Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - RigNet, Inc. | d446232d8k.htm |

Exhibit 99.1

| JEFFERIES 2012 GLOBAL ENERGY CONFERENCE November 29, 2012 |

| Forward-looking Statements 2 Certain statements made over the course of this presentation may constitute forward- looking statements, including statements regarding the markets in which we operate, the demand for our products and services and the advantages of our services compared to others. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or other achievements. Actual results may differ materially from the results anticipated by these forward-looking statements, which apply only as of the date of this presentation, as a result of various important factors, including those described in Item 1A of our Annual Report filed on Form 10-K for the fiscal year ended December 31, 2011 and other reports filed with the Securities and Exchange Commission. If one or more of these factors materialize, or if any underlying assumptions prove incorrect, our actual results, performance or achievements may vary materially from any future results, performance or achievements expressed or implied by these forward-looking statements. We disclaim any obligation to update any forward-looking statement for subsequently occurring events or circumstances. In addition to U.S. GAAP financials, this presentation includes certain non-GAAP financial measures. These non-GAAP measures are in addition to, not a substitute for or superior to, measures of financial performance prepared in accordance with GAAP. Definitions of these non-GAAP measures and reconciliations between certain GAAP and non-GAAP measures are included in the appendix to this presentation. |

| RigNet Investment Highlights 3 Strong Organic Growth within the Oil and Gas Industry Growing and Attractive Market Runway High Operating Leverage / Free Cash Flow Relative Valuation Discount Market Share Growth Founded in 2001, RigNet (NASDAQ: RNET) is a leading provider of remote communications, systems integration and collaborative applications to the oil and gas industry, both offshore and onshore, around the world |

| Providing Reliable, Remote Communications for the Life of the Oil Field 4 Communications for the Life of the Oil Field The oil and gas industry is remote, mobile and variable, with the reliance on technology greater than ever. RigNet provides managed communications services that free customers to focus on finding and producing oil and gas: Reliable communications around the world, supporting rig productivity, safety and crew welfare Technology flexibility - providing best-of-breed solutions that best meet customers' needs Local customer support for rapid deployment and resolution |

| RigNet Business Model 5 Provide mission critical remote communications services to the oil and gas industry, principally on offshore drilling rigs that are mobile and becoming increasingly remote in the search for oil and gas Majority of revenues from recurring, multi-tenant revenue model under long-term contracts Revenue growth from sites added as well as ARPU growth from secondary customers and industry-leading value-added services Provide managed services to 1,000+ sites in 30+ countries on six continents1 Partner with our customers' IT departments to serve remote end users, develop new services and allow customers to focus on finding and producing oil and gas Purposefully not as backward-integrated as others, which allows for best-of-breed solutions and success-based capex at the edge Low customer churn, stable end-user pricing and high barriers-to-entry (1) As of September 30, 2012 Global, Diversified Presence Note: As of December 31, 2011. Offshore represents Eastern and Western Hemispheres; onshore represents U.S. Land as reported in Company filings. U.S. Service Centers |

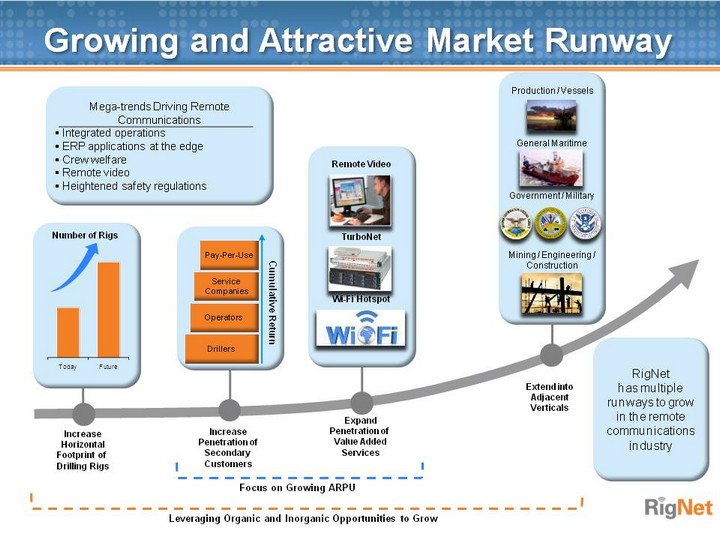

| Growing and Attractive Market Runway RigNet has multiple runways to grow in the remote communications industry Increase Penetration of Secondary Customers Cumulative Return Drillers Operators Service Companies Pay-Per-Use Expand Penetration of Value Added Services Increase Horizontal Footprint of Drilling Rigs Number of Rigs Focus on Growing ARPU Extend into Adjacent Verticals Leveraging Organic and Inorganic Opportunities to Grow |

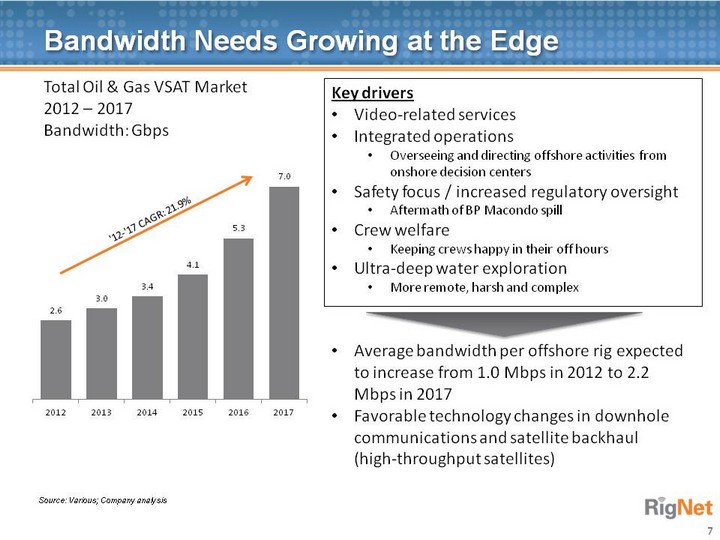

| 7 Bandwidth Needs Growing at the Edge Source: Various; Company analysis Total Oil & Gas VSAT Market 2012 - 2017 Bandwidth: Gbps Key drivers Video-related services Integrated operations Overseeing and directing offshore activities from onshore decision centers Safety focus / increased regulatory oversight Aftermath of BP Macondo spill Crew welfare Keeping crews happy in their off hours Ultra-deep water exploration More remote, harsh and complex Average bandwidth per offshore rig expected to increase from 1.0 Mbps in 2012 to 2.2 Mbps in 2017 Favorable technology changes in downhole communications and satellite backhaul (high-throughput satellites) |

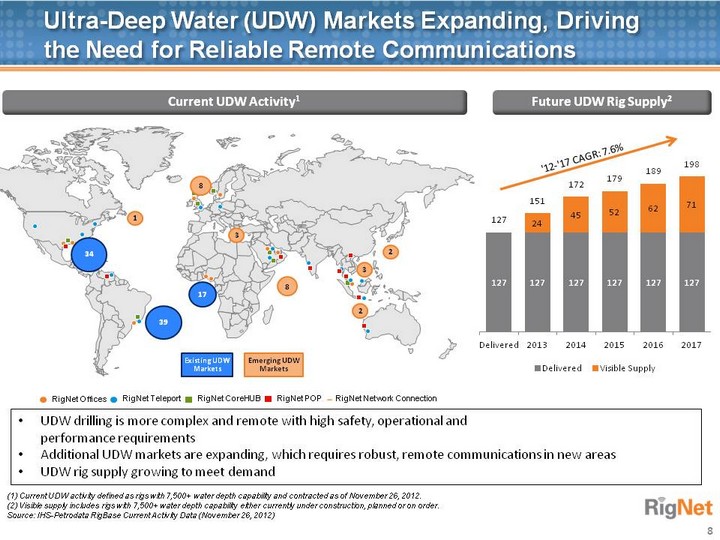

| Ultra-Deep Water (UDW) Markets Expanding, Driving the Need for Reliable Remote Communications RigNet POP RigNet Network Connection RigNet Offices RigNet Teleport RigNet CoreHUB (1) Current UDW activity defined as rigs with 7,500+ water depth capability and contracted as of November 26, 2012. (2) Visible supply includes rigs with 7,500+ water depth capability either currently under construction, planned or on order. Source: IHS-Petrodata RigBase Current Activity Data (November 26, 2012) Future UDW Rig Supply2 39 34 17 8 8 3 3 2 2 1 Current UDW Activity1 UDW drilling is more complex and remote with high safety, operational and performance requirements Additional UDW markets are expanding, which requires robust, remote communications in new areas UDW rig supply growing to meet demand Existing UDW Markets Emerging UDW Markets 8 |

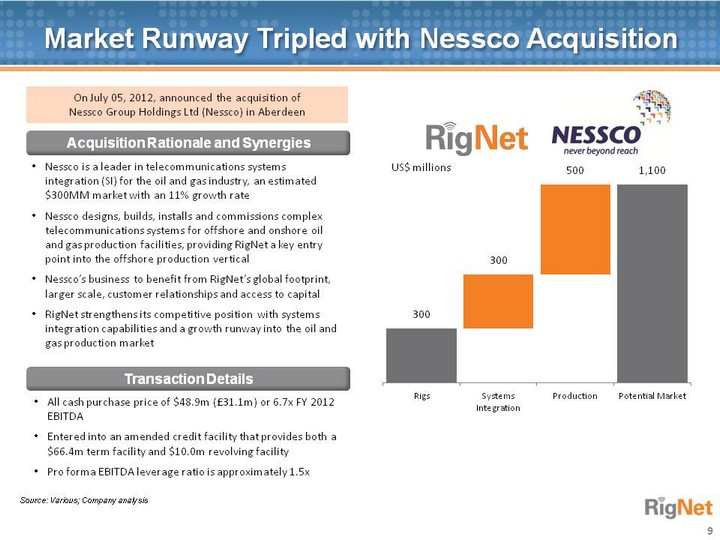

| 9 Market Runway Tripled with Nessco Acquisition Source: Various; Company analysis Transaction Details Acquisition Rationale and Synergies Nessco is a leader in telecommunications systems integration (SI) for the oil and gas industry, an estimated $300MM market with an 11% growth rate Nessco designs, builds, installs and commissions complex telecommunications systems for offshore and onshore oil and gas production facilities, providing RigNet a key entry point into the offshore production vertical Nessco's business to benefit from RigNet's global footprint, larger scale, customer relationships and access to capital RigNet strengthens its competitive position with systems integration capabilities and a growth runway into the oil and gas production market All cash purchase price of $48.9m (£31.1m) or 6.7x FY 2012 EBITDA Entered into an amended credit facility that provides both a $66.4m term facility and $10.0m revolving facility Pro forma EBITDA leverage ratio is approximately 1.5x On July 05, 2012, announced the acquisition of Nessco Group Holdings Ltd (Nessco) in Aberdeen US$ millions |

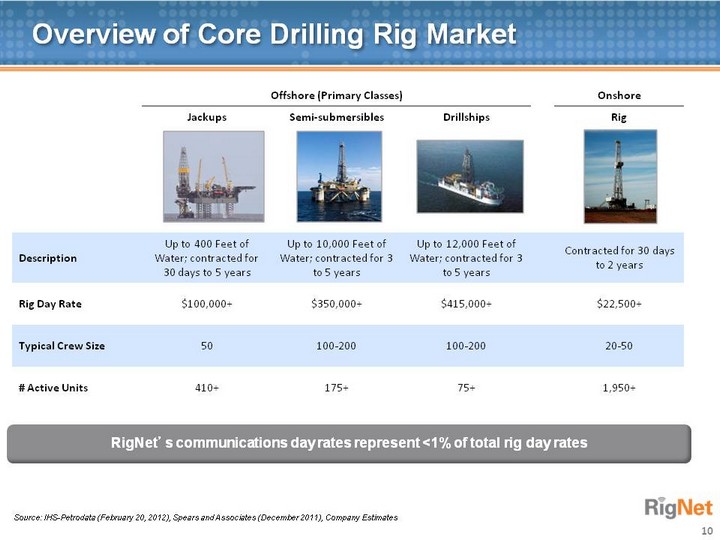

| Overview of Core Drilling Rig Market 10 Offshore (Primary Classes) Offshore (Primary Classes) Offshore (Primary Classes) Onshore Jackups Semi-submersibles Drillships Rig Description Up to 400 Feet of Water; contracted for 30 days to 5 years Up to 10,000 Feet of Water; contracted for 3 to 5 years Up to 12,000 Feet of Water; contracted for 3 to 5 years Contracted for 30 days to 2 years Rig Day Rate $100,000+ $350,000+ $415,000+ $22,500+ Typical Crew Size 50 100-200 100-200 20-50 # Active Units 410+ 175+ 75+ 1,950+ RigNet's communications day rates represent <1% of total rig day rates Source: IHS-Petrodata (February 20, 2012), Spears and Associates (December 2011), Company Estimates |

| Overview of Oil and Gas Step-out Markets 11 Production Production Production Energy Maritime International Land International Land International Land SOIL Fixed Floating Vessels Rigs OFS Corporate Networks Description Manned and Unmanned installations, MOPU FPSO/FSO, TLP/Spars, Semis, FLNG Supply, Seismic, Support and Construction Land based rigs outside of the United States Man Camps, Remote Offices, Wireline Trucks, etc. Collaborative Oil & Gas Extranet # Active Units 9,000+ 330+ 3,400+ 3,100+ N/A N/A Customer Value Proposition Provide reliable communications to same customers after the drilling campaign Provide reliable communications to same customers after the drilling campaign Provide reliable communications to same customers after the drilling campaign Provide global connectivity for vessels that work specifically in O&G markets Provide enterprise grade communications anywhere our customers drill Provide enterprise grade communications anywhere our customers drill Provide enterprise grade communications anywhere our customers drill Allow secure, reliable sharing of information, applications Investor Impact Long term contracts leveraging same infrastructure and solutions Long term contracts leveraging same infrastructure and solutions Long term contracts leveraging same infrastructure and solutions Leverage economies of scale in highest margin maritime segment Extend successful US Land model to more stable market segment Extend successful US Land model to more stable market segment Extend successful US Land model to more stable market segment Differentiated offering Source: IHS-Petrodata (September 2011), Baker Hughes (January 2012), Company estimates |

| Blue-chip Customer Base 12 Drilling Companies Operators Service Companies Top 10 customers accounted for 37% of 2011 revenue BruneiShell Diverse customer base with no excessive concentration |

| History of Strong Growth 13 Revenue1 $ millions Q3'12 Nessco revenue contribution was $10.3MM UFCF defined as EBITDA less CapEx Source: RigNet, Wall Street Estimates High EBITDA margins from operating leverage; favorable free cash flow Strong balance sheet to support future organic and inorganic growth All organic growth until Nessco acquired in Q3, 2012 EBITDA and UFCF2 $ millions |

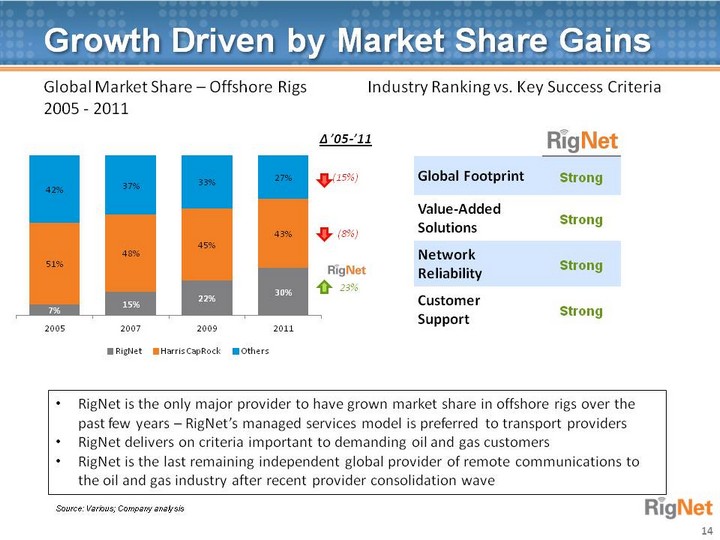

| Growth Driven by Market Share Gains 14 Global Market Share - Offshore Rigs 2005 - 2011 RigNet is the only major provider to have grown market share in offshore rigs over the past few years - RigNet's managed services model is preferred to transport providers RigNet delivers on criteria important to demanding oil and gas customers RigNet is the last remaining independent global provider of remote communications to the oil and gas industry after recent provider consolidation wave Source: Various; Company analysis Industry Ranking vs. Key Success Criteria Global Footprint Strong Value-Added Solutions Strong Network Reliability Strong Customer Support Strong ^ '05-'11 |

| 15 Valuation Upside Potential EV / EBITDA 2013 Multiples for Peer Groups RigNet is being valued at a discount relative to peer groups, measured both as a multiple of EBITDA and as a multiple of free cash flow Note: numbers in parentheses next to peer groups denote number of companies Source: FactSet EV / FCF 2013 Multiples for Peer Groups |

| Stock Performance 16 Share price up nearly 50% since IPO, but hampered by size, available float and low trading volume Analysts raised 12-month price targets to $24-26 following Q3, 2012 earnings release Source: FactSet |

| RigNet Investment Highlights 17 Strong Organic Growth within the Oil and Gas Industry Growing and Attractive Market Runway High Operating Leverage / Free Cash Flow Relative Valuation Discount Market Share Growth Leading provider of managed and mission critical remote communications, systems integration and collaborative applications to the oil and gas industry, both offshore and onshore, around the world: RigNet (NASDAQ: RNET) |

| THANK YOU 18 |