Attached files

| file | filename |

|---|---|

| 8-K - 8-K - STATE BANK FINANCIAL CORP | stbz-20121115x8k.htm |

State Bank Financial Corporation Sandler O’Neill 2012 East Coast Financial Services Conference Joe Evans – Chairman and CEO November 15, 2012

2 Cautionary Note Regarding Forward-Looking Statements Certain statements contained in this earnings deck that are not statements of historical fact may constitute forward-looking statements. These forward-looking statements, which are based on certain assumptions and describe our future plans, strategies and expectations, can generally be identified by the use of the words “may,” “would,” “could,” “will,” “expect,” “anticipate,” “believe,” “intend,” “plan” and “estimate,” as well as similar expressions. These forward-looking statements include statements related to our projected growth, anticipated future financial performance, and management’s long-term performance goals, as well as statements relating to the anticipated effects on results of operations and financial condition from expected developments or events, or business and growth strategies, including anticipated internal growth and plans to establish or acquire banks or the assets of failed banks. These forward-looking statements involve significant risks and uncertainties that could cause our actual results to differ materially from those anticipated in such statements. Potential risks and uncertainties include the following: • general economic conditions (both generally and in our markets) may be less favorable than expected, which could result in, among other things, a continued deterioration in credit quality, a further reduction in demand for credit and a further decline in real estate values; • the general decline in the real estate and lending markets, particularly in our market areas, may continue to negatively affect our financial results; • our ability to raise additional capital may be impaired if current levels of market disruption and volatility continue or worsen; • we may be unable to collect reimbursements on losses that we incur on our assets covered under loss share agreements with the FDIC as we anticipate; • costs or difficulties related to the integration of the banks we acquired or may acquire from the FDIC as receiver may be greater than expected; • restrictions or conditions imposed by our regulators on our operations may make it more difficult for us to achieve our goals; • legislative or regulatory changes, including changes in accounting standards and compliance requirements, may adversely affect us; • competitive pressures among depository and other financial institutions may increase significantly; • changes in the interest rate environment may reduce margins or the volumes or values of the loans we make or have acquired; • other financial institutions have greater financial resources and may be able to develop or acquire products that enable them to compete more successfully than we can; • our ability to attract and retain key personnel can be affected by the increased competition for experienced employees in the banking industry; • adverse changes may occur in the bond and equity markets; • war or terrorist activities may cause further deterioration in the economy or cause instability in credit markets; • economic, governmental or other factors may prevent the projected population, residential and commercial growth in the markets in which we operate; and • we will or may continue to face the risk factors discussed from time to time in the periodic reports we file with the SEC. For these forward-looking statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. You should not place undue reliance on the forward-looking statements, which speak only as of the date of this report. All subsequent written and oral forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. See Item 1A, Risk Factors, in our Annual Report on Form 10-K for the year ended December 31, 2011, as well as Part II, Item 1A, Risk Factors, in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2012, for a description of some of the important factors that may affect actual outcomes.

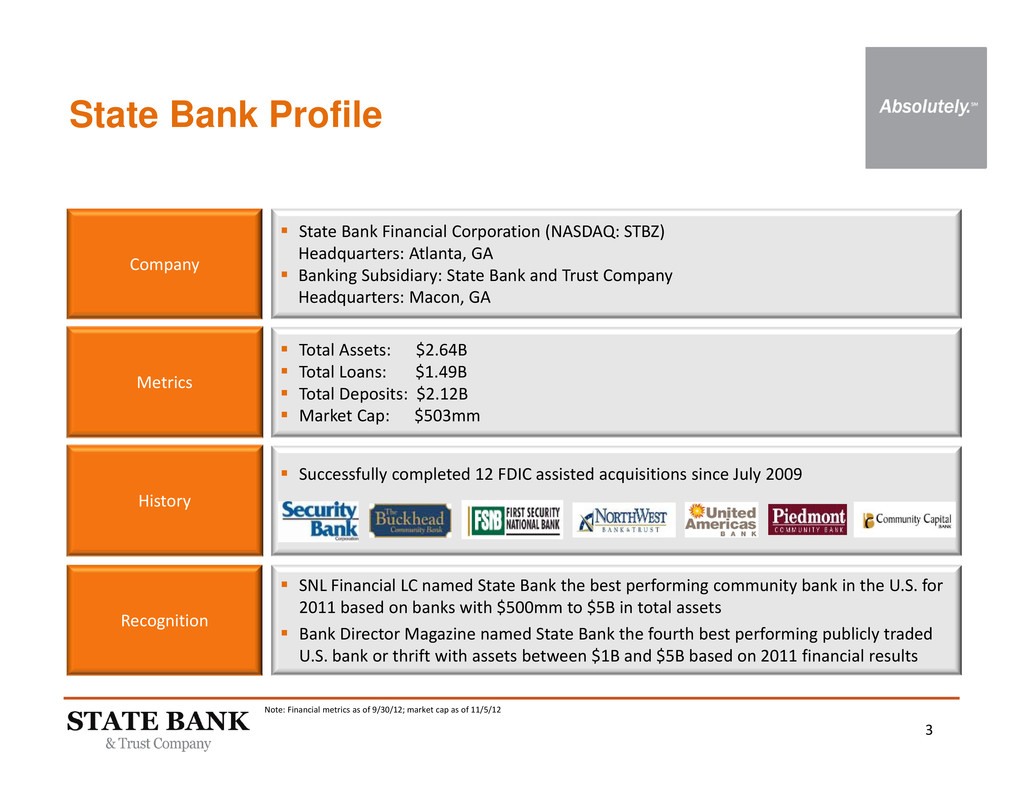

3 State Bank Profile Company Metrics Recognition State Bank Financial Corporation (NASDAQ: STBZ) Headquarters: Atlanta, GA Banking Subsidiary: State Bank and Trust Company Headquarters: Macon, GA Total Assets: $2.64B Total Loans: $1.49B Total Deposits: $2.12B Market Cap: $503mm SNL Financial LC named State Bank the best performing community bank in the U.S. for 2011 based on banks with $500mm to $5B in total assets Bank Director Magazine named State Bank the fourth best performing publicly traded U.S. bank or thrift with assets between $1B and $5B based on 2011 financial results History Successfully completed 12 FDIC assisted acquisitions since July 2009 Note: Financial metrics as of 9/30/12; market cap as of 11/5/12

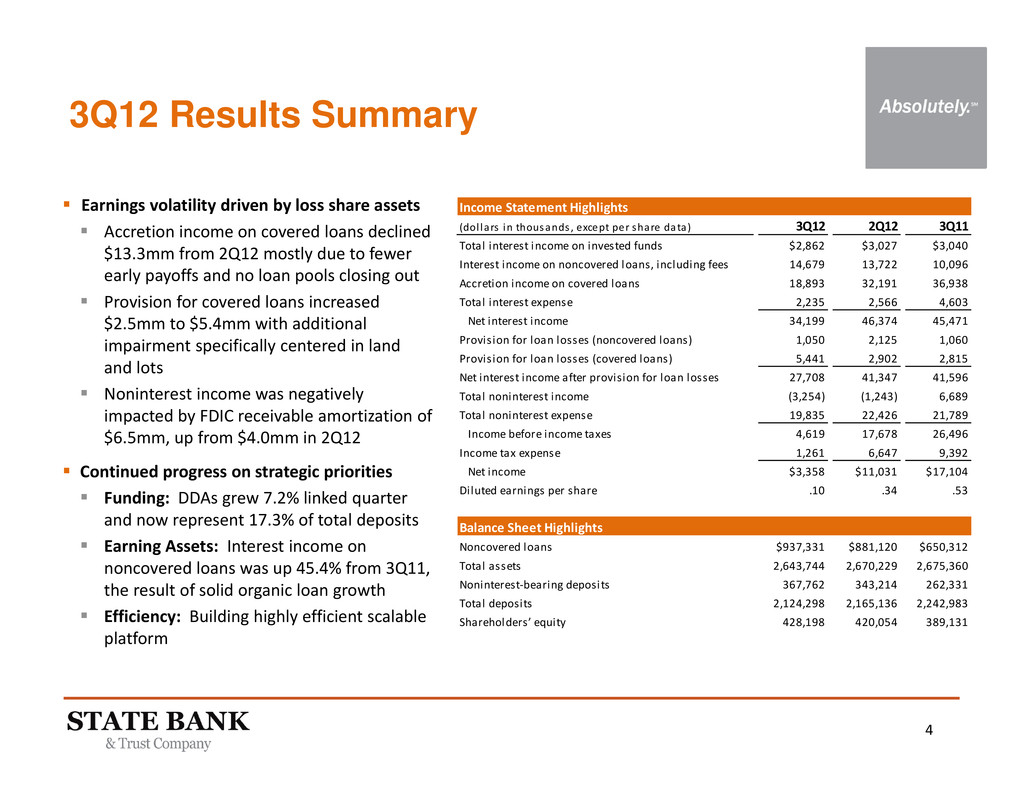

4 3Q12 Results Summary Earnings volatility driven by loss share assets Accretion income on covered loans declined $13.3mm from 2Q12 mostly due to fewer early payoffs and no loan pools closing out Provision for covered loans increased $2.5mm to $5.4mm with additional impairment specifically centered in land and lots Noninterest income was negatively impacted by FDIC receivable amortization of $6.5mm, up from $4.0mm in 2Q12 Continued progress on strategic priorities Funding: DDAs grew 7.2% linked quarter and now represent 17.3% of total deposits Earning Assets: Interest income on noncovered loans was up 45.4% from 3Q11, the result of solid organic loan growth Efficiency: Building highly efficient scalable platform Income Statement Highlights (dol lars in thousands , except per share data) 3Q12 2Q12 3Q11 Total interest income on invested funds $2,862 $3,027 $3,040 Interest income on noncovered loans, including fees 14,679 13,722 10,096 Accretion income on covered loans 18,893 32,191 36,938 Total interest expense 2,235 2,566 4,603 Net interest income 34,199 46,374 45,471 Provision for loan losses (noncovered loans) 1,050 2,125 1,060 Provision for loan losses (covered loans) 5,441 2,902 2,815 Net interest income after provision for loan losses 27,708 41,347 41,596 Total noninterest income (3,254) (1,243) 6,689 Total noninterest expense 19,835 22,426 21,789 Income before income taxes 4,619 17,678 26,496 Income tax expense 1,261 6,647 9,392 Net income $3,358 $11,031 $17,104 Diluted earnings per share .10 .34 .53 Balance Sheet Highlights Noncovered loans $937,331 $881,120 $650,312 Total assets 2,643,744 2,670,229 2,675,360 Noninterest‐bearing deposits 367,762 343,214 262,331 Total deposits 2,124,298 2,165,136 2,242,983 Shareholders’ equity 428,198 420,054 389,131

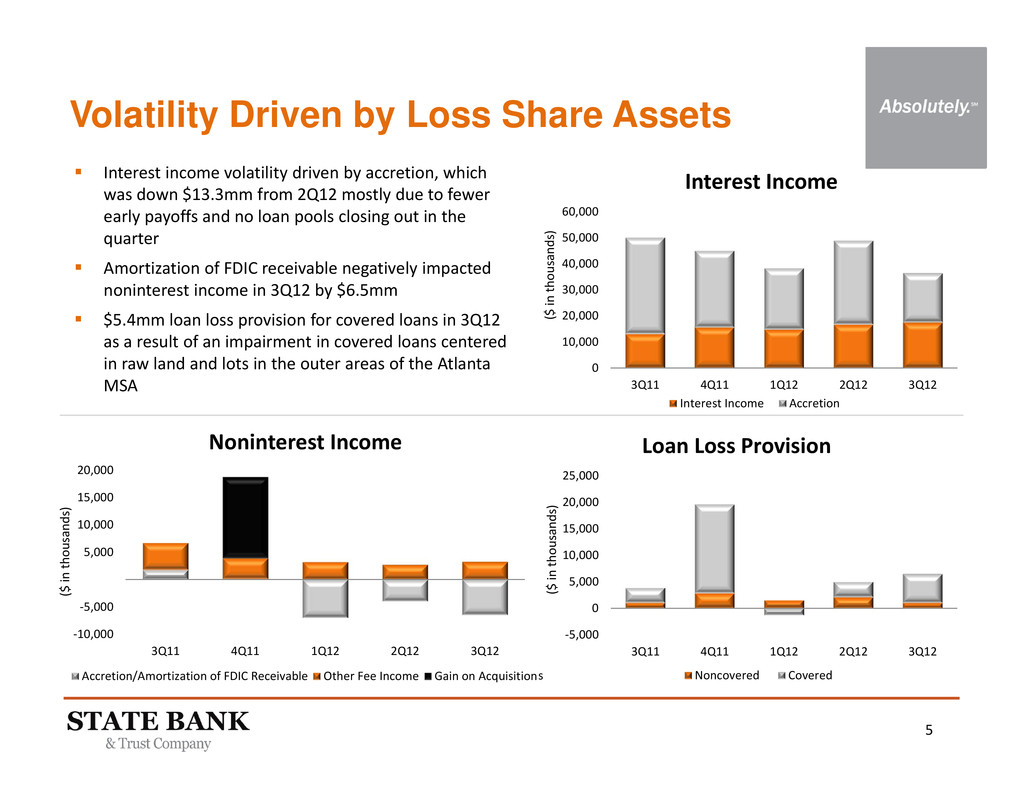

5 ‐10,000 ‐5,000 5,000 10,000 15,000 20,000 3Q11 4Q11 1Q12 2Q12 3Q12 Noninterest Income Accretion/Amortization of FDIC Receivable Other Fee Income Gain on Acquisition 0 10,000 20,000 30,000 40,000 50,000 60,000 3Q11 4Q11 1Q12 2Q12 3Q12 Interest Income Interest Income Accretion ‐5,000 0 5,000 10,000 15,000 20,000 25,000 3Q11 4Q11 1Q12 2Q12 3Q12 Loan Loss Provision Noncovered Covered Volatility Driven by Loss Share Assets ( $ i n t h o u s a n d s ) Interest income volatility driven by accretion, which was down $13.3mm from 2Q12 mostly due to fewer early payoffs and no loan pools closing out in the quarter Amortization of FDIC receivable negatively impacted noninterest income in 3Q12 by $6.5mm $5.4mm loan loss provision for covered loans in 3Q12 as a result of an impairment in covered loans centered in raw land and lots in the outer areas of the Atlanta MSA ( $ i n t h o u s a n d s ) ( $ i n t h o u s a n d s ) s

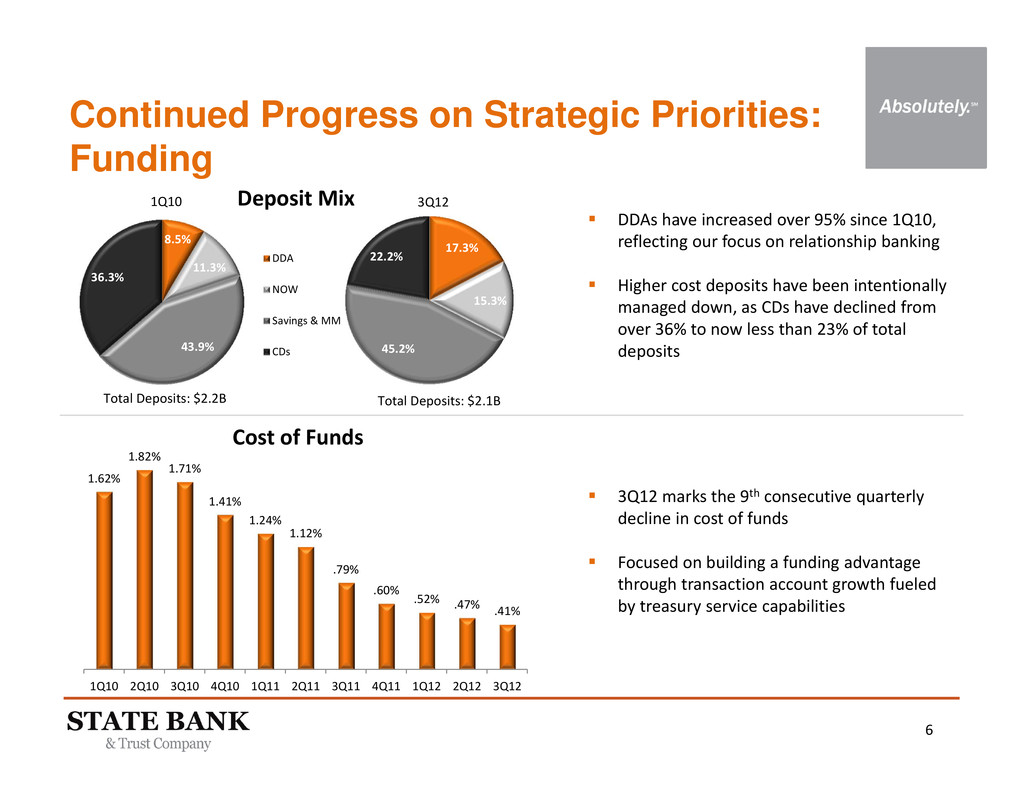

6 8.5% 11.3% 43.9% 36.3% DDA NOW Savings & MM CDs 1Q10 17.3% 15.3% 45.2% 22.2% 3Q12 Total Deposits: $2.1B DDAs have increased over 95% since 1Q10, reflecting our focus on relationship banking Higher cost deposits have been intentionally managed down, as CDs have declined from over 36% to now less than 23% of total deposits Total Deposits: $2.2B Continued Progress on Strategic Priorities: Funding 3Q12 marks the 9th consecutive quarterly decline in cost of funds Focused on building a funding advantage through transaction account growth fueled by treasury service capabilities Deposit Mix 1.62% 1.82% 1.71% 1.41% 1.24% 1.12% .79% .60% .52% .47% .41% 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 Cost of Funds

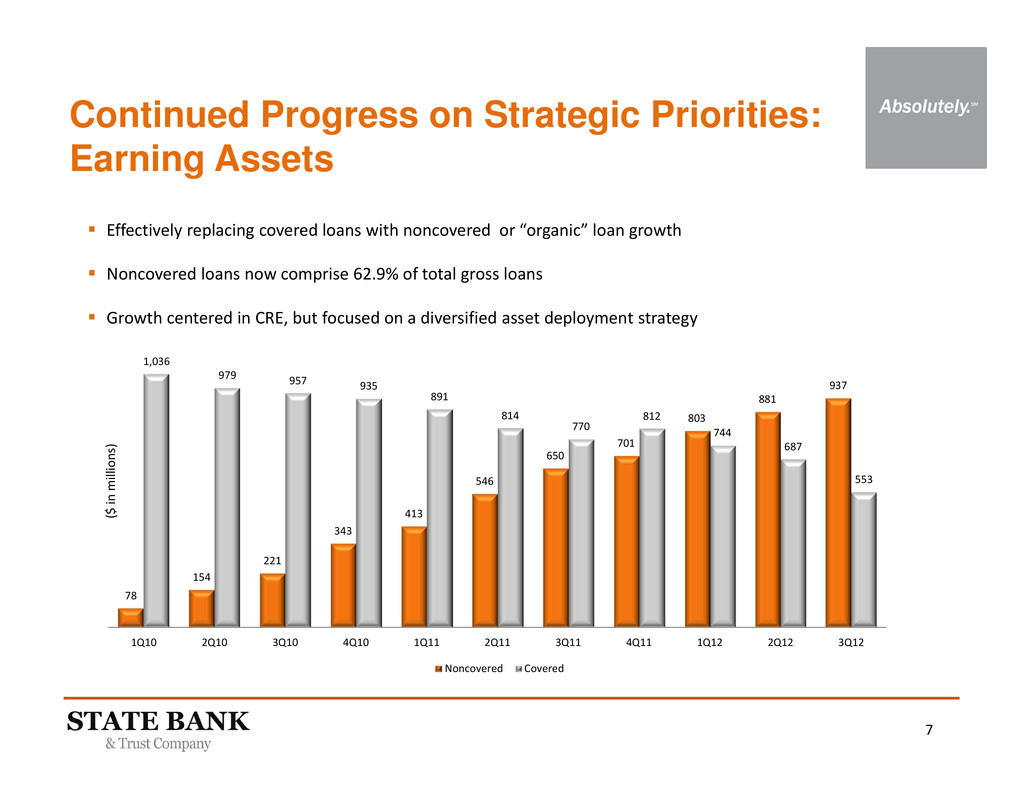

7 78 154 221 343 413 546 650 701 803 881 937 1,036 979 957 935 891 814 770 812 744 687 553 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 Noncovered Covered ( $ i n m i l l i o n s ) Continued Progress on Strategic Priorities: Earning Assets Effectively replacing covered loans with noncovered or “organic” loan growth Noncovered loans now comprise 62.9% of total gross loans Growth centered in CRE, but focused on a diversified asset deployment strategy

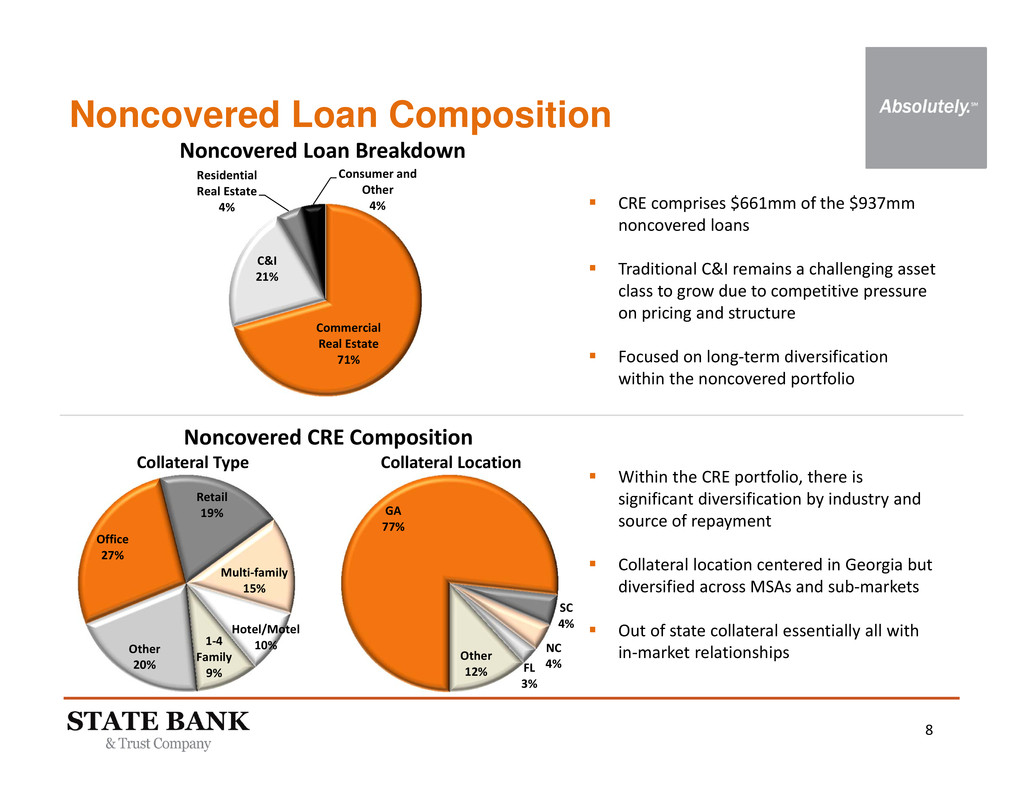

8 GA 77% SC 4% NC 4%FL 3% Other 12% Collateral Location Noncovered Loan Composition Commercial Real Estate 71% C&I 21% Residential Real Estate 4% Consumer and Other 4% Noncovered Loan Breakdown CRE comprises $661mm of the $937mm noncovered loans Traditional C&I remains a challenging asset class to grow due to competitive pressure on pricing and structure Focused on long‐term diversification within the noncovered portfolio Noncovered CRE Composition Within the CRE portfolio, there is significant diversification by industry and source of repayment Collateral location centered in Georgia but diversified across MSAs and sub‐markets Out of state collateral essentially all with in‐market relationships Office 27% Retail 19% Multi‐family 15% Hotel/Motel 10%1‐4 Family 9% Other 20% Collateral Type

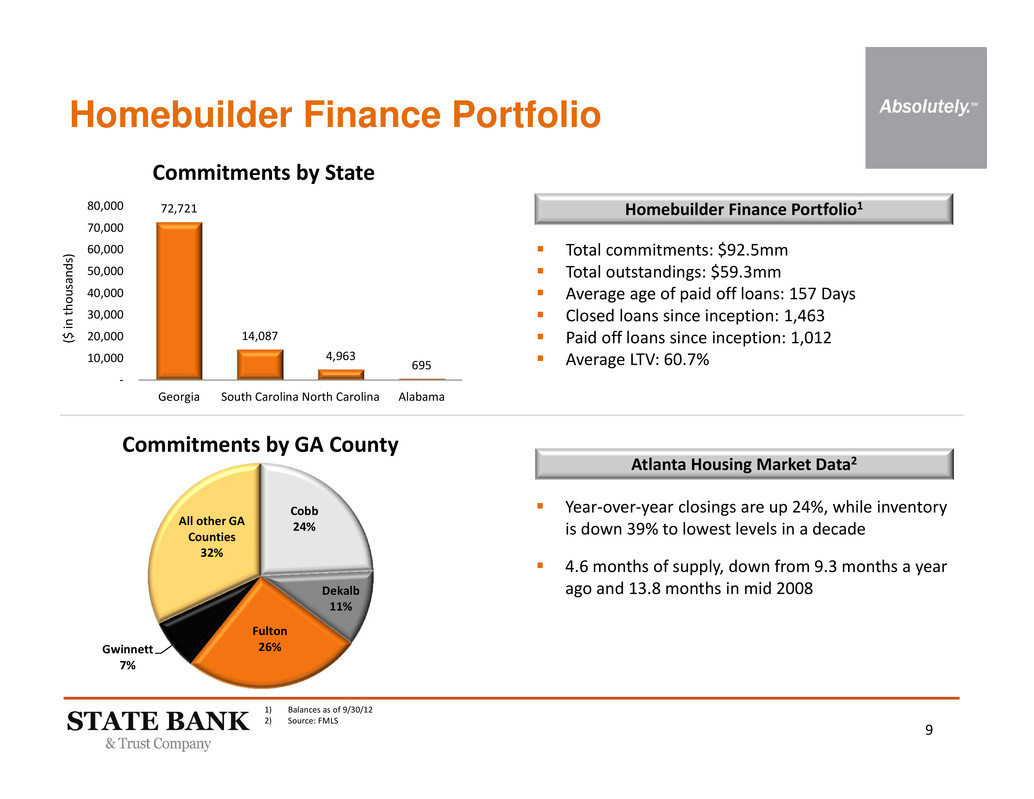

9 72,721 14,087 4,963 695 ‐ 10,000 20,000 30,000 40,000 50,000 60,000 70,000 80,000 Georgia South Carolina North Carolina Alabama Commitments by State ( $ i n t h o u s a n d s ) Homebuilder Finance Portfolio Cobb 24% Dekalb 11% Fulton 26%Gwinnett 7% All other GA Counties 32% Commitments by GA County Total commitments: $92.5mm Total outstandings: $59.3mm Average age of paid off loans: 157 Days Closed loans since inception: 1,463 Paid off loans since inception: 1,012 Average LTV: 60.7% Year‐over‐year closings are up 24%, while inventory is down 39% to lowest levels in a decade 4.6 months of supply, down from 9.3 months a year ago and 13.8 months in mid 2008 Homebuilder Finance Portfolio1 Atlanta Housing Market Data2 1) Balances as of 9/30/12 2) Source: FMLS

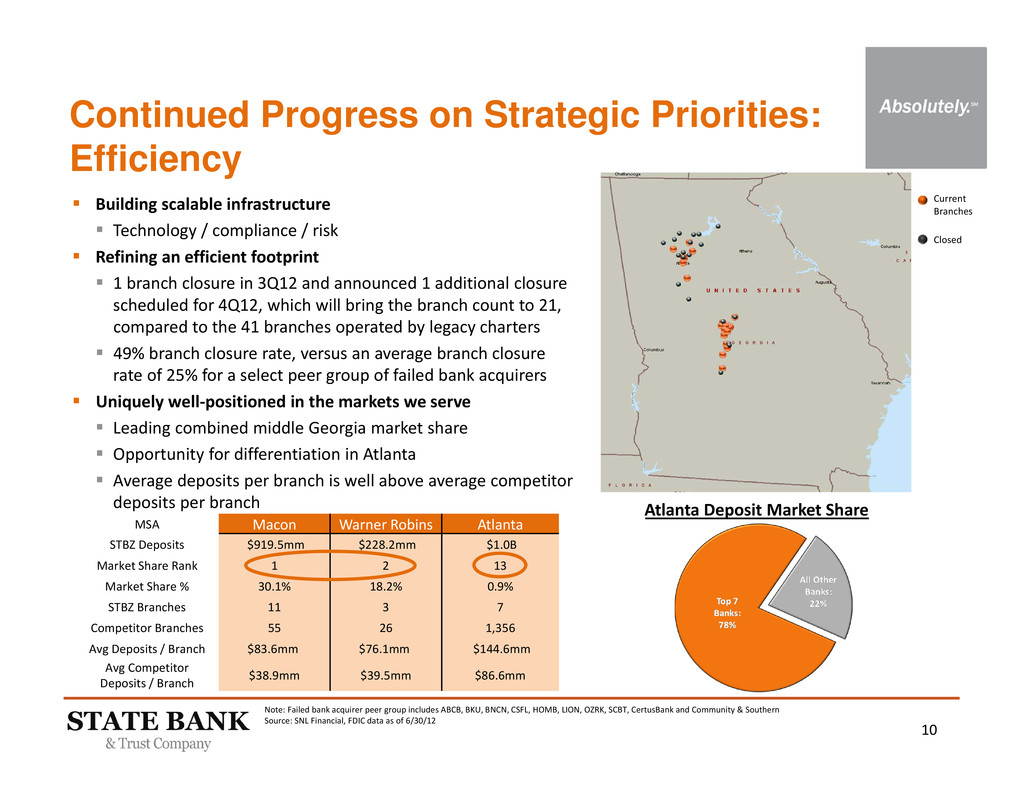

10 Note: Failed bank acquirer peer group includes ABCB, BKU, BNCN, CSFL, HOMB, LION, OZRK, SCBT, CertusBank and Community & Southern Source: SNL Financial, FDIC data as of 6/30/12 Continued Progress on Strategic Priorities: Efficiency Current Branches Closed Building scalable infrastructure Technology / compliance / risk Refining an efficient footprint 1 branch closure in 3Q12 and announced 1 additional closure scheduled for 4Q12, which will bring the branch count to 21, compared to the 41 branches operated by legacy charters 49% branch closure rate, versus an average branch closure rate of 25% for a select peer group of failed bank acquirers Uniquely well‐positioned in the markets we serve Leading combined middle Georgia market share Opportunity for differentiation in Atlanta Average deposits per branch is well above average competitor deposits per branch MSA Macon Warner Robins Atlanta STBZ Deposits $919.5mm $228.2mm $1.0B Market Share Rank 1 2 13 Market Share % 30.1% 18.2% 0.9% STBZ Branches 11 3 7 Competitor Branches 55 26 1,356 Avg Deposits / Branch $83.6mm $76.1mm $144.6mm Avg Competitor Deposits / Branch $38.9mm $39.5mm $86.6mm Atlanta Deposit Market Share

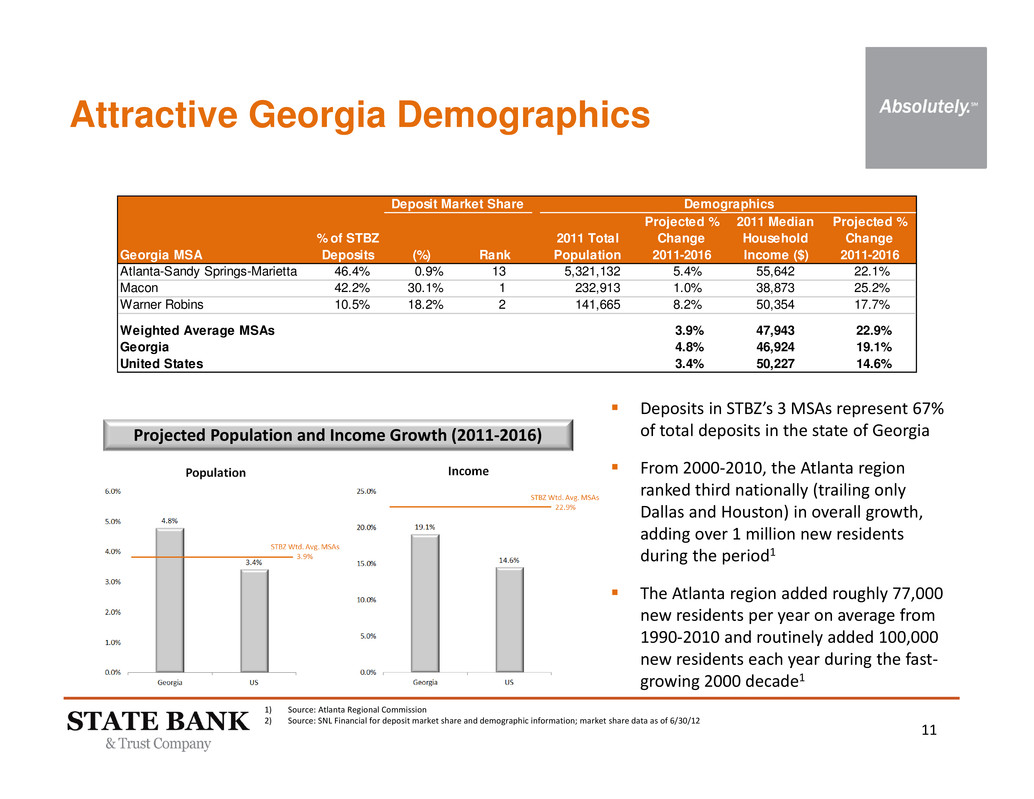

11 Attractive Georgia Demographics Deposits in STBZ’s 3 MSAs represent 67% of total deposits in the state of Georgia From 2000‐2010, the Atlanta region ranked third nationally (trailing only Dallas and Houston) in overall growth, adding over 1 million new residents during the period1 The Atlanta region added roughly 77,000 new residents per year on average from 1990‐2010 and routinely added 100,000 new residents each year during the fast‐ growing 2000 decade1 Projected Population and Income Growth (2011‐2016) 1) Source: Atlanta Regional Commission 2) Source: SNL Financial for deposit market share and demographic information; market share data as of 6/30/12 Georgia MSA % of STBZ Deposits (%) Rank 2011 Total Population Projected % Change 2011-2016 2011 Median Household Income ($) Projected % Change 2011-2016 Atlanta-Sandy Springs-Marietta 46.4% 0.9% 13 5,321,132 5.4% 55,642 22.1% Macon 42.2% 30.1% 1 232,913 1.0% 38,873 25.2% Warner Robins 10.5% 18.2% 2 141,665 8.2% 50,354 17.7% Weighted Average MSAs 3.9% 47,943 22.9% Georgia 4.8% 46,924 19.1% United States 3.4% 50,227 14.6% Deposit Market Share Demographics

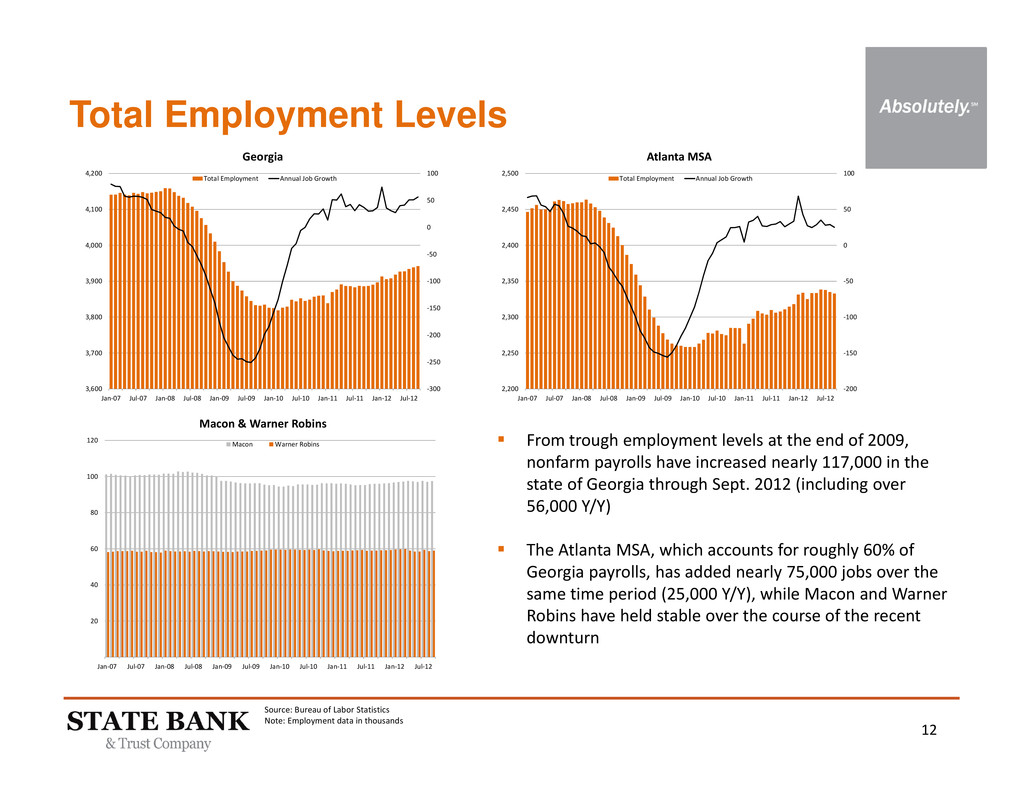

12 Total Employment Levels From trough employment levels at the end of 2009, nonfarm payrolls have increased nearly 117,000 in the state of Georgia through Sept. 2012 (including over 56,000 Y/Y) The Atlanta MSA, which accounts for roughly 60% of Georgia payrolls, has added nearly 75,000 jobs over the same time period (25,000 Y/Y), while Macon and Warner Robins have held stable over the course of the recent downturn ‐300 ‐250 ‐200 ‐150 ‐100 ‐50 0 50 100 3,600 3,700 3,800 3,900 4,000 4,100 4,200 Jan‐07 Jul‐07 Jan‐08 Jul‐08 Jan‐09 Jul‐09 Jan‐10 Jul‐10 Jan‐11 Jul‐11 Jan‐12 Jul‐12 Georgia Total Employment Annual Job Growth ‐200 ‐150 ‐100 ‐50 0 50 100 2,200 2,250 2,300 2,350 2,400 2,450 2,500 Jan‐07 Jul‐07 Jan‐08 Jul‐08 Jan‐09 Jul‐09 Jan‐10 Jul‐10 Jan‐11 Jul‐11 Jan‐12 Jul‐12 Atlanta MSA Total Employment Annual Job Growth 20 40 60 80 100 120 Jan‐07 Jul‐07 Jan‐08 Jul‐08 Jan‐09 Jul‐09 Jan‐10 Jul‐10 Jan‐11 Jul‐11 Jan‐12 Jul‐12 Macon & Warner Robins Macon Warner Robins Source: Bureau of Labor Statistics Note: Employment data in thousands

13 Well capitalized balance sheet Tier 1 Ratio: 29.95% Leverage Ratio: 15.44% Funding organic growth Leadership focused on the customer experience and growing relationships Adding value through M&A Senior resources in Corporate Development dedicated to identifying and evaluating expansion opportunities On October 16, 2012, announced the acquisition of Macon, Georgia‐based Altera Payroll, Inc., which broadens the treasury services / cash management product offering for our commercial clients and will enhance our fee‐based revenue M&A Strategies Leverage our distressed debt capabilities through failed / impaired bank M&A or unassisted acquisitions of distressed debt portfolios Conventional M&A Line of business acquisitions – fee / asset generating Capital Strength to be Opportunistic

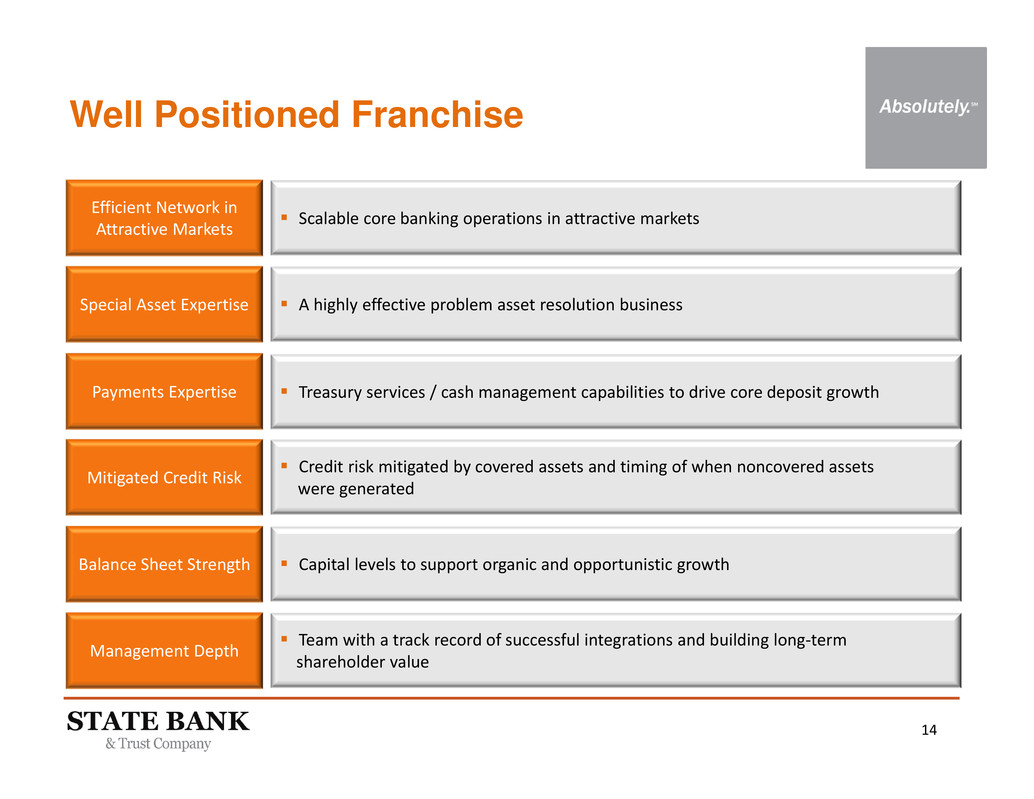

14 Well Positioned Franchise Efficient Network in Attractive Markets Special Asset Expertise Mitigated Credit Risk Balance Sheet Strength Management Depth Scalable core banking operations in attractive markets A highly effective problem asset resolution business Capital levels to support organic and opportunistic growth Team with a track record of successful integrations and building long‐term shareholder value Credit risk mitigated by covered assets and timing of when noncovered assets were generated Payments Expertise Treasury services / cash management capabilities to drive core deposit growth