Attached files

| file | filename |

|---|---|

| 8-K - 8-K Q3 2012 MEMBER PRESENTATION - Federal Home Loan Bank of Seattle | a8-k11192012q3resultsandme.htm |

Federal Home Loan Bank of Seattle Q3 2012 Business and Financial Update Michael L. Wilson President and Chief Executive Officer November 19, 2012

2 Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including highlights of financial statements as of and for the three and nine months ended September 30, 2012. Forward-looking statements are subject to known and unknown risks and uncertainties. Actual financial performance and condition, as well as other actions, including those relating to the Consent Arrangement, may differ materially from that expected or implied in forward- looking statements because of many factors. Such factors may include, but are not limited to, changes in general economic and market conditions (including effects on, among other things, U.S. debt obligations and mortgage-related securities), regulatory and legislative actions and approvals (including those of the Finance Agency), business and capital plan and policy adjustments and amendments, demand for advances, the Seattle Bank's ability to meet adequate capital levels, accounting adjustments or requirements (including changes in assumptions and estimates used in the bank's financial models), changes in the bank's management and Board of Directors, competitive pressure from other Federal Home Loan Banks and alternative funding sources, interest-rate volatility, shifts in demand for our products and consolidated obligations, changes in projected business volumes, the bank's ability to appropriately manage its cost of funds, the cost-effectiveness of the bank's funding, changes in the bank's membership profile or the withdrawal of one or more large members, and hedging and asset-liability management activities. Additional factors are discussed in the Seattle Bank's most recent annual report on Form 10-K and subsequent quarterly reports on Form 10-Q. The Seattle Bank does not undertake to update any forward-looking statements made in this announcement.

Opening Remarks Q3 2012 Business and Financial Update Current Member-Focused Initiatives 2013 Challenges and Strategies Today’s Discussion 3

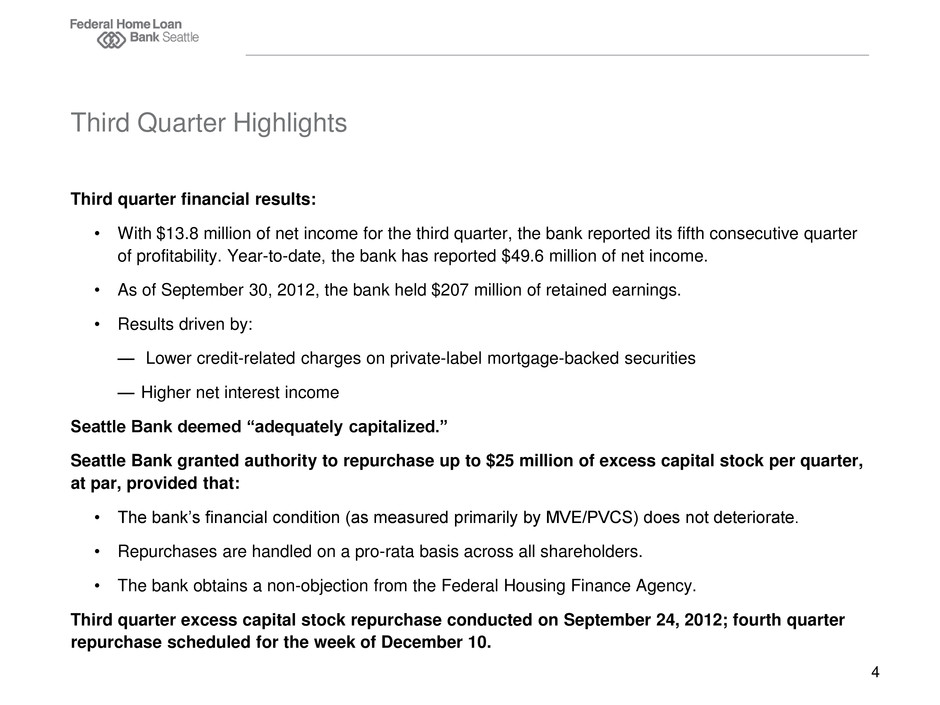

Third quarter financial results: • With $13.8 million of net income for the third quarter, the bank reported its fifth consecutive quarter of profitability. Year-to-date, the bank has reported $49.6 million of net income. • As of September 30, 2012, the bank held $207 million of retained earnings. • Results driven by: — Lower credit-related charges on private-label mortgage-backed securities — Higher net interest income Seattle Bank deemed “adequately capitalized.” Seattle Bank granted authority to repurchase up to $25 million of excess capital stock per quarter, at par, provided that: • The bank’s financial condition (as measured primarily by MVE/PVCS) does not deteriorate. • Repurchases are handled on a pro-rata basis across all shareholders. • The bank obtains a non-objection from the Federal Housing Finance Agency. Third quarter excess capital stock repurchase conducted on September 24, 2012; fourth quarter repurchase scheduled for the week of December 10. Third Quarter Highlights 4

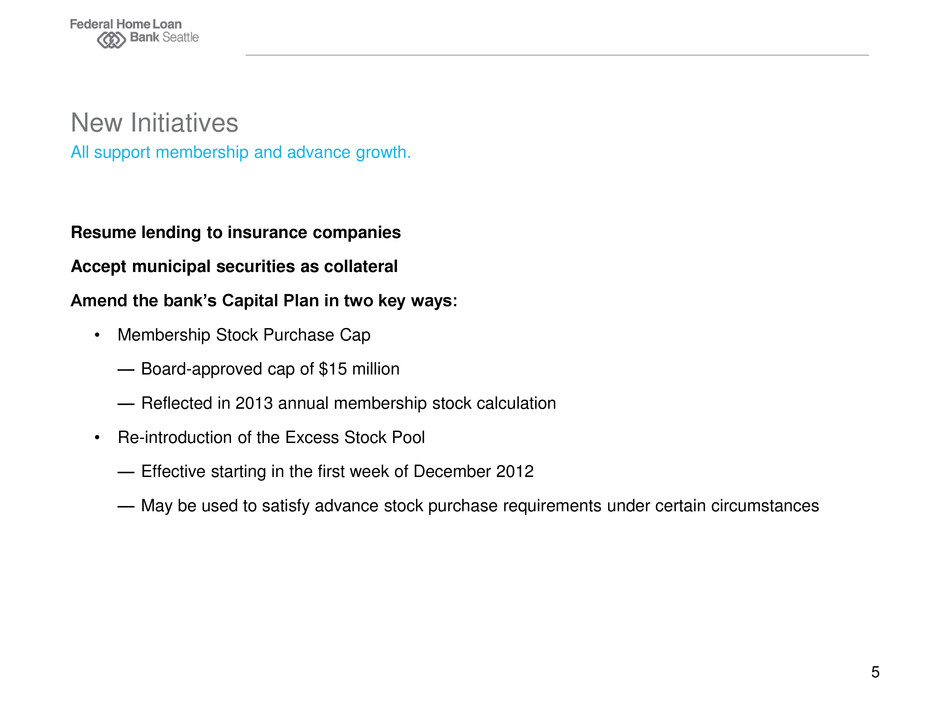

All support membership and advance growth. New Initiatives Resume lending to insurance companies Accept municipal securities as collateral Amend the bank’s Capital Plan in two key ways: • Membership Stock Purchase Cap — Board-approved cap of $15 million — Reflected in 2013 annual membership stock calculation • Re-introduction of the Excess Stock Pool — Effective starting in the first week of December 2012 — May be used to satisfy advance stock purchase requirements under certain circumstances 5

Q3 2012 Business and Financial Update 6

For the Three Months Ended September 30, For the Nine Months Ended September 30, 2012 2011 2012 2011 Net interest income after benefit (provision) for credit losses(1) $ 33,417 $ 33,531 $ 86,360 $ 77,917 Net other-than-temporary impairment credit losses (1,982) (311) (7,575) (88,295) Other non-interest income (2) 1,938 101,553 30,559 137,988 Total other expense 18,087 15,958 54,247 49,067 Total assessments (AHP) 1,529 7,854 5,510 7,854 Net Income (loss) 13,757 110,961 49,587 70,689 ($ thousands) / unaudited Selected Statements of Income Data 7 (1) Includes prepayment fees on advances, net. A benefit for credit losses of $2.4 million was recorded for the three and nine months ended September 30, 2012; a provision for credit losses of $1.4 million was recorded for the same periods in 2011. (2) Includes some or all of the following: gain on sale of mortgage loans, gain on sale of available-for-sale securities, gain on sale of held-to-maturity securities, gain (loss) on financial instruments held under fair value option, gain (loss) on derivatives and hedging activities, loss on early extinguishments of consolidated obligations, service fees, and other non-interest income. Gain on sale of $1.3 billion in mortgages in July 2011 resulted in $73.9 gain.

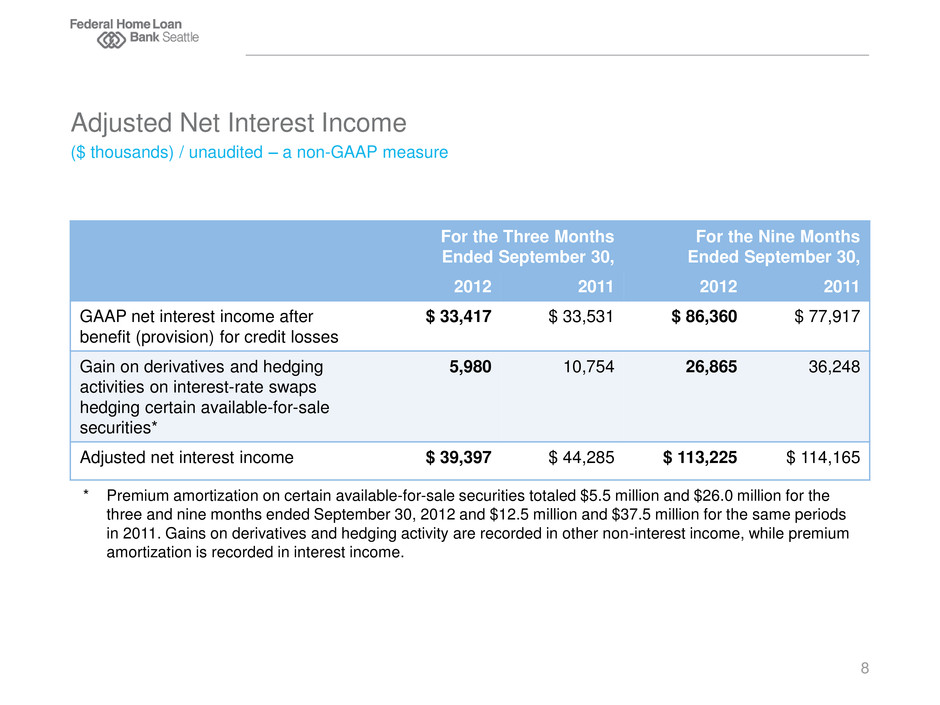

($ thousands) / unaudited – a non-GAAP measure Adjusted Net Interest Income 8 For the Three Months Ended September 30, For the Nine Months Ended September 30, 2012 2011 2012 2011 GAAP net interest income after benefit (provision) for credit losses $ 33,417 $ 33,531 $ 86,360 $ 77,917 Gain on derivatives and hedging activities on interest-rate swaps hedging certain available-for-sale securities* 5,980 10,754 26,865 36,248 Adjusted net interest income $ 39,397 $ 44,285 $ 113,225 $ 114,165 * Premium amortization on certain available-for-sale securities totaled $5.5 million and $26.0 million for the three and nine months ended September 30, 2012 and $12.5 million and $37.5 million for the same periods in 2011. Gains on derivatives and hedging activity are recorded in other non-interest income, while premium amortization is recorded in interest income.

2008 – Q3 2012 ($ millions) / Unaudited except for annual amounts Incremental Credit-Related OTTI Charges 9 $0 $20 $40 $60 $80 $100 $120 $140 Cumulative OTTI Charges as of September 30, 2012 = $524.8 million

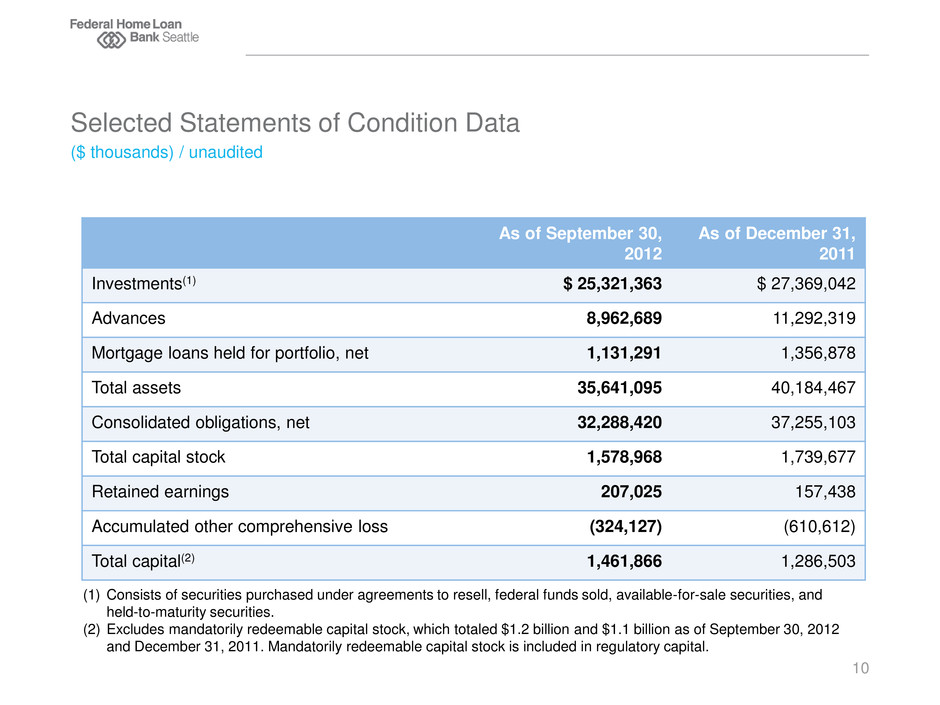

($ thousands) / unaudited Selected Statements of Condition Data 10 As of September 30, 2012 As of December 31, 2011 Investments(1) $ 25,321,363 $ 27,369,042 Advances 8,962,689 11,292,319 Mortgage loans held for portfolio, net 1,131,291 1,356,878 Total assets 35,641,095 40,184,467 Consolidated obligations, net 32,288,420 37,255,103 Total capital stock 1,578,968 1,739,677 Retained earnings 207,025 157,438 Accumulated other comprehensive loss (324,127) (610,612) Total capital(2) 1,461,866 1,286,503 (1) Consists of securities purchased under agreements to resell, federal funds sold, available-for-sale securities, and held-to-maturity securities. (2) Excludes mandatorily redeemable capital stock, which totaled $1.2 billion and $1.1 billion as of September 30, 2012 and December 31, 2011. Mandatorily redeemable capital stock is included in regulatory capital.

-$100 -$50 $0 $50 $100 $150 $200 $250 ($ millions) / unaudited except for annual amounts Key Metric: Total Retained Earnings 11

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% unaudited Key Metric: Market Value of Equity / Par Value of Capital Stock 12

-40% -30% -20% -10% 0% 10% 20% Quarterly Return on PVCS Quarterly Average Fed Funds Effective Rate Q3 2012 result reflects $73.9M gain on sale of mortgage loans. unaudited Key Metric: Return on PVCS vs. Federal Funds 13 Q408 result reflects prior accounting treatment for OTTI securities.

. All 12 FHLBanks reported a profit in third quarter 2012. OTTI charges were down significantly from prior periods. Advances were down slightly across the system, although some FHLBanks reported increases due to activity by large members. GAAP capital increased due to higher retained earnings and lower accumulated other comprehensive loss (AOCL). FHLBank System 14

Current Member-Focused Initiatives 15

Current Advance Offerings • 3-, 5-, and 7-Year Fixed-Rate Advance Offerings • Capped Floating-Rate Advance Offering • Competitively priced, short-term funding via Auction Advances • Coming Soon: A New “Test Your Credit Line” Offering Financial Strategies and Tools • Blended Funding Model • Marginal Cost of Funds Tool • What Counts and Economic Update Current Product Offerings 16

Liquidity and Off-the-Shelf Funding • Fixed- and adjustable-rate advances for terms from overnight to 30 years • Structured funding solutions for balance sheet and interest-rate risk management • Standby Letters of Credit – up to 10 years for commercial and 20 years for housing finance Transaction Services • Securities safekeeping • Wire transfers Community Investment Products • AHP: Direct subsidy and subsidized advances for affordable housing • Home$tart Program: Downpayment assistance grants now available for more than just first-time homebuyers • CIP / EDF: Reduced-rate advances for affordable housing and economic development in areas up to 115% of area median income Educational Programming • Fall Seminar Series Featuring Tom Farin • Member Educational Events Introducing the New Credit and Collateral Management System (CCMS) Your investment in the Seattle Bank gives you access to…. 17

2013 Challenges and Strategies 18

Industry Issues • Dodd-Frank Legislation • Basel III • Housing Finance Reform Seattle Bank Resources • Board of Directors • Affordable Housing Advisory Council • Executive Team • Relationship Managers 2013 Industry Challenges 19

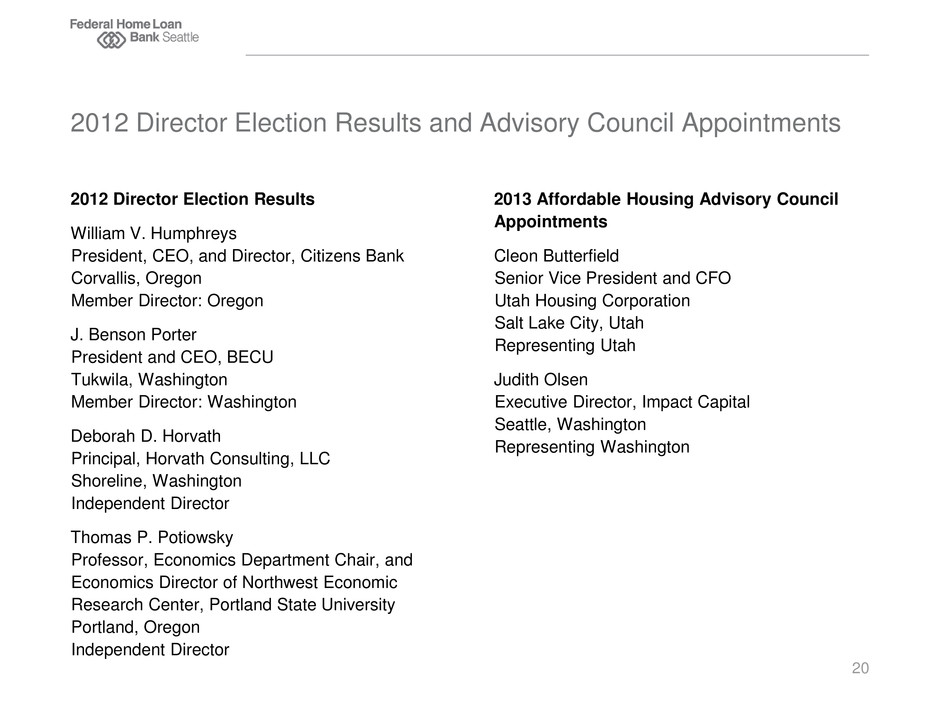

2012 Director Election Results William V. Humphreys President, CEO, and Director, Citizens Bank Corvallis, Oregon Member Director: Oregon J. Benson Porter President and CEO, BECU Tukwila, Washington Member Director: Washington Deborah D. Horvath Principal, Horvath Consulting, LLC Shoreline, Washington Independent Director Thomas P. Potiowsky Professor, Economics Department Chair, and Economics Director of Northwest Economic Research Center, Portland State University Portland, Oregon Independent Director 2012 Director Election Results and Advisory Council Appointments 20 2013 Affordable Housing Advisory Council Appointments Cleon Butterfield Senior Vice President and CFO Utah Housing Corporation Salt Lake City, Utah Representing Utah Judith Olsen Executive Director, Impact Capital Seattle, Washington Representing Washington

The Seattle Bank exists to provide members with funding and liquidity. • Advances are our core business. Reliability is crucial. • We must be available at all points in an economic cycle and during a member’s lifecycle. We want to be innovative to help members thrive in a challenging environment. • We work to anticipate member needs, and value our members’ input. We have an obligation to safeguard the capital our members have entrusted to us. • We must be able to redeem/repurchase stock at par. Any dividend must be reasonable. • We strive to optimize value to our members. Our Value Proposition for Seattle Bank Members 21

Questions? 22