Attached files

| file | filename |

|---|---|

| 8-K - 8-K - MERIT MEDICAL SYSTEMS INC | a8k11262012.htm |

| EX-99.1 - EX-99.1 - MERIT MEDICAL SYSTEMS INC | pressrelease11262012.htm |

Acquisition of Thomas Medical NASDAQ: MMSI November 2012 1

Forward Looking Statements Statements contained in this release which are not purely historical are forward‐looking statements within, the meaning of the Private Securities Litigation Reform Act of 1995 and are subject to risks and uncertainties such as those described in Merit's Annual Report on Form 10‐K for the year ended December 31, 2011. Such risks and uncertainties include risks relating to: healthcare policy changes which may have a material adverse effect on Merit’s operations or financial results; infringement of Merit's technology or the assertion that Merit's technology infringes the rights of other parties; national economic and industry changes and their effect on Merit's revenues, collections and supplier relations; termination or interruptions of supplier relationships, or failure of suppliers to perform; product recalls and product liability claims inability to successfully manage growth through acquisitions delays in obtaining regulatory approvals or; , ; , the failure to maintain such approvals; failure to comply with governing regulations and laws; concentration of Merit's revenues among a few products and procedures; development of new products and technology that could render Merit's products obsolete; market acceptance of new products; introduction of products in a timely fashion; price and product competition; availability of labor and materials; cost increases; fluctuations in and obsolescence of inventory; volatility of the market price of Merit's common stock; foreign currency fluctuations; changes in key personnel; work stoppage or transportation risks; modification or limitation of governmental or private insurance reimbursements; changes in health care markets related to health care reform initiatives; limits on reimbursement imposed by governmental programs; impact of force majeure events on Merit's business, including severe weather conditions; failure to comply with applicable environmental laws; and other factors referred to in Merit's Annual Report on Form 10‐K for the year ended December 31, 2011, and other reports filed with the Securities and Exchange Commission. All subsequent forward‐looking statements attributable to Merit or persons acting on its behalf are expressly qualified in their entirety by these cautionary statements. Actual results will differ, and may differ materially, from anticipated results. Financial estimates are subject to change and are not intended to be relied upon as predictions of future operating results, and Merit assumes no obligation to update or disclose revisions to those estimates. 2

Merit Medical Focus • Merit designs, manufactures and markets single‐use products for use in: – Interventional Radiology – Interventional Cardiology – Gastroenterology – Stand‐alone Imaging Centers 3

Merit Medical Highlights • Broad and Diversified Product Offering • History of Internal Product Development • Expansive Patent Portfolio • Global Footprint • Highly Trained Direct Sales Force in Key Markets • Manufacturing and Regulatory Excellence • Market Driven Innovation • Experienced Management • Track Record of Growth and Profitability 4

Merit Medical Strategic Objectives • Increase addressable market opportunity • Expand offering to targeted call points • Advance technology base • Leverage global sales channels • Create product pull through ‐ • Increase margins • Maximize profitability and cash flow • Participate in emerging procedural opportunities 5

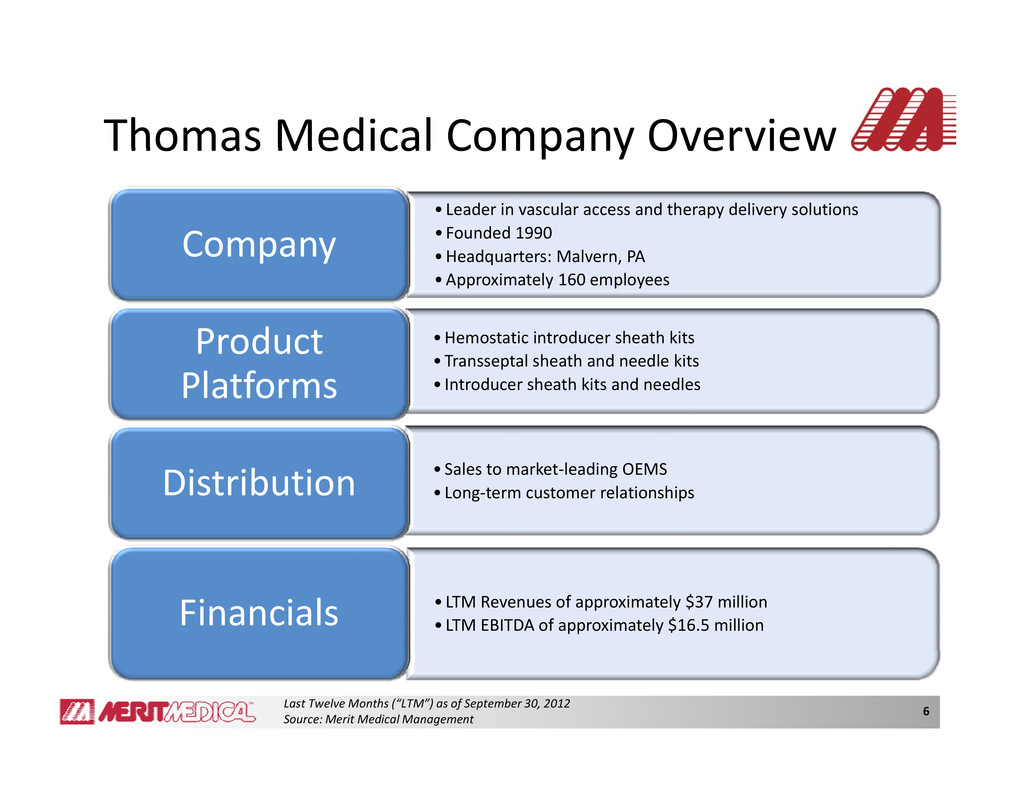

Thomas Medical Company Overview •Leader in vascular access and therapy delivery solutions • Founded 1990Company •Headquarters: Malvern, PA •Approximately 160 employees •Hemostatic introducer sheath kitsProduct •Transseptal sheath and needle kits • Introducer sheath kits and needles Platforms •Sales to market‐leading OEMS • Long‐term customer relationshipsDistribution •LTM Revenues of approximately $37 million • LTM EBITDA of approximately $16.5 millionFinancials 6 Last Twelve Months (“LTM”) as of September 30, 2012 Source: Merit Medical Management

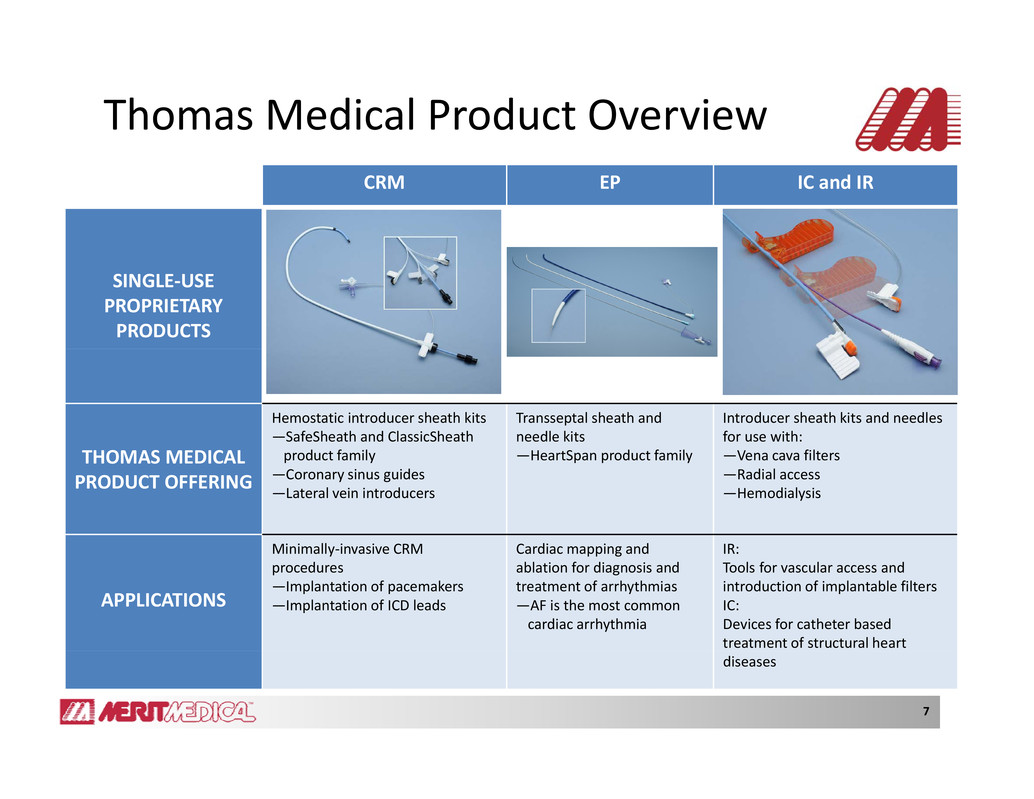

Thomas Medical Product Overview CRM EP IC and IR SINGLE‐USE PROPRIETARY PRODUCTS Hemostatic introducer sheath kits —SafeSheath and ClassicSheath Transseptal sheath and needle kits Introducer sheath kits and needles for use with: THOMAS MEDICAL PRODUCT OFFERING product family —Coronary sinus guides —Lateral vein introducers —HeartSpan product family —Vena cava filters —Radial access —Hemodialysis Minimally‐invasive CRM Cardiac mapping and IR: • • • APPLICATIONS procedures —Implantation of pacemakers —Implantation of ICD leads ablation for diagnosis and treatment of arrhythmias —AF is the most common cardiac arrhythmia Tools for vascular access and introduction of implantable filters IC: Devices for catheter based treatment of structural heart 7 diseases

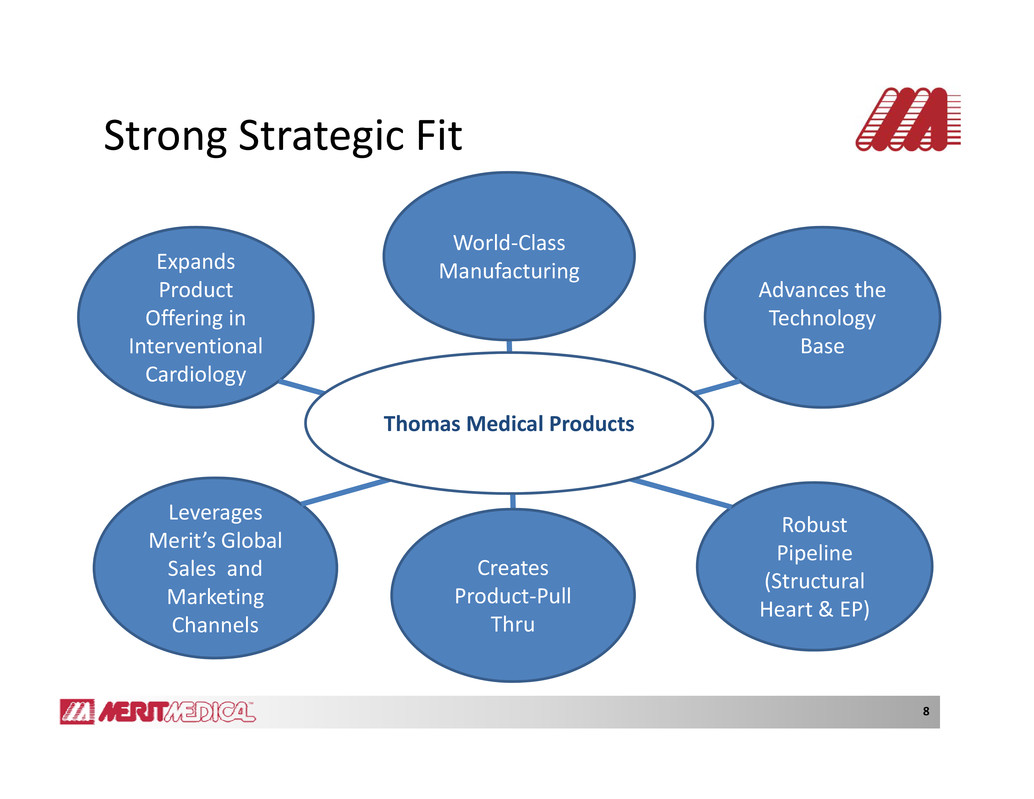

Strong Strategic Fit World‐Class Advances the Technology Base Expands Product Offering in Interventional Manufacturing Cardiology Thomas Medical Products Robust Pipeline Leverages Merit’s Global (Structural Heart & EP) Sales and Marketing Channels Creates Product‐Pull Thru 8

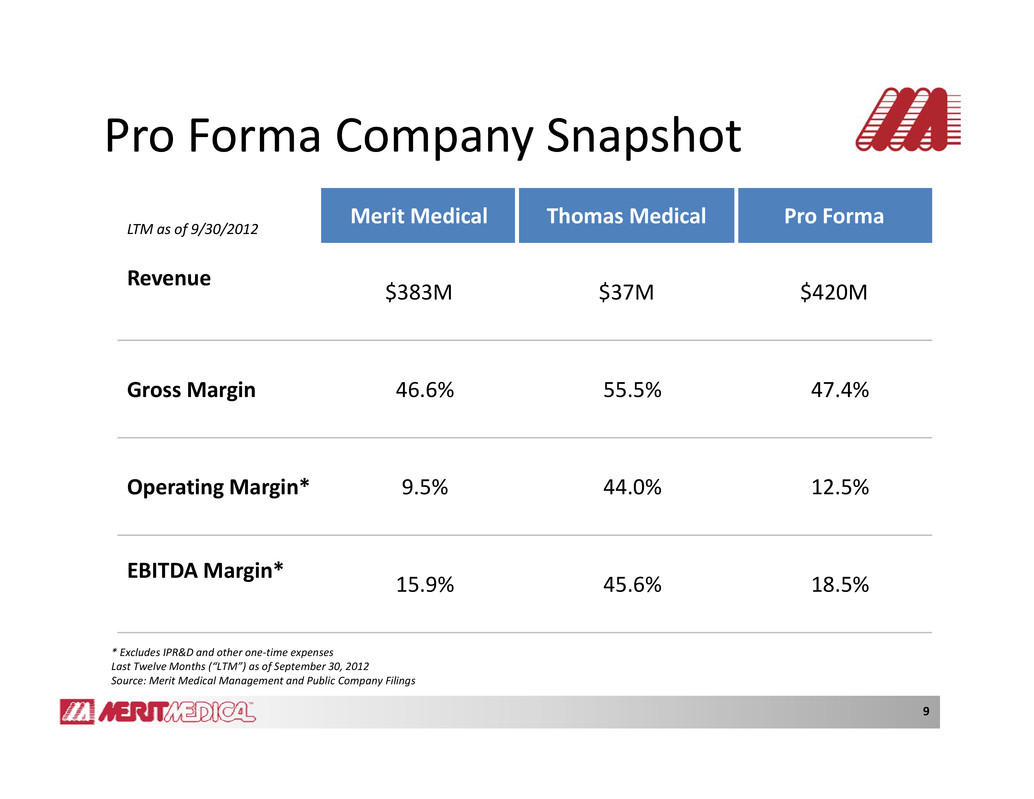

Pro Forma Company Snapshot LTM as of 9/30/2012 Merit Medical Thomas Medical Pro Forma Revenue $383M $37M $420M Gross Margin 46.6% 55.5% 47.4% Operating Margin* 9.5% 44.0% 12.5% EBITDA Margin* 15.9% 45.6% 18.5% * Excludes IPR&D and other one time expenses 9 ‐ Last Twelve Months (“LTM”) as of September 30, 2012 Source: Merit Medical Management and Public Company Filings

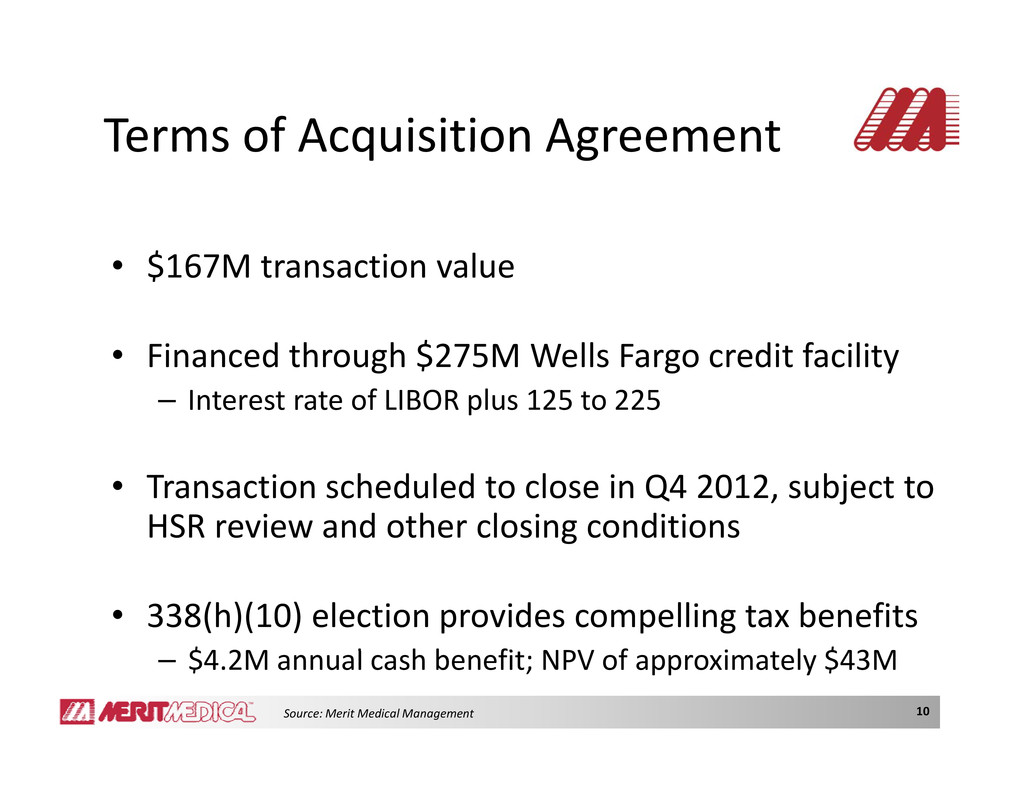

Terms of Acquisition Agreement • $167M transaction value Fi d th h $275M W ll F dit f ilit• nance roug e s argo cre ac y – Interest rate of LIBOR plus 125 to 225 • Transaction scheduled to close in Q4 2012, subject to HSR review and other closing conditions • 338(h)(10) election provides compelling tax benefits $4 2M l h b fi NPV f i l $43M 10 – . annua cas ene t; o approx mate y Source: Merit Medical Management

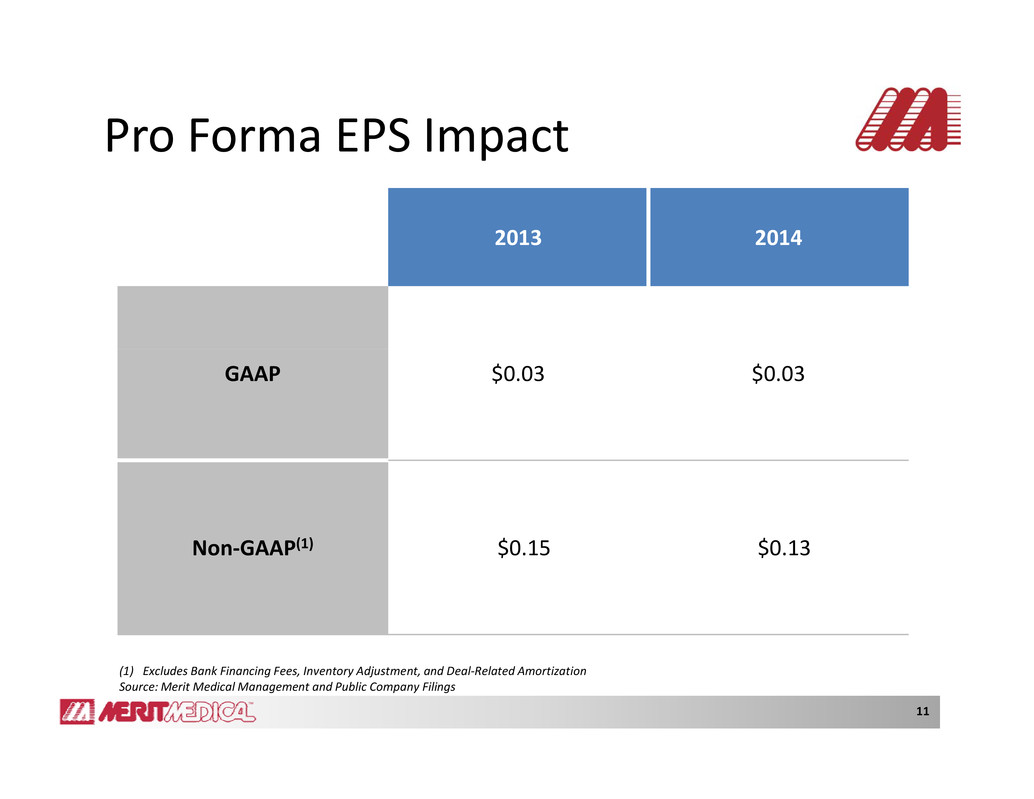

Pro Forma EPS Impact 2013 2014 GAAP $0.03 $0.03 Non‐GAAP(1) $0 15 $0 13. . 11 (1) Excludes Bank Financing Fees, Inventory Adjustment, and Deal‐Related Amortization Source: Merit Medical Management and Public Company Filings