Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Travelport LTD | d448444d8k.htm |

1

Full Year and Q3 2012 highlights and

business update

Gordon Wilson, President and CEO

Travelport

Exhibit 99.1 |

2

Travelport is executing its strategic plan

•

Financial Performance is in line with management expectations and is trending

positively: –

–

Gross

Margin

-

four

consecutive

quarters

of

growth

–

Continued

strong

cash

flow

generation

–

YTD

September

cash

flows

from

operations

improved

by

+56%

from

$86m to $134m

–

In compliance with all financial covenants as of September 30, 2012

•

Strategic

plan

is

being

executed

in

content,

product,

technology

and

adjacency

business

growth:

–

Signed significant new technology and hosting agreement with Japan’s leading

GDS, expanded co-operation with China’s leading GDS

–

Acquired and integrated Southern Africa franchise and expanded into new African

regions –

–

Gaining real traction in BtoB travel payments through eNett

–

Increased

deployment

of

new

Point-of-Sale

technology

–

desktop

and

mobile

–

Enhanced on-going technology investment program with new IBM hardware and

software agreement –

Signed and converted high profile travel agencies across all regions

(1)

Excluding the effects of the loss of the United MSA and foreign exchange.

(1)

RevPas - six consecutive quarters of growth Demonstrated

significant growth in Hotel, Merchandising and Rail content |

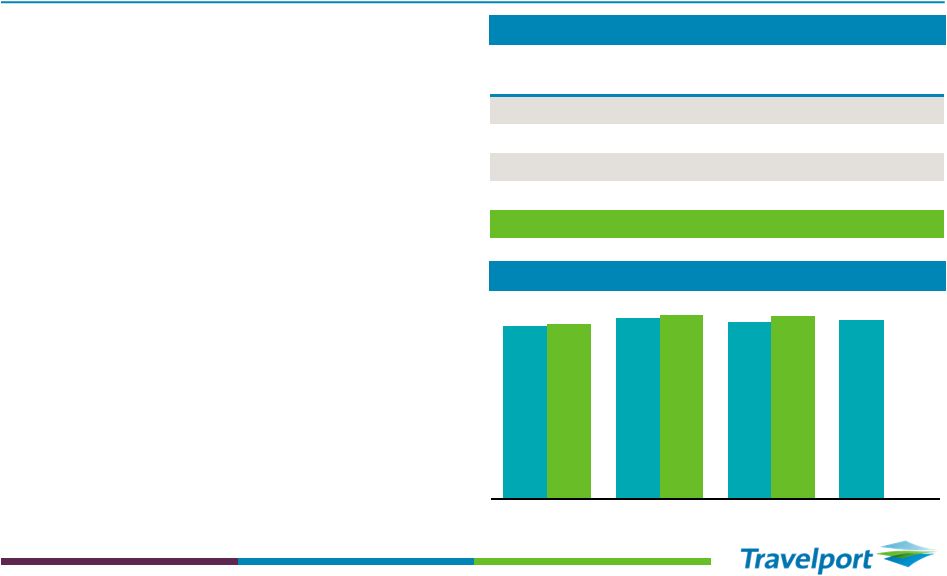

3

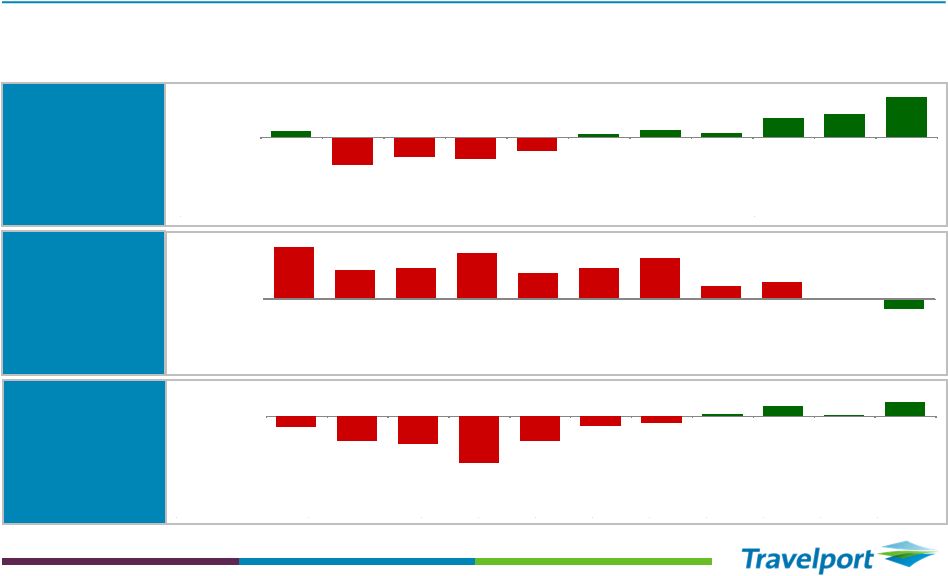

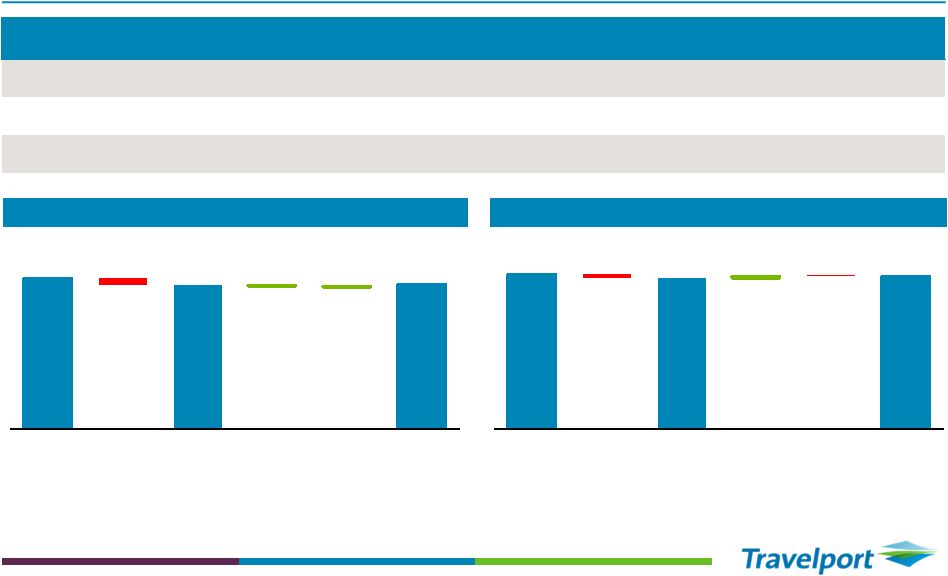

Key performance metrics

Note:

RevPas is calculated as transaction processing revenue divided by the number of available

segments. (1)

Year on Year movement excludes the impact of the loss of the United MSA.

(2)

Gross Margin is defined as Total Revenue less Commissions.

Q1 2010

Q2 2010

Q3 2010

Q4 2010

Q1 2011

Q2 2011

Q3 2011

Q4 2011

Q1 2012

Q2 2012

Q3 2012

RevPas

$5.06

$5.23

$5.10

$5.18

$5.01

$5.24

$5.13

$5.19

$5.08

$5.34

$5.30

Year on Year

$0.03

$(0.12)

$(0.08)

$(0.09)

$(0.06)

$0.01

$0.03

$0.02

$0.08

$0.10

$0.17

1%

(2)%

(2)%

(2)%

(1)%

0%

1%

0%

2%

2%

3%

Q1 2010

Q2 2010

Q3 2010

Q4 2010

Q1 2011

Q2 2011

Q3 2011

Q4 2011

Q1 2012

Q2 2012

Q3 2012

COR Per Segment

$2.37

$2.46

$2.45

$2.52

$2.48

$2.60

$2.64

$2.58

$2.56

$2.63

$2.63

Year on Year

$0.21

$0.13

$0.14

$0.20

$0.12

$0.14

$0.19

$0.06

$0.08

$0.00

(1)

$(0.05)

(1)

10%

6%

6%

9%

5%

6%

8%

2%

3%

0%

(1)

(2)%

(1)

RevPas

Year on Year

Growth (Decline)

(2)%

(6)%

(7)%

(11)%

(6)%

(2)%

(2)%

0%

2%

0%

(1)

3%

(1)

Q1 2010

Q2 2010

Q3 2010

Q4 2010

Q1 2011

Q2 2011

Q3 2011

Q4 2011

Q1 2012

Q2 2012

Q3 2012

Gross Margin

$309

$297

$275

$255

$291

$291

$271

$256

$297

$275

$262

Year on Year

$(8)

$(18)

$(20)

$(32)

$(18)

$(7)

$(4)

$1

$7

$1

(1)

$9

(1)

)

Gross Margin ear on Year Growth (Decline)

Gross Margin

(2)

Year on Year

Growth (Decline)

COR Rate

Year on Year

Growth (Decline)

•

2012 revenue per average segment (“RevPas”) growth trajectory follows 2011

priority investment program •

Continued cost of revenue (“COR”) reduction follows product innovation and

increasing customer adoption •

Consecutive quarterly Gross Margin improvement since end 2010; Seventh

consecutive quarter of Gross Margin improvement |

4

Full year and Q3 highlights

Q3 2012

Better/(Worse)

than

prior year

Proforma

(1)

Better/(Worse)

than prior year

Net revenue

489

(20)

4

Adj. EBITDA

106

(12)

–

Cash flow from

continuing operations

6

18

N/A

Sep YTD 2012

Better/(Worse)

than

prior year

Proforma

(1)

Better/(Worse)

than prior year

Net revenue

1,545

(25)

20

Adj. EBITDA

366

(35)

(7)

Cash flow from

continuing operations

134

48

N/A

Note:

Adjusted EBITDA is defined as EBITDA adjusted to exclude the impact of purchase accounting, impairment

of goodwill and intangibles assets, expenses incurred to acquire and integrate Travelport’s portfolio of

businesses, costs associated with Travelport’s restructuring efforts, non-cash

equity-based compensation, and other adjustments made to exclude expenses management views as outside the normal course of

operations.

(1)

Proforma

variance

is

stated

excluding

the

effects

of

the

loss

of

the

United

MSA

and

foreign

exchange.

•

Global Industry

–

Modest growth in global travel trends with Q3 air

segment volumes +1% YoY amid continued

macroeconomic uncertainty

–

YTD volumes +2% YoY

•

Travelport

–

Q3

volume

(2)%

and

Q3

Net

Revenue

+1%

YoY

(1)

YTD

volume

flat

and

YTD

Net

Revenue

+1%

YoY

(1)

–

Driven largely by geographic footprint

–

Q3 RevPas +3% YoY

–

Driven by growth in hotel distribution,

advertising, travel agency product sales and

merchandising

–

Adjusted EBITDA +$5m in Q3 excluding the impact

of the loss of the United MSA |

5

Continued strategic execution

•

Enhanced Travel Content

–

Hotel

–

Content more than tripled

–

340k unique hotel properties

–

~900k room offers

–

Air

–

29 air agreements signed YTD

–

New agreements include:

–

Merchandizing milestones include:

–

Car

–

Launched

Travelport

Drive

Me™

in

APAC

–

Signed new content agreement with Italian car

park provider, ParkinGo

–

Rail

–

New uAPI agreement with thetrainline.com

–

Partnership agreement with Rail Europe

–

Innovative content agreement with NTV (Italy)

Americas: Aeromexico, Air Canada

Europe: easyJet, Lufthansa, TAP Portugal

MEA: South African Airways, Gulf Air, PIA

APAC: Air China, China Southern, Qantas

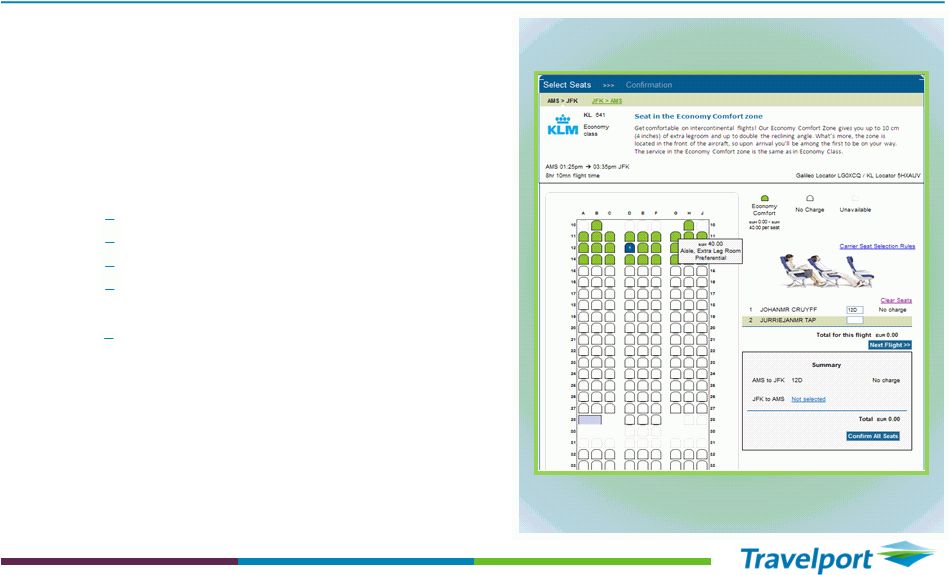

Air Canada, Delta Airlines, easyJet, KLM |

6

Continued strategic execution (cont'd)

Differentiated Product Momentum

–

Increased adoption of new point of sale technology

–

70% agency and TMC customers targeted to be on

upgraded PoS platforms by end of 2012

–

New innovative mobile technology launched globally

include:

–

Travelport Mobile Agent™, Travelport ViewTrip

Mobile™, GalileoTerminal™

–

Launched

Travelport

Universal

API™

in

MEA

–

Launched first Russian language corporate booking

tool, TripGate

–

Development work with Japan’s AXESS GDS on track

for end of 2013 implementation

–

eNett joint venture continues to progress rapidly:

–

Long-term strategic partnership agreed with

Mastercard

–

2012 TTV on track to exceed $1bn

–

Software-as-a-Service products sold to TUIfly.com,

Copa (Panama), AviancaTaca (Colombia), GOL and

Azul (Brazil) as well as TravelSky (China)

Investing in Key Adjacencies |

7

Continued strategic execution (cont'd)

•

Targeted Geographical Growth

–

Increasing momentum of high profile customer

migrations to Travelport, including, in Q3:

–

ebookers (France), Statesman Travel (UK), TIX.nl

(Netherlands) and Delgado Travel (US)

–

Multiple customer renewals in all regions

–

Successful expansion in growth regions, most

recently:

–

New Africa distributor in Tanzania

–

New East African hub operation in Kenya

–

2nd Travelport Russian operation in St. Petersburg

•

Technology Investment

–

Executed new hardware and software

agreement with IBM to further

advance platform delivery –

Technology co-operation agreement with HRG

–

No service interruptions or performance issues

•

Multiple Technology and Travel industry accolades:

–

Gold

“Stevie”

-

American

Business

Award

for

“Information Technology Team of the Year”

–

“Best GDS”

in APAC

–

“Favorite GDS”

in Canada |

8

Geography / customer segments

RevPas

$5.01

$5.24

$5.13

$5.19

$5.08

$5.34

$5.30

Q1

Q2

Q3

Q4

Region

(2)

2012

2011

Better /

(Worse)

Proforma

(1)

Better / (Worse)

Americas

41

45

(6.2%)

(0.8%)

Europe

21

21

0.7%

0.7%

APAC

13

14

(9.2%)

(9.2%)

MEA

10

9

0.9%

0.9%

Global

85

89

(4.4%)

(1.7%)

Travelport GDS Q3 Segments

(In millions)

(1)

Proforma variance is stated excluding the effect of the loss of the United MSA.

(2)

Brazil is combined with Europe and not Americas.

•

Q3 softening in air volume growth in US (33% of global

GDS volume) and Western Europe (27% of global

GDS volume)

•

BRICS region, however, still showing growth in Q3

YoY, except India and Brazil:

–

Russia 39%

–

China 23%

–

South Africa 9%

–

India impacted by demise of Kingfisher Airlines

•

Low Cost Carriers (LCCs) continue segment growth:

–

7% of Travelport GDS YTD air segments

–

Travelport developing improved LCC connectivity

as a source of further growth

•

Q3 RevPas $5.30 or +3% YoY reflecting:

–

New Travelport products and services

–

Growth in hotels and advertising sales |

9

Q3 2012 financial results

Philip Emery, CFO

Travelport |

10

Financial highlights

•

Excluding the impact of foreign exchange and loss of the United MSA, Q3 Net Revenue

and Sep YTD Net Revenue are both +1% higher compared to prior year. On an

actual basis, Q3 Net Revenue is (4)% lower and Sep YTD Net Revenue is (2)%

lower compared to prior year. •

Excluding the impact of foreign exchange and loss of the United MSA, Q3 Adjusted

EBITDA is flat compared to prior year

and

Sep

YTD

Adjusted

EBITDA

is

(2)%

lower

compared

to

prior

year,

which

is

in

line

with

management

expectations. On an actual basis, Q3 Adjusted EBITDA is (10)% lower and Sep YTD

Adjusted EBITDA is (9)% lower than prior year.

•

Q3 and Sep YTD Adjusted EBITDA include $16 million and $44 million of amortization

charges for upfront payments to travel agencies, respectively. Working

capital includes $158 million of upfront payments and prepaid commissions as

of September 30, 2012. •

Sep YTD Interest expense of $215 million is $8 million lower in 2012 due to a lower

net debt balance and favorable impact of interest rate hedges, offset by a

higher underlying interest rate. •

Cash flows from operations in Q3 of $6 million is $18 million higher compared to

prior year primarily as a result of a decrease in cash interest payments and

fluctuations in our collections and payments cycles. •

Q3 unlevered free cash flow of $57 million is $8 million higher than prior year and

represents 54% of Adjusted EBITDA.

For

Sep

YTD,

unlevered

free

cash

flow

of

$262

million

is

$(3)

million

lower

than

prior

year

and

represents

72% of Adjusted EBITDA. |

Net

revenue Net Revenue

Q3 2012

Better/(Worse)

than prior year

Sep YTD 2012

Better/(Worse)

than prior year

Transaction Processing

451

(5)

1,414

3

Airline IT Solutions

38

(15)

131

(28)

Net Revenue

489

(20)

1,545

(25)

509

485

489

(24)

4

(0)

Q3 2011

Net Revenue

United MSA

and FX

Q3 2011

Proforma

Net Revenue

Transaction

Processing

Airline IT

Solutions

Q3 2012

Net Revenue

1,570

1,525

1,545

(45)

23

(3)

Sep YTD

2011

Net Revenue

United MSA

and FX

Sep YTD

2011

Proforma

Net Revenue

Transaction

Processing

Airline IT

Solutions

Sep YTD

2012

Net Revenue

Net Revenue Bridge Sep YTD 2012

Net Revenue Bridge Q3 2012

11 |

12

Summary income statements

(1)

Proforma

variance

is

stated

excluding

the

effects

of

the

loss

of

the

United

MSA

and

foreign

exchange.

Net Revenue

Q3 2012

Better /

(Worse)

than prior

year

Proforma

(1)

Better/

(Worse) than

prior year

Sep YTD

2012

Better/

(Worse)

than prior

year

Proforma

(1)

Better/

(Worse) than

prior year

Net revenue

489

(20)

4

1,545

(25)

20

Adjusted EBITDA

106

(12)

–

366

(35)

(7)

Operating income

27

(24)

(12)

155

(41)

(13)

Interest expense, net

(71)

3

3

(215)

8

8

Gain on early extinguishment of debt

5

5

5

6

6

6

Loss from continuing operations before

income taxes and equity in investment in

Orbitz Worldwide

(39)

(16)

(4)

(54)

(27)

1 |

13

Summary of cash flows

Q3 2012

Better/(Worse)

than prior year

Sep YTD 2012

Better/(Worse)

than prior year

Adjusted EBITDA

106

(12)

366

(35)

Less:

Cash interest payments

(86)

3

(202)

38

Tax payments

(5)

(1)

(9)

4

Changes in operating working capital

12

30

44

53

FASA liability payments

–

3

(7)

5

Defined benefit pension plan funding

(10)

1

(15)

(2)

Other adjusting items

(11)

(6)

(43)

(15)

Net cash provided by operating

activities of continuing operations

6

18

134

48

Add cash interest payments

86

(3)

202

(38)

Less capital expenditures

(29)

(8)

(61)

(11)

Less repayments of capital leases

(6)

1

(13)

(2)

Unlevered free cash flow

57

8

262

(3)

Cash flow conversion

54%

72% |