Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Bank of New York Mellon Corp | d447077d8k.htm |

December 5, 2012

Presented by:

Gerald

Hassell

–

Chairman

&

CEO

Todd

Gibbons

–

Chief

Financial

Officer

Exhibit 99.1

Goldman Sachs Financial Services Conference 2012 |

Goldman Sachs

Financial Services Conference 2012

Cautionary Statement

A number of statements in our presentations, the accompanying slides and the

responses to your questions are “forward- looking

statements.”

These

statements

relate

to,

among

other

things,

The

Bank

of

New

York

Mellon

Corporation’s

(the

“Corporation”) financial outlook and future financial results, including

statements with respect to market and economic outlook

and

the

Corporation's

growth

profile,

balance

sheet,

capital

and

culture;

priorities

in

a

challenging

operating

environment; driving organic revenue growth, including statements about Global

Collateral Services and building on our international presence; operational

excellence initiatives, including statements regarding business operations, technology and

corporate services initiatives, projected program savings and annualized targeted

savings; expectations regarding Basel III; statements regarding the

operating environment’s impact on revenue, including 4Q12 trends with respect to net interest

revenue, Corporate Trust and the Depositary Receipts market; expectations with

respect to returning capital to shareholders; and statements regarding the

Corporation's aspirations, as well as the Corporation’s overall plans, strategies, goals, objectives,

expectations, estimates, intentions, targets, opportunities and initiatives.

These forward-looking statements are based on assumptions that involve

risks and uncertainties and that are subject to change based on various important factors (some of

which are beyond the Corporation’s control).

Actual results may differ materially from those expressed or implied as a result of

the factors described under “Forward Looking Statements”

and “Risk Factors”

in the Corporation’s 2011 Annual Report on Form 10-K for the year ended

December 31, 2011, the “2011 Annual Report”, the Quarterly Reports

on Form 10-Q for the quarters ended June 30, 2012 and September 30, 2012

and in other filings of the Corporation with the Securities and Exchange Commission

(the “SEC”). Such forward-looking statements speak only

as of December 5, 2012, and the Corporation undertakes no obligation to update any forward-looking

statement to reflect events or circumstances after that date or to reflect the

occurrence of unanticipated events. Non-GAAP Measures: In this

presentation we will discuss some non-GAAP measures in detailing the Corporation’s

performance. We believe these measures are useful to the investment community

in analyzing the financial results and trends of ongoing operations.

We believe they facilitate comparisons with prior periods and reflect the principal basis on which our

management monitors financial performance. Additional disclosures relating to

non-GAAP measures are contained in the Appendix and in the

Corporation’s reports filed with the SEC, including the 2011 Annual Report and the

Quarterly

Report

on

Form

10-Q

for

the

quarter

ended

September

30,

2012,

available

at

www.bnymellon.com.

1 |

Goldman Sachs

Financial Services Conference 2012

Attractive Business Model

A leading manager and servicer of global financial assets

2

Growth

Profile

Deliver revenue growth in challenging markets, significant upside

in normalized markets

Operational

Excellence

Improve efficiency to increase margins, reduce operational risk and

deliver the highest service quality

Balance

Sheet

Highly liquid, excellent credit quality and strong capital position

Capital

Significant capital generation, disciplined capital deployment and

high returns on tangible equity

Culture

Collaborate across our businesses to power global investments for

our clients and shareholders |

Goldman Sachs

Financial Services Conference 2012

Investment Services

(36% non-U.S. Revenue)

•

Largest global custodian

•

Global

Collateral

Management

–

#1

•

Alternative

Investment

Services

–

#3

Fund

Administrator

•

Corporate

Trust

–

#1

~$11.6T

in

outstanding

debt

serviced

•

Depositary

Receipts

–

#1

>60%

market

share

•

Pershing

–

#1

clearing

firm

in

U.S.,

U.K.,

Ireland,

Australia

•

Treasury Services –

Top 5 global payments

Investment Management

(44% non-U.S. Revenue)¹

•

Asset

Management

–

#7

global

asset

manager

•

Wealth Management –

#8 U.S. wealth manager

Leading Manager and Servicer of Global Financial Assets

3

The global leader in

Investment Services,

~$27.9T AUC/A

LTM ended 9/30/12:

Revenue $9.9B

Pretax Income $2.6B

A leading global

Investment Manager,

~$1.4T AUM

LTM ended 9/30/12:

Revenue $3.6B

Pretax Income $1.0B

NOTES:

1 Non-U.S. revenue percentages are last twelve months (LTM) ended

9/30/12. Rankings reflect BNY Mellon's size in the markets in which it

operates and are based on internal data as well as BNY Mellon's knowledge of

those markets. For additional details regarding these rankings, see page 23

of the Quarterly Report on Form 10-Q for the quarter

ended September 30, 2012, available at

See Appendix for revenue and pretax income

reconciliation.

1

www.bnymellon.com/investorrelations. |

Goldman Sachs

Financial Services Conference 2012

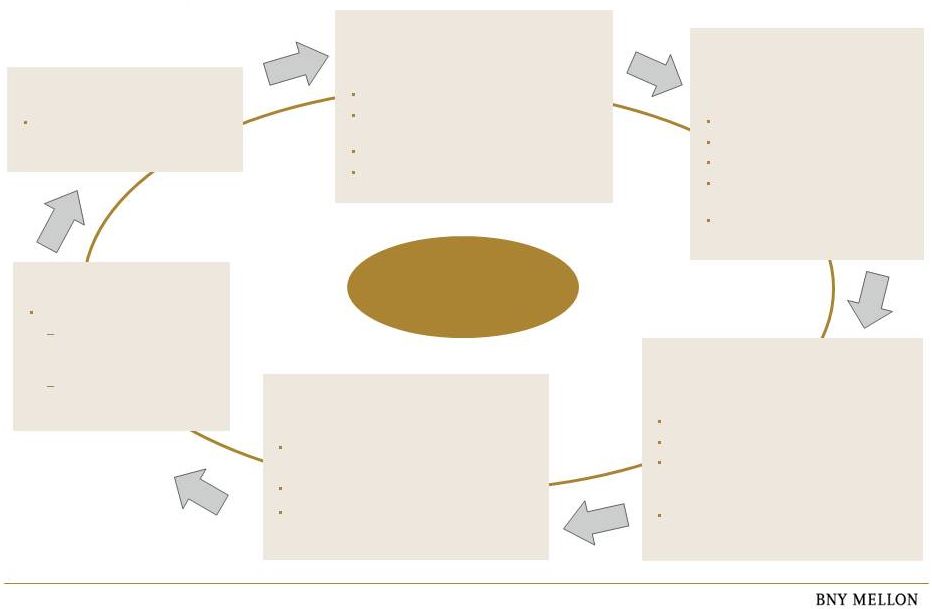

We are an Investments Company

Serving clients across and at any point in the investment life cycle

Investment

Life

Cycle

4

Depositary

Receipts

Broker-Dealer

Svcs.

Global Markets

Treasury Services

Asset

Servicing

Investment

Management

Investment

Management

Pershing

Corporate

Trust

Create

Assets

Trade

Assets

Hold

Assets

Manage

Assets

Distribute

Assets

Restructure

Assets |

Goldman Sachs

Financial Services Conference 2012

MANAGE

Investment Management

TRADE

Global Collateral Services,

Lending, Global Markets,

and Treasury Services

HOLD

Asset Servicing, Pershing,

Liquidity Services

CREATE

Corporate Trust, Depositary Receipts,

Capital Markets, Lending

DISTRIBUTE

Pershing, Liquidity Services

5

Spanning the Investment Life Cycle

A client example

RESTRUCTURE

Corporate Trust

Client Example:

Large Global

Financial Institution

RIA = Registered Investment Advisors

Debt Servicing globally

Depositary Receipts agent for “end”

client’s equity issuance

Debt underwriting

Secured lending

U.S. Domestic Clearance

Global collateral management

Secured financing

Currency hedging for alternative

investment funds

U.S. Cash Management for

broker/dealer funding operations

Custody and fund services

Check-writing for U.S. Operations

Administrative / operational support for

separately-managed accounts in client’s

wealth management business

Tri-party custody of initial margin for client’s

prime brokerage clients

Manage institutional and private wealth

assets:

Manage U.S. employee 401(k) assets

Overnight cash deposits invested via BNY

Mellon Cash Investment Strategies

Debt Servicing in the Americas,

EMEA and APAC for CDOs, CLOs,

and Re-securitizations

Distribute client’s:

Mutual funds via

Pershing’s extensive RIA

network

Money-market funds to

our Investment Servicing

clients |

Goldman Sachs

Financial Services Conference 2012

Challenging Operating Environment Persists

6

•

“Lower for longer”

macro environment

–

Interest rates and economic forecasts

•

Eurozone and U.S. “fiscal cliff”

concerns

•

De-risking

•

Lower trading volumes and volatility

•

Weak structured debt securitizations market

•

Cyclical headwinds for Depositary Receipts |

Goldman Sachs

Financial Services Conference 2012

Priorities in a Challenging Operating Environment

7

Organic Revenue Growth

•

Winning new business

•

Providing client solutions to address increasing regulation

•

Building on our international presence

•

Fostering culture of collaboration and innovation

Operational Excellence Initiatives

•

Targeting $650-$700MM in pre-tax savings for 2015

Strong and Liquid Balance Sheet

•

Excellent credit quality

•

Significant capital generation

•

Business model performs well under stress tests

•

Highest credit ratings among U.S. banks

Disciplined Capital Deployment

•

Investing in business

•

Returning capital to shareholders through share

repurchases and dividends

Deliver consistent EPS growth and return capital to shareholders

|

Goldman Sachs

Financial Services Conference 2012

Cumulative Assets Under Custody Wins

LTM ending 9/30/12

Driving Organic Revenue Growth

Continuing to win new business

($ billions)

Cumulative Long-Term Net Flows

LTM ending 9/30/12

($ billions)

8

$431

$884

$1,198

$1,720

$0

$500

$1,000

$1,500

$2,000

4Q11

1Q12

2Q12

3Q12

$16

$23

$49

$58

$0

$20

$40

$60

$80

4Q11

1Q12

2Q12

3Q12 |

Goldman Sachs

Financial Services Conference 2012

As of September 30, 2012

9

Global Collateral Services

By the Numbers

$2.0 trillion in global collateral

assets

$40 billion in derivatives collateral

assets

$100 billion in assets invested

through the Liquidity DIRECT

investment portal

$300 billion average daily

outstanding securities on loan

Driving Organic Revenue Growth

Global

Collateral

Services

–

client

solutions

to

address

increasing

regulation

SM

Hold /

Segregate /

Aggregate

Manage

Inventory /

Process

Transform

/

Finance

Transparency

/ Reporting

Collateral |

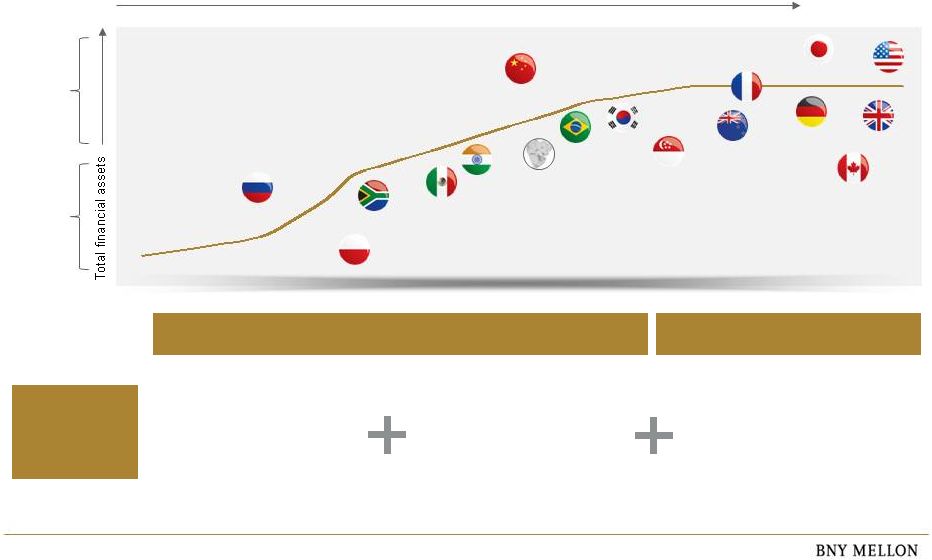

Goldman Sachs

Financial Services Conference 2012

BNY Mellon

Solutions

Emerging

Mature

Trade Finance

Cash & Credit

Depositary Receipts

Corporate Trust

Fund Administration

Asset Management

Asset Servicing

Wealth Management

Asset Management

Asset Servicing

Wealth Management

Clearing Services

Alternative Investment Services

Driving Organic Revenue Growth

Building on our international presence

China

Mexico

Russia

Brazil

Singapore

South Africa

US

UK

Japan

India

Germany

France

Poland

Gulf region

Maturity of market

Australia/NZ

$10-60T

$1-10T

Canada

South

Korea

SOURCE: McKinsey Global Banking Pools database

10 |

Goldman Sachs

Financial Services Conference 2012

Winning Through Collaboration and Innovation

Issuer & Treasury

Services

Investment

Management

•

Embed a culture of

ongoing collaboration

and innovation

–

Leverage our product

breadth to deliver value-

added client solutions

–

Realize revenue cross-

sell opportunities

–

Enhance operations and

technology efficiency

11

Clearing

Services

Asset

Servicing

Prime Custody

Operations Utility

System Consolidation

Global Collateral Services

D360

Leverage Corporate Infrastructure and Buying Power

Platforms –

RIA, DC, Managed Accts |

Goldman Sachs

Financial Services Conference 2012

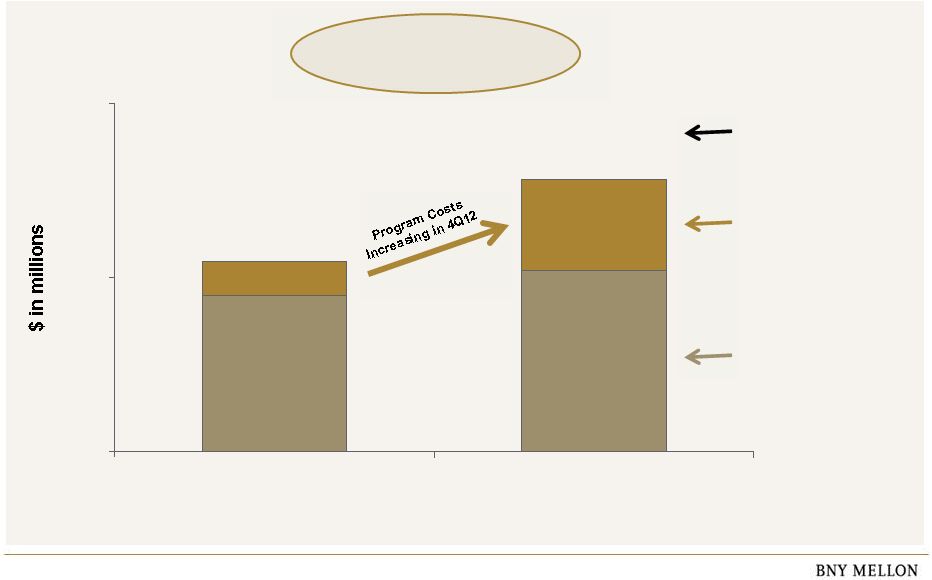

Operational Excellence Initiatives

Transforming Operations, Technology and Corporate Services

12

$0

$250

$500

Gross Savings

Program Costs

Net Savings

$223

$240

-

$260

$120 -

$130

$360

-

$390

Sept –

2012

YTD

2012

Target

$51

$274

Total Targeted Pre-tax Savings

for 2015: $650 -

$700MM |

Goldman Sachs

Financial Services Conference 2012

Continuing to Leverage Our Strengths

Strong capital generation and disciplined deployment

13

($ billions)

Basel I Tier 1 Common

60 –

65%

35 –

45%

20 –

25%

~68%

Share

Repurchases

Dividends

~45%

~23%

Tangible Capital

(cumulative)

9/30/12 YTD

Payout Ratio³

Target Annual

Payout Ratio

Payout Ratio

(as a % of Net Income)

CCAR 2012

Stress Test Results²

Growing capital…

Performing well in

stress tests…

Flexibility to

return capital…

1

BK

SOURCE: Federal Reserve –

CCAR 2012

Methodology and Results for Stress

Scenario Projections

0%

2%

4%

6%

8%

10%

12%

14%

Ally

STI

C

MET

KEYJPM

MS

USBGS

BACPNCWFCFITBBBT

RF

COF

AXPSTT

$0.6

$1.3

$1.8

$2.6

$0.0

$1.0

$2.0

$3.0

4Q11

1Q12

2Q12

LTM 3Q12

1 Represents a non-GAAP measure. See Appendix for a reconciliation.

Additional disclosure regarding this measure and other non-GAAP measures is available in

the

Corporation’s

reports

filed

with

the

SEC,

including

our

Form

10-Q

for

the

quarter

ended

September

30,

2012,

available

at

www.bnymellon.com/investorrelations.

2

Represents

minimum

stressed

ratios

with

all

proposed

capital

actions

through

Q4

2013

from

2012

Comprehensive

Capital

Analysis

and

Review

(CCAR).

3 9/30/12 YTD payout ratio reflects net income adjusted for the

impact of certain litigation expenses. |

Goldman Sachs

Financial Services Conference 2012

3,002

2,634

2,516

501

524

836

754

670

0

500

1,000

1,500

2,000

2,500

3,000

3,500

2005

2006

2007

2008

2009

2010

2011

YTD*

2012

6

7

8

9

10

Jul-12

Aug-12

Sep-12

Oct-12

Nov-12

0

100

200

300

400

500

600

2011

2012

Operating Environment: Continuing to Pressure Revenue

0.25

0.30

0.35

0.40

0.45

0.50

Jul-12

Aug-12

Sep-12

Oct-12

Nov-12

3-Month LIBOR (U.S.)

FX Volatility

FX Volatility

3Q12 Average

4Q12 Average

Source: Bloomberg (Deutsche Bank Index, Ticker = CVIX)

3-Month LIBOR (U.S.)

Source: Bloomberg (Ticker = US0003M)

Depositary Receipts (DR) Market Drivers

(DR Capital Raisings, Non-U.S. Market IPOs

& DR Corporate Actions)

Source: Renaissance Capital and internal company data; IPO threshold,

>US$100MM NOTE: Reflects volumes for Jan. 1 through Nov. 30

of 2011 and 2012. 14

Global Debt Issuance Volume

(ABS, MBS, CDOs & CLOs)

Source: Thomson Reuters * YTD = year-to-date (11/30/12)

NOTE: Reflects ABS, MBS, CDO and CLO issuances only.

474

338 |

Goldman Sachs

Financial Services Conference 2012

Our Business Model Drives Value

Broadest product breadth to deliver client solutions

Benefits from globalization and long-term growth of financial assets

Generates recurring core fee revenue that is less reliant on risk-

weighted asset growth

Generates significant levels of capital that can be returned to

shareholders

Strong relative performance in challenging markets; significant

upside when markets normalize

15 |

|

Appendix |

Goldman Sachs

Financial Services Conference 2012

BNY Mellon Peer Groups

Corporate 12-Member

Peer Group

Top 10 U.S. Banks

(by Market Capitalization)

American Express

BNY Mellon

Bank of America

Bank of America

BlackRock

Citigroup

Charles Schwab

JPMorgan Chase

Citigroup

Fifth Third

JPMorgan Chase

Northern Trust

Northern Trust

PNC Financial

PNC Financial

State Street

Prudential Financial

SunTrust

State Street

U.S. Bancorp

U.S. Bancorp

Wells Fargo

Wells Fargo

18 |

Goldman Sachs

Financial Services Conference 2012

Reconciliation Schedule

Business –

revenue and pretax income

($millions)

Revenue

4Q11

1Q12

2Q12

3Q12

LTM 3Q12

Investment Services

$2,415

$2,494

$2,488

$2,487

$9,884

Investment Management

$822

$907

$913

$924

$3,566

($millions)

Pretax Income

4Q11

1Q12

2Q12

3Q12

LTM 3Q12

Investment Services

$709

$699

$405

$756

$2,569

Investment Management

$190

$288

$271

$280

$1,029

Note:

Pre-tax metrics exclude the impact of historical intangible amortization.

LTM

= last twelve months ended 9/30/12

19 |

Goldman Sachs

Financial Services Conference 2012

Capital Ratio Definitions

Tier 1 Capital

Represents common shareholders’

equity (excluding certain components of

comprehensive

income)

and

qualifying

trust

preferred

securities,

adjusted

for

goodwill

and certain intangible assets, deferred tax liabilities associated with non-tax

deductible intangible assets and tax deductible goodwill, pensions,

securities valuation allowance, merchant banking investments and deferred

tax asset. Tier 1 Common Equity

Represents Tier 1 capital excluding qualifying trust preferred securities divided

by total risk weighted assets.

20 |

Goldman Sachs

Financial Services Conference 2012

Reconciliation Schedule

Tangible capital generation

($millions)

Tangible Net Income

4Q11

1Q12

2Q12

3Q12

LTM 3Q12

Net

income

–

continuing

operations¹

$505

$619

$466

$720

$2,310

Intangible amortization –

after-tax

66

61

61

60

248

Tangible Net Income

$571

$680

$527

$780

$2,558

1

Represents a non-GAAP measure. Additional disclosure regarding this and other

non-GAAP measures is available in the Corporation’s reports filed with the SEC,

including our current reports on Form 8-K filed on October 17, 2012 and October

19, 2012, particularly page 21 of Exhibit 99.1 (Earnings Review), available at

www.bnymellon.com/investorrelations.

21 |

Goldman Sachs

Financial Services Conference 2012

Reconciliation Schedule

Return on tangible common equity

($millions)

Net Income

2012 YTD

($millions)

Average Tangible

Common Equity

2012 YTD

Net income –

continuing operations¹

$1,805

Average common shareholder’s

equity

$34,123

Intangible amortization

182

Less: Average goodwill

17,941

Average intangible assets

5,023

Net Income applicable to common

shareholders

$1,987

Add: Tax deductible goodwill (DTL)

1,057

Non-tax deductible intangible

assets (DTL)

1,339

Average tangible common equity

$13,555

Return on tangible common equity (annualized) = 19.6%

1

Represents a non-GAAP measure. Additional disclosure regarding this and other

non-GAAP measures is available in the Corporation’s reports filed with the SEC,

including

our

current

reports

on

Form

10-Q

filed

for

quarter

ended

September

30,

2012,

available

at

www.bnymellon.com/investorrelations.

22 |

Goldman Sachs

Financial Services Conference 2012

$MM

2015

Investment Management

$40 -

$45

Investment Services

375 -

405

Total Business Operations

$415 -

$450

Technology / Corporate Services

235 -

250

Pre-tax Savings

$650 -

$700MM

Driving Operational Excellence

$650MM to $700MM of savings for 2015

23 |

Goldman Sachs

Financial Services Conference 2012

Financial Summary

2015

Program

Savings

•

Estimated

pre-tax

savings

of

$650

-

$700 MM

Calendar Year

Savings

•

2012: $240 –

$260 MM

•

2013: $400 –

$430 MM

•

2014: $535 –

$575 MM

Savings net of

program costs /

reinvestment

4Q11

Impact

•

$80-$100 MM of incremental expense

Driving Operational Excellence

Transforming Operations, Technology and Corporate Services

24 |