Attached files

| file | filename |

|---|---|

| 8-K - TECHPRECISION FORM 8-K - TECHPRECISION CORP | tpcs8k.htm |

Exhibit 99.1

Annual Shareholder Meeting

December 5, 2012

© 2012. All rights reserved.

© 2012. All rights reserved.

2

Safe Harbor Statement

Safe Harbor Statement Under the Private Securities Litigation Reform Act of 1995: Any statements set

forth in this presentation that are not historical facts are forward-looking statements that involve risks

and uncertainties that could cause actual results to differ materially from those in the forward-looking

statements, which may include, but are not limited to, such factors as unanticipated changes in

product demand, increased competition, downturns in the economy, failure to comply with specific

regulations pertaining to government projects, fluctuation of revenue due to the nature of project

lifecycles, and other information detailed from time to time in the Company filings and future filings

with the United States Securities and Exchange Commission. The forward-looking statements

contained in this presentation are made only of this date, and the Company is under no obligation to

revise or update these forward-looking statements.

forth in this presentation that are not historical facts are forward-looking statements that involve risks

and uncertainties that could cause actual results to differ materially from those in the forward-looking

statements, which may include, but are not limited to, such factors as unanticipated changes in

product demand, increased competition, downturns in the economy, failure to comply with specific

regulations pertaining to government projects, fluctuation of revenue due to the nature of project

lifecycles, and other information detailed from time to time in the Company filings and future filings

with the United States Securities and Exchange Commission. The forward-looking statements

contained in this presentation are made only of this date, and the Company is under no obligation to

revise or update these forward-looking statements.

Table of Contents

© 2012. All rights reserved.

3

• Strategic Vision

• Markets Focus

• Market Growth

• Expansion Plans

• Maximize Ranor Performance

Strategic Vision

4

Expand the Company revenue to $100-million plus in

the next 3 - 5 years; primarily through “organic

growth” with strategic customers/products in the

medical, defense, nuclear, alternative energy

markets and constant review of “inorganic growth”

through acquisition

the next 3 - 5 years; primarily through “organic

growth” with strategic customers/products in the

medical, defense, nuclear, alternative energy

markets and constant review of “inorganic growth”

through acquisition

© 2012. All rights reserved. Not for use or disclosure without the expressed written permission from TechPrecision Corp.

Strategic Vision

5

• Product Solution involves supplying the engineering, large-parts, small parts (mechanical

and electrical) in a complete/tested solution

and electrical) in a complete/tested solution

• Product Viability: Products must have long-term opportunity (>5-years) in order for the

Company to justify investments and support predictable growth/profitability

Company to justify investments and support predictable growth/profitability

Electro/Mechanical

Actuation Cylinder

Assembled and

Tested Assembly

Tested Assembly

Small Value-ad Parts

(Completed

Assembly)

(Completed

Assembly)

Support and Install

Frame (Completed

Assembly)

Frame (Completed

Assembly)

Sapphire Furnace

“Product Solution”

Solar Furnace

“Piece Part”

© 2012. All rights reserved. Not for use or disclosure without the expressed written permission from TechPrecision Corp.

Design

Machine

Fabrication

Electrical

Test

Strategic Production Solutions

© 2012. All rights reserved.

6

Nuclear Isotope and Fissile

(pending) Transport Casks

(pending) Transport Casks

Proton Beam

Cancer Treatment

Gantries

Carbon Black

Furnaces

GDEB/BAE: Multiple

Confidential Virginia Class

Product Assemblies

Confidential Virginia Class

Product Assemblies

Sapphire Furnaces

PolySi Furnaces

Diversified Market Growth

© 2012. All rights reserved.

7

Transitioned from a single-site operation with one customer representing ~65% of revenues to a

diversified platform, with growth opportunities in a variety of industries on two continents

diversified platform, with growth opportunities in a variety of industries on two continents

Medical: Exclusive

manufacturer of

Proton Beam Therapy

Device

manufacturer of

Proton Beam Therapy

Device

Nuclear: Reactor

components, fuel

storage and transport

casks

components, fuel

storage and transport

casks

Defense: Critical

and classified naval

product assemblies

and classified naval

product assemblies

Alternative energy:

Solar, Sapphire and

PolySi vacuum furnaces

PolySi vacuum furnaces

Aerospace:

Rocket Fuel

Domes and

Nozzles

Rocket Fuel

Domes and

Nozzles

Medical Device Market

© 2012. All rights reserved.

8

Medical products addressable market (Source: Espicom, 2010)

• TPCS has been exclusively producing equipment for Mevion Medical

Systems’ S250 cancer treatment unit

Systems’ S250 cancer treatment unit

• 1,000 unit sales projected for the United States (Source ProNova Solutions)

• Estimated Served Available Market (SAM) in US: $80-million/year

• Technology allows patients to be re-treated

• Radiotherapy CAGR 25% 2010 - 2020 (Source Journal of Clinical Oncology)

PBRT is Indicated over conventional

radiation treatment in:

radiation treatment in:

• Pediatric Cancer • Prostate Cancer

• Brain Tumors • Head & Neck Cancer

• Ocular Cancer • Lung Cancer

• Liver Cancer • Bone/Spinal Cancer

Conventional X-ray radiation therapy Proton therapy

Image of Mevion S250

Copyright Mevion Medical Systems

Source: ProNova Solutions

Nuclear Isotope

Transport Cask

• Resurgent markets:

• 6 U.S. plants under contract

• 52 China plants under contract

• 12 European plants in planning phase

• Nuclear addressable markets

• Estimated Served Available Market (SAM): $30-million/year

• New construction: new generation advanced-passive nuclear plant

construction required on a global basis ($9B - $14B/plant )

construction required on a global basis ($9B - $14B/plant )

• NCR has approved the AP1000/AP1400 Reactors

• Transport casks: NRC approved new isotope transport casks (fissile material in Q2 2013)

• Nuclear fabricators are few and far between

• Since 1980, 75% reduction in ASME N-stamp certificate holders in the US, 60% reduction

internationally

internationally

• Supply chain is critical path issue for reactor and casks suppliers

• Ranor remains one of few ASME N-stamp certified fabricators of high-

precision components to the nuclear industry

precision components to the nuclear industry

• Positioned to capture market share to meet current and projected demand for product

assemblies

assemblies

Nuclear Energy Market

© 2012. All rights reserved.

9

Defense & Aerospace Market

© 2012. All rights reserved.

10

• Navy addressable market

• Spending for new navy ships (313 ship fleet target) = $25B/year

• Block 4 NEW Submarine Program Scheduled for release in 2013

• Block 5 NEW Submarine Program target release 2015

• Aircraft Carriers “Ford” and “Kennedy” under construction

• Estimated Served Available Market (SAM): $40-million/year

• Product Solutions for multiple defense contractors

• Product assemblies and subassemblies for nuclear submarines

• Subassemblies for aircraft carriers

• Classified ITAR products for defense customers

• Large- and small-scale fuel cell domes for commercial

rocket booster cores

rocket booster cores

• Jet engine test equipment for large jet engine manufacturers

• Key supply chain relationships with several large defense contractors

Renewable Energy Market

© 2012. All rights reserved.

11

• Rapidly growing addressable market with strong long-term prospects

• Estimated Served Available Market (SAM): $30-million/year

• TechPrecision has produced more than 1,200 high temperature vacuum

chambers for the solar and sapphire markets

chambers for the solar and sapphire markets

• WCMC division provides the quality operation to deliver chambers for the

China and Asia Pacific markets

China and Asia Pacific markets

• Ranor division provides the quality operation to deliver chambers for

domestic requirements

domestic requirements

• Manufacture proprietary chambers for sapphire production

• Sapphire (LED) $9.4-billion 2011; 20% CAGR through 2016 *

• Future markets include consumer smart phones & tablets

• Manufacture proprietary chambers for the solar industry

• Solar forecasted growth: 22.7GW (2011) - 43.8GW (2015) **

• Expanding programs for high energy wave generation, hydro power and

next-generation wind turbine

next-generation wind turbine

• Renewable energy has strong long-term prospects

* Source: Strategies Unlimited, LED Magazine March 2012

** Source: IDC Energy Insights; December 13, 2011

Strategic Revenue Outlook/Market Growth

12

© 2012. All rights reserved. Not for use or disclosure without the expressed written permission from TechPrecision Corp.

13

3

Ø 20,625 sq. ft. with 50-Ton Crane 60-ft. under-hook

Ø IRB CapEx Plans: ~$6-7 million over 3-years

Ø Target Ground-breaking: Q1 FY2014

Ø Target Completion: Q4 FY2014

Ø Incremental Personnel: 48

Expansion Plans:

© 2012. All rights reserved. Not for use or disclosure without the expressed written permission from TechPrecision Corp.

14

© 2012. All rights reserved. Not for use or disclosure without the expressed written permission from TechPrecision Corp.

Ø South Carolina

Ø 68,000 sq. ft. with 50-Ton Crane 60-ft. under-hook

Ø Direct Water Access/Barge Shipment

Ø Feeder site for large-scale projects from Ranor

Ø Target Ground-breaking: FY2015

Ø IRB Financed CapEx: ~$10-12 million

Ø Incremental Personnel: 85

Ø All required Permits/Licenses received

Ø State provides Trained/Certified Personnel

Expansion Plans:

Maximizing Ranor’s Performance

© 2012. All rights reserved.

15

• Organization Changes

• New Operational Systems

• New KPI Systems

© 2012. All rights reserved.

16

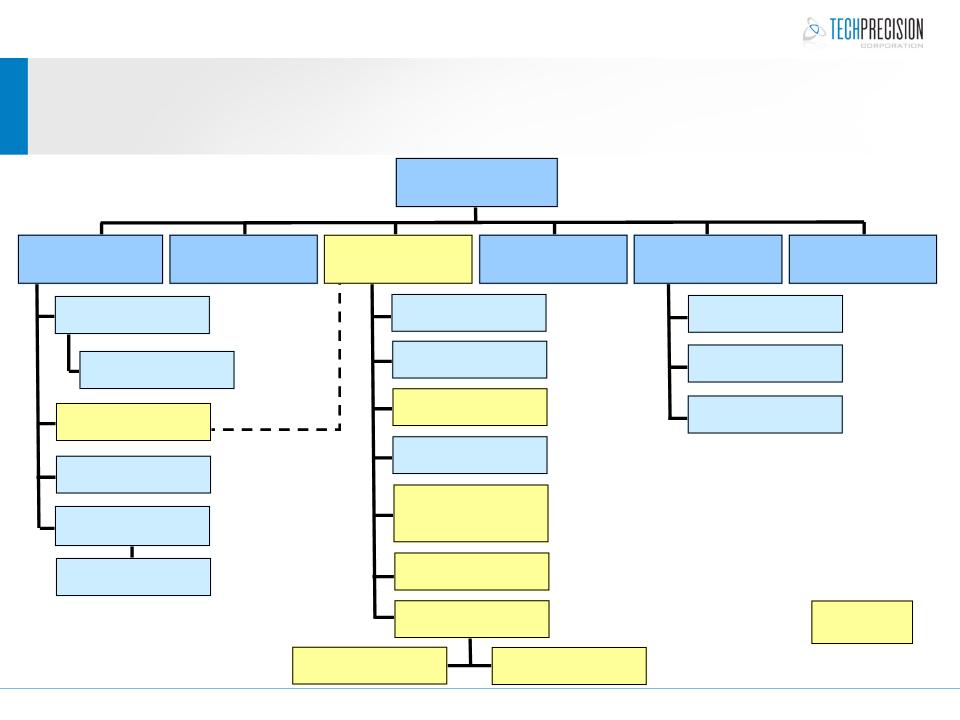

Organization Changes

James Molinaro

CEO

Rich Fitzgerald

CFO

Bob Francis

President, Ranor Inc.

Controller, Ranor Inc.

Finance Manager,

WCMC-Wuxi

Tax Accountant, WCMC

Machine Manager

Fabrication Manager

Sales Manager

Dir. of Quality

Engineering Manager

Materials Manager

(Purchasing, Planning &

Scheduling)

Scheduling)

Ken Stephens

Mngr, Nuclear Market

Bill Hogenauer

Dir. Business Devel.

Dir. Financial Reporting

Financial Plan & Analysis

Office Manager

Chris Poplaski

President, WCMC

Jiang Han

CBO - China

Position

Upgrade

Upgrade

PE Engineer: ASME

PE Engineer: N-Stamp

Director of Quality

Machine Manager

Fabrication Manager

Program Manager

Ranor Systems/Process Improvements

© 2012. All rights reserved.

17

New Operational Systems/Process implemented at Ranor:

•Management Quotation Approval

•ERP Implementation

•Order Entry Process

•Root Cause Correction Analysis

•Automated DL Entry

Ranor Systems/Process: Examples

© 2012. All rights reserved.

18

Management Quotation Approval: requires

all department managers review and approve

each quote before it is issued to the customer.

If a Purchase Order is received for the quoted

item; the Materials Cost, Direct Labor, Quality

Control and Engineering hours are then

entered as part of the ERP systems and the

Department Manager is accountable for

meeting and not exceeding the estimates that

he/she approved.

all department managers review and approve

each quote before it is issued to the customer.

If a Purchase Order is received for the quoted

item; the Materials Cost, Direct Labor, Quality

Control and Engineering hours are then

entered as part of the ERP systems and the

Department Manager is accountable for

meeting and not exceeding the estimates that

he/she approved.

Ranor Systems/Process: Examples

© 2012. All rights reserved.

19

ERP System: Ranor is now utilizing the ERP systems and its

modules to automate the manufacturing operations of the

business, including but not limited to:

modules to automate the manufacturing operations of the

business, including but not limited to:

•Production Scheduling

•Work-order/Routers

•Priority Dispatch Report: Fabrication

•Priority Dispatch Report: Machining

•Machine Scheduling

EXAMPLE ERP PRIORITY DISPATCH

EXAMPLE ERP MACHINE SCHEDULING

Ranor Operational KPI’s

© 2012. All rights reserved.

20

New Operational KPI’s implemented at Ranor:

•Monthly Project GM Reports (Estimates vs. Actual)

•Weekly Shipment Report

•Monthly on-time Shipment

•Monthly Safety Incident Reports

•Weekly Machine Utilization Hours

•Monthly Non-conformance Reports

•Monthly re-work costs

Ranor Operational KPI: Examples

© 2012. All rights reserved.

21

Weekly Machine Utilization Report: in

order to achieve the required

monthly/quarterly revenue increases

required from the backlog and Long Term

Agreements (LTA); Ranor needs to

increase the utilization hours of the

existing tools. Management is increases

the weekly/monthly utilization hours

required from each and every tool.

order to achieve the required

monthly/quarterly revenue increases

required from the backlog and Long Term

Agreements (LTA); Ranor needs to

increase the utilization hours of the

existing tools. Management is increases

the weekly/monthly utilization hours

required from each and every tool.

Summary

© 2012. All rights reserved.

22

Well positioned for the future - with strong momentum and

further upside:

further upside:

• Attractive and improving strategic end markets

• Growing innovation side-by-side with our Customers

• Strong penetration and positioning in developed markets with

significant potential in developing markets

significant potential in developing markets

Re-positioning of businesses to deliver sustainable results:

• Operational excellence, pricing, and innovation to deliver increased

margins, working capital efficiency, and improved Customer share of

wallet

margins, working capital efficiency, and improved Customer share of

wallet

Focused on cash generation

Disciplined capital allocation strategy to fund continued

investments in business, improve financial strength and

deliver returns to shareholders

investments in business, improve financial strength and

deliver returns to shareholders

Strategy and execution to realize value for shareholders

www.TechPrecision.com

www.ranor.com

www.wcmcsolutions.com