal and repair costs that are materially in excess of the removal and repair costs associated with standard office improvements (collectively referred to as “Required Removables”). Required Removables shall include, without limitation, internal stairways, raised floors, personal restrooms and showers, vaults, rolling file systems and structural alterations and modifications. The designated Required Removables shall be removed by Tenant before the Termination Date. Tenant shall repair damage caused by the installation or removal of Required Removables. If Tenant fails to perform its obligations in a timely manner, Landlord may perform such work at Tenant’s expense. Tenant, at the time it requests approval for a proposed Alteration, may request in writing that Landlord advise Tenant whether the Alteration or any portion of the Alteration is a Required Removable. Within ten (10) days after receipt of Tenant’s written request accompanied by plans and specifications of the proposed Alterations at issue, Landlord shall advise Tenant in writing as to which portions of the

10

Alteration are Required Removables. However, it is agreed that Required Removables shall not include any usual office improvements such as gypsum board, partitions Building standard, ceiling grids and tiles, fluorescent lighting panels, Building standard doors and non-glued down carpeting.

| 9. | Repairs and Alterations. |

9.01 Tenant shall, at its sole cost and expense, perform all maintenance and repairs to the Premises (in clarification of the foregoing, in no event shall Tenant be responsible for performing any maintenance or repair to the exterior of the Building except in connection with any signage or other equipment installed on the roof or exterior of the Building by or for the benefit of Tenant) that are not Landlord’s express responsibility under this Lease, and keep the Premises in good condition and repair, reasonable wear and tear and damage by casualty (subject to the terms of Article 16) excepted, provided that, subject to the provisions of Article 15, Tenant shall not be responsible for repairs to the Premises to the extent that any damage is caused by the negligence of Landlord or Landlord’s employees, agents or contractors or by any failure of Landlord to perform its obligations hereunder. Tenant’s repair and maintenance obligations include, without limitation, repairs to: (a) floor covering; (b) interior partitions; (c) doors; (d) the interior side of demising walls; (e) electronic, phone and data cabling and related equipment that is installed by or for the exclusive benefit of Tenant (collectively, “Cable”); (f) supplemental air conditioning units, kitchens, including hot water heaters, plumbing, and similar facilities exclusively serving Tenant; and (g) Alterations. Subject to Section 15, Tenant shall reimburse Landlord for the cost of repairing damage to the Building caused by the negligent or willful acts of Tenant, Tenant Related Parties and their respective contractors and vendors. If Tenant fails to make any repairs to the Premises for more than thirty (30) days after notice from Landlord (although notice shall not be required in an emergency immediately threatening life or property), Landlord may make the repairs, and Tenant shall pay the reasonable cost of the repairs, together with an administrative charge in an amount equal to five percent (5%) of the cost of the repairs.

9.02 Landlord shall keep and maintain in good repair and working order and perform maintenance upon the: (a) the Base Building; (b) mechanical (including HVAC), electrical, plumbing and fire/life safety systems serving the Building in general; (c) Common Areas; (d) exterior windows of the Building; and (e) elevators serving the Building. Landlord shall promptly make repairs for which Landlord is responsible. In addition to the foregoing, Landlord shall (i) perform all of its obligations under that certain Declaration of Covenants, Restrictions, Development Standards and Easements dated January 6, 2009 between Landlord and other parties and recorded with the Suffolk County Registry of Deeds in Book 44571, Page 100 (the “Street Agreement”), and (ii) use commercially reasonable efforts to enforce for the benefit of Tenant the obligations of the other parties to, and the association responsible for the implementation of, the Street Agreement, with respect to the Common Areas, Infrastructure and Streetscape Improvements (as such terms are defined in the Street Agreement).

9.03 Tenant shall not make alterations, repairs, additions or improvements or install any Cable (collectively referred to as “Alterations”) without first obtaining the written consent of Landlord in each instance, which consent shall not be unreasonably withheld, conditioned, or delayed. Landlord agrees to respond to a request for consent within ten (10) business days after receipt of Tenant’s plans and specifications for such Alterations. Landlord’s consent is solely for

11

the benefit of Landlord, and neither Tenant nor any third party shall have the right to rely on Landlord’s consent, or its approval of Tenant’s plans, for any purpose whatsoever. However, Landlord’s consent shall not be required for any Alteration that satisfies all of the following criteria (a “Cosmetic Alteration”): (a) is of a cosmetic nature such as painting, wallpapering, hanging pictures and installing carpeting; (b) will not adversely affect the Base Building; and (c) the cost of such work does not exceed $50,000.00 in each instance. Cosmetic Alterations shall be subject to all the other provisions of this Section 9.03. Prior to starting work, Tenant shall furnish Landlord with plans and specifications; names of contractors reasonably acceptable to Landlord (provided that Landlord may designate specific contractors with respect to Base Building provided the same will perform on competitive rates and terms); required permits and approvals; evidence of contractor’s and subcontractor’s insurance in amounts reasonably required by Landlord and naming Landlord as an additional insured. Changes to the plans and specifications must also be submitted to Landlord for its approval. Alterations shall be constructed in a good and workmanlike manner using materials of a quality reasonably approved by Landlord. Tenant shall reimburse Landlord for any reasonable sums paid by Landlord for third party examination of Tenant’s plans (in both paper and CAD file formats) for non-Cosmetic Alterations; provided that no reimbursement shall be required in connection with the examination of the plans for the Initial Improvements. In addition, Tenant shall pay Landlord a fee for Landlord’s oversight and coordination of any Alterations other than Cosmetic Alterations equal to five percent (5%) of the cost of the Alterations; provided that no fee shall be required in connection with the Initial Improvements. Upon completion, Tenant shall furnish “as-built” plans (in both paper and CAD file formats) for all Alterations other than Cosmetic Alterations, completion affidavits and full and final waivers of lien. Landlord’s approval of an Alteration shall not be deemed a representation by Landlord that the Alteration complies with Law.

| 10. | Entry by Landlord. |

Landlord may enter the Premises to inspect, show or clean the Premises or to perform or facilitate the performance of repairs, alterations or additions to the Premises or any portion of the Building and for no other purpose without the consent of Tenant, which consent shall not be unreasonably withheld, conditioned, or delayed. Notwithstanding the foregoing, Landlord agrees that it will not show the Premises to prospective tenants except during the last eighteen (18) months of the Term. Except in emergencies or to provide Building services, Landlord shall provide Tenant with reasonable prior verbal notice of entry and shall use reasonable efforts to minimize any interference with Tenant’s use of the Premises. If reasonably necessary, Landlord may temporarily close all or a portion of the Premises to perform repairs. However, except in emergencies, Landlord will not close the Premises if the repairs can reasonably be completed on weekends and after Building Service Hours. Entry by Landlord shall not constitute a constructive eviction or entitle Tenant to an abatement or reduction of Rent. Landlord will not permit access to the Premises by competitors of Zipcar, Inc. identified by written notice to Landlord from Tenant from time to time. Tenant reserves the right to designate portions of the Premises that may be accessed by Landlord only in the presence of a representative of Tenant except in case of emergency, and Tenant agrees to make a representative available for such purpose upon reasonable advance notice from Landlord.

12

| 11. | Assignment and Subletting. |

11.01 Except in connection with a Permitted Transfer (defined in Section 11.04), Tenant shall not assign, sublease, transfer or encumber any interest in this Lease or allow any third party to use any portion of the Premises (collectively or individually, a “Transfer”) without the prior written consent of Landlord, which consent shall not be unreasonably withheld, conditioned or delayed if Landlord does not exercise its recapture rights under Section 11.02. In connection with any request for approval of a Transfer, Tenant shall provide Landlord with financial statements for the proposed transferee (except that financial statements shall not be required in connection with a proposed sublease of less than thirty-three percent (33%) of the rentable area of the Premises, in the aggregate with all other then-extant subleases), a fully executed copy of the proposed assignment, sublease or other Transfer documentation and such other information as Landlord may reasonably request within ten (10) days of Landlord’s receipt of Tenant’s request for consent. Within fifteen (15) Business Days after receipt of the required information and documentation, Landlord shall, at its election, either: (a) consent to the Transfer by execution of a consent agreement in a form reasonably designated by Landlord; (b) reasonably refuse to consent to the Transfer in writing. Without limitation, it will not be unreasonable for Landlord to withhold consent to a proposed Transfer to (i) any prospective occupant of the complex of buildings owned by Landlord of which the Building is a part (the “Complex”) to whom Landlord has offered space in the Complex within the two (2) month period immediately previous to the Tenant’s request for consent to the proposed Transfer or (ii) any other occupant of the Complex if either Landlord has available space in the Complex comparable to the space being offered by Tenant or the occupancy by such other occupant of the space being offered by Tenant will directly cause a vacancy in the premises which such other occupant currently occupies in the Complex. Tenant shall pay Landlord a review fee of $1,500.00 for Landlord’s review of any Permitted Transfer or requested Transfer. Any attempted Transfer in violation of this Section is voidable by Landlord. In no event shall any Transfer, including a Permitted Transfer, release or relieve Tenant from any obligation under this Lease.

11.02 If Tenant intends to market the Premises for an assignment of this Lease or subletting of more than fifty percent (50%) of the Rentable Area of the Premises (other than in connection with a Permitted Transfer), Tenant shall notify Landlord thereof (“Transfer Notice”), and Landlord shall have forty-five (45) days after receipt of the Transfer Notice to notify Tenant that Landlord elects to recapture the portion of the Premises that Tenant is proposing to Transfer. If Landlord exercises its right to recapture, this Lease shall automatically be amended (or terminated if the entire Premises is being assigned or sublet) to delete the applicable portion of the Premises effective on the proposed effective date of the Transfer and Tenant’s Base Rent and Pro Rata Share shall be appropriately adjusted. To the extent the recapture relates to less than the entire Premises, Landlord shall be responsible for separately demising the recapture portion from the remaining Premises, creating appropriate Common Areas (including a common lobby area in the first floor of the Building where Tenant will have signage typical of a tenant for the size of Tenant at such time), separately metering all utilities and making other adjustments to reflect the multi-tenant nature of the Building.

If Landlord does not elect to recapture the Premises or such portion thereof within such forty-five day period, then Tenant shall have the right, subject to the other provisions of this Article 11 to enter into a Transfer with respect to the Premises or such portion for a period of one

13

hundred eighty (180) days after the expiration of such forty-five-day-period or such earlier date on which Landlord notifies Tenant that Landlord declines to recapture. If Tenant fails to enter into a Transfer within such one hundred eighty day-period, then, before entering into any subsequent Transfer, Tenant shall again give Landlord the right to recapture the Premises, or the portion thereof proposed to be sublet, pursuant to this Section 11.02.

11.03 Tenant shall pay Landlord fifty percent (50%) of all rent and other consideration which Tenant receives as a result of a Transfer (other than a Permitted Transfer) that is in excess of the Rent payable to Landlord for the portion of the Premises and Term covered by the Transfer, after first deducting therefrom all reasonable, out of pocket expenses incurred by Tenant in order to effect such Transfer, including, without limitation, attorneys’ fees, construction costs, tenant improvement allowances, marketing costs, brokerage fees, and any free rent. Tenant shall pay Landlord for Landlord’s share of the excess within thirty (30) days after Tenant’s receipt of the excess. If Tenant is in Default, Landlord may require that all sublease payments be made directly to Landlord, in which case Tenant shall receive a credit against Rent in the amount of Tenant’s share of payments received by Landlord.

11.04 Tenant may assign this Lease to a successor to Tenant by purchase, merger, consolidation or reorganization (an “Ownership Change”) or assign this Lease or sublet all or a portion of the Premises to an Affiliate without the consent of Landlord, provided that all of the following conditions are satisfied (a “Permitted Transfer”): (a) Tenant is not in Default; (b) in the event of an Ownership Change, Tenant’s successor shall own substantially all of the assets of Tenant and will have a net worth immediately after the Ownership Change which is at least equal to Tenant’s net worth as of the day prior to the proposed Ownership Change; (c) the Permitted Use does not allow the Premises to be used for retail purposes; and (d) Tenant shall give Landlord written notice at least fifteen (15) Business Days prior to the effective date of the Permitted Transfer to the extent permitted by applicable law and otherwise immediately after the Permitted Transfer. Landlord shall not disclose the existence of a Permitted Transfer to any other person or entity until the same is publicly announced by Tenant or otherwise becomes public knowledge. Tenant’s notice to Landlord shall include information and documentation evidencing the Permitted Transfer and showing that each of the above conditions has been satisfied. If requested by Landlord, Tenant’s successor shall sign a commercially reasonable form of assumption agreement. “Affiliate” shall mean an entity controlled by, controlling or under common control with Tenant (for such period of time as such entity continues to be controlled by, controlling or under common control with Tenant, it being agreed that the subsequent sale or transfer of stock resulting in a change in voting control, or any other transaction(s) having the overall effect that such entity ceases to be controlled by, controlling or under common control with Tenant, shall be treated as if such sale or transfer or transaction(s) were, for all purposes, an assignment of this Lease governed by the provisions of this Article 11).

| 12. | Liens. |

Tenant shall not permit mechanics’ or other liens to be placed upon the Property, Premises or Tenant’s leasehold interest in connection with any work or service done or purportedly done by or for the benefit of Tenant or its transferees (it being agreed that the filing of a Notice of Contract shall not be deemed to constitute a lien unless a Statement of Account is filed thereafter with respect thereto). Tenant shall give Landlord notice at least fifteen (15) days

14

prior to the commencement of any work in the Premises to afford Landlord the opportunity, where applicable, to post and record notices of non-responsibility. Tenant, within ten (10) days of notice from Landlord, shall fully discharge any lien by settlement, by bonding or by insuring over the lien in the manner prescribed by the applicable lien Law. If Tenant fails to do so, Landlord may bond, insure over or otherwise discharge the lien. Tenant shall reimburse Landlord for any amount paid by Landlord, including, without limitation, reasonable attorneys’ fees, plus an administrative fee equal to five percent (5%) of the amount otherwise paid by Landlord. Landlord shall have the right to require Tenant to post a performance or payment bond in connection with any work or service done or purportedly done by or for the benefit of Tenant to the extent the same is reasonably expected to cost in excess of $250,000 but no bond shall be required by Landlord with respect to the Initial Alterations if the general contractor is Structuretone or JDL Construction. Tenant acknowledges and agrees that all such work or service is being performed for the sole benefit of Tenant and not for the benefit of Landlord.

| 13. | Indemnity and Waiver of Claims. |

Tenant hereby waives all claims against and releases Landlord and its trustees, members, principals, beneficiaries, partners, officers, directors, employees, Mortgagees (defined in Article 23) and agents (the “Landlord Related Parties”) from all claims for any damage to property or business loss in any manner related to (a) Force Majeure, (b) acts of third parties other than any agent or contractor of Landlord, (c) the bursting or leaking of any tank, water closet, drain or other pipe, unless due to or arising out of the negligence or willful misconduct of the Landlord or any of Landlord’s contractors, employees, or agents, (d) the inadequacy or failure of any security services, personnel or equipment, unless due to or arising out of the negligence or willful misconduct of the Landlord or any of Landlord’s contractors, employees, or agents, or (e) any matter not within the reasonable control of Landlord. In addition to the foregoing Tenant agrees that Landlord shall have no responsibility or liability whatsoever for any loss or damage, however caused, to furnishings, fixtures, equipment, or other personal property of Tenant or of any persons claiming by, through, or under Tenant except to the extent caused by the negligence or willful misconduct of Landlord or any of Landlord’s contractors, employees, or agents but subject to Section 15 below. Except to the extent caused by the negligence or willful misconduct of Landlord or any of Landlord’s contractors, employees, or agents, Tenant shall indemnify, defend and hold Landlord and Landlord Related Parties harmless against and from all liabilities, obligations, damages, penalties, claims, actions, costs, charges and expenses, including, without limitation, reasonable attorneys’ fees and other professional fees (if and to the extent permitted by Law) (collectively referred to as “Losses”), which may be imposed upon, incurred by or asserted against Landlord or any of the Landlord Related Parties by any third party and arising out of or in connection with (i) any damage or injury occurring in the Premises or (ii) any negligence or willful misconduct (including violations of Law) of Tenant, the Tenant Related Parties or any of Tenant’s transferees, contractors, licensees, employees or agents. Except to the extent caused by the negligence or willful misconduct of Tenant or any Tenant Related Parties or any of Tenant’s transferees, contractors, licensees, employees or agents, Landlord shall indemnify, defend and hold Tenant, its trustees, members, principals, beneficiaries, partners, officers, directors, and employees (“Tenant Related Parties”) harmless against and from all Losses which may be imposed upon, incurred by or asserted against Tenant or any of the Tenant Related Parties by any third party and arising out of or in connection with the negligence or willful misconduct (including violations of Law) of Landlord or any of Landlord’s contractors, employees or agents.

15

| 14. | Insurance. |

(a) Tenant’s Insurance. Tenant shall obtain, and shall keep in full force and effect, the following insurance, with insurers that are authorized to do business in the Commonwealth of Massachusetts and are rated at least A (Class X) in Best’s Key Rating Guide:

(i) Commercial General Liability Insurance, which shall include premises liability, contractual liability covering Tenant’s indemnity obligations under Section 13 of this Lease (to the extent covered as an Insured Contract in a standard ISO GCL Policy), all risk legal liability, personal & advertising injury and products/completed operations coverage. Policy shall insure against claims for bodily injury, personal injury, death or property damage occurring on, in or about the Premises with limits of not less than $1,000,000.00 per occurrence and $2,000,000.00 in the aggregate.

(ii) Special Form (“All Risk”) Property, insuring all equipment, trade fixtures, inventory, fixtures and personal property (“Tenant’s Property”) and any Alterations or other Leasehold Improvements which are the responsibility of Tenant, located on or in the Premises with an agreed amount endorsement and equal to the full replacement cost value of such property.

(iii) Workers’ Compensation Insurance as required by applicable laws of the State in which the Premises is located, including Employers’ Liability Insurance with limits of not less than: (x) $500,000 per accident; (y) $500,000 disease, policy limit; and (z) $500,000 disease, each employee.

(iv) Excess or Umbrella Liability Insurance with limits of not less than Four Million Dollars ($4,000,000.00) per occurrence and in the aggregate providing coverage excess and follow-form of the primary general and employer’s liability insurances required hereinto.

(v) Such other insurance as Landlord reasonably deems necessary and prudent or as may be required by any Mortgagee (defined below).

(vi) In addition to the above aforementioned insurances, and during any such time as any alterations or work is being performed at the Premises (except that work being performed by the Landlord or on behalf of Landlord) Tenant, at its sole cost and expense, shall carry, or shall cause to be carried and shall deliver to Landlord at least ten (10) days prior to commencement of any such alteration or work, evidence of insurance with respects to (a) workers compensation insurance covering all persons employed in connection with the proposed alteration or work in statutory

16

limits, (b) general/excess liability insurance, in an amount commensurate with the work to be performed but not less than Three Million Dollars ($3,000,000) per occurrence and in the aggregate, for ongoing and completed operations insuring against bodily injury and property damage and naming all additional insured parties as outlined below and required of Tenant and shall include a waiver of subrogation in favor of such parties, (c) builders risk insurance, to the extent such alterations or work may require, on a completed value form including permission to occupy, covering all physical loss or damages, in an amount and kind reasonable satisfactory to Landlord, and (d) such other insurance, in such amounts, as Landlord deems reasonably necessary to protect Landlord’s interest in the Premises from any act or omission of Tenant’s contactors or subcontractors.

(b) Policy Requirements. The policies of insurance required to be maintained by Tenant pursuant to this Section 14 must be reasonably satisfactory to Landlord and must be written as primary policy coverage and not contributing with, or in excess of, any coverage carried by Landlord. All policies must name Tenant as the named insured party and (except for worker’s compensation and property insurance) all policies shall name as additional insureds for on-going and completed operations, Landlord, Crosspoint Associates, Inc., the Mortgagee under any Mortgage (as those terms are defined below), and Landlord’s managing agent, if any. In addition Tenant agrees and shall provide thirty (30) days’ prior written notice of suspension, cancellation, termination, or non-renewal of coverage to Landlord. Tenant shall not self-insure for any insurance coverage required to be carried by Tenant under this Lease. The deductible for any insurance policy required hereunder must not exceed $100,000.00. Tenant shall have the right to provide the insurance coverage required under this Lease through a blanket policy, provided such blanket policy expressly affords coverage to the Premises and to Landlord as required by this Lease.

(c) Certificates of Insurance. Prior to the Commencement Date, Tenant shall deliver to Landlord certificates of insurance evidencing all insurance Tenant is obligated to carry under this Lease, together with a copy of the endorsement(s), specifically but not limited to Waiver of Rights to Recover From Others, Additional Insureds (on-going and completed operations) and Contractual Liability endorsements. Within ten (10) days prior to the expiration of any such insurance, Tenant shall deliver to Landlord certificates of insurance evidencing the renewal of such insurance. Tenant’s certificates of insurance must be on: (i) Acord Form 27 with respect to property insurance; and (ii) Acord Form 25-S with respect to liability insurance or, in each case, on successor forms approved by Landlord, and in any event state Landlord as the certificate holder.

(d) No Separate Insurance. Tenant shall not obtain or carry separate insurance concurrent in form or contributing in the event of loss with that required by Section 14(a) unless Landlord and Tenant are named as insureds therein.

(e) Tenant’s Failure to Maintain Insurance. If Tenant fails to maintain the insurance required by this Lease, which failure continues for more than two (2) business days after notice to Tenant thereof. Landlord may, but shall not be obligated to, obtain, and pay the premiums for, such insurance. Upon demand, Tenant shall pay to Landlord all amounts paid by Landlord pursuant to this Section 14(e).

17

(f) Landlord’s Insurance. Landlord, shall at all times during the Term of this Lease procure and keep in force (i) commercial general liability insurance, which includes contractual liability coverage for Landlord’s indemnity obligations set forth in Section 13 above at limits no less than $2,000,000 per occurrence and $4,000,000 annual aggregate and, (ii) Special Form “All Risk” property insurance covering the full replacement cost of the Building with no coinsurance limitation and including all coverages and perils as required by Landlord’s mortgagee, including, without limitation, earthquake and flood insurance.

| 15. | Subrogation. |

Landlord and Tenant agree to have all property insurance policies which are required to be carried by either of them hereunder endorsed to provide that the insurer waives all rights of subrogation which such insurer might have against the other party and Landlord’s mortgagee, if any. By this clause, the parties intend and hereby agree that the risk of loss or damage to property shall be borne by the parties’ insurance carriers. It is hereby agreed that Landlord and Tenant shall look solely to, and seek recovery from, only their respective insurance carriers in the event a loss is sustained for which Property Insurance is carried or is required to be carried under this Lease. Without limiting any release or waiver of liability or recovery contained in any other Section of this Lease but rather in confirmation and furtherance thereof, Landlord waives all claims for recovery from Tenant, and Tenant waives all claims for recovery from Landlord, and their respective agents, partners and employees, for any loss or damage to any of its property insured under the insurance policies required hereunder including but not limited to any business interruption, loss of income or special, indirect or consequential damages. The provisions of this Section 15 will survive the expiration or earlier termination of this Lease.

| 16. | Casualty Damage. |

16.01 If all or any portion of the Premises or Building becomes untenantable by fire or other casualty to the Premises (collectively a “Casualty”), Landlord, with reasonable promptness (not to exceed forty-five (45) days after the Casualty), shall cause a general contractor selected by Landlord to provide Landlord and Tenant with a good faith written estimate of the amount of time required using standard working methods to Substantially Complete the repair and restoration of the Premises and the Building (“Completion Estimate”). If the Completion Estimate indicates that the Premises or Building cannot be restored within two hundred ten (210) days from the date of the Casualty, then either party shall have the right to terminate this Lease upon written notice to the other within ten (10) days after receipt of the Completion Estimate. In addition, Landlord, by notice to Tenant within ninety (90) days after the date of the Casualty, shall have the right to terminate this Lease if: (1) the Premises have been materially damaged (i.e., damaged such that the restoration thereof will, in the ordinary course, require more than sixty (60) days to complete after the commencement of such work) and there is less than seventeen (17) months of the Term remaining on the date of the Casualty; (2) any Mortgagee requires that the insurance proceeds be applied to the payment of the mortgage debt; or (3) a material uninsured loss to the Building occurs provided Landlord maintained the Property insurance required under Section 14(f)(ii).

18

16.02 If this Lease is not terminated, Landlord shall promptly and diligently, subject to reasonable delays for insurance adjustment or other matters beyond Landlord’s reasonable control, restore the Premises and the Building. Such restoration shall be to substantially the same condition that existed prior to the Casualty, except for modifications required by Law. Upon notice from Landlord, Tenant shall assign to Landlord (or to any party designated by Landlord) all property insurance proceeds payable to Tenant under Tenant’s Insurance with respect to any Leasehold Improvements performed by or for the benefit of Tenant; provided if the estimated cost to repair such Leasehold Improvements exceeds the amount of insurance proceeds received by Landlord from Tenant’s insurance carrier, the excess cost of such repairs shall be paid by Tenant to Landlord prior to Landlord’s commencement of repairs. Landlord shall not be liable for any inconvenience to Tenant, or injury to Tenant’s business resulting in any way from the Casualty or the repair thereof. Provided that Tenant is not in Default, during any period of time that all or a material portion of the Premises is rendered untenantable as a result of a Casualty, the Rent shall abate for the portion of the Premises that is untenantable and not used by Tenant. In the event Landlord has not Substantially Completed the restoration of the Building or the Premises by the later of (i) two hundred and ten (210) days from the Casualty, or (ii) the period set forth in the Completion Estimate, then Tenant may elect to terminate this Lease by giving Landlord notice of such election at any time after the expiration of the applicable period and before Landlord has Substantially Completed such restoration. If Tenant so elects, then this Lease shall terminate on the date that is thirty (30) days after delivery of Tenant’s termination notice with the same force and effect as if such date were the Termination Date unless, on or before the expiration of such thirty-day period, Landlord has Substantially Completed such restoration, in which event Tenant’s termination election shall automatically become void.

| 17. | Condemnation. |

Either party may terminate this Lease if any material part of the Premises is taken or condemned for any public or quasi public use under Law, by eminent domain or private purchase in lieu thereof (a “Taking”). The terminating party shall provide written notice of termination to the other party within forty-five (45) days after it first receives notice of the Taking. The termination shall be effective on the date the physical taking occurs. If this Lease is not terminated, Base Rent and Tenant’s Pro Rata Share shall be appropriately adjusted to account for any reduction in the square footage of the Building or Premises. All compensation awarded for a Taking shall be the property of Landlord. The right to receive compensation or proceeds is expressly waived by Tenant, however, Tenant may file a separate claim for Tenant’s Property and Tenant’s reasonable relocation expenses, provided the filing of the claim does not diminish the amount of Landlord’s award. If only a part of the Premises is subject to a Taking and this Lease is not terminated, Landlord, with reasonable diligence, will restore the remaining portion of the Premises as nearly as practicable to the condition immediately prior to the Taking.

| 18. | Events of Default. |

Each of the following occurrences shall be a “Default”: (a) Tenant’s failure to pay any portion of Rent when due, if the failure continues for ten (10) days after written notice to Tenant (“Monetary Default”); (b) Tenant’s failure (other than a Monetary Default) to comply with any term, provision, condition or covenant of this Lease, if the failure is not cured within thirty (30) days after written notice to Tenant provided, however, if Tenant’s failure to comply cannot

19

reasonably be cured within thirty (30) days, Tenant shall be allowed additional time (not to exceed an additional thirty (30) days) as is reasonably necessary to cure the failure so long as Tenant begins the cure within ten (10) days after such notice to Tenant and diligently pursues the cure to completion; (c) Tenant or any Guarantor becomes insolvent, makes a transfer in fraud of creditors, makes an assignment for the benefit of creditors, admits in writing its inability to pay its debts when due or forfeits or loses its right to conduct business; (d) the leasehold estate is taken by process or operation of Law. If Landlord provides Tenant with notice of Tenant’s failure to comply with any specific provision of this Lease on three (3) separate occasions during any twelve-(12)-month period, Tenant’s subsequent violation of such provision shall, at Landlord’s option, be an incurable Default by Tenant. All notices sent under this Article shall be in satisfaction of, and not in addition to, notice required by Law.

| 19. | Remedies. |

19.01 Upon Default, Landlord shall have the right to pursue any one or more of the following remedies:

(a) Terminate this Lease, in which case Tenant shall immediately surrender the Premises to Landlord. If Tenant fails to surrender the Premises, Landlord, in compliance with Law, may enter upon and take possession of the Premises and remove Tenant, Tenant’s Property and any party occupying the Premises. Tenant shall pay Landlord, on demand, all past due Rent and other losses and damages Landlord suffers as a result of Tenant’s Default, including, without limitation, all Costs of Reletting (defined below) and any deficiency that may arise from reletting or the failure to relet the Premises. “Costs of Reletting” shall include all reasonable costs and expenses incurred by Landlord in reletting or attempting to relet the Premises, including, without limitation, legal fees, brokerage commissions and marketing expenses, the cost of alterations and the value of other commercially reasonable concessions or allowances granted to a new tenant.

(b) Terminate Tenant’s right to possession of the Premises and, in compliance with Law, remove Tenant, Tenant’s Property and any parties occupying the Premises. Landlord may (but, except as expressly provided below, shall not be obligated to) relet all or any part of the Premises, without notice to Tenant, for such period of time and on such terms and conditions (which may include concessions, free rent and work allowances) as Landlord in its absolute discretion shall determine. Landlord may collect and receive all rents and other income from the reletting. Tenant shall pay Landlord on demand all past due Rent, all Costs of Reletting and any deficiency arising from the reletting or failure to relet the Premises. The re-entry or taking of possession of the Premises shall not be construed as an election by Landlord to terminate this Lease.

(c) Landlord shall use reasonable efforts to relet the Premises on such terms as Landlord in its sole discretion may determine (including a term different from the Term, rental concessions, and alterations to, and improvement of, the Premises); however, Landlord shall not be obligated to relet the Premises before leasing other portions of the Building. Landlord shall not be liable for, nor shall Tenant’s obligations hereunder be diminished because of, Landlord’s failure to relet the Premises or to collect rent due for such reletting.

20

19.02 In lieu of calculating damages under Section 19.01, Landlord may elect to receive as damages the sum of (a) all Rent accrued through the date of termination of this Lease or Tenant’s right to possession, and (b) an amount equal to (i) the total Rent that Tenant would have been required to pay for the remainder of the Term discounted to present value using the then applicable so-called Federal Discount Rate less (ii) the then fair market rental value of the Premises for the remainder of the Term, discounted to present value as aforesaid. If Tenant is in Default of any of its non-monetary obligations under the Lease, Landlord shall have the right to perform such obligations. Tenant shall reimburse Landlord for the cost of such performance upon demand together with an administrative charge equal to ten percent (10%) of the cost of the work performed by Landlord. The repossession or re-entering of all or any part of the Premises shall not relieve Tenant of its liabilities and obligations under this Lease. No right or remedy of Landlord shall be exclusive of any other right or remedy. Each right and remedy shall be cumulative and in addition to any other right and remedy now or subsequently available to Landlord at Law or in equity.

| 20. | Limitation of Liability. |

NOTWITHSTANDING ANYTHING TO THE CONTRARY CONTAINED IN THIS LEASE, THE LIABILITY OF LANDLORD (AND OF ANY SUCCESSOR LANDLORD) SHALL BE LIMITED TO LANDLORD’S INTEREST IN THE PROPERTY (INCLUDING THE UNDISTRIBUTED RENTS AND PROCEEDS THEREFROM) AND ANY INSURANCE PROCEEDS FOR THE RECOVERY OF ANY JUDGMENT OR AWARD AGAINST LANDLORD OR ANY LANDLORD RELATED PARTY. NONE OF TENANT, LANDLORD NOR ANY TENANT RELATED PARTY OR LANDLORD RELATED PARTY SHALL BE PERSONALLY LIABLE FOR ANY JUDGMENT OR DEFICIENCY, AND IN NO EVENT SHALL LANDLORD OR ANY LANDLORD RELATED PARTY BE LIABLE TO TENANT OR TENANT OR ANY TENANT RELATED PARTY BE LIABLE TO LANDLORD FOR ANY LOST PROFIT, DAMAGE TO OR LOSS OF BUSINESS OR ANY FORM OF SPECIAL, INDIRECT OR CONSEQUENTIAL DAMAGE EXCEPT AS PROVIDED IN SECTION 22 BELOW. BEFORE FILING SUIT FOR AN ALLEGED DEFAULT BY LANDLORD, TENANT SHALL GIVE LANDLORD AND THE MORTGAGEE(S) WHOM TENANT HAS BEEN NOTIFIED HOLD MORTGAGES (DEFINED IN ARTICLE 23 BELOW), NOTICE AND REASONABLE TIME TO CURE THE ALLEGED DEFAULT. WITHOUT LIMITING THE FOREGOING, IN NO EVENT SHALL LANDLORD OR ANY MORTGAGEES OR LANDLORD RELATED PARTIES EVER BE LIABLE FOR ANY CONSEQUENTIAL OR INCIDENTAL DAMAGES OR ANY LOST PROFITS OF TENANT.

LANDLORD AND TENANT EXPRESSLY DISCLAIM ANY IMPLIED WARRANTY THAT THE PREMISES ARE SUITABLE FOR TENANT’S INTENDED COMMERCIAL PURPOSE, AND TENANTS OBLIGATION TO PAY RENT HEREUNDER IS NOT DEPENDENT UPON THE CONDITION OF THE PREMISES OR THE PERFORMANCE BY LANDLORD OF ITS OBLIGATIONS HEREUNDER, AND, EXCEPT AS OTHERWISE EXPRESSLY PROVIDED HEREIN, TENANT SHALL CONTINUE TO PAY THE RENT, WITHOUT ABATEMENT, SETOFF OR DEDUCTION, NOTWITHSTANDING ANY BREACH BY LANDLORD OF ITS DUTIES OR OBLIGATIONS HEREUNDER, WHETHER EXPRESS OR IMPLIED.

21

| 21. | Intentionally Omitted. |

| 22. | Holding Over. |

If Tenant fails to surrender all or any part of the Premises at the termination of this Lease, occupancy of the Premises after termination shall be that of a tenancy at sufferance. Tenant’s occupancy shall be subject to all the terms and provisions of this Lease, and Tenant shall pay an amount (prorated for partial months during the holdover) equal to one hundred fifty percent (150%) of the sum of the Base Rent and Additional Rent for the first thirty (30) days of any such holdover and thereafter two hundred percent (200%) of the sum of the Base Rent and Additional Rent (and such payment of increased Additional Rent shall not be subject to any annual reconciliation based upon actual expenses) due for the period immediately preceding the holdover. No holdover by Tenant or payment by Tenant after the termination of this Lease shall be construed to extend the Term or prevent Landlord from immediate recovery of possession of the Premises by summary proceedings or otherwise. If Landlord is unable to deliver possession of the Premises to a new tenant or to perform improvements for a new tenant as a result of Tenant’s holdover that continues for more than thirty (30) days, Tenant shall be liable for all damages that Landlord suffers from the holdover.

| 23. | Subordination to Mortgages; Estoppel Certificate. |

Subject to Landlord’s delivery of an SNDA (defined below) for the benefit of Tenant as provided below, Tenant accepts this Lease subject and subordinate to the lien of any mortgage(s), deed(s) of trust, ground lease(s) or other lien(s) now or subsequently arising upon the Premises, the Building or the Property, and to the lien of renewals, modifications, refinancings and extensions thereof (collectively referred to as a “Mortgage”). The party having the benefit of a Mortgage shall be referred to as a “Mortgagee”. As an alternative, a Mortgagee shall have the right at any time to subordinate its Mortgage to this Lease. Upon request, Tenant, without charge, shall attorn to any successor to Landlord’s interest in this Lease, provided, however, that the subordination of this Lease to any mortgage or ground lease entered into after the date of this Lease shall be upon the express condition that so long as Tenant is not in Default of the Lease beyond applicable notice and cure periods, Tenant’s possession and enjoyment of the Premises and Tenant’s rights under this Lease shall not be disturbed or interfered with in the event of a foreclosure of such mortgage or lease or the exercise of any rights thereunder. Landlord and Tenant shall each, within fifteen (15) days after receipt of a written request from the other, execute and deliver a commercially reasonable estoppel certificate to those parties as are reasonably requested by the other (including a Mortgagee or prospective purchaser). Without limitation, such estoppel certificate may include a certification as to the status of this Lease, the existence of any Defaults and the amount of Rent that is due and payable.

Notwithstanding the foregoing, Landlord will obtain a non-disturbance, subordination and attornment agreement (an “SNDA”) from (i) Landlord’s current Mortgagee on such Mortgagee’s current standard form of agreement, a copy of which is attached hereto as Exhibit H, concurrently with the execution of this Lease and as a condition to Tenant’s obligations hereunder, and (ii) any future Mortgagee in a commercially reasonable form as a condition of Tenant’s subordination as contained herein. Tenant will execute each such SNDA and return the same to Landlord for execution by the Mortgagee within fifteen (15) days after delivery thereof

22

to Tenant. Landlord represents that (i) Yellow Brick Real Estate Capital I, LLC holds the only Mortgage encumbering the Premises as of the date of this Lease (the “Existing Mortgage”), (ii) no default exists or has been threatened by Mortgagee under the Existing Mortgage, and (iii) the maturity date of the Existing Mortgage is August 16, 2017.

| 24. | Notice. |