Isola Group Ltd. - FORM S-1/A - November 13, 2012

Attached files

Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

Table of Contents

As filed with the Securities and Exchange Commission on November 13, 2012

Registration No. 333-177611

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 5

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Isola Group Ltd.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Cayman Islands

(State or other jurisdiction of

incorporation or organization) |

|

3672

(Primary Standard Industrial

Classification Code Number) |

|

38-3853493

(I.R.S. Employer

Identification No.) |

3100 West Ray Road, Suite 301

Chandler, Arizona 85226

(480) 893-6527

(Address, including zip code, and telephone number, including

area code, of registrant's principal executive offices)

Raymond P. Sharpe

President and Chief Executive Officer

Isola Group Ltd.

3100 West Ray Road, Suite 301

Chandler, Arizona 85226

(480) 893-6527

(Name, address, including zip code, and telephone number, including area code, of agent for service)

|

|

|

| Copies to: |

Steven D. Pidgeon, Esq.

DLA Piper LLP (US)

2525 East Camelback Road, Suite 1000

Phoenix, Arizona 85016

(480) 606-5100

Fax: (480) 606-5101 |

|

Julia Cowles, Esq.

Davis Polk & Wardwell LLP

1600 El Camino Real

Menlo Park, California 94025

(650) 752-2000

Fax: (650) 752-2111 |

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effectiveness of this registration statement.

If any of the securities being registered on this Form are being offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of

1933, check the following box. o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of "large accelerated filer", "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

|

|

|

| Large accelerated filer o |

|

Accelerated filer o |

|

Non-accelerated filer ý

(Do not check if a

smaller reporting company) |

|

Smaller reporting company o |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall

file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or

until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be

changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and

we are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

|

|

|

|

|

|

PRELIMINARY PROSPECTUS |

|

Subject to completion, |

|

Dated November 13, 2012 |

|

Shares

Ordinary shares

This is the initial public offering of our ordinary shares. No public market currently exists for our ordinary shares. It is currently estimated that the

initial public offering price will be between $ and $ per share.

We

have applied to have our ordinary shares listed on the Nasdaq Global Market under the symbol "ISLA".

We are an "emerging growth company" under applicable federal securities laws and will be subject to reduced public company reporting requirements. Investing in our ordinary

shares involves a high degree of risk. Before buying any shares, you should carefully read the discussion of material risks of investing in our ordinary shares in "Risk Factors" beginning on

page 12 of this prospectus.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or

complete. Any representation to the contrary is a criminal offense.

|

|

|

|

|

|

|

|

|

|

Per share

|

|

Total

|

|

| |

|

Initial public offering price |

|

$ |

|

|

$ |

|

|

| |

|

Underwriting discount |

|

$ |

|

|

$ |

|

|

| |

|

Proceeds, before expenses, to us |

|

$ |

|

|

$ |

|

|

| |

|

The

underwriters have the option, exercisable on or before the thirtieth day after the date of this prospectus, to purchase up to an

additional ordinary shares from us

at the public offering price, less the underwriting discounts and commissions, to cover over-allotments, if any.

The

underwriters are offering the ordinary shares as set forth under "Underwriting". Delivery of the shares will be made on or

about , 2012.

|

|

|

|

UBS Investment Bank

|

|

Piper Jaffray

|

|

|

|

|

Needham & Company

|

|

Oppenheimer & Co.

|

The

date of this prospectus is , 2012

Table of Contents

You should rely only on the information contained in this prospectus. We and the underwriters have not authorized anyone to provide you with information different from that

contained in this prospectus. We are offering to sell, and seeking offers to buy, ordinary shares only in jurisdictions where offers and sales are permitted. The information contained in this

prospectus is accurate only as of the date on the front cover of this prospectus, or such other dates as are stated in this prospectus, regardless of the time of delivery of this prospectus or of any

sale of our ordinary shares.

TABLE OF CONTENTS

Prospectus

Through and including , 2012 (25 days after the commencement of

the offering), all dealers effecting transactions

in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealer's obligation to deliver a prospectus when acting as an

underwriter and with respect to unsold allotments or subscriptions.

i

Table of Contents

MARKET RANKING AND INDUSTRY DATA

This prospectus includes estimates of market share and industry data and forecasts that we obtained from industry publications and surveys, including

market research firms and government sources, and internal company sources. We commissioned and paid for some of this research. Industry publications, surveys and forecasts generally state that the

information contained therein has been obtained from sources believed to be reliable. In addition, certain market and industry data included in this prospectus, and our position and the positions of

our competitors within these markets, are based on estimates of our management, which are primarily based on our management's knowledge and experience in the markets in which we operate. These

estimates involve risks and uncertainties and are subject to change based on various factors, including those discussed under the heading "Risk Factors" in this prospectus.

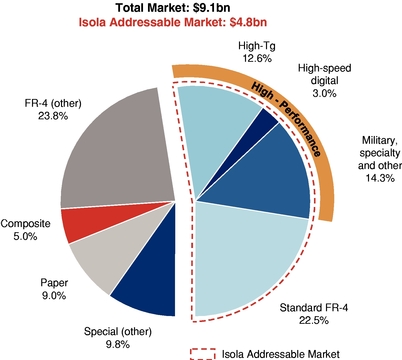

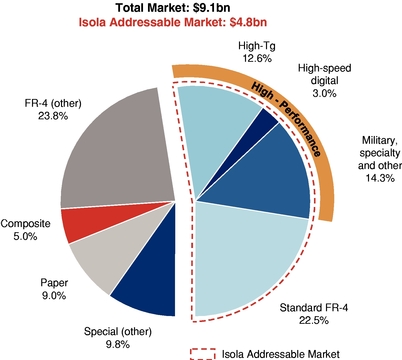

Throughout

this prospectus, when we refer to our "addressable" market for PCB laminate materials, or segments of our "addressable" market for PCB laminate materials, we exclude paper and composite

segments, portions of the FR-4 and specialty laminate segments, and the internal Japanese market, none of which are addressed by Isola.

TRADEMARKS AND TRADE NAMES

This prospectus contains registered and unregistered trademarks and service marks of us and our subsidiaries, as well as trademarks and service marks

of third parties. All brand names, trademarks and service marks appearing in this prospectus are the property of their respective holders.

CONVENTIONS THAT APPLY IN THIS PROSPECTUS

Fiscal Year

In this prospectus, unless the context requires otherwise, references to fiscal 2011 are for the fiscal year ending December 31, 2011,

references to fiscal 2010 are for the fiscal year ended January 1, 2011, references to fiscal 2009 are for the fiscal year ended December 26, 2009, references to fiscal 2008 are for the

fiscal year ended December 27, 2008, references to fiscal 2007 are for the fiscal year ended December 29, 2007, references to fiscal 2006 are for the fiscal year ended

December 30, 2006, references to fiscal 2005 are for the fiscal year ended December 31, 2005, and references to fiscal 2004 are for the fiscal year ended December 31, 2004.

Technical Terms

- –>

- "Dielectric"

refers to an electrical insulator that can be polarized by an applied electric field. When a dielectric is placed in an electric field, electric charges

do not flow through the material, as in a conductor, but only slightly shift from their average equilibrium positions causing dielectric polarization.

- –>

- "Dielectric

Constant" refers to a measure of how close a material comes to free space (air) conditions and how constant these conditions hold through the material.

- –>

- "Glass

Transition Temperature" or "Tg" refers to the temperature in Celsius at which the laminate begins to change between a hard, relatively brittle condition and a

viscous, or rubbery, condition.

- –>

- "Lead-free"

refers to laminates or prepreg that are suitable for lead-free soldering in the assembly of finished printed circuit boards. No

laminates or prepreg actually contain the element lead. The distinction is important, however, as lead-free solders melt at higher temperatures than solders containing lead, which require

laminates and prepreg capable of withstanding the stresses of a higher temperature environment.

ii

Table of Contents

- –>

- "Loss",

in the context of a material's characteristics, refers to the ratio of energy dissipated to energy stored.

- –>

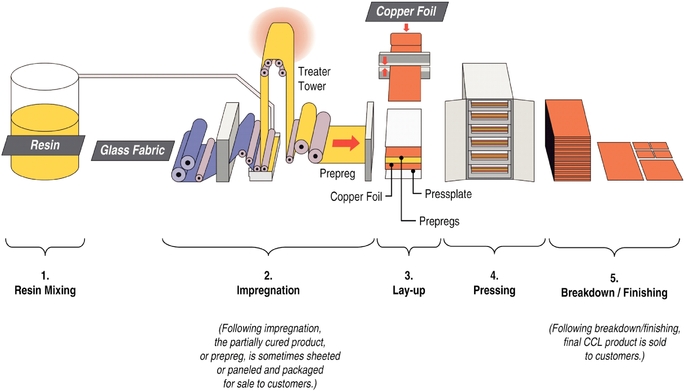

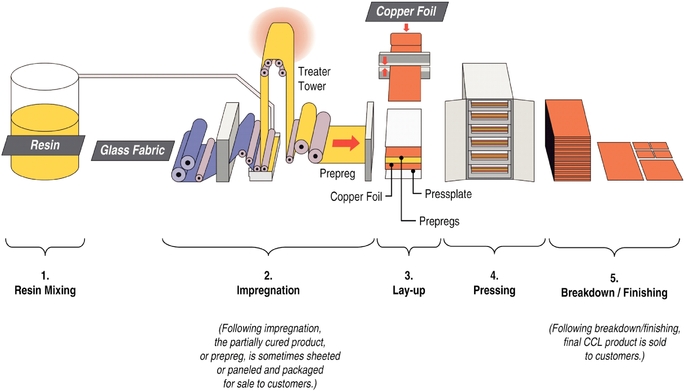

- "Prepreg"

is an industry term derived from the contraction of "previously

impregnated". Prepreg is a dielectric material that provides electrical insulation properties. It is manufactured, as the

term suggests, by the impregnation of fabric with specially formulated resin systems that confer specific electrical, thermal and physical properties to the prepreg. While modern prepreg is generally

made from fiberglass fabric, some simple consumer electronics still use prepreg made from paper or paper composite. Prepreg is both a final product and an intermediate-stage product in the manufacture

of copper-clad laminate.

iii

Table of Contents

Prospectus Summary

This summary highlights important information about our business and about this prospectus. This summary does

not contain all of the information that may be important to you. You should carefully read this prospectus in its entirety before making an investment decision. In particular, you should read the

section titled "Risk Factors" and the consolidated financial statements and notes related to those statements included elsewhere in this prospectus. Unless the context indicates otherwise, we use the

terms "Isola", "we", "our", the "Company", and "us" in this prospectus to refer to Isola Group Ltd., and, where appropriate, its consolidated subsidiaries. Unless otherwise indicated, the

information contained in this prospectus assumes the completion of the reorganization as described in this prospectus under "Concurrent Transactions" immediately prior to the consummation of this

offering.

ISOLA GROUP LTD.

Overview

Isola is a leading global material sciences company that designs, develops and manufactures copper-clad laminate ("CCL")

and prepreg (collectively, "laminate materials") used to fabricate advanced multilayer printed circuit boards ("PCBs"). PCBs provide the physical platform for the semiconductors, passive components

and connection circuitry that power and control virtually all modern electronics. We focus on the market for high-performance laminate materials, developing proprietary resins that are

critical to the performance of PCBs used in advanced electronic applications. We continually invest in research and development ("R&D") and believe that our industry-leading resin formulations, many

of which are patented, provide us with a competitive advantage. With 11 manufacturing facilities and three research centers worldwide, as well as a global sales force, we are the largest supplier of

laminate materials to PCB fabricators in the United States and Europe, and we are one of the larger suppliers in our addressable Asian market, based on revenue for fiscal year 2011.

Our

high-performance PCB laminate materials are used in a variety of advanced electronics, including network and communications equipment and high-end consumer electronics, as

well as advanced automotive, aerospace, military and medical applications. Demand in these markets is driven by the rapid growth of bandwidth-intensive high-speed data transmission, the

expansion of the internet, the emergence of cloud computing and the evolution of increasingly complex communications technology. This has led to an urgent need for the development of the underlying

infrastructure to support this growth, including faster and more efficient semiconductor technology. In addition, increasingly pervasive environmental regulations are driving a need for

lead-free compatible, high-performance laminate materials.

We

sell our products globally to leading PCB fabricators, including Ruwel, Sanmina, TTM Technologies, Viasystems and WUS Printed Circuit. These fabricators produce PCBs incorporating our laminate

materials for electronic equipment designed or produced by a broad group of major original equipment manufacturers, or OEMs, including Alcatel-Lucent, Brocade, Cisco, Dell, Ericsson, Google,

Hewlett-Packard, Huawei, IBM and Sun Microsystems (now Oracle). We work closely with these leading PCB fabricators and major OEMs to ensure that our high-performance laminate

materials incorporating our proprietary resins meet the thermal, electrical and physical performance criteria of each new generation of electronic equipment.

We

were acquired in 2004 by a group of investors led by TPG, a global private equity firm, and Redfern Partners, a strategic partner and investor in the laminate materials industry. Under the

direction of TPG and our management, we have undertaken a number of operational changes that have increased manufacturing efficiencies and improved business processes. We believe that these measures,

together with our focus on higher margin high-performance products, provide us with the operating leverage to take advantage of improving economic conditions.

1

Table of Contents

Our

history dates back 100 years to the founding of Isola Werke AG in Germany in 1912. Isola Werke AG manufactured insulators utilizing the then-revolutionary Bakelite plastic

technology, which provided superior insulating and heat resistance properties. We began production of copper-clad epoxy laminates, the direct predecessors of today's PCB laminate products,

in the 1960s. In 2006, we acquired the assets of Polyclad Laminates, Inc., which extended our product portfolio and expanded our business in the growing Asian markets.

For the nine months ended September 29, 2012, our revenue was $437.8 million, our net loss was $64.5 million, and our Adjusted EBITDA was $78.4 million, as compared to

revenue of $459.4 million, net income of $7.1 million, and Adjusted EBITDA of $68.6 million for the nine months ended October 1, 2011. For fiscal 2011, our revenue was

$597.0 million, our net income was $10.0 million, and our Adjusted EBITDA was $86.2 million. For fiscal 2010, our revenue was $612.0 million, our net income was

$1.2 million, and our Adjusted EBITDA was $92.4 million, as compared to revenue of $424.2 million, a net loss of $100.7 million, and Adjusted EBITDA of $31.6 million

in fiscal 2009. For an understanding of our primary non-GAAP metric, Adjusted EBITDA, including reconciliation to net income, see our discussion of non-GAAP financial measures

in "Selected Historical Consolidated Financial and Other Data", included elsewhere in this prospectus.

We continue to shift our product mix towards high-growth, high-margin, high-performance laminates. In 2011, we generated 83% of our gross sales (revenues less

certain adjustments, as described in "Management's Discussion and Analysis of Financial Condition and Results of Operations") from high-performance laminate products, compared to 68% in

2008. For the nine months ended September 29, 2012, high-performance laminate products accounted for 87% of gross sales. We witnessed significant migration towards high-performance

laminates in Asia, our largest market, with the high-performance category generating 92% of gross sales in 2011 compared to 76% in 2008. In Europe, sales of high-performance

laminate products grew from 28% of gross sales in 2008 to 45% of gross sales in 2011. Europe is a distinct market with standard products accounting for a significant portion of our laminate sales.

However, nearly half of the standard products we sell in Europe are sold to less price-sensitive end markets, including applications for industrial and medical equipment. In the Americas,

high-performance laminate products accounted for 98% of gross sales in 2011 compared to 97% in 2008.

Industry Overview and Market Opportunity

Current trends and drivers in the PCB laminate materials industry include:

- –>

- rapidly

expanding infrastructure requirements for high-speed data transmission and increasing demand for high-performance PCB laminate

materials;

- –>

- increased

performance requirements of advanced electronics requiring high-performance PCB laminate materials;

- –>

- growing

demand for environmentally friendly, lead-free compatible laminate materials; and

- –>

- greater

emphasis on collaboration with OEMs and PCB fabricators.

High-performance

PCB laminate materials are defined by their superior performance capabilities achieved primarily through the use of advanced resin formulations. These products compete

primarily on their technological capabilities and are used in circuit boards that combine eight or more layers, with some applications requiring circuit boards with more than 20 layers. Our

high-performance laminate materials have a variety of applications in the markets for servers and storage devices, network communications, advanced automotive electronics,

high-end consumer electronics, military/aerospace equipment, medical equipment and satellite television receivers.

Significant

barriers to entry exist within the high-performance PCB laminate materials industry, including capital intensity, long-term customer relationships characterized by

pre-production collaboration, and lengthy periods (often up to one year) taken by OEMs to qualify laminates for new products. Once a

2

Table of Contents

particular

PCB laminate material is designed in or qualified for use in a specific product line and one or more particular laminate suppliers are selected, these suppliers tend to remain suppliers of

choice, even as the PCBs for these products change to address OEM product line improvements, extensions or next generation developments.

According

to Prismark, an independent research firm, our addressable market for PCB laminate materials was $4.8 billion in 2011. Prismark prepared this analysis at our request, and we paid a

customary fee for its services. A majority of our high-performance product sales are low-loss laminates used primarily in applications for routers and servers. According to

BPA, another independent research firm, the markets for low loss laminate for routers and servers are expected to grow from 2011 to 2015 at compound annual growth rates (CAGRs) of 10% and 6%,

respectively.

Our Competitive Strengths

We believe that we possess the following competitive strengths, which will enable us to continue to grow our business globally:

Product technology leadership. Our significant technology expertise enables us to produce market-leading high-performance PCB laminate materials. We

possess an extensive portfolio of patent and other intellectual property rights covering our proprietary resin formulations and we believe we have pioneered the development of several product

categories with "best in class" technology. Our proprietary resin formulations are capable of supporting complex circuit boards used in the most demanding electronic equipment and differentiate our

products from commonly available, lower-performance materials. We continue to devote considerable efforts to research and develop new resin formulations and other PCB laminate materials to meet

evolving market needs.

Recognized market leadership. We maintain leading market shares, based on revenues, in our

addressable markets in the high-Tg and high-speed digital categories within the high-performance segment for PCB laminate materials. According to Prismark, our

market share in our high-Tg addressable market increased to 30% in 2011 from 29% in 2010; and our market share in our high-speed digital addressable market increased to 45% in

2011 from 37% in 2010. We have an established reputation as an industry leader and product innovator with strong brand recognition, which we believe will play a significant role in our future growth.

Blue-chip customer base served by global strategic manufacturing locations. We have developed strong, long-term relationships with leading

global PCB fabricators and the major OEMs they serve. We believe that these collaborative relationships provide us with a competitive advantage and assist us in bringing new products to market

in a timely manner. As new products gain market acceptance, many OEMs shift high-volume production to lower cost Asian facilities. Because we maintain

state-of-the-art equipment in manufacturing facilities that are strategically located throughout Asia, we are able to seamlessly move laminate production to meet

our customers' needs. In addition, our global network of plants facilitates quick-turn manufacturing and delivery of product, which reduces our customers' inventory levels and shipping

costs.

Streamlined manufacturing with significant operating leverage. We seek to achieve continual improvement in our manufacturing and business processes in order to

improve quality and reduce costs. We use "six sigma" processes and "lean" best practices; we recently completed the implementation of a sophisticated SAP-based enterprise resource planning

("ERP") system across our global operations which has enhanced our production planning and inventory management capabilities on a worldwide basis. In 2009, we closed three of our manufacturing

facilities to improve factory utilization in our remaining facilities, which lowered our fixed and semi-fixed manufacturing costs and improved our remaining manufacturing capacity

utilization. Together with other measures, we estimate that these closures reduced our annual net costs by approximately $30.0 million (with approximately $15.0 million first realized in

fiscal 2009 and approximately $15.0 million first realized in fiscal 2010).

3

Table of Contents

Experienced management team. We have a highly experienced management team comprised of well-respected industry veterans who possess an average of over

20 years of experience in the electronics industry. Our management team has a proven track record of implementing sound

business practices, including focusing our product development on higher margin products, improving the efficiency of our manufacturing facilities and successfully integrating acquired businesses.

Our Growth Strategies

We intend to extend our market leadership in the higher margin, high-performance laminate materials market through the following growth

strategies:

Leverage collaborative relationships and technology leadership to develop innovative solutions. We have implemented focused product development teams to further

expand our relationships with leading PCB fabricators and the OEMs they serve. Our product development teams include members of our research and development, technical support and OEM marketing

groups, all working under the direction of our Chief Technology Officer. Our teams actively monitor OEM product developments and engage in regular dialog with OEMs and their PCB fabricators in

order to anticipate and plan for future electrical, thermal and physical product specifications. Through this collaborative effort, we seek to develop innovative laminate materials solutions that meet

future OEM product requirements.

Further penetrate the Asian market. Many OEMs and PCB fabricators are migrating manufacturing of increasingly complex electronic equipment to Asia. In

addition, several Asian markets are simultaneously undergoing infrastructure build-outs as their economies grow and develop. To supply this market, six of our 11 manufacturing facilities

are located in Asia, and we maintain a sales force dedicated to serving this region. We will seek to capitalize on the opportunities presented by the very large and fast growing Asian markets for

high-performance laminate materials based on the high quality of our products and technology.

Extend high-performance products into new applications. We believe that other markets will benefit from our laminate materials and proprietary resin

formulations, including the markets for advanced automotive equipment and consumer devices such as next generation smart phones and tablets. In addition, we believe that environmental regulations will

become increasingly global and expand the addressable market for our high-performance, lead-free compatible and halogen-free PCB laminate materials. We intend to

devote sales and technical resources to address these growing potential markets.

Opportunistically pursue strategic acquisitions and alliances. We have grown through select acquisitions since we were acquired in 2004. While we believe that our

future success will depend primarily on product innovation from collaborative relationships with our major customers and the OEMs they serve, we may pursue strategic acquisitions that provide

complementary products or technologies.

Risk Factors

An investment in our ordinary shares involves risks. For a discussion of factors you should consider before deciding to invest in our ordinary

shares, we refer you to "Risk Factors" and the following summary:

- –>

- the

markets for our customers' products are volatile, which can cause wide swings in the demand for our products;

- –>

- we

depend upon a relatively small number of customers for a large portion of our sales, and a decline in sales to major customers could harm our results of

operations;

- –>

- we

sell on a purchase order basis and are subject to uncertainties and variability in demand by our customers that could decrease revenues and harm our results of

operations;

- –>

- we

depend on a small number of suppliers for the raw materials and certain components used to manufacture our products. If these suppliers fail to provide an

adequate supply of raw materials or components of sufficient quality, or these suppliers become unavailable to us, we may experience

4

Table of Contents

significant

delays in the manufacturing and shipping of our products to customers and our business could suffer;

- –>

- we

face intense competition in the PCB materials industry, including from diversified manufacturers and suppliers, which could negatively impact our results of

operations and cause our market share to decline;

- –>

- if

demand for high-performance, higher margin products does not increase, our future gross margins and operating results may be worse than expected; and

- –>

- our

failure to respond timely or adequately to market changes may render our existing technology less competitive or obsolete, and our operating results may suffer.

The Principal Sponsors

Our current principal sponsors (the "Principal Sponsors") are:

TPG. TPG Global, LLC (together with its affiliates, "TPG") is a leading private investment firm founded in 1992 with approximately $49 billion of assets

under management as of December 31, 2011 and offices in Fort Worth, Houston, New York, San Francisco, Brazil, Beijing, Chongqing, Hong Kong, Melbourne, Mumbai, Shanghai, Singapore, Tokyo,

London, Luxembourg, Moscow, and Paris. TPG has extensive experience with global public and private investments executed through leveraged buyouts, recapitalizations, spinouts, growth investments,

joint ventures and restructurings. TPG's investments span a variety of industries including financial services, travel and entertainment, technology, industrials, retail, consumer, media and

communications, and healthcare.

Oaktree. Oaktree Capital Management, L.P. (together with its affiliates, "Oaktree") is a premier global alternative and non-traditional

investment manager with approximately $74.9 billion of assets under management as of December 31, 2011. The firm emphasizes an opportunistic, value-oriented and

risk-controlled approach to investments in distressed debt, high-yield bonds, convertible securities, senior loans, corporate control, real estate, emerging market equities and

mezzanine finance. Oaktree was founded in 1995 by a number of

principals who had previously worked together since the mid-1980s. Headquartered in Los Angeles, the firm has over 600 staff members and offices in 13 cities worldwide.

Concurrent Transactions

Corporate Reorganization

Currently, we operate through Isola Group S.à r.l., a holding company incorporated in Luxembourg (the "Luxembourg Holding

Company"), a low-tax jurisdiction. The Luxembourg Holding Company is owned by investors that include TPG, Oaktree, Clearlake Capital and its affiliates, Tennenbaum Capital and its

affiliates, GSO Capital Partners LP (an affiliate of The Blackstone Group LP) and its affiliates, Redfern Partners, LLC and its affiliates and certain members of our management

(collectively, the "Sponsors"). The Sponsors hold their investment in the Luxembourg Holding Company through two parent entities: TPG Hattrick Partners, L.P. (the "Sponsor Limited Partnership")

and TPG Hattrick Holdco, LLC (the "Sponsor Holding Company"). The Sponsor Holding Company is the general partner of the Sponsor Limited Partnership.

The

Sponsor Limited Partnership currently owns all of the issued and outstanding securities of the Luxembourg Holding Company, including 500 common shares and three classes of convertible preferred

certificates (420,455 Class A convertible preferred certificates, 95,788,400 Class B convertible preferred certificates and 43,500,666 Class C convertible preferred certificates)

that are accounted for as debt.

In preparation for our initial public offering, the Sponsor Limited Partnership recently formed a new company, Isola Group Ltd., in the Cayman Islands, a tax-exempt jurisdiction.

Isola Group Ltd. will be our

5

Table of Contents

new holding company and the issuer in this initial public offering. Immediately prior to the completion of our initial public offering, we will undergo a corporate reorganization that includes the

following steps:

- –>

- all

of the outstanding securities of the Luxembourg Holding Company, including the common shares and convertible preferred certificates described above, will be

contributed by the Sponsor Limited Partnership to Isola Group Ltd. which will result in Isola Group Ltd. becoming our new holding company and the Luxembourg Holding Company becoming a

subsidiary of Isola Group Ltd.;

- –>

- both

the Sponsor Limited Partnership and the Sponsor Holding Company will be liquidated and the ordinary shares of Isola Group Ltd. will be distributed to our

Sponsors; and

- –>

- all

outstanding management equity awards in the Sponsor Limited Partnership will be terminated and replaced with new equity awards for ordinary shares of Isola

Group Ltd. that have the same value and substantially the same terms.

At

the completion of our initial public offering:

- –>

- Isola

Group Ltd. will be a public company;

- –>

- assuming

the underwriters do not exercise their over-allotment option, the Principal Sponsors will together own approximately % of our

outstanding ordinary shares, investors in our initial public offering will own approximately % of our outstanding ordinary shares and there will be options outstanding to purchase

approximately % of our outstanding ordinary shares; and

- –>

- the

Sponsors and Isola Group Ltd. will enter into a shareholders' agreement that provides for certain board representation rights and registration rights with

respect to their ordinary shares.

Refinancing

Concurrently with this offering, we expect to enter into a new $ million senior secured revolving credit facility and issue

$ million of senior secured notes due 2019 at an assumed interest rate of %. The proceeds from the issuance of the senior secured notes, together with the net

proceeds of this offering, will be used to repay the remaining outstanding balances under the existing senior secured credit agreement and mezzanine credit agreement as described in "Use of Proceeds".

See "Description of Indebtedness" for a more detailed description of our new revolving credit facility and senior secured notes. This offering, the senior secured notes offering and the closing of the

senior secured revolving credit facility are each conditional upon the closing of the other transactions.

For

an illustration of the pro forma financial impacts of the corporate reorganization and refinancing described above, see "Unaudited Pro Forma Financial Information".

Corporate Information about Isola Group Ltd.

Isola Group Ltd. was incorporated under the laws of the Cayman Islands on September 20, 2011. Our principal executive offices

are located at 3100 W. Ray Road, Suite 301, Chandler, Arizona 85226. The telephone number of our principal executive offices is (480) 893-6527, and we maintain

a website at www.isola-group.com. The information on, or that can be accessed through, our website is not part of this prospectus.

6

Table of Contents

The Offering

|

|

|

| Issuer |

|

Isola Group Ltd. |

Ordinary Shares Offered by Issuer |

|

shares. |

Option to Purchase Additional Shares |

|

We have granted the underwriters a 30-day option to purchase up to an additional ordinary

shares at the initial public offering price less the underwriting discount. |

Ordinary Shares to Be Outstanding Immediately After this Offering |

|

shares. |

Ordinary Shares to be Beneficially Owned by the Sponsors Immediately After this Offering |

|

shares. See "Principal Shareholders". |

Use of Proceeds |

|

We intend to use the net proceeds of this offering, together with the proceeds of the senior secured notes that we have issued, to prepay all of the term loans outstanding under our existing senior

secured credit agreement and mezzanine credit agreement plus interest to the prepayment date. The syndicate of lenders under our existing senior secured credit agreement and mezzanine agreement includes certain of our Sponsors. See "Certain

Relationships and Related Party Transactions—Agreements With Our Sponsors—Loan Agreement and Private Placement of Securities". |

|

|

As of September 29, 2012, we had $210.0 million aggregate principal amount of senior secured term loans outstanding that currently bear interest at a rate of 10% per annum and mature on

September 30, 2015, and $201.0 million aggregate principal amount of unsecured term loans outstanding, plus $4.1 million of accrued paid-in-kind ("PIK") interest, outstanding that currently bear interest at a rate of 16% per annum and

mature on March 24, 2016. See "Use of Proceeds" and "Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources". |

Conditions to This Offering |

|

This offering, the senior secured notes offering and the closing of the senior secured revolving credit facility are each conditional upon the closing of the other transactions. For a discussion of

the conditions precedent to the senior secured notes offering and the senior secured revolving credit facility, see "Description of Indebtedness". |

Dividend Policy |

|

We do not intend to pay cash dividends on our ordinary shares for the foreseeable future. See "Dividend Policy". |

7

Table of Contents

|

|

|

| Lock-up |

|

We, our executive officers and directors and certain holders of our outstanding ordinary shares, stock options and other equity awards that together hold at

least % of our outstanding ordinary shares have agreed with the underwriters, subject to certain exceptions, not to offer, sell, contract to sell or otherwise, directly or indirectly, dispose of or

hedge any of our ordinary shares or securities convertible into or exchangeable or exercisable for our ordinary shares for a period of 180 days after the date of this prospectus. See "Underwriting" for more information. |

Proposed Nasdaq Global Market Symbol |

|

ISLA. |

The number of ordinary shares to be outstanding immediately after this offering as set forth above is based on the number of ordinary shares outstanding at

, 2012, and excludes an aggregate

of additional ordinary shares that will be available for future awards pursuant to our

2012 Equity Incentive Plan.

Unless

otherwise indicated, all information in this prospectus assumes no exercise of the underwriters' option to purchase additional ordinary shares from us.

8

Table of Contents

Summary Historical Consolidated and Pro Forma Financial and Other Data

The following table presents our summary historical consolidated and pro forma financial and other data for the periods and as of the dates

presented. The consolidated statements of operations data and other financial data for fiscal 2011, 2010, and 2009, and the consolidated balance sheet data as of the end of fiscal 2011, are derived

from our audited consolidated financial statements which are included elsewhere in this prospectus. The consolidated statements of operations and other financial data for the nine months ended

September 29, 2012 and October 1, 2011, and the consolidated balance sheet data as of September 29, 2012, are derived from our unaudited interim financial statements for those

periods, which are also included elsewhere in this prospectus. These unaudited interim financial statements have been prepared on a basis consistent with the respective audited consolidated financial

statements and, in the opinion of management, include all adjustments, consisting of normal, recurring adjustments, necessary for a fair presentation of that

information for such periods. The financial data presented for the interim periods are not necessarily indicative of the results for the full year.

The unaudited pro forma financial information has been derived by the application of pro forma adjustments to our historical consolidated financial statements. The unaudited pro forma consolidated

balance sheet as of September 29, 2012 gives effect to the following events as if they had occurred on September 29, 2012. The unaudited pro forma statements of operations for the nine

months ended September 29, 2012 and the year ended December 31, 2011 give effect to the following events as if they had occurred on January 2, 2011:

- –>

- the

issuance of ordinary shares in this offering to investors;

- –>

- the

issuance of $ principal amount of new senior secured notes (at an assumed interest rate of %), the entrance into a new senior secured

revolving credit facility and the reduction of our annual interest expense as a result of the repayment of our existing loans described below;

- –>

- the

application of the net proceeds of this offering, together with the proceeds of the senior secured notes, to repay all of the term loans outstanding under our

existing senior secured and mezzanine credit agreements;

- –>

- the

termination of the TPG Management Agreement; and

- –>

- the

reorganization as Isola Group Ltd. as described under "Prospectus Summary—Concurrent Transactions—Corporate Reorganization".

The summary historical consolidated and pro forma financial and other data below should be read in conjunction with "Use of Proceeds", "Capitalization", "Selected Historical Consolidated Financial and

Other Data", "Unaudited Pro Forma Financial Information", "Management's Discussion and Analysis of Financial Condition and Results of Operations" and the consolidated financial statements and related

notes included elsewhere in this prospectus. The unaudited pro forma financial information is presented for illustrative purposes only, and is based on preliminary estimates and currently available

information and assumptions that our management believes are reasonable. Therefore, the unaudited pro forma balance sheet as of September 29, 2012 and the unaudited pro forma statements of

operations for the nine months ended September 29, 2012 and the year ended December 31, 2011 are not necessarily indicative of the financial position or results of operations that would

have been achieved had the foregoing events occurred on September 29, 2012 and January 2, 2011, respectively, nor is it indicative of our results to be expected for any future period. A

number of factors may affect our results. See "Forward-Looking Statements" and "Risk Factors".

9

Table of Contents

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pro forma |

|

For the

nine months ended |

|

Fiscal year |

|

|

|

For the

nine

months

ended

September 29,

2012

|

|

Fiscal

year

2011

|

|

September 29,

2012

|

|

October 1,

2011

|

|

2011

|

|

2010

|

|

2009

|

|

| |

|

|

|

(dollars in thousands,

except share data)

|

|

Consolidated Statement of Operations Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

|

|

|

|

|

|

$ |

437,804 |

|

$ |

459,448 |

|

$ |

596,989 |

|

$ |

611,987 |

|

$ |

424,199 |

|

Cost of goods sold |

|

|

|

|

|

|

|

|

310,585 |

|

|

350,669 |

|

|

455,404 |

|

|

467,751 |

|

|

342,832 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

|

|

|

|

|

|

|

127,219 |

|

|

108,779 |

|

|

141,585 |

|

|

144,236 |

|

|

81,367 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Sales, general and administrative |

|

|

|

|

|

|

|

|

59,647 |

|

|

57,057 |

|

|

77,545 |

|

|

65,271 |

|

|

61,816 |

|

| |

Research and development |

|

|

|

|

|

|

|

|

9,248 |

|

|

7,913 |

|

|

10,653 |

|

|

9,532 |

|

|

9,239 |

|

| |

Restructuring |

|

|

|

|

|

|

|

|

(76 |

) |

|

462 |

|

|

1,250 |

|

|

4,782 |

|

|

17,497 |

|

| |

Loss on liquidation of subsidiary |

|

|

|

|

|

|

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

3,548 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Total operating expenses |

|

|

|

|

|

|

|

|

68,819 |

|

|

65,432 |

|

|

89,448 |

|

|

79,585 |

|

|

92,100 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income / (loss) |

|

|

|

|

|

|

|

|

58,400 |

|

|

43,347 |

|

|

52,137 |

|

|

64,651 |

|

|

(10,733 |

) |

Other income—net |

|

|

|

|

|

|

|

|

2,382 |

|

|

1,375 |

|

|

1,629 |

|

|

4,758 |

|

|

1,268 |

|

Embedded derivative gain / (loss)—net |

|

|

|

|

|

|

|

|

(45,890 |

) |

|

27,959 |

|

|

42,256 |

|

|

21,165 |

|

|

(27,513 |

) |

Interest expense(1) |

|

|

|

|

|

|

|

|

(62,840 |

) |

|

(59,544 |

) |

|

(80,210 |

) |

|

(72,134 |

) |

|

(54,893 |

) |

Interest income |

|

|

|

|

|

|

|

|

79 |

|

|

138 |

|

|

221 |

|

|

339 |

|

|

567 |

|

Foreign exchange gain / (loss)—net |

|

|

|

|

|

|

|

|

1,920 |

|

|

(4,132 |

) |

|

4,833 |

|

|

9,596 |

|

|

(2,083 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income / (loss) before taxes |

|

|

|

|

|

|

|

|

(45,949 |

) |

|

9,143 |

|

|

20,866 |

|

|

28,375 |

|

|

(93,387 |

) |

Provision for income taxes(2) |

|

|

|

|

|

|

|

|

(18,593 |

) |

|

(2,075 |

) |

|

(10,893 |

) |

|

(27,158 |

) |

|

(7,339 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income / (loss) |

|

|

|

|

|

|

|

$ |

(64,542 |

) |

$ |

7,068 |

|

$ |

9,973 |

|

$ |

1,217 |

|

$ |

(100,726 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income / (loss) per common share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Basic |

|

|

|

|

|

|

|

$ |

(129.08 |

) |

$ |

14.14 |

|

$ |

19.95 |

|

$ |

2.43 |

|

$ |

(201.45 |

) |

| |

Diluted |

|

|

|

|

|

|

|

$ |

(129.08 |

) |

$ |

14.14 |

|

$ |

19.95 |

|

$ |

2.43 |

|

$ |

(201.45 |

) |

Weighted average number of common and common equivalent shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Basic |

|

|

|

|

|

|

|

|

500 |

|

|

500 |

|

|

500 |

|

|

500 |

|

|

500 |

|

| |

Diluted |

|

|

|

|

|

|

|

|

500 |

|

|

500 |

|

|

500 |

|

|

500 |

|

|

500 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pro

Forma |

|

|

|

|

|

|

|

Nine months

ended |

|

|

|

|

|

Nine

months

ended

September 29,

2012

|

|

|

|

|

|

Fiscal year |

|

|

|

September 29,

2012

|

|

|

|

2011

|

|

| |

|

|

|

|

|

(dollars in thousands)

|

|

Consolidated Balance Sheet Data: |

|

|

|

|

|

|

|

|

|

|

Cash |

|

|

|

|

$ |

60,171 |

|

$ |

47,481 |

|

Current assets |

|

|

|

|

|

232,729 |

|

|

206,909 |

|

Current liabilities |

|

|

|

|

|

145,270 |

|

|

130,478 |

|

Working capital |

|

|

|

|

|

87,459 |

|

|

76,431 |

|

Long-term debt and capital lease obligations |

|

|

|

|

|

352,454 |

|

|

331,592 |

|

Convertible preferred certificates |

|

|

|

|

|

218,560 |

|

|

208,009 |

|

Embedded derivative liability |

|

|

|

|

|

74,666 |

|

|

28,924 |

|

Total liabilities |

|

|

|

|

|

860,729 |

|

|

772,952 |

|

Common stock and additional paid in capital |

|

|

|

|

|

35,186 |

|

|

33,284 |

|

Total stockholders' deficiency |

|

|

|

|

|

(468,259 |

) |

|

(404,778 |

) |

10

Table of Contents

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pro Forma |

|

For the

nine months ended |

|

Fiscal year |

|

|

|

For the nine

months ended

September 29,

2012

|

|

Fiscal

year

2011

|

|

September 29,

2012

|

|

October 1,

2011

|

|

2011

|

|

2010

|

|

2009

|

|

| |

|

|

|

(dollars in thousands)

|

|

Other Financial Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA(3) |

|

|

|

|

|

|

|

$ |

78,354 |

|

$ |

68,635 |

|

$ |

86,183 |

|

$ |

92,365 |

|

$ |

31,625 |

|

- (1)

- Interest expense for the nine months ended September 29, 2012 was $62.8 million (comprised of cash interest expense of $28.1 million and non-cash

interest expense of $34.7 million). Non-cash interest expense includes the amortization of deferred loan origination costs, the amortization of original issue discount, interest

paid-in-kind ("PIK") on the debt under our mezzanine credit agreement and the accretion of interest on our convertible preferred certificates. We intend to use the proceeds of

this offering to reduce our current indebtedness and to refinance the remaining balance of our current indebtedness with the proceeds from the issuance of $ million of senior

secured notes bearing interest at % per annum. If such transactions had occurred as of the end of fiscal 2011, our total interest expense would have been

$ million

for the nine months ended September 29, 2012, and our cash interest expense would have been $ million for the nine months ended September 29, 2012. See "Unaudited

Pro Forma Financial Information".

- (2)

- Provision for income taxes and net income / (loss) were impacted by unfavorable changes in our uncertain tax positions, after the effect of valuation allowances, in

the amount of

$2.5 million for fiscal 2011, $9.8 million for fiscal 2010 and $3.5 million for fiscal 2009. The unfavorable impact in fiscal 2010 resulted from changes in estimates of prior

years' positions arising out of an ongoing examination by taxing authorities in Germany. During fiscal 2011, a favorable adjustment reduced the provision for income taxes in the amount of

$12.1 million as a result of settlements with taxing authorities in Germany and Taiwan.

- (3)

- Adjusted EBITDA is a supplemental non-GAAP measure used by management and external users of our consolidated financial statements. We define Adjusted EBITDA as net

income / (loss) plus (i) interest expense and interest income, net, (ii) provision for income taxes, (iii) depreciation and amortization and (iv) certain additional

adjustments. These additional adjustments include stock-based compensation, restructuring charges, foreign exchange gain / (loss)—net, goodwill impairment, management fees paid to

TPG, embedded derivatives gain / (loss)—net, expenses related to this offering and a gain related to the settlement of a patent infringement dispute in fiscal 2010. For more

information on Adjusted EBITDA and a reconciliation of net income (loss), the most directly comparable financial measure under accounting principles generally accepted in the U.S.

("U.S. GAAP"), to Adjusted EBITDA for the periods presented, see footnote 3 to "Selected Historical Consolidated Financial and Other Data". Because not all companies use identical

calculations, our presentation of Adjusted EBITDA may not be comparable to other similarly titled measures of other companies.

11

Table of Contents

Risk Factors

An investment in our ordinary shares involves a high degree of risk. You should carefully consider the

following information, together with other information in this prospectus, before buying our ordinary shares. If any of the following risks or uncertainties occur, our business, results of operations

and financial condition could be materially adversely affected. In that case, the trading price of our ordinary shares could decline, and you may lose all or a part of the money you paid to buy our

ordinary shares.

RISKS RELATED TO OUR INDUSTRY AND BUSINESS

The markets for our customers' products are volatile, which can cause wide swings in the demand for our products.

Our business depends on the electronics industry, which is cyclical and subject to significant downturns characterized by diminished product demand,

rapid declines in average selling prices and over-capacity. This industry has experienced periods characterized by relatively low demand and price depression and is likely to experience

recessionary periods in the future. Economic conditions affecting the electronics industry in general, or specific market segments, such as computers and communications, have adversely affected our

operating results in the past and may do so in the future.

Over

the past three years, the global economy has been greatly impacted by the recessionary conditions linked to rising default levels in the U.S. home mortgage sector, volatile fuel prices, and a

changing political and economic landscape. These factors have contributed to historically low consumer confidence levels, resulting in a significantly intensified downturn in demand for products

incorporating PCBs, which in turn lowered demand for our products and adversely affected our operating results. When we experience excess capacity, variable margins from our revenues may not fully

cover our fixed overhead expenses, and our gross margins may fall. A lasting economic recession, excess manufacturing capacity, or a prolonged decline in the electronics industry could negatively

affect our business, results of operations, and financial condition.

In order to respond to quick-turn orders and offer short lead times at some of our production facilities, in some cases as little as 12 to 48 hours, these facilities must operate at less

than full capacity. However, if we do not receive as many quick-turn orders as we expect at these facilities and have foregone other production, we may underutilize our manufacturing

capacity.

We depend upon a relatively small number of customers for a large portion of our sales, and a decline in sales to major customers could harm our results of operations.

A small number of customers, which include PCB manufacturers and distributors, are responsible for a significant portion of our sales. Our ten

largest customers accounted for approximately 63% of our revenue for the nine months ended September 29, 2012 and 61% of our revenue in fiscal 2011. Our single largest customer (Viasystems and

its subsidiaries) accounted for approximately 15% of our revenue for the nine months ended September 29, 2012 and 16% our revenue in fiscal 2011. Although we cannot assure you that our

principal customers will continue to purchase our products at past levels, we expect to continue to depend upon a relatively small number of customers for a significant portion of our revenue. Our

customer concentration could fluctuate, depending on future customer requirements, which will depend in large part on conditions in the end-markets in which our customers operate. The loss

of one or more significant customers or a decline in sales to our significant customers could harm our business, results of operations, and financial condition and lead to declines in the trading

price of our ordinary shares.

In

addition, during industry downturns, we may need to reduce prices and we may be unable to collect payments from our customers. There can be no assurance that key customers will not cancel orders,

or that

12

Table of Contents

Risk Factors

they

will continue to place orders with us in the future at the same levels as experienced by us in prior periods, or that they will be able to meet their payment obligations. This concentration of

customers may materially and adversely affect our operating results due to the loss or cancellation of business from any of these key customers, significant changes in scheduled deliveries to any of

these customers, or decreases in the prices of the products sold to any of these customers.

We sell on a purchase order basis and are subject to uncertainties and variability in demand by our customers that could decrease revenues and harm our operating results.

We sell to customers on a purchase order basis and not pursuant to long-term contracts. Customers may cancel their orders, reduce

production quantities or delay production at any time for a number of reasons. Many of our customers have, over the past several years, experienced significant decreases in demand for their products

and services. The uncertain economic conditions in the global economy and in several of the markets in which our customers operate have in the past prompted some of our customers to cancel orders,

delay the delivery of some of the products that we manufacture or order fewer products than we previously anticipated. Consequently, our sales are subject to short-term variability in

demand by our customers. In the past, we have been required to increase staffing and other expenses in order to meet the anticipated demand of our customers. The level and timing of orders placed by

our customers may vary due to:

- –>

- changes

in our customers' inventory levels;

- –>

- changes

in customers' manufacturing strategies;

- –>

- demand

fluctuations for our customers' products; and

- –>

- changes

in new product introductions.

Future

terminations, reductions, or delays in our customers' orders could harm our business, results of operations, and financial condition. Variability in demand from our customers may contribute to

fluctuations in our quarterly results, which may make our revenues more difficult to accurately forecast.

In

addition, we have experienced a gradual shift of revenue to Asia where our customers typically have negotiated longer payment terms than in our other regions. Our days' sales outstanding ("DSOs")

in Asia are generally between 85 to 95 days while DSOs in the Americas are between 45 to 50 days and in Europe are between 35 to 45 days.

While

this revenue shift has not historically had a materially adverse effect on our financial position, operating results or cash flows, as sales to Asia increase, the increase in our accounts

receivable could have an increasingly adverse effect on our working capital position.

Just

as we extend relatively long payment terms to our customers in Asia, our vendors in Asia also extend relatively long payment terms to us. As our business in Asia expands, short-term

vendor financing also increases. For more information, see "Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital

Resources—Liquidity".

We depend on a small number of suppliers for the raw materials and certain components used to manufacture our products. If these suppliers fail to provide an adequate supply of raw materials or components of sufficient

quality, or these suppliers become unavailable to us, we may experience significant delays in the manufacturing and shipping of our products to customers and our business could suffer.

We depend on a small number of suppliers for the raw materials, including copper, resin and fiberglass, as well as certain components, used in the

manufacture of our products. These suppliers must comply with Isola's stringent specifications and technical requirements. Our reliance on these suppliers involves

13

Table of Contents

Risk Factors

significant

risks and uncertainties, including whether they will provide an adequate supply of required raw materials or components of sufficient quality, will not increase prices for the raw

materials or components and will perform their obligations on a timely basis. If we are unable to obtain raw materials or components from third-party suppliers in the quantities and of the quality

that we require on a timely basis and at acceptable prices, we may not be able to deliver our products on a timely or cost-effective basis to our customers, which could cause customers to

end their business with us, reduce our gross profit and seriously harm our business, results of operations and financial condition. Moreover, if any of our suppliers becomes financially unstable, we

may have to find new suppliers. It may take several months to locate alternative suppliers, if required. We may experience significant delays in manufacturing and shipping our products to customers

and incur additional development, manufacturing and other costs to establish alternative sources of supply if we lose any of these sources. We cannot predict if we will be able to obtain replacement

raw materials and components within the time frames that we require at an affordable cost, or at all.

There may be shortages of, or price fluctuations with respect to, raw materials or components, which would cause us to curtail our manufacturing or incur higher than expected costs.

We purchase the raw materials and certain components we use in producing our products, and we may be required to bear the risk of price fluctuations

of raw materials or components. Shortages of raw materials and price fluctuations have occurred in the past and may occur in the future. The cost of copper foil comprises approximately half of the

total cost of our raw materials. Copper prices have been particularly volatile in the last four years, declining to less than $3,000 per ton in late 2008 and increasing to more than $10,000 per ton

during fiscal 2011. Although historically we have been able to pass through a substantial portion of the raw material cost increases

to our customers, we may not continue to be able to do so in the future if we experience significant supply disruptions or excess levels of industry capacity or due to other factors outside of our

control, in which case our profitability could suffer. We generally experience a delay of approximately one to two months from the time when costs of raw materials change until we are able to make

corresponding price adjustments. Our ability to pass through raw material price increases may also be limited by the level of industry excess capacity, competitive practices and other

regional-specific factors which are out of our control. In addition, if we experience a shortage of materials or components, we may not be able to produce products for our customers in a timely

fashion.

In addition, the SEC adopted rules required by the Dodd-Frank Act of 2010 that impose new annual disclosure and reporting requirements for public companies to report their use of "conflict

minerals" originating from the Democratic Republic of Congo and its nine immediate neighbors. The new requirements are effective for 2013 with a reporting deadline of May 31, 2014 for affected

issuers. The current list of "conflict minerals" under the Dodd-Frank Act includes gold, tantalum, tin and tungsten (although additional minerals may be added in the future). To the best

of our knowledge, the only metal which is added to our products is copper foil, which is not currently listed as a "conflict mineral." If any of the metals used in our products are classified as

"conflict minerals" in the future, there may only be a limited pool of suppliers who provide conflict-free metals, and we cannot assure you that we will be able to obtain products in

sufficient quantities or at competitive prices.

We are vulnerable to an increase in the cost of energy.

Our production processes require us to use substantial amounts of power. In the past several years, there has been a significant increase in global

energy prices. Changes in the cost or availability of energy resources, including oil, gas and electricity, are beyond our control and could materially increase our cost of operations. We maintain

only limited back-up power generation facilities at some of our manufacturing locations. In the event of a power shortage, we could be required to cease operations at an affected facility

14

Table of Contents

Risk Factors

until power is restored. There can be no assurance that our facilities will avoid material utility-based interruptions, which could have a material adverse effect on our results of operations and

financial condition.

We may experience significant fluctuations in results of operations from period to period.

Our periodic results may vary significantly depending on various factors, many of which are beyond our control. These factors include:

- –>

- the

volume of customer orders;

- –>

- changes

in demand for customers' and OEMs' products;

- –>

- pricing

and other competitive pressures;

- –>

- our

effectiveness in managing manufacturing processes;

- –>

- changes

in cost and availability of raw materials and labor;

- –>

- changes

in our product mix;

- –>

- changes

in political and economic conditions; and

- –>

- local

factors and events that may affect our production volume, such as local holidays.

Our

sales may, from time to time, shift from one period to the next, affecting anticipated results. See "Management's Discussion and Analysis of Financial Condition and Results of

Operations—Results of Operations" for more information about our period to period results and the effect of these factors on them.

If demand for high-performance, higher margin products does not increase, our future gross margins and operating results may be worse than expected.

We typically earn lower gross margins on certain of our base, low-Tg products and higher gross margins on certain of our

high-performance laminate materials. We experience continued pressure from customers to reduce prices, and competition remains intense, particularly in Asia. This pricing pressure has

affected, and could continue to adversely affect, our gross margins. If demand for our high-performance, higher margin products does not increase in the future, our gross margins and

operating results may be worse than expected.

Our failure to respond timely or adequately to market changes may render our existing technology less competitive or obsolete, and our operating results may suffer.

The market for our products is characterized by continuing product development and changing technologies. The success of our business depends in part

upon our ability to maintain and enhance our technological capabilities, develop and market products and services that meet changing customer needs and successfully anticipate or respond to

technological product platform changes on a cost-effective and timely basis. There can be no assurance that we will effectively respond to the technological product requirements of the

changing market, including having sufficient cash flow to make additional capital expenditures that may be required as a result of those changes. To the extent we are unable to respond to such

technological product requirements, our operating results may suffer.

15

Table of Contents

Risk Factors

Our customers require our products to undergo a lengthy and expensive qualification process which does not assure follow-on product sales. If we are unsuccessful or delayed in qualifying any of our products with a

customer, our business and operating results would suffer.

In general, OEMs require that our products undergo an extensive qualification process, which may involve testing of our products for

performance and reliability. This qualification process may continue for several months or even up to one year in certain cases. Moreover, qualification of a product by a customer does not assure any

sales of the product to that customer. After our products are qualified, it can take several months or more before the customer commences volume production of components or systems that incorporate

our products. Despite these uncertainties, we devote substantial resources, including design, engineering, sales, marketing and management efforts, to qualifying our products with customers in

anticipation of sales. If we are unsuccessful or delayed in qualifying any of our products with a customer, sales of those products to the customer may be precluded or delayed, which may impede our

growth and cause our business to suffer.

In

addition, we work closely with OEMs to develop products that are well suited to their changing needs. We will not recover the cost of this product development directly even if we are

actually engaged as a supplier to an OEM's product line, and there can be no guarantee that such collaborations will result in any sales of our products to such OEM.

Our products may contain design or manufacturing defects, which could result in reduced demand for our services and liability claims against us.

We manufacture products that are highly complex and need to meet increasingly demanding technical and quality requirements. These products may

contain design or manufacturing errors or failures, despite our quality control and quality assurance efforts. Defects in the products we manufacture, whether caused by a design, manufacturing, or

materials failure or error, may result in delayed shipments, customer dissatisfaction, a reduction or cancellation of purchase orders, or liability claims against us. If these defects occur frequently

or in large quantities, our reputation may be impaired. Although our invoices and sales arrangements contain provisions designed to limit our exposure to product liability and related claims, existing

or future laws or unfavorable judicial decisions could negate these provisions. Product liability litigation against us, even if it were unsuccessful, would be time-consuming and costly to

defend. We may not maintain technology errors and omissions insurance at any given time for all or certain of our operations, and we may not be able to purchase such insurance coverage in the future

on terms that are satisfactory to us, if at all. Moreover, such coverage may not be sufficient to cover actual losses.

We face intense competition in the PCB materials industry, including from diversified manufacturers and suppliers, which could negatively impact our results of operations and cause our market share to decline.

The PCB materials industry is intensely competitive, and we compete worldwide in the markets for such materials. Our principal competitors are

substantially larger and have greater financial resources than us, and our operating results may be affected by our ability to maintain our competitive positions in these markets. Some of our