Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SUNTRUST BANKS INC | bodyof8-kgs12042012.htm |

Goldman Sachs Financial Services Conference December 4, 2012

2 Important Cautionary Statement About Forward-Looking Statements The following should be read in conjunction with the financial statements, notes and other information contained in the Company’s 2011 Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K. This presentation includes non-GAAP financial measures to describe SunTrust’s performance. The reconciliations of those measures to GAAP measures are provided within or in the appendix of this presentation. In this presentation, net interest income and net interest margin are presented on a fully taxable-equivalent (“FTE”) basis, and ratios are presented on an annualized basis. The FTE basis adjusts for the tax-favored status of income from certain loans and investments. The Company believes this measure to be the preferred industry measurement of net interest income and provides relevant comparison between taxable and non-taxable amounts. This presentation contains forward looking statements. Statements about the future direction of the loan portfolio, and efficiency ratio expectations and targets, are forward looking statements. Also, any statement that does not describe historical or current facts is a forward-looking statement. These statements often include the words “believes,” “expects,” “anticipates,” “estimates,” “intends,” “plans,” “goals,” “targets,” “initiatives,” “potential” or “potentially,” “probably,” “projects,” “outlook” or similar expressions or future conditional verbs such as “may,” “will,” “should,” “would,” and “could.” Such statements are based upon the current beliefs and expectations of management and on information currently available to management. Such statements speak as of the date hereof, and we do not assume any obligation to update these statements or to update the reasons why actual results could differ from those contained in such statements in light of new information or future events. Forward-looking statements are subject to significant risks and uncertainties. Investors are cautioned against placing undue reliance on such statements. Actual results may differ materially from those set forth in the forward-looking statements. Factors that could cause actual results to differ materially from those described in the forward-looking statements can be found in Item 1A of Part II of our 10-K and in other periodic reports that we file with the SEC. Those factors include: we may not achieve targeted level of expense reductions and efficiency goals; if in the future we incur additional loan losses, then we will need to record additional mortgage repurchase provision expense; if in the future we receive greater levels of mortgage repurchase requests than expected, then we may will need to record additional mortgage repurchase provision expense; difficult market conditions have adversely affected our industry; concerns over market volatility continue; the Dodd-Frank Act makes fundamental changes in the regulation of the financial services industry, some of which may adversely affect our business; we are subject to capital adequacy and liquidity guidelines and, if we fail to meet these guidelines, our financial condition would be adversely affected; emergency measures designed to stabilize the U.S. banking system are beginning to wind down; we are subject to credit risk; our ALLL may not be adequate to cover our eventual losses; we will realize future losses if the proceeds we receive upon liquidation of nonperforming assets are less than the carrying value of such assets; weakness in the economy and in the real estate market, including specific weakness within our geographic footprint, has adversely affected us and may continue to adversely affect us; weakness in the real estate market, including the secondary residential mortgage loan markets, has adversely affected us and may continue to adversely affect us; we are subject to certain risks related to originating and selling mortgages. We may be required to repurchase mortgage loans or indemnify mortgage loan purchasers as a result of breaches of representations and warranties, borrower fraud, or certain borrower defaults, which could harm our liquidity, results of operations, and financial condition; we are subject to risks related to delays in the foreclosure process; we may continue to suffer increased losses in our loan portfolio despite enhancement of our underwriting policies; as a financial services company, adverse changes in general business or economic conditions could have a material adverse effect on our financial condition and results of operations; changes in market interest rates or capital markets could adversely affect our revenue and expense, the value of assets and obligations, and the availability and cost of capital or liquidity; the fiscal and monetary policies of the federal government and its agencies could have a material adverse effect on our earnings; depressed market values for our stock may require us to write down goodwill; clients could pursue alternatives to bank deposits, causing us to lose a relatively inexpensive source of funding; consumers may decide not to use banks to complete their financial transactions, which could affect net income; we have businesses other than banking which subject us to a variety of risks; hurricanes and other natural or man-made disasters may adversely affect loan portfolios and operations and increase the cost of doing business; negative public opinion could damage our reputation and adversely impact business and revenues; the soundness of other financial institutions could adversely affect us; we rely on other companies to provide key components of our business infrastructure; we rely on our systems, employees, and certain counterparties, and certain failures could materially adversely affect our operations; we depend on the accuracy and completeness of information about clients and counterparties; regulation by federal and state agencies could adversely affect the business, revenue, and profit margins; competition in the financial services industry is intense and could result in losing business or margin declines; maintaining or increasing market share depends on market acceptance and regulatory approval of new products and services; we may not pay dividends on your common stock; disruptions in our ability to access global capital markets may negatively affect our capital resources and liquidity; any reduction in our credit rating could increase the cost of our funding from the capital markets; we have in the past and may in the future pursue acquisitions, which could affect costs and from which we may not be able to realize anticipated benefits; we are subject to certain litigation, and our expenses related to this litigation may adversely affect our results; we depend on the expertise of key personnel, and if these individuals leave or change their roles without effective replacements, our operations may suffer; we may not be able to hire or retain additional qualified personnel and recruiting and compensation costs may increase as a result of turnover, both of which may increase costs and reduce profitability and may adversely impact our ability to implement our business strategies; our accounting policies and processes are critical to how we report our financial condition and results of operations and require management to make estimates about matters that are uncertain; changes in our accounting policies or in accounting standards could materially affect how we report our financial results and condition; our stock price can be volatile; our disclosure controls and procedures may not prevent or detect all errors or acts of fraud; our financial instruments carried at fair value expose us to certain market risks; our revenues derived from our investment securities may be volatile and subject to a variety of risks; and we may enter into transactions with off-balance sheet affiliates or our subsidiaries. Goldman Sachs Financial Services Conference 12.4.12

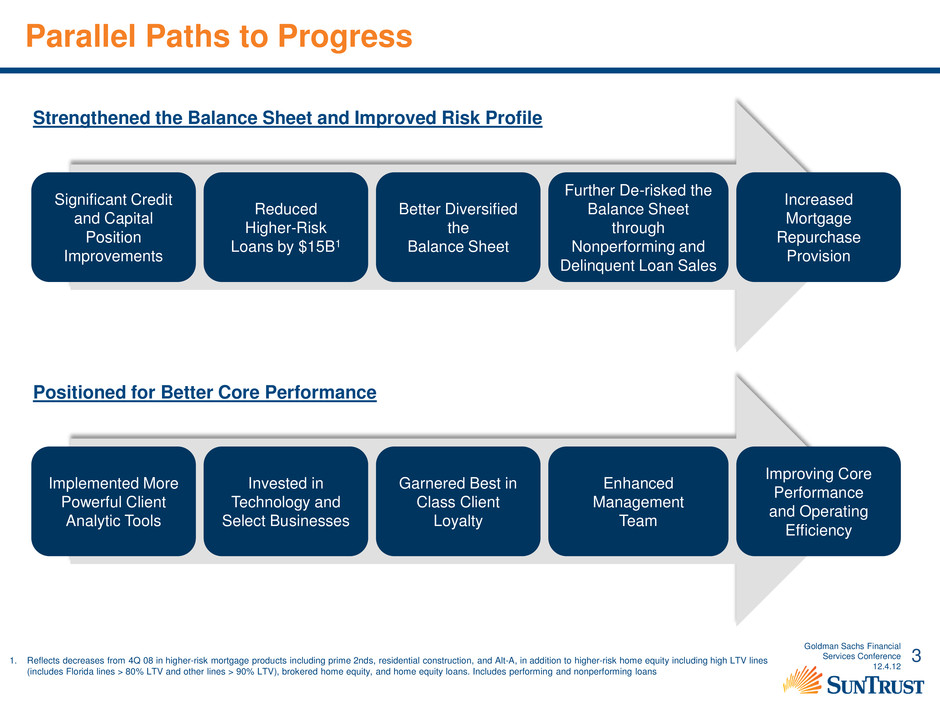

3 Parallel Paths to Progress Strengthened the Balance Sheet and Improved Risk Profile Positioned for Better Core Performance Significant Credit and Capital Position Improvements Reduced Higher-Risk Loans by $15B1 Better Diversified the Balance Sheet Further De-risked the Balance Sheet through Nonperforming and Delinquent Loan Sales Increased Mortgage Repurchase Provision Implemented More Powerful Client Analytic Tools Invested in Technology and Select Businesses Garnered Best in Class Client Loyalty Enhanced Management Team Improving Core Performance and Operating Efficiency 1. Reflects decreases from 4Q 08 in higher-risk mortgage products including prime 2nds, residential construction, and Alt-A, in addition to higher-risk home equity including high LTV lines (includes Florida lines > 80% LTV and other lines > 90% LTV), brokered home equity, and home equity loans. Includes performing and nonperforming loans Goldman Sachs Financial Services Conference 12.4.12

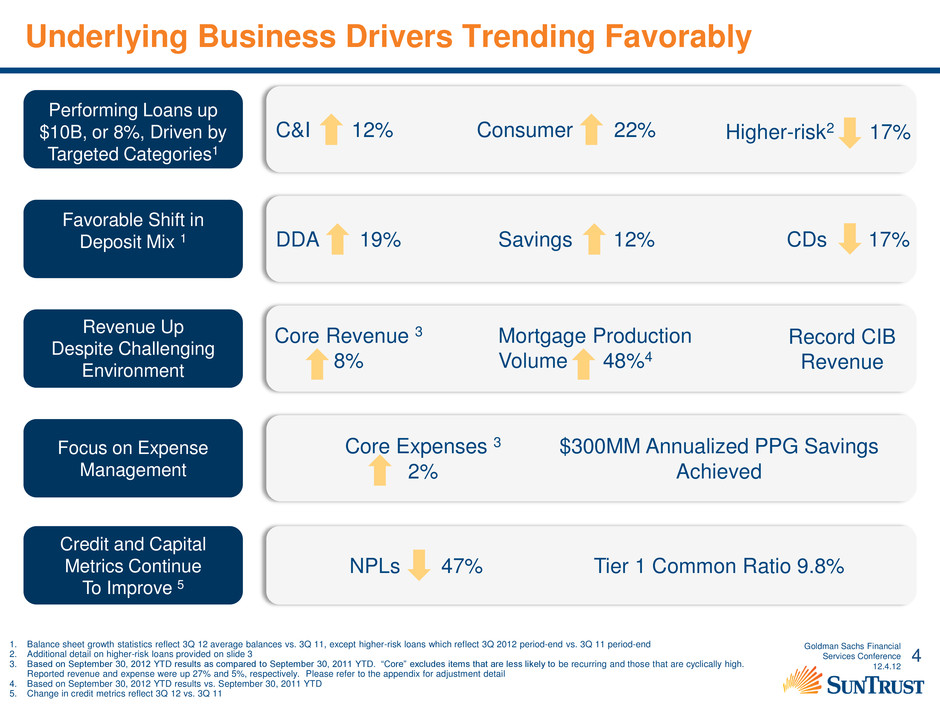

4 Underlying Business Drivers Trending Favorably Higher-risk2 17% CDs 17% Performing Loans up $10B, or 8%, Driven by Targeted Categories1 Favorable Shift in Deposit Mix 1 Revenue Up Despite Challenging Environment Focus on Expense Management Credit and Capital Metrics Continue To Improve 5 C&I 12% Consumer 22% DDA 19% Savings 12% Core Revenue 3 8% Mortgage Production Volume 48%4 Record CIB Revenue Tier 1 Common Ratio 9.8% $300MM Annualized PPG Savings Achieved NPLs 47% 1. Balance sheet growth statistics reflect 3Q 12 average balances vs. 3Q 11, except higher-risk loans which reflect 3Q 2012 period-end vs. 3Q 11 period-end 2. Additional detail on higher-risk loans provided on slide 3 3. Based on September 30, 2012 YTD results as compared to September 30, 2011 YTD. “Core” excludes items that are less likely to be recurring and those that are cyclically high. Reported revenue and expense were up 27% and 5%, respectively. Please refer to the appendix for adjustment detail 4. Based on September 30, 2012 YTD results vs. September 30, 2011 YTD 5. Change in credit metrics reflect 3Q 12 vs. 3Q 11 Core Expenses 3 2% Goldman Sachs Financial Services Conference 12.4.12

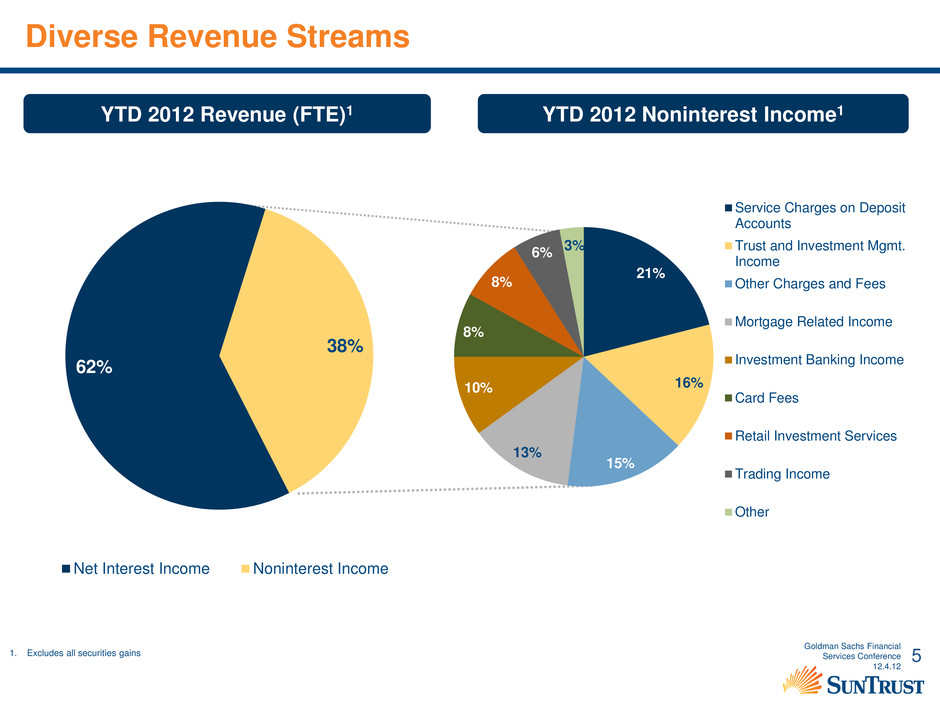

5 Diverse Revenue Streams YTD 2012 Revenue (FTE)1 YTD 2012 Noninterest Income1 1. Excludes all securities gains 62% 38% Net Interest Income Noninterest Income 21% 16% 15% 13% 10% 8% 8% 6% 3% Service Charges on Deposit Accounts Trust and Investment Mgmt. Income Other Charges and Fees Mortgage Related Income Investment Banking Income Card Fees Retail Investment Services Trading Income Other Goldman Sachs Financial Services Conference 12.4.12

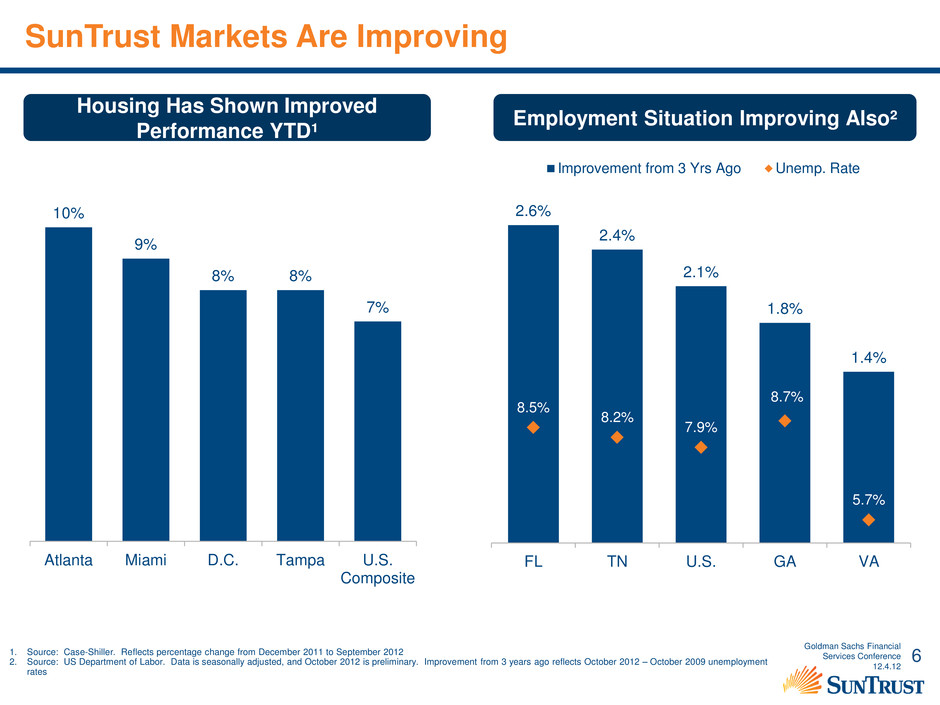

6 SunTrust Markets Are Improving Housing Has Shown Improved Performance YTD¹ Employment Situation Improving Also² 1. Source: Case-Shiller. Reflects percentage change from December 2011 to September 2012 2. Source: US Department of Labor. Data is seasonally adjusted, and October 2012 is preliminary. Improvement from 3 years ago reflects October 2012 – October 2009 unemployment rates 2.6% 2.4% 2.1% 1.8% 1.4% 8.5% 8.2% 7.9% 8.7% 5.7% FL TN U.S. GA VA Improvement from 3 Yrs Ago Unemp. Rate 10% 9% 8% 8% 7% Atlanta Miami D.C. Tampa U.S. Composite Goldman Sachs Financial Services Conference 12.4.12

7 Excellence in Execution Building a Performance Driven Culture Corporate Strategic Priorities Improve Efficiency Deepen Share of Wallet to Drive Market Share Optimize the Balance Sheet and Business Mix Goldman Sachs Financial Services Conference 12.4.12

8 Loan Portfolio at 12/31/09 Optimize the Balance Sheet and Business Mix Changing Composition – Decreases in Residential Real Estate and Increases in Commercial Categories 1. Consumer includes direct consumer loans (other than student guaranteed), consumer indirect loans and consumer credit cards 2. Guaranteed includes guaranteed student loans and guaranteed residential mortgages 3. Construction includes both commercial and residential construction Note: Totals may not foot due to rounding Loan Portfolio at 9/30/12 Future Direction of Loan Portfolio Goldman Sachs Financial Services Conference 12.4.12 Guaranteed² 9% Consumer ¹ 11% CRE + Construction ³ 5% Non Guaranteed Residential Mortgage + Home Equity 32% C&I 43% Guaranteed ² 3%Consumer ¹ 8% CRE + Construction ³ 12% Non Guaranteed Residential Mortgage + Home Equity 38% C&I 39% Guaranteed² Consumer ¹ CRE + Construction ³ Non Guaranteed Residential Mortgage + Home Equity C&I ~25 – 30% ~5 – 10% ~45 – 50% ~10 – 15% ~5%

9 Deepen Share of Wallet to Drive Market Share Client Segment Prioritization SunTrust Client Loyalty Sales Management Teammate Development Solutions Enhancements Determine Target Client Segments Prioritize Existing Clients First Align Resources Leverage Client Analytics Expand Client Planning Institutionalize Key Cross Segment Business Opportunities Increase Sales Productivity Enhance Training and Development Recruit Top Talent Modify Goals and Incentive Programs Address Product Gaps Develop Total Solutions Understand Where Clients Want To Transact Expand the Breadth and Depth of Client Relationships SIGNIFICANT SUNTRUST REVENUE OPPORTUNITY Goldman Sachs Financial Services Conference 12.4.12

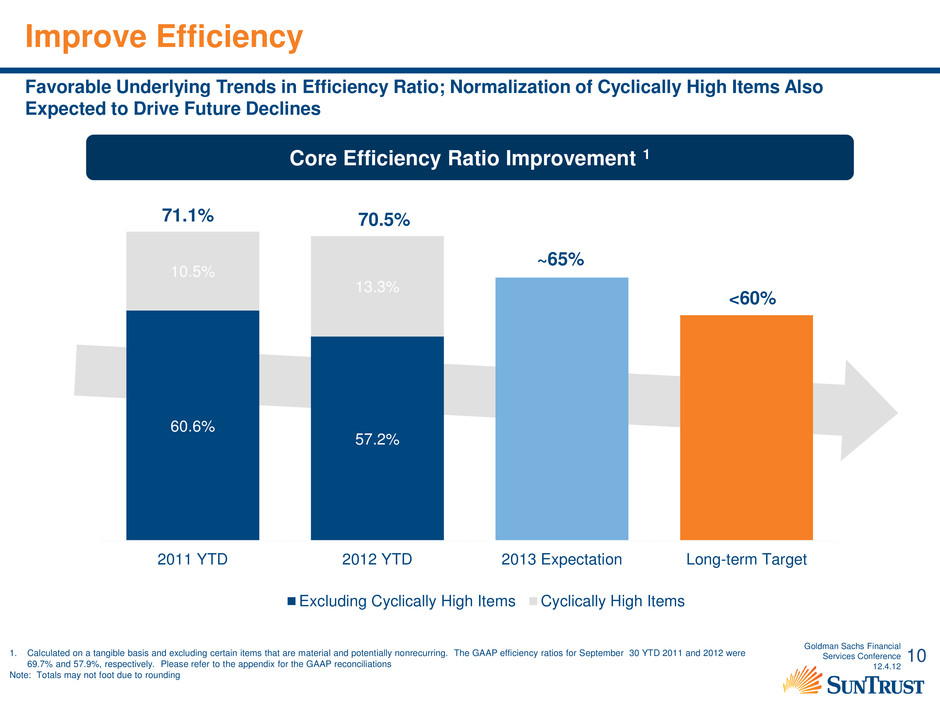

10 Improve Efficiency 71.1% 70.5% ~65% <60% Favorable Underlying Trends in Efficiency Ratio; Normalization of Cyclically High Items Also Expected to Drive Future Declines 1. Calculated on a tangible basis and excluding certain items that are material and potentially nonrecurring. The GAAP efficiency ratios for September 30 YTD 2011 and 2012 were 69.7% and 57.9%, respectively. Please refer to the appendix for the GAAP reconciliations Note: Totals may not foot due to rounding Core Efficiency Ratio Improvement 1 60.6% 57.2% 10.5% 13.3% 2011 YTD 2012 YTD 2013 Expectation Long-term Target Excluding Cyclically High Items Cyclically High Items Goldman Sachs Financial Services Conference 12.4.12

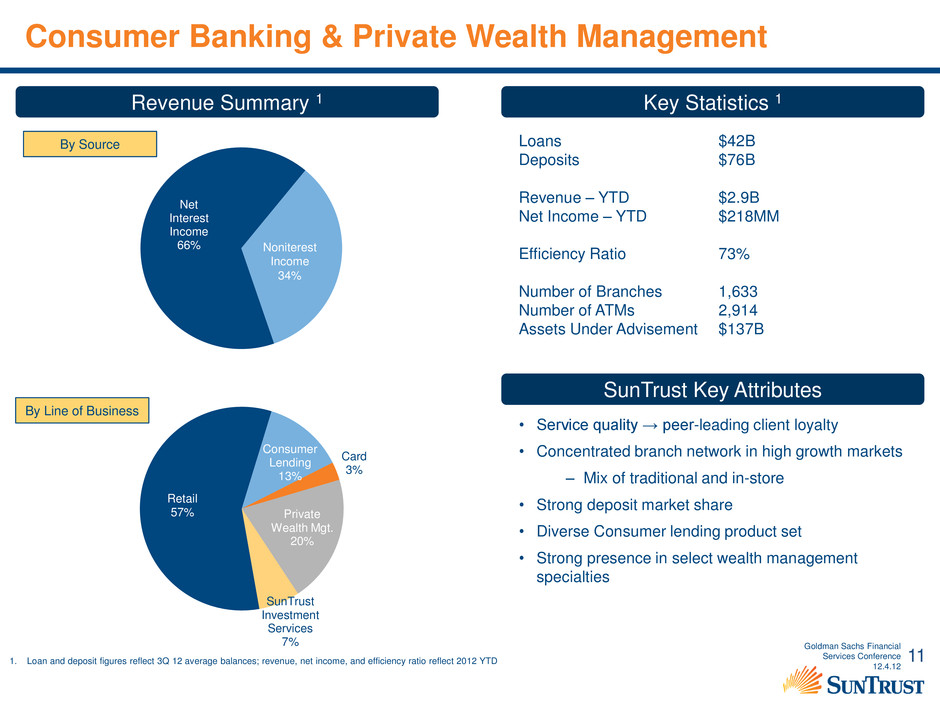

11 Net Interest Income 66% Consumer Banking & Private Wealth Management Revenue Summary 1 Key Statistics 1 SunTrust Key Attributes Loans $42B Deposits $76B Revenue – YTD $2.9B Net Income – YTD $218MM Efficiency Ratio 73% Number of Branches 1,633 Number of ATMs 2,914 Assets Under Advisement $137B 1. Loan and deposit figures reflect 3Q 12 average balances; revenue, net income, and efficiency ratio reflect 2012 YTD • Service quality → peer-leading client loyalty • Concentrated branch network in high growth markets – Mix of traditional and in-store • Strong deposit market share • Diverse Consumer lending product set • Strong presence in select wealth management specialties By Line of Business By Source Noniterest Income 34% Goldman Sachs Financial Services Conference 12.4.12 Retail 57% Consumer Lending 13% Card 3% Private Wealth Mgt. 20% SunTrust Investment Services 7%

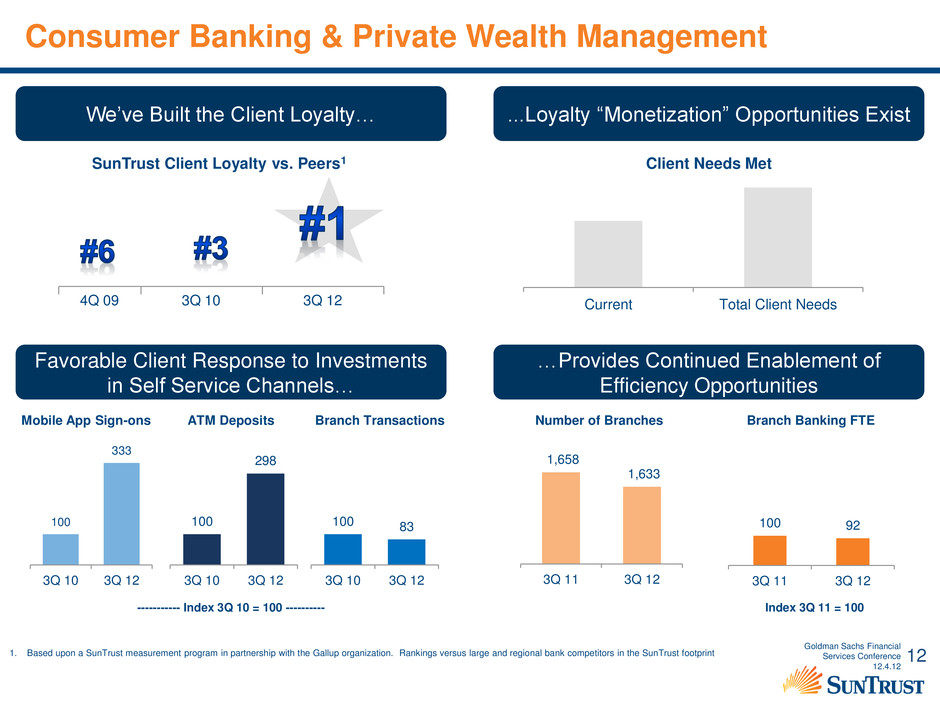

12 Consumer Banking & Private Wealth Management We’ve Built the Client Loyalty… ...Loyalty “Monetization” Opportunities Exist Favorable Client Response to Investments in Self Service Channels… …Provides Continued Enablement of Efficiency Opportunities Current Total Client Needs Client Needs Met 1. Based upon a SunTrust measurement program in partnership with the Gallup organization. Rankings versus large and regional bank competitors in the SunTrust footprint 100 333 3Q 10 3Q 12 Mobile App Sign-ons Branch Transactions 1,658 1,633 3Q 11 3Q 12 Number of Branches Branch Banking FTE ATM Deposits 100 298 3Q 10 3Q 12 ----------- Index 3Q 10 = 100 ---------- Index 3Q 11 = 100 100 92 3Q 11 3Q 12 SunTrust Client Loyalty vs. Peers1 4Q 09 3Q 10 3Q 12 100 83 3Q 10 3Q 12 Goldman Sachs Financial Services Conference 12.4.12

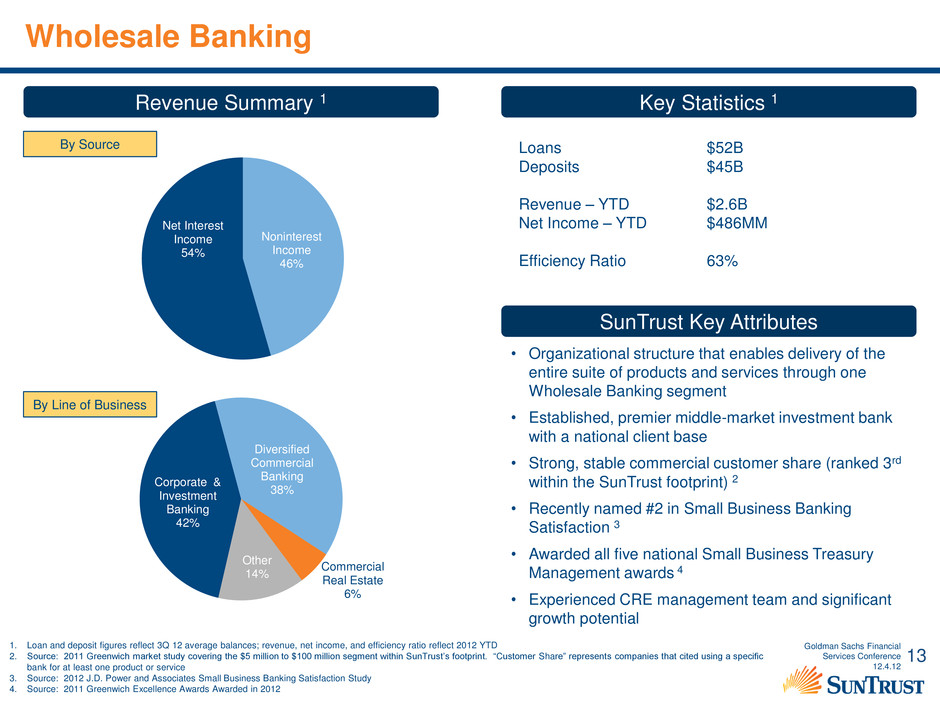

13 Revenue Summary 1 Key Statistics 1 SunTrust Key Attributes Loans $52B Deposits $45B Revenue – YTD $2.6B Net Income – YTD $486MM Efficiency Ratio 63% 1. Loan and deposit figures reflect 3Q 12 average balances; revenue, net income, and efficiency ratio reflect 2012 YTD 2. Source: 2011 Greenwich market study covering the $5 million to $100 million segment within SunTrust’s footprint. “Customer Share” represents companies that cited using a specific bank for at least one product or service 3. Source: 2012 J.D. Power and Associates Small Business Banking Satisfaction Study 4. Source: 2011 Greenwich Excellence Awards Awarded in 2012 • Organizational structure that enables delivery of the entire suite of products and services through one Wholesale Banking segment • Established, premier middle-market investment bank with a national client base • Strong, stable commercial customer share (ranked 3rd within the SunTrust footprint) 2 • Recently named #2 in Small Business Banking Satisfaction 3 • Awarded all five national Small Business Treasury Management awards 4 • Experienced CRE management team and significant growth potential Corporate & Investment Banking 42% Diversified Commercial Banking 38% Commercial Real Estate 6% Other 14% Wholesale Banking By Source By Line of Business Noninterest Income 46% Net Interest Income 54% Goldman Sachs Financial Services Conference 12.4.12

14 Wholesale Banking DIVERSIFIED COMMERCIAL BANKING CORP. & INVESTMENT BANKING COMMERCIAL REAL ESTATE Strong Track Record Established, Opportunity to Continue to Grow Proven Revenue Generating Model – Hiring Top Talent and Improving Productivity Leveraging Client Loyalty and Planning Analytics to Deepen Wallet Share Loans Stabilized in 2012 – Pursuing Targeted Growth Opportunities Solidly Profitable Business with Growth Opportunities Previously in Loss Mitigation Mode – Now Focusing on Profitable Growth 1. 2012 figures are YTD annualized as of September 30, 2012. 2012 CRE net income excludes the $60 million tax effected impact of the 3Q 2012 affordable housing write-down 2. 2012 figure is YTD annualized as of September 30, 2012 3. Represents Commercial Banking client penetration, which is tracked by determining the percentage of clients that utilize 50% or more of the predetermined product categories 4. YTD average loan balance as of September 30, 2012 ($ in m ill io n s ) ($ in m ill io n s ) ($ in m ill io n s ) 2011 2014 Goal Client Penetration Goal ³ $(591) $(329) $(311) $(148) 2009 2010 2011 2012 Net Income ¹ $222 $234 $246 $282 2009 2010 2011 2012 Net Income ¹ $163 $356 $403 $548 2009 2010 2011 2012 Net Income ¹ ($ in t h o u s a n d s ) ² $948 $1,483 2008 2012 Revenue Per FTE $12.5 $9.7 $7.0 $5.8 4 ($ in b ill io n s ) $7.0 $5.4 $4.6 $4.6 $5.5 $4.3 $2.4 $1.2 2009 2010 2011 2012 CRE Average Loan Balances Excluding Special Assets Average Special Assets Division Loan Balances Goldman Sachs Financial Services Conference 12.4.12

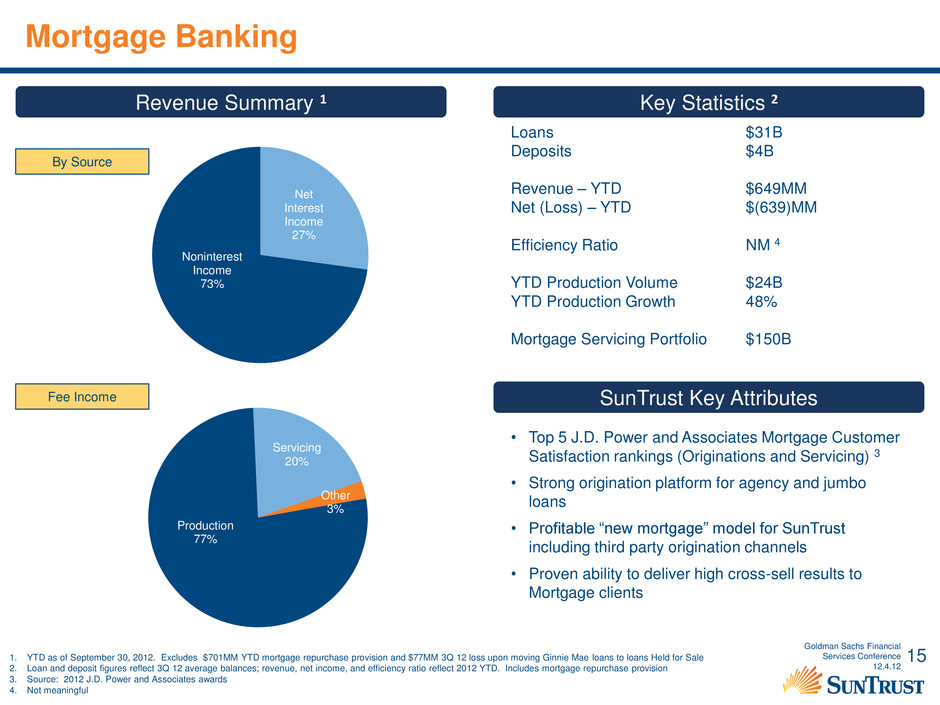

15 Production 77% Servicing 20% Other 3% Mortgage Banking Revenue Summary 1 Key Statistics 2 SunTrust Key Attributes 1. YTD as of September 30, 2012. Excludes $701MM YTD mortgage repurchase provision and $77MM 3Q 12 loss upon moving Ginnie Mae loans to loans Held for Sale 2. Loan and deposit figures reflect 3Q 12 average balances; revenue, net income, and efficiency ratio reflect 2012 YTD. Includes mortgage repurchase provision 3. Source: 2012 J.D. Power and Associates awards 4. Not meaningful • Top 5 J.D. Power and Associates Mortgage Customer Satisfaction rankings (Originations and Servicing) 3 • Strong origination platform for agency and jumbo loans • Profitable “new mortgage” model for SunTrust including third party origination channels • Proven ability to deliver high cross-sell results to Mortgage clients By Source Fee Income Net Interest Income 27% Noninterest Income 73% Loans $31B Deposits $4B Revenue – YTD $649MM Net (Loss) – YTD $(639)MM Efficiency Ratio NM 4 YTD Production Volume $24B YTD Production Growth 48% Mortgage Servicing Portfolio $150B Goldman Sachs Financial Services Conference 12.4.12

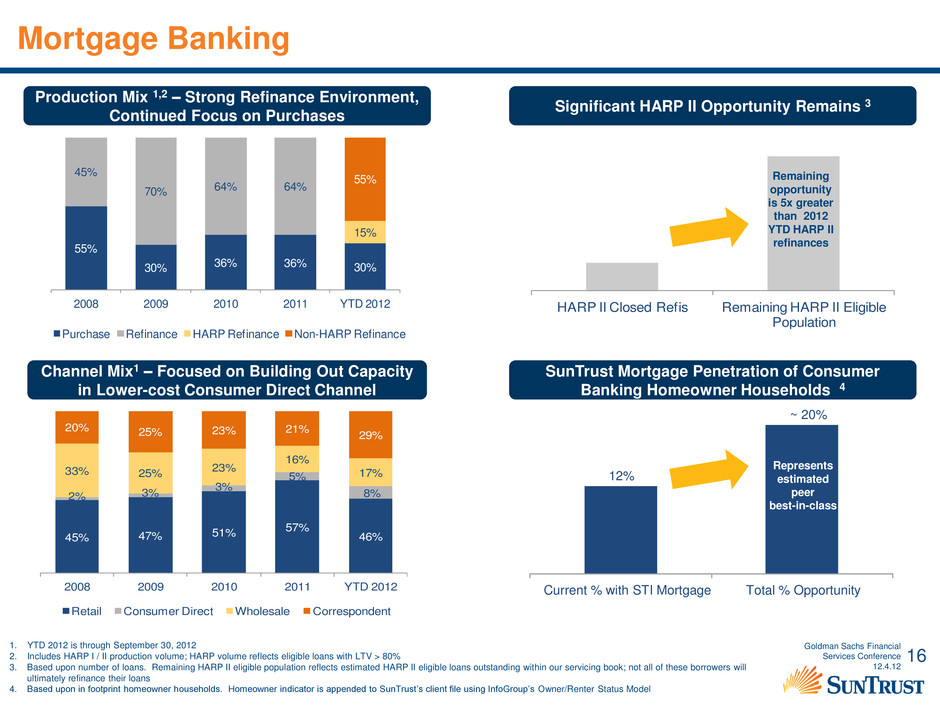

16 Mortgage Banking 1. YTD 2012 is through September 30, 2012 2. Includes HARP I / II production volume; HARP volume reflects eligible loans with LTV > 80% 3. Based upon number of loans. Remaining HARP II eligible population reflects estimated HARP II eligible loans outstanding within our servicing book; not all of these borrowers will ultimately refinance their loans 4. Based upon in footprint homeowner households. Homeowner indicator is appended to SunTrust’s client file using InfoGroup’s Owner/Renter Status Model Channel Mix1 – Focused on Building Out Capacity in Lower-cost Consumer Direct Channel Production Mix 1,2 – Strong Refinance Environment, Continued Focus on Purchases SunTrust Mortgage Penetration of Consumer Banking Homeowner Households 4 Significant HARP II Opportunity Remains 3 45% 47% 51% 57% 46% 2% 3% 3% 5% 8% 33% 25% 23% 16% 17% 20% 25% 23% 21% 29% 2008 2009 2010 2011 YTD 2012 Retail Consumer Direct Wholesale Correspondent HARP II Closed Refis Remaining HARP II Eligible Population Remaining opportunity is 5x greater than 2012 YTD HARP II refinances 55% 30% 36% 36% 30% 45% 70% 64% 64% 15% 55% 2008 2009 2010 2011 YTD 2012 Purchase Refinance HARP Refinance Non-HARP Refinance Represents estimated peer best-in-class Goldman Sachs Financial Services Conference 12.4.12 12% ~ 20% Current % with STI Mortgage Total % Opportunity Represents estimated peer best-in-class

17 SunTrust’s Advantageous Position Improving Operating Leverage Improving Credit Quality Improving Markets • Housing prices and employment improving • Strong population and income growth projected • NPLs and NCOs down significantly from their peaks • Continued improvement expected • Core performance trends have been favorable • Cyclically–high items expected to abate Goldman Sachs Financial Services Conference 12.4.12

Appendix

19 Reconciliation of Non-GAAP Items 1. Adjusted revenue and expenses are provided as they remove certain items that are material and potentially non-recurring. Adjusted figures are intended to provide management and investors information on trends that may be more easily compared to other institutions Note: Totals may not foot due to rounding ($ millions) Sept. 30 YTD % 2011 2012 Growth Reported (GAAP) Basis Total Revenue - FTE $6,553 $8,307 27% Total Noninterest Expense 4,567 4,813 5% Amortization of Intangibles / Impairment of Goodwill 34 39 Efficiency Ratio 69.7% 57.9% Tangible Efficiency Ratio 69.2% 57.5% Adjusted Basis 1 Reported Revenue $6,553 $8,307 Adjustment Items: Securities Gains 98 1,973 3Q 12 Student and Ginnie Mae Loan Sale (Losses) 0 (92) Fair Market Value Adjustments (4) 5 STI Debt Valuation 62 (58) SunTrust Index-linked CDs (SILC) 10 (13) Auction Rate Securities 17 3 Fair Value Adjustments (8) 10 Adjusted Revenue $6,379 $6,480 2% Reported Noninterest Expense $4,567 $4,813 Adjustment Items: Affordable Housing Writedown 0 96 Charitable Contribution of KO Shares 0 38 Real Estate Charge 0 17 Goodwill Impairment 0 7 (Gain) / Loss on Debt Extinguishment (3) 15 Severance 0 40 Adjusted Expense $4,570 $4,601 1% Efficiency Ratio - Adjusted Basis 71.6% 71.0% Tangible Efficiency Ratio - Adjusted Basis 71.1% 70.5% Goldman Sachs Financial Services Conference 12.4.12

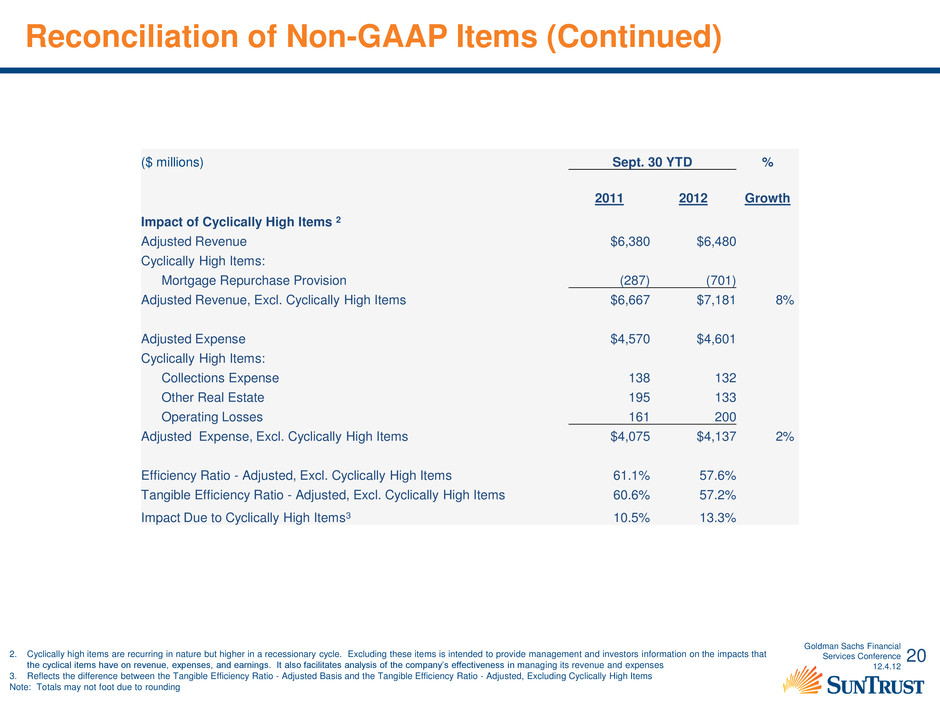

20 Reconciliation of Non-GAAP Items (Continued) 2. Cyclically high items are recurring in nature but higher in a recessionary cycle. Excluding these items is intended to provide management and investors information on the impacts that the cyclical items have on revenue, expenses, and earnings. It also facilitates analysis of the company’s effectiveness in managing its revenue and expenses 3. Reflects the difference between the Tangible Efficiency Ratio - Adjusted Basis and the Tangible Efficiency Ratio - Adjusted, Excluding Cyclically High Items Note: Totals may not foot due to rounding ($ millions) Sept. 30 YTD % 2011 2012 Growth Impact of Cyclically High Items 2 Adjusted Revenue $6,380 $6,480 Cyclically High Items: Mortgage Repurchase Provision (287) (701) Adjusted Revenue, Excl. Cyclically High Items $6,667 $7,181 8% Adjusted Expense $4,570 $4,601 Cyclically High Items: Collections Expense 138 132 Other Real Estate 195 133 Operating Losses 161 200 Adjusted Expense, Excl. Cyclically High Items $4,075 $4,137 2% Efficiency Ratio - Adjusted, Excl. Cyclically High Items 61.1% 57.6% Tangible Efficiency Ratio - Adjusted, Excl. Cyclically High Items 60.6% 57.2% Impact Due to Cyclically High Items3 10.5% 13.3% Goldman Sachs Financial Services Conference 12.4.12