Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PACIFIC GAS & ELECTRIC Co | form8k110912.htm |

* PG&E Corporation These materials are a subset of materials presented on the PG&E Corporation Q3 Earnings call on October 29, 2012. This presentation is not complete without the full earnings presentation and accompanying statements made by management during the webcast conference call held on October 29, 2012. The regulatory calendar has been updated to reflect recent CPUC decisions related to the procedural schedule for the items mentioned. The full presentation, including Exhibits, and the accompanying press release, were attached to PG&E Corporation’s Current Report on Form 8-K that was furnished to the Securities and Exchange Commission on October 29, 2012, and along with the replay of the conference call, are also available on PG&E Corporation’s website at www.pge-corp.com.

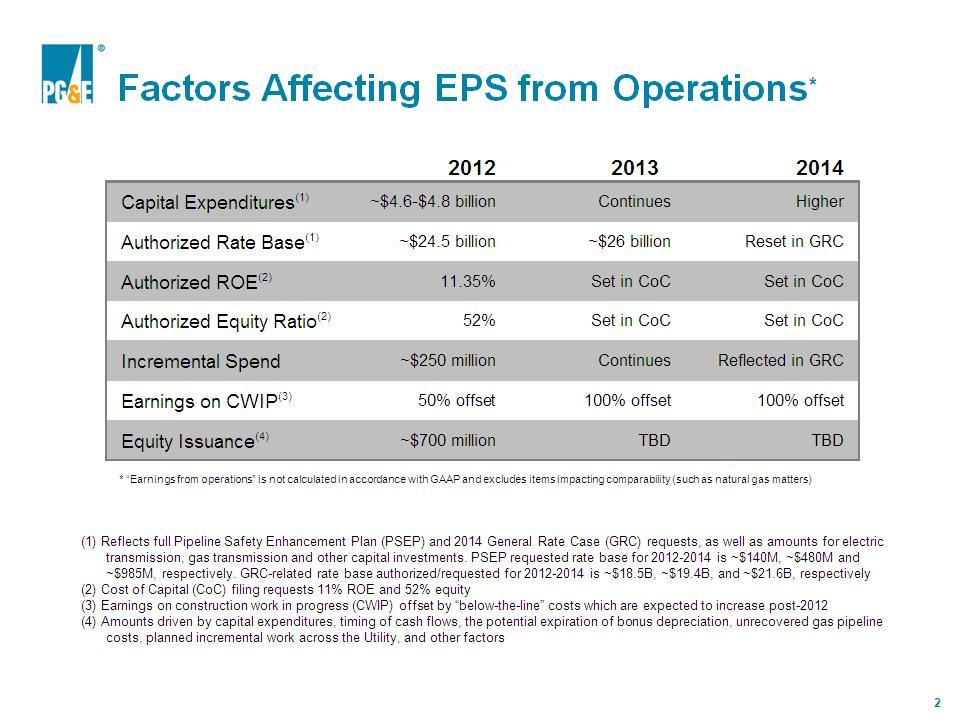

* (1) Reflects full Pipeline Safety Enhancement Plan (PSEP) and 2014 General Rate Case (GRC) requests, as well as amounts for electric transmission, gas transmission and other capital investments. PSEP requested rate base for 2012-2014 is ~$140M, ~$480M and ~$985M, respectively. GRC-related rate base authorized/requested for 2012-2014 is ~$18.5B, ~$19.4B, and ~$21.6B, respectively (2) Cost of Capital (CoC) filing requests 11% ROE and 52% equity (3) Earnings on construction work in progress (CWIP) offset by “below-the-line” costs which are expected to increase post-2012 (4) Amounts driven by capital expenditures, timing of cash flows, the potential expiration of bonus depreciation, unrecovered gas pipeline costs, planned incremental work across the Utility, and other factors * “Earnings from operations” is not calculated in accordance with GAAP and excludes items impacting comparability (such as natural gas matters) Factors Affecting EPS from Operations*

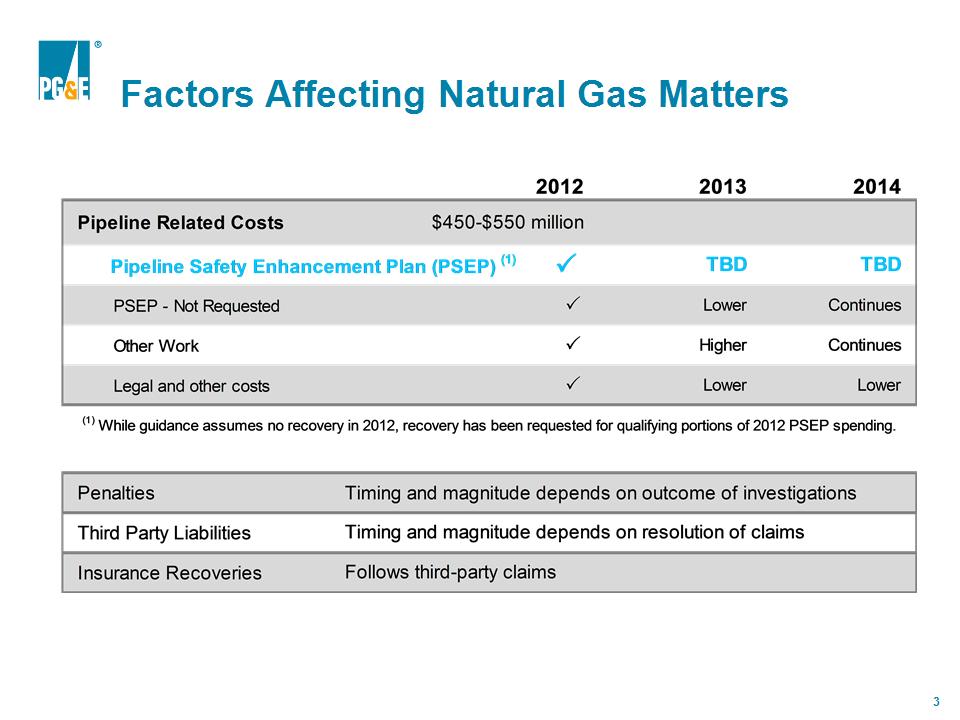

* Factors Affecting Natural Gas Matters

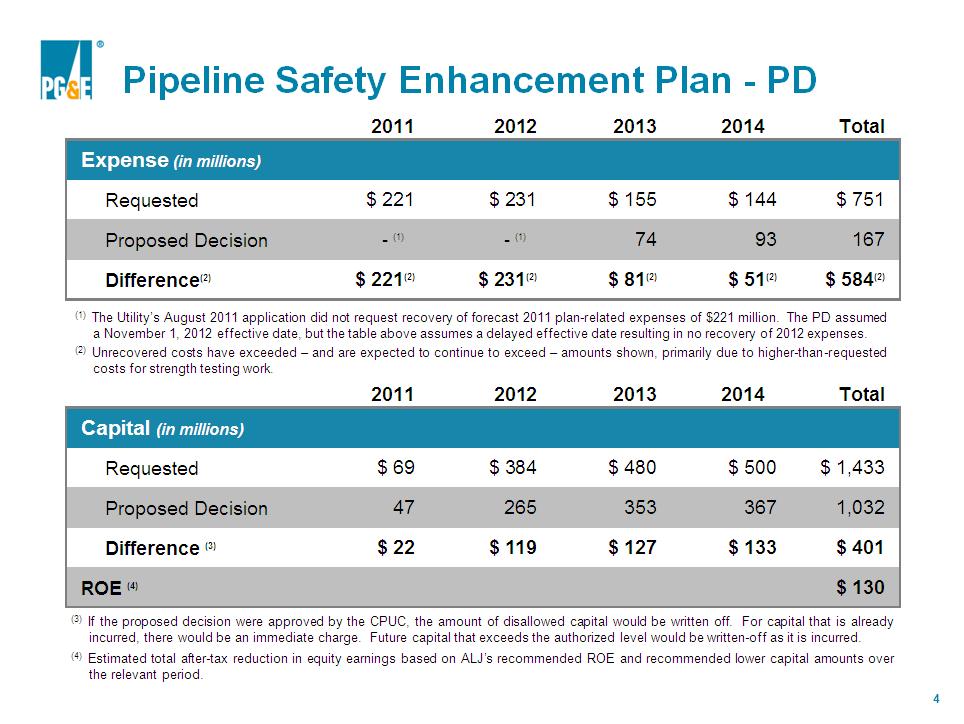

* Pipeline Safety Enhancement Plan - PD (3) If the proposed decision were approved by the CPUC, the amount of disallowed capital would be written off. For capital that is already incurred, there would be an immediate charge. Future capital that exceeds the authorized level would be written-off as it is incurred. (4) Estimated total after-tax reduction in equity earnings based on ALJ’s recommended ROE and recommended lower capital amounts over the relevant period. (1) The Utility’s August 2011 application did not request recovery of forecast 2011 plan-related expenses of $221 million. The PD assumed a November 1, 2012 effective date, but the table above assumes a delayed effective date resulting in no recovery of 2012 expenses. (2) Unrecovered costs have exceeded – and are expected to continue to exceed – amounts shown, primarily due to higher-than-requested costs for strength testing work.

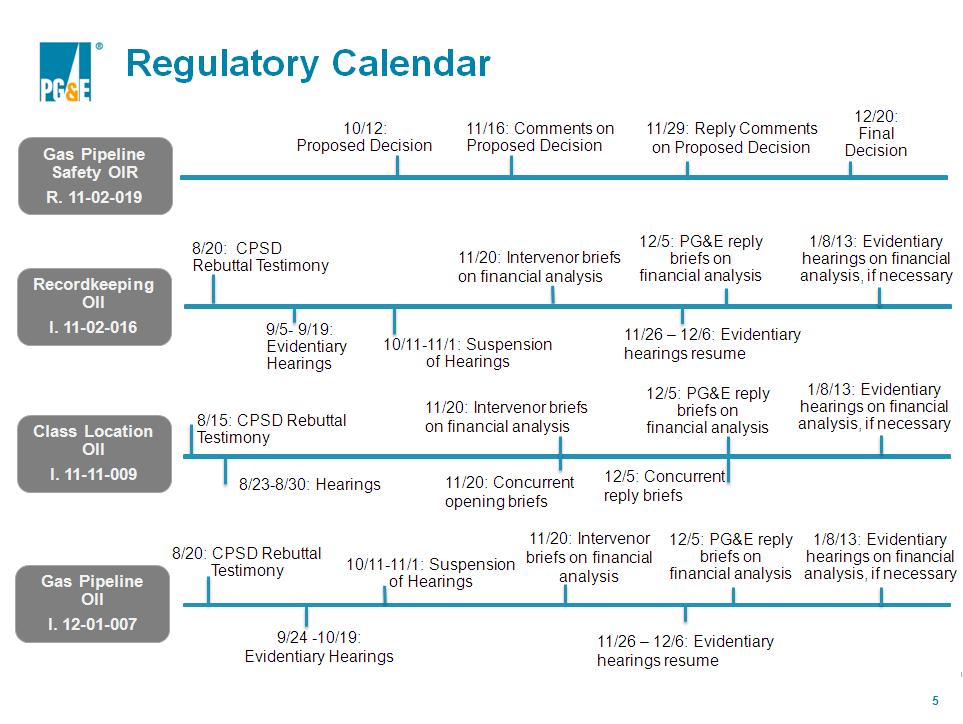

* Regulatory Calendar 11/26 – 12/6: Evidentiary hearings resume 8/20: CPSD Rebuttal Testimony 12/20: Final Decision Recordkeeping OII I. 11-02-016 Gas Pipeline Safety OIR R. 11-02-019 10/12: Proposed Decision 11/16: Comments on Proposed Decision 11/29: Reply Comments on Proposed Decision 8/15: CPSD Rebuttal Testimony Class Location OII I. 11-11-009 8/23-8/30: Hearings 8/20: CPSD Rebuttal Testimony 11/20: Intervenor briefs on financial analysis 10/11-11/1: Suspension of Hearings 9/24 -10/19: Evidentiary Hearings Gas Pipeline OII I. 12-01-007 9/5- 9/19: Evidentiary Hearings 11/20: Intervenor briefs on financial analysis 12/5: PG&E reply briefs on financial analysis 12/5: Concurrent reply briefs 11/20: Concurrent opening briefs 10/11-11/1: Suspension of Hearings 11/20: Intervenor briefs on financial analysis 12/5: PG&E reply briefs on financial analysis 1/8/13: Evidentiary hearings on financial analysis, if necessary 11/26 – 12/6: Evidentiary hearings resume 12/5: PG&E reply briefs on financial analysis 1/8/13: Evidentiary hearings on financial analysis, if necessary 1/8/13: Evidentiary hearings on financial analysis, if necessary

* Management's statements regarding guidance for PG&E Corporation’s future financial results and earnings from operations per common share, the underlying assumptions, and general earnings sensitivities, constitute forward-looking statements that are necessarily subject to various risks and uncertainties. These statements reflect management’s judgment and opinions which are based on current expectations and various forecasts, estimates, and projections, the realization or resolution of which may be outside of management’s control. PG&E Corporation and the Utility are not able to predict all the factors that may affect future results. Some of the factors that could cause actual results to differ materially include: the outcomes of the investigations, enforcement matters, and litigation related to the Utility’s natural gas system operating practices and the San Bruno accident, including the ultimate amount of penalties or loss the Utility incurs; the outcomes of regulatory proceedings, such as the CPUC’s natural gas rulemaking proceeding, and ratemaking proceedings, such as the 2014 GRC and the 2013 cost of capital proceeding; the ultimate amount of costs the Utility incurs in the future that are not recovered through rates, including costs under its pipeline safety enhancement plan and to perform incremental work to improve the safety and reliability of its electric and natural gas operations; whether PG&E Corporation and the Utility are able to repair the reputational harm that they have suffered, and may suffer in the future, due to the San Bruno accident and the related civil litigation, the occurrence of adverse developments in the CPUC investigations or the criminal investigation, including any finding of criminal liability; the level of equity contributions that PG&E Corporation must make to the Utility to enable the Utility to maintain its authorized capital structure as the Utility incurs charges and costs, including costs associated with natural gas matters and penalties imposed in connection with investigations, that are not recoverable through rates or insurance; the impact of environmental remediation laws, regulations, and orders; the ultimate amount of the Utility’s environmental remediation costs; the extent to which the Utility is able to recover such costs through rates or insurance; and the ultimate amount of environmental costs the Utility incurs that are not recoverable, such as the remediation costs associated with the Utility’s natural gas compressor station site located near Hinkley, California; the impact of new legislation, regulations, recommendations, orders or policies applicable to the operations, security, safety, or decommissioning of nuclear generation facilities, the storage of spent nuclear fuel, seismic design, cooling water intake, or other issues; the occurrence of events, including cyber-attacks, that can cause unplanned outages, reduce generating output, disrupt the Utility’s service to customers, or damage or disrupt the facilities, operations, or information technology and systems owned by the Utility, its customers, or third parties on which the Utility relies; and the other factors and risks discussed in PG&E Corporation and the Utility’s 2011 Annual Report on Form 10-K and other reports filed with the Securities and Exchange Commission. Safe Harbor Statement