Attached files

| file | filename |

|---|---|

| 8-K - 8-K - NUPATHE INC. | a12-26868_18k.htm |

Exhibit 99.1

|

|

Corporate Presentation November 13, 2012 © 2012 NuPathe Inc. All rights reserved. |

|

|

Forward-Looking Statements This presentation contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All remarks and information that are not historical facts are hereby identified as forward-looking statements for this purpose and include, among others, remarks and information relating to: the sufficiency of current cash to fund debt service and interest obligations and continue operations into the fourth quarter of 2013; the timing and prospects for FDA approval of Zecuity; the therapeutic benefits, pricing, reimbursement and market opportunity for Zecuity; partnering and commercialization plans for the Company’s product candidates; duration and scope of patent protection; and all other remarks and information relating to the Company’s plans, objectives, expectations and beliefs regarding future performance, operations, financial condition and other future events (including assumptions underlying or relating to any of the foregoing). Forward-looking statements are based on the Company’s current expectations, plans and beliefs and are subject to a number of risks, uncertainties, assumptions and other factors that could cause actual results to differ materially and adversely from those indicated by such statements including, among others: the ability to obtain FDA approval of Zecuity; the extent to which the FDA may request or require additional information, studies or redesign of Zecuity and the costs and time required to complete such activities; the ability to obtain partners for the Company’s product candidates; the ability to obtain additional capital to continue as a going concern; varying interpretation of trial, study, market and research data; physician and patient acceptance of the Company’s product candidates; risks and uncertainties relating to intellectual property; and the other factors discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2011 and Quarterly Report on Form 10-Q for the quarter ended September 30, 2012 under the captions “Risk Factors” and elsewhere in such reports, which are available on the Company’s website at www.nupathe.com in the “Investor Relations – SEC Filings” section. You are cautioned not to place undue reliance on any forward-looking statements. While the Company may update certain forward-looking statements from time to time, it specifically disclaims any obligation to do so. |

|

|

Innovative solutions for diseases of the central nervous system Focused on key objectives Gaining approval for Zecuity™ Securing commercial partners Conducting additional pre-launch commercial activities Financial resources to execute on key objectives NuPathe – Specialty Pharmaceutical Company |

|

|

Game-changing, disruptive technology for migraine Utilizes proprietary active transdermal delivery technology Uniquely positioned to address migraine-related nausea & vomiting (MRNV) – significant unaddressed disease burden Rapid relief of both headache pain and nausea, very low rate of triptan sensations MRNV impacts half of all migraine sufferers MRNV drives higher headache-related health care utilization and direct costs Near-term commercial opportunity PDUFA Date - January 17, 2013 Attractive specialist–driven market Zecuity – The First and Only Migraine Patch |

|

|

Applied during migraine to arm or thigh Rapidly delivers sumatriptan, the #1 prescribed Triptan Bypasses GI tract – mouth & gut Simple to use, single use, disposable Long life: issued patents until April 2027 Zecuity – Harnessing the Power of Sumatriptan |

|

|

Tablets and MRNV Patients often unwilling or unable to take tablets when nauseated >30% of patients delay/avoid orals – too nauseated/fear of vomiting1,2,3 Tolerability limitations of existing non-orals Nasal sprays: taste issues, nausea, and vomiting are common AEs Injections: high incidence and intensity of “triptan-effects” related to Cmax Zecuity Addresses Limitations of Other Formulations Imitrex Nasal Spray 20mg4 Bad Taste 25% Nausea/Vomiting 14% Imitrex Injection 6mg5 Atypical Sensations* 42% Nausea/Vomiting 12% * Atypical sensations include tingling, warm/hot sensation, burning sensation, feeling of heaviness, pressure sensation, feeling of tightness, numbness |

|

|

Pivotal phase 3 efficacy data demonstrate: 39% more Zecuity patients had pain relief than placebo at 30 minutes* Sustained pain relief from 2 to 24 hours (P = 0.0015) Significant pain relief at 1 hour (P = 0.0135) Significant elimination of nausea at 1 hour (P = 0.0251) 71% nausea free at 1 hour, reaching 84% by hour 2 Relieves Pain and Eliminates Nausea within One Hour * Not statistically significant. FDA Endpoints (Data at 2 hours) P-Value Pain free – Primary = 0.0092 Pain relief < 0.0001 Nausea free < 0.0001 Photophobia free = 0.0028 Phonophobia free = 0.0002 |

|

|

Pivotal Phase 3 Data Adverse Event Profile Application site events were typical of patches Majority were mild in intensity and transient Minimal incidence of adverse events known as triptan sensations Compared with product labeling for oral (>8%) and injection (>42%) Patch Placebo Application site pain 26% 17% Application site tingling 9% 16% Application site itching 8% 7% Application site warmth 6% 3% Application site discomfort 6% 6% Patch Placebo Atypical sensations 1.7% 0.0% Pain and other pressure sensations 1.7% 0.4% |

|

|

Extensive clinical program including more than 800 patients and 10,000 patch applications No drug-related serious adverse events Two 12-month, repeat use, open-label trials Very low incidence of triptan sensations (0.9%) No increased skin irritation with repeat or increased use 12-month completers used approximately 2.5 patches per month Additional clinical pharmacology safety studies Cumulative skin irritation PK and safety in elderly PK in migraine patients Excellent Safety and Efficacy Demonstrated through Robust Clinical Program |

|

|

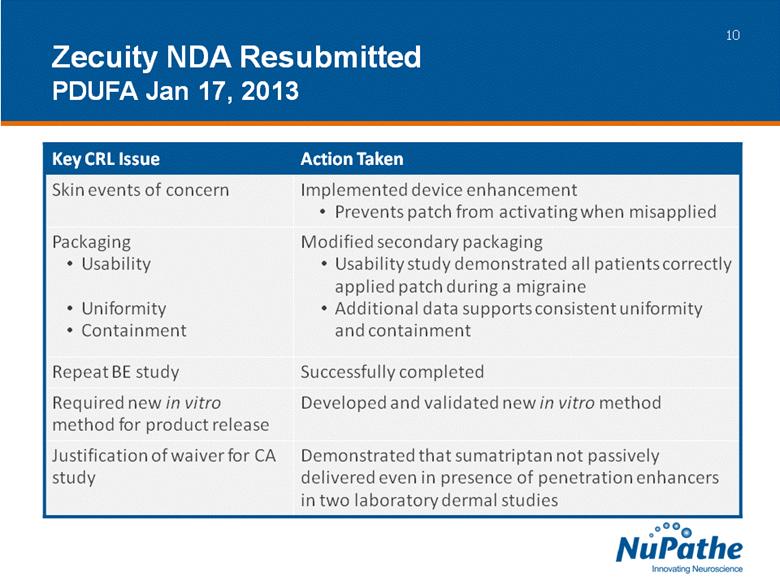

Key CRL Issue Action Taken Skin events of concern Implemented device enhancement Prevents patch from activating when misapplied Packaging Usability Uniformity Containment Modified secondary packaging Usability study demonstrated all patients correctly applied patch during a migraine Additional data supports consistent uniformity and containment Repeat BE study Successfully completed Required new in vitro method for product release Developed and validated new in vitro method Justification of waiver for CA study Demonstrated that sumatriptan not passively delivered even in presence of penetration enhancers in two laboratory dermal studies Zecuity NDA Resubmitted PDUFA Jan 17, 2013 |

|

|

31 million migraine sufferers1 Triptan share 94% of migraine prescriptions2 97% of migraine sales2 Preferred class of migraine treatment 3 – 4 triptan trials before moving to different classes (e.g. opioids, DHE)3 Key challenge for triptans: circumventing pervasive migraine-related GI issues Injection is poorly tolerated and orals/nasals can be unreliable Triptans Dominate the Migraine Market Triptans 94% Analgesic Combos 5% Ergots 1% |

|

|

Triptan Sensations Mimic a cardiovascular event >42% of injection patients3 > 8% of oral tab patients3 Millions Remain Underserved * Linked to a variety of factors, including gastroparesis. Gastroparesis Unreliable absorption Inconsistent Efficacy* >40% of treated patients4 Migraine-Related Nausea (MRN) 8.0 million patients in >50% of attacks1 4.7 million patients in 100% of attacks2 Migraine-Related Vomiting (MRV) 3.4 million patients in >50% of attacks2 1.5 million patients in 100% of attacks2 Note: Overlap amongst patient types. |

|

|

Frequent nausea patients are less satisfied with their migraine medications (p < 0.0001)1,2 Frequent nausea patients drive direct medical costs for migraine3 2.2 times as many visits to a specialist 5.4 times as many emergency/urgent care visits 8.2 times higher overnight hospital stay costs Presence of nausea predicts poor response to oral medications in treating headache pain4,5 Headache pain relief with patch not compromised by presence of nausea* (p < 0.0001) MRN Drives Tremendous Disease Burden * Ad hoc data analysis of Phase 3 pivotal study . |

|

|

Insurance is >90% commercial private pay Payors see value in a patch for migraine Recognize cost of poorly controlled migraine patients Acknowledge barrier of GI issues Accept patch as a unique solution Payors indicate broad formulary access Majority Tier 3 with a single step edit Select opportunities to contract for Tier 2 Non-orals priced up to $95 per unit (WAC) Annual gross revenue per patient using 2 patches/month $100/patch = $2,400 Pricing and Reimbursement Aligned with Product Positioning |

|

|

Physicians rate Zecuity superior to oral, nasal, and injectable triptans for MRN patients on key attributes including: Ability to use early in a migraine attack despite GI issues Frequency of triptan sensations and overall tolerability Elimination of nausea at 1 and at 2 hours 77% of MRN patients will ask their physician about the patch Quantitative Research Confirms the Market Opportunity for Zecuity Physicians (n=409) Priority segments Heightened concern about MRN High interest in prescribing a migraine patch Patients (n=400) Priority segments Actively seeking new treatments Highest % of migraines with nausea |

|

|

8 million patients experience nausea in >50% of attacks1 1.5 million patients vomit in 100% of attacks2 Branded injection WAC pricing of $95/migraine Treat 24 migraines per year Illustrative Market Segment Opportunities Migraine-Related Nausea (>50% of Attacks) and Vomiting Segment (100% of Attacks) 1.5 MM vomit during every attack |

|

|

Secure commercial partnerships Zecuity is a versatile asset within a portfolio Migraine co-morbidity rates include: sleep disorders (52%), depression (45%), arthritis (35%), GERD (26%)1 Headache specialists drive ~ 1/3rd of triptan volume2 ~ 10K headache specialists and neurologists Discrete segment of primary care doubles the opportunity ~30K PCPs account for an additional 1/3rd of the market2 Significant commercial opportunity in ROW Commercialization Strategy 17 |

|

|

NP202: 90-day risperidone biodegradable implant to treat schizophrenia and bipolar disorder Designed to address significant patient non-compliance Continuous delivery reduces psychotic breaks and improves patient functionality1 Seeking global development & commercial partner NP201: 60-day ropinirole biodegradable implant to treat the signs and symptoms of Parkinson’s disease Designed to address the challenges of “on and off” time due to intermittent dosing and reducing drug-related adverse events Evidence suggests continuous dopaminergic stimulation delays disease progression and improves treatment2 Seeking global development & commercial partner Pipeline |

|

|

Financing & cost containment measures expected to provide cash runway into 4Q13 $28 million financing ($26.3 net proceeds) closed in October Restructured $7.5 million of outstanding debt Headcount reduction and reduced operating expenses Financial |

|

|

Focused on key objectives Gaining FDA approval for Zecuity Game-changing, disruptive technology for migraine Uniquely positioned to address migraine-related nausea & vomiting (MRNV) – significant unaddressed disease burden Near-term commercial opportunity Attractive specialist–driven market Securing commercial partners Conducting additional pre-launch commercial activities Financial resources to execute on key objectives NuPathe – Specialty Pharmaceutical Company |

|

|

References Slide 6: 1. National Headache Foundation Patient Survey (June 2008). 2.Silberstein, S. Migraine symptoms: results of a survey of self-reported migraineurs. Headache 1995;35:387-396. 3. NuPathe market research (2008,2011). 4. US Prescribing Information for Imitrex Nasal Spray. 5. US Prescribing Information for Imitrex Injection Slide 11: 1. Lipton, R. Prevalence and Burden of Migraine in the United States: Data from the American Migraine Study II. Headache 2001 41:646-657. and US Census data (2010) 2. Data from IMS MAT June 2011. Triptans include Treximet. Analgesic combos = analgesic combos + Cambia 3. NuPathe proprietary market research. Slides 12: 1. Lipton, R. Data presented at the 53rd Annual Scientific Meeting of the American Headache Society (AHS), June 2011. 2.Silberstein, S. Migraine symptoms: results of a survey of self-reported migraineurs. Headache 1995;35:387-396. 3. US prescribing information Imitrex tablets and Imitrex injection. 4. Ferrari et al. Oral triptans (serotonin 5-HT1B/1D agonists) in acute migraine treatment: a meta-analysis of 53 trials. Lancet 2001; 358: 1668–75. Slide 13: 1. Lipton et al. Data presented at the 53rd Annual Scientific Meeting of the American Headache Society (AHS), June 2011. 2. Buse et al. Data presented at the 53rd Annual Scientific Meeting of the American Headache Society (AHS), June 2011. 3. Lipton et al. Data presented at the Academy of Managed Care Pharmacy’s 2011 Educational Conference, October 2011. 4.Diener et al. Predicting the response to sumatriptan, the sumatriptan naratriptan aggregate database. Neurology 2004;63:520–524. 5. Diener et al. Identification of negative predictors of pain-free response to triptans: analysis of the eletriptan database. Cephalalgia 2007, 28, 35–40. Slides 16: 1. Lipton, R. Data presented at the 53rd Annual Scientific Meeting of the American Headache Society (AHS), June 2011. 2.Silberstein, S. Migraine symptoms: results of a survey of self-reported migraineurs. Headache 1995;35:387-396. Slide 17: 1. The Migraine Market: US Core Therapeutic Report, National Health and Wellness Survey (2006). 2. Data from IMS MAT June 2011. Triptans include Treximet. Analgesic combos = analgesic combos + Cambia. Slide 18: 1. Thieda P. An economic review of compliance with medication therapy in the treatment of schizophrenia. Psychiatric Services 2003: 54;508-516. 2. Stocchi F 2009 (The therapeutic concept of continuous dopaminergic stimulation (CDS) in the treatment of Parkinson’s disease. Parkinsonism Related Disorders. 2009 Dec;15 Suppl 3:S68-71). |