Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) November 13, 2012

Southern Hospitality Development Corporation

(Name of registrant as specified in its charter)

| Colorado | 000-53853 | 80-0182193 |

| State of Incorporation | Commission File Number | IRS Employer Identification No. |

2 N. Cascade Ave, Suite 1400

Colorado Springs, CO 80903

(Address of principal executive offices)

719-265-5821

Telephone number, including

Area code

Art Dimensions, Inc.

(Former name or former address if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 1.01 Entry Into a Material Definitive Agreement

On November 13, 2012, Art Dimensions, Inc. (the “Company”) entered into an Agreement and Plan of Merger and Reorganization (the “Merger Agreement”) with Southern Hospitality Franchisee Holding Corporation (“SH”) whereby the Company would acquire SH in a reverse triangular merger (the “Acquisition”). On November 13, 2012, the parties closed the Acquisition and a Statement of Merger was filed and effective with the Colorado Secretary of State on that day. Upon closing the Acquisition, the Company issued a total number of common shares to the SH shareholders in exchange for all of their ownership interests in SH such that they now own approximately 89% of the Company. The shareholders of the Company prior to the Acquisition own approximately 11% of the Company after the closing of the Acquisition.

Item 2.01 Completion of Acquisition or Disposition of Assets

On November 13, 2012, the Company and SH closed the Acquisition, and the Company’s wholly owned subsidiary, ADI Merger Corp., was merged with and into SH. An aggregate of 5,259,129 Company shares were issued in the Acquisition.

Market Price of and Dividends on the Registrant’s Common Equity and Related Stockholder Matters

For a description of the Company’s Common Equity, see Item 5 in the Company’s 10-K for the year ended December 31, 2011. The price of a share of the Company’s common stock as of the date immediately prior to the public announcement of the Acquisition was $1.01.

Item 3.02 Unregistered Sale of Equity Securities

On November 13, 2012, the Company issued 5,259,129 shares of its common stock as consideration in the Acquisition in a private transaction in connection with the Acquisition. The Company relied on the exemption in Rule 506 of Regulation D of the Securities Act of 1933 for the share issuance. No commission or other remuneration was paid in connection with the share issuance.

Item 4.01 Changes in Registrant's Certifying Accountant.

(a) Previous Independent Registered Public Accounting Firm

(i) On November 14, 2012, the Company’s Board of Directors voted to dismiss its independent registered public accounting firm, MaloneBailey, LLP, of Houston, Texas, effective November 14, 2012, and to replace them with GHP Horwath, P.C., of Denver, Colorado. MaloneBailey, LLP has rendered an independent auditor’s report on the Company’s financial statements as of December 31, 2011 and 2010, and for the years then ended, and for the period from January 29, 2008 (inception) through December 31, 2011.

(ii) The dismissal of MaloneBailey, LLP was approved by the Company’s Board of Directors.

(iii) During the years ended December 31, 2011 and 2010 and through November 14, 2012, there were no disagreements between the Company and Malone Bailey, LLP. with respect to its accounting principles or practices, financial statement disclosure or audit scope or procedure, which, if not resolved to the satisfaction of MaloneBailey, LLP would have caused them to make reference to the subject matter of the disagreement in connection with their report. Further, the reports of MaloneBailey, LLP for the past two years did not contain an adverse opinion or disclaimer of opinion, nor were they modified as to uncertainty, audit scope, or accounting principles, except for an explanatory paragraph describing substantial doubt about our ability to continue as a going concern.

(b) New Independent Registered Public Accounting Firm

The Company engaged GHP Horwath, P.C. as our new independent registered public accounting firm as of November 14, 2012. During the two most recent fiscal years and through November 14, 2012, the Company has not consulted with GHP Horwath, P.C. regarding any of the following:

(1) The application of accounting principles to a specific transaction, either completed or proposed or the type of audit opinion that might be rendered on the Company's consolidated financial statements, and neither a written report nor oral advice was provided to the Company by GHP Horwath, P.C. that GHP Horwath, P.C. concluded was an important factor considered by the Company in reaching a decision as to an accounting, auditing or financial reporting issue;

1

(2) Any matter that was the subject of a disagreement, as that term is defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions to Item 304 of Regulation S-K; or

(3) Any matter that was a reportable event, as that item is defined in Item 304(a)(1)(v) of Regulation S-K.

Item 5.01 Changes in Control of Registrant

See “Officers and Directors After the Acquisition” and “Security Ownership of Officers/Directors and Management” below. The change in control occurred on November 13, 2012, in conjunction with the closing of the Acquisition. The shareholders of the Company prior to the Acquisition own approximately 11% of the Company after the closing of the Acquisition.

Item 5.02 Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers

On November 7, 2012, pursuant to the terms of the Merger Agreement, Kathy Sheehan submitted her resignation as a director and the Chief Financial Officer of the Company, effective as of October 31, 2012. Immediately thereafter Rebecca Gregarek, the sole remaining director, expanded the number of directors to four persons, and appointed JW Roth, Gary Tedder and Steve Cominsky to fill the vacancies created by expansion of the Board. The four Board members then elected JW Roth to serve as Chairman of the Board. Further, the Board members appointed Steve Cominsky to serve as Chief Executive Officer, Gary Tedder to serve as President, and David Lavigne to serve as Secretary and Treasurer.

On November 14, 2012, Rebecca Gregarek submitted her resignation as a director and officer of the Company.

See the discussion below for additional information about Messrs. Roth, Tedder and Cominsky.

Item 5.03 – Amendments to Articles of Incorporation or Bylaws

At the Special Meeting of shareholders held on November 12, 2012 (the “Special Meeting”), the Company’s shareholders approved an amendment to the Company’s Articles of Incorporation to change the name of the Company to Southern Hospitality Development Corporation. The Company filed the amendment to its Articles of Incorporation with the Colorado Secretary of State on November 13, 2012, and was effective immediately.

Item 5.06 – Change in Shell Company Status

The Company ceased being a shell company in connection with the Acquisition. See Items 1.01 and 2.01 for a description of the material terms of the Acquisition.

Item 5.07 – Submission of Matters to a Vote of Security Holders.

At the Special Meeting, the proposal to change the Company’s name to Southern Hospitality Development Corporation was submitted to the shareholders for approval. As of the record date, October 19, 2012, the Company had outstanding shares of common stock entitled to cast a total of 1,082,600 votes. In total, the holders of record of shares of common stock entitled to cast 838,700 votes were present in person or represented by proxy at the Special Meeting, which represented approximately 77% of the votes entitled to be cast at the meeting.

At the Special Meeting, the shareholders approved the proposal. The votes on the proposal were cast as follows:

|

For

|

Against

|

Abstain

|

||

|

838,700

|

0

|

0

|

2

Item 8.01 Other

On November 15, 2012, the Company filed a press release relating to the Acquisition. A copy of the press release is filed herewith as Exhibit 99.1.

The following information is included relating to the business and operations of SH, which, following the Acquisition is the business of the Company and its subsidiaries. In addition, financial statements for SH are filed herewith as Exhibits 99.2, 99.3 and 99.4.

1. Business of SH

The Company acquired Southern Hospitality Franchisee Holding Corporation (“SH”) in the Acquisition that closed November 13, 2012. SH is a Colorado corporation formed in August 2011. In November 2011 SH entered into an Area Developer Agreement (“ADA”) and a Franchise Agreement (“FA”) with SH Franchising & Licensing LLC (the “Franchisor”), for the exclusive rights for the first 10 cities identified in the ADA, subject to customary conditions and exceptions, and for the ownership and operation of up to 30 Southern Hospitality restaurants in the United States. The restaurants are intended to primarily serve southern or Memphis style barbeque and cuisine and alcoholic beverages (such as a range of bourbons and other spirits and cocktails) and will also sell certain related products and merchandise (such as meat rubs and memorabilia). Currently, one restaurant in New York City operates under the Southern Hospitality name.

The concept of the Southern Hospitality restaurants was largely created by Eytan Sugarman and Justin Timberlake. Currently there is one restaurant open in New York City, located in New York’s Hell’s Kitchen neighborhood and was opened in March 2011. Ryan Tedder, a singer-songerwriter and record producer and currently a member of the pop rock band, OneRepublic, is a part owner in the Hell’s Kitchen restaurant venture.

Southern Hospitality restaurants strive to provide guests with unique and high quality cuisine, along with a complimenting selection of spirits and wines served in an-upscale and high energy environment. Southern Hospitality restaurants are intended to be unique and fill what SH believes is a relative void in the restaurant and food service industry – being a full service “Memphis barbeque” or southern style restaurant. Our restaurants will serve menu items that SH does not believe are commonly found in full service restaurants, including dry rubbed barbeque ribs, sweet and sticky baby back ribs, unique fried chicken, fried pickles, as well as complimenting side dishes such as rosemary grits and southern style macaroni and cheese. Southern Hospitality restaurants have coupled their food menu with a full line of draft beers, an extensive list of tequilas and over fifty bourbons.

SH hopes to build upon Southern Hospitality’s business model by coupling its food and beverage offerings in store locations in traditionally vibrant areas, and have a history of attracting a range of clientele including persons interested in night-life and entertainment. SH believes that its model will help SH attract both persons interested in SH’s fare, and also permit SH to operate beyond the traditional lunch and dinner time periods. It is SH’s hope that its distinctive barbeque concept, combined with its unique and high-quality food, along with the ambiance and location of its restaurants will appeal to a wide range of persons.

SH anticipates generally attracting new customers through word-of-mouth, the visibility of its branded merchandise, traditional advertising channels (such as radio and print advertising) and through media coverage. In addition, certain Franchisor-owned restaurants may employ their own public relations personnel and engage in certain promotional activities – such as the distribution or sale of vouchers to encourage people to visit Southern Hospitality restaurants. SH also anticipates hosting fund-raising parties for local charities at its restaurants with the support of celebrities.

SH intends to locate restaurants in what it believes are high profile cities and/or in or near traditional entertainment and night life areas or near major tourist markets and attractions. The ADA identifies the first ten cities where SH has rights to open such restaurants: Denver, CO; Scottsdale/Phoenix, AZ; Chicago, IL; Dallas, TX; Austin, TX; Houston, TX; Washington, DC; Palo Alto, CA; New Orleans, LA; and Atlanta, GA. SH anticipates expects open its first restaurant in Denver in January 2013 (the “Denver Restaurant”). The Denver Restaurant will be located in the historic St. Elmo’s Hotel building in lower downtown Denver.

3

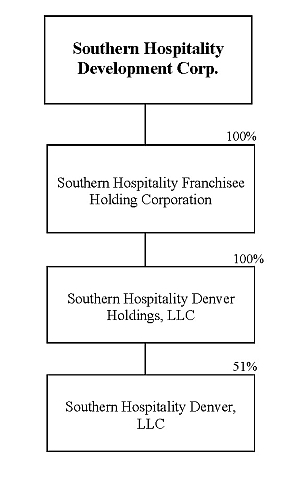

The following is the Company’s organizational chart, listing ownership of each subsidiary, after the Acquisition:

4

Southern Hospitality Denver, LLC (“Denver LLC”) entered into a lease for the space located at 1433 17th Street, Suite 150, Denver, Colorado, which is the location of the Denver Restaurant. The lease commenced on April 16, 2012, and will expire on August 31, 2022, subject to a right to renew. The leased space consists of 7,464 square feet and includes both indoor and outdoor seating.

Denver LLC is owned 51% by the Company (through its subsidiaries), and 49% by an entity controlled by its members. SH assigned the FA for the Denver Restaurant to Denver LLC. The material terms of the ADA and the FA, as amended, are as follows:

The ADA grants SH the exclusive right to develop Southern Hospitality restaurants in Denver, CO; Scottsdale/Phoenix, AZ; Chicago, IL; Dallas, TX; Austin, TX; Houston, TX; Washington, DC; Palo Alto, CA; New Orleans, LA; and Atlanta, GA.. Additionally, SH has the right to open up to 20 additional restaurants upon the renewal of the development terms. Under the current ADA, the first ten restaurants must be opened by 2015 before the development terms can be renewed. The royalty fees per restaurant range from 3% to 5% of gross sales, and advertising fees owed to the Franchisor do not apply until the opening of the fifth restaurant, after which the Franchisor and SH must mutually agree upon the fee. Two officers of SH have personally guaranteed SH’s performance of the ADA requirements.

The FA grants to SH a non-exclusive license to use the Franchisor’s marks, business methods, proprietary products, confidential information and intellectual property to operate a Southern Hospitality restaurant. The Franchisor will provide training for the restaurant managers and staff, and the FA generally requires SH to follow the Franchisor’s systems and methods for operating the restaurant. The FA is effective for ten years from November 4, 2011, and has an option to be renewed for two subsequent terms, each of 5 years. Although SH has licensing rights pursuant to the FA, the Franchisor may still market and sell products and services through various channels, including online and through third parties.

Management Agreement with AMHC Managed Services. Effective September 1, 2011, SH entered into a management agreement (the “Management Agreement”) with AMHC Managed Services, Inc. (“AMHC Services”). The significant terms of the Management Agreement provide for monthly payments to AMHC Services in exchange for the ability of the SH to fully utilize the management expertise, financial and accounting expertise, support staff and location of AMHC Services, including the expertise for the position of the SH’s Chief Financial Officer and necessary support for compliance under the securities laws with respect to any private or public reports, including filings with the SEC. The initial Management Agreement was for a one year term, and included monthly cash payments as well as a grant to AMHC Services of a warrant to purchase 500,000 shares of SH common stock at $0.0005 per share, exercisable for a three year term. The Management Agreement was renewed effective October 12, 2012 for an additional twelve months. An additional warrant for 500,000 shares of SH common stock, exercisable at $0.0005 per share was granted as part of the renewal. Both warrants were exercised for SH common stock prior to the Acquisition. The total cash amount paid to AMHC Services under the agreement in 2011 was $140,000 and in 2012 (through September 30) was $315,000.

Competition

The restaurant industry is highly competitive. There are many well-established restaurants that are direct and indirect competitors in the market and that have significant financial and other resources. There is also active competition for management personnel, attractive suitable real estate sites, supplies and restaurant employees. Further, we face growing competition from the supermarket industry, with improved selections of prepared meals, and from quick service and fast casual restaurants, as a result of higher-quality food and beverage offerings. We expect intense competition to continue in all of these areas.

Industry and internal research conducted suggests that consumers consider casual dining restaurants within a given trade area when making dining decisions. As a result, an individual restaurant’s competitors will vary based on their trade area and will include both independent and chain restaurants. At an aggregate level, all major casual dining restaurants would be considered competitors of our concepts.

5

We believe our principal strategies, which include but are not limited to, the culture in which we choose to operate our business; the belief that every team member makes a difference, our overall commitment to the guests, the fact that our brand as well as product differentiates us from others in the industry, and that we have and are committed to quality, systems and process in all things food, beverage, service and hospitality allow us to effectively and efficiently compete in the restaurant industry. We believe that our Southern-style food and service will set us apart from the many other established restaurant brands.

Employees

SH employs 6 full time and no part-time employees, of which 2 are employed directly by SH, and 4 are employed directly by its subsidiary, Southern Hospitality Denver, LLC, the operator of the first Restaurant.

For a description of the Company and its other businesses prior to the Acquisition, see Item 1 in the Company’s 10-K for the year ended December 31, 2011.

2. Management of SH.

Security Ownership of Certain Beneficial Owners and Management

Director and Officers who serve after the Acquisition did not own any shares in the Company prior to the Acquisition. 5,259,129 shares of the Company’s common stock were issued in the Acquisition. The following table sets forth the approximate security ownership of the Company immediately after the closing of the Acquisition, assuming 5,909,091 shares of the Company’s common stock are outstanding, for: (i) each person beneficially owning 5% or more of the Company’s common stock; (ii) each Director and Officer of the Company; and (iii) all Directors and Officers as a group:

|

Name and Address of Director/Officer

|

Position

|

Amount and Nature of Beneficial Ownership

|

Percent of Voting Power

|

|||||||

|

Steve Cominsky

2 North Cascade Ave, #1400

Colorado Springs, CO 80903

|

Director and Chief Executive Officer

|

75,943 | (1) | 1. 27 | % | |||||

|

Gary Tedder

2 North Cascade Ave, #1400

Colorado Springs, CO 80903

|

Director and President

|

660,362 | 11.12 | % | ||||||

|

J.W. Roth

2 North Cascade Ave, Suite1400

Colorado Springs, CO 80903

|

Director, Chairman

|

1,320,736 | (2) | 22.35 | % | |||||

|

David Lavigne

2 North Cascade Ave, Suite1400

Colorado Springs, CO 80903

|

Secretary,

Treasurer

|

1,320,730 | (3) | 22.35 | % | |||||

|

The directors and executive

officer set forth herein as a group (four persons)

|

2,717,403 | 45.40 | % | |||||||

6

|

(1)

|

Represents 66,037 shares underlying vested options and 9,906 shares owned by his spouse.

|

|

(2)

|

Includes 330,184 shares owned by his spouse and 660,368 shares owned by AMHC Managed Services, an entity controlled by Mr. Roth and Mr. Lavigne.

|

|

(3)

|

Includes 660,368 shares owned by AMHC Managed Services, an entity controlled by Mr. Lavigne and Mr. Roth.

|

Officers and Directors after the Acquisition

Steve Cominsky, age 43, is the Chief Executive Officer and a Director of the Company. Mr. Cominsky has served as CEO and a Director of Southern Hospitality Franchisee Holding Corp. since October 1, 2012, and COO of its subsidiaries since July 2012. Mr. Cominsky is an established leader in people, sales, profit and process leadership in the hospitality industry. Mr. Cominsky has worked in the Brewery Group Division of Craftworks Restaurants and Breweries Inc. since 1996. He has served as the Regional Manager, overseeing six general managers and numerous other employees. Mr. Cominsky has won numerous awards for his leadership with Craftworks.

Gary Tedder, age 60, is the President, Secretary and Director of the Company. Mr. Tedder worked from September 2009 to November 2011 Accredited Members, Inc., and served as the Senior Vice President of that entity from January 2010. Since November 2011 he has devoted substantially all of his business time to Southern Hospitality Franchisee Holding Corp. For more than ten years prior to joining Accredited Members, Inc., Mr. Tedder was self-employed as a business consultant. Mr. Tedder has over 35 years of experience as an entrepreneur and business development director for various companies, from real estate to entertainment. Additionally, he has been instrumental in making strategic introductions throughout the nonprofit world and business community, through creatively deploying contact capital from his extensive network.

J.W. Roth, age 49, is a Director and Chairman of the Board. He has been an officer and director of Accredited Members, Inc. since December 2008. From November 2006 to November 2008 Mr. Roth served as an officer and director of Disaboom, Inc. He has also served as an officer and director of various other early stage companies. Mr. Roth has approximately twenty years of private and public company experience in more than ten different industries. Mr. Roth formerly served as a director of the following companies who had securities registered pursuant to Section 12 of the Exchange Act: Hangover Joe’s Holding Corp. fka Accredited Members Holding Corp.; and Integrated Management Information, Inc. He has founded, advised, structured, and/ or served as an executive officer and board member for multiple startup and early stage companies such as Fear Creek Ranches, IMI Global, Inc., CattleNetwork, Inc., Front Porch Direct, AspenBio Pharma, Inc., and Sound Technologies, Inc.

David L. Lavigne, age 50, is the Company’s Secretary/Treasurer. He is currently an officer and director of Accredited Members, Inc. Mr. Lavigne was the founder of EdgeWater Research Partners LLC, the predecessor of Accredited Members, Inc. EdgeWater Research was started in 2002 and was a subscription based service providing micro-cap and small-cap research to institutions, brokers and individual investors. Mr. Lavigne formerly served as a director of Hangover Joe’s Holding Corp. f/k/a Accredited Members Holding Corp., which had securities registered pursuant to Section 12 of the Exchange Act. Mr. Lavigne has spent approximately 25 years in the financial and investment industry - primarily employed by small regional sell-side broker-dealers involved in the provisioning of both investment banking and research services with respect to micro cap and small cap issuers. Mr. Lavigne’s experience includes creating research and analysis for retail and institutional clients, as well as research that augments the due diligence process of the corporate finance departments of his respective employers. His generalist research has encompassed several dozen public companies. Mr. Lavigne from the University of Idaho in 1984 with a Bachelors of Science degree in Finance.

For additional information related to the Company’s Management prior to the Acquisition, see Item 10 in the Company’s 10-K for the year ended December 31, 2011.

7

Audit Committee

Currently the Company does not have an audit committee, a designated audit committee financial expert, a compensation committee, a nominating committee, or any other committee of the Board that performs similar functions. Because of its small size, and because the Company is still in its early stages of operations, the Company does not believe any such committees is warranted. Additionally, because the Company’s common stock is not listed for trading or quotation on a national securities exchange, the Company is not required to have such committees. Instead the Company’s Board of Directors, as a whole, performs the functions of an audit, nominating, and compensation committees.

The Company has not adopted a code of ethics because it does not believe that, given its small size and limited operations, a code of ethics is warranted. However, as the Company grows and it continues to develop its operations it may consider adopting a code of ethics.

The entire Board of Directors serves as the Company’s audit committee. As such, the Board will continue to communicate with the Company’s independent auditors concerning their independence.

Independence of Board Members

None of the Directors would be considered “independent” as that term defined by Section 803A of the NYSE MKT Company Guide inasmuch as each of the Directors has material relationships with the Company. The Board considers all relevant facts and circumstances in its determination of independence of all members of the Board.

Legal Proceedings

During the past ten years none of the Directors or Officers has been the subject matter of any legal proceeding that is required to be disclosed.

Section 16(a) Beneficial Ownership Reporting Compliance

None of the Directors and Officers has failed to file any reports required to be filed under Section 16(a) of the Exchange Act.

Certain Relationships and Related Transactions

There have been no transactions between the Company and any of the Directors or Officers prior to the Acquisition, except as follows:

As described above, SH entered into the Management Agreement with AMHC Services pursuant to which AMHC Services is providing certain services on behalf of SH. Mr. Roth and Mr. Lavigne are control persons of AMHC Services. Additionally, under the terms of the Management Agreement the Company issued two separate warrants to AMHC Services or its assignee to purchase 500,000 shares per warrant of SH stock. Both warrants were exercised prior to the closing of the Acquisition, resulting in AMHC Services being a significant shareholder of the Company.

In May 2012, the Company formed Southern Hospitality Denver Holdings, LLC (“SHDH”), a wholly-owned subsidiary, and Southern Hospitality Denver, LLC (“SHD”). SHD was formed for the purpose of owning and operating the Company’s first franchised restaurant in Denver, Colorado. SHD is 51% owned by SHDH and 49% owned by non-controlling interest holders, of which a board member of the Company is a 22% non-controlling interest holder. SHDH and the non-controlling interest holders are to contribute $900,000 each (an aggregate of $1.8 million) to fund the initial capitalization of the Company’s first Denver-based franchised restaurant.

8

Compensation of Directors and Executive Officers

None of the Directors and Officers received compensation from the Company during the preceding fiscal year or prior to the Acquisition. The Directors do not expect to receive any compensation for serving in such capacity during the next twelve months.

Mr. Cominsky has an employment agreement with SH, which was assumed by the Company, whereby he is paid a salary and has been granted 660,367 options in the Company that may vest and become exercisable if certain milestones are met. Only 66,037 of such options are currently vested. Mr. Cominsky received no salary from SH in 2011. His 2012 annual salary under his employment agreement is $210,000, of which $41,539 was paid by SH from commencement of employment through September 30, 2012.

Mr. Tedder is paid a salary by SH of $125,000 per annum, which will now be paid by the Company. He does not have an employment agreement with SH or with the Company. He received total compensation from SH in 2011 of $29,986, and in 2012 (through September 30) of $93,750.

For additional information related to the Company’s executive compensation, see Item 11 in the Company’s 10-K for the year ended December 31, 2011.

Indemnification

The Company’s Articles of Incorporation limit the liability of its directors to the fullest extent permitted by Colorado law. Specifically, the directors will not be personally liable to the Company or any of its shareholders for monetary damages for break of fiduciary duty as directors, except liability for (i) any breach of the director’s duty of loyalty to the corporation or its shareholders; (ii) acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (iii) acts specified under Section 7-108-403 of the Colorado Business Corporation Act or any amended or successor provision thereof, or (iv) any transaction from which the director derived an improper personal benefit.

At present, there is no pending litigation or proceeding involving any of our directors, officers, employees or agents where indemnification will be required or permitted. Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to our directors, officers and controlling persons pursuant to the foregoing provisions, or otherwise, we have been advised that in the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable.

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

During its last two fiscal years, there has not been any material disagreement between ADI (nor SH) and its independent registered public accounting firm on any matter regarding accounting or financial disclosure.

3. Management’s Discussion and Analysis of Financial Conditions and Results of Operations.

Cautionary Statement about Forward-Looking Statements

This Report contains forward-looking statements regarding future events and SH’s future results that are subject to the safe harbors created under the Securities Act of 1933 (the “Securities Act”) and the Securities Exchange Act of 1934 (the “Exchange Act”). These statements are based on current expectations, estimates, forecasts, and projections about the industry in which SH operates and the beliefs and assumptions of the SH’s management. Words such as “hopes,” “expects,” “anticipates,” “targets,” “goals,” “projects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “continues,” “may,” variations of such words, and similar expressions are intended to identify such forward-looking statements. In addition, any statements that refer to projections of SH’s future financial performance, SH’s anticipated growth and potentials in its business, and other characterizations of future events or circumstances are forward-looking statements. Readers are cautioned that these forward-looking statements are only predictions and are subject to risks, uncertainties, and assumptions that are difficult to predict, including those identified under “Risk Associated with SH” below. Therefore, actual results may differ materially and adversely from those expressed in any forward-looking statements.

9

SH is under no duty to update any of these forward-looking statements after the date of this Report. You should not place undue reliance on these forward-looking statements.

Overview

For a brief description of the business of SH, refer to Section 1 above. Refer to Item 7 in the Company’s Form 10-K for the year ended December 31, 2011 for additional financial information of the Company.

Results of Operations – Period ended Inception (August 19, 2011) through December 31, 2011

Revenues

Through December 31, 2011, the Company had no revenue generating activities as the Company was in the development stage.

Operating Expenses

For the period ended Inception (August 19, 2011) through December 31, 2011, SH total operating expenses were $283,212. SH’s total operating expenses are categorized as general and administrative, related party management services or selling and marketing. During this period, general and administrative expenses were $125,968, related party management services expenses were $156,584 and selling and marketing expenses were $660. Salary and professional fees constituted the most significant expense for general and administrative while related party management services (include monthly payments to AMMS plus the value of the warrant) were the most significant expenses for this period.

Other Expenses

SH recognized other expenses in for this period of $5,891 relating to interest expense on the promissory notes.

Liquidity and Capital Resources

Current Assets

On December 31, 2011, SH had total current assets of $70,014. Cash constituted 39% of total current assets at the end of 2011 or $27,533. That increase resulted from the addition of cash from SH completing a private placement of promissory notes and common stock. Along with the increase in cash, prepaid expenses constituted 61%, or $42,481, of total current assets at the end of 2011.

Intangible Asset

On December 31, 2011, SH’s intangible asset represent franchise license costs for ten planned restaurants for $300,000.

Current Liabilities

On December 31, 2011, SH had current liabilities of $62,973. Of total current liabilities, accounts payable constitutes 9%, or $5,646, accrued expenses constitutes 25%, or $15,786 and related party payables constitutes the remaining 66% or $41,541.

10

Operating Activities

Net cash used in operating activities for the period of Inception (August 19, 2011) through December 31, 2011, was approximately $213,000.

Investing Activities

Net cash used in investing activities for the period of Inception (August 19, 2011) through December 31, 2011, was approximately $300,000 for the purchase of intangible assets.

Financing Activities

Net cash provided by financing activities for the period of Inception (August 19, 2011) through December 31, 2011, was approximately $540,500 from the proceeds of issuance of promissory notes and common stock (the “Notes”). SH sold Notes with a face amount of $537,500 along with 537,500 shares of common stock for cash of $537,500, and sold $25,000 of Notes and common stock to a related party management company. SH allocated the proceeds received between the Notes and the common stock based on their relative fair value at issuance. The fair values of the Notes and common stock issued was determined to be $456,875 and $80,625, respectively. Consequently SH recorded a discount of $80,625 at the issuance date of the Notes, with an offsetting increase to paid-in capital on the SH's balance sheet. The debt discount is being amortized to interest expense over the terms of the related Notes.

The Notes bear interest at 5% per annum, they are unsecured, and their maturity dates are seven years from their issue date. The effective interest rate on the Notes is approximately 15%. Quarterly payments will be applied against accrued interest first, then principal. The minimum aggregate quarterly payment to Note holders is 2.5% of the Company’s portion of gross quarterly revenues from each restaurant. The first minimum quarterly payment will be due 45 days after the first calendar quarter in which the Denver restaurant opens.

By their original terms, the Notes and accrued interest become convertible, at the option of the holder, upon the Company’s common stock becoming publicly traded. The conversion price will be 80% of the 20-day average closing sales price on the date conversion is elected, but not less than $0.50 per share.

Results of Operations – Nine months ended September 30, 2012 and 2011

Revenues

For the nine months ended September 30, 2012 compared to September 30, 2011, the Company had no revenue generating activities as the Company was in the development stage.

Operating Expenses

For the nine months ended September 30, 2012, SH’s total operating expenses were $1,030,196 compared to $46,989 for the same period in 2011. SH’s total operating expenses are categorized as general and administrative, related party management services or selling and marketing. During the nine months ended September 30, 2012 and 2011, general and administrative expenses were $601,811 and $7,843, related party management services expenses were $348,169 and $39,146 and selling and marketing expenses were $80,116 and $0. Salary and professional fees constituted the most significant expenses for general and administrative while related party management services (include monthly payments to AMMS plus the value of the warrant) were the most significant expenses for both periods.

Other Expenses

SH recognized other expenses in for both periods of $78,035 and $0 relating to interest expense on the promissory notes.

11

Liquidity and Capital Resources

Current Assets

On September 30, 2012, SH had total current assets of $616,700. Cash constituted 99% of total current assets at September 30, 2012. The cash balance resulted from the addition of cash from SH initiating a private placement of promissory notes and common stock. Along with the cash, prepaid expenses constituted 1% of total current assets at the same time.

Intangible Asset

On September 30, 2012, SH’s intangible asset represent franchise license costs for ten planned restaurants for $300,000.

Current Liabilities

On September 30, 2012, SH had current liabilities of $140,174. Of total current liabilities, accounts payable constitutes 3%, or $4,563, accrued expenses constitute 23%, or $31,640 and short-term notes payable and accrued interest constitute the remaining 74% or $103,971.

Operating Activities

Net cash used in operating activities for the first nine months ended September 30, 2012, was approximately $909,200 primarily due to the net loss for the period in addition to related party payable, and deposit offset by accrued expenses and deferred rent. Net cash provided by operating activities for the first nine months ended September 30, 2011, was approximately $4,100 for the amortization of prepaid management services.

Investing Activities

Net cash used in investing activities for the nine months ended September 30, 2012 and 2011, was approximately $668,600 and $0, with $397,300 for cash restricted for leasehold improvements and $271,300 for the purchase of property and equipment.

Financing Activities

Net cash provided by financing activities for the nine months ended September 30, 2012 and 2011, was approximately $2,161,300 and $0, from the proceeds of issuance of promissory notes and common stock. The SH sold Notes with a face amount of $1,936,001 along with 1,936,001 shares of common stock for cash of $1,936,001. SH also issued a $50,000 Note along with 50,000 shares of common stock to a third party for $50,000 of services provided to the SH. SH allocated the proceeds received between the Notes and the common stock based on their relative fair value at issuance. Consequently the Company recorded a discount of $297,900 at the issuance date of the Notes, with an offsetting increase to paid-in capital on the Company's balance sheet. The debt discount is being amortized to interest expense over the terms of the related Notes.

The Notes bear interest at 5% per annum, they are unsecured, and their maturity dates are seven years from their issue date. The effective interest rate on the Notes is approximately 15%. Quarterly payments will be applied against accrued interest first, then principal. The minimum aggregate quarterly payment to Note holders is 2.5% of SH’s portion of gross quarterly revenues from each restaurant. The first minimum quarterly payment will be due 45 days after the first calendar quarter in which the Denver restaurant opens.

By their original terms, the Notes and accrued interest becomes convertible, at the option of the holder, upon SH’s common stock becoming publicly traded. The conversion price will be 80% of the 20-day average closing sales price on the date conversion is elected, but not less than $0.50 per share.

12

Critical Accounting Policies

The preparation of financial statements in conformity with U. S. generally accepted accounting principles requires management to make a variety of estimates and assumptions that affect (i) the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities as of the date of the financial statements. and (ii) the reported amounts of revenues and expenses during the reporting periods covered by the financial statements.

Our management routinely makes judgments and estimates about the effect of matters that are inherently uncertain. As the number of variables and assumptions affecting the future resolution of the uncertainties increase, these judgments become even more subjective and complex. Although we believe that our estimates and assumptions are reasonable, actual results may differ significantly from these estimates. Changes in estimates and assumptions based upon actual results may have a material impact on our results of operation and/or financial condition.

4. Risks Associated with SH

Risks Associated with the Company

The Company has no operating history and no revenues from operations. SH was formed in August 2011 and has not yet engaged in active business operations. Therefore the Company is subject to many risks common to enterprises with limited or no operating history, including potential under-capitalization, limitations with respect to personnel, financial and other resources, and limited customers and revenue sources. Our ability to successfully generate sufficient revenues from operations is dependent on a number of factors, including availability of funds to fund our current and anticipated operations, and to commercialize our business concept. There can be no assurance that we will not encounter setbacks with the on-going development and implementation of our business plan, or the funding from this Offering will be sufficient to allow the Company to fully implement its business plan. In addition, our assumptions and projections may not prove to be accurate, and unexpected capital needs may arise. If such needs arise our inability to raise additional funds, either through equity or debt financing, will materially impair our ability to implement our business plan and generate revenues. Further, as a result of the recent volatility of the global markets, a general tightening of lending standards, and a general decrease in equity financing and similar type transactions it could be difficult for us to obtain funding to allow us to continue to develop our business operations.

The Company is significantly leveraged and has significant debt service requirements. The Company, through the Notes issued by SH, has a significant amount of indebtedness which could limit its ability to incur additional indebtedness for capital raising purposes, securing a line of credit, or otherwise. SH’s indebtedness could adversely affect SH’s operations, including among other things its ability to obtain additional financing if necessary, and a significant portion of cash flow from operations could be dedicated to the repayment of interest and principal on the Notes which would reduce the amount of funds available for other corporate purposes. SH’s ability to meet its debt service obligations and reduce its indebtedness will be dependent upon the Company’s future performance, which will be subject to the success of its business strategy, general economic conditions, and other factors affecting SH’s operations, many of which are beyond SH’s control. SH is not required to establish a sinking fund (or any similar type of segregated accounts) for the repayment of the Notes. There can be no assurance that SH’s business operations will generate sufficient cash flow from operations to meet its debt service requirements and the potential payment of principal in cash when due, and if SH is unable to do so, it may be required to liquidate assets, to refinance all or a portion of the indebtedness or seek to obtain additional financing.

Our success will in large part depend on hiring qualified and experienced executive officers, managers and other personnel. Although our officers and directors have significant experience with early stage companies, the Company’s current officers and directors other than Mr. Cominsky do not have experience in managing and operating restaurants or other significant food-service industry experience. Our success will largely depend on our ability to hire the necessary executive level and managerial level personnel to oversee our business operations and manage our restaurants. There can be no assurance that we will be able to successfully identify, attract, hire, train, and/or retain such executive level personnel highly or the necessary administrative, marketing and customer service personnel. Competition for such personnel can be intense and there is no certainty that we will be able to successfully attract, integrate or retain sufficiently qualified personnel. The failure to attract and retain the necessary personnel could have a materially adverse effect on our business, operations and financial condition.

13

We likely will need additional capital in the future and it may not be available on acceptable terms. The development of our business model will likely require significant additional capital in the future to, among other things, fund our operations and growth strategy. We may rely on bank financing and also may seek access to the debt and/or equity capital markets. There can be no assurance, however, that these sources of financing will be available on reasonable terms, or at all. Although we hope to file for an underwritten public offering, our ability to obtain additional financing will be subject to a number of factors, including market/economic conditions, identifying a willing and suitable underwriter, our operating performance, and investor sentiment. These factors may make the timing, amount, terms and conditions of additional financings unattractive to us. If we are unable to raise additional capital, our growth could be significantly impeded and/or we may be unable to execute upon our business model.

New or less mature restaurants, once opened, may vary in profitability and levels of operating revenue for six months or more and may underperform compared to existing or established restaurants. New and less mature restaurants typically experience higher operating costs in both dollars and percentage of revenue initially when compared to restaurants in the comparable restaurant base. Further, restaurants located in one city or location may not perform as well as restaurants in another city or location. We expect that our restaurants may take several months to reach normalized operating levels due to inefficiencies typically associated with new restaurants. These include operating costs, which are often significantly greater during the first several months of operation. Further, some or all of our less mature restaurants may not attain operating results similar to those of the Franchisor-owned restaurant in New York City.

The restaurant industry is highly competitive and subject to changes in consumer preferences. The Company’s business is to own and operate barbeque/southern-food themed restaurants in several cities in the United States. Competition in the restaurant industry is increasingly intense. Our competitors include a large and diverse group of restaurant chains and individual restaurants that range from independent local operators that have opened restaurants to well-capitalized national restaurant companies. Many of our competitors are well established and some of our competitors have substantially greater financial, marketing, and other resources than do we. Accordingly, they may be better equipped than us to increase marketing or to take other measures to maintain their competitive position.

Moreover, the bar and restaurant industry is characterized by the continual introduction of new concepts and is subject to rapidly changing consumer preferences, tastes and habits. Our success depends on the popularity of Southern U.S. based foods and drinks, and shifts in consumer preferences away from this cuisine and style would likely have a material adverse effect on our future profitability.

Our operating results will likely experience significant fluctuations. Our operating results may fluctuate significantly due to various risks and unexpected circumstances, increases in costs, seasonality, weather, and other factors outside our control. The restaurant and bar business is subject to a number of significant risks such as: general economic conditions; extended periods of inclement weather which may affect guest visits as well as limit the availability of key commodities and items that are important ingredients in our products; increases in energy costs, costs of food, supplies, maintenance, labor and benefits, as well as other operating costs; and unanticipated expenses such as repairs to damaged or lost property. Moreover, our business may be subject to seasonal fluctuations. Accordingly, our results of operations from any given period may not necessarily be indicative of results to be expected for any particular future period.

Our ability to open and profitably operate new restaurants is subject to factors beyond our control. Our objective is to grow our business and increase shareholder value primarily by (i) establishing and then expanding our base of restaurants that are profitable; and (ii) once established, increasing sales at existing restaurants. Our ability to timely and efficiently open new restaurants and to operate these restaurants on a profitable basis will depend upon numerous factors, many of which are beyond our control, including the following:

|

§

|

continued unstable, negative macroeconomic factors nationally and regionally that impact restaurant-level performance and influence our decisions on the rate of expansion, timing, and the number of restaurants to be opened;

|

|

§

|

identification and ability to secure an adequate supply of available and suitable restaurant sites;

|

14

|

§

|

negotiation of favorable lease terms;

|

|

§

|

cost and availability of capital to fund restaurant expansion and operation;

|

|

§

|

our ability to obtain liquor license(s);

|

|

§

|

the availability of construction materials and labor;

|

|

§

|

our ability to manage construction and development costs of new restaurants;

|

|

§

|

timely adherence to development schedules;

|

|

§

|

securing required governmental approvals and permits and in a timely manner;

|

|

§

|

availability and retention of qualified operating personnel to staff our new restaurants, especially managers;

|

|

§

|

competition in our markets and general economic conditions that may affect consumer spending or choice;

|

|

§

|

our ability to attract and retain guests; and

|

|

§

|

our ability to operate at acceptable profit margins.

|

As a new business venture, the Company’s start up and operational costs may be greater than projected. The costs of new business start-ups in the restaurant industry are often underestimated and may increase by reason of factors beyond the Company’s control. Such factors may include weather conditions, legal costs, labor disputes, governmental regulations, equipment breakdowns, property availability, governmental regulatory interference and other disruptions. While the Company intends to manage these costs diligently, the risk of running over budget is always significant and may have a substantial adverse impact on the profitability of the Company. In such event, additional sales of Company ownership interests or additional financing may be required to continue the business of the Company, and there can be no guaranty that the Company could successfully conclude such additional sales or obtain such additional financing at all or on terms that were acceptable to the Company, which could have a materially adverse effect on the Company and its operations and result in the loss of some or all of the investor’s investment in the Company.

As a new business enterprise the Company likely will experience fluctuations in its results of operations. The Company's operating results may fluctuate significantly as a result of a variety of factors, many of which are outside the Company's control. As a result of the Company's lack of operating history it is difficult for the Company to forecast its revenues or earnings accurately. The Company may be unable to adjust spending in a timely manner to compensate for any unexpected revenue shortfall. Accordingly, any significant shortfall in revenues relative to the Company's planned expenditures would have an immediate adverse effect on the Company's business, results of operations and financial condition.

As a franchisee we have significant obligations to our Franchisor. In addition to the up front Development Fee of $300,000 we are obligated to pay the Franchisor various fees and royalties, including a per restaurant store opening fee of up to $50,000, royalties on gross sales per restaurant, and other potential fees including marketing and local advertising related fees. These costs and fees will require that the Company devote a substantial amount of its financial resources to paying such fees and costs, which could negatively affect the Company’s results of operations and liquidity.

15

Our success depends on the ability of the Franchisor to protect intellectual property used in our business operations. At the closing of the Offering we will license certain intellectual property and know-how from the Franchisor. The Franchisor has filed for trademark protection of certain of its logos and name, however, as a licensee we are dependent on the owner of the intellectual property to take the necessary steps to protect such intellectual property and continue make it available for our use. In addition, we expect to rely on trade secrets and proprietary know-how in operating our restaurants, and we expect to employ various methods to protect those trade secrets and that proprietary know-how. However, such methods may not afford adequate protection and others could independently develop similar know-how or obtain access to our know-how, concepts and recipes. We cannot offer any assurance that third parties will not claim that the trademarks or menu offerings we utilize infringe upon their proprietary rights. Any such claim, whether or not it has merit, could be time-consuming, result in costly litigation, cause delays in introducing new menu items in the future or require us to enter into royalty or licensing agreements. As a result, any such claim could have a material adverse effect on our business, results of operations, financial condition or liquidity.

If we fail to manage our growth effectively, it could harm our business. Failure to manage our growth effectively could harm our business. Our business model anticipates that we will open multiple restaurants in various cities across the United States. Our restaurant management systems, financial and management controls and information systems may not be adequate to support our planned expansion. Our ability to manage our growth effectively will require us to develop and enhance these systems, procedures and controls and to locate, hire, train and retain management and operating personnel. We cannot offer any assure that we will be able to respond on a timely basis to all of the changing demands that our planned expansion will impose on management and on our infrastructure. If we are unable to manage our growth effectively, our business and operating resultscould be materially adversely impacted.

Our operations will be susceptible to the changes in cost and availability of food which could adversely affect our operating results. Our profitability will depend in part on our ability to anticipate and react to changes in food costs. Various factors beyond our control, including adverse weather conditions, governmental regulation, production, availability, recalls of food products, and seasonality, as well as the impact of the current macroeconomic environment on our suppliers, may affect our food costs or cause a disruption in our supply chain. Changes in the price or availability of commodities for which we do not have fixed price contracts could materially adversely affect our profitability. Expiring contracts with our food suppliers could also result in unfavorable renewal terms and therefore increase costs associated with these suppliers or may even necessitate negotiations with alternate suppliers. We cannot predict whether we will be able to anticipate and react to changing food costs by negotiating more favorable contract terms with suppliers or by adjusting our purchasing practices and menu prices, and a failure to do so could adversely affect our operating results. In addition, the ability of our suppliers to meet our supply requirements upon favorable terms, if at all, may be impacted by the economic recovery.

The restaurant business is subject to a significant amount of regulation and licensing requirements. Our proposed business is subject to various federal, state, and local government regulations, including those relating to the food safety and disclosure, alcoholic beverage sale and control, public accommodations, and public health and safety. These regulations are subject to continual changes and updating. Difficulties or failures in obtaining or maintaining the required licenses and approvals or maintaining compliance with existing or newly enacted requirements could delay the opening or affect the continued operation and profitability of one or more restaurants in a particular area.

We are also subject to "dram shop" statutes in certain states, such as Colorado. These statutes generally allow a person injured by an intoxicated person to recover damages from an establishment that wrongfully served alcoholic beverages to the intoxicated person. Failure to comply with alcoholic beverage control or dram shop regulations could subject the Company to liability and could adversely affect our business.

Various federal and state employment laws will govern our relationship with our team members and affect operating costs. These laws govern minimum wage requirements, overtime pay, meal and rest breaks, unemployment tax rates, workers' compensation rates, citizenship or residency requirements, labor relations, child labor regulations, and discriminatory conduct. Additional government-imposed increases in federal and state minimum wages, overtime pay, paid leaves of absence, and mandated health benefits, increased tax reporting and tax payment requirements for team members who receive tips or a reduction in the number of states that allow tips to be credited toward minimum wage requirements could harm our operating results.

16

The food service industry is affected by litigation and publicity concerning food quality, health and other issues, which can cause guests to avoid our restaurants and result in significant liabilities or litigation costs. Food service businesses can be adversely affected by litigation and complaints from guests, consumer groups or government authorities resulting from food quality, illness, injury or other health concerns or operating issues stemming from one restaurant or a limited number of restaurants. Adverse publicity about these allegations may negatively affect us, regardless of whether the allegations are true, by discouraging guests from eating at our restaurants. We could also incur significant liabilities if a lawsuit or claim results in a decision against us or litigation costs regardless of the result.

Health concerns relating to the consumption of certain food products could affect consumer preferences and could negatively impact our results of operations. Like other restaurants, consumer preferences could be affected by health concerns about the consumption of certain food products (such as beef or chicken), or negative publicity concerning food quality, illness and injury in general. In recent years there has been negative publicity concerning e-coli, hepatitis A, "mad cow," "foot-and-mouth" disease and "bird flu." The restaurant industry has also been subject to a growing number of claims that the menus and actions of restaurant chains have led to the obesity of certain of their guests, resulting in legislation in some jurisdictions which require nutritional information to be disclosed to guests. Nutritional labeling could be enacted in many additional states, counties or cities as well as on a federal level. Nutritional labeling requirements and negative publicity concerning any of the food products we serve may adversely affect demand for our food and could result in a decrease in guest traffic to our restaurants. If we react to the labeling requirements or negative publicity by changing our concept or our menu offerings or their ingredients, we may lose guests who do not prefer the new concept or products, and we may not be able to attract sufficient new guests to produce the revenue needed to make our restaurants profitable. In addition, we may have different or additional competitors for our intended guests as a result of a change in our concept and may not be able to compete successfully against those competitors. A decrease in guest traffic to our restaurants as a result of these health concerns or negative publicity or as a result of a change in our menu or concept could materially harm our business.

Uncertainty regarding the economic recovery may negatively affect consumer spending and have adversely impacted our revenues and our results of operations and may continue to do so in the future. Current uncertainty regarding economic conditions and the existence and rate of any economic recovery may have an adverse effect on the businesses, results of operations and financial condition of the Company and its customers, distributors and suppliers. These conditions include continued unemployment, weakness and lack of consistent improvement in the housing markets; downtrend or delays in residential or commercial real estate development; volatility in financial markets; inflationary pressures and reduced consumer confidence. As a result, our customers may continue to remain apprehensive about the economy and maintain or further reduce their already lowered level of discretionary spending. This could impact the frequency with which our customers choose to dine out or the amount they spend on meals while dining out, thereby decreasing our revenues and potentially negatively affecting our operating results. We believe there is a risk that prolonged negative economic conditions might cause consumers to make long-lasting changes to their discretionary spending behavior, including dining out less frequently on a more permanent basis, which would have an adverse effect on our business.

We expect to rely heavily on information technology, and any material failure, weakness or interruption could prevent us from effectively operating our business. The restaurant industry relies heavily on information systems, including point-of-sale processing in restaurants, payment of obligations, collection of cash, credit and debit card transactions and other processes and procedures. Our ability to efficiently and effectively manage our business will in part depend on the reliability and capacity of these systems. The failure of these systems to operate effectively, maintenance problems, upgrading or transitioning to new platforms could result in delays in guest service and reduce efficiency in our operations. Remediation of such problems could result in significant, unplanned capital investments.

We identified material weaknesses in our disclosure controls and procedures and our Internal Controls Over Financial Reporting. There are inherent limitations in the effectiveness of any system of internal control, and accordingly, even effective ICFR can provide only reasonable assurance with respect of financial statement preparation and may not prevent or detect misstatements. Material weaknesses make it more likely that a material misstatement of annual or interim financial statements will not be prevented or detected. In addition, effective ICFR at any point in time may become ineffective in future periods because of changes in conditions or due to deterioration in the degree of compliance with our established policies and procedures.

17

There are many risks associated with forward-looking information. Much of the information presented in this Agreement contains forward-looking statements. Although we believe the forward-looking statements have reasonable bases, we cannot offer any assurance that we will be able to conduct our operations as contemplated. You should carefully review all of the information and assumptions contained in this Agreement with your legal, tax, financial, investment, and accounting advisors with these risks in mind.

We are dependent on our key personnel, and the loss of any could adversely affect our business. We depend on the continued performance of our officers and directors, particularly Steve Cominsky, J.W. Roth, and Gary Tedder, who have contributed significantly to the expertise of the planning and development of our business. Further, we are reliant on our significant shareholders, such as Ryan Tedder, to help develop and promote our business operations. To date we have not entered into an employment agreement with any of our key personnel, other than Steve Cominsky. If we lose the services of Mr. Cominsky, J.W. Roth, or Gary Tedder, or other key individuals, and are unable to locate suitable replacements for such persons in a timely manner, it could have a material adverse effect on our business. We do not expect to obtain key man life insurance for any members of management in the foreseeable future.

For additional risks associated with the Company prior to the Acquisition, see Item 1A of the Company’s Form 10-K for the year ended December 31, 2011.

Item 9.01(b) Exhibits

|

99.1

|

Press Release dated November 15, 2012

|

|

99.2

|

SH Financial Statements as of and for the period from inception (August 19, 2011) through December 31, 2011

|

|

99.3

|

SH Unaudited Condensed Financial Statements as of September 30, 2012, and for the nine months ended September 30, 2012 and the period of inception (August 19, 2011) through September 30, 2011

|

|

99.4

|

Unaudited Proforma Financial Statements representing the consummation of the SH Acquisition

|

18

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, on the 16th day of November 2012.

| Southern Hospitality Development Corporation | |||

|

|

By:

|

/s/ JW Roth | |

| JW Roth, Chairman | |||

19