Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HOLOGIC INC | d440854d8k.htm |

| EX-99.2 - TRANSCRIPT OF CONFERENCE CALL - HOLOGIC INC | d440854dex992.htm |

Non-GAAP Financial Measures Supplement

September 29, 2012

Exhibit 99.3 |

Hologic has presented the following non-GAAP financial measures in this

supplement: adjusted revenues; adjusted gross margins; adjusted

operating

expenses;

adjusted

operating

income;

adjusted

interest

expense;

adjusted

pre-tax

income;

adjusted

net

income;

adjusted EPS; and adjusted EBITDA. Hologic defines its non-GAAP adjusted

revenues to include contingent revenue earned under the Novartis

collaboration post-acquisition which was eliminated under purchase accounting. Hologic defines its non-GAAP adjusted gross

margins, adjusted operating expenses, adjusted operating income,

adjusted interest expense, adjusted pre-tax income and adjusted EPS

to exclude, as applicable: (i) the amortization of intangible assets; (ii)

acquisition-related charges and effects, such as charges for

contingent

consideration

(comprised

of

(a)

adjustments

for

changes

in

the

fair

value

of

the

contingent

consideration

liabilities

initially

recorded as part of the purchase price of an acquisition as required by GAAP, and

(b) contingent consideration that is tied to continuing employment of the

former shareholders and employees which is recorded as compensation expense), transaction costs, integration costs

including retention, and credits and/or charges associated with the write-up of

acquired inventory and fixed assets to fair value, and the effect

of

a

reduction

in

revenue

related

to

the

write-up

of

acquired

unbilled

accounts

receivable

to

fair

value;

(iii)

non-cash

interest

expense related to amortization of the debt discount for convertible debt

securities; (iv) divestiture and restructuring charges; (v) non-cash

loss on exchange of convertible notes; (vi) litigation settlement charges

(benefits); (vii) other-than-temporary impairment losses on

investments; and (viii) other one-time, nonrecurring, unusual or infrequent

charges, expenses or gains that may not be indicative of Hologic’s core

business results; and to include income taxes related to such adjustments. Hologic defines adjusted EBITDA as its non-

GAAP adjusted net income plus interest expense, net, income taxes, and depreciation

and amortization expense included in its non- GAAP adjusted net income.

Hologic believes the use of these non-GAAP financial measures is useful

to investors by eliminating certain of the more significant effects of its

acquisitions and related activities, non-cash charges resulting from the application of GAAP to convertible debt instruments with

cash

settlement

features,

charges

related

to

debt

extinguishment

losses,

investment

impairments,

litigation

settlements,

and

divestiture

and restructuring initiatives. These measures also reflect how Hologic manages its

businesses internally. In addition to the adjustments set forth in the

calculation of Hologic’s non-GAAP adjusted net income and adjusted EPS, its non-GAAP adjusted EBITDA eliminates the

effects

of

financing,

income

taxes

and

the

accounting

effects

of

capital

spending.

As

with

the

items

eliminated

in

its

calculation

of

non-

GAAP adjusted net income, these items may vary for different companies for reasons

unrelated to the overall operating performance of a company’s business.

When analyzing Hologic’s operating performance, investors should not consider these non-GAAP financial

measures as a substitute for net (loss) income prepared in accordance with GAAP.

Use of Non-GAAP Financial Measures

2 |

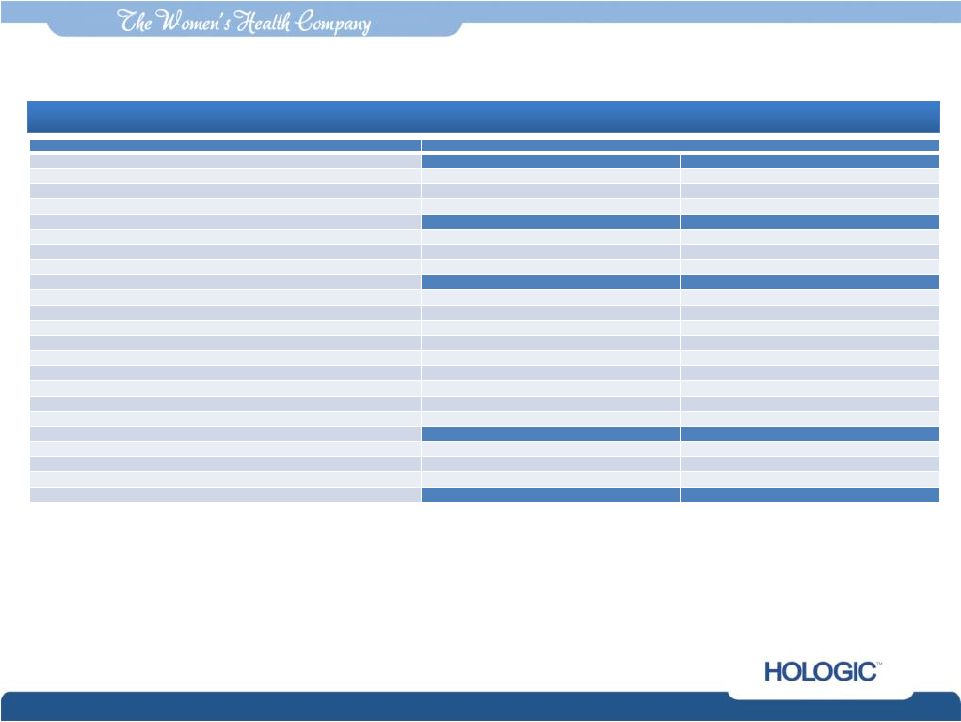

Reconciliation of GAAP to Non-GAAP

(unaudited)

In thousands, except earnings per share

In thousands, except earnings per share

3

Footnotes:

1

To reflect a fair value adjustment recorded in purchase accounting relating to

contingent revenue earned and received under the Novartis collaboration post acquisition which was

eliminated under purchase accounting.

2

Non-GAAP adjusted earnings per share was calculated based on: 268,106; 264,878;

and 267,294 weighted average diluted shares outstanding for the three months ended

September 29, 2012, September 24, 2011, and June 23, 2012, respectively.

Continued on next page

Three Months Ended

Three Months Ended

September 29, 2012

September 29, 2012

September 24, 2011

September 24, 2011

June 23, 2012

June 23, 2012

REVENUES

GAAP revenues

$588,548

Adjustment related to Novartis collaboration

11,606

1

Non-GAAP adjusted revenues

$600,154

$600,154

(LOSS) EARNINGS PER SHARE

GAAP (loss) earnings per share-

Diluted

$(0.29)

$0.10

$0.09

Adjustments to net (loss) income (as detailed below)

0.66

0.24

0.26

Non-GAAP adjusted earnings per share-

Diluted

$0.37

$0.37

2

2

$0.34

$0.34

2

2

$0.35

$0.35

2

2

GROSS MARGINS

GAAP gross margins

$274,317

$243,199

$244,640

Adjustments:

Contingent revenue from Novartis collaboration

11,606

-

-

Amortization of intangibles

66,072

45,978

45,280

Fair value write-up of acquired inventory sold

19,918

-

-

Fair value adjustment for depreciation expense

1,203

-

-

Adiana closure costs

(427)

-

1,546

Acquisition-related costs

612

-

138

Non-GAAP gross margins

$373,301

$373,301

$289,177

$289,177

$291,604

$291,604

GROSS MARGIN PERCENTAGE

GAAP gross margin percentage

46.6%

52.1%

52.0%

Impact of adjustments above

15.6%

9.8%

10.0%

Non-GAAP adjusted gross margin percentage

62.2%

62.2%

61.9%

61.9%

62.0%

62.0% |

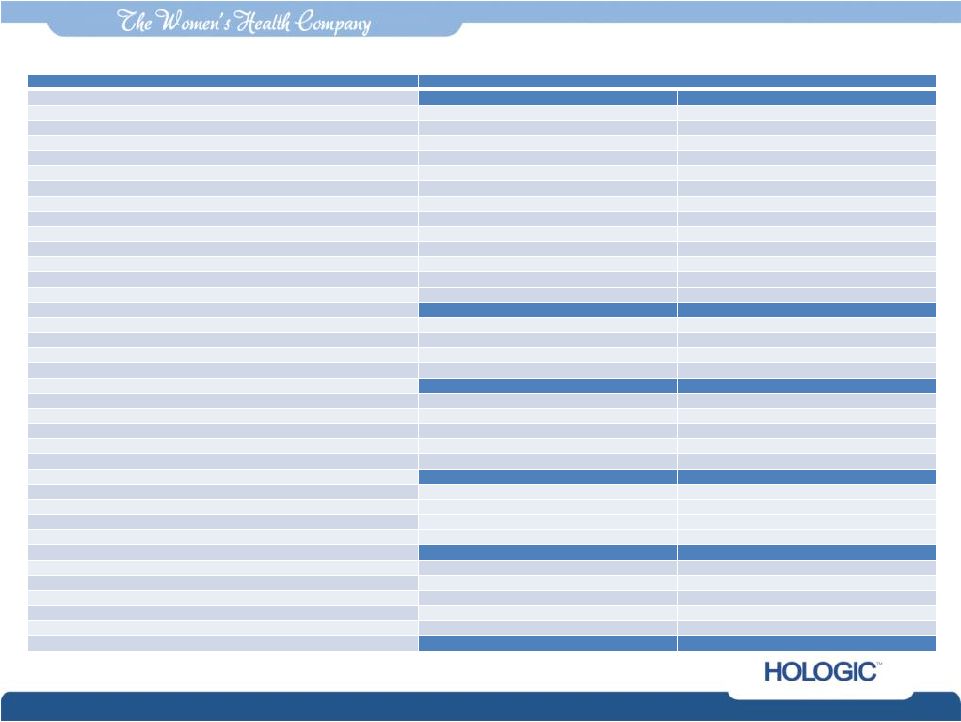

In

thousands, except earnings per share In thousands, except earnings per

share 4

Three Months Ended

Three Months Ended

September 29, 2012

September 29, 2012

September 24, 2011

September 24, 2011

June 23, 2012

June 23, 2012

OPERATING EXPENSES

GAAP operating expenses

$318,020

$169,778

$164,113

Adjustments:

Amortization of intangible assets

(24,832)

(14,492)

(15,733)

Contingent consideration

(40,399)

(11,316)

(2,226)

Acquisition-related costs

(37,901)

(153)

(4,892)

Restructuring and divestiture costs

(16,697)

71

14

Impairment of goodwill

(5,826)

-

-

In-process research and development

(4,500)

-

-

Fair value adjustment for depreciation expense

(1,300)

-

-

Adiana closure costs

-

-

(150)

Other charges

(2)

(320)

-

Non-GAAP adjusted net operating expenses

$186,563

$186,563

$143,568

$143,568

$141,126

$141,126

INTEREST EXPENSE

GAAP interest expense

$56,673

$29,079

$25,593

Adjustment for non-cash interest expense relating to

convertible notes

(16,514)

(18,470)

(15,119)

Other interest expense

-

(214)

(186)

Non-GAAP interest expense

$40,159

$40,159

$10,395

$10,395

$10,288

$10,288

PRE-TAX (LOSS) INCOME

GAAP pre-tax (loss) income

$(97,964)

$41,606

$55,007

Adjustments to pre-tax (loss) income as detailed above

246,955

90,872

85,256

Non-GAAP pre-tax income

$148,991

$148,991

$132,478

$132,478

$140,263

$140,263

NET (LOSS) INCOME

GAAP net (loss) income

$(77,767)

$27,569

$23,594

Adjustments to pre-tax (loss) income as detailed above

246,955

90,872

85,256

Income tax effect of reconciling items

(70,854) ³

(29,655) ³

(16,276) ³

Non-GAAP adjusted net income

$98,334

$98,334

$88,786

$88,786

$92,574

$92,574

EBITDA

Non-GAAP adjusted net income

$98,334

$88,786

$92,574

Interest expense, net, not adjusted above

39,766

9,887

9,593

Provision for income taxes

50,657

43,692

47,689

Depreciation expense, not adjusted above

21,241

17,908

15,926

Adjusted EBITDA

$209,998

$209,998

$160,273

$160,273

$165,782

$165,782

Footnotes:

3

To reflect an annual effective tax rate of 34.0%, 33.2% and 34.0% on a non-GAAP

basis for the three months ended September 29, 2012, September 24, 2011, and

June 23, 2012, respectively. Reconciliation of GAAP to Non-GAAP (unaudited) |

Reconciliation of GAAP to Non-GAAP

(unaudited)

In thousands, except earnings per share

In thousands, except earnings per share

5

Year Ended

Year Ended

September 29, 2012

September 29, 2012

September 24, 2011

September 24, 2011

REVENUES

GAAP revenues

$2,002,652

Adjustment related to Novartis collaboration

11,606

1

Non-GAAP adjusted revenues

$2,014,258

$2,014,258

(LOSS) EARNINGS PER SHARE

GAAP (loss) earnings per share-

Diluted

$(0.28)

$.59

Adjustments to net (loss) income (as detailed below)

1.66

0.68

Non-GAAP adjusted earnings per share-

Diluted

$1.38

$1.38

2

2

$1.27

$1.27

2

2

GROSS MARGINS

GAAP gross margins

$994,437

$923,181

Adjustments:

Contingent revenue from Novartis collaboration

11,606

-

Amortization of intangibles

201,864

177,456

Fair value write-up of acquired inventory sold

19,918

3,298

Fair value adjustment for depreciation expense

1,203

-

Adiana closure costs

19,064

-

Acquisition-related costs and other

800

-

Non-GAAP gross margins

$1,248,892

$1,248,892

$1,103,935

$1,103,935

GROSS MARGIN PERCENTAGE

GAAP gross margin percentage

49.7%

51.6%

Impact of adjustments above

12.3%

10.1%

Non-GAAP adjusted gross margin percentage

62.0%

62.0%

61.7%

61.7%

Footnotes:

1

To reflect a fair value adjustment recorded in purchase accounting relating to

contingent revenue earned and received under the Novartis collaboration post acquisition which was

eliminated under purchase accounting.

2

Non-GAAP

adjusted

earnings

per

sharewas

calculated

based

on

266,795

and

264,305

weighted

average

diluted

shares

outstanding

for

the

year

ended

September

29,

2012

and

September 24, 2011, respectively.

Continued on next page |

6

Year Ended

Year Ended

September 29, 2012

September 29, 2012

September 24, 2011

September 24, 2011

OPERATING EXPENSES

GAAP operating expenses

$880,720

$548,736

Adjustments:

Amortization of intangible assets

(72,036)

(58,334)

Contingent consideration

(119,497)

(11,986)

Acquisition-related costs and other

(44,305)

(2,102)

Restructuring and divestiture costs (benefit)

(17,036)

71

Impairment of goodwill

(5,826)

-

In-process research and development

(4,500)

-

Fair value adjustment for depreciation expense

(1,300)

-

Adiana closure costs

(479)

-

Gain on sale of intellectual property, net

12,424

84,502

Other

(452)

(770)

Non-GAAP adjusted net operating expenses

$627,713

$627,713

$560,117

$560,117

INTEREST EXPENSE

GAAP interest expense

$140,287

$114,846

Adjustment for non-cash interest expense relating to convertible notes

(68,532)

(72,908)

Other interest expense

(528)

(214)

Non-GAAP interest expense

$71,227

$71,227

$41,724

$41,724

PRE-TAX (LOSS) INCOME

GAAP pre-tax (loss) income

$(61,661)

$227,386

Adjustments to pre-tax (loss) income as detailed above

576,522

242,495

Deb extinguishment loss

42,347

29,891

Other

-

2,445

Non-GAAP pre-tax income

$557,208

$557,208

$502,217

$502,217

NET (LOSS) INCOME

GAAP net (loss) income

$(73,634)

$157,150

Adjustments to pre-tax (loss) income as detailed above

618,869

274,831

Income tax effect of reconciling items

(177,478) ³

(96,500) ³

Non-GAAP adjusted net income

$367,757

$367,757

$335,481

$335,481

EBITDA

Non-GAAP adjusted net income

$367,757

$335,481

Interest expense, net, not adjusted above

68,887

39,864

Provision for income taxes

189,451

166,736

Depreciation expense, not adjusted above

69,348

68,946

Adjusted EBITDA

$695,443

$695,443

$611,027

$611,027

Footnotes:

3

To reflect an annual effective tax rate of 34.0% and 33.2% for the year ended

September 29, 2012 and September 24, 2011, respectively. Reconciliation of GAAP

to Non-GAAP (unaudited) |