Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MOSAIC CO | d439056d8k.htm |

| EX-99.1 - PRESS RELEASE - MOSAIC CO | d439056dex991.htm |

Exhibit 99.2

The Mosaic Company

Focused on Execution

November 2012 |

2

Safe Harbor Statement

This presentation contains forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995. Such statements include,

but are not limited to, statements about future financial and operating results. Such

statements are based upon the current beliefs and expectations of The Mosaic

Company’s management and are subject to significant risks and

uncertainties. These risks and uncertainties include but are not limited to the predictability and

volatility of, and customer expectations about, agriculture, fertilizer, raw

material, energy and transportation markets that are subject to competitive

and other pressures and economic and credit market conditions; the level of inventories in the

distribution channels for crop nutrients; changes in foreign currency and exchange

rates; international trade risks; changes

in

government

policy;

changes

in

environmental

and

other

governmental

regulation,

including

greenhouse

gas

regulation, implementation of the U.S. Environmental Protection Agency’s

numeric water quality standards for the discharge of nutrients into Florida

lakes and streams or possible efforts to reduce the flow of excess nutrients into the

Gulf of Mexico; further developments in judicial or administrative proceedings;

difficulties or delays in receiving, increased costs of or challenges to

necessary governmental permits or approvals or increased financial assurance

requirements; resolution of global tax audit activity; the effectiveness of the

Company’s processes for managing its strategic priorities; adverse

weather conditions affecting operations in Central Florida or the Gulf Coast of the United

States, including potential hurricanes or excess rainfall; actual costs of various

items differing from management’s current estimates, including, among

others, asset retirement, environmental remediation, reclamation or other

environmental regulation, or Canadian resources taxes and royalties; accidents and

other disruptions involving Mosaic’s operations, including brine

inflows at its Esterhazy, Saskatchewan potash mine and other potential mine fires, floods,

explosions, seismic events or releases of hazardous or volatile chemicals, as well

as other risks and uncertainties reported from time to time in The Mosaic

Company’s reports filed with the Securities and Exchange Commission. Actual

results may differ from those set forth in the forward-looking statements.

Safe Harbor |

Limited

arable land

Mosaic’s Role in Feeding the World

Population

Growth

Need to

Improve

Yield

Long-Term

Sustainability

Optimum use of crop nutrients is essential

to growing the food the world needs today

and tomorrow

Crop nutrients directly account for 40 to 60

percent of crop yields

World population will reach 9 billion people

by 2050*

* Source: IHS Global Insight

3 |

Near-term Outlook |

Current Market Conditions

Critically low grain & oilseed

stocks-to-use

Near record affordability of

crop nutrients

Strong North America fall

application

Channel risk aversion

Low river levels

Delayed India and

China contracts

Impact to Mosaic:

Unchanged 2013 forecast for record global shipments of

both phosphate and potash

Near term pressure on results

5

Strong Fundamentals

Near-term Challenges |

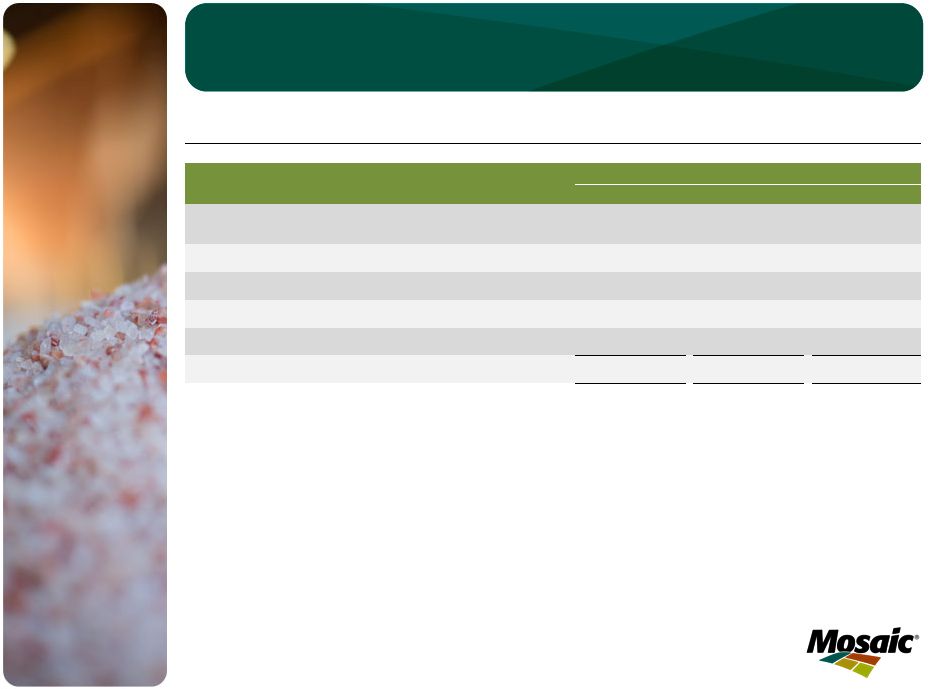

6

Segment

Category

Old Guidance –

Fiscal 2013

New Guidance –

Fiscal 2013

Potash

Q2 Sales volume

Q2 MOP selling price

Q2 Operating rate

1.6 -

1.9 million tonnes

$420-

$450 per tonne

Above 70 percent

1.3 -

1.4 million tonnes

$435 -

$450 per tonne

Above 70 percent

Phosphates

Q2 Sales volume

Q2 DAP selling price

Q2 Operating rate

3.0-3.4 million tonnes

$520-

$550 per tonne

Above 80 percent

2.9-

3.1 million tonnes

$535-

$550 per tonne

Above 80 percent

Consolidated

Effective Tax Rate

Upper 20 percent

range

Mid-teens, including

discrete tax benefit

Financial Guidance Summary

Capital Expenditures, Canadian Resource Taxes & Royalties and

SG&A guidance has not been changed |

Mosaic’s Strategic Priorities |

8

Focused on Phosphate & Potash

Mosaic is in great position to be the world’s leading

crop nutrition company

Agriculture

•

Attractive sector

Crop

Nutrition

•

Best business

within agriculture

Phosphate

& Potash

•

Most compelling

nutrients |

Our

Strategic Priorities People

Growth

Market Access

Innovation

Total Shareholder

Return

9 |

People

The foundation of

our success

Invest in talent and

development

Align incentives

with TSR

10 |

Growth

11

Increase Cash Flow

Grow volumes

Expand Product

Margins |

Market Access

Expand reach and

impact

Lower distribution

costs

Minimize working

capital

12 |

Industry leading

innovation in:

Drive margin

improvement

Innovation

13

•

Product

•

Process

•

Sustainability |

Our

Strategic Priorities People

Growth

Market Access

Innovation

Total Shareholder

Return

14 |

Financial Policy Key Component of TSR

Dividend Growth

Net Cash

*see Net Cash reconciliation on slide 18

15

-$2.4

billion

5/31/06

$1.3

billion

5/31/09

$2.8

billion

5/31/12

$0.20

December

2011

$0.50

February

2012

$1.00

July 2012 |

16

Strategic Priority: Shareholder Value

Our TSR goal:

Top 3 among 10 global crop nutrient peers

Execute our

strategy

Deliver

strong value

Return

capital to

shareholders |

|

18

Net Cash Reconciliation

Net Cash

May 31,

(in millions)

2006

2009

2012

Cash and cash equivalents

$ 173.3

$ 2,703.2

$ 3,811.0

Less: Short-term debt

152.8

92.7

42.5

Current maturities of long-term debt

69.3

43.3

0.5

Long-term debt, less current maturities

2,384.6

1,256.1

1,010.0

Long-term debt due to Cargill, Inc. and affiliates

3.5

0.4

-

Net Cash

$ (2,436.9)

$ 1,310.7

$ 2,758.0 |