Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Covidien plc | cov1126128-k.htm |

Spin-off of Pharmaceuticals November 26, 2012 Exhibit 99.1

Forward-Looking Statements November 26, 2012 2 | This presentation contains certain “forward-looking statements” that are not historical facts. These statements are based on management’s current expectations and are subject to risks, uncertainty and changes in circumstances, which may cause actual results to differ materially from anticipated results. All statements contained herein that are not clearly historical in nature are forward-looking and the words “anticipate,” “believe,” “expect,” “estimate,” “plan,” and similar expressions are generally intended to identify forward-looking statements. The forward-looking statements in this presentation may include statements addressing the following subjects: the expected timing of the completion of the transaction, the effect of the transaction on Covidien’s business and competitive position, future innovation and market growth, Covidien’s future financial performance, financial condition and operating results, and economic, business, competitive and/or regulatory factors affecting our business. Any of the following factors may affect our future results: – Uncertainties as to the timing of the transaction – The possibility that various closing conditions for the transaction may not be satisfied or waived, including that a governmental entity may prohibit, delay or refuse to grant approval for the consummation of the transaction – The effects of disruption from the transaction making it more difficult to maintain relationships with employees, customers, vendors and other business partners – The risk that stockholder litigation in connection with the transaction may result in significant costs of defense, indemnification and liability

Forward-Looking Statements (con’t) – Other business effects, including the effects of industry, economic or political conditions outside of Covidien’s control – Transaction costs and other risks and uncertainties discussed in Covidien’s filings with the U.S. Securities and Exchange Commission, including the “Risk Factors” sections of Covidien’s most recent annual report on Form 10-K and subsequent quarterly reports on Form 10-Q. Covidien does not undertake any obligation to update any forward-looking statements as a result of new information, future developments or otherwise, except as expressly required by law. All forward-looking statements in this announcement are qualified in their entirety by this cautionary statement. November 26, 2012 3 |

Non-GAAP Financial Measures This presentation discusses measures which may be considered “non-GAAP” financial measures under applicable Securities and Exchange Commission rules and regulations. These non-GAAP financial measures should be considered supplemental to and not a substitute for financial information prepared in accordance with generally accepted accounting principles. The definition of these non-GAAP measures may differ from similarly titled measures used by others. The Company generally uses non-GAAP financial measures to facilitate management’s internal comparisons to Covidien’s historical operating results, to competitors’ operating results, and to provide greater transparency to investors of supplemental information used by management in its financial and operational decision-making, including to evaluate Covidien’s operating performance and to determine management incentive compensation. The Company presents its operating margin forecast before special items to give investors a perspective on the expected underlying business results. Because the Company cannot predict the timing and amount of such items and the associated charges or gains that will be recorded in the Company’s financial statements, it is difficult to include the impact of those items in the forecast. The following is a list of the non-GAAP financial measures which may be discussed in this presentation: Adjusted Gross Margin: Gross profit excluding inventory charges, impairments, transaction costs, restructuring related charges, net / Net Sales (expressed as a percentage). Adjusted Operating Income: Operating income excluding charges or income for class action and shareholder settlements, net of insurance recoveries, impairments, restructuring, legal, licensing fees, loss on divestiture, environmental, separation costs, transaction costs and in-process R&D. Adjusted Operating Income Margin: Adjusted Operating Income / Net Sales (expressed as a percentage). Additional information is available in the Investor Relations section of our website www.covidien.com November 26, 2012 4 |

References to “New Covidien” in this presentation reflect the Covidien plc historical reported GAAP results less the historical reported GAAP results of the Pharmaceuticals segment. These results are not necessarily representative of the results that will be reported by “New Covidien” or the Pharmaceuticals segment as stand-alone companies. In addition, they are not necessarily indicative of the future results of these companies. November 26, 2012 5 |

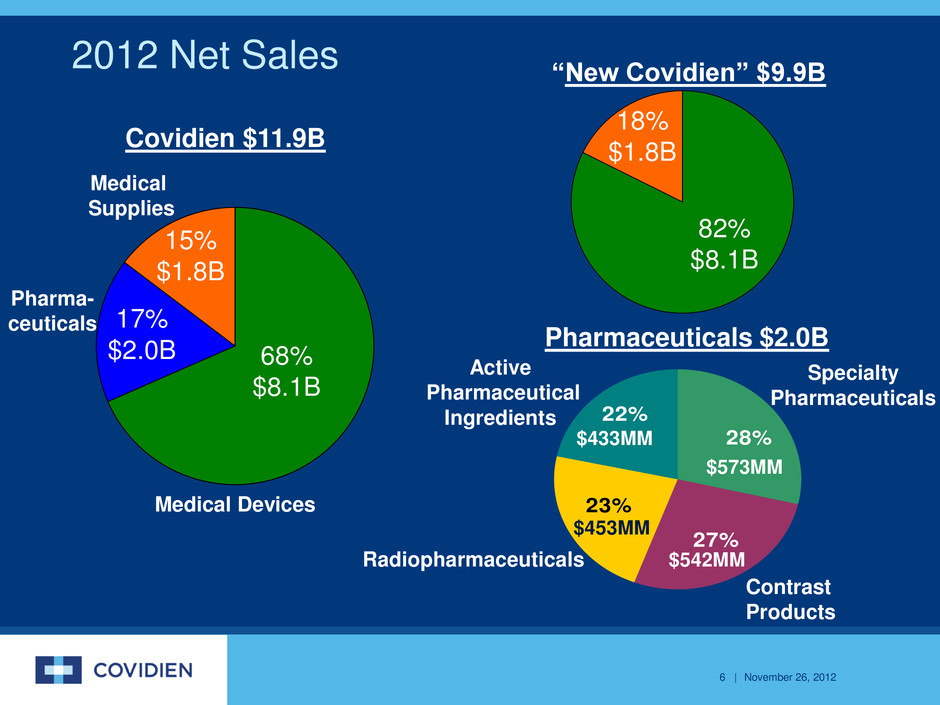

Medical Supplies 2012 Net Sales Medical Devices Pharma- ceuticals 68% $8.1B 15% $1.8B 17% $2.0B 82% $8.1B 18% $1.8B Active Pharmaceutical Ingredients Contrast Products Specialty Pharmaceuticals Radiopharmaceuticals 28% 27% 23% 22% Covidien $11.9B “New Covidien” $9.9B Pharmaceuticals $2.0B $573MM $542MM $433MM $453MM November 26, 2012 6 |

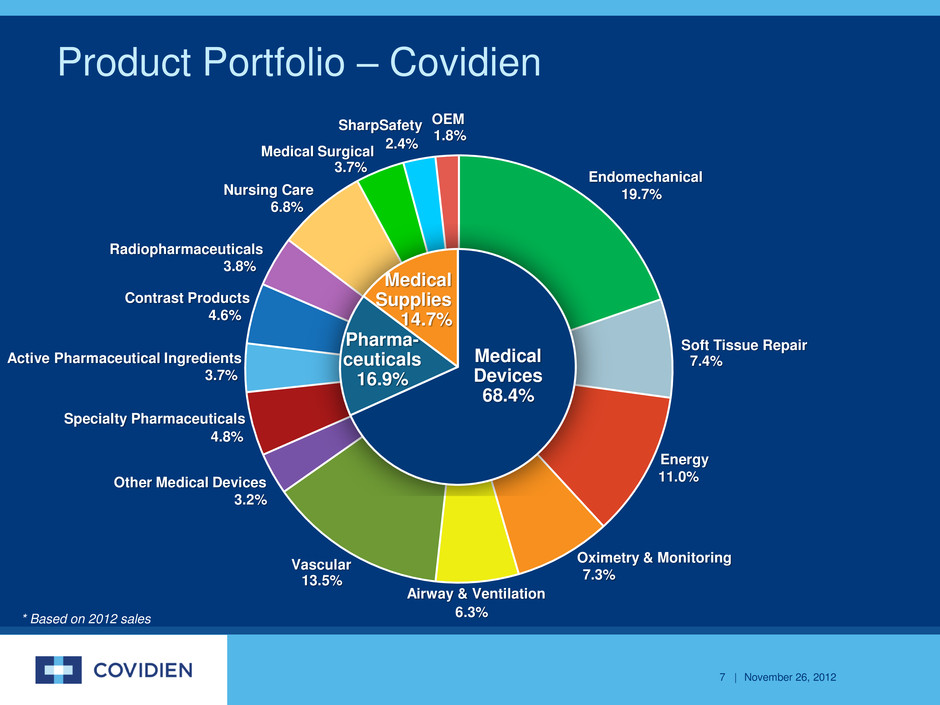

Product Portfolio – Covidien Endomechanical 19.7% Soft Tissue Repair 7.4% Energy 11.0% Oximetry & Monitoring 7.3% Airway & Ventilation 6.3% Vascular 13.5% Other Medical Devices 3.2% Specialty Pharmaceuticals 4.8% Active Pharmaceutical Ingredients 3.7% Contrast Products 4.6% Radiopharmaceuticals 3.8% Nursing Care 6.8% Medical Surgical 3.7% SharpSafety 2.4% OEM 1.8% Medical Devices 68.4% Medical Supplies 14.7% Pharma- ceuticals 16.9% * Based on 2012 sales November 26, 2012 7 |

Endomechanical 23.7% Soft Tissue Repair 9.0% Energy 13.2% Oximetry & Monitoring 8.8% Airway & Ventilation 7.5% Vascular 16.3% Other Medical Devices 3.8% Nursing Care 8.2% Medical Surgical 4.5% SharpSafety 2.9% OEM 2.1% Medical Devices 82.3% Medical Supplies 17.7% * Based on 2011 sales Product Portfolio – “New Covidien” November 26, 2012 8 |

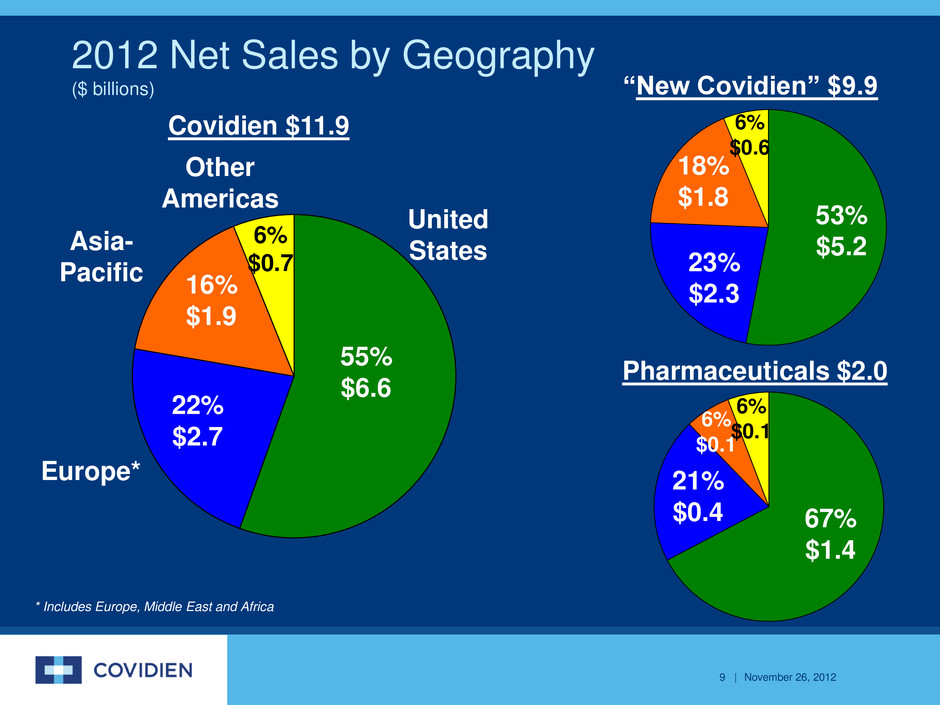

United States Europe* Other Americas 2012 Net Sales by Geography ($ billions) Asia- Pacific 6% $0.7 55% $6.6 16% $1.9 22% $2.7 Covidien $11.9 6% $0.6 53% $5.2 18% $1.8 23% $2.3 “New Covidien” $9.9 Pharmaceuticals $2.0 6% $0.1 67% $1.4 6% $0.1 21% $0.4 * Includes Europe, Middle East and Africa November 26, 2012 9 |

Historical Sales Growth ($ billions) 2012 2007-2012 Net Sales* CAGR Medical Devices $8.1 9.2% Pharmaceuticals 2.0 0.4% Medical Supplies 1.8 0.3% Total Covidien $11.9 5.9% “New Covidien” $9.9 7.3% Pharmaceuticals 2.0 0.4% * As reported November 26, 2012 10 |

2012 Adjusted Gross Margin, R&D, Depreciation & Amortization ($ millions) Adjusted Adjusted Net Sales Gross Profit* Gross Margin* Covidien $11,852 $6,859 57.9% “New Covidien” $9,851 $5,947 60.4% Pharmaceuticals $2,001 $912 45.6% R&D % of Depreciation & Net Sales Amortization Covidien 5.3% $633 “New Covidien” 4.9% $502 Pharmaceuticals 7.2% $131 November 26, 2012 11 |

2012 Segment Operating Income and Margin* ($ millions) % of Operating Income Net Sales Medical Devices $2,499 30.8% Pharmaceuticals 337 16.8% Medical Supplies 214 12.3% Reportable Segments 3,050 25.7% Less Pharmaceuticals (337) “New Covidien” $2,713 27.5% November 26, 2012 12 |

2012 Segment Operating Income and Margin* ($ millions) Covidien “New Covidien” November 26, 2012 13 |

Manufacturing Footprint Covidien 51 Manufacturing facilities in 18 countries Pharmaceuticals 10 Manufacturing facilities in 4 countries “New Covidien” 41 Manufacturing facilities in 17 countries November 26, 2012 14 |

Reconciliation ($ millions) Gross margin Covidien plc 2012 percent GAAP gross profit $6,814 57.5% Impairments 15 Restructuring and related charges, net* 13 Transaction costs* 17 Adjusted gross profit $6,859 57.9% November 26, 2012 15 | * Restructuring includes restructuring-related accelerated depreciation and transaction costs relate to the sale of acquired inventory that had been written up to fair value upon acquisition.

Spin-off of Pharmaceuticals November 26, 2012