Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - DYCOM INDUSTRIES INC | d445399d8k.htm |

$90

million add-on to 7.125% Senior Subordinated Notes

November

2012

Exhibit 99.1 |

1

Cautionary Statement about Forward-

Looking Statements & Confidential Information

This presentation contains “forward-looking statements” which are statements relating to

future events, including a proposed acquisition, future financial performance, strategies,

expectations, and the competitive environment. All statements, other than statements of

historical facts, contained in this presentation, including statements regarding the

Company’s future financial position, future revenue, prospects, plans and objectives of

management, are forward-looking statements. Additionally, forward – looking

statements include statements of expectations regarding the proposed acquisition, including

expected benefits and synergies of the transaction, future financial and operating results, future

opportunities for the combined businesses and other statements regarding events or developments

that the Company believes or anticipates will or may occur in the future as a result of the

transaction. Words such as “believe,” “expect,” “anticipate,”

“estimate,” “intend,” “forecast,” “may,” “should,” “could,” “project,”

“looking ahead” and similar expressions, as well as statements in future tense, identify

forward-looking statements. You should not read forward looking statements as a

guarantee of future performance or results. They will not necessarily be accurate

indications of whether or at what time such performance or results will be achieved.

Forward-looking statements are based on information available at the time those statements

are made and/or management’s good faith belief at that time with respect to future events,

including the Company’s ability to consummate the proposed acquisition. Such statements are

subject to risks and uncertainties that could cause actual performance or results to differ materially

from those expressed in or suggested by the forward-looking statements. Important

factors that could cause such differences include, but are not limited to factors described

under Item 1A, “Risk Factors” of the Company’s Annual Report on Form 10-K

for the year ended July 28, 2012, and other risks outlined in the Company’s periodic

filings with the Securities and Exchange Commission (“SEC”). The forward-looking

statements in this presentation are expressly qualified in their entirety by this cautionary

statement. Except as required by law, the Company may not update forward-looking statements

even though its situation may change in the future. This presentation includes certain

"non-GAAP" financial measures as defined by SEC rules. |

2

Transaction Overview

Appendix

Financial Summary

Business Overview

Target Overview

Credit Strengths

Agenda |

3

Dycom Industries, Inc. (the “Company”) is a leading provider of

specialty contracting services in the United States for telecommunications,

underground facility locating and electric and gas utilities

customers On

November

19 ,

Dycom

announced

that

it

signed

a

definitive

agreement

to

acquire

substantially

all

of

Quanta

Services’

(the

“Seller”)

domestic

telecommunications

infrastructure

services subsidiaries (collectively, the “Target”) for total

consideration of $275 million plus related transaction adjustments

Dycom intends to fund the acquisition with a combination of:

Pro forma for the acquisition and financing, Dycom will have secured leverage of

1.1x and total leverage

of

2.7x

based

on

LTM

Pro

Forma

2012

Adjusted

EBITDA

of

$179.5

million

1

Executive Summary

1

PF numbers reflect Dycom FY2012 (28-Jul-2012) and Target LTM 30-Sep-2012 results. PF

amounts and calculations herein derived from PF financial information filed

The

transaction

is

expected

to

close,

subject

to

customary

closing

conditions,

in

December

$90 million add-on to the Company’s existing 7.125% Senior Subordinated

Notes due in 2021

$201 million of borrowings under a new 5-year senior secured credit facility

comprised of a $275 million Revolving Credit Facility, of which $76 million

will be drawn at close of the acquisition, and a $125 million Term Loan

A by Dycom on Form 8-K on 28-Nov-2012. th

|

4

Strengthens our customer base, geographic scope and technical service

offerings

Reinforces our rural engineering and construction capabilities, wireless

construction resources and broadband construction competencies

Creates scale as industry announcements indicate customer expenditures will

be growing

Experienced management team with solid industry reputation

For the LTM period ended September 30, 2012, Target generated $535 million

of sales

Acquisition Rationale |

5

Sources and Uses

Pro Forma Capitalization

Sources, Uses and PF Capitalization

1

2

Excludes $7.0 million in acquisition related costs and $6.9 million in debt

issuance costs to be paid on or subsequent to the date of the acquisition.

3

PF amounts and calculations herein derived from PF financial information filed by

Dycom on Form 8-K on 28-Nov-2012. 4

PF cash reflects $1.8 million in estimated debt premiums from the notes offered

hereby. 5

Effective upon closing of the acquisition.

Sources of Funds

Uses of Funds

$275mm Revolver

$76.0

Purchase Price

1

$311.8

New Term Loan A

125.0

New Senior Sub. Notes

90.0

Cash on Balance Sheet

20.8

Total Sources

$311.8

Total Uses

2

$311.8

Note: Adjusted EBITDA reflects Dycom results for the fiscal year ended 28-Jul-2012 and Target

results for the LTM ended 30-Sep-2012. Does not reflect Dycom Adjusted EBITDA for the quarter ended 27-Oct-2012 of $40.405 million which compares to Dycom's prior

year Adjusted EBITDA for the quarter ended 29-Oct-2011 of $40.397 million.

3

10/27/12

PF

xPF Adj.

($ in millions)

Amount

xAdj. EBITDA

Change

Amount

EBITDA

Coupon

Maturity

Cash and Equivalents

4

$

54.7

$(19.0)

$

35.7

New $275mm Revolver

5

0.0

0.0x

76.0

76.0

0.4x

L+200 bps

Dec-17

New Term Loan A

5

0.0

0.0x

125.0

125.0

1.1x

L+200 bps

Dec-17

Total Secured Debt

$

0.1

0.0x

$

201.1

1.1x

Senior Subordinated Notes

187.5

1.4x

0.0

187.5

2.2x

7.125%

Jan-21

New Add-On Senior Subordinated Notes

0.0

0.0x

90.0

90.0

2.7x

7.125%

Jan-21

Total Debt

$

187.6

1.4x

$

478.6

2.7x

LTM Adj. EBITDA

$

135.5

$

179.5

Includes purchase price of $275 million and estimated amount for working capital adjustments and other

payments to Seller based on balances as of September 30, 2012. |

6

New Senior Subordinated Notes

Issuer

Dycom Investments, Inc., a direct wholly-owned subsidiary of Dycom Industries, Inc. (same as

existing) Guarantors

Dycom Industries, Inc. and its existing and future subsidiaries that guarantee any credit facility of

Dycom Industries, Inc.

Add-on Amount

$90 million add-on to existing 7.125% notes due 2021

Ranking

Senior Subordinated Notes (same as existing)

Maturity

January 15, 2021

Coupon

7.125%

Indicative Price

TBD

Indicative Yield

TBD

Non-Call Period

Non-Callable until January 2016

Equity Clawback

Beginning in 2014, up to 35% of the Notes may be redeemed with the proceeds of an equity issuance at

107.125 Optional Redemption

Callable at 103.563 in 2016, ratably declining to par thereafter

Customary Make Whole Call during the Non-Call Period

Mandatory Repayment

Put option upon change of control at 101% of principal plus unpaid and accrued interest

Covenants

Standard and customary high yield incurrence covenants which mirror existing subordinated notes;

limit Company’s ability to:

—

Incur additional indebtedness

—

Pay dividends

—

Make loans and investments

—

Sell assets and incur liens

Summary Terms and Conditions |

7

Transaction Overview

Appendix

Financial Summary

Business Overview

Target Overview

Credit Strengths

Agenda |

8

Dycom Introduction

A leading supplier of specialty contracting

services to telecommunication providers

nationwide

Telecommunications networks are fundamental

to economic progress

Significant end market opportunities include

wireless backhaul, rural fiber networks, fiber

deployments to businesses, wireless network

upgrades, and FTTx deployments

Significant portion of revenues from multi-year

Master Service Agreements

Experienced management team operates

through a decentralized, customer-focused

organizational structure

Strong cash flows and liquidity |

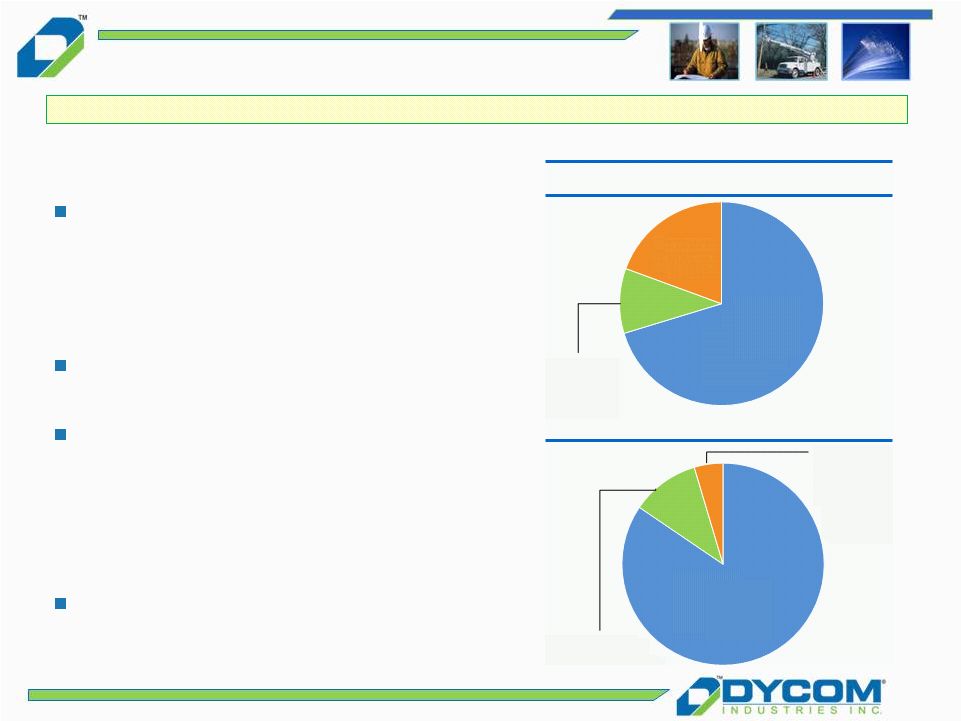

9

Nationwide footprint

—

Operates in 48 states and in Canada

—

31 operating subsidiaries and hundreds of

field offices

Fiscal 2012 revenues of $1,201.1 million grew

organically 15.4% year over year

Strong financial profile

—

Cash and equivalents $54.7 million at

October 27, 2012

—

Shareholders’

equity $392.0 million at

October 27, 2012

8,001 employees as of October 27, 2012

Dycom Overview (Standalone)

Dycom

is

a

leading

telecommunications

infrastructure

provider

in

the

United

States

Revenue by Contract Type

Revenue by Customer Type

Master

Service

Agreements

70.3%

Long-term

Contracts

10.3%

Short-term

Contracts

19.4%

Fiscal 2012

Telecom

84.5%

Electric

and Gas

Utilities

and

Other

4.6%

Underground

Facility

10.9%

Locating |

10

Services

Crucial to Customer Success

Engineering

Underground Facility Locating

Outside

Plant

&

Equipment

Installation

Premise Equipment Installation

Wireless Services |

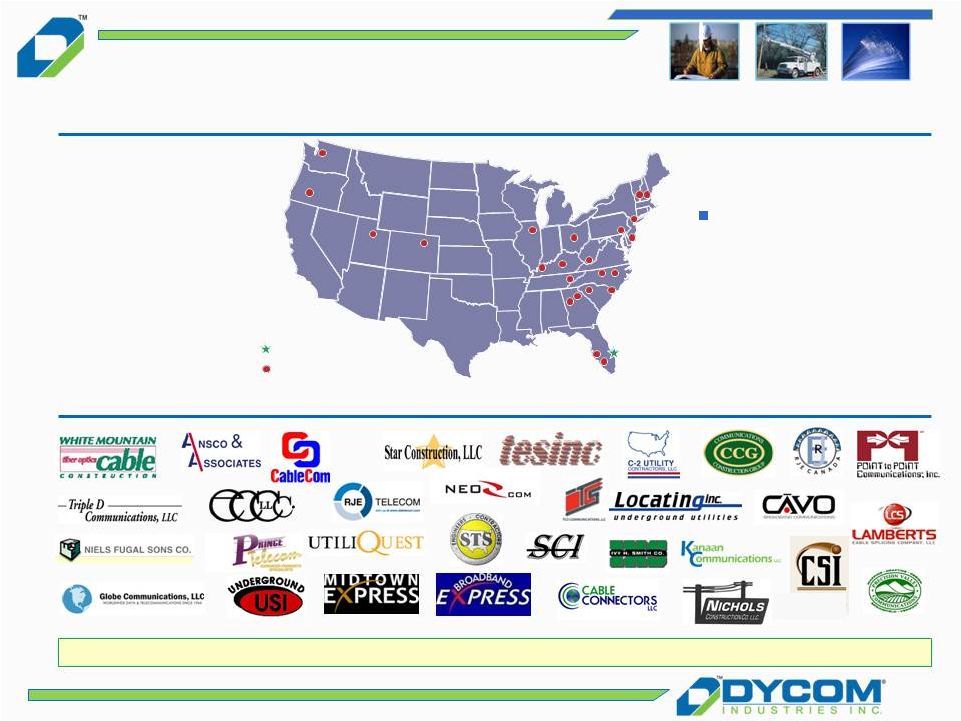

Dycom Operating Overview

Broad national footprint and strong local subsidiaries allow Dycom to go to market

as both a national and local provider Dycom’s Nationwide Presence

Subsidiaries

Dycom has field locations

well beyond the subsidiary

headquarters depicted

which enable the Company

to extend its coverage

footprint

Dycom Headquarters

Subsidiary Headquarters

11 |

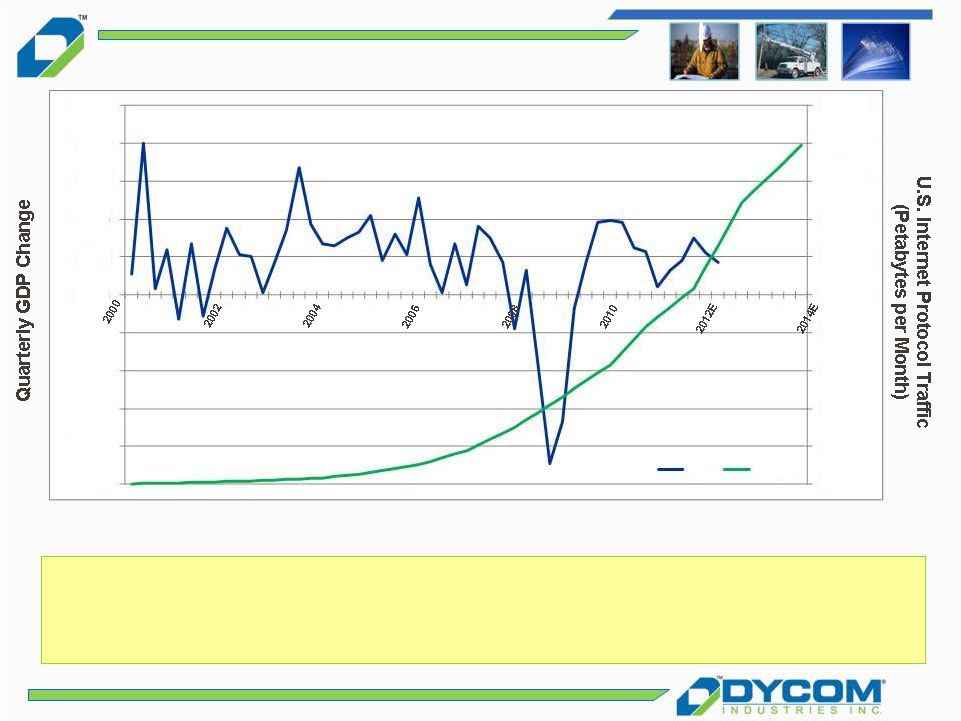

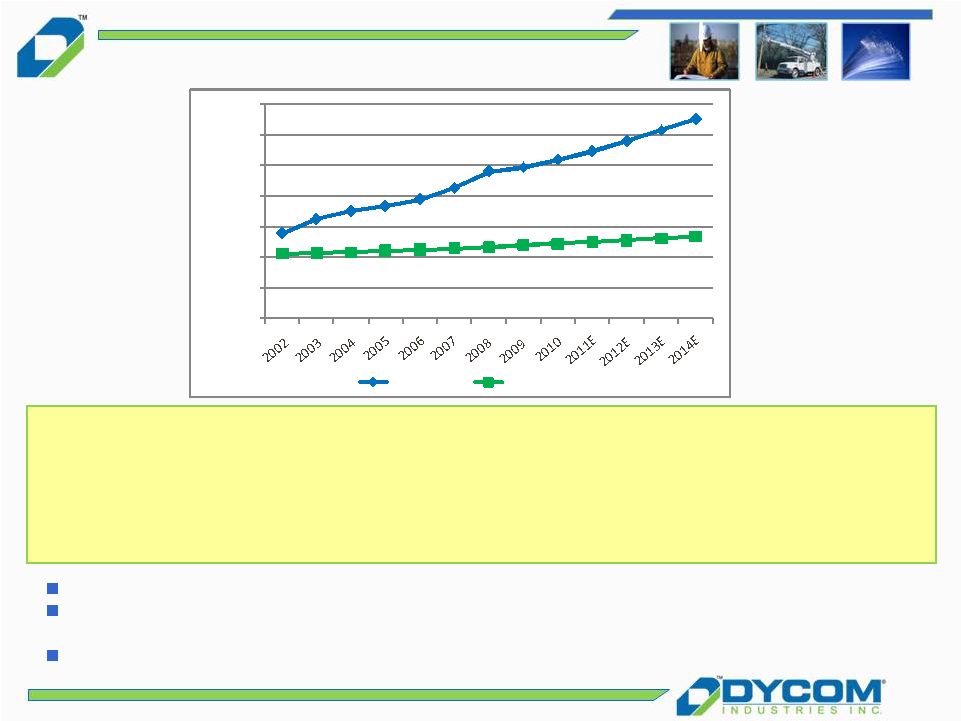

12

Sources:

U.S. Telecom, The Broadband Association

Cisco Visual Networking Index

U.S. National Bureau of Economic Analysis

“When the stability of an entire economy depends on the speed, intelligence,

quality of service, robustness and security of its Internet backbone, will a

just good network be good enough?” John Chambers, Chairman and CEO, Cisco,

Inc. Strong Secular Trend

0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

18,000

20,000

-10.0%

-8.0%

-6.0%

-4.0%

-

2.0%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

GDP

Traffic |

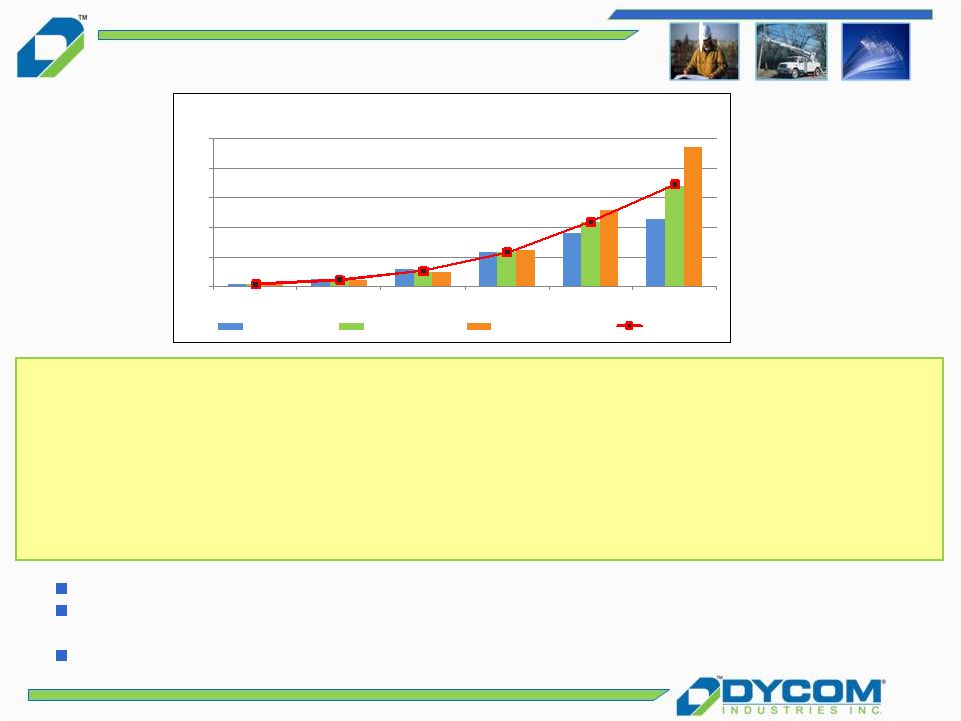

13

“Our third key strategic initiative is investing in fiber builds to as many

towers in our service area as economically feasible. This initiative

supports anticipated long-term growth in data transport, much of which is

driven by wireless data traffic. And expands our addressable customer footprint by enabling fiber access

points to other strategic locations where viable, along these routes. During second

quarter, we completed approximately 1,350 fiber builds. This is in line with

expectations. And we continue to anticipate completing 4,000 to 5,000 builds

in 2012, as fiber-to-the-tower construction continues to ramp up through the remainder

of the year.”

Glen

Post

III,

CEO

&

President,

CenturyLink,

Inc.

-

August

2012

Very attractive returns to our customers

Telephone, cable and other companies aggressively deploying fiber to provide wireless

backhaul services

Continues to provide significant growth opportunities

Sources: FCC OBI Technical Paper

6, Mobile Broadband: The Benefits

of Additional Spectrum

Key Driver: Wireless Backhaul

0X

10X

20X

30X

40X

50X

2009

2010

2011

2012E

2013E

2014E

Mobile Data Traffic Growth Relative to 2009

Yankee Group

Coda Research

Cisco Systems, Inc.

Average |

14

The American Recovery and Reinvestment Act

(ARRA) provided the Department of Commerce’s

National Telecommunications and Information

Administration (NTIA) and the U.S. Department of

Agriculture’s Rural Utilities Service (RUS) with

$7.2 billion to expand broadband services in the

United States.

Cumulatively, total Federal expenditures have now exceeded $2.1 billion

and have been matched by recipient funds of more than $820 million.

NTIA BTOP Quarterly Program Status Report –

September 2012

Demand has absorbed significant industry capacity

Meaningfully increased exposure to rural service providers

Key Driver: Rural Fiber Networks |

15

2011 Business Services Revenue

$3.9 Billion

Current Addressable Business Services Market

~$53.5 Billion

Emerging as an industry battleground

Multi-year cap-ex trajectory provides visible revenue opportunities

Leverages Dycom’s existing cable engineering and construction resources

“…so give or take $700 million a year I think is the number for capital

spending for business services. [….] That $700 million is powering a

business that grew 40% the last several years and is on pace to be a

couple

billion

dollar

plus

business

a

year

from

zero

and

we

can

go

into

the

medium-size

and

sell backhaul

and Metro Ethernet businesses. So first answer is we would love to put more capital

at the business

services

if

we

can

continue

to

get

30%

IRRs

or

whatever

as

we've

been

historically

getting.

It

is

a

50%

margin

business,

fantastic.”

Brian

Roberts,

Chairman

and

CEO,

Comcast

Corporation

–

June

2012

Sources: Company Filings, Company Transcripts

Key Driver: Fiber to Business

$25.0B

$8.5B

$20.0B

$0.6B

$1.5B

$1.8B |

16

“…We've had a volume surge that is hard to explain what's transpired.

The last five years

we've had literally in the mobile Internet traffic going across our network it's been

a 20,000 percent increase in traffic, and we're seeing no signs of that

slowing anytime soon. In fact,

we're on a pace this year that it grows another 75 percent, and our current planning

assumption is that that just continues for the next five years after this

year.” Randall Stephenson, CEO, AT&T –

July 2012

Wireless network spending increasing faster than overall spending

Entered wireless market via NeoCom acquisition in December 2010 and is further

expanding its wireless services to key customers

Strong growth opportunities as industry migrates from 3G to 4G technologies

Sources: CTIA, Collins Stewart, LLC

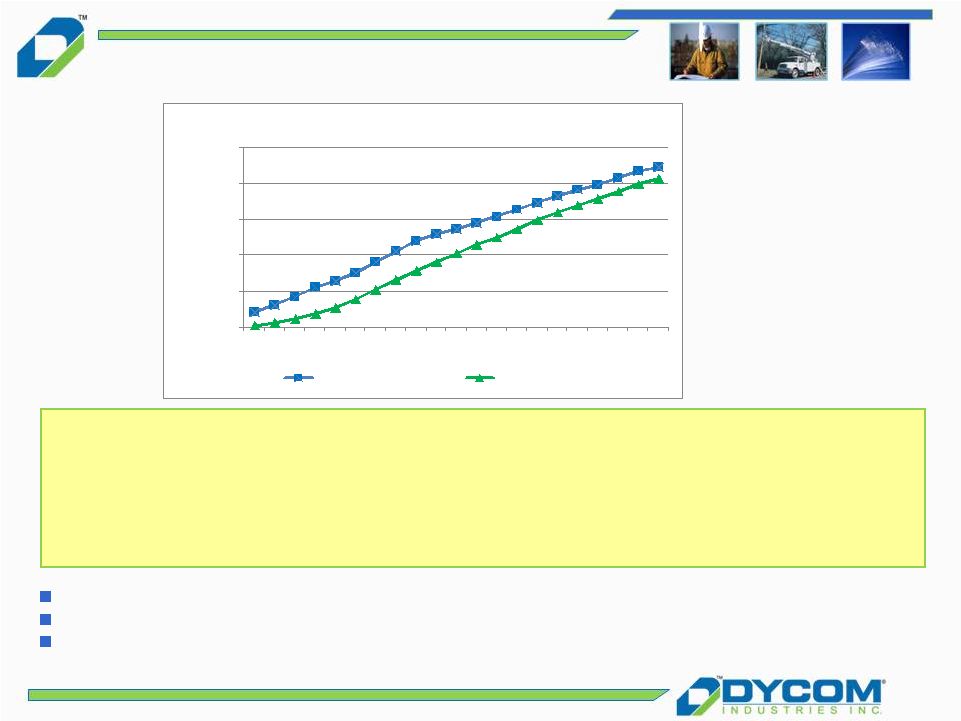

Key Driver: Wireless Network Upgrades

-

50,000

100,000

150,000

200,000

250,000

300,000

350,000

US cell sites

US Towers |

17

0

1,000,000

2,000,000

3,000,000

4,000,000

5,000,000

2Q 07

4Q 07

2Q 08

4Q 08

2Q 09

4Q 09

2Q 10

4Q 10

2Q 11

4Q 11

2Q 12

Cumulative Subscribers

Verizon FiOS Video

AT&T U-Verse

"We feel good about the success we've had in the IP broadband and U-verse

platform, and we believe that we can further grow the business with additional

investments to maximize technology improvements and our improved operating

scale. As Randall said, we plan to expand IP broadband to reach 57 million total customer

locations or 75% of all customer locations in our 22-state serving area. We have

a high level of confidence that we can execute this plan and achieve our growth

targets by simply extending our current track record." John Stankey, Group

President and Chief Strategy Officer, AT&T - November 2012

A key competitive response by telephone companies to cable MSO’s

CenturyLink just beginning scale deployments

Dycom is leveraging prior, extensive FTTx experience with Verizon and AT&T

Source: Company Filings

Key Driver: FTTx Deployments |

18

Agenda

Transaction Overview

Appendix

Financial Summary

Business Overview

Target Overview

Credit Strengths |

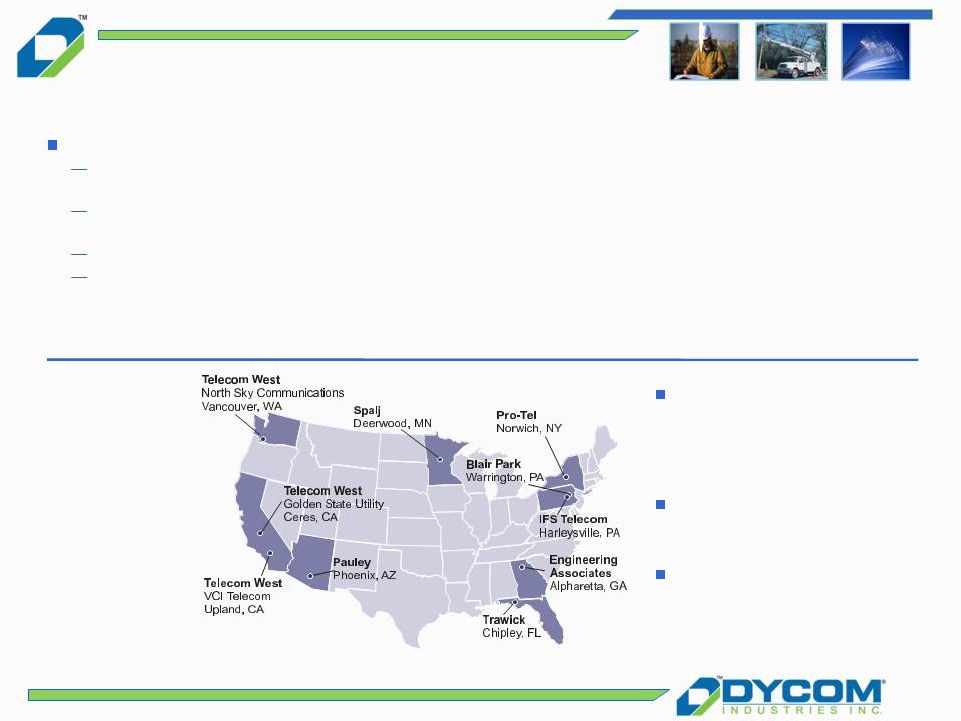

19

Target provides network services and solutions for the telecommunications and cable

television industries, including: Geographic

Footprint

–

Subsidiary

Headquarters

Source: Company Filings.

Target Overview

Target has complimentary

geographies to Dycom that both

enhance current footprint and

expand presence in certain

markets

Target has a strong rural footprint

that diversifies the combined

business profile

Target has field locations well

beyond the subsidiary

headquarters depicted

Design, installation, repair and maintenance of fiber optic, copper and coaxial

cable networks used for video, data and voice transmission

Design, installation and upgrade of wireless communications networks, including

towers, switching systems and "backhaul" links from wireless

systems to voice, data and video networks Cable

locating,

splicing

and

testing

of

fiber

optic

networks

and

residential

installation

of

fiber

optic

cabling

Emergency restoration services, particularly for infrastructure damaged by

inclement weather |

20

Agenda

Transaction Overview

Appendix

Financial Summary

Business Overview

Target Overview

Credit Strengths |

21

Long-standing relationship with blue chip customers

Stable revenue base

Breadth of service offering to meet customer requirements

Variable and scalable operating structure

Operating model focused on cash flow generation

Proven and experienced management team

Key Credit Highlights |

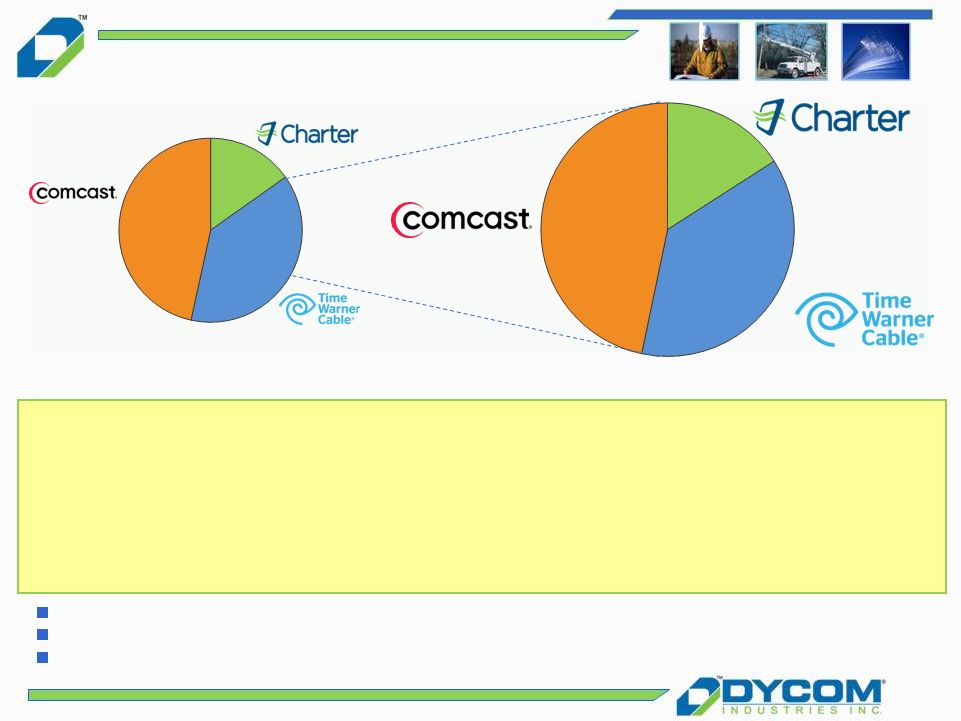

22

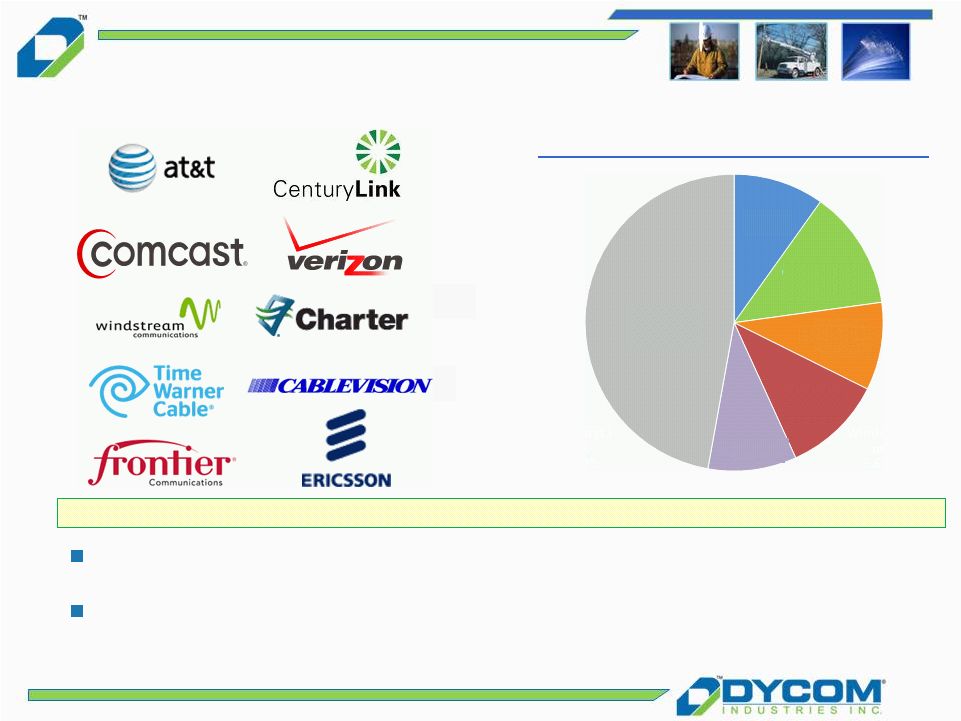

Dycom has established relationships with many leading telephone companies, cable

television multiple system operators and electric utility companies

Target further strengthens customer base by a combination of enhanced presence

with existing customers and further diversity with new customers

Blue Chip Customer Base

Blue chip, predominantly investment grade, clients comprise the vast majority of

revenue Dycom Pro Forma Customer Mix

Note: PF numbers reflect Dycom FY2012 (28-Jul-2012) and Target LTM

30-Sep-2012 results. AT&T

9.9%

Comcast

9.5%

Verizon

10.8%

Other

47.2%

Windstream

9.6%

CenturyLink

12.9% |

23

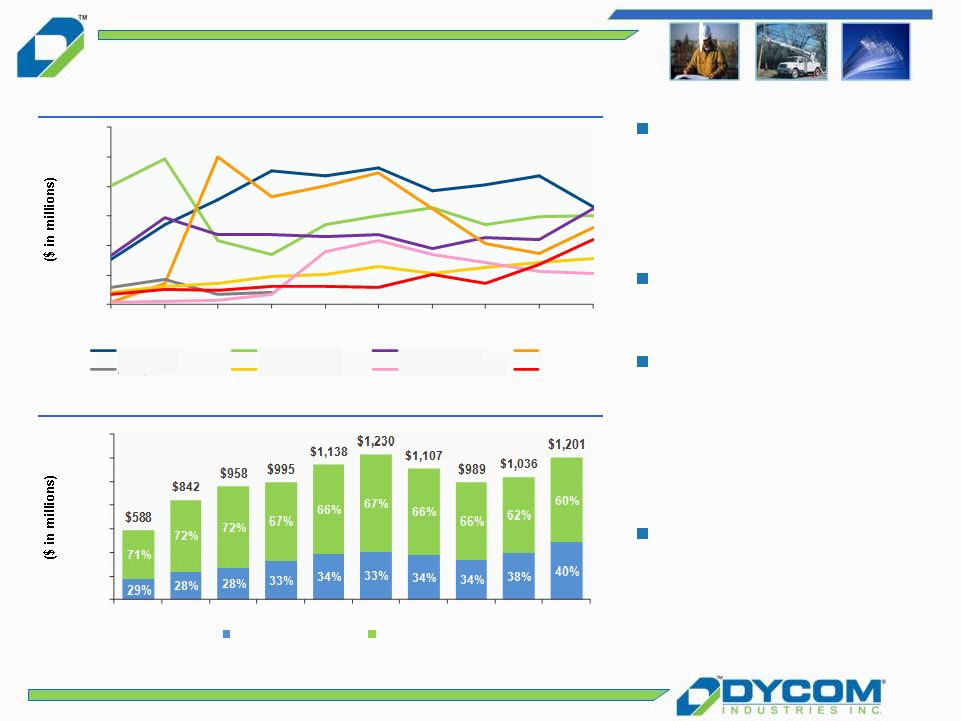

Durable Customer Relationships

Developed and maintained

strong, long-term

relationships that help

manage cyclical nature of

telecom and cable capex

spending

Significant number of these

customer relationships span

decades

The Company’s decentralized

operations create multiple

points of contact with

customers, numerous

individual relationships, and

numerous contract

opportunities per customer

Pro forma, Top 5 customers

account for 52.9% of

revenue

(a)

vs. 59.6% of

revenue for Dycom

standalone in 2012

Revenue

by

Customer

1

Revenue

(Top

5

Customers)

1

1

Numbers reflect Dycom standalone.

(a) Pro forma numbers reflect combination of Dycom last twelve months ended

October 27, 2012 and Target last twelve months ended September 30,

2012. $0

$50

$100

$150

$200

$250

$300

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

Other Customers

Top 5 Customers

AT&T

Comcast

CenturyLink

Verizon

Adelphia

CharterComm

Time Warner Cable

Windstream |

24

Stable Revenue Base

Master Service Agreements (MSAs)

Long-term

contracts

relate

to

specific

projects

with terms in excess of one year from the contract

date

Dycom is party to numerous MSAs and other

arrangements with customers that extend for

periods of one or more years and generally has

multiple agreements with each customer

Short-term

contracts

relate

to

spot

market

requirements

Significant majority of contracts are based on units

of delivery

Dycom’s revenue stream is primarily generated by long-term contractual

agreements Fiscal

2012

Revenue

by

Contract

Type

1

1

Numbers reflect Dycom standalone.

Master

Service

Agreements

70.3%

Long

-term

Contracts

10.3%

Short-term

Contracts

19.4%

—

Multi-year, multi-million dollar arrangements

covering thousands of individual work orders

—

Generally exclusive requirement contracts that

extend for one or more years |

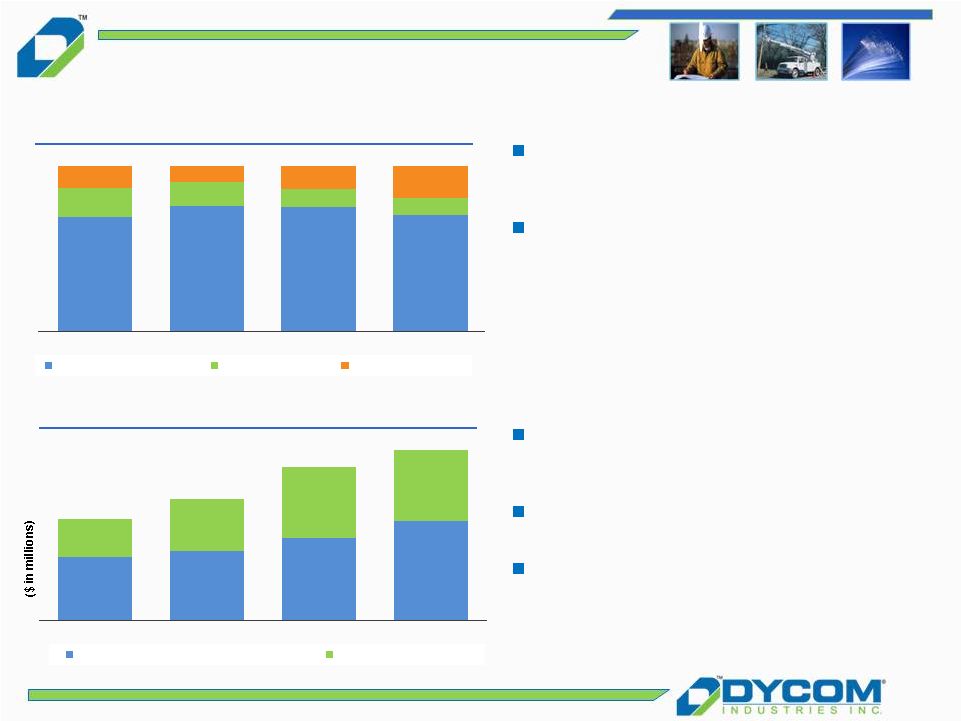

25

MSA and other long-term contracts

represent 80% or greater of total contract

revenues in recent periods

Increase in short-term contracts in fiscal

2012 from broadband stimulus spending

Stable Revenue Base

Historical Revenue by Contract Type

Historical Backlog

1

Numbers reflect Dycom standalone.

69.5%

76.0%

75.5%

70.3%

17.2%

14.6%

10.4%

10.3%

13.3%

9.4%

14.1%

19.4%

0.0%

20.0%

40.0%

60.0%

80.0%

100.0%

FY2009

FY2010

FY2011

FY2012

Master Service Agreements

Long-Term Contracts

Short-Term Contracts

Backlog comprised of the estimated

uncompleted portion of services to be

performed under job-specific contracts

Significant backlog growth in recent 3

year period from new contract awards

As of October 27, 2012, total backlog

and backlog to be completed in next 12

months at $1.376 billion and $822

million, respectively

$582

$640

$754

$909

$353

$474

$658

$656

$935

$1,114

$1,412

$1,565

$0

$400

$800

$1,200

$1,600

FY2009

FY2010

FY2011

FY2012

Backlog to be Completed in Next 12 Months

Backlog > 12 Months

1

1 |

26

Breadth of Service Offering

Leading provider of services in a fragmented industry, with breadth and scope of

operations to support national customer base

—

As a service provider operating on a national basis, Dycom benefits from its

customers trending towards a consolidated vendor base with broad service

capabilities —

Strong

balance

sheet

and

scale

enable

the

Company

to

compete

for

large

contracts

which

further

enhance the depth of Dycom’s customer relationships

Despite its national scale, Dycom has decentralized operations that reflect the

importance of relationships at the local and regional level

|

27

Variable and Scalable Operating

Structure

Scalable business model provides

operating flexibility

Highly variable cost structure allows for

efficient responses to changes in the

business environment as largest direct cost

is labor

—

Cost of labor managed by flexing the

size of the workforce and level of

subcontractors

—

Significant amount of project-related

inventory provided by customers

Number

of

Employees

1

1

Numbers reflected for Dycom standalone.

9,352

10,899

10,746

9,231

8,897

8,320

8,001

7,500

8,500

9,500

10,500

11,500

2006

2007

2008

2009

2010

2011

2012 |

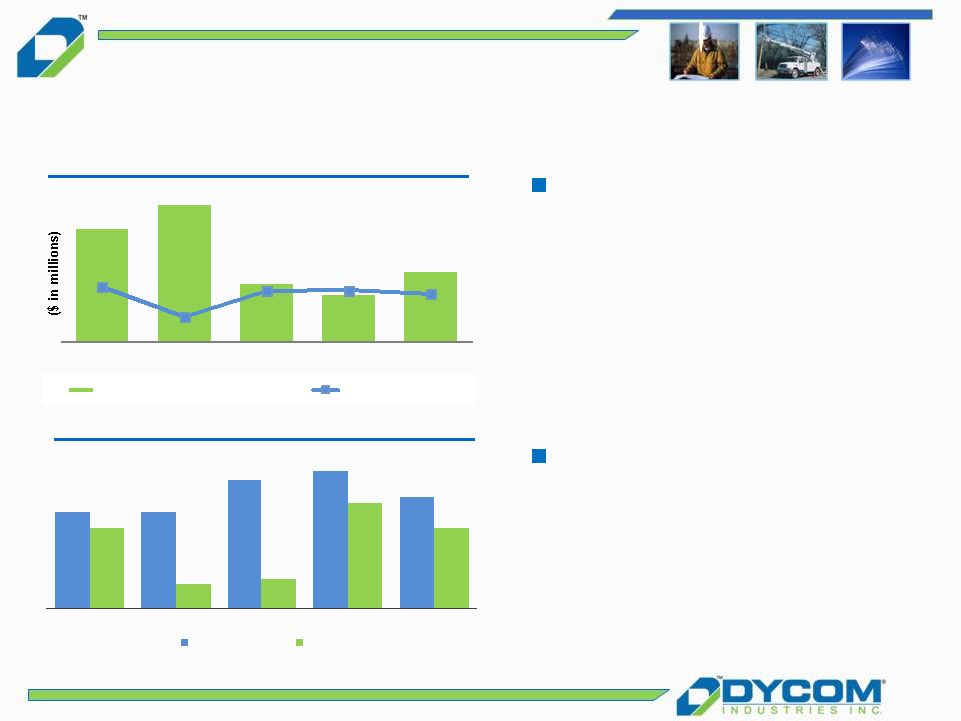

28

Operating Model Focused on Cash

Flow Generation

Solid cash flow from

operations and prudent

management of capital

expenditures has provided

strong liquidity position

Note: Leverage and Net Leverage excludes L/C’s.

1

Numbers reflect Dycom standalone. Capital expenditures are net of proceeds from

disposals of assets. Cash from Operations and Capex

1

Leverage

1

1.2x

1.2x

1.6x

1.7x

1.4x

1.0x

0.3x

0.4x

1.3x

1.0x

0.0x

0.5x

1.0x

1.5x

2.0x

FY2008

FY2009

FY2010

FY2011

FY2012

Leverage

Net Leverage

Low historical and net

leverage contribute to strong

balance sheet and provide

capacity for strategic

expansion

$104

$127

$54

$44

$65

5.1%

2.3%

4.7%

4.7%

4.4%

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

14.00%

0

20

40

60

80

100

120

140

FY2008

FY2009

FY2010

FY2011

FY2012

Cash Flow from Operating Activities

Capex % of Revenue |

29

Proven and Experienced Senior

Management Team

Executive

Industry Tenure

Comment

Steven E. Nielsen

President & CEO

27 years

19 years with Dycom; prior experience with Henkels &

McCoy

Timothy R. Estes

EVP & COO

39 years

18 years with Dycom; prior experience with BellSouth

H. Andrew DeFerrari

Sr. VP & CFO

8

years

8

years with Dycom; prior experience with Ernst & Young

Richard B. Vilsoet

General Counsel

7

years

7 Years with Dycom as external counsel; prior experience

with Shearman & Sterling

Seasoned management team with several decades of combined industry experience

Dycom’s executive management team has successfully navigated multiple

business cycles with the Company emerging stronger and poised for continued

stability Subsidiary management has cultivated and maintained deep and

sustained relationships with decision-makers and local service

providers in their respective locales over time |

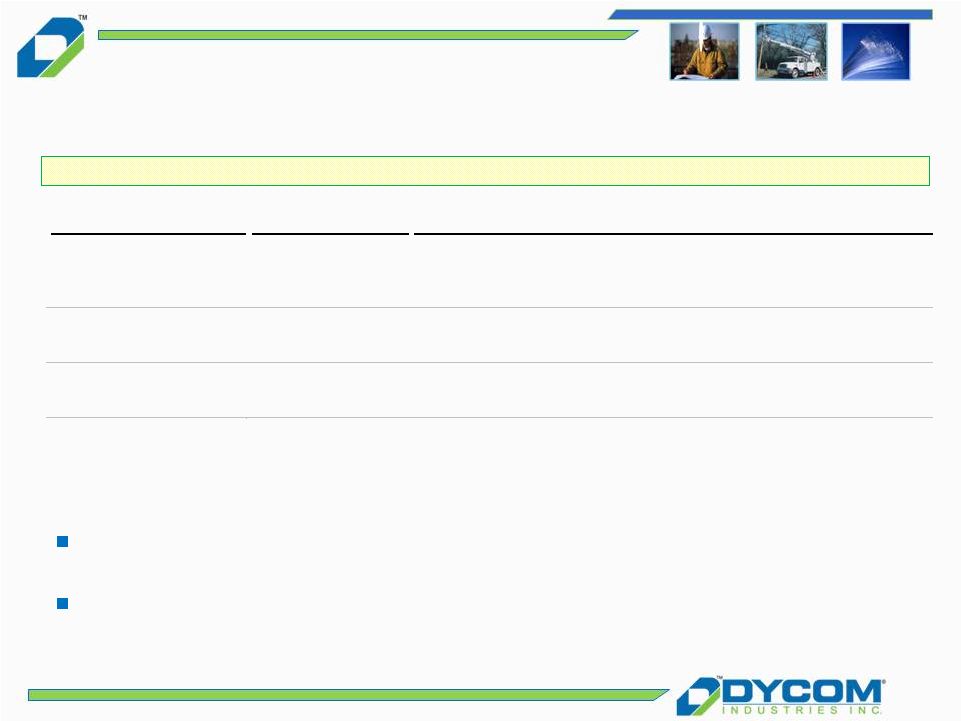

30

Agenda

Transaction Overview

Appendix

Financial Summary

Business Overview

Target Overview

Credit Strengths |

31

Historical and Pro Forma Financials

Revenue

Adjusted EBITDA

Adjusted EBITDA less Capex

2

Leverage

$131

$117

$86

$110

FY2008

FY2009

FY2010

FY2011

PF 2012¹

Dycom Adj. EBITDA

Target Adj. EBITDA

$179

$1,230

$1,107

$989

$1,036

FY2008

FY2009

FY2010

FY2011

PF 2012¹

Dycom Revenue

Target Revenue

$1,736

$69

$92

$39

$61

FY2008

FY2009

FY2010

FY2011

PF 2012¹

Dycom Adj. EBITDA

-

Capex

Target Adj. EBITDA -

Capex

$113

1.2x

1.2x

1.6x

1.7x

2.7x

1.0x

0.3x

0.4x

1.3x

2.5x

FY2008

FY2009

FY2010

FY2011

PF 2012¹

Leverage

Net Leverage

1

2

PF numbers reflect Dycom FY2012 (28-Jul-2012) and Target LTM 30-Sep-2012 results. PF

amounts and calculations herein derived from PF financial information filed by Dycom on Form

8-K on 28-Nov-2012.

Pro forma 2012 capital expenditures net of proceeds from disposals of $24.8 million for Dycom FY2012

and $1.1 million for Target for LTM September 30, 2012. |

32

Agenda

Transaction Overview

Appendix

Financial Summary

Business Overview

Target Overview

Credit Strengths |

33

Adjusted EBITDA Reconciliation

Pro Forma

LTM

2

Fiscal Year Ended

2

($ in millions)

July 28,

2012

October 27,

2012

July 28,

2012

July 30,

2011

July 31,

2010

July 25,

2009

July 26,

2008

Net Income from continuing operations

$40.2

$38.3

$39.4

$16.1

$5.8

$(53.2)

$24.4

Interest expense, net

28.9

16.7

16.7

15.9

14.2

14.5

12.4

Income tax provision

25.7

23.9

25.2

12.4

4.9

(1.4)

13.2

Depreciation and amortization

86.5

62.0

62.7

62.5

63.6

65.4

67.2

EBITDA

$181.3

$141.0

$144.0

$106.9

$88.5

$25.4

$117.3

Gain on sale of assets

(15.7)

(14.1)

(15.4)

(10.2)

(7.7)

(3.9)

(6.7)

Stock-Based Compensation

7.0

7.9

7.0

4.4

3.4

3.9

5.2

Charges for certain litigation matters

-

-

-

0.6

1.6

-

7.6

Loss on extinguishment of debt, net

-

-

-

8.3

-

(3.0)

-

Acquisition related costs

-

0.7

-

0.2

-

-

-

Write-off of deferred financing costs

-

-

-

-

-

0.6

-

Goodwill impairment charges

-

-

-

-

-

94.4

9.7

Reversal of pre-acquisition related accrual

-

-

-

-

-

-

(1.7)

Target Management Fees

3

6.9

-

-

-

-

-

-

Adjusted EBITDA

$179.5

$135.5

$135.5

$110.2

$85.8

$117.2

$131.2

Total Debt

$

478.6

$

187.6

$

187.6

$

187.8

$

135.4

$

136.3

$

153.4

Net Debt

$

442.9

$

132.8

$

135.0

$

143.0

$

32.1

$

31.6

$

131.3

Total Debt / Adjusted EBITDA

2.7

x

1.4

x

1.4

x

1.7

x

1.6

x

1.2

x

1.2

x

Net Debt / Adjusted EBITDA

2.5

x

1.0

x

1.0

x

1.3

x

0.4

x

0.3

x

1.0

x

1

1

PF numbers reflect Dycom FY2012 (28-Jul-2012) and Target LTM 30-Sep-2012 results. PF

amounts and calculations herein derived from PF financial information filed by Dycom on

2

Numbers reflect Dycom

standalone.

3

Target Management Fees adjusted herein represent other corporate charges of Target from the seller

which would not have existed on a pro forma basis and will not continue upon

the consummation of the Acquisition. Form 8-K on

28-Nov-2012. |