Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BEACON ROOFING SUPPLY INC | v329345_8k.htm |

| EX-99.1 - EXHIBIT 99.1 - BEACON ROOFING SUPPLY INC | v329345_ex99-1.htm |

2012 Fourth Quarter Earnings Call November 29, 2012 www.BeaconRoofingSupply.com 1 Quarterly Results 23.1% Existing Market Sales, Gross Profit & Gross Margin Existing Market Product Mix Northeast -7.2% Mid-Atlantic -0.5% Southeast -2.3% Southwest 5.7% Midwest -18.5% West -12.9% Canada 0.6% Total -5.6% Organic Sales Growth (Decline) 24.9% $ in millions Existing Marketresults above exclude branches acquired after the beginning of last year’s fourth quarter.

2012 Fourth Quarter Earnings Call November 29, 2012 www.BeaconRoofingSupply.com 2 $ in millions 15.5% of Sales 16.0% of Sales 14.8% of Sales Existing Market Operating Expenses Quarterly Results Payroll 2.8$ General & Administrative 1.7 Other 0.2 Selling (0.6) Depreciation & Amortization (1.1) Bad Debts (1.3) Total 1.7$ Operating Expense Incr (Decr)

2012 Fourth Quarter Earnings Call November 29, 2012 www.BeaconRoofingSupply.com 3 Existing Market Operating Margin Adjusted Diluted EPS (3) Quarterly Results (1) Earnings in the fourth quarter of fiscal 2012 were impacted by the following: a charge of $3.0 million ($1.8 million net of tax), or approximately $0.04 diluted earnings per share, for the recognition of certain termination benefits; and a benefit of $1.1 million ($0.7 million net of tax), or approximately $0.01 diluted earnings per share, for the recognition of the change in the fair value of certain interest rate derivatives. $0.60 (1) (2) Earnings in the fourth quarter of fiscal 2011 were impacted by a one-time income tax benefit of $5.1 million, or $0.11 diluted earnings per share (3) The Company’s management believes that "Adjusted Diluted Earnings Per Share (EPS)”is useful to investors because it permits investors to better understand year-over-year changes in underlying operating performance. While management believes Adjusted Diluted EPS is a usefulmeasure for investors, it is not a measurement presented in accordance with United States generally accepted accounting principles (GAAP). Investors should not consider Adjusted EPS in isolation or as a substitute for diluted earnings per share calculated in accordance with GAAP.

2012 Fourth Quarter Earnings Call November 29, 2012 www.BeaconRoofingSupply.com 4 Annual Results 23.1% Existing Market Sales, Gross Profit & Gross Margin Existing Market Product Mix Northeast 6.3% Mid-Atlantic 10.9% Southeast 13.9% Southwest 10.3% Midwest -3.0% West 2.8% Canada 3.1% Total 6.3% Organic Sales Growth 24.4% $ in millions Existing Marketresults above exclude branches acquired after the beginning of fiscal year 2011.

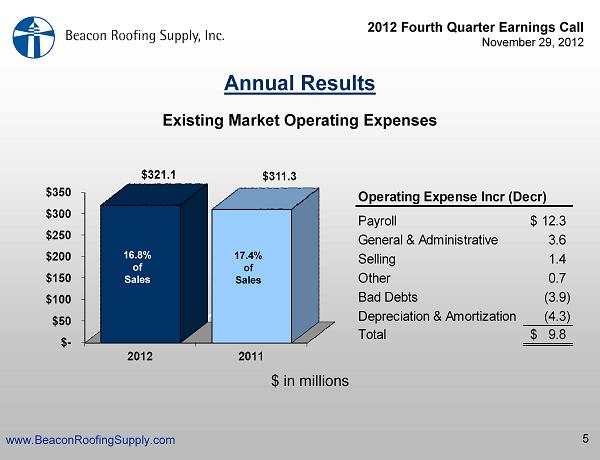

2012 Fourth Quarter Earnings Call November 29, 2012 www.BeaconRoofingSupply.com 5 $ in millions 15.5% of Sales 16.8% of Sales 17.4% of Sales Existing Market Operating Expenses Annual Results Payroll 12.3$ General & Administrative 3.6 Selling 1.4 Other 0.7 Bad Debts (3.9) Depreciation & Amortization (4.3) Total 9.8$ Operating Expense Incr (Decr)

2012 Fourth Quarter Earnings Call November 29, 2012 www.BeaconRoofingSupply.com 6 Existing Market Operating Margin Adjusted Diluted EPS (3) Annual Results (1) Fiscal 2012 earnings were impacted by the following charges: $3.0 million ($1.8 million net of tax), or approximately $0.04 diluted earnings per share, for the recognition of certain termination benefits; $3.8 million ($2.3 million net of tax), or approximately $0.05 diluted earningsper share, for the recognition of the fair value of certain interest rate derivatives and other charges; and $0.3 million, or approximately $0.01 diluted earningsper share, from the increase in the liability for consideration due for the Enercon acquisition. $1.67 (1) (2) Fiscal 2011 earnings were impacted by a one-time income tax benefit of $5.1 million, or $0.11 diluted earnings per share.

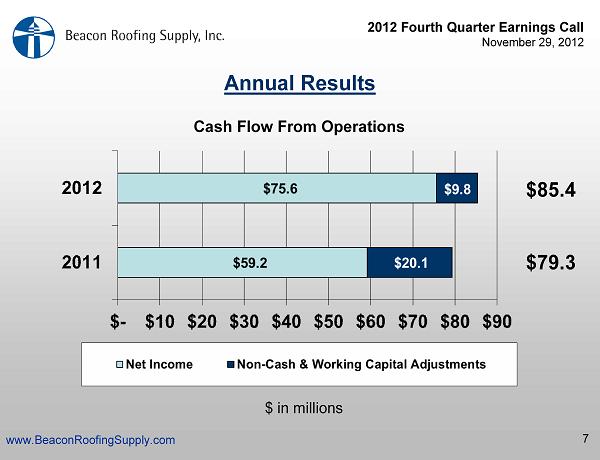

2012 Fourth Quarter Earnings Call November 29, 2012 www.BeaconRoofingSupply.com 7 $85.4 $79.3 $ in millions Cash Flow From Operations Annual Results